@Strawman I've had a chance to listen to today's meeting as well as updating my analysis .... albeit I have not revisited my valuation properly, as yet.

TLDR: $IKE is making progress, but I can't yet see favourable economics or operating leverage for this to be investible. As you say, it is also NOT CHEAP.

I'm very numbers driven in this reply. That's because I've written a lot about $IKE in the past, and nothing has changed. The market, the strategy, the overall trends are 100% consistent, as its not a fast moving industry, as Glenn made clear.

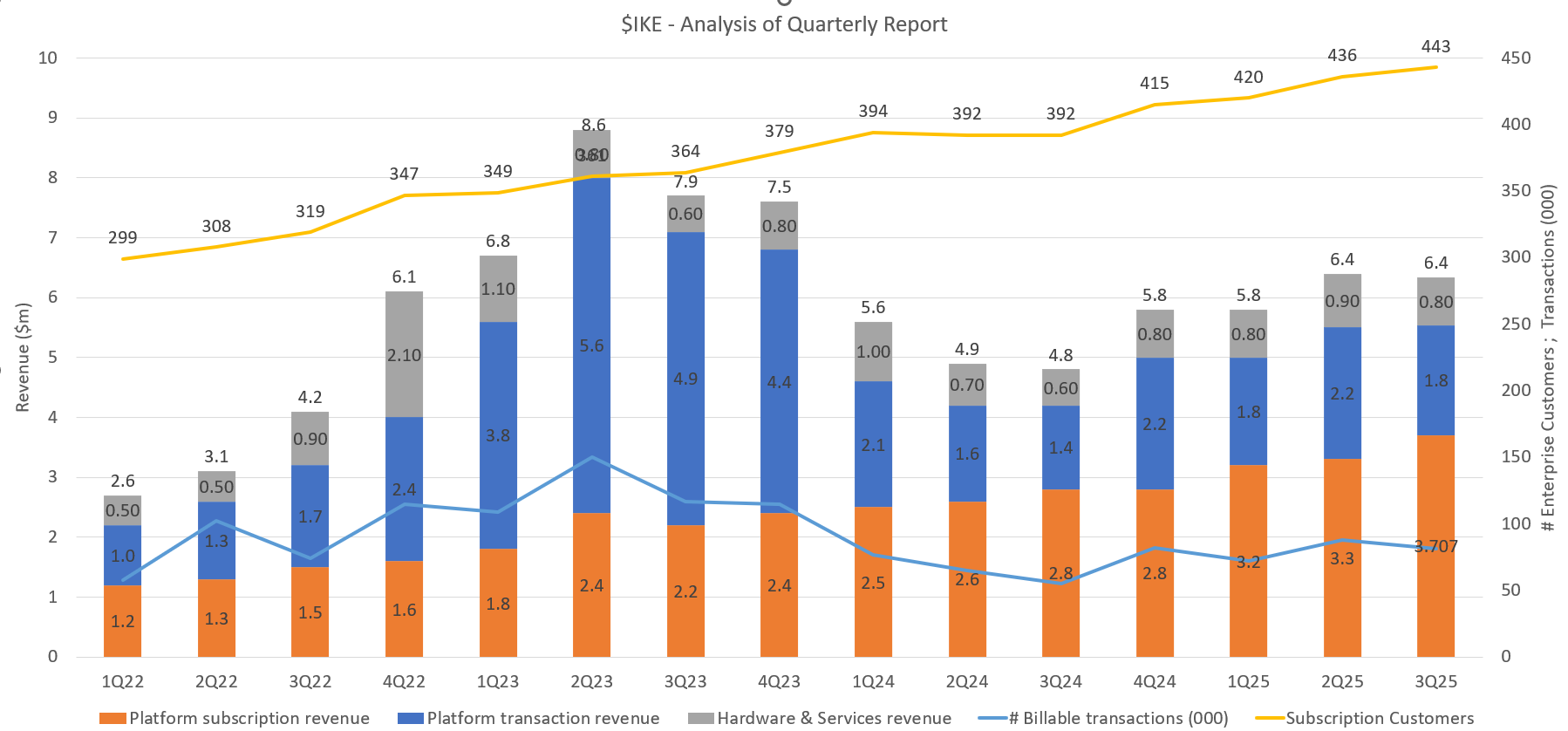

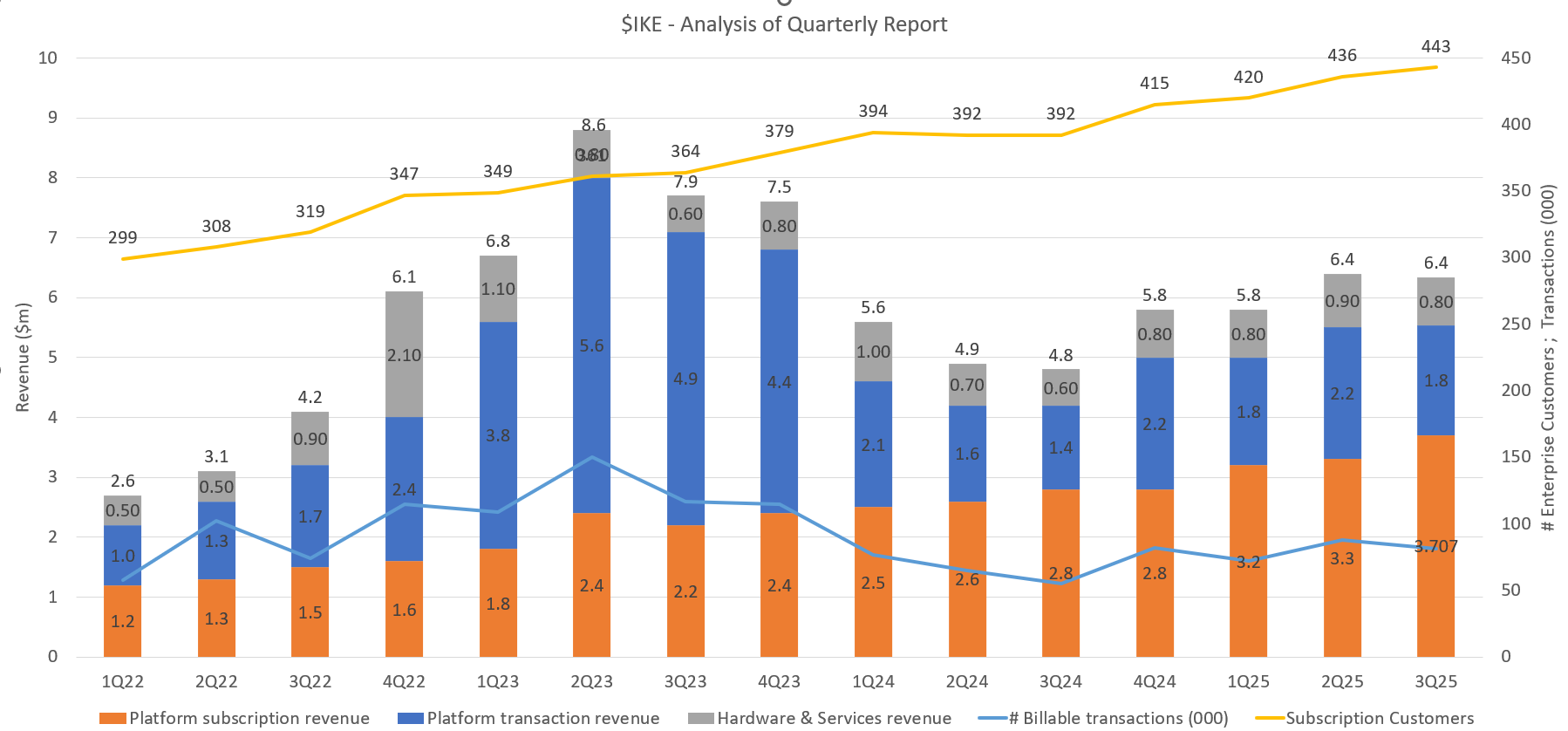

I've updated my revenue tracker (took me a while as individual quarters and reported as YTD, and my spreadsheet is a mess and hasn't been updated for a while - so there might be a few minor errors in the data, which are hard to trap! BEWARE)

