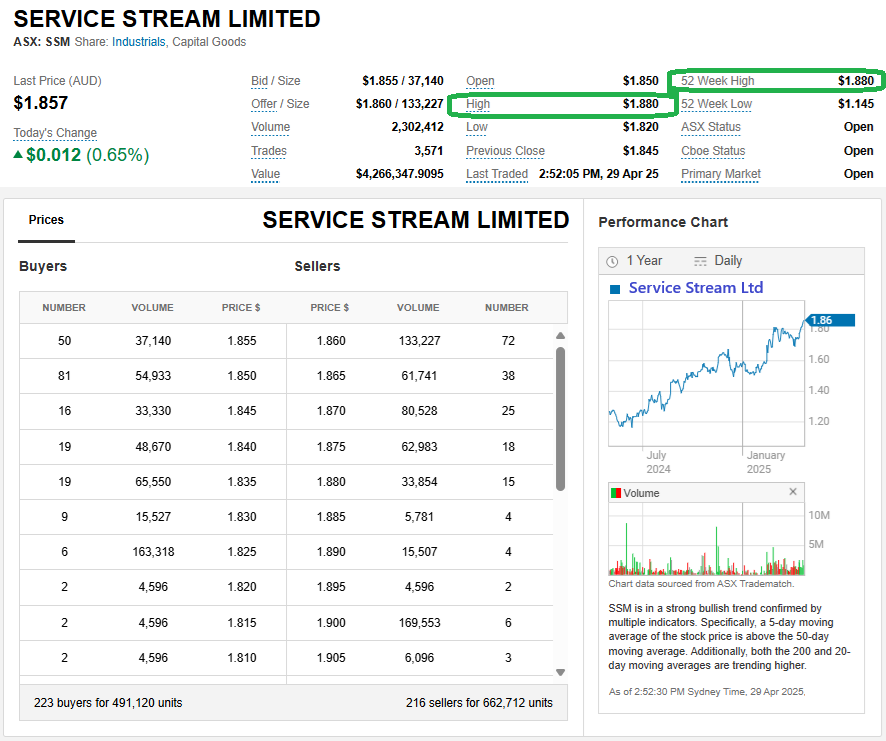

I haven't been following SSM @thunderhead however I took a wild stab in the dark just now and assumed they probably picked up the nbn contract that BSA lost in Feb, and it turns out that's exactly what happened:

