Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

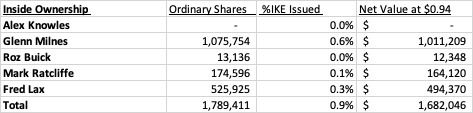

Market Cap Today $182.4m (NZ$211.45m) at share price $0.94

Board Bios

Alex Knowles - Chair and Director

Alex has investing and operating experience with international companies in the information technology and transportation industries. Based in Los Angeles, he was formerly Chief Operating Officer of the largest international freight forwarder and small parcel consolidator in the U.S.

Glenn Milnes - CEO & Managing Director

Glenn Milnes is the CEO and Managing Director at ikeGPS, where he is accountable for the company's overall strategy, performance, and growth. Prior to leading ikeGPS, Glenn previously held senior executive, strategy and corporate development positions in the Communications industry with Cable & Wireless International, and No 8 Ventures.

Roz Buick - Independent Director

Roz brings more than 25 years’ experience from executive leadership positions across global utility, engineering, construction, real estate and agriculture markets with companies including Oracle Inc. and Trimble Inc. Roz is an industry leader who has led businesses through new growth strategies that are market differentiating and innovative, both with product and go to market strategies.

Mark Ratcliffe - Independent Director

Mark was the founding CEO of Chorus New Zealand from 2007 to 2017 where he led the deployment of New Zealand’s national fiber network. Prior to Chorus Mark was CIO and COO of Spark (formerly Telecom NZ). Prior governance roles include Director of 2 Degrees from 2017 to 2020. The majority of his current portfolio is in the Infrastructure Sector and he is currently the Chair of First Gas, Tuatahi Fast Fibre, and a number of other private and public sector boards.

Fred Lax - Independent Director

Fred Lax is an executive leader with extensive global experience in the telecommunications industry and related technologies. Based in California, he is a former director of NASDAQ listed Ikanos Communications Inc. (acquired by Qualcomm Atheros), and former Chief Executive Officer and President of NASDAQ listed Tekelec, Inc.

IKE Capital Raises History (Since Dual Listing on ASX, so from 2016)

Total Raised Approximately NZ$89.86m. Its Market Cap today is NZ$211.45m. Note: Keep everything in NZ$ to try keep it simple.

· July 2025 Raised NZ$28.6m, Placement NZ$19.6m, SPP NZ$9.0m at NZ$0.88 per new share https://announcements.asx.com.au/asxpdf/20250714/pdf/06lrr8jflwd6d8.pdf

· August 2021 Raised NZ$24.7m, Placement NZ$19.2, SPP $NZ5.5m at NZ$1.00 per share. https://announcements.asx.com.au/asxpdf/20210811/pdf/44z65p83968j59.pdfhttps://announcements.asx.com.au/asxpdf/20210831/pdf/44zygm3b344sy1.pdf

· July 2020 Raised NZ$19.7m, NZ$9.8m Institutional Placement, Entitlement offer NZ$9.9m at $NZ0.68 per new share https://announcements.asx.com.au/asxpdf/20200728/pdf/44kwq1k3cdrv9c.pdf

· September 2019 Raised $6.5m, $5m Placement, $1.5m Retail at $0.60 per share https://announcements.asx.com.au/asxpdf/20190927/pdf/448xj8yj2zpzln.pdfhttps://announcements.asx.com.au/asxpdf/20191023/pdf/449sgc7pc3qt21.pdf

· September 2018 – NZ$1.25 SPP at NZ$0.52 per share https://announcements.asx.com.au/asxpdf/20180928/pdf/43yryjm2yq3n8m.pdf

· August 2018 – NZ$5.0m Placement at NZ$0.52 per sharehttps://announcements.asx.com.au/asxpdf/20180824/pdf/43xnd8d8d08g5q.pdf

· September 2017 – NZ$387,000 SPP at NZ$0.29 per sharehttps://announcements.asx.com.au/asxpdf/20170929/pdf/43mscgcbqdzy85.pdf

· August 2017 - NZ$3.725m, Placement existing and new institutional and wholesale investor at NZ$0.29 per share https://announcements.asx.com.au/asxpdf/20170818/pdf/43lhnx6v1qrfxk.pdf

Acquisitions History

· January 2021 Acquires certain assets of Visual Globe, a US based Artificial Intelligence (AI) and low code/no code software company that specializes in the automated analysis of power poles. Initial payment of US$3.3m in cash and with a potential earn out of additional US$4.99m of cash and up to US$2.1m of IKE shares. https://announcements.asx.com.au/asxpdf/20210105/pdf/44rhgyvt2nbkzh.pdf

· September 2019 Acquires Powerline Technology flagship product “PoleForeman” a leading pole loading analysis software solution used in the North American Market for US$3.4m (NZ$5.4m) https://announcements.asx.com.au/asxpdf/20190927/pdf/448xj8yj2zpzln.pdf

I've looked at IKE a few times over the years, but I've never gained conviction in it. Spoiler, and after Q1 that hasn't changed.

I last looked at IKE when they have capital raise at 81c in July 2025. It never quite got me across the line then, so thought I'd check in on where they are at after Q1 FY26 results were released (with HY due in November). What put me off IKE in the past was the lumpiness in their revenue and how low quality it was. I dislike how they also refer to the prior corresponding period but are using SaaS metrics.

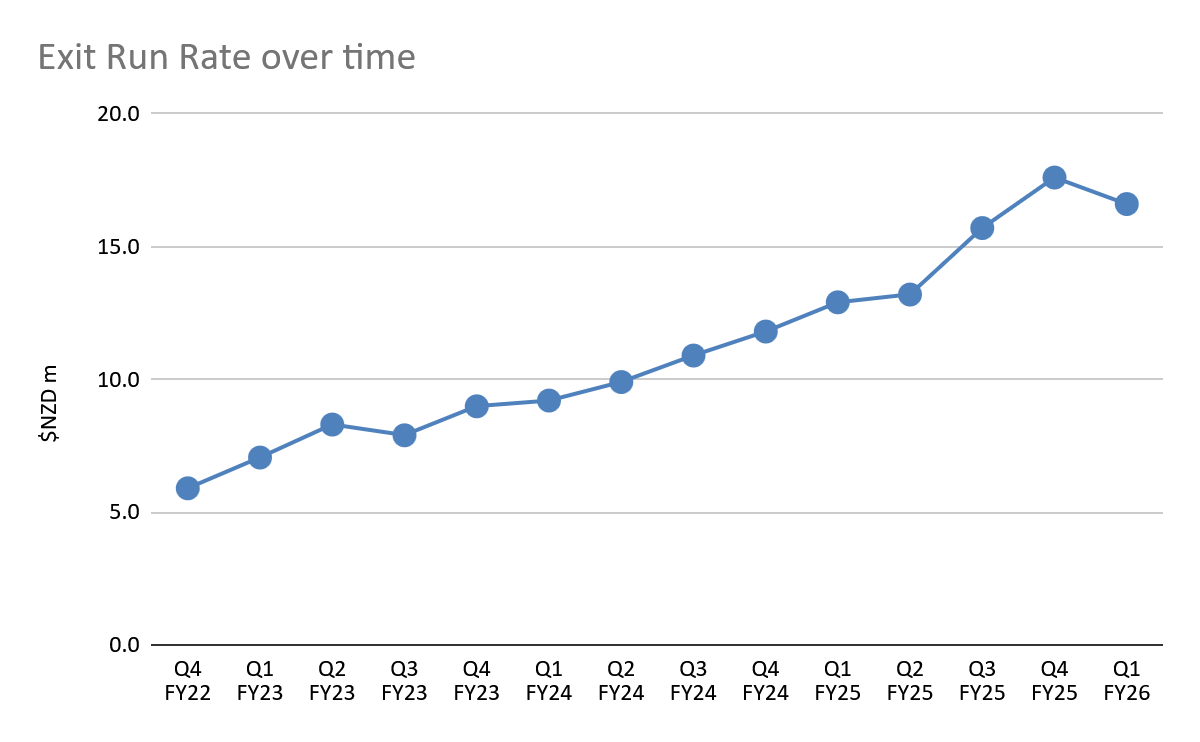

The first place to start is Exit Run Rate. It went down in Q1 FY26. Note they don't release a transparent chart like the below, it's always pcp numbers. After congratulating themselves on the growth on pcp (ancient history) they eventually comment on the decline putting it down to foreign exchange (1.3m) and the change of 2 customers unsubscribing and moving to transaction revenue.