The key message is that if you look at overall revenue, you can mistake the quality of the business. In 2022 and 2023, transaction revenue (driven by two big fibre rollouts) exploded and drove high Total Revenue growth. That was when the SP took off (and, alas, also when I invested based on the overall growth signal, not understanding the quality of the transaction revenue! I thought it was something like transaction revenues at $XRO. It's not, as I explain below.)

The Transaction Revenue proved to be of low quality - both in its volume and its margin.

Margins, Quality of Revenue and Subscribers

Subscription Revenue has %GM in the range 82% to 92%, and has grown consistently quarter by quarter, almost without exception. This seems to be a sound basis to project the growth of the business into the future, given the large and largely under-penetrated market.

However, Transaction Revenue is of a much lower quality with Gross Margins highly variable ranging from 0% to around 50%. So the "transactions" are not like normal SaaS transactions, which have an almost $0 incremental cost. The transactions appear to come with some $IKE support costs, which is why I referred to them as an outsourced service from the customer to $IKE, which you can also pick up sometimes in the Glenn's language ("we're helping them do the analysis" ... "for a period of 12-18 month" ... "it could come back, it might not").

This then explains the peak in the blue bars, in the graph below. Two big customers doing fibre rollouts called on $IKE to provide these "transaction services" (per pole calcuations?). But these programs came to an end and the transaction revenues fell sharply ... which was the key driver of $IKE's SP collapse in mid-to-late FY23.

But all the while, Subscription Revenue has continued to grow as about 10 new enterprise subscribers are added every quarter on average.

Back in 2022 annual revenue per subscription was about $16k, it has grown to $33k in the latest report. There are two drivers for this. First, functionality - for example, the new version of Pole Foreman was a 5x increase in revenue for that module. The second driver is number of licence seats, which I think $IKE has only recently started to report. You picked up on this in the call, and in the big utilities, with hundreds and thousands of engineers, it takes a while to roll out the software (years!).

Bottomline, Subscription Revenue Growth is the big value driver - it's now where Total Revenue was only 2.5 years ago.

