Slowly catching up with companies I follow/own but not many others do, as this is of more interest than the already excellent coverage others have provided on more common holdings.

I cannot prove the same depth or quality of assessment as others, particularly in breaking down in questioning financial statements as more esteemed members, but hope there are some points that are worthwhile.

For context (and for new members), GNP is one of my largest holdings in my portfolio outside of Super. I have been happy with their progress since I have owned and so far the thesis is holding and panning out pretty much as well as I could have hoped. This is not a company with fantastic near term re-rate potentials, but I hope to be one of those steady 15-20% compounders. Rare gems.

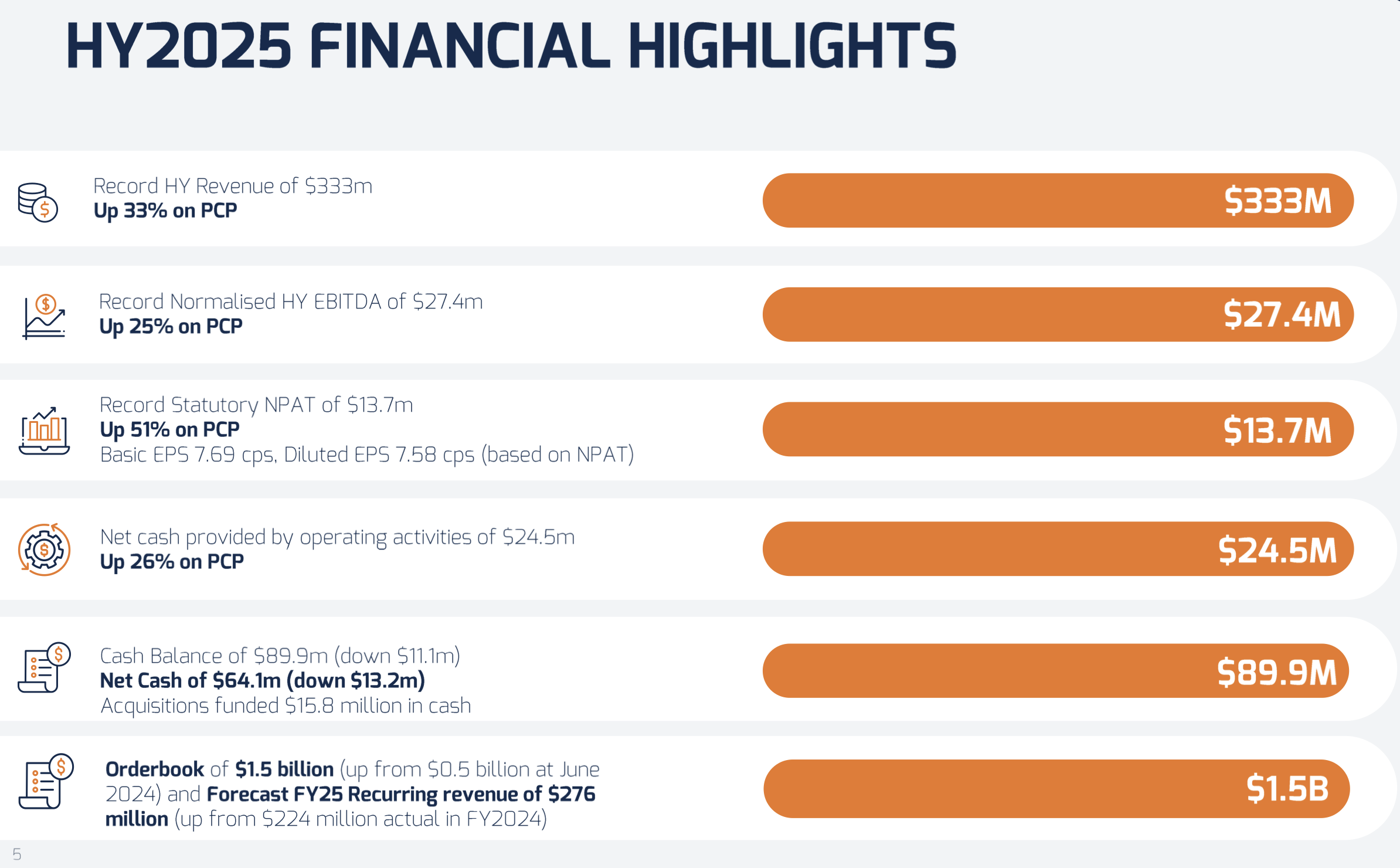

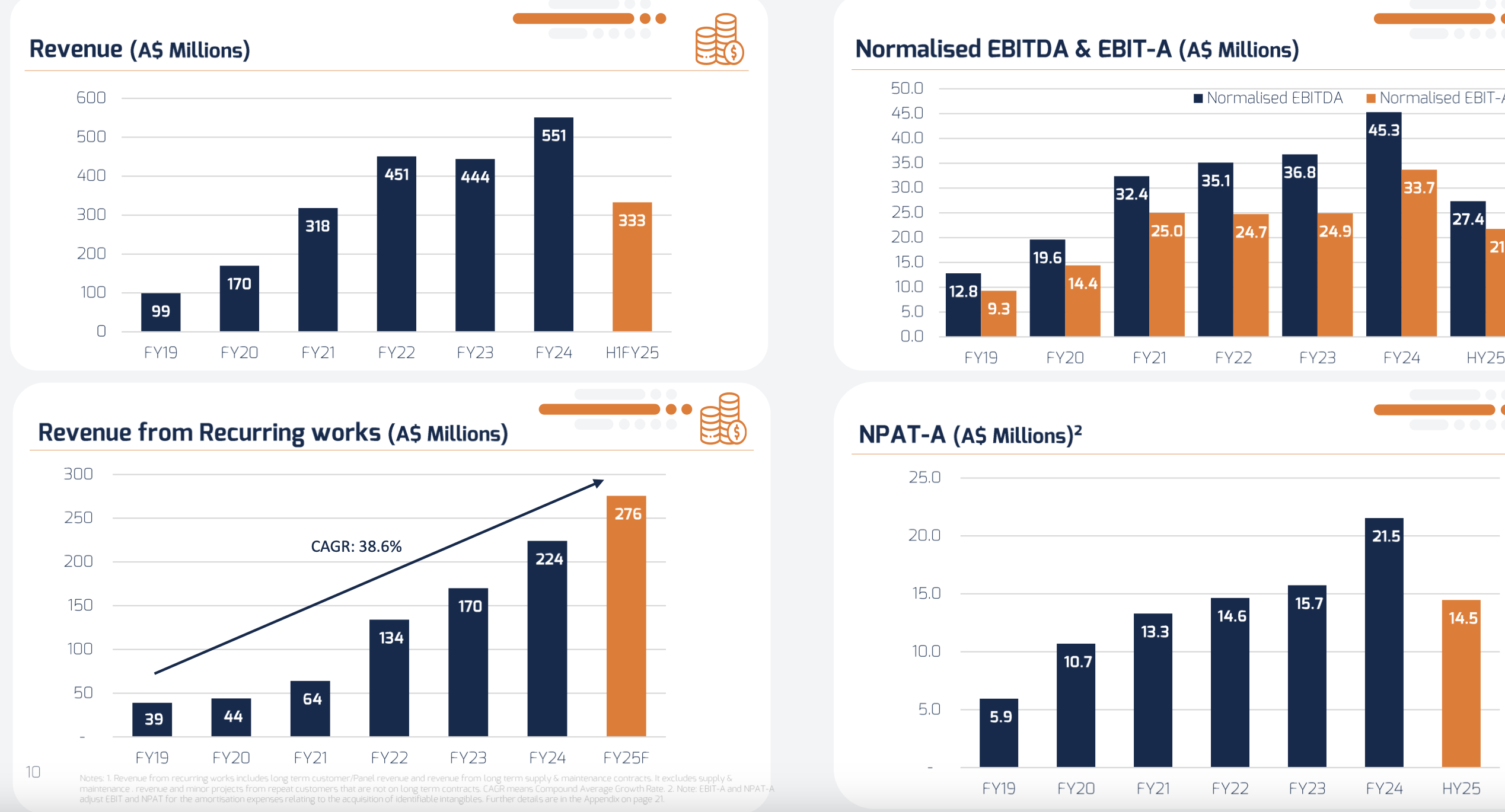

In summary, it was another great half with headline numbers all impressively up (with exception of their debt - due to an acquisition)

They split their business into three segments, infrastructure, industrial and telecommunications

To me, the first two are an ever increasingly overlapping set of circles in a Venn diagram.

