Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

• Genus, as part of the ACCIONA Genus JV (AGJV) has been awarded a contract by AusNet to

construct the Western Renewables Link (WRL) Project in Victoria subject to project approvals

• AGJV Contract for the construction of WRL is worth approximately AUD$1.6 billion

• A further strategic move into the VIC Renewables market for Genus

GNP are 25% of the partnership, so a $400m increase revenue

However, it’s not unalloyed good news given the grumpy farmers blocking access to Vicgrid like these two:

Its difficult to know if resistance to the work will incur extra costs for GNP or not

SP up 10% on the news

Here’s the link to the announcement

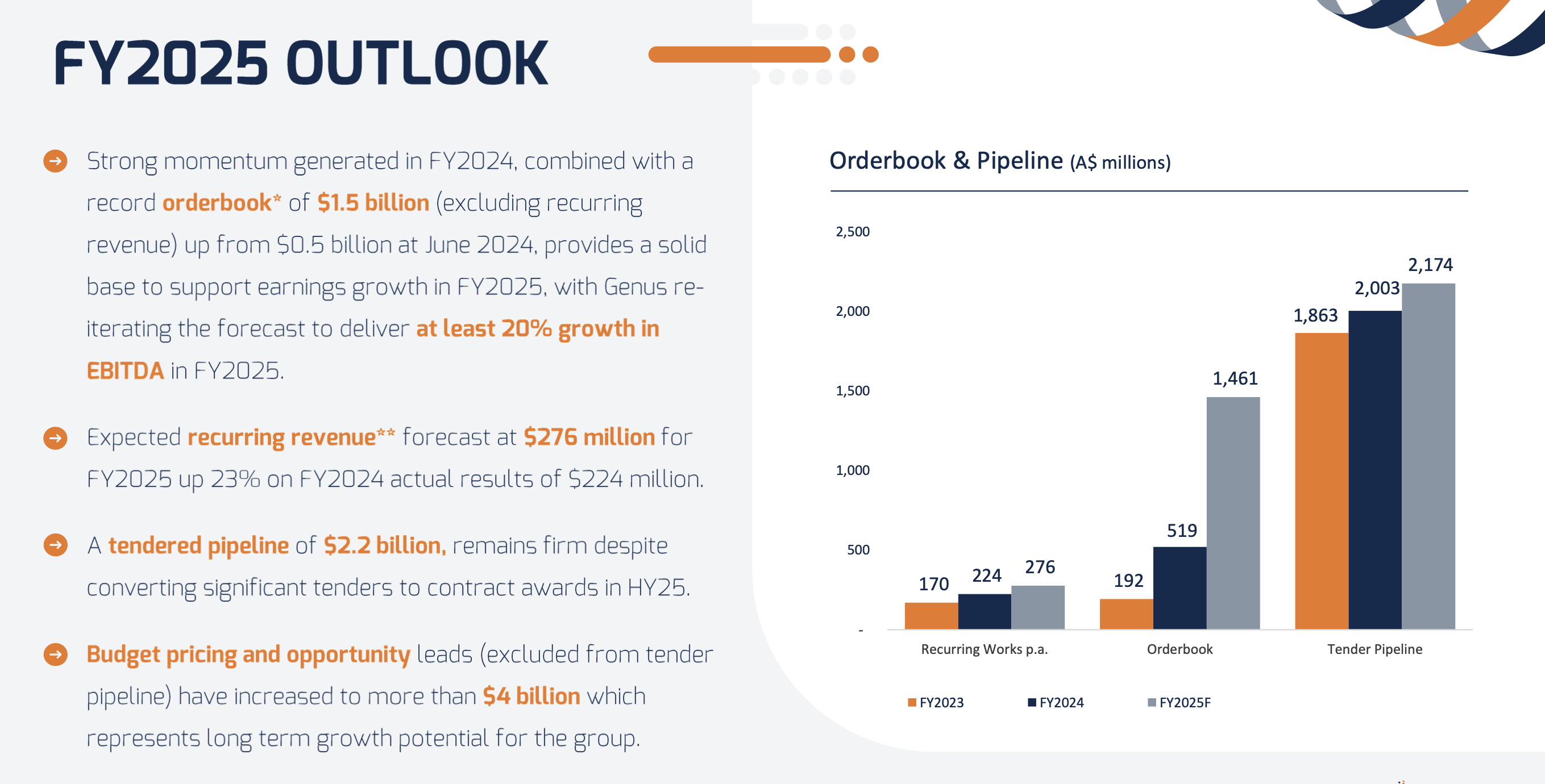

GNP has already surpassed my valuation for the end of next FY. There have been a couple of director sales, and referencing the other straw on position sizing, I am going to sell ~10% of my holding on SM and IRL, to bring it down to a still weighty 25%

Still have great confidence in the future, but this is not a company that will be exponential in profitability!

c

This is for the end of FY 2026.