Half Year Trends

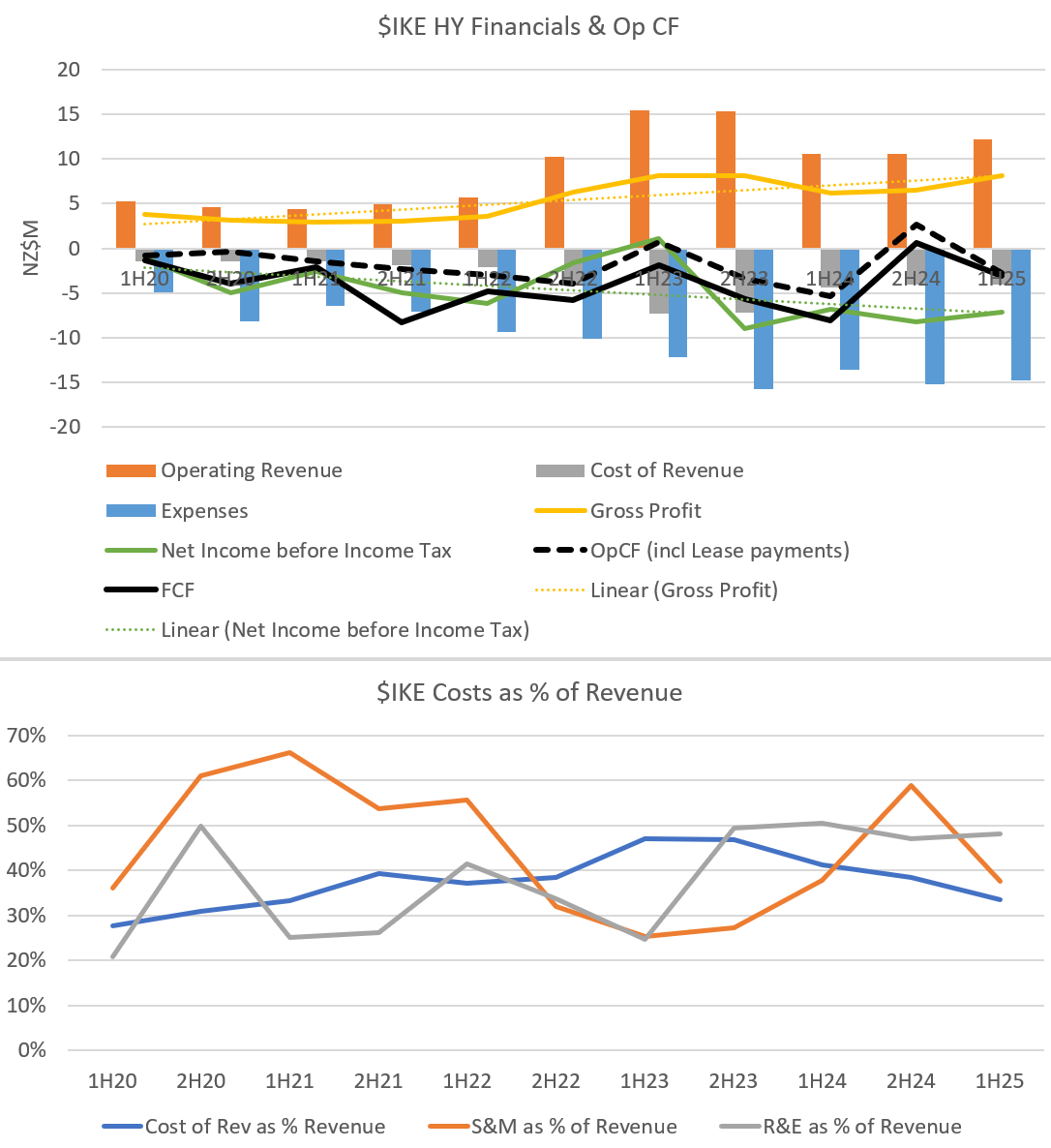

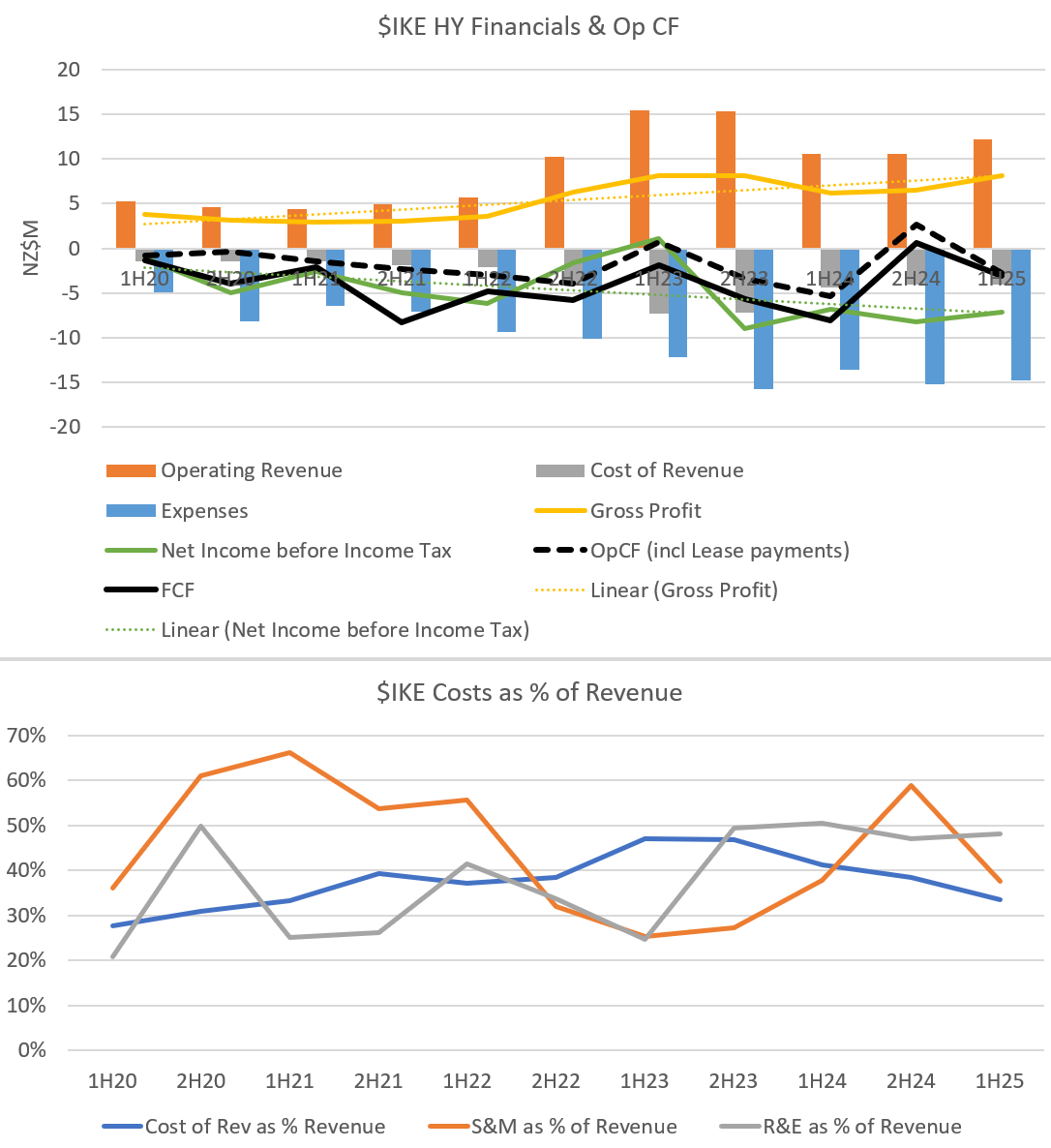

The graph below shows key financial and cash flow trends from recent Half Year reports. Here, of course, we can't break out the subscription component. (Well, we could, I just haven't done the analysis!)

$IKE is still loss making and was still burning cash as at the 1H FY25 report.

However, in 3Q FY25 cash increased from $6.7m to $9.2m. However, the variability in Free Cash Flow means that it might be premature to get too excited about this. Certainly, the market reacted strongly to result as we saw the SP recover from around $0.50 up to above $0.70,

Given the increasing importance of recurring Subscription Revenue as a proportion of total receipts, it is possible that $IKE has now passed through the inflection point to sustainable cash generation. The FY result should give confirmation of this.

Furthermore, given that some of the historical variability in cashflow was driven by highly variable contribution margins from Transactions and Hardware, then it is likely that Subscription growth has pushed $IKE through the inflection point.

On expenses, the lower graph shows various expesne categories as a % of Revenue. Operating leverage is not apparent yet.

Valuation

OK, so let's say that last Q's Subscription Revenue represents an annualised runrate of $14.8m.

At today's close, $IKE has a Market Cap of A$117M or NZ$129M (as all numbers above are $NZ).

So, $IKE is currently valued at almost 9x the annualised Subscription Revenue, if you give no credit to transactions and hardware/other services.

Eyeballing the quarterly subscription revenues, these are currently growing with good quality at about 35-40% p.a.

However, because I can't see the operating leverage trend, I'm not convinced this business has favourable economics. So at this stage it remains uninvestible for me. I continue to follow it, and will be keen to see the FY25 report and, in particular, whether positive recent trends are being sustained.

Bottom line: 9 x Annual Recurring Revenue is a lot to pay if you can't see the operating economics!

I have been a bit harsh in this judgement. So let's try an alternative. Let's assume $IKE can delivered total revenue in FY25 of $23-25M. That still a revenue multiple of over 5x, for a business with unclear overall economics. Not for me,... yet.

Disc: Not Held