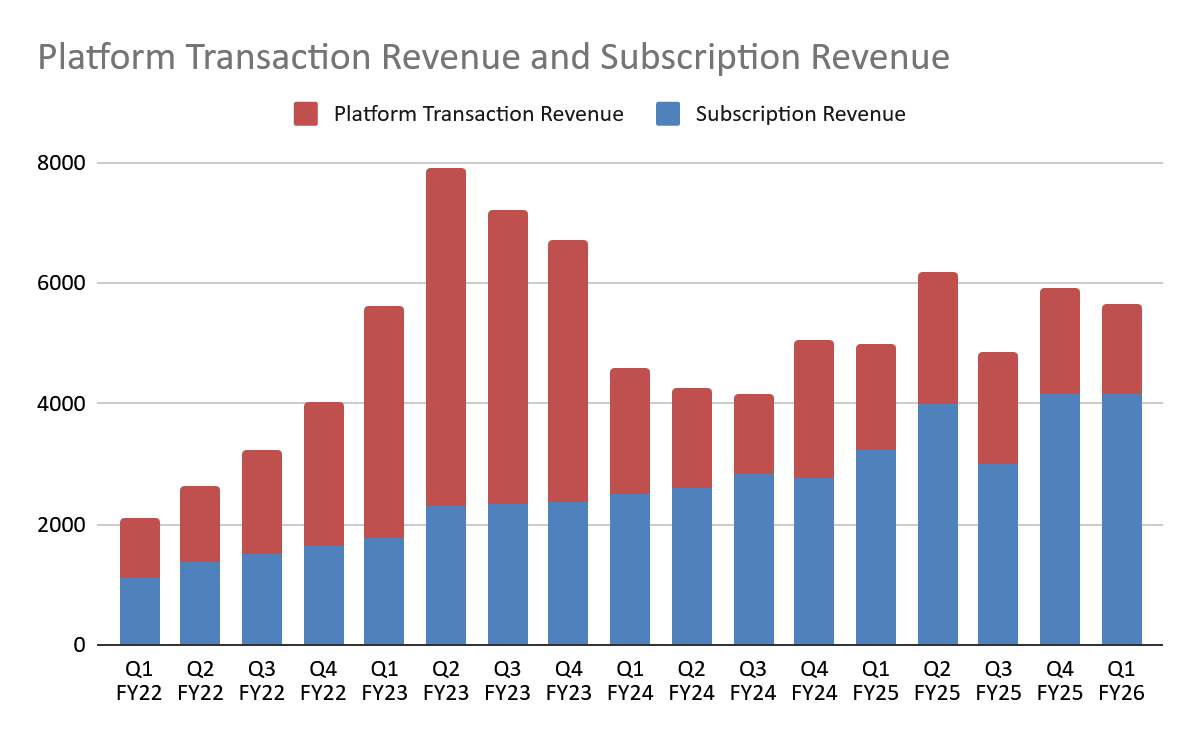

Looking at revenue break-down (ignoring hardware sales) we see the past lumpiness in FY23 (project based) but overall there's a steady growth in subscription revenue. I assume the strategy was to grow subscription revenue, since transaction revenue has been flat over the past 2 years. This makes the switch away from subscription revenue in the most recent quarter from long-term customers concerning.

Guidance for 35% subscription revenue growth was reaffirmed. Historically, next quarter, Q2, looks like a strong quarter and Q3 looks weak, so I expect Q2 and Q4 to do most of the heavy lifting if guidance is to be achieved. If they achieve it, they would be trading around 8x subscription revenue. They are still making large losses but hovering around free cash flow positivity. When I compare with other SaaS like business, it's not that compelling at the moment.

There's a real business here, it's impressive the growth they have achieved in the US against many better funded competitors. In summary, compared to other opportunities I don't find it compelling, but I will keep watching.

11-Mar-2025

$0.50 ($0.20 - $1.20)

Quick update having revisited following Strawman Meeting with CEO Glenn.

"Finger in the air" based on multiple of Subscriber Revenue, huge range of uncertainty because we can't see the operating economics yet.

Could narrow the range at FY25 result if cash generation is confirmed.

29-Sept-2023

Basis of valuation - sale price realised in my sell-down today.

I came away from today's chat with CEO Glenn Milnes feeling pretty good about the business and its opportunity. He strikes me as pretty down to earth, and even when i gave him some fat pitches, he came back with a tone of conservatism, and even highlited a range of things they could do better (unprompted).

While it is still fresh, here are some of the things that stood out:

- The fact that ikeGPS's largest investors refused to back a $1/share takeover when the stock was trading well below that is telling. Maybe they’re overly optimistic, but clearly, they see something bigger on the horizon. You tend to take what you can get when things arent looking good -- you certainly don't reject a takeover offer with a fat premium

- The opportunity in the US is massive, and ikeGPS isn’t just playing at the edges -- they’re deeply embedded with the biggest players in the industry. Glenn emphasized that the demand for infrastructure upgrades is set to explode over the next two decades. Specifically, the North American electrical grid needs to double in capacity, and utilities are under pressure to harden networks against extreme weather. Ike’s solutions are right in the middle of this shift. Growth is already materializing, with subscription revenue expected to jump 40-45% this year, and Glenn sounded confident that momentum will continue. Big investors are clearly paying attention..

- The company is in a position where they could flip to EBITDA profitability if they wanted to, but they’re choosing to keep reinvesting in product development and expanding their sales reach. With ~$10m in cash and no debt, there’s no immediate risk of a capital raise -- something Glenn made clear. Given the scale of the opportunity, it’s probably the right approach.

- They also have solid pricing power and aren’t afraid to use it. Their platform is a small fraction of their customers’ overall costs, but it delivers significant efficiency gains. Glenn explained that once customers start using ikeGPS, they don’t leave. In fact, they’ve never really lost a customer. That kind of stickiness speaks volumes.

- A key advantage is that Ike’s platform doesn’t force customers to rip out their existing systems; it integrates into their current tech stack. That removes a major friction point in the buying decision. The industry itself is dominated by natural monopolies, but rather than competing aggressively, these players are highly collaborative (this is something we also heard from Ian Olson at pointerra). That dynamic makes it easier for Ike to scale relationships and deepen its penetration into the market.

- Glenn was clear that AI is becoming a bigger part of what they do, enhancing how their systems process and analyze infrastructure data. But he was also very much avoiding the hype. The key thing for me is that ike has a huge training library of images, which could be a decent comnpetitive edge in regard to AI.

- Importantly, Glenn seemed laser-focused on the customer experience. Everyone says that, but not many companies actually give that the attention it deserves.

- In terms of areas of improvement, Glenn acknowledged they need to simplify how they communicate their industry and technology to investors. Their work is complex, and clearer messaging would help investors and customers grasp its impact. He also sees room to enhance customer support, even with a dedicated team in place. He also noted pricing strategy as a key lever they could optimize further.

- In response to @mikebrisy questions and previously raised concerns over transaction revenue, Glenn explained that the recent spike was largely driven by two major national fiber businesses that utilized Ike’s transaction service intensively over a 12 to 18-month period. This resulted in an outsized jump in revenue during that timeframe. However, he acknowledged that while the broader business continues to grow steadily, that specific surge may not be sustained at the same level moving forward. He clarified that it’s not a case of losing those customers (they’re still using Ike’s platform) but rather that their rate of activity fluctuates. Essentially, this part of Ike’s revenue stream is influenced by the pace at which these large infrastructure companies deploy their networks, which can ebb and flow over time.

All told, I'm rather interested. It's clear they have good sales traction in a massive industry with strong tailwinds. They are operating at a small loss, by only because of the focus on growth, and with a rather healthy balance sheet. The have a lot of room to expand even with existing customers, and I love the focus on customer experience, as well as the super sticky nature of the product, and the pricing power that comes with it. It's also nice that their customers are somewhat resilient to economic headwinds.

Still, the industry has very long sales cycles, transaction revenue (as we have seen) can move around a lot, and shares are still on something like 4-5x sales.

Not cheap by traditional standards, but perhaps not so when viewed in the context of expected growth and potential for very attractive operating leverage..

What do others think?

Small contract announcement - NZ$0.8m 3 year deal for Ike Pole foreman.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02781556-3A638241

Market reaction of increase by 17% (additional +11m MC) seems a bit overdone, unless this is the start of more contract wins.

I'll wait for some more announcements (or non-announcements) before working out what to do with my holding.

Disc: Held.

$IKE issued their quarterly prformance report, with the investor presentation later this morning.