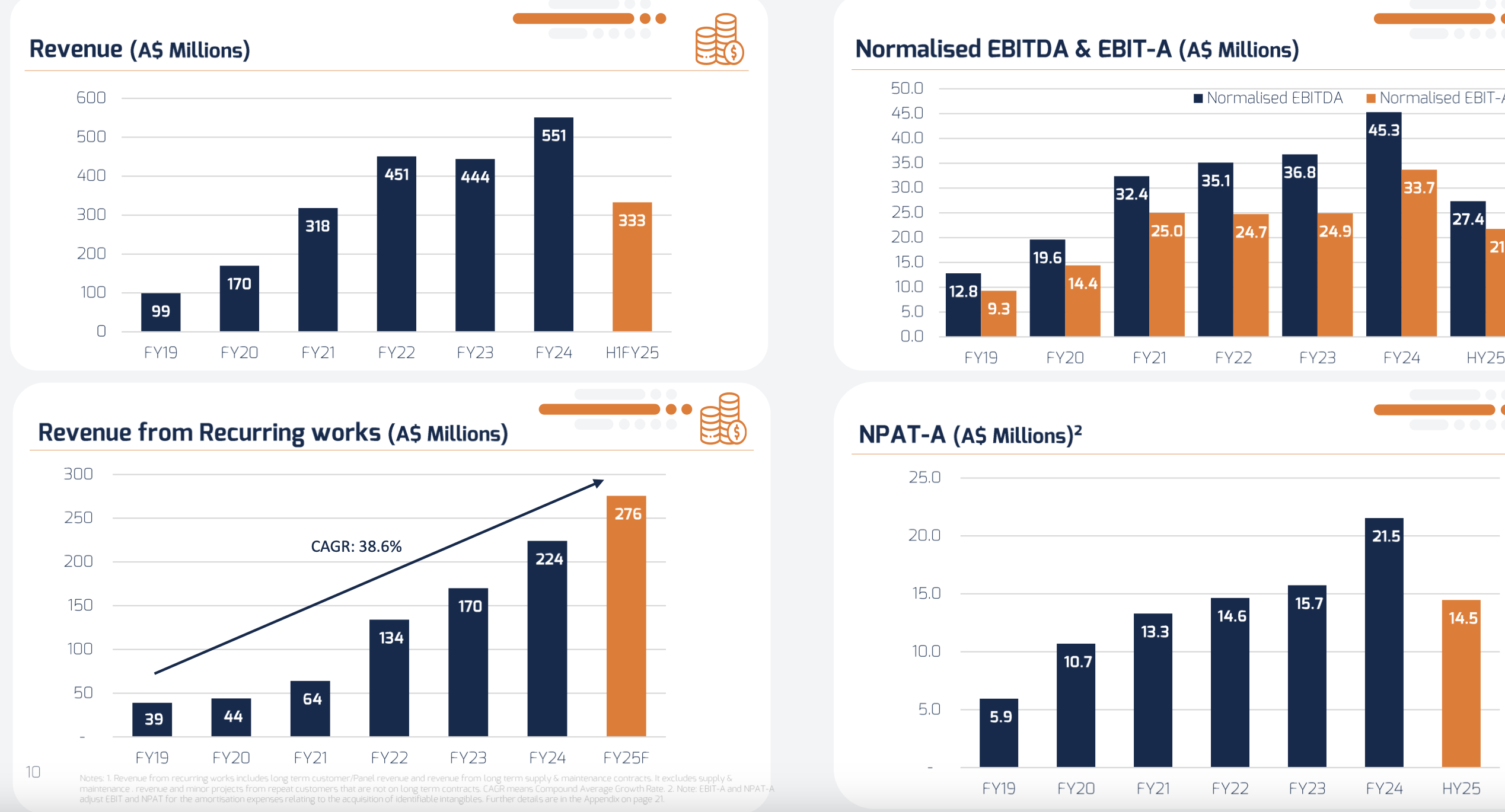

Assumes no increase in margin, stable share count, 20% increase in recurring revenue and also 20% in non-recurring revenue (order book indicates 25% increase, but timeframe unclear)

generates EPS of just over 23.5 cps

apply current PE of ~ 25 = $5.90

I think this is a pretty conservative number.