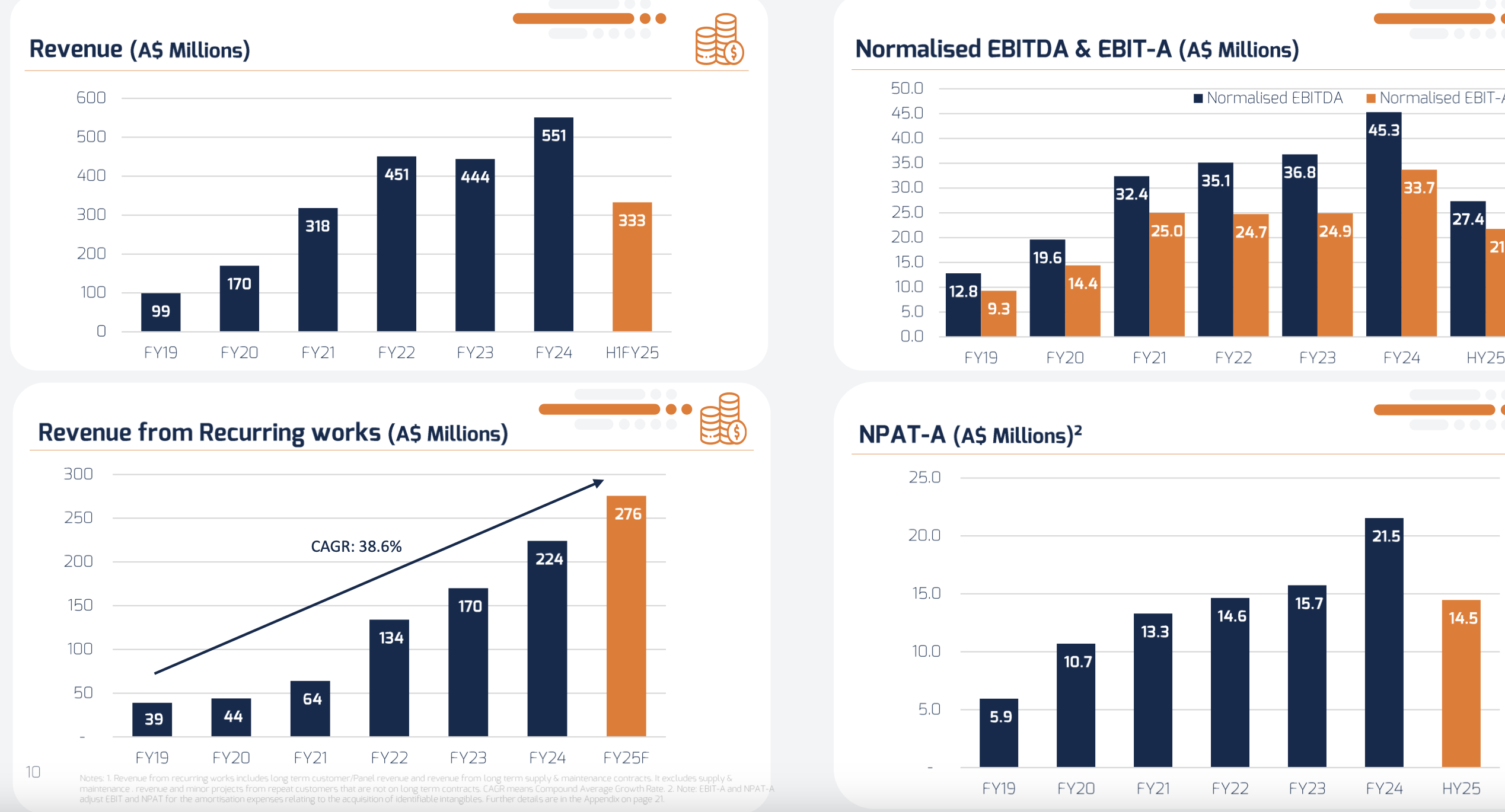

They infrastructure and industrial segments are mostly exposed to the "green revolution" of the renewable energy grid build out. Predominantly this means pylons, batteries and smart grid upgrades to existing networks. But an increasing part of their contracts have a repair and maintenance contract build in which gives a recurring revenue:

This is increasing quickly and gives a small degree of downside protection to the investment thesis. These segments contribute the majority of the earnings. Interestingly, the "telecoms" servicing business which I had always thought to be a lemon and an irrelevance to the rest of the company, has had a spectacular turn around:

It is also good to see the revenue by geography slowly become less concentrated in WA. This remains a significant risk.

