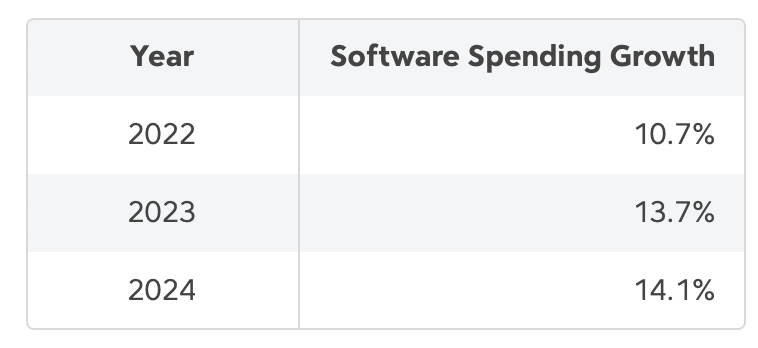

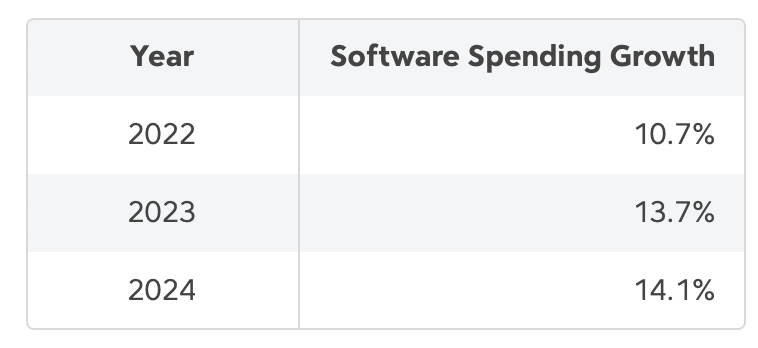

I came across this blog post by Tomasz Tunguz, a venture capitalist, estimating software spending growth for 2024:

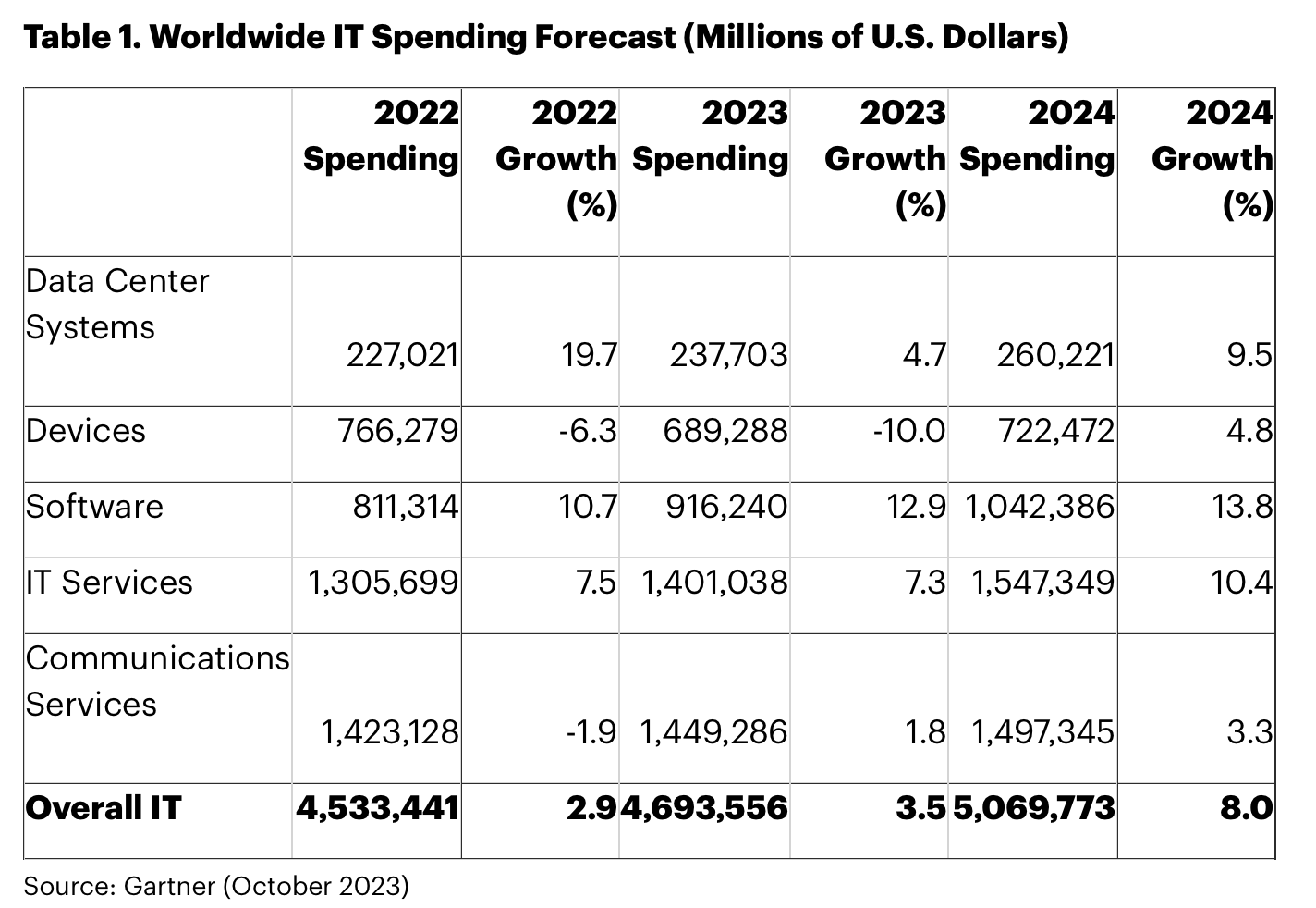

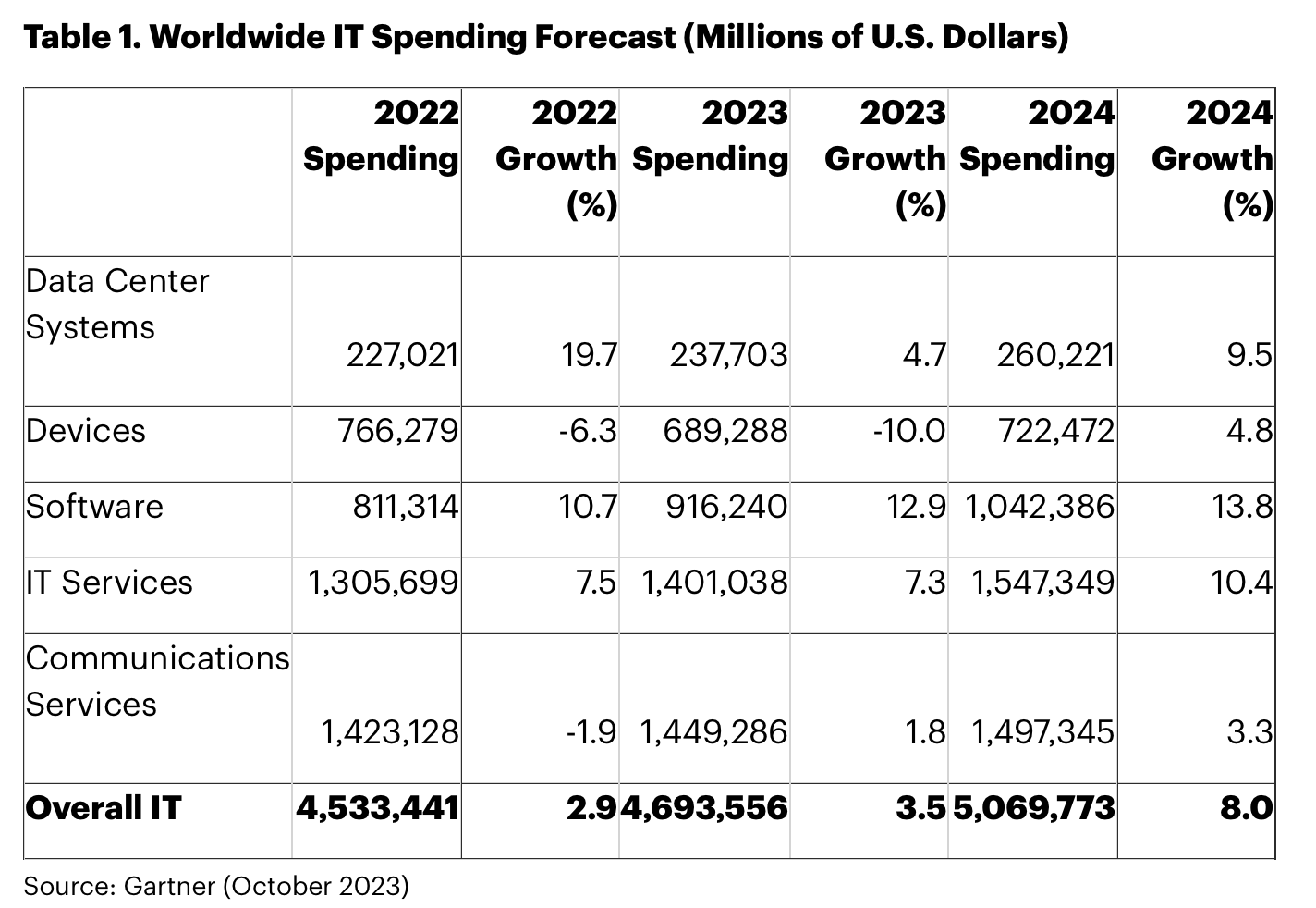

His analysis is based on a Gartner report . It is mainly concerned with cloud spending but breaks out some subcategories of IT spending.

Dicker Data released an encouraging update last week which showed an 8% increase in revenue compared to the prior corresponding period.

If the forecasts are correct this is promising for Dicker Data sales growth going forward. Although software only makes up a small percentage of their revenue I would assume it is higher margin (but I couldn’t confirm what this is from a brief search.)

Also worth noting is that hardware, which is the bulk of DDR’s revenue, is also forecast to grow modestly after two grim years.

This is all speculative, obviously, but my thinking is that IT spending has been constrained recently but that can't continue forever.

Disc: Held IRL