Their Highightls

+ YTD revenue of ~NZ$15.3m (-34% pcp)

+ Subscription revenue of ~NZ$7.9m (+24% vs pcp)

+ Transaction revenue of ~NZ$5.1m (-65% vs pcp).

+ YTD gross margin of ~NZ$8.8m (-28% vs pcp), with a gross margin percentage of ~58% (up from pcp of ~53%).

+ Total cash and receivables as of 31 December 2023 of NZ$15.2m (vs NZ$16.3m at 30 September 2023), comprised of NZ$8.0m cash and NZ$7.2m receivables, with payables of NZ$0.8m and no debt.

My Analysis

Annoyingly, $IKE have stopped issuing the quarterly numbers in the handy KPI report table, only showing the YTD numbers. (I wonder why!) Fortunately, as I track each Q, my spreadsheet backs it out automatically.

Because there is noise in the GM margin numbers as a result of subtracting two small number from each other, I am only going to show the revenue plots. But I think therein lies the clue that we aren't getting full transparency on the quarter.

I've discontinued the number of Enterprise Customers metric, because this metric has now changed to number of Subscription Customers which, to be fair is probably a better metric, but we don't have much history. It's up to 368 from 356 in the PCP (i.e. Q3FY23). +3% in one year is hardly insporing.

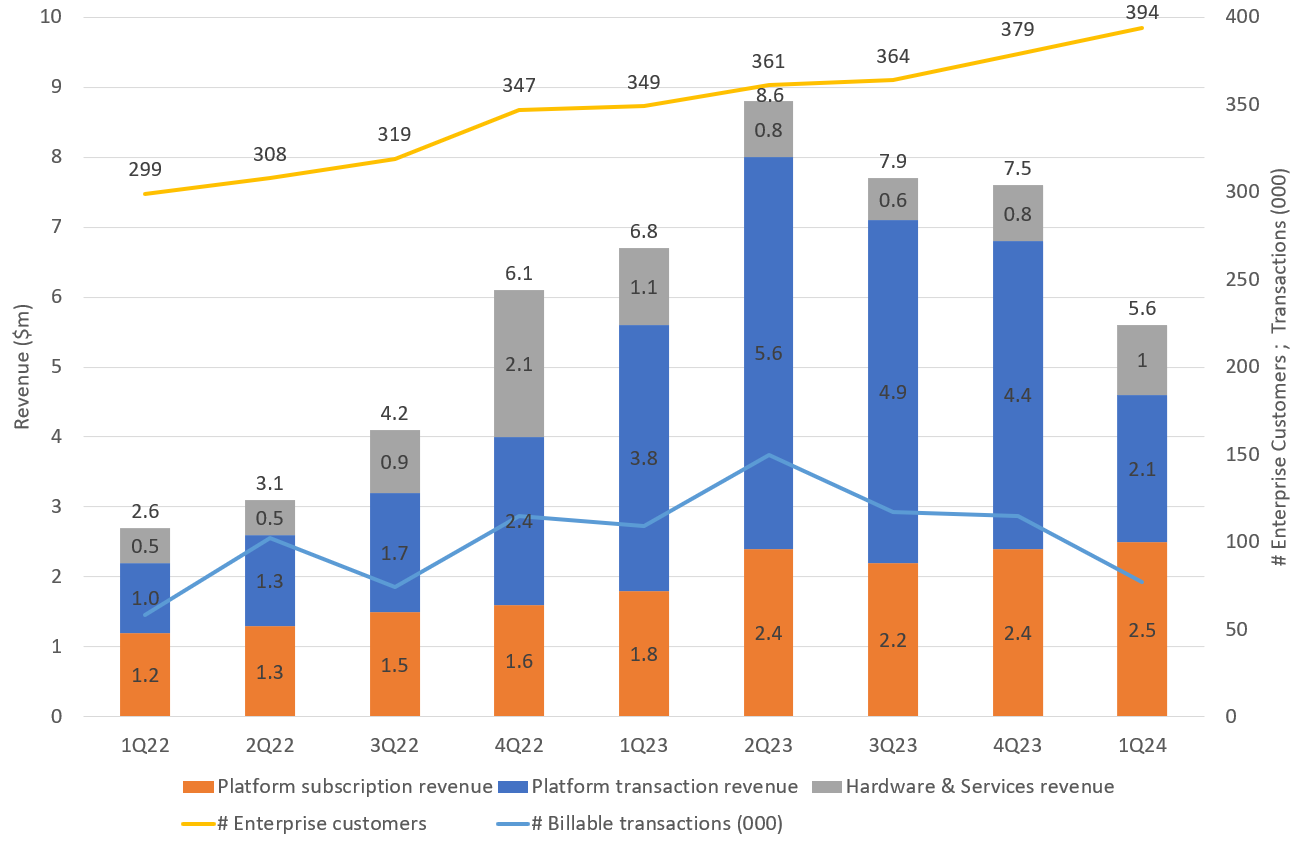

As shown below, in summary, no sign of growth returning. (Note, the quarterly numbers for the latest quarter are not reported but backed out from YTD report numbers. So they can be out by +/- $0.2m)

So what is the "stronger period" that CEO Glenn Milnes is referring to? Well the report contains several good contract wins including significant upgrades from existing customers. And, the one bright spot does appear to be a steadily growing base of subscription revenue. This should be getting turbocharged by the new generation software which has a higher subscription cost.

The rest of the release is complicated and trying to tell a positive story about various customers, activity and transaction levels. We'll see.

My Key Takeway

I've posted a lot on $IKE before, and exited the stock early last year on concern that we weren't seeing sustained growth.

I do like to keep track of my "Exits" just in case I was wrong. So far, $IKE is yet to return to growth.

Glenn has turned attention to the cost base, and the burn for the Q was NZ$1,1m, with cash at Dec-31 NZ$15.2m vs $16.3m at Sep-30. If they can hold the cost base flat AND return to growing receipts, then they might just be sustainable.

However, a small cap growth stock it no long appears to me. So I remain out. I'll not be attending the presentation.

Disc: Not held

$IKE has issued it 1H FY24 performance update.

Their Highlights

Revenue 1H FY24 of ~$10.5m (-32% vs pcp).

+ Subscription revenue was ~$5.1m (+24% vs pcp).

+ Transaction revenue was ~$3.7m (-60% vs pcp).

+ Gross margin 1H FY24 of ~$6.2m (-24% vs pcp), reflected in the revenue mix above.

+ Gross margin percentage 1H FY24 of ~59% (up from pcp of ~53%).

+ Cash and receivables as at 30 September 2023 ~$16.3m, comprised of $10.2m cash and $6.1m receivables, with payables of $1.2m and no debt.

My Analysis

It is a while since we heard the term "fortress balance sheet". Cash at $10.2m is down from $13.7m at 1Q and $18.0m at EOFY23 . They continue to burn and, at this rate, will be raising again within a year. The tone has also changed, with the Board now focused on maintaining a healthy balance sheet by "managing costs appropriately."

With the full financials to follow in November, today's report is just the operational KPIs report.

Except its not the standard quarterly KPI report. One key metric, the number of enterprise customers, last reported in 1Q at 394 has been dropped. Let me underscore the signficance of this. This metric has been reported quarterly for the last 10 conseuctive quarters I have been tracking $IKE, perhaps for longer. Therefore, I infer the metric has gone backwards. Of course, the customer concentration issue that has become evident in the last 3 quarters has shown the metric doesn't mean a whole lot. But this is another negative inflection point.

They also don't break out the quarterly numbers anymore (ever since the trend turned negative), so I have provided this below as it can be backed out of the half year numbers easily enough (and my model does this automatically ;-) ).

Figure 1: Quarterly KPI Trends

As predicted in my previous straw on this company, the negative revenue trend has continued, with a further reduction in the number of transactions (i.e. indicative of platform useage). Reasons for this have been exhaustively covered in my earlier straws.

A bright spot, if I can call it that, is that subscription revenues continue to advance, setting a new record of $2,6m for the quarter. Indeed the release focsues on several positive developments with new or expanding customers.

However, to underscore how important transaction revenue is, while subscriptions have slowly grown over the last 5 quarters, total revenue has collapsed from a high point of $8.6m to $4.9m.