EPS has increased 50% vs pcp

Overall a great result and......

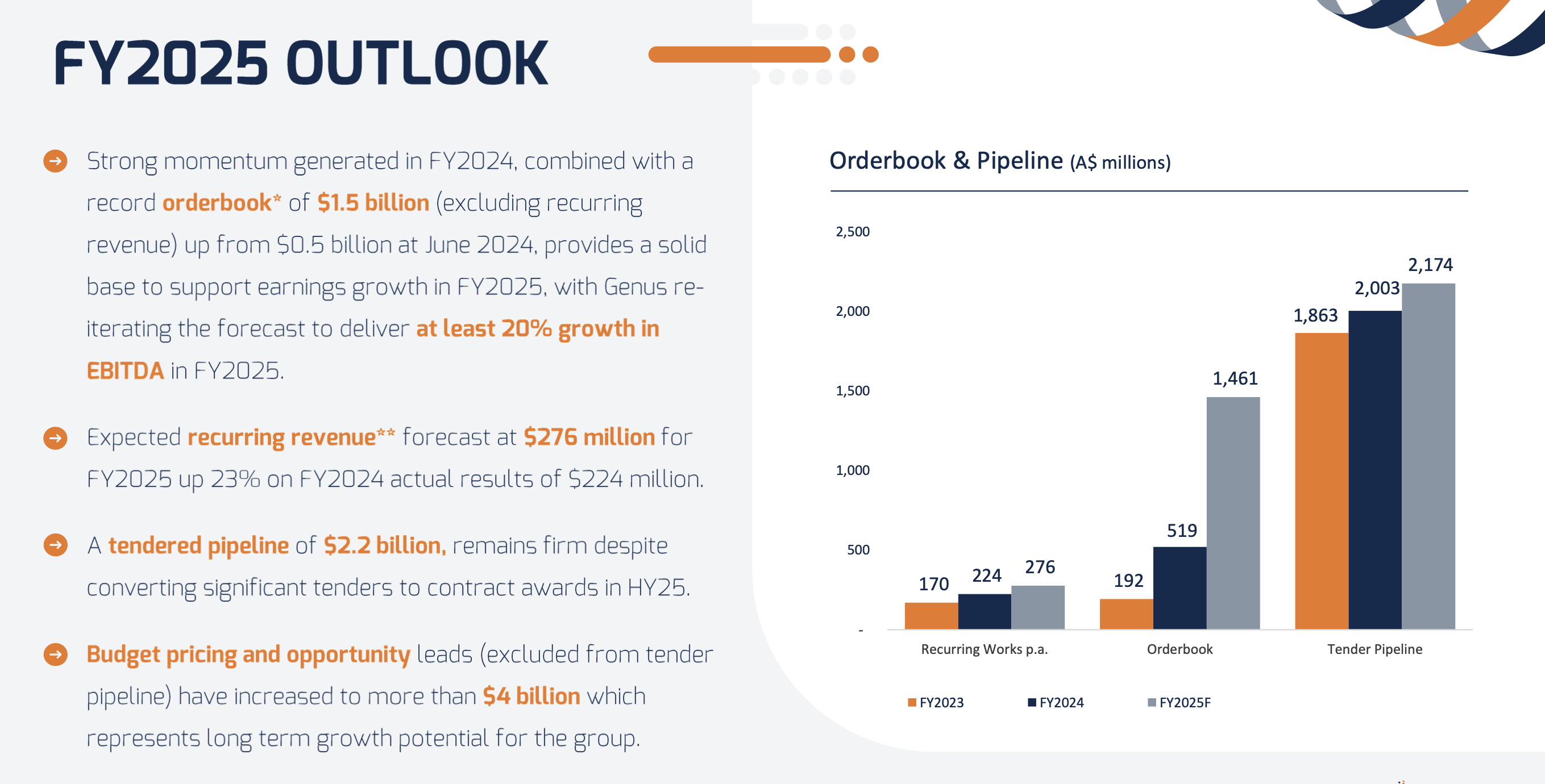

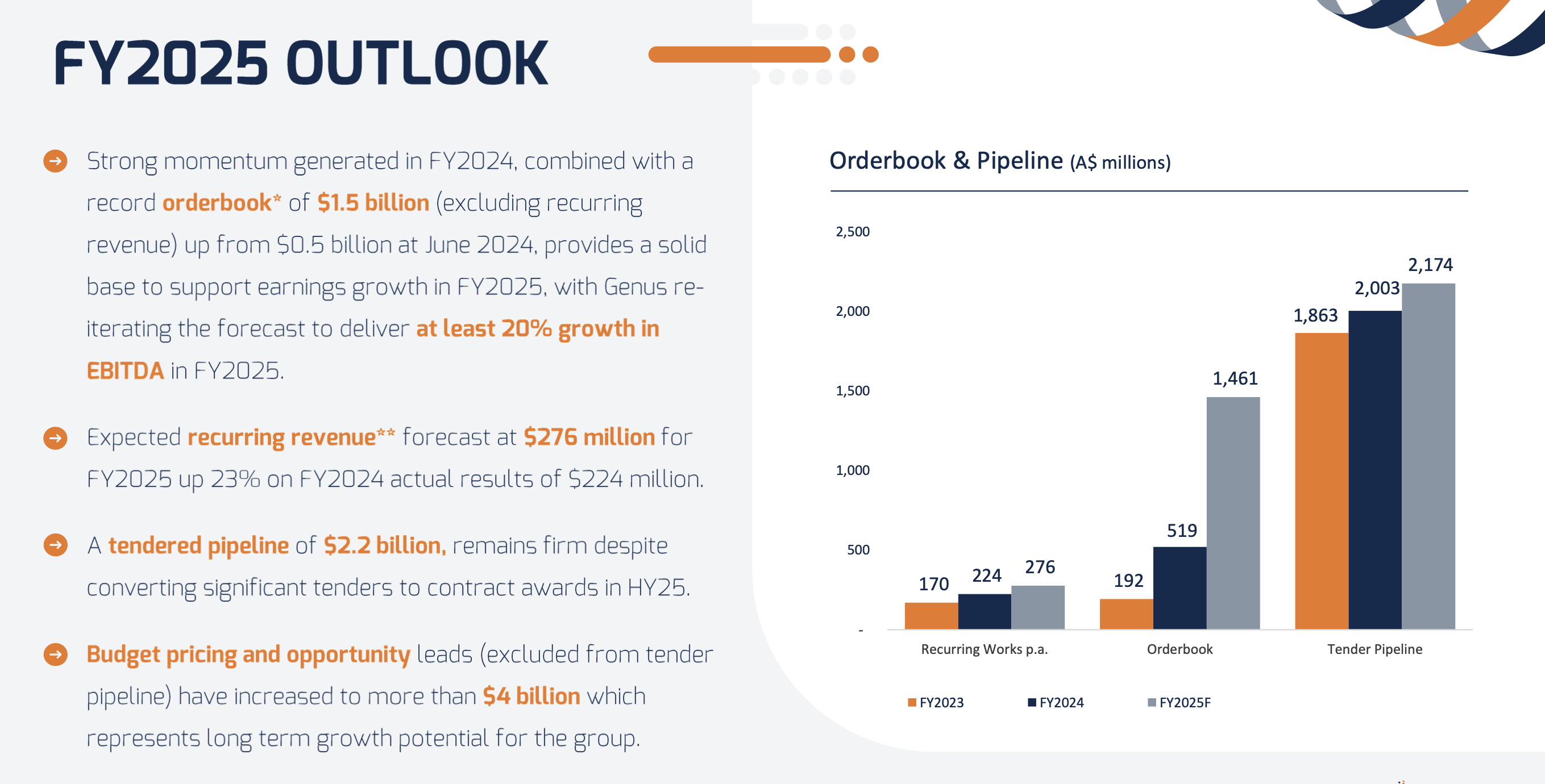

The outlook is rosy:

The only issue was the suspension of the dividend, which caused an intra-day drop in the SP of ~6% from memory. It is now up 7% from the pre-announcement SP.

I am happy with this decision as I believe this reflects a conviction that the company can achieve a higher ROIC with that money than returning as dividends, to the benefit of all shareholders.

David Riches, the Director, is a 50% shareholder.

HELD IRL & SM