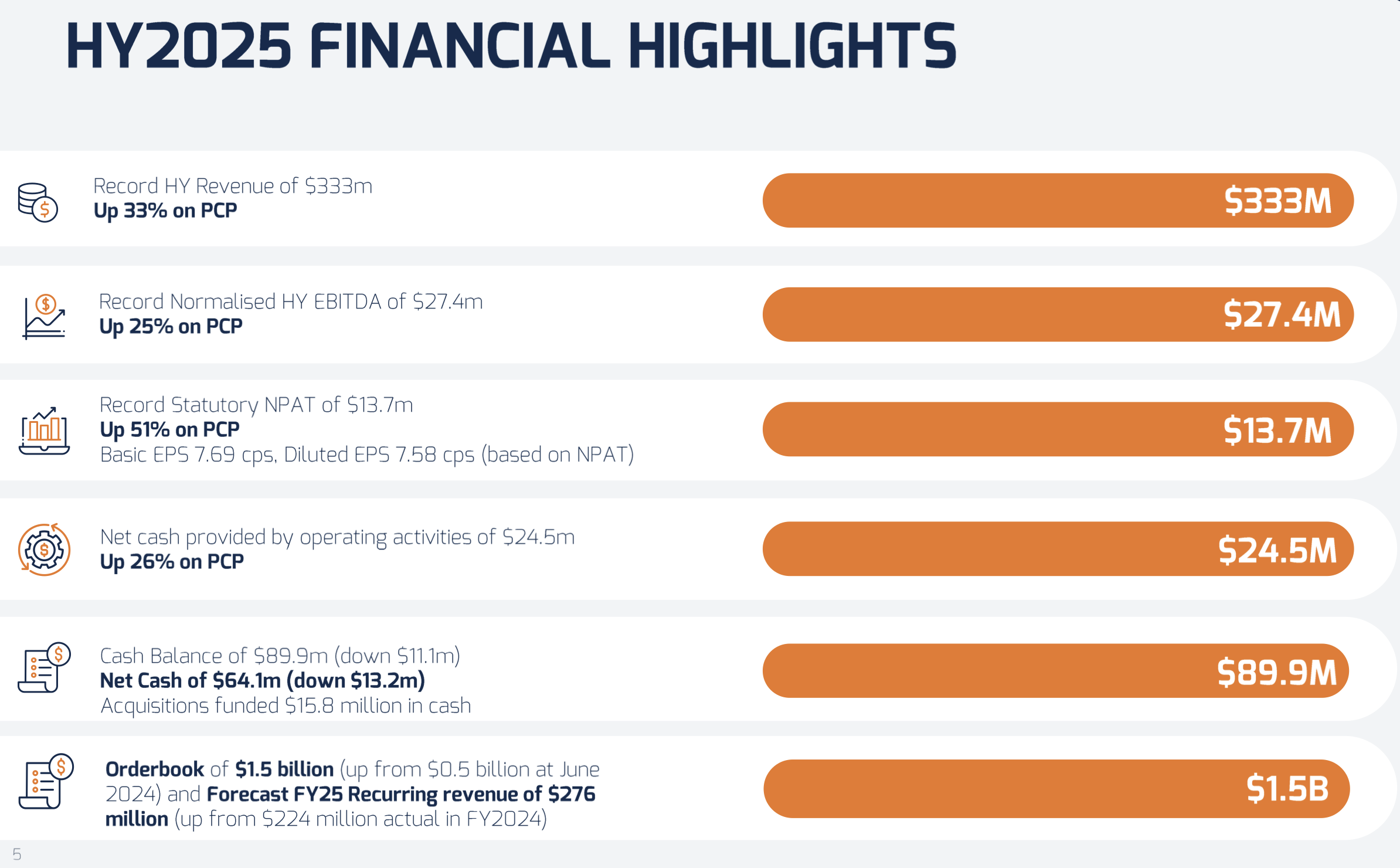

GNP posted there results for FY 2025 and it was another good one:

Selected highlights

All 3 divisions of the business saw huge improvements and with the Energy transition still in the early stages and GNP able to bid for an execute profitably on multiple projects, plus have an increasing fraction of revenue coming from maintenance as evidenced by the above graph, the future continues to look good.

I calculate

Net profit margin is 4.7% - about standard for the industry they operate in

ROE of 25.2%

The SP is up ~15% in early trade producing a PE ratio of ~25 with isn't too onerous given how full the order book is.

GNP is my largest holding outside of super and is now an outsized 25% of that portfolio. I am happy to keep it that size as my confidence in their future is high.

You can access full results here https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02984836-6A1280466&v=4a466cc3f899e00730cfbfcd5ab8940c41f474b6

HELD IRL AND SM

Assumed 3 scenarios

Bull Case Growth 20% for next 5 years Net Margins 5.5%

Base Case Growth 11% for next 5 years Net Margins 4.5%

Bear Case Growth 6% for next 5 years Net Margins 2.75%

Assumed Share count to growth 5% a year. PE Ratios ranging from Bull 33 down to 14 for Bear. Discounted and blended together on likelyhood of occurring arrived at $3.24

Market Cap today price $4.54 of $818m

Management Bio's

Board Members

David Riches - Managing Director

Mr Riches is the founder of GenusPlus and is a third generation recognised expert in the electrical contracting industry. He has presided over the business with a track record of year on year successful growth, generated through his leadership and strategic planning.Mr Riches offers a wide range of experience in strategy, leadership, planning, design, and management having continually delivered challenging and difficult projects within time and budget. He is held in high regard by clients, competitors, employees and subcontractors.