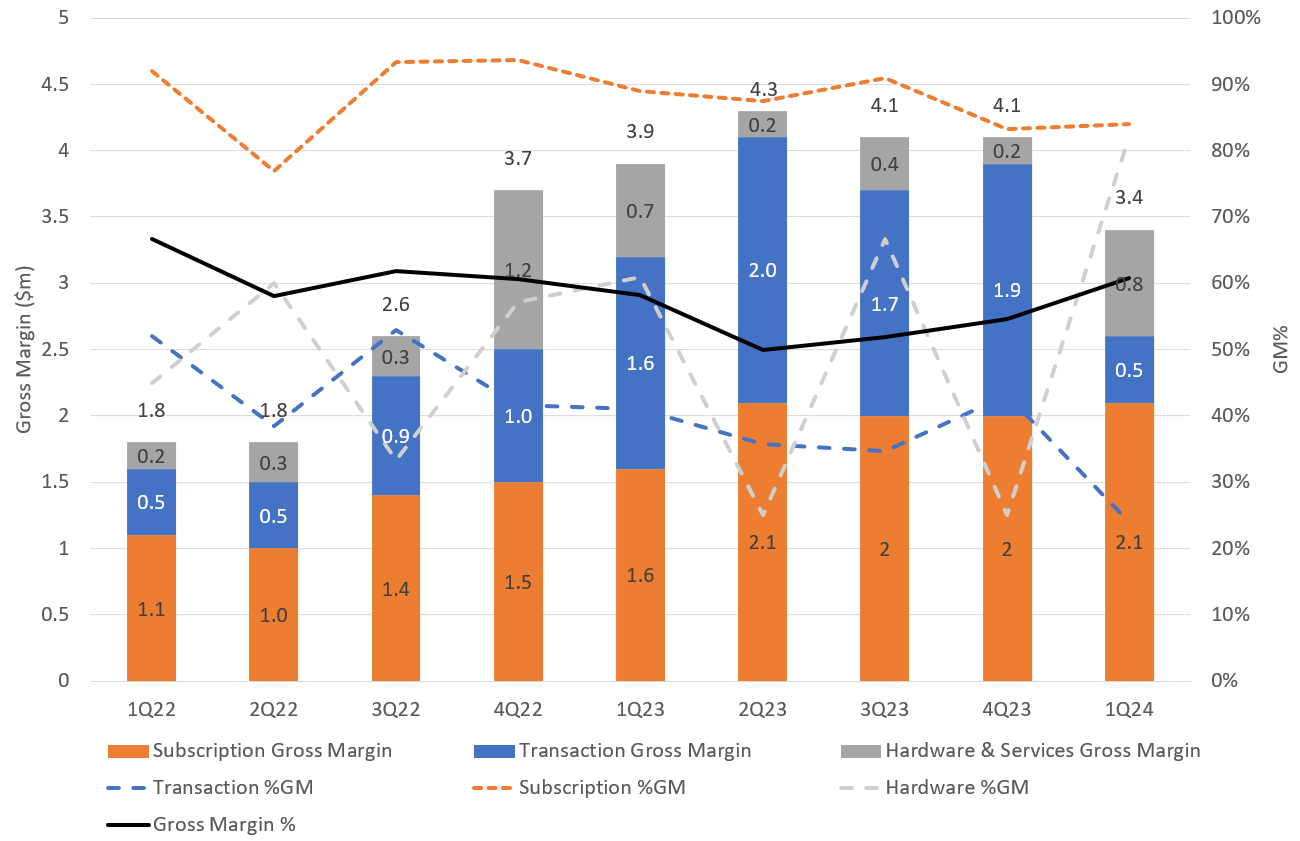

Figure 2: Margins

The margin picture is mixed. Gross Margin decline is dominated by the fall in transactions. While individual %GMs are all over the place, overall %GM is reasonably stable at 57%.

My Key Takeaways

As predicted, this was another weak quarter for platform use. On a positive note, subscriptions continue to grow steadily. New generation Poleforeman is out with previously reported 5x subscription value. But the question is 5x of what portion of the revenue base? I guess we'll see over the coming Qs.

Management continue to change metric reporting if it doesn't suit them. Dropping total customers is another flag. (Decide for yourself what colour, as it doesn't matter to me anymore)

So the big questions is, do the established large customers return to using the platform, as new subscribers build their use over time? And related to this, does this all happen before the company faces yet another need to raise capital?

These are existential questions. Today's release and presentation hold no answers. There is no setting of expectations that transaction revenues are coming back, a further change in the rhetoric that previously assured investors of growth returning in FY24.

I continue to follow $IKE but for now my thesis is that this is interesting tech that adds value to customers but management has so far been unable to turn this into a business.

I continue to watch $IKE, but no longer hold in RL nor SM. Although it was painful to sell and cyrstallise a reasonable loss, I am glad I was driven by my own analysis. History is showing results can get worse and on the SP there is always further to fall.

One potential path is that if the company doesn't renew its trend towards breakeven, the SP will steadily fall as a future capital raising approaches. $IKE then surely becomes an attractive acquisition target. Without the burden of management overhead, there appears to be a valuable tech platform and customer base here for the long term.

It will be interesting to see how this plays out.

Disc: Not held

SUMMARY

Following addresses by Chairman and CEO at today’s AGM, I’ve lost my remaining conviction in $IKE, and this morning gingerly exited my RL position. (I was a little nervous at the open as volumes are very thin, and I consider myself lucky to have gotten a good price,… $0.595 and $0.59, albeit a reasonably hefty loss.)

For those who follow $IKE, I have foreshadowed this decision in previous straws, including my selldown of 50% of my holding following the FY23 results. I’ll not repeat the background in this straw, but rather explain why my thesis is broken.

To summarise, for my thesis to remain intact, I needed to begin to see evidence of a return to growth during FY24. $IKE is a small company, still burning cash, so the level of growth I needed to see coming back was strong growth. I can’t see that growth in prospect and, given that guidance provided in the AGM included new elements of bad news, I am exiting to use the capital elsewhere.

What was Communicated Today

Glenn Milnes provided an update on the FY24 outlook as part of his AGM address today. The key messages are (verbatim from the presentation):

- "Revenue in 1H FY24 is expected to be below analyst expectations due to timing delays of engineering programs across three of IKE’s largest national infrastructure customers. Specifically, this will result in:

- Lower reoccurring transaction revenue in the period vs pcp

- Overall, lower revenue in 1H FY24 vs pcp

- Importantly, the delayed long-term customers referred to are not ‘lost’ and in fact are guiding for very high levels of IKE product usage over the coming future periods

- In addition, the company continues to see ongoing strong growth in recurring subscription revenue vs pcp

- IKE’s additive sales opportunity pipeline supports the potential for substantially increased revenue in the 2H FY24 period, and beyond, from existing customers and new logos"

Covered in previous straws, this is the continuation of less than positive news that began three quarters ago and which the Chairman in his address summarised as follows:

“Looking forward, we expect to see continued overall growth, noting that for Q1 and Q2 FY24 transaction revenue was softer on a run rate level due to the traditional engineering practices of one or two utilities where two larger IKE customers are building their fibre networks.“

That was old news, and the SP and my model have accounted for it. The impact of a reversal of the strong growth from FY22 into early FY23 is clear to see in graph below showing the quarterly numbers. (Note: you can't see this picture when you look at the annual results.) With the sharp reversal of growth over recent quarters it dawned on me that $IKE’s revenues are concentrated in a small number of large customers – something that wasn’t clear to me until these major customers slowed down and it had to be explained.

Figure 1: Trend Analysis from Quarterly Reports

Source: Analysis from $IKE Quarterly Report

So, today’s guidance is more of the same. Now three major customers are experiencing “delays” in their infrastructure programs which, in aggregate, has a material impact on overall forecast company revenue.

What does this likely mean for the numbers?

Glenn makes reference to “analyst forecasts”. What does he mean?

The single analyst covering $IKE currently has FY24 revenue forecast at $38.5m, up 25% over pcp. According to TradingView.com that analyst has a price target of $1.28, and according to marketscreener.com their last revenue revision was an upgrade (!) after the annual results were released – something I cannot get my head around.

I’m not sure who the covering analyst is. Bell Potter had $IKE on their “Picks for 2023” with a price target of $1.21. I also have an old report from Forsyth Barr from September 2022 with a “spot valuation” of $NZ1.07. That old report bears the disclaimer “Forsyth Barr has been engaged and paid by the company covered in this report for ongoing research coverage.”

Whatever the source, the forecast revenue number was perhaps a reasonable estimate given that Glenn had guided investors that growth would resume in FY24. The analyst’s number for 1H FY24 is $17.8m vs $15.4m in the pcp. Following today, that needs to be revised DOWNWARDS, and it will be interesting to see whether it is.

So, Glenn is guiding the market to 1H revenue in the pcp of less than $15.4m, because activity levels at three of $IKE’s largest customers are “delayed”. To soften the blow, Glenn optimistically states that these customers are guiding for “very high levels of IKE product usage over coming future periods.”