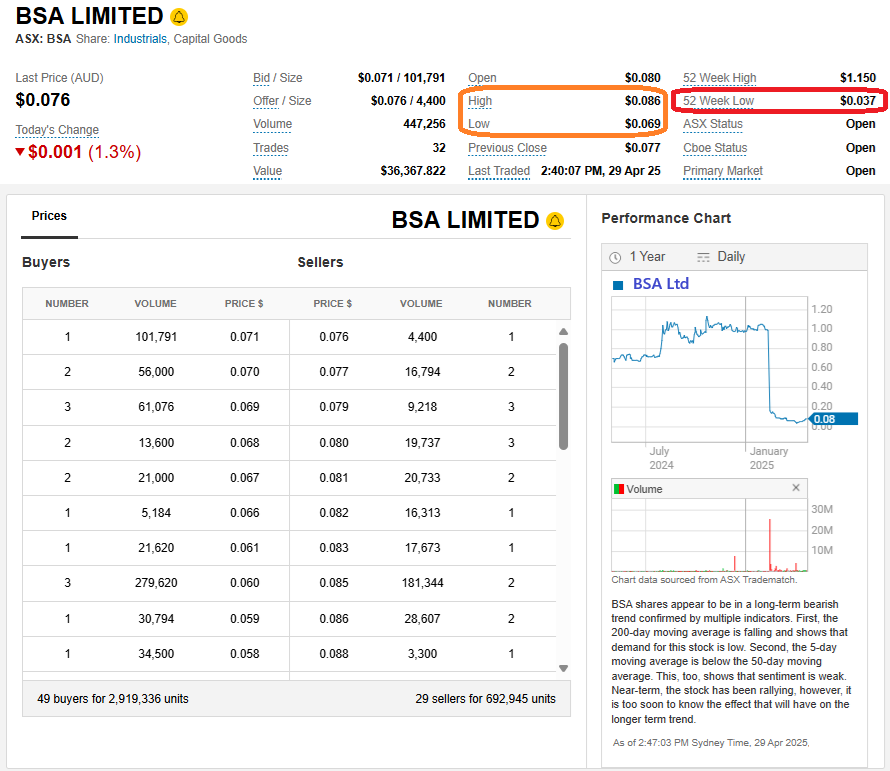

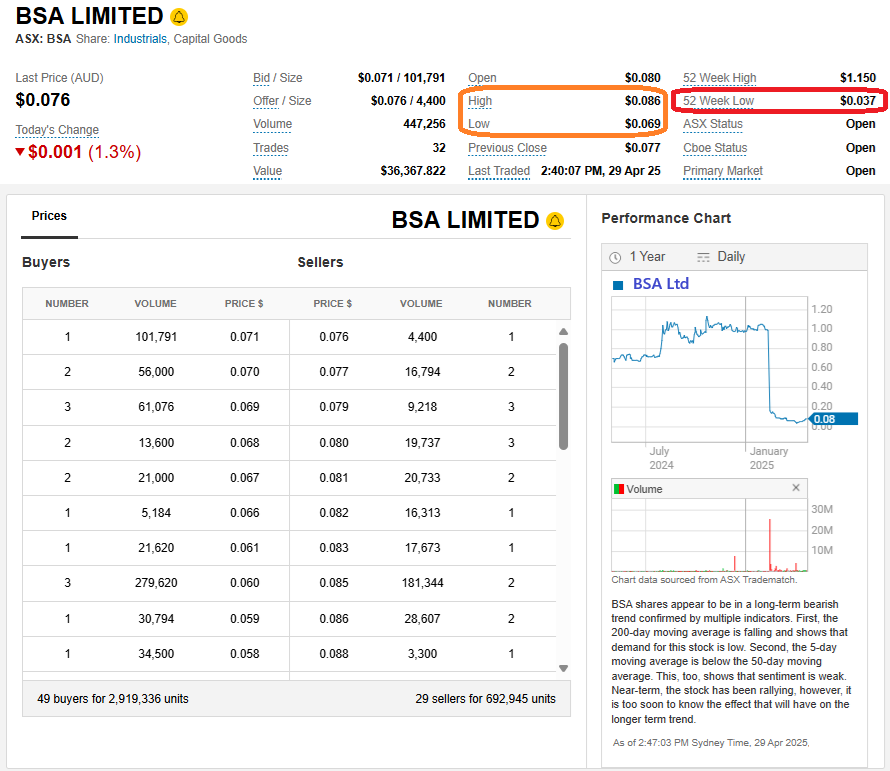

BSA down -89.44% over the past 12 months while SSM is up +45.88%.

Pretty much ALL of BSA's SP falls can be attributed to losing that nbn contract that accounted for almost 90% of their revenue, so a real company killer to lose.