Simon High - Non-Executive Chairman

Mr High has over 45 years of global experience in the oil and gas, mining and industrial and infrastructure industries. Mr High was formerly the CEO of SGX-listed Ausgroup and Managing Director/CEO of ASX-listed Southern Cross Electrical Engineering Limited.Mr High held senior management and executive positions within Clough Limited, United Construction Group, Kvaerner Oil & Gas Ltd, Trafalgar House Offshore and John Brown E&C, and was an Independent Non-Executive Director of Coogee Resources. He has a proven track record in successful financial delivery, organisational turnaround, development of high-performance companies operating in cyclical and highly competitive economic global environments. Mr High holds a BSc (Civil Engineering) from the UK, is a Fellow of the Institute of Engineers Australia and a Fellow of the Institute of Company Directors, Australia.

José Martins - Non-Executive Director

Mr Martins joined the Board in January 2018 and has over 25 years’ experience in the financial management of public and private companies. Mr Martins is currently chief financial officer of Alliance Mining Commodities Ltd. Previously, Mr Martins was Chief Financial Officer of Ausdrill Ltd (now Perenti Global Ltd) and Macmahon Holdings Ltd.

Paul Gavazzi - Non-Executive Director

Mr Gavazzi has over 40 years of experience as a practising lawyer in commercial law, specialising in construction, projects and infrastructure. Mr Gavazzi was formerly senior partner of a large national law firm, and founder of the firm’s Construction, Projects and Infrastructure Group. Mr Gavazzi is the founder & Managing Director of Solve Global Pty Limited, a company that plans, manages, predicts and solves high-stakes commercial disputes using data-based analytics and strategic problem solving. Mr Gavazzi has broad experience in all facets of project procurement, contracting, administration and dispute resolution. A member of the Australian Institue of Company Directors (AICD), Mr Gavazzi has been on the Genus Board since 2017.

Key Management

Damian Wright - Chief Financial Officer & Joint Company Secretary

Damian Wright has over 20 years’ experience in senior management of public and private companies. He is an experienced financial and corporate executive with a broad understanding of all aspects of accounting, finance and corporate governance having worked in the mining services and funds management industries, including CFO and Company Secretary for ASX listed entities and managed investment schemes. Damian was formerly company secretary of Viento Group Ltd and VCS Civil & Mining Pty Ltd, and is a Fellow of both CPA Australia and the Governance Institute of Australia.

George Lloyd - Executive General Manager

George Lloyd is the founder of Proton Power (a subsidiary of GenusPlus) and a Shareholder in GenusPlus. Proton Power was incorporated in January 2017 and quickly established itself in the power infrastructure market providing services to mining, oil and gas and utility companies throughout Australia. Prior to Genus, George was Energy Manager at Kiewit Australia focussing on large scale electrical instrumentation controls projects and power generation projects throughout Australia. Previous to this George was tasked with delivering large scale E&I projects throughout Australia for Kent E&C now known as SNC Lavelin. George provides a wealth of knowledge and expertise across the full range of the Genus businesses. He has a strong focus on the Group’s strategy, growth and business development.

Strati Gregoriadis - Group General Counsel & Joint Company Secretary

Strati is a qualified lawyer and senior executive who worked in private practice prior to being appointed to Group General Counsel & Company Secretary roles across ASX-listed entities. Strati has more than 22 years’ experience as an in-house lawyer and company secretary in the resources and construction industries, covering legal, governance, compliance and risk. He is recognised for the strong ethical and practical approach he takes in dealing with people and managing and resolving issues; and for his focus on contributing to a healthy culture through positive and productive engagement with all company stakeholders.

David Fyfe - Chief Operating Officer

David brings extensive executive experience in operations, commercial, asset management, and business development. His expertise in major utilities is invaluable for Genus as we continue to grow. Before joining Genus, David was most recently Chief Executive Officer of Synergy, where he joined in late 2020 as General Manager Commercial and was appointed as CEO in early 2022. Prior to that, he spent over a decade with Western Australian utility Western Power where, as executive manager of asset operations, he managed blue collar workforces, CapEx and OpEx works programs across multiple locations. Over the course of his career, Mr Fyfe has held senior managerial positions in technical, commercial sales, customer service and operations environments. Prior to Western Power, he was Group Manager of Enterprise Sales at Telstra in WA. He has also held several board positions across listed and not-for-profit organisations. He is currently the Chair of the Fiona Wood Foundation and a Non-Executive Director of Ability WA. David has an Honours Degree in Electrical and Electronic Engineering from the University of Strathclyde in Glasgow and is a graduate of the Institute of Company Directors.

Hasan Murad - Egm - Commercial

Hasan Murad has over 35 years’ experience in the construction industry which have been honed across a wide range of high profile, multibillion-dollar projects within the power, marine, dredging, rail, mining and major LNG related infrastructure sectors. With a unique blend of commercial acumen, legal practice and engineering knowledge, Hasan was head of infrastructure business at Qatar Petroleum/North Field LNG which included being accountable for infrastructure projects including almost USD 8 billion expenditure on port expansion, common cooling facilities and LPG tank farm common areas. Hasan was an advisor to South Australian Government – Department of Transport on contracting strategy to rail electrification Project worth $2.5 billion, the claims and contracts manager for Flour/SKM Joint Venture and more recently Area Manager (Contracts Delivery) for Western Power responsible for the delivery of all major projects including transmission lines and substations, including $180 million 330kV line substations. Hasan is recognised for high standards and his ability to manage and close out construction contracts, claims and disputes. He was listed as an expert within Thomson Reuters panel of experts in construction claims.He has a Diploma of Engineering, Bachelor of Law in Australia and Lebanon and is a member of the Society of Construction Law Australia.

GNP has just managed to breach the $4 mark today, on the back of a recent slew of contract wins

Individually, none are particularly huge but would seem to validate the thesis that they are gaining significant momentum.

This slide gives a summary of the 3 arms of the business all continuing to perform well:

GNP is my largest holding in my "beer money portfolio" (ie not Super)

Slowly catching up with companies I follow/own but not many others do, as this is of more interest than the already excellent coverage others have provided on more common holdings.

I cannot prove the same depth or quality of assessment as others, particularly in breaking down in questioning financial statements as more esteemed members, but hope there are some points that are worthwhile.

For context (and for new members), GNP is one of my largest holdings in my portfolio outside of Super. I have been happy with their progress since I have owned and so far the thesis is holding and panning out pretty much as well as I could have hoped. This is not a company with fantastic near term re-rate potentials, but I hope to be one of those steady 15-20% compounders. Rare gems.

In summary, it was another great half with headline numbers all impressively up (with exception of their debt - due to an acquisition)

They split their business into three segments, infrastructure, industrial and telecommunications

To me, the first two are an ever increasingly overlapping set of circles in a Venn diagram.

They infrastructure and industrial segments are mostly exposed to the "green revolution" of the renewable energy grid build out. Predominantly this means pylons, batteries and smart grid upgrades to existing networks. But an increasing part of their contracts have a repair and maintenance contract build in which gives a recurring revenue:

This is increasing quickly and gives a small degree of downside protection to the investment thesis. These segments contribute the majority of the earnings. Interestingly, the "telecoms" servicing business which I had always thought to be a lemon and an irrelevance to the rest of the company, has had a spectacular turn around:

It is also good to see the revenue by geography slowly become less concentrated in WA. This remains a significant risk.

EPS has increased 50% vs pcp

Overall a great result and......

The outlook is rosy:

The only issue was the suspension of the dividend, which caused an intra-day drop in the SP of ~6% from memory. It is now up 7% from the pre-announcement SP.

I am happy with this decision as I believe this reflects a conviction that the company can achieve a higher ROIC with that money than returning as dividends, to the benefit of all shareholders.

David Riches, the Director, is a 50% shareholder.

HELD IRL & SM

Not the largest contract in the world, but another proof of concept win.

Ausgrid supply 1.8 million homes in NSW. This is one of their first smart grid upgrades, and GNP are in the box seat. Importantly, this is an east coast contract, validating their take over activity of the last few years.

There has been a fair bit of discussion of engineering services companies on Strawman, I remain non-plussed why this company hasn't received more love. It's kicking goal after goal and rewarding shareholders handsomely. The energy transition and grid re-build is only just starting with an expected $16-20 billion price tag over the next 10 years.

It's still reasonably priced and one of my biggest holdings IRL.

C

Pretty good result from GNP as largely flagged in previous updates.

All metrics improved significantly and they confidently predict increased contracts wins and higher recurring revenue through service contracts. It is largely due to the rapid increase in the Industrial segment, see below, which builds electrification solutions (Poles, wires and BESS stations)

EPS have leapt to 10.8 cent, up 43.4%, this makes the current ~PE 20. They predict strong growth of the medium term and "at least 20% increase in EBITDA", so not expensive for company with good medium term growth prospects. Maybe a forward PE of 15?

The other aspect that is gratifying to see is the ROE start to trend beck up towards where it has been historically 15-25%. This fills me with a bit more confidence that the recent big acquisitions have been successful and it is becoming a quality company.