So once more, we have bad news on the facts with a promise that things will be better in later periods.

From my perspective, however, what is more concerning is that there isn’t any message that current activity levels have increased from the decline we have already seen over the last three quarters into 1Q24, evident in the graph above.

$IKE claim to have good line of sight into revenues based on the usage of their platform and the deployment plans of their customers.

With $IKE’s 2Q FY24 almost done, I would have thought Glenn would have reassured investors if activity levels were looking more like any of 2Q23, 3Q23 or 4Q23, which they would need to be if the 1HFY24 revenue isn’t going to fall materially below $15m. Now, for full disclosure, I wasnt able to attend the AGM today, and so I don't know what was said in the Q&A. Certainly, transactions and price action indicate that none of the attendees today were spooked. So I may be missing something.

The message of ongoing “strong growth” in recurring subscription revenue is only partial comfort. Here’s why. 1HFY23 subscription revenue was $4.2m. “Ongoing strong growth” would imply to me >30% growth to pcp, meaning that 1HFY24 subscription revenue would be in the region of $5.5m or more, leaving as much as $10m of revenue to find from transaction and hardware revenues to stay flat over the pcp. But that would imply a very strong 2Q24 number for transactions, and there is no message to indicate that this is occurring based on what Glenn is seeing now.

So putting all the pieces together, 1H FY24 revenue might be (and I emphasise MIGHT) significantly below $15m, and I wouldn’t be surprised if it came in anywhere in the range $11-14m.

With closing cash in FY23 of $18 and a cash burn in the year of $7.5m, $IKE isn’t in any immediate need for new capital. However, with costs rising and revenue flat (at best), “Fortress Balance Sheet” has now gone from the lexicon.

On a positive note, $IKE is continuing to add logos, maintaining a rate of about one new enterprise customer per week, and we had the good news of a significant contract of an existing customer moving into a deployment mode and committing to $1.5m of subscription spend over 18 to 24 months. IN addition FY24 will see the launch of the next generation of Poleforeman as well as new versions of AI-powered IKE Insights. Both will drive significant increases in revenue per user.

New customer numbers are good. But more of those 379 enterprise customer on board at the end of FY23, including from many very large utility companies and engineering service companies, need to start using the products, enterprise-wide. Performance cannot continue to rest in the hands of a handful of large customers. Now I know utility network engineers are a conservative bunch in their work practices and I recognise that it may take time for full deployments to be realised. But if that's true, then as an investor it will gradually become apparent over time that the ship is turning, and I will be able to get back onboard.

My Conclusions

I hold small cap, unprofitable companies on SM and RL because their strategy, market position, leadership, and track record indicate they are going to move through the inflection point, on their way to becoming profitable, future industry leaders.

I know it takes many years to build a great company, and that progress is not continuous. Equally, I know most small businesses don’t make it.

$IKE has fallen to the bottom of my merit order, and the loss of conviction has occurred over a 12 month period. I need the capital elsewhere. So, with today’s news I have to exit and I have.

I still believe in the industry opportunity, the product looks like a good one that will drive productivity in its customer organisations, the competition is limited, the management team know their business well.

There is a lot to like about $IKE. It remains a business I would like to own, and I’ll continue to follow it as closely as ever. But I need to see numbers heading in the right direction, and I am happy to sit on the sidelines for a year or some and return if they do.

Disc: Not held in RL; selling on SM

Disclaimer: This is not investment advice. It is a record of a personal investment decision and rationale.

$IKE has landed a new material contract.

IKE wins Subscription Contract for expected $1.5m+ supporting a Customer that is Assessing more than One Million Distribution Assets

ikeGPS Group Limited (ASX/NZX:IKE) or IKE, today announces:

- That it has signed a new subscription contract with a large U.S.-wide infrastructure customer, in this instance supporting a network assessment in California.

- This customer contract is expected to generate approximately $1.5m or greater of subscription revenue in the coming 18 to 24 months.

- This is a contract extension following an initial proof of concept deployment.

- This customer is utilizing the IKE software platform to speed the engineering assessment of ultimately more than one million distribution network pole assets.

IKE CEO Glenn Milnes commented, “The growth across this infrastructure customer further demonstrates the value that the IKE platform provides to communications companies and electric utilities, and our ability to expand the use of our platform over time across customers. The initial contract with this customer is large, however there are opportunities to deliver significantly more IKE capability into this group over time. This customer also represents the new and large market opportunity for IKE in California, with recent regulatory requirements requiring all pole owners to perform a full engineering assessment of their networks. IKE products dramatically increase the speed, quality, and safety for the construction and maintenance of distribution assets. Our broader in-market momentum with existing customers and targets gives us a high degree of confidence for strong long-term growth.”

My Take Away

The next few reports ($IKE follows an end-March FY but provides quarterly performance updates) will be critical to my thesis on this utility SaaS provider. Having grown contracts and transactions strongly through FY22 (which looked like a "breakout year") revenue and platform usage then declined through 3 consecutive quarters in FY23/1QFY24. The explanation was that a major customer was delivering infrastructure in a jurisdiction where the pole-owning utility would not allow the use of $IKE's digital tools. Investors have been assured that as the rollout moves beyond this utility's area, growth would resume.

While good news to see a repeated commitment to growth, the issue raised a question about customer concentration, something on which $IKE's reporting is not transparent.

So today's report is welcome news. Large contracts diversifying the customer base are key to supporting the thesis. It is also good to see proof of concept (POC) trials translating into material contracts. Given $IKE's large list of customer "logos" of the very large US utilities and engineering service firms, the customer concentration issue belatedly dawned on me that many of these "logos" are likely to be in an evaluation phase rather than a deployment phase. Hopefully, more of these POCs will convert over time. So more of today's type of annoucement are key to supporting the thesis.

On the back of abovementioned declines, I have earlier in the year scaled my RL position back to a more modest 1.2% (from 2,5%). One swallow does not a summer make so, while I take today's announcement as encouraging, I'm sitting tight for now and looking forward to further evidence of renewed growth momentum. But it does take time to build a business!

Disc: Held in RL and SM

Interesting announcement. $IKE has appointed an SVP Product Development in the US. What makes it interesting is that the appointee comes from SPIDA Software, one of $IKE's key competitors which was acquired by Bentley Systems in 2021.

Glenn Milnes says "We have known and admired Brett and SPIDA, who our PoleForeman product competes with directly, for many years. As such we are very excited to welcome his deep domain expertise into our company where he will work alongside myself and our US-centred leadership team. As noted, Brett’s experiences are uniquely matched to IKE’s product suite, our industry, and our growth goals."

This could be a great hire.

Disc: Held RL and SM.

$IKE issued their 1Q FY24 Performance Report this morning.

In May, at the last quarterly update and again at the FY report, $IKE warned of a slowdown in transactions driven by two of their larger customers doing a fibre rollout in an area where the pole owning utility does not allow use of digital tools for the key engineering processes that $IKE delivers. Today we got to see how bad this was. And its bad. I go into this in further detail below.

Their Highlights

- Q1 FY24 revenue of ~$5.6m (-18% vs pcp).

- Subscription revenue of $2.5m (+36% vs pcp)

- Transaction revenue of $2.1m (-45% vs pcp)

- Q1 FY24 gross margin approximately of ~$3.4m (-12% vs pcp), with a gross margin percentage of ~61%. (up from pcp of ~56%)

- Total cash and receivables as at 30 June 2023 of $18.1m, comprised of $13.7m cash and $4.4m receivables, with payables of $1.1m and no debt.

Other key items in the report commentary

First, good news. $IKE continues to add about one enterprise customer per week, so the upward trend in number of customers is steady. Subscription revenue was up slightly over Q4 and +36% on the pcp. So steady growth.

The issue is that transactions and transaction revenue fell dramatically. We knew it would be a decline, but the decline is significant at -45% vs. pcp.

On a positive note, Glenn reports that forecasts coming from customers point to transactions building strongly through the rest of FY24 and that $IKE has not changed their growth outlook from a broader FY24 perspective.

The "soft launch" of next generation software is referred to as a "near term milestone" so it is still ahead of us. What's new is the information that the new features which have been developed in consultation with the customer council are expected to generate subscription revenues of "more than 5 times the level of revenue per annum per customer" than the legacy platform. Wow.

On cash, this is reported at $13.7m.

Trend Analysis

I include my two trend reports. Figure 1 for volumes and revenues and Figure 2 for Gross Margins ($ and %).