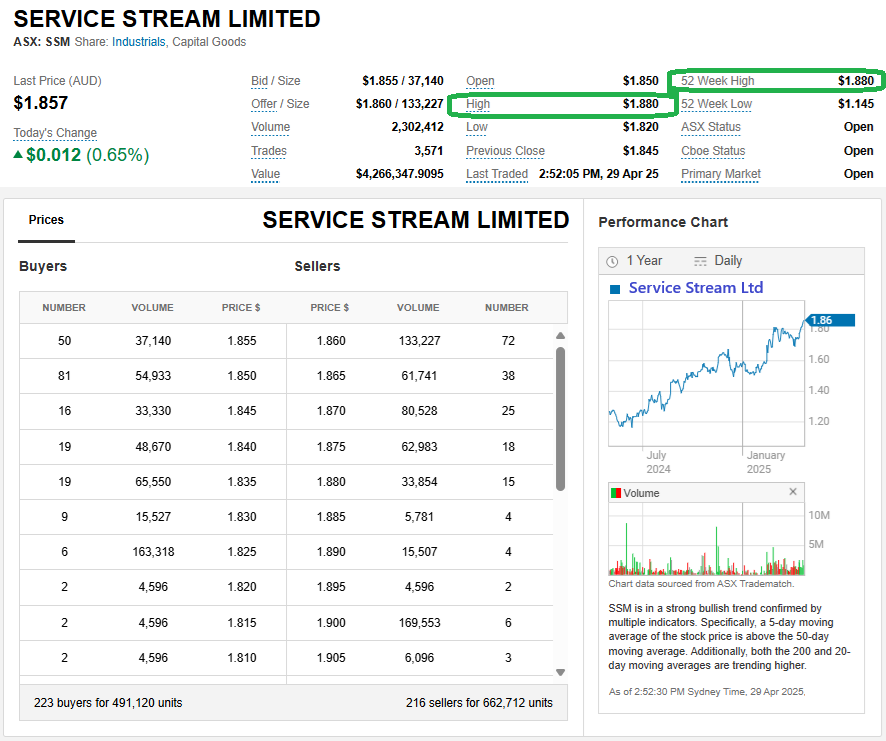

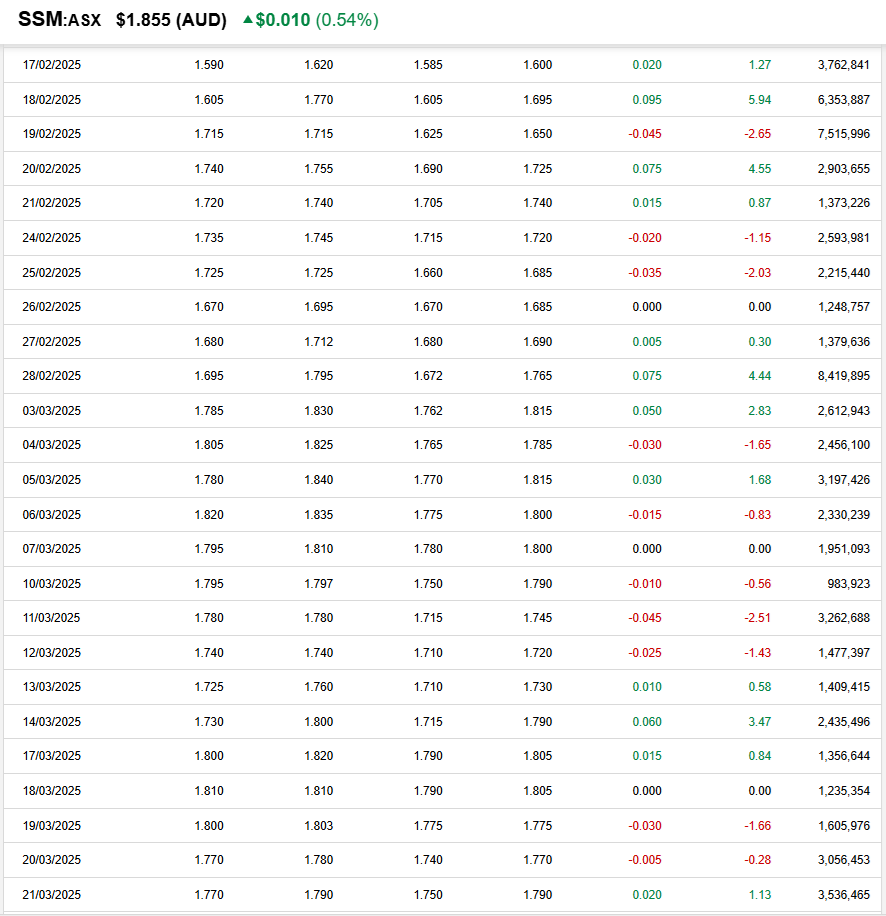

However SSM have had a steady share price rise over the year, both before and after their nbn contract win.

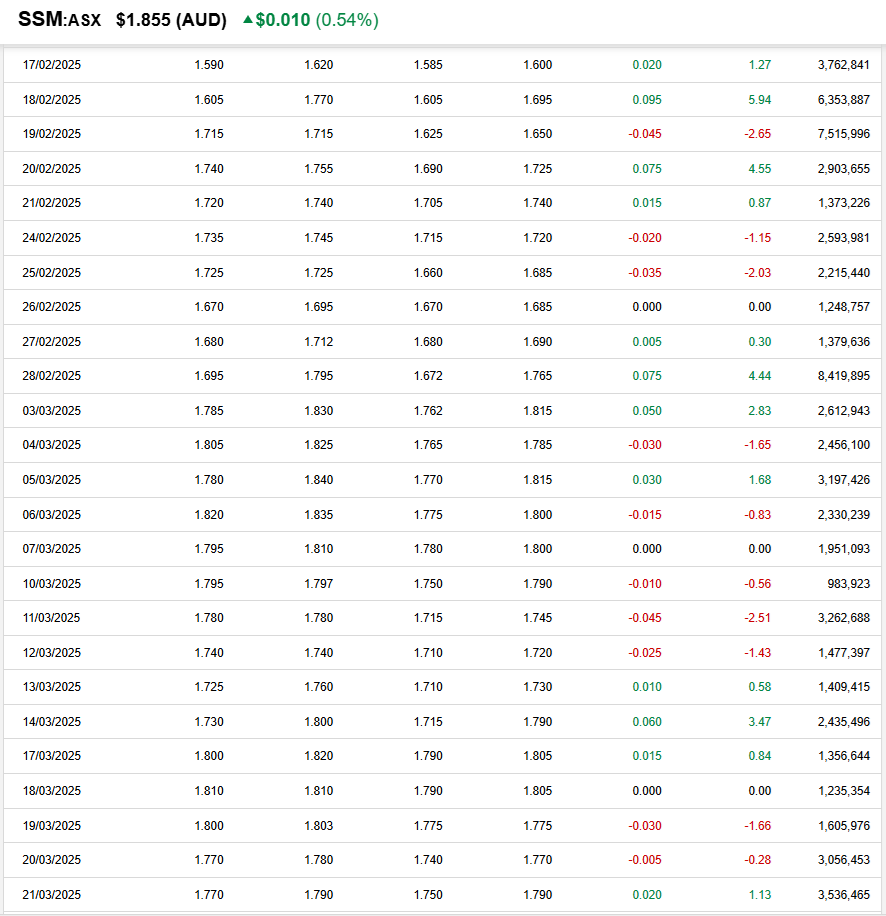

That's just a snapshot of the daily SSM SP movement for the 5 weeks from when BSA signalled they'd lost that nbn contract - and I've done the same for BSA below - note the BIG share price falls, because that contract represented so much of BSA's revenue, whereas SSM is much more diversified, and a lot bigger - SSM's current m/cap is $1.13 Billion whereas BSA's is less than $6 million now, so BSA have gone from being a microcap to now being an ultra-nanocap stock, whereas SSM remain a mid-sized Telco services provider (yes, I know they service other industries / sectors - as well as Telcos and ISPs).

And BSA remain highly volatile too, check out that daily range up until 2:47pm this arvo (highlighted in orange above) - a low of 6.9 cps up to a high of 8.6 cps, which is +24.6% higher, yet they're still down for the day, or at least they were when I snapped that a few minutes ago.

