@Noddy74 thanks for your straw on GenusPlus. Coincidently, I have recently added GNP to my watch list (don’t hold yet).

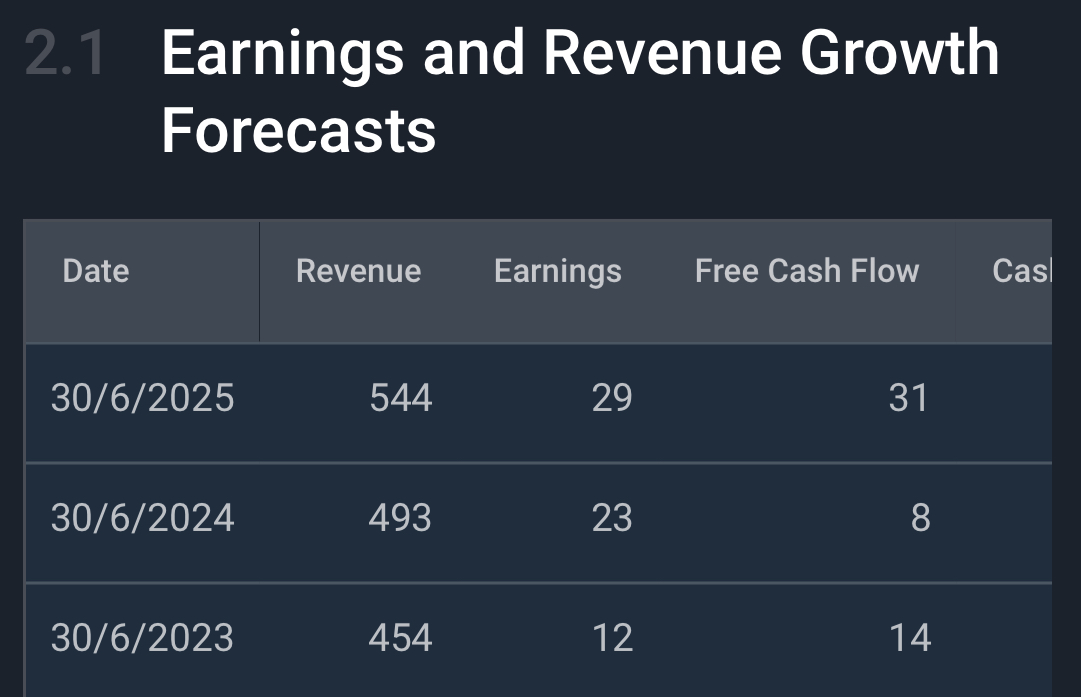

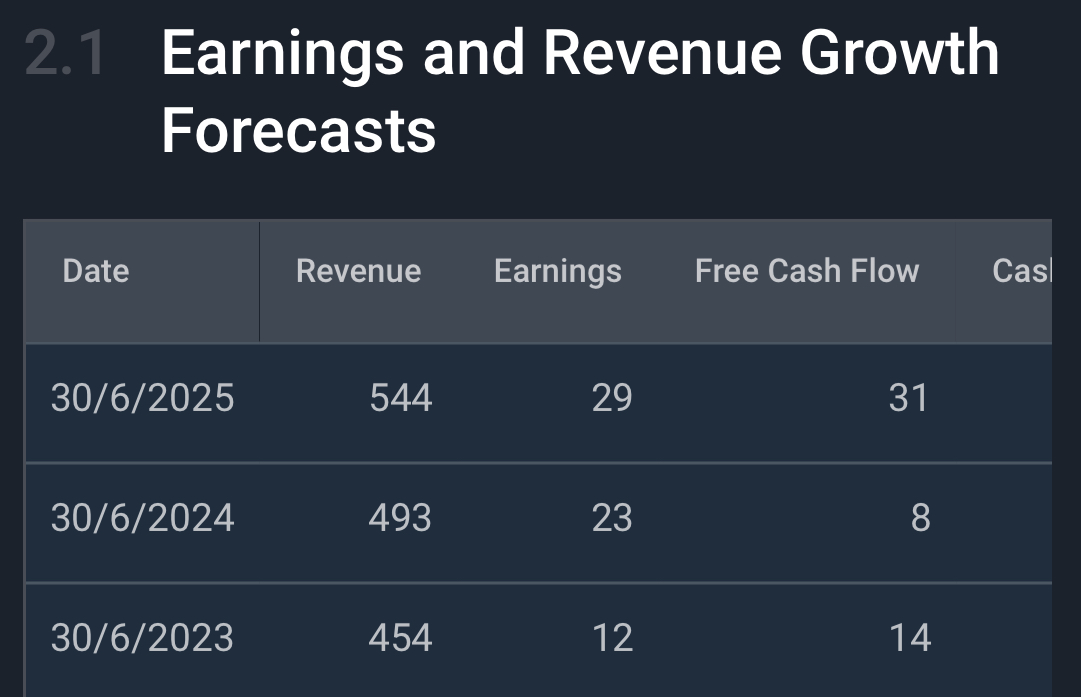

For what it’s worth, Steven Anastasiou from Bell Potter has forecast the following (data on Simply Wall Street):

Revenue: FY23 $454 million, FY24 $493 million and FY25 $544 million.

NPAT; FY23 $12 million, FY24 $23 million (13 cps).

I’m not sure what you think of these estimates @Noddy74. If they turn out to be correct that would get the business back to a ROE of c. 20% and I think that would make GNP good buying at the current price of 96 cps (7.4x FY24 earnings). The outlook sounds promising, bar the inflationary headwinds.

OUTLOOK (from 1H results announcement)

The Company orderbook is strong with $413 million work in hand comprised of $215 million for FY23 and $198 million FY24.

The tendered pipeline of $1.446 billion, up from $848 million at the end of FY22 and budget pricing and opportunity leads (excluded from tender pipeline) have increased to in excess of $3 billion which represents strong growth potential for the group.

The Group expects to see continued growth from its east coast operations. The Federal Governments $20 billion Rewiring the Nation Plan is designed to ensure the transmission infrastructure is funded & delivered. Genus is one of the few Australian companies operationally capable of completing large-scale Transmission & Distribution projects and is set to benefit from the Rewiring the Nation Plan.

Genus expects to return to strong growth in the medium term with a large pipeline of renewables, transmission projects and network connections to drive medium to long term growth in the business.

The increased focus of the network issues around Australia should see significant opportunities present during the coming 10-20 years as the Australian power network goes through a substantial transition from traditional energy source of coal to generation from new and renewable energy.

Genus continues to manage challenges across the supply chain, inflation and labour supply and we expect them to continue into FY2023.

Disc: not held