Figure 1 Volumes and Revenues

Figure 2 Gross Margin ($ LHS and % RHS)

My Analysis of the Results

Volumes

While we were prepared to expect the decline in transactions, the fall is quite dramatic. It this is down to a loss of activity as two larger customers traversed a "no-go" utility area in their fibrerollout, it points to very high concentration in the subscription revenue.

But what is also clear from Figure 1, is that this wasn't just a one quarter phenomenon. 1Q represents the third consecutive quarter of declining transaction volume. So even though we were given the "heads-up" in May, it looks like this has been a longer time coming, so I have a question as to whether Glenn was being transparent with investors, or only telling us when it became obvious to him that there was no way we were not going to find out.

We are told to now expect growth again moving forward. I'm not surprised that the two engineering customer likely took 3-4 quaters to traverse a State in their fibre rollout (I'll assert this, even though Glenn hasn't said this - just to be clear), what is disappointing is that this implies that growth in the use of the platform across the other almost 400 customers hasn't rapidly compensated for the decline. That says to me that the "super-users" of the platform are highly concentrated.

Reporting the number of customers is an almost meaningless metric. A customer could be a small enginering firm with a handful of engineers, or it could be a large cap utility with 100s or even 1000s of engineers. $IKE would do better by shareholders to report the "number of seats" in the way that $ALU does.

Disappointing though this is, it is not thesis-breaking from my perspective for two reasons. First, in the short term, the two super-user customers will move to other juridictions and begin to use the $IKE tools again. This appears to be forecast. Secondly, and more importantly, provided that other customers are rolling out the use of the $IKE tools, then over time, this lumpiness will smooth out.

As ever, we can either choose to accept Glenn at his word or not, that growth will resume for the rest of FY24. Historically, Glenn has a good track record on forward-looking statements, so I will give benefit of the doubt.

Margins

Margins collpased in transactions. It is unclear how costs are allocated to transactions. Unlike normal SaaS where the incremental transaction cost is $0, we know that $IKE provides services in support of the use of the tools. Given the collapse in volumes, some of these support resources are potentially being recovered over a smaller volume.

More generally, margins appear to not be a concern, as the overall % GM has continued the postive trend up over the last 3 quarters getting back to where is was in 2022.

Cash

Cash has fallen from $18.0m at the end of FY23 to $13.7m at the end of Q1, and Glenn has dropped the use of the term "fortress balance sheet". From my perspective, that puts $IKE on a "negative watch" because, were this rate of burn to continue, $IKE would be only two or three quarters away from raising cash. However, if growth resumes through the rest of FY24, then the propsect of a raising might be averted.

Outlook

The forward guidance is clear about a return to growth, both from transactions and with the propsect of strong subscription revenue growth as the next generation software is released and progressively adopted through the rest of FY24. This will be a key proving point for $IKE. If customers value the new product and adopt it, subscription revenue will grow strongly and - given the value to customers - you'd expect transaction volumes to follow. If not, $IKE could face the prospect of supporting customer on mutliple platforms, which could potentially drive costs. So it will be an interesting year or two ahead!

My Key Takeaways

The result is disappointing and it raises (or rather strengthens) questions over the longer term trajectory for $IKE. Frankly, it is worse than I feared, but it is not inconsistent with what Glenn has said. I believe we could have been warned earlier and you could debate whether Glenn should have done this, if he could.

In May, given the negative outlook and my concern about customer concentration risk, I cut my $IKE position in half, as I was too overweight for such a high-risk proposition.

The $IKE SP can be volatile given illiquidity. So if any shareholders weren't paying attention in May and June, they might get a nasty shock this morning. We'll see as the day unfolds.

Unless anything material transpires in the call at midday, I intend to sit tight with my current position. Indeed, if $IKE can maintain subscription growth and restore strong transaction growth, then given all the reasons I've written about before, I'd like to hold more of this stock. It is possible an adverse market reaction could give me an opportunity to pick up more cheaply in the near term. However, I have to be honest and say I do have questionmarks now, and my conviction in the thesis is not as strong as a year ago.

For now, I'll sit tight whatever Mr Market decides.

Disc. Held in RL (1.3%) and SM

I attended the FY23 result call this morning for $IKE. I've reported the gist of the results yesterday, so today I focus on the detailed insights from the brief call.

1) Research and Engineering Expense

The uptick in R&E expense in H2 over H1 is due to a $3m impairment of capitalised prior year R&E investment. It is a non-cash item and follows from the regular impairment tests. This means that some historical R&E spend is now not expected to generate the returns in the future that were envisaged originally. I'll take Glenn at his word that this is a "one-off", but will be alert to any further "one-offs" in future reports.

If I exclude this item, H2 R&E expense falls from $7.6m to $4.6m, compared with $3,8m in H1. And total FY R&E expense falls from $11.4m to $8.4m, an increase of 44% over FY22.

Total expenses without the one-off was $25.0m or 81% of revenue in FY23, vs. $19.5m or 121% of revenue in FY22.

Looking to FY24, Glenn said that FY23 R&E was "almost normalised in terms of absolute cost". This response to my question is ambiguous, as it is unclear whether he was referring to the expense including or excluding the impairment.

On expenses overall, Glenn made clear that he expects these to scale at a lower rate than revenue growth from hereon in.

So, with this item explained and excluded, $IKE FY net income was neatly within my forecast range.

To Glenn's credit, there is no massaging of numbers, no "adjusteds" or "underlyings". The results are reported on a statutory basis and everything is there in the Accounts. That's a Green Flag for me compared with so many of our CEOs.

2) Revenue Concentration

Given that the expected progress of two customers in rolling out their networks with in the catchment of a single utility in Kansas has caused $IKE to flag that Q1FY24 subscription revenue is likely to fall below Q4FY23 results, I asked how concentrated $IKE's customer base is.

In response, Glenn said that there is some concentration risk. He added that the top 10 customers account for 45% of total revenue. So, it is good to have this datapoint, and the concentration is not as bad as I feared, but still enough to drive volatility from period to period. Glenn added that this will reduce over time as the business scales.

On the Kansas rollout, Glenn said that IKE has good visibility into their customers' rollout plans, which include many States. He is confident that growth will resume once the programs move beyond the catchment of the current utility that is "old fashioned in their processing of data".

3) Next Gen Pole Foreman

Glenn reiterated that this is due for rollout in the second half of this year, which has been a consistent message for the last few presentations. (However, ambiguous as to CY or FY.)

4) M&A

Glenn reported that the IKE Structural product, developed via an acquisition in 2019, has achieved 5-10x revenue growth and they are very pleased with it. He reiterated that they are continuing to key an eye out for further "well-priced" opportunities over the next 12-24 months.

5) Geographic Expansion

Glenn reiterated that for now they remain laser-focused on North America, but that longer term, geographic expansion is on the agenda.

He reiterated that they are now the "poles data partner" for one of the global mapping companies that drive cars and fly planes in 90 countries to generate maps. He said they can't mention the firm, but think about the giants ("like Apple, Microsoft, Google"). While Glenn has now mentioned this a time time in recent reports it is not clear to me what this means from a business model perspective. I mention this because if there is a route to market through this partnership, then that could drive geographic expansion via customer pull.

Personally, I hope they continue to remain laser-focused on the USA. I want to see a business that can grow strongly, and start throwing off cash at attractive SaaS-like margins. International expansion before achieving this would be a thesis-breaker for me because it would put off indefinitely, the time it would take to see the real economics of the business.

Conclusion

For FY23 over FY22, $IKE's incremental revenue over incremental cost (direct + expenses) was 102% including non-cash costs, and 123% excluding the impairment item. So, operating leverage is starting to show through, and Glenn is clear that expenses can now be managed to grow slower than revenue. The question is, after a flat H2 compared to H1, does revenue growth take off again in FY24?

For now, I will hold my reduced position. $IKE has a product customers appear to want, and industry competition is favourable to them. But will all those impressive logos increase their use of the $IKE products to drive their productivity?

Disc. Held IRL and SM

$IKE has just released their FY23 results. The results call is tomorrow morning, 10:30am.

Their Highlights

+ FY23 revenue of ~$30.8m (+93% vs pcp).

+ FY23 Subscription and Transaction revenue of ~$27.m (+93% vs pcp). ~90% of IKE’s revenue in FY23 came from theses recurring and re-occurring sources.

+ FY23 gross margin of ~$16.3m (pcp of $9.9m), with FY23 gross margin percentage 53% (pcp of 62%).

+ FY23 EBITDA loss of ~$2.1m (pcp -$5.3m).