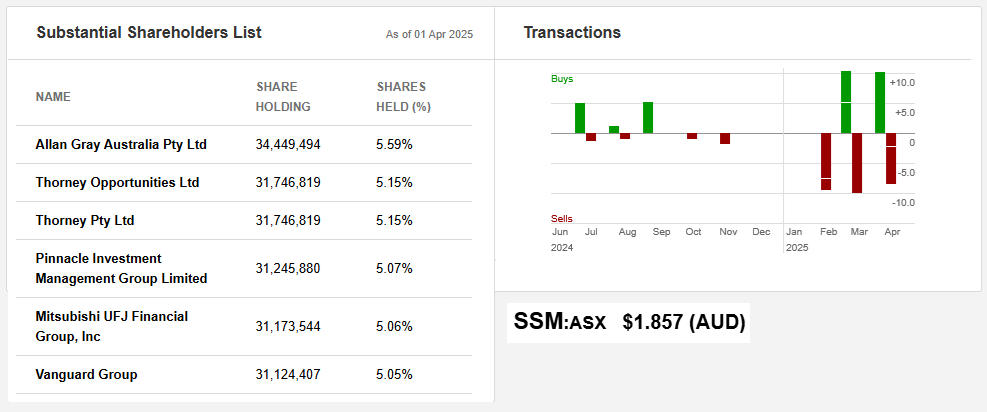

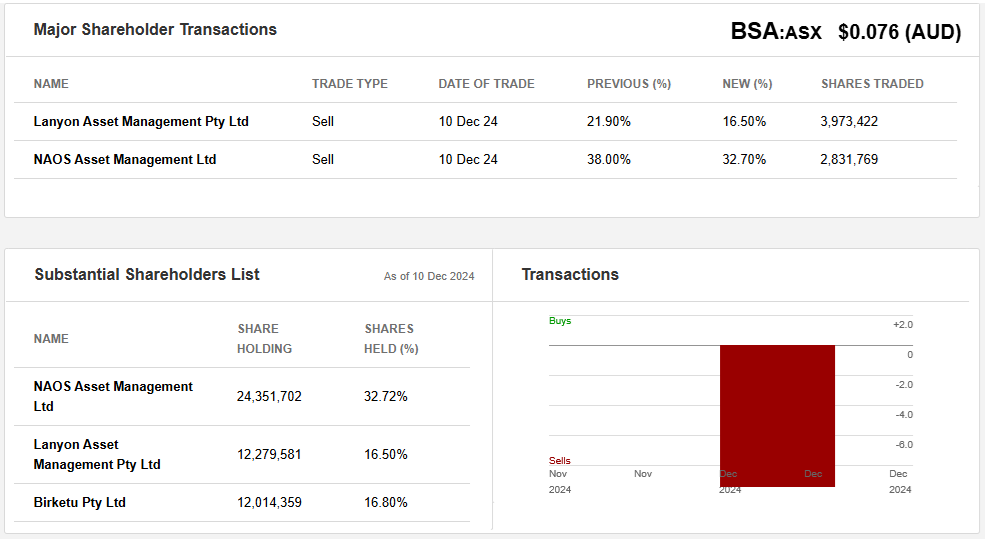

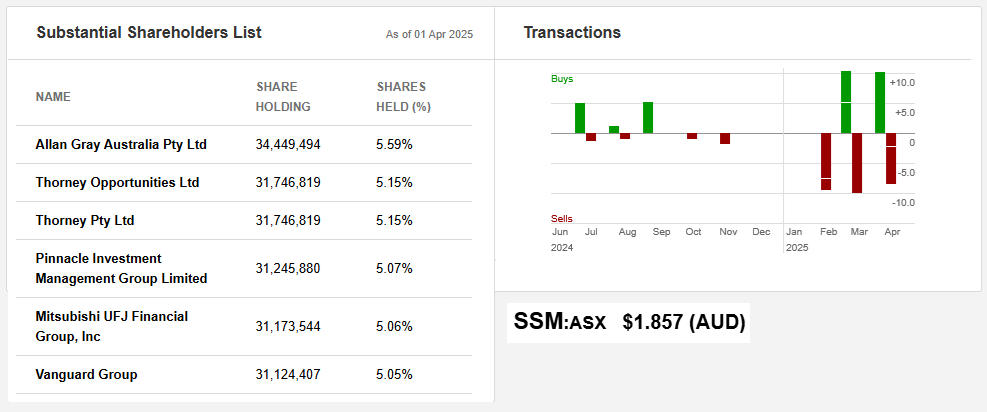

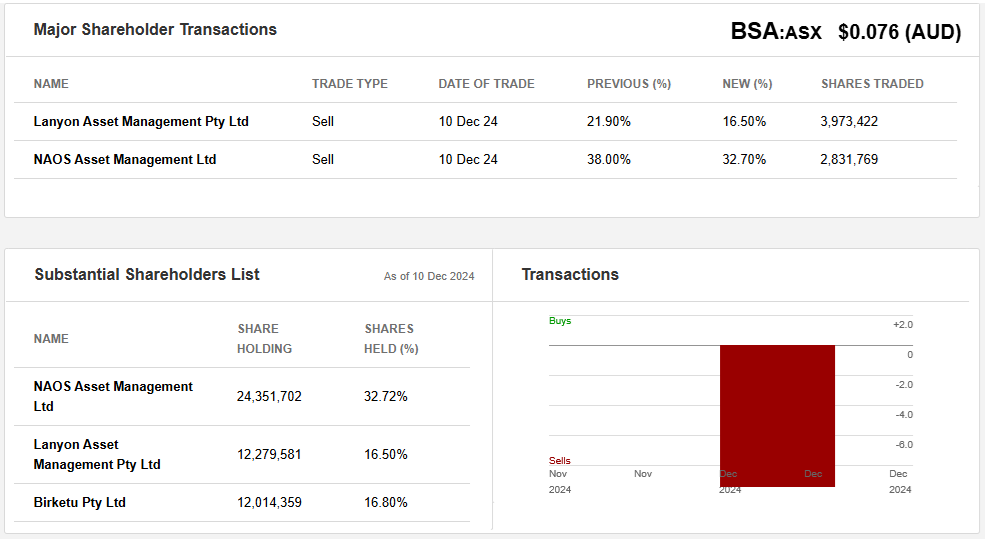

I find the "Subs" lists for the two companies interesting also:

SSM above, BSA below:

Lanyon's David Prescott quit the BSA Board as soon as they knew they'd lost the nbn contract - see here: Director-Resignation-David-Prescott.PDF

Here's how that nbn field operations services contract saga played out this year - in their own words:

Trading-Halt-BSA-[14-Feb-2025].PDF

New-NBN-Co-Field-Services-Contract-Update(BSA).PDF [18-Feb-2025] plus Director-Resignation-David-Prescott.PDF

BSA-unsuccessful-in-new-NBN-Co-Field-Module-contract-bid.PDF [28-Feb-2025]

SSM-secures-long-term-field-operations-agreement-with-NBN.PDF [28-Feb-2025]

nbn-Unified-Field-Operations---BSA Transition-Update-[20-March-2025].PDF

Certainly two companies heading in different directions.

And while SSM look like a solid investment, BSA looks a lot like a lobster trap (/lobster pot) stock, with 66% of the company owned by three fundies (or two fundies and the family office fund of one HNWI) who can not exit without smashing the share price down even further. Realistically, there just aren't the buyers for NAOS' 32.7%, or even Lanyon's 16.5% or Bruce Gordon's 16.8% of SSM - BSA were highly illiquid when they were a microcap, and now they're a sub-$6m-nanocap, they're toast.

Too many eggs in one basket, and them eggs are smashed now. That probably applies equally to BSA Management in terms of almost 90% of their revenue being reliant on a single contract, which they've now lost - and also to fundies like NAOS for owning one third of a company like BSA.

Perhaps the biggest lesson here is in the respective management quality at these two companies. Chalk and Cheese.

SSM management appear to be doing a good job, however what's left of BSA management, not so much, and certainly not historically.