I'll do a valuation a bit later today if I get the chance

EDIT: PE should have been 20 not 9.2. Ive rounded it up to 20 for simplicity. A few more comments included

GNP published their 1/2yr today. The headline numbers are positive and the SP has edged higher after appreciating significantly over the last few months:

They have been expanding eastward from their home state of WA and are staking a claim to be part of the $20 billion "re-wiring the nation" program. This "new grid" has been talked about a lot over the past few years but the Government is actually starting to throw some real money at it now, and this can be seen by how large the potential order book is now. GNP have a healthy pipeline of works and have been winning contracts fairly regularly in all states. There are three arms to the business but I am predominantly interested in the New Energy Infrastructure section.

Before they expanded eastward, they had a very healthy ROE in excess of 25% (at one point in excess of 40%), but given the investment and re-structuring required to compete in the Eastern states this has dropped to the low - mid teens.

Of note, I was pleased they elected to not pay a dividend but instead re-invest the cash into growing the business.

My thesis for this company is as follows:

- there are healthy tailwinds creating a sh*t-ton of work that needs to be done over the next 10 years and beyond

- GNP have demonstrated they can win large contracts and deliver them

- As efficiency returns to the business, they will return to their above average ROE and hence become a highly attractive business

The risks are the that they cannot return to that higher ROE because:

- they are competing in a new market, with new operating costs and I am comparing apples to oranges

- they bid for a big contract and find they are on the hook for a blow out in costs

- the cost of labour continues to escalate and their margin gets eroded away by the time arbitrage thingy working in reverse

it is therefore concerning that contract and labour hire costs are increasing proportionately faster than revenue:

I currently hold - please see valuation straw for updated numbers

Bell Potter maintains a Buy recommendation with a Target Price of $1.18/sh (previously $1.72/sh).

@Noddy74 thanks for your straw on GenusPlus. Coincidently, I have recently added GNP to my watch list (don’t hold yet).

For what it’s worth, Steven Anastasiou from Bell Potter has forecast the following (data on Simply Wall Street):

Revenue: FY23 $454 million, FY24 $493 million and FY25 $544 million.

NPAT; FY23 $12 million, FY24 $23 million (13 cps).

I’m not sure what you think of these estimates @Noddy74. If they turn out to be correct that would get the business back to a ROE of c. 20% and I think that would make GNP good buying at the current price of 96 cps (7.4x FY24 earnings). The outlook sounds promising, bar the inflationary headwinds.

OUTLOOK (from 1H results announcement)

The Company orderbook is strong with $413 million work in hand comprised of $215 million for FY23 and $198 million FY24.

The tendered pipeline of $1.446 billion, up from $848 million at the end of FY22 and budget pricing and opportunity leads (excluded from tender pipeline) have increased to in excess of $3 billion which represents strong growth potential for the group.

The Group expects to see continued growth from its east coast operations. The Federal Governments $20 billion Rewiring the Nation Plan is designed to ensure the transmission infrastructure is funded & delivered. Genus is one of the few Australian companies operationally capable of completing large-scale Transmission & Distribution projects and is set to benefit from the Rewiring the Nation Plan.

Genus expects to return to strong growth in the medium term with a large pipeline of renewables, transmission projects and network connections to drive medium to long term growth in the business.

The increased focus of the network issues around Australia should see significant opportunities present during the coming 10-20 years as the Australian power network goes through a substantial transition from traditional energy source of coal to generation from new and renewable energy.

Genus continues to manage challenges across the supply chain, inflation and labour supply and we expect them to continue into FY2023.

Disc: not held

It's not an industry I love but GenusPlus was worth looking at last year given some of the other attributes it was showing that I did like. These included:

- founder led

- with high insider ownership (over 50%)

- which he was increasing with on market purchases despite recent listing

- viable growth prospects by moving to eastern seaboard, but remaining in core competency

- strong tailwinds given government investment in connecting renewables to the grid

- no net debt

Going back and looking at the half year result I'd say the thesis is still hanging in there but with a few challenges that will need to be overcome. Revenue growth slowed (and even went backwards half on half) and costs continued to rise, which meant half year earnings before tax were the lowest in some time, although still significantly positive. To enable their growth into the eastern states they've been reasonably acquisitive and some of those appear to have integrated better than others.

Despite this I think there is some reason for optimism. The Comms business is a bit of a problem child but commentary suggests the most recent quarter has seen a turnaround - this will be on watch in the full year result. But the real reason for optimism comes from the order book and tendered pipeline, which are at record levels. I like the way GenusPlus break down the order book and pipeline by financial year. My base case has them doing $260m in 2H FY23, which is alot more than their order book for the next six months but they'd only need to deliver about a quarter of their tendered pipeline in order to do that. In the previous two years they delivered 46% and 59% of the pipeline. If they do $260m revenue I think they could come out with profit before tax of around $15m or about 11x their EV - a level I'd be ok with but not too excited about.

If they can get closer to my bull case than I think they would look really good value. To do that they'd need to deliver closer to their historical level of pipeline and do $300m revenue in 2H. At that level they're probably closer to $24m PBT, which is about 6x their EV. Given the combined order book and pipeline for FY24 and beyond, that the looks very interesting.

None of these figures include the Humelink tender (except as pipeline), which they were recently announced as preferred proponent in a JV with two other entities. That deal is worth $3.3b, although it's not clear what portion of that is attributable to Genus.

Still, lots could go wrong:

- Skinny margins make costings critical

- Look likely to continue to be acquisitive, which brings opportunity and risks

- Relative to 12 months ago a lot of the heavy lifting in FY24 looks like needs to be coming from the pipeline. You'd rather that was tied in as firm orders

- Timeline until 'Rewiring the Nation' really gets going is not clear, presenting a potentially awkward patch to get through before tailwinds really kick in

[It's a small real life only position for now. Given tailwinds I may average up into if they deliver]

The thesis that GNP is able to leverage off its contacts in WA and primarily FFI, seems to be playing out.

However, as discussed in this weeks Baby Giants, it is less clear that they can contain costs and make a profit off all this activity. I remain reasonably confident that they can, given the electrification sphere is their bread and butter - they are not expanding into a new competency.

latest announcement below. There have been previous announcements that the predicted contract value for the next few years is increasing significantly. This latest is not particularly large but does prove their ability to win contracts in this space, which is going to grow massively in the medium term

Held

MARKET UPDATE

HIGHLIGHTS:

• Genus wins Design and Construct contract with Fortescue Future Industries at the Green Energy Manufacturing Centre in Gladstone, Queensland

• Approximately $15 million contract value

• Contract work to commence immediately and estimated to be completed in 2023

• National expansion of Genus continues with growth in our Queensland operations

National essential power and communications infrastructure provider GenusPlus Group Ltd (ASX: GNP) (GenusPlus, or the Company) today announced the award of a circa $15 million contract with Fortescue Future Industries (FFI).

GenusPlus has been contracted for the design and construction of a 275kV substation at FFI’s Green Energy Manufacturing Centre (GEM) in Gladstone, Queensland.

Stage One of GEM is the construction of an electrolyser facility which will see Gladstone become a world leading hub for the manufacture of electrolysers. These are vital in the production of green hydrogen – a fuel containing zero carbon that can help decarbonise hard-to-abate sectors such as heavy haulage, shipping, aviation, and industry.

The substation designed and built by GenusPlus will support GEM operations, with work commencing immediately and estimated to be completed in 2023.

GenusPlus Group’s Managing Director David Riches said he was excited by the opportunity to extend the relationship with Fortescue Future Industries.

“It is particularly pleasing to be expanding our Queensland presence working alongside a long-term valued customer at the forefront of the green energy revolution.”

“GenusPlus will engage a local workforce of 35 personnel to complete the project using local content from regional Queensland.”

“This opportunity in the rapidly evolving Queensland market with FFI is a significant milestone for the Group. It shows yet again Genus has the capacity and expertise to support the national energy transition as we continue to seek to expand our footprint in this evolving market.” Mr Riches said.

05/09/22

not content with the two previous purchases, he has bought a further 1 million shares on-market for $920,000 !! That’s nearly $2million in the last 6 months or so.

That is quite a vote of confidence

-——————————————————————

He's at it again, CEO David Riches makes another on-market trade for $416,000.

roughly $1.15/share

That's a cool million bucks in on-market trades in the last few months.

Looking forward to their report.

There was nothing particularly wrong with this report, but I was hoping for more.

As a recap - GNP have been executing on a strategy to expand their core WA based business to the East coast by acquisition.

They have made a number of purchases over the last few years and have been successful at bidding for a lot of contracts. Consequently revenue has increased significantly, but EBIT and NPAT, not so much. In many ways this is to be expected when bedding down acquisitions, dealing with both pandemic induced labour market disruptions, supply chain disruptions and an inflationary environment - so perhaps I am being unrealistic.

I am not able to give any insight into the accounting differences between the normalised and non-adjusted figures.

Due to the increased share count from the takeover of FPA, the EPS has actually decreased:

They make much of the forward order book and pipeline being enormous. And this is great but only if its possible to make a bigger profit off all this increased work.

Management have flagged that FY23 will be a year of consolidation. It remains to be seen whether they can cope with all the pressures of assimilating new acquisitions in new geographical areas, plus all the labour market, supply chain and cost increases whilst increasing profitability.

From my reading, and David Riches repeated and sizeable on market share purchases, I have a degree of confidence that GNP can fix this. Will have to watch for drift in my thesis over next 12 months, but happy to hold for now.

Just a heads up that GNP gets a look over on latest podcast. If anyone is interested in some further research on this company.

CEO D Riches, who already owns 58% of shares, bought another 1/2 million on market for nearly $600k.

no small vote of confidence in the company’s future!

Genus have made a couple of further small steps recently.

on 17/12 they announce a new contract win for $30m. This is for the construction of a nearly 100km transmission line for a subsidiary of FMG in the Pilbara. This cements an ongoing working relationship with FMG which I raised in the bull case below.

Today they announced the acquisition of 50% of Blue Tongue for $1 m which is modest multiple of this year’s turnover of $3.5m. They expect to do $7m in FY22. At first blush this would appear to be too small to announce as price sensitive. However BT, specialise in renewable energy and hybrid energy projects. Solar, BESS, battery storage and hydrogen technology.

Genus are clearly pivoting to be able to compete for all the upcoming projects in renewable energy. It might be a long bow to draw, but it’s not impossible to connect FMG and FFI’s known huge plans to develop green hydrogen, the already cosy relationship with Genus, and the increasing capability of Genus to bid for complex renewable energy projects.

I am also hopeful that as WA opens up that labour costs there will be contained allowing GNP to maintain margins.

the SP has increase ~20% since my last valuation, which, I will retain, but there have been significant improvements which I think bode well for the future.

GNP announced a contract win for $16m for the construction and maintenance of a Defence industry Power installation.

This is of inconsequential financial significance, however it demonstrates 2 important and potentially positive facts:

1) it is a win in QLD, ie outside of their home base in WA and in the territory of one of their new take overs. To a certain extent this validates their expansion strategy

2) It is new government customer and hopefully indicates their ability to win potentially larger and more lucrative government contracts.

The number of buyers has increased significantly since this announcement, and the SP has increased 7%. As mentioned previously, it is highly illiquid - yesterday there were only 2 sellers.

I believe it still remains undervalued.

Release

11 November 2021

For immediate release to the market

GENUSPLUS GROUP LTD - MARKET UPDATE

HIGHLIGHTS:

- Genus wins first power infrastructure contract for the Defence industry in Queensland

- Construction and maintenance of Defence industry infrastructure is a large market in Australia with

- significant barriers to entry

- Genus sees this market as a logical extension to the work that it already does for the government on critical infrastructure

- The power installation contract has a value of circa $16 million

- Contract work is to start in November 2021 and be completed over approximately 6 months

- The contract also continues the national expansion of Genus and it will be accompanied by a new central Queensland branch for Genus

GENUSPLUS GROUP CONTRACTS UPDATE

Perth-based essential power and telecommunications infrastructure provider GenusPlus Group Limited (ASX: GNP) (“GenusPlus”, or the “Company”) today announced its first contract win in the defence sector

GenusPlus, has been awarded a contract with Laing O’Rourke for the Australia-Singapore Military Training Initiative (“ASMTI”) training area at Shoalwater Bay. ASMTI is an opportunity for Australia to build Defence capability and enhance its bilateral relationship with Singapore, while providing enduring economic benefits to Central and North Queensland.

The power installation contract has a value of approximately $16 million. The contract is scheduled to commence immediately and be completed over a period of approximately 6 months. The works will be completed by our Queensland branch. The scope of work includes the installation, testing and commissioning of high voltage electrical cables and associated equipment as part of the new and upgrading of existing facilities and infrastructure.

GenusPlus Managing Director, David Riches, said “The Shoalwater Bay ASMTI contract in Queensland is of particular significance as it contributes to the national expansion of the Company, and continues to demonstrate a strong return on the investment we have made in Queensland. It is also our first power installation contract servicing the defence industry. We look forward to completing the works safely and on time.”

Further, GenusPlus has established a new central Queensland branch in Rockhampton that is expected to facilitate expansion into the region’s growing and developing industries.

GNP are aiming to expand their core PowerlinePlus business from a predominantly West Coast business to include the Eastern States. This is their bread and butter, but moving focus from one geography to another is not without execution risk. Multiple acquistions make that risk larger.

Thay are also making a bit of play for the renewables market.

They are also aiming to diversify their revenue streams by creating several other divisions:

Diamond - telecoms division. They have recently acquired staff and contracts off Tandem (a Melbourne based operation) that went bust. Telstra was a large customer.

rebuild ECM - I dont really understand this arm of the business as they have provided next to no details in any of their communications. It counts for 3% of revenue in their prospectus

Power - create a steady recurring revenue maintenance arm

Too much going on?

My major concern is that htey have bitten off more than they can chew and/or digest. The acquisitions have all been small in comparison to the parent company, but trying to replicate a successful culture in multiple locations at the same time could be a step too far.

Its the COVID, stupid

WA is not a separate state, its a separate country these days. Contrary to the sandgropers opinion, 'rona will make it there one day. The bulk of GNPs operations have been carrying on in without any impact, but this cant last. It's unknown what this will do to their operations.

Boom bust

The 30% of the business exposed to the raw materials industry could be adversely effected if resource boom runs out of steam (China, Evergrande, Fed tightens, insert risk here)

Key man risk

Seems like the main man David Riches is an integral part of the success story. Its unclear what would happen if he left or were otherwise unable to continue.