+ FY23 Net Loss of ~$6.6m (pcp -$7.9m).

+ Total cash and receivables 31 March 2022 of $23.2m, comprised of $18m cash and $5.2m receivables, with payables of $2.3m and no debt.

My Observations

I'll keep things brief and post after the call tomorrow if there is anything of note.

Earnings

I was expecting net income to be in the range -$NZ$0 m to -NZ$5m. Instead, it came in at -NZ$6.6m. So what drove the difference?

The largest single item appears to be in Research and Engineering Expense. FY23 came in at $11.39m vs only $3.798m in H1, meaning that $7.592m was spent in H2. There is no callout or explantion of this in the release, so I hope it is addressed in the presentation tomorrow. Clearly, I want $IKE to spend to develop its platform, and it is possible that expenditure has ramped up in the half to deliver the impending next release of the platform, which has features driven by the user council and hopefully includes enhanced data analytics and automations. But I would have preferred some narrative and call out of such a material increase in spend, particularly as it is material to the overall recent trend in expense control.

A glimmer of good news: other expenses (support, sales and marketing, and corporate costs) have been well-controlled, coming in at $8.2m in H2 compared with $8.4m in H1, in aggregate.

Growth

No new insights here over what was available at the 4C. Flat revenue and direct costs (half-on-half) are in line with what I have commented on previously. As expected from the 4C, gross margin erosion appears to have plateaued H2 over H1, both at 53%.

While the y-o-y comparison on operating metrics are great as expected, there is no further insight regarding the flattening of growth that we've seen in Q3 and Q4. All that is repeated is the head's up for FY24: "IKE expects growth to continue in FY24, noting the potential for Q1 FY24 transaction revenue to be below the Q4 FY23 run rate level because of the traditional engineering practices of one or two utilities where a larger IKE customer is building a fibre network."

My Key Takeaways

The result is as expected, save for the significantly larger R&E expense, for which an explanation will be sought tomorrow. (Why the large increase? What's the forward spend picture in this category - this must be known?)

Questions on the growth trajectory are unanswered, as expected. It sounds like H1 could be softer (or at least Q1), and this question might not be answered until another year has passed. Hence my reason for a softening conviction, and reducing my holding in $IKE.

Let's see what tomorrow brings.

Disc. Held (RL and SM)

For those who want to hear it straight out of the horses mouth there is a recording and transcript posted on Capital IQ Pro if you have an account

I can't find it anywhere else (ie: factset etc) so this must be an exclusive service.

Might listen to it later and perhaps provide feedback when I have a chance.

My straw yesterday reported on the results call. From this I noted a flattening of performance in H2 compared with H1, and we also heard from CEO Glenn that platform transaction growth would likely be lower in Q1FY24 than Q4FY23. Because of this, I have taken a bit of a dive into the quarterly data for FY22 and FY23. I will also comment further on risks around the FY23 financials, expanding on my response to question from @Vandelay yesterday. As usual, I end with some important key takeaways.

Annual Performance

Let's start with annual numbers for FY21, FY22 and FY23: Figure 1 shows revenues, customers and transactions and Figure 2 shows Gross Margin.

Figure 1: Annual Revenue, #Customers and # Billable Transactions (000)

Figure 2: Annual Gross Margins

Overall, pretty impressive growth. Revenue CAGR is 82% and GM CAGR is 67%. So far, so good. Importantly, we can clearly see that the strategically unimportant Hardware and Services are becoming less significant, while the Transaction Revenue is becoming a major revenue driver while also making a major margin contribution.

There's been some discussion here about declining %GMs: 64% (FY21), 62% (FY22) and 53% (FY23), although within this I have noted that H1 FY23 was 53% and H2 FY23 was 54%, so it may have bottomed out - but one to keep an eye on.

Figures 1 and 2 also shows over the last two years, more customers are on contracts with a transaction component and/or customers are using the platform a lot more - frankly, over 2 years transaction revenue has exploded. If this continues with large enterprise customers, then perhaps we will see the strong net revenue retention shown by SaaS firms like $ALU and $WTC, where existing customers grow strongly for several years as the platform is adopted and integrated by more team (departments / geographies) into work flows. That's a core part of the thesis.

So far, all so good. But now let's look at the quarterly performance.

Quarterly Performance

Figures 3 and 4 show the same KPIs broken down on a quarterly basis. The picture is (obviously) the same in aggregate, but it raises an important question. (Note these pictures are less flattering because we don't have the full quarterly breakdown for FY21, as the information has only been reported consistently for the last two years. So only FY22 and FY23 are shown.)

Figure 3. Quarterly Revenue, #Customers and # Billable Transactions (000)

Figure 4: Quaterly Gross Margins

When looked at on a quarterly basis, it is clear that revenues and margins have been flat and/or in decline for the last three quarters.

More significantly, even though Glenn reported that Transaction Revenues in 1Q FY24 are expected to be lower than 4Q FY23, what he omitted to point out is that transaction volumes, revenues and margins have already been declining since 2Q FY23!

This wasn't immediately apparent from the report and presentation, because the quarterly data isn't presented in an easy-to-read format, You have to break it out across the reports.

If, as Glenn reports, transaction volumes are lower in 1Q FY24 than 4Q FY23, then that would represent 4 consecutive quarters of decline. This is at odds with aspects of the core thesis: that customers number are growing (true), that customer capex and therefore engineering work is growing (true - 5G, Broadband, Electricity distribution ... you can see it in the annual reports of the major US utilities), and that customers are increasingly using the platform to deliver work more efficiently and that over time, large customers are rolling it out (in question).

Now we know that growth is not linear, and that progress ebbs and flows, and that data can be lumpy from one quarter to the next.

We also know (from yesterday's call) that some customers will not be able to use the $IKE platform in all geographies, depending on the policy of the owner of the poles, and more specifically, that two major customers are currently working in areas where this is impacting utilisation.

But it raises a question-mark - and it is something to keep an eye in future reports.

FY23 Financials

I wanted to conclude with a further comment on FY23 financials, as I gave a "first pass" response to @Vandelay yesterday.

For this, consider the 1H FY23 P&L in Figure 5.

Figure 5: 1H FY23 $IKE P&L

Let's go through line by line and see if we can scope out a directional forecast for 2H FY23! Some items are impossible to forecast, but I'll comment on those that can be.

GM is slightly better at 54% although revenue is slightly down. So let's say GM is flat at $8.2m.

FX was +$2.2m in 1H. Having looked at NZD and USD rates and cash balances, I forecast this to be -$0.8m to -$1.2m for 2H.

On expenses, Ian said on the call that costs are being controlled well. However, he also indicated that $IKE are continuing to invest heavily in the product and the supporting systems. He spent quite a bit of time on the call detailing this, even adding a slide that was in the ASX release! In addition, all the staff in the Expense item are subject to wage pressures, so it we modestly assume a 5% step up in expenses in the half, that would add -$0.6m. I could be wrong on this, if more of the staff effort on development has been capitalised.

Bottom line, it is easy to see negative pressure of $3-4m on the P&L while we know that GM is flat, half on half.

Given that Net Income was $1.1m in 1H, that would point to the result for the FY leaning towards a $2-3m loss.

This could be swung either way by those line items that we cannot predict, so my window for the result is $0m to -$5m, which compares with a loss in FY22 of -$7.86m.

So, in answer to @Vandelay , no, I don't think $IKE will post a profit in FY23.

And neither does the market. The consensus (n=2) is for a -$3.54m loss, which agrees with my result.

In short, I don't think there'll be any positive surprises in a few weeks time.

My Key Takeaways

As I have said, $IKE is my highest conviction, small cap. Until today, I had been holding a "double allocation" compared with what I normally hold for high risk holdings.

The analysis I have laid out today and the insights from the call yesterday don't change my overall view of the investment thesis, and my view that I believe that, over the LONG TERM, $IKE will be a profitable and much more material business.

It is also the kind of business that is very likely to be acquired by the large corporates providing technology solutions to utilities (think Siemens, ABB, Mitsubishi etc.). The reputation it is building in the space and its blue chip client list makes this very likely, in my view.

However, the lesson I have learned over the last 3 years in holding high risk, unprofitable businesses, it that I have suffered outsized losses mainly due to failing to manage position size. By this I mean, I have at times confused getting to know a company with getting caught up in the story and not properly evaluating the risks and adjusting over time, ahead of the market telling me what I really already knew!

I believe the immediacy and quantum of the growth trajectory is today more of a risk, standing here in FY24 than it was in FY22 and even 1H FY23.

Adding to my assessment of risk, is that I feel that $IKE could more clearly communicate their results. The quarterly KPI data is all there, its really good, and I hope they stick to it. It's just that you have to do some unnecessary analysis yourself to extract the full picture.

In addition, by no longer reporting New Contract Sales or TCV, investors are losing some forward visibility. I said yesterday that I support this decision for reasons set out in yesterday's straw. However, $IKE also do not report churn or net revenue retention, so investors do not have visibility that other SaaS companies provide into the quality of their revenues.

In the same vein, the number of customers metric is almost meaningless. An engineering firm of 50 engineers counts that same as a $100bn cap utility with thousands of engineers. Yesterday's narrative on transaction revenues indicates that customer concentration may be more of an issue than is apparent.

As a result, I have halved my RL position in $IKE from 3.0% to 1.5%. (And will make a proportionate adjustment today in SM.)

I look forward to being able to increase position size when growth trajectory and profiability are confirmed. In this decision, I am prepared to give up some upside as the price of securing that option.

Disc: Held SM and RL

IKE issued its Q4 and FY23 performance update today. In this straw I cover:

- Their key highlights

- Insights from the presentation and the Q&A discussion

- My key takeaways

Overall, Q4 brought home a very strong result for FY23.

Their Key Highlights

- FY24 revenue of ~$30.8m (+93% vs pcp)

o ~$6m ahead of internal budgets set at the beginning of the financial year and above upgraded analyst consensus.

o FY23 gross margin approx. ~$16.4m (+67% vs pcp), with a gross margin percentage of ~53%.

- Total cash and receivables as at 31 March 2023 of $23.2m, comprised of $18m cash and $5.2m receivables, with payables of $2.3m and no debt.

Figure 1: Revenue Performance

Figure 2: Key Metrics

Insights from the Presentation and Q&A Discussion

1. Revenue and Margins

Overall, Q4 finished off a very strong year above both internal management “stretch targets” and analyst views. Q4 contributed $7.5m of revenue to take the unaudited total for the year to $30.8m.

While Q4 was slightly softer on revenue than Q3 ($7.9m), a stronger %GM performance meant that Q3 and Q4 each contributed a GM of $4.1m, taking GM for the year to $16.4m, up 66% on FY22.

I’ll write a separate straw providing a detailed analysis quarter by quarter across each of the segments over the last two years. However, the good news is this will show that the concerns raised in this forum about weakening %GM performance over time appear to have stabilised from 1H to 2H of FY23, even if we aren’t yet into margin expansion. That lies ahead, given some of the investments being made and discussed below.

Importantly, 89% of revenue now comes from “recurring and re-occurring revenue” – subscriptions and transactions.

2. Cash

Although $IKE don’t report a quarterly 4C, the total of cash, cash equivalents and receivables were essentially unchanged from Q3.

Given a slight weakening of the NZD vs. USD over Q3, I estimate they gained a small FX benefit. Because of this, I estimate they were once again mildly OpCF positive and mildly FCF negative for the half, due to ongoing investment in the platform focused on IKE Insight, development of next generation of Pole Foreman, and building out core business systems (See below).

We’ll get a proper look when the financials are released in a few weeks’ time and we can back out H2 cashflows, however, cash burn for FY23 is very significantly reduced from FY22 (-$10.6m) and by my estimate likely to be in the range –($3.5-5.0)m, given the -$1.8m FCF (or -$2.0m including lease payments) in 1H and the even split of margin between 1H and 2H.

I tried to draw Glenn on how they are thinking about FY24 cash generation, however, as expected he refused to give guidance on cash flow. He said: “we keep a close eye and engagement on analyst consensus, and we’re quite comfortable with where they sit at the moment.” (Note: According to marketscreener.com, based on the one analyst that provides a FCF outlook, they have $IKE at -$4.5m (FY23), -$1.30m (FY24) and +$2.90m (FY25).)

Overall, $IKE maintain a strong balance sheet to continue to build the platform, increase automation, and embed themselves in their customer workflows, without a need for further capital. As subscription and transaction revenues grow, they can if they choose transition to the point where future growth could be supported out of operating cash flowsby managing the rate of investment in platform development.

3. Market Update (slide 10)

Glenn indicated that while the tailwinds of broadband and 5G buildouts are key in the next 3-5 years and are well understood, the biggest and most rapid change in the market is the required investment in the electricity grid where the energy transition will see the grid grow from providing 20% of US energy to around 50%. Importantly, this is a multi-decadal shift out to 2050. Glenn summarised $IKE’s position as simply being in the right place at the right time, as much of this investment will be focused on the distribution – adding “capacity and stability to the grid”.

4. New Sales

Glenn reported that they are going to stop reporting new contract wins and renewals. The primary reason for this is that many of their customers who have embedded the product in their workflows are no longer taking out long term contracts and are now being billed on a monthly basis according to licences (seats) and usage (transactions).

Being the suspicious type, I wondered if this was a convenient time to make the transition – being potentially a softer quarter. (I’m still troubled by Ian’s behaviour at $3DP!) Glenn was challenged on this in the Q&A, and he repeated his stance.

Throughout the presentation and discussion some further information relevant to this, and the success $IKE continues to have, was obtained.

1. Glenn said the sales team are working well, closing on average “one new enterprise customer per week”. He showed a slide on the sales team organisation, which has dedicated resources focused both on winning new customers, but then also on customer success and expanding use within accounts. They are following a strictly direct to market strategy (good!) and following a clear priority order based on customer size.

2. He repeated information stated at the ASX Conference earlier in the year, that they have recently won one of the large ("top 5") East Coast publicly-owned utilities from a competitor. According to Glenn, the competitor product had been used by the utility for around 20 years – showing how sticky utility customers are. So, a good win for $IKE. More on that below.

3. Engineering Service providers: These have huge significance in supporting the utilities and often have decades long contracts doing the network development and maintenance work. $IKE have just won the “second largest engineering group in the USA in terms of customer footprint across utilities”. They are starting in New Mexico on a big, 10-year project and $IKE hope to be successful there, so that they get rolled out across the entire organisation, which will “take time”.

Overall, even if this might have been a convenient quarter to make the reporting change, the change makes sense. For now, the quarterly operational updates give investors great transparency on revenue by type (transaction, subscription, product/service) and customer numbers. And with transaction volumes becoming a dominant revenue component, it makes no sense for customers to lock in defined volumes when their contract sees them being billed on a monthly basis based on usage. (I think Glenn has been smart to drop the TCV metric to avoid getting into the pickle that Ian is facing at $3DP.)

5.System Investments (slide not in ASX release)

For some reason, the below slide wasn’t in the ASX release, and Glenn spent several minutes speaking to this.

On System Efficiency, this is all about scalability and operating leverage via investing in core systems (“unglamorous stuff"). This was new information, and he described the system investments $IKE has been making so that they can scale the business efficiently in finance, HR and staff development, marketing/CRM. He also spoke about the substantial SOC2 compliance investments were proving important in customer procurement decisions (“IT departments now just tick that we are SOC2 compliant.”).

The points on Brand and CX have been made previously, albeit not directly linked to driving pricing power.

Glenn went on to say that “when you look at our P&L, you will see that we are investing very substantially in product and technology investment. We are still small and early in penetrating the market, but we’ve got a good view into what our customers require.” I took that as potentially preparing the market for a larger Research and Engineering Expense in H2. This item has been trending up over the last three halves as follows: $3.2m, $3.3m, and $3.9m. (So, if it has moved up again then it will move FCF to the lower end of my estimated range (or beyond?). Even if this cost is increased, given the traction $IKE is getting with its customers, I am happy for this to be the case – now is the time to lock in customers for the next 2-3 decades of growth.

Pole Foreman: A key focus for investment has been the next generation of Pole Foreman, and Glenn spoke about the early positive feedback they are getting from the Customer Council. “We believe it can be quite disruptive versus competition.” Glenn linked this to a key reason for flipping “one of the top 5 investor owned utilities” to $IKE from an incumbent providers, starting with a 100 user licence for 3 years. (See section 6 below.)

AI and Automation: Glenn referred to a small AI acquisition they’d made and said they have been working for two years on using generative AI for poles. He indicated that they are getting some very interesting proof points, and are just coming to market with one of the “world’s largest digital data collection companies” as their pole or distribution asset partner. “This is exciting because it lets us access data at real scale and potentially bring some quite disruptive automation capability into the North American market.” (Note to self: look out for more information flow about this.) (Further note: previously Glenn had spoken about collaborating with $3DP in WA with a utility, but it sounds like they are moving ