Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

• Genus, as part of the ACCIONA Genus JV (AGJV) has been awarded a contract by AusNet to

construct the Western Renewables Link (WRL) Project in Victoria subject to project approvals

• AGJV Contract for the construction of WRL is worth approximately AUD$1.6 billion

• A further strategic move into the VIC Renewables market for Genus

GNP are 25% of the partnership, so a $400m increase revenue

However, it’s not unalloyed good news given the grumpy farmers blocking access to Vicgrid like these two:

Its difficult to know if resistance to the work will incur extra costs for GNP or not

SP up 10% on the news

Here’s the link to the announcement

GNP has already surpassed my valuation for the end of next FY. There have been a couple of director sales, and referencing the other straw on position sizing, I am going to sell ~10% of my holding on SM and IRL, to bring it down to a still weighty 25%

Still have great confidence in the future, but this is not a company that will be exponential in profitability!

c

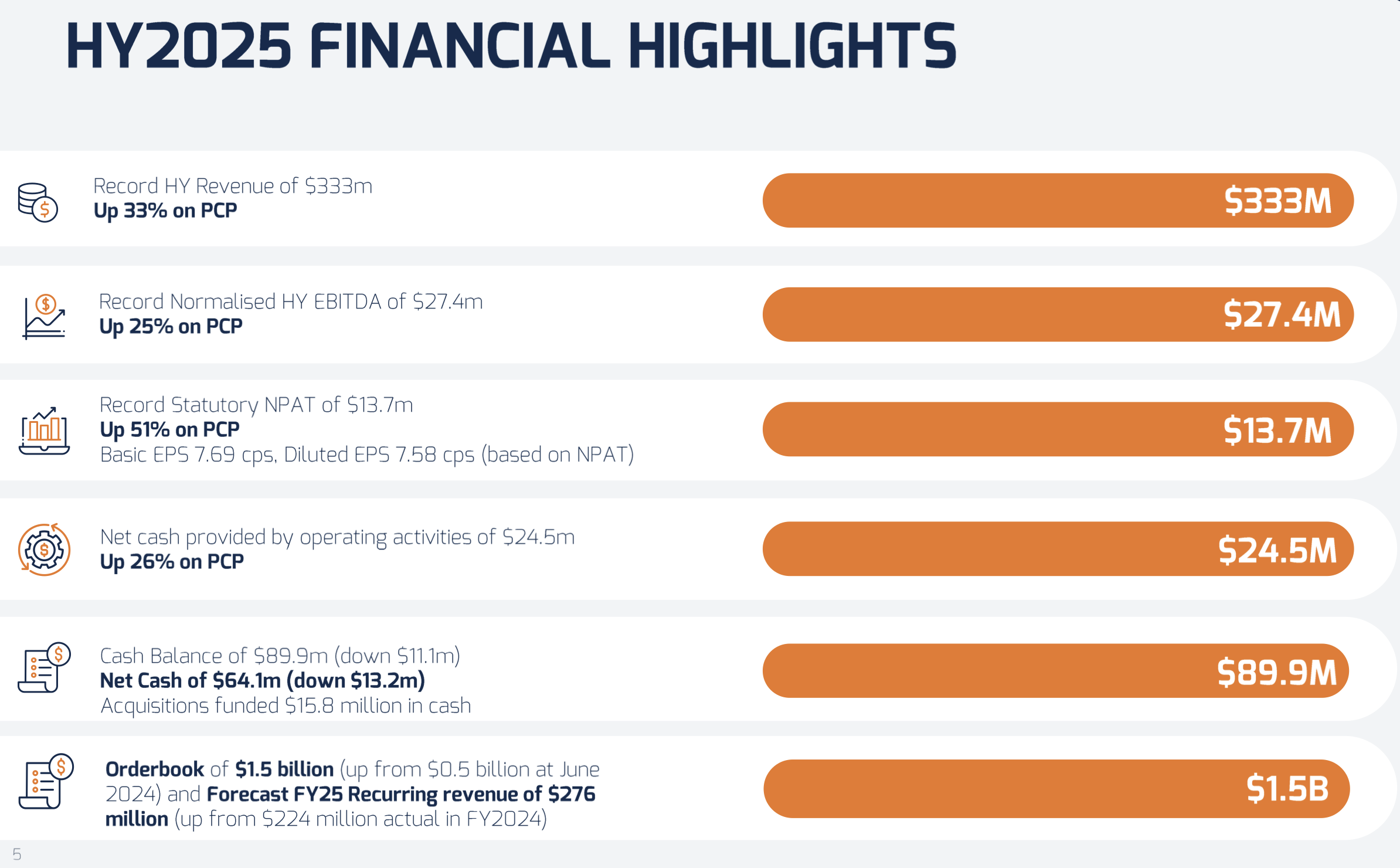

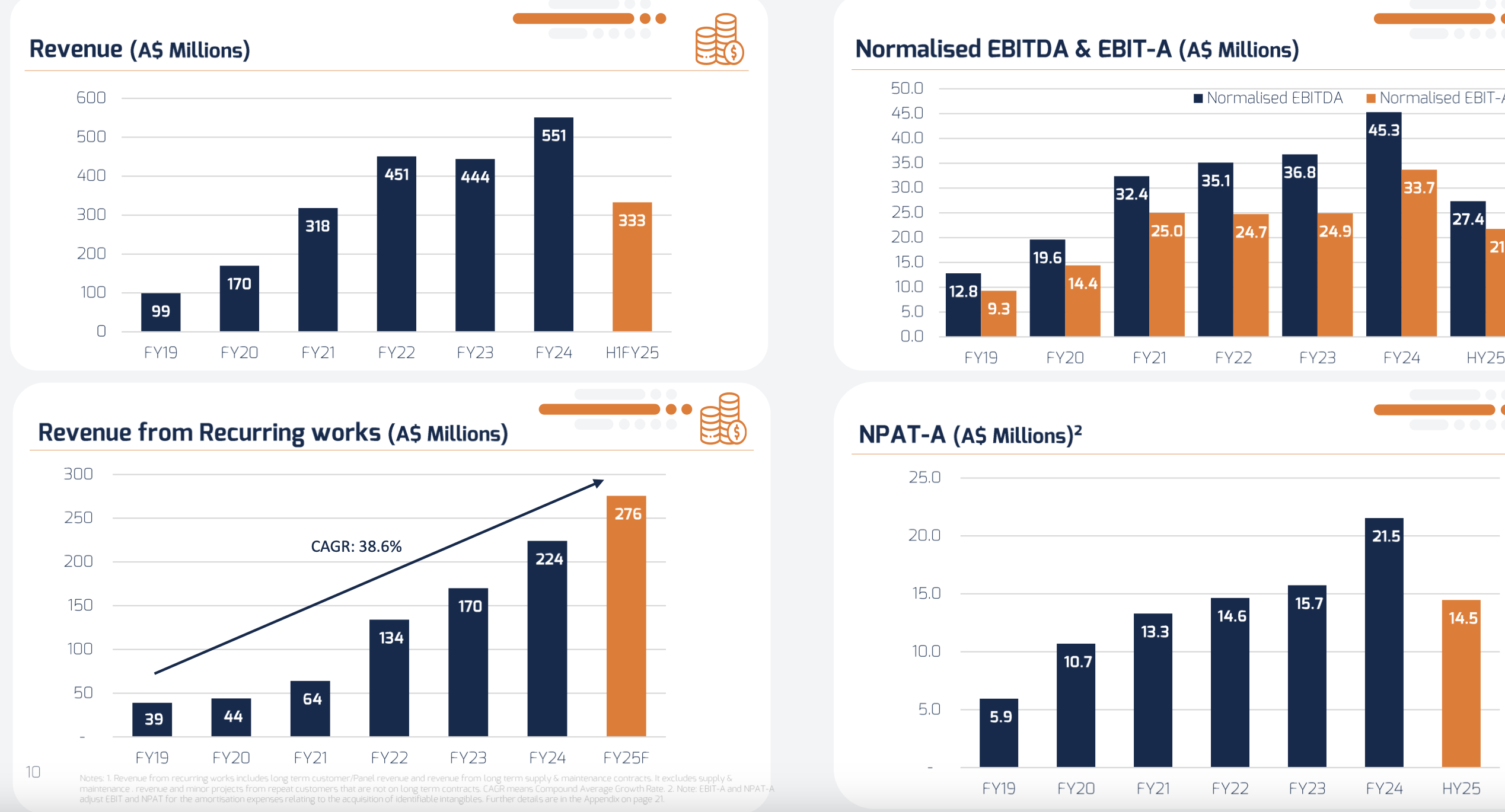

GNP posted there results for FY 2025 and it was another good one:

Selected highlights

All 3 divisions of the business saw huge improvements and with the Energy transition still in the early stages and GNP able to bid for an execute profitably on multiple projects, plus have an increasing fraction of revenue coming from maintenance as evidenced by the above graph, the future continues to look good.

I calculate

Net profit margin is 4.7% - about standard for the industry they operate in

ROE of 25.2%

The SP is up ~15% in early trade producing a PE ratio of ~25 with isn't too onerous given how full the order book is.

GNP is my largest holding outside of super and is now an outsized 25% of that portfolio. I am happy to keep it that size as my confidence in their future is high.

You can access full results here https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02984836-6A1280466&v=4a466cc3f899e00730cfbfcd5ab8940c41f474b6

HELD IRL AND SM

GNP has just managed to breach the $4 mark today, on the back of a recent slew of contract wins

Individually, none are particularly huge but would seem to validate the thesis that they are gaining significant momentum.

This slide gives a summary of the 3 arms of the business all continuing to perform well:

GNP is my largest holding in my "beer money portfolio" (ie not Super)

Slowly catching up with companies I follow/own but not many others do, as this is of more interest than the already excellent coverage others have provided on more common holdings.

I cannot prove the same depth or quality of assessment as others, particularly in breaking down in questioning financial statements as more esteemed members, but hope there are some points that are worthwhile.

For context (and for new members), GNP is one of my largest holdings in my portfolio outside of Super. I have been happy with their progress since I have owned and so far the thesis is holding and panning out pretty much as well as I could have hoped. This is not a company with fantastic near term re-rate potentials, but I hope to be one of those steady 15-20% compounders. Rare gems.

In summary, it was another great half with headline numbers all impressively up (with exception of their debt - due to an acquisition)

They split their business into three segments, infrastructure, industrial and telecommunications

To me, the first two are an ever increasingly overlapping set of circles in a Venn diagram.

They infrastructure and industrial segments are mostly exposed to the "green revolution" of the renewable energy grid build out. Predominantly this means pylons, batteries and smart grid upgrades to existing networks. But an increasing part of their contracts have a repair and maintenance contract build in which gives a recurring revenue:

This is increasing quickly and gives a small degree of downside protection to the investment thesis. These segments contribute the majority of the earnings. Interestingly, the "telecoms" servicing business which I had always thought to be a lemon and an irrelevance to the rest of the company, has had a spectacular turn around:

It is also good to see the revenue by geography slowly become less concentrated in WA. This remains a significant risk.

EPS has increased 50% vs pcp

Overall a great result and......

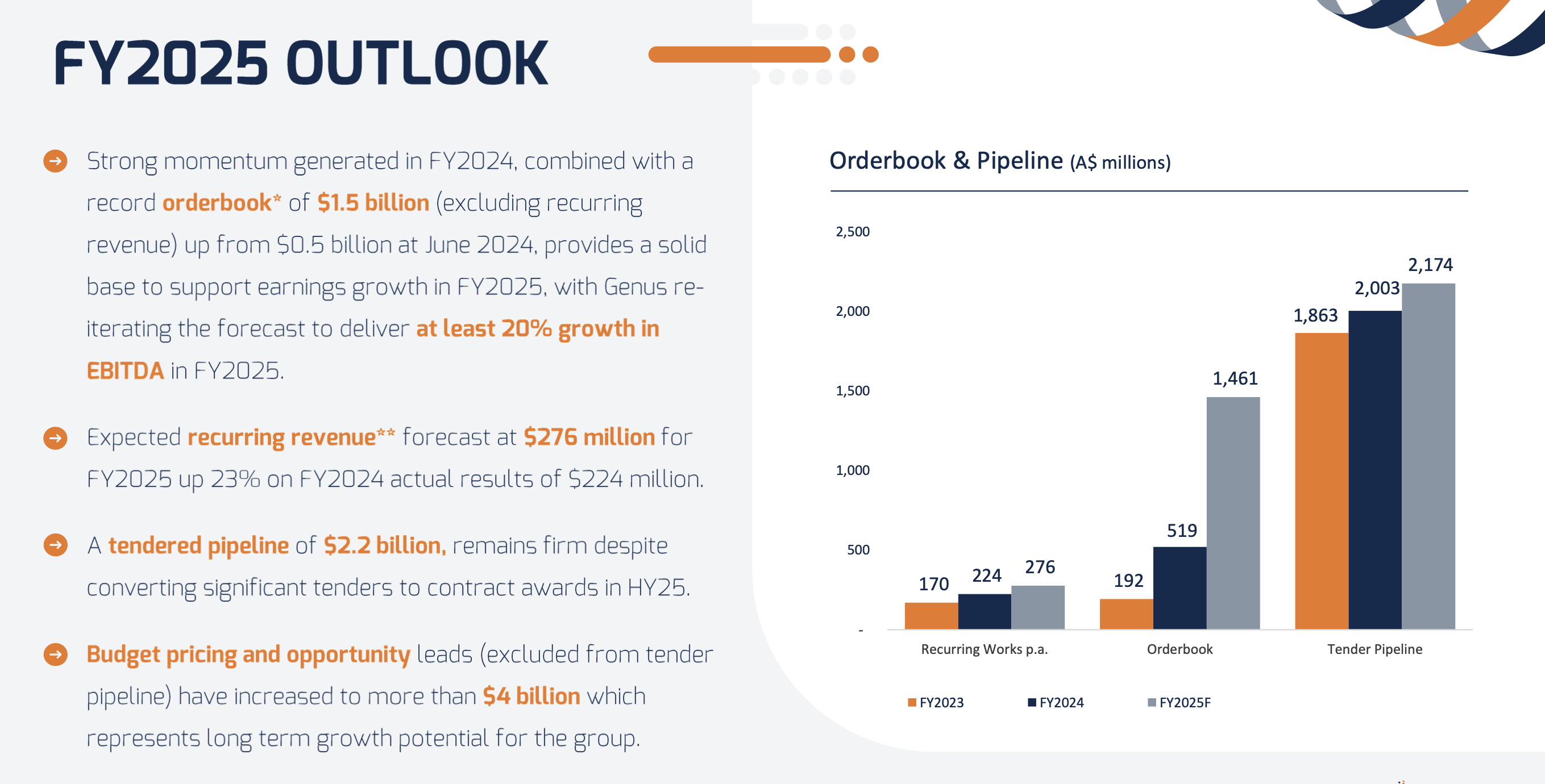

The outlook is rosy:

The only issue was the suspension of the dividend, which caused an intra-day drop in the SP of ~6% from memory. It is now up 7% from the pre-announcement SP.

I am happy with this decision as I believe this reflects a conviction that the company can achieve a higher ROIC with that money than returning as dividends, to the benefit of all shareholders.

David Riches, the Director, is a 50% shareholder.

HELD IRL & SM

GENUSPLUS AWARDED CONTRACT FOR WESTERN POWER CLEAN

ENERGY LINK – NORTH REGION PROJECT

HIGHLIGHTS:

• Genus has been awarded a contract for Western Power’s Clean Energy Link – North Region

project

• Contract value of approximately $270 million

• Work will commence in January 2025 with scheduled completion expected mid-2027

GNP announced another smart grid contract win today. This time in Tassie: its small but the carrot is the whole contract would be worth nearly $1bn.

There is no suggestion they the full $1bn is likely to be awarded to GNP. It is extremely unlikely, however they could get a reasonable fraction of that.

Interesting to see how this case evolves, validates the thesis that GNP are well positioned for many of these large contracts that will be rolling out over the medium term

GENUS AWARDED CONTRACT FOR TASNETWORKS NORTH WEST

TRANSMISSION DEVELOPMENTS (NWTD) STAGE 1 PROJECT

HIGHLIGHTS:

• Genus has been awarded a contract for Stage 1 of TasNetworks’ North West Transmission

Developments (NWTD) project.

• The staged contract commences with award to Genus of the Early Contractor Involvement phase of

NWTD Stage 1 under an initial Limited Notice to Proceed for approximately $42 million.

• Works comprise new dual circuit 220kV transmission lines with decommissioning and demolition of

existing 220kV single circuit lines, augmentation of Burnie, Sheffield and Palmerston substations,

and construction of the Heybridge Switching Station.

National essential power and communications infrastructure provider GenusPlus Group Ltd (ASX: GNP) (Genus or

the Company) has entered into a 2-part contract with TasNetworks, commencing with an Early Contractor

Involvement (ECI) Phase of NWTD Stage 1 followed by a Construction Phase.

Together with Marinus Link, NWTD will contribute to Australia meeting its future energy demands through a greater

mix of low emission renewable energy sources. These projects, together being ‘Project Marinus’ will support the

increased supply of low-cost, reliable renewable energy in Tasmania and to the National Electricity Market as Australia

transitions to a low carbon future. In accordance with the RIT-T update submitted to the Australian Energy Regulator

in April 2024, the estimated total project cost for NWTD Stage 1 is approximately $950 million.

NWTD Stage 1 involves the upgrade and augmentation of the existing transmission network in North-West Tasmania

and will support the connection of Marinus Link Stage 1 and the likely future demand from increased renewable

energy production in Tasmania.

NWTD Stage 1 consists of the design, procurement and construction, pre-commissioning, and commissioning of; dual

circuit 220kV Transmission Lines for Palmerston to Sheffield and Sheffield to Heybridge to Burnie (and the removal

of the existing 220kV single circuit transmission lines between Palmerston to Sheffield and Sheffield to Burnie);

substation augmentations at Palmerston, Sheffield and Burnie; and a new Switching Station at Heybridge to enable

connection of Marinus Link into the Tasmanian 220kV transmission Network.

The initial Limited Notice to Proceed will incorporate the ECI Phase, to include engineering and design and surveys.

The ECI Phase has an approximate value of $42 million. Long lead time equipment and material procurement will

follow under separate early works agreements during the LNTP phase. Following the ECI Phase, and subject to

TasNetworks’ issuing a Notice to Proceed, the Construction Phase will then commence.

The Construction Phase of NWTD Stage 1 is subject to conditions including a Final Investment Decision, Planning

and Environmental approvals, and the Australian Energy Regulator’s (AER) revenue determination, with the

Construction Phase expected to commence Q2 2026 and scheduled for completion in 2029.

Genus Managing Director, David Riches, said Genus is very pleased to be expanding its presence on the East Coast

and working with TasNetworks on the delivery of this important project in Tasmania.

“Genus is very pleased to have secured this project in Tasmania and to be working with TasNetworks on a project

that will assist with supporting increased supply of low-cost, reliable renewable energy in Tasmania and to the National

Energy Market, bringing significant benefits to Tasmanians. Genus is looking forward to developing a strong and

longstanding relationship with TasNetworks as a key delivery partner.

happy holder

c

Not the largest contract in the world, but another proof of concept win.

Ausgrid supply 1.8 million homes in NSW. This is one of their first smart grid upgrades, and GNP are in the box seat. Importantly, this is an east coast contract, validating their take over activity of the last few years.

There has been a fair bit of discussion of engineering services companies on Strawman, I remain non-plussed why this company hasn't received more love. It's kicking goal after goal and rewarding shareholders handsomely. The energy transition and grid re-build is only just starting with an expected $16-20 billion price tag over the next 10 years.

It's still reasonably priced and one of my biggest holdings IRL.

C

Pretty good result from GNP as largely flagged in previous updates.

All metrics improved significantly and they confidently predict increased contracts wins and higher recurring revenue through service contracts. It is largely due to the rapid increase in the Industrial segment, see below, which builds electrification solutions (Poles, wires and BESS stations)

EPS have leapt to 10.8 cent, up 43.4%, this makes the current ~PE 20. They predict strong growth of the medium term and "at least 20% increase in EBITDA", so not expensive for company with good medium term growth prospects. Maybe a forward PE of 15?

The other aspect that is gratifying to see is the ROE start to trend beck up towards where it has been historically 15-25%. This fills me with a bit more confidence that the recent big acquisitions have been successful and it is becoming a quality company.

I'll do a valuation a bit later today if I get the chance

EDIT: PE should have been 20 not 9.2. Ive rounded it up to 20 for simplicity. A few more comments included

GNP has rallied significantly over the last 6 months and is now sitting at ~$1.90.

They updated the market yesterday with increased guidance:

So, the bull case is very much coming to pass: they are winning more and larger contracts and managing to maintain reasonable margins on contracted work (a big worry for me previously).

There are huge tailwinds in this sector as outlined in previous straws, and it is great to see them executing well.

@Strawman would it be possible to get David Riches in for a meeting to see what he has to say?

Thanks

Held: 11% IRL (beer money portfolio)

GNP published their 1/2yr today. The headline numbers are positive and the SP has edged higher after appreciating significantly over the last few months:

They have been expanding eastward from their home state of WA and are staking a claim to be part of the $20 billion "re-wiring the nation" program. This "new grid" has been talked about a lot over the past few years but the Government is actually starting to throw some real money at it now, and this can be seen by how large the potential order book is now. GNP have a healthy pipeline of works and have been winning contracts fairly regularly in all states. There are three arms to the business but I am predominantly interested in the New Energy Infrastructure section.

Before they expanded eastward, they had a very healthy ROE in excess of 25% (at one point in excess of 40%), but given the investment and re-structuring required to compete in the Eastern states this has dropped to the low - mid teens.

Of note, I was pleased they elected to not pay a dividend but instead re-invest the cash into growing the business.

My thesis for this company is as follows:

- there are healthy tailwinds creating a sh*t-ton of work that needs to be done over the next 10 years and beyond

- GNP have demonstrated they can win large contracts and deliver them

- As efficiency returns to the business, they will return to their above average ROE and hence become a highly attractive business

The risks are the that they cannot return to that higher ROE because:

- they are competing in a new market, with new operating costs and I am comparing apples to oranges

- they bid for a big contract and find they are on the hook for a blow out in costs

- the cost of labour continues to escalate and their margin gets eroded away by the time arbitrage thingy working in reverse

it is therefore concerning that contract and labour hire costs are increasing proportionately faster than revenue:

I currently hold - please see valuation straw for updated numbers

GENUSPLUS & SAMSUNG C&T JOINT VENTURE AWARDED MELBOURNE

RENEWABLE ENERGY HUB PROJECT

National essential power and communications infrastructure provider GenusPlus Group Ltd (ASX: GNP) (Genus or

the Company) has, in joint venture with Samsung C&T Corporation, been awarded three contracts for the

engineering, procurement, construction, and commissioning for the Balance of Plant scope and BESS installation for

a 600MW/1,600MWh battery energy storage project for Phase 1 of the Melbourne Renewable Energy Hub (MREH)

on a lump sum and turn-key basis.

MREH is a globally significant energy storage precinct located 25km northwest of Melbourne’s commercial business

district. The MREH project is owned by Equis Development Pte. Ltd (“Equis”), Asia-Pacific’s leading infrastructure

developer and Victoria’s State Electricity Commission (SEC). Equis’ major shareholders are Abu Dhabi Investment

Authority and Ontario Teachers' Pension Plan Board. As a Project of State Significance with the Victorian Government

gazetting a Planning Scheme amendment in April 2021, MREH has completed all required planning and

environmental approvals and community impact assessments. The combined contract values are approximately $200

million with works to commence immediately and estimated be completed by June 2025.

Fully developed, MREH will be a 1.2GW/2.4GWh Battery Energy Storage System (BESS).

MREH Phase 1 has been divided into 3 projects, 2 projects each comprising 400MWh of 2-hour storage capacity,

which will be owned 70% by Equis and 30% by the SEC and one project comprising 800MWh of 4 hour storage

capacity which will be owned 51% by Equis and 49% by the SEC.

The joint venture, where Genus has a 30% interest, will perform the turn-key contract for the engineering,

procurement, construction, and commissioning for BOP scope and BESS installation of the MREH Project.

Genus Managing Director David Riches welcomes the opportunity to play an important role in delivering this Project

of State Significance, helping to lead the transition to Australia’s clean future.

“We are delighted to have secured this contract alongside our joint venture partner Samsung C&T. This is a milestone

project for Genus. This contract gives us great confidence that the market sees our capability and capacity to deliver

a project of this size and complexity. We look forward to working closely with EQUIS to deliver the project safely,

successfully and on time.

The Board of the Company has authorised the release of this announcement to the market.

HIGHLIGHTS:

• GenusPlus and Samsung C&T joint venture has been awarded Melbourne Renewable Energy Hub

(MREH) Project

• Joint venture comprises Genus 30% and Samsung C&T 70%

• The Contract for MREH engineering, procurement, construction, and commissioning for BOP

scope and BESS installation works is valued at approximately $200 million

• The MREH Project will be a 600MW/1600MWh Battery Energy Storage System (BESS)

Improving narrative for energy transition, particularly if they can land a few similar contracts in the Eastern States

GENUSPLUS AWARDED SYNERGY KWINANA BATTERY ENERGY STORAGE SYSTEM STAGE 2

HIGHLIGHTS:

• Genus has been awarded Kwinana Battery Energy Storage System Two (KBESS2) Civil and Electrical Balance of Plant

• Contract for KBESS2 Civil and Electrical Balance of Plant works approximately $90 million

• KBESS2 will be Synergy's second lithium-ion, large scale battery energy storage system, and the

largest, in the South West Interconnected System (SWIS)

• KBESS2 will connect to the 330kV Western Power transmission system via existing infrastructure at the adjacent KBESS1 site

National essential power and communications infrastructure provider GenusPlus Group Ltd (ASX: GNP) (Genus or the Company) has been awarded a contract by Synergy to perform the Civil and Electrical Balance of Plant works (BOP Works) for the KBESS2 250 MVA/1000 MWh battery storage facility located in Kwinana. The contract including early works has an approximate value of $90 million. The contract is scheduled for completion by the end of 2024.

The BOP Works will include all works and services required to complete the: civil and structural works; precast and in-situ concrete culverts for cable trenches; earthing system; firewater ring main, reticulation and hydrant system; foundations and concrete pavement; installation and commissioning of battery container units; installation and commissioning of Power Conversion Systems (PCS), comprising inverter/chargers, transformers and Ring Main Units (RMUs); installation and commissioning auxiliary substations, comprising LV distribution boards, 33/0.415 kV transformer and RMU; communication and Supervisory Control and Data Acquisition (SCADA) system; roads, drainage works, pre-action deluge dry pipe sprinkler system to battery container units; firewater supply system comprising piping, tanks (if required) and pump skid; and firewater run-off collection and transfer system comprising piping, valving, buffer pit, and pump skid.

KBESS2 has four times the storage capacity than the recently completed KBESS1. This project is part of the Western Australia State Government’s decarbonisation strategy including its commitment to retire State-owned coal power stations by 2030. KBESS2 will support the ongoing growth in distributed solar generation and the connection of large- scale renewable generation assets to the network.

Genus Managing Director David Riches welcomes the opportunity to support Synergy in leading WA’s transition to a cleaner, more reliable and affordable energy system.

“Genus is pleased to have been selected by Synergy for the Project following on from the work Genus performed at KBESS1. We welcome the opportunity to continue to work with Synergy on these exciting projects, and to develop our relationship with Synergy, and look forward to delivering the Project safely and successfully for all parties.

The thesis that GNP is able to leverage off its contacts in WA and primarily FFI, seems to be playing out.

However, as discussed in this weeks Baby Giants, it is less clear that they can contain costs and make a profit off all this activity. I remain reasonably confident that they can, given the electrification sphere is their bread and butter - they are not expanding into a new competency.

latest announcement below. There have been previous announcements that the predicted contract value for the next few years is increasing significantly. This latest is not particularly large but does prove their ability to win contracts in this space, which is going to grow massively in the medium term

Held

MARKET UPDATE

HIGHLIGHTS:

• Genus wins Design and Construct contract with Fortescue Future Industries at the Green Energy Manufacturing Centre in Gladstone, Queensland

• Approximately $15 million contract value

• Contract work to commence immediately and estimated to be completed in 2023

• National expansion of Genus continues with growth in our Queensland operations

National essential power and communications infrastructure provider GenusPlus Group Ltd (ASX: GNP) (GenusPlus, or the Company) today announced the award of a circa $15 million contract with Fortescue Future Industries (FFI).

GenusPlus has been contracted for the design and construction of a 275kV substation at FFI’s Green Energy Manufacturing Centre (GEM) in Gladstone, Queensland.

Stage One of GEM is the construction of an electrolyser facility which will see Gladstone become a world leading hub for the manufacture of electrolysers. These are vital in the production of green hydrogen – a fuel containing zero carbon that can help decarbonise hard-to-abate sectors such as heavy haulage, shipping, aviation, and industry.

The substation designed and built by GenusPlus will support GEM operations, with work commencing immediately and estimated to be completed in 2023.

GenusPlus Group’s Managing Director David Riches said he was excited by the opportunity to extend the relationship with Fortescue Future Industries.

“It is particularly pleasing to be expanding our Queensland presence working alongside a long-term valued customer at the forefront of the green energy revolution.”

“GenusPlus will engage a local workforce of 35 personnel to complete the project using local content from regional Queensland.”

“This opportunity in the rapidly evolving Queensland market with FFI is a significant milestone for the Group. It shows yet again Genus has the capacity and expertise to support the national energy transition as we continue to seek to expand our footprint in this evolving market.” Mr Riches said.

05/09/22

not content with the two previous purchases, he has bought a further 1 million shares on-market for $920,000 !! That’s nearly $2million in the last 6 months or so.

That is quite a vote of confidence

-——————————————————————

He's at it again, CEO David Riches makes another on-market trade for $416,000.

roughly $1.15/share

That's a cool million bucks in on-market trades in the last few months.

Looking forward to their report.

There was nothing particularly wrong with this report, but I was hoping for more.

As a recap - GNP have been executing on a strategy to expand their core WA based business to the East coast by acquisition.

They have made a number of purchases over the last few years and have been successful at bidding for a lot of contracts. Consequently revenue has increased significantly, but EBIT and NPAT, not so much. In many ways this is to be expected when bedding down acquisitions, dealing with both pandemic induced labour market disruptions, supply chain disruptions and an inflationary environment - so perhaps I am being unrealistic.

I am not able to give any insight into the accounting differences between the normalised and non-adjusted figures.

Due to the increased share count from the takeover of FPA, the EPS has actually decreased:

They make much of the forward order book and pipeline being enormous. And this is great but only if its possible to make a bigger profit off all this increased work.

Management have flagged that FY23 will be a year of consolidation. It remains to be seen whether they can cope with all the pressures of assimilating new acquisitions in new geographical areas, plus all the labour market, supply chain and cost increases whilst increasing profitability.

From my reading, and David Riches repeated and sizeable on market share purchases, I have a degree of confidence that GNP can fix this. Will have to watch for drift in my thesis over next 12 months, but happy to hold for now.

Just a heads up that GNP gets a look over on latest podcast. If anyone is interested in some further research on this company.

CEO D Riches, who already owns 58% of shares, bought another 1/2 million on market for nearly $600k.

no small vote of confidence in the company’s future!

GNP has announced a couple of telecommunications network deals in the last week or so. One with Telstra and now one with Hyperone. Demonstrates ability to win big national scale contracts and reinforces investment case away from being a pure power service and construction company.

HIGHLIGHTS:

• GenusPlus has executed a 5-year Framework Agreement with HyperOne as a preferred supplier for the delivery of its national communications network infrastructure

• The initial stage between Sydney and Melbourne via Canberra is expected to generate circa $50 million revenue over the first 12 months

• Works are commencing in early 2022

• The contract expands GenusPlus’ national communications services footprint and delivers

increased works resulting from the communications acquisition announced in July 2021

• The HyperOne Network will be the largest private independent digital infrastructure project in Australia’s history

National essential power and communic

Genus have made a couple of further small steps recently.

on 17/12 they announce a new contract win for $30m. This is for the construction of a nearly 100km transmission line for a subsidiary of FMG in the Pilbara. This cements an ongoing working relationship with FMG which I raised in the bull case below.

Today they announced the acquisition of 50% of Blue Tongue for $1 m which is modest multiple of this year’s turnover of $3.5m. They expect to do $7m in FY22. At first blush this would appear to be too small to announce as price sensitive. However BT, specialise in renewable energy and hybrid energy projects. Solar, BESS, battery storage and hydrogen technology.

Genus are clearly pivoting to be able to compete for all the upcoming projects in renewable energy. It might be a long bow to draw, but it’s not impossible to connect FMG and FFI’s known huge plans to develop green hydrogen, the already cosy relationship with Genus, and the increasing capability of Genus to bid for complex renewable energy projects.

I am also hopeful that as WA opens up that labour costs there will be contained allowing GNP to maintain margins.

the SP has increase ~20% since my last valuation, which, I will retain, but there have been significant improvements which I think bode well for the future.

GNP announced a contract win for $16m for the construction and maintenance of a Defence industry Power installation.

This is of inconsequential financial significance, however it demonstrates 2 important and potentially positive facts:

1) it is a win in QLD, ie outside of their home base in WA and in the territory of one of their new take overs. To a certain extent this validates their expansion strategy

2) It is new government customer and hopefully indicates their ability to win potentially larger and more lucrative government contracts.

The number of buyers has increased significantly since this announcement, and the SP has increased 7%. As mentioned previously, it is highly illiquid - yesterday there were only 2 sellers.

I believe it still remains undervalued.

Release

11 November 2021

For immediate release to the market

GENUSPLUS GROUP LTD - MARKET UPDATE

HIGHLIGHTS:

- Genus wins first power infrastructure contract for the Defence industry in Queensland

- Construction and maintenance of Defence industry infrastructure is a large market in Australia with

- significant barriers to entry

- Genus sees this market as a logical extension to the work that it already does for the government on critical infrastructure

- The power installation contract has a value of circa $16 million

- Contract work is to start in November 2021 and be completed over approximately 6 months

- The contract also continues the national expansion of Genus and it will be accompanied by a new central Queensland branch for Genus

GENUSPLUS GROUP CONTRACTS UPDATE

Perth-based essential power and telecommunications infrastructure provider GenusPlus Group Limited (ASX: GNP) (“GenusPlus”, or the “Company”) today announced its first contract win in the defence sector

GenusPlus, has been awarded a contract with Laing O’Rourke for the Australia-Singapore Military Training Initiative (“ASMTI”) training area at Shoalwater Bay. ASMTI is an opportunity for Australia to build Defence capability and enhance its bilateral relationship with Singapore, while providing enduring economic benefits to Central and North Queensland.

The power installation contract has a value of approximately $16 million. The contract is scheduled to commence immediately and be completed over a period of approximately 6 months. The works will be completed by our Queensland branch. The scope of work includes the installation, testing and commissioning of high voltage electrical cables and associated equipment as part of the new and upgrading of existing facilities and infrastructure.

GenusPlus Managing Director, David Riches, said “The Shoalwater Bay ASMTI contract in Queensland is of particular significance as it contributes to the national expansion of the Company, and continues to demonstrate a strong return on the investment we have made in Queensland. It is also our first power installation contract servicing the defence industry. We look forward to completing the works safely and on time.”

Further, GenusPlus has established a new central Queensland branch in Rockhampton that is expected to facilitate expansion into the region’s growing and developing industries.

I was trying to find out where the BESS mentioned in the latest announcement was going to be situated, but it is still confidential. With luck it will be in the Eastern States demonstrating their ability to win large contracts in new Geographical areas.

The additional 50m contract brings them up to 86.5% of the FY22 expected revenue of circa $400m

Given we are only 1/4 of the way through the FY it isnt too much of a stretch to imagine that this forecast is going to be beaten, and potentially by a significant margin.

I have also been reading up on the increasingly pressing need for more flexible power grids in the light of the surge in the price of hydrocarbons.

Australia will not be an exception to this, which plays further into the thesis for GNP.

I am looking to add to my position as dips allow. I dont anticipate a heavy news flow so hopefully sentiment will wax and wane over the next few months.

GNP are aiming to expand their core PowerlinePlus business from a predominantly West Coast business to include the Eastern States. This is their bread and butter, but moving focus from one geography to another is not without execution risk. Multiple acquistions make that risk larger.

Thay are also making a bit of play for the renewables market.

They are also aiming to diversify their revenue streams by creating several other divisions:

Diamond - telecoms division. They have recently acquired staff and contracts off Tandem (a Melbourne based operation) that went bust. Telstra was a large customer.

rebuild ECM - I dont really understand this arm of the business as they have provided next to no details in any of their communications. It counts for 3% of revenue in their prospectus

Power - create a steady recurring revenue maintenance arm

Too much going on?

My major concern is that htey have bitten off more than they can chew and/or digest. The acquisitions have all been small in comparison to the parent company, but trying to replicate a successful culture in multiple locations at the same time could be a step too far.

Its the COVID, stupid

WA is not a separate state, its a separate country these days. Contrary to the sandgropers opinion, 'rona will make it there one day. The bulk of GNPs operations have been carrying on in without any impact, but this cant last. It's unknown what this will do to their operations.

Boom bust

The 30% of the business exposed to the raw materials industry could be adversely effected if resource boom runs out of steam (China, Evergrande, Fed tightens, insert risk here)

Key man risk

Seems like the main man David Riches is an integral part of the success story. Its unclear what would happen if he left or were otherwise unable to continue.

Genusplus listed last year at $0.96.

It was a predominantly WA based company but has recently expanded to the East coast and is looking to continue this expansion through organic and possibly

It has four divisions:

- PowerlinesPlus = Design, construction and maintenance of overhead transmission and distribution lines/substations

- Diamond = Construction and maintenance of Underground power and telecommunications infrastructure (acquisition 2019)

- ECM = electrical and instrumentation services, assembly and installation.

- Protonpower = High Voltage testing and commissioning services plus repairs. (new service division)

Industry

GNP provide services to the following industries: power generation and distribution for power, utilities and resource sectors; plus similar infrastructure services for telecommunications companies.

Government customers include: Western Power, Horizon, Ergon.

Resource customers include: FMG, Rio, BHP and Roy Hill

Telecom customers include Telstra, NBN, Optus, Nokia, Ericssion.

The PowerlinesPlus division is the core business contributing ~75% of revenue.

Contracts

Vary in nature from fixed lump sum, fee for services and unit rate contracts. These create the possibility of a lumpy revenue stream as most of the revenue is from fixed price contracts. However, there is a predictable baseline of constant services revenue (~20-30%). The contracts can be with either the asset owners or as sub-contractors.

~50% of revenue comes from utilities

~30% from mining

~20% from private companies

Most of these contracts have been from Tier 1 customers where they are appointed to the panel bid for contracts.

In the past, they have demonstrated excellent cost discipline on fixed rate contracts contributing to their ROCE of >40%. (which was how I came across them whilst doing a screen for high ROCE companies)

Industry Growth and The Size of the Pie

GNP is operating in fields that are experiencing significant tailwinds.

Power:

- State and Federal government are looking to increase infrastructure spending

- Australia has an aging energy generation fleet (lots of coal) and a transmission grid which will need upgrading over the next decade.

- Specifically, about $5bn worth of interconnectors will need to be constructed.

- I anticipate a significant uptick in State backed new clean energy projects (solar and wind), which will need designing, building, connecting to the grid and maintaining.

- Same for Private companies and equity

- In total, construction and maintenance spending is expected to be ~10bn per annum over next 5 years

Mining

- new resource projects are coming on stream operating in remote areas (GNP's history in WA makes it a specialist in this area)

- Multiple companies intend to also construct processing plants to value-add to raw product extracts

- Green Hydrogen projects in WA. FMG is a current large customer and hence FFI may be well predisposed to GNP

Telecommunications:

- spend is expected to reduce after the massive NBN rollout but then increase from 2022 onwards

- the roll out of 5G is being led by Telstra (major customer) but other providers will need to increase their spend to remain competitive

- continued maintenance of NBN, existing fibreoptic and copper cable assets

Winning a bigger slice of the pie

GNP has long term relationships with existing Tier 1 clients (listed above) operating in the sectors. Historically their sphere of influence has been exclusively in WA. They have embarked on an ambitious program of expanding into the Eastern Seaboard:

- In 2019 they acquired Burton Power (unknown price) a privately held company in Townsville. Since acquisition they have been appointed to the panel of Ergon (QLD state owned network) and increased annual revenue run rate from ~$2.5m to $10m

- December 2019 acquired EC&M for $1.5m in cash

- In 2020 acquired Picton Power lines in NSW for $546k in cash

On 1 June 2021 GenusPlus Group Ltd completed a Share Sale and Purchase Agreement to acquire 100% of the shares in Connect Engineering Pty Ltd and its wholly owned subsidiaries for a total consideration of $5.55 million, including $500,000 in shares.

On 6 August 2021, GenusPlus Group Ltd through its wholly owned subsidiary Diamond Underground Services Pty Ltd finalised the purchase of selected key contracts, intellectual property, IT systems, plant and equipment and employee contracts of Tandem Corp Pty Ltd (Administrators Appointed). This acquisition greatly extends the capability of the Group’s communications division, and significantly expands the Group’s ongoing relationship with Telstra

I believe the goal with these acquisitions is to gain a toe hold in strategic areas and then utilise Genplus' demonstrated ability to execute large contracts (in WA, and now QLD) to successfully replicate their success in the Eastern states.

Inside Ownership

It was a family owned business (the Riches) and the Managing Director David Riches still owns a whopping 51% of the share count personally, and a family trust holds an additional 8.3%.

Other management own 2.1%.

Execution of strategy since listing

So far, they are certainly increasing revenue, but costs are also up considerably.

Revenue is up 87%, to $318m, EBITDA (normalised) up 65.7% to $32m, NPAT up 25% to $13.4m but impacted by one-off costs of IPO and settling claims related to ECM acquisition totalling ~$3.5m

The forward order book is very healthy with 74% of FY2022 forecast (~$400m) already contracted. They have tendered for $610m. I do note that all of the big contract wins are in WA, which is not surprising but would be good to see some evidence of East coast expansion landing some big contracts too.

ROCE remains 43%. This has been consistent for many years

Cash is sitting at $32m with $15m of debt

EPS has increased to 8.6c from 7.5c in 2020 and 4.3c in 2019.

They are paying a maiden 1.8c dividend.

Costs are increasing though, partly due to acquistion and associated costs of East coast expansion. But I also suspect a tighter labour market may also by impacting the bottom line as employee expenses and contractors/labour hire costs have ballooned from ~$100m to ~$175m.

Revenue/cost split per division - is not spelt out, however, so there is no visibility of how each part of the business is performing. I suspect that the old profitable WA business is doing very well and the other areas are loss-making. This is probably to be expected this early in the execution of the expansion, but it would be nice to see how they are tracking over time to help decide whether their strategy is working.

D Riches seems to be the driving force here. He has run the family firm for many years prior to listing and has built the company successfully over many years.

as mentioned in previous straw he owns 58% of the company, so is well aligned.

Excluding small amounts of additional shares issued for acquistions, dilution is minimal.

However, Bit of a red flag here:

Related party transactions

Legal services

During 2021, the Group used the legal services of one Company Director (Mr Paul Gavazzi) and the law firm over which he exercises significant influence. The amounts billed related to this legal service amounted to $1,144,517 (2020: $128,838), based on normal market rates. $87,472 was un-paid as of the reporting date.

Property leases

During 2021, the Group rented various properties from D. Riches and his related parties as part of normal business operations. The amount for which each property was leased was negotiated on commercial terms in accordance with lease agreements verified by the board. During 2021 $1,096,668 was recognised as an expense in relation to these properties and was fully paid as of the reporting date.

Engineering services

During 2021, the Group utilised the engineering services of Partum Engineering Pty Ltd, of which D Riches is also a Director, for design and other work related to FMG sub-station and powerlines. $6,673,059 was recognised as an expense in relation to these services and was fully paid as of the reporting date.

Injury management

During 2021, Edge People Management Pty Ltd, in which D. Riches holds an interest, provided injury management services to the Group. $15,662 was recognised as an expense in relation to these services and was fully paid as of the reporting date.

Post a valuation or endorse another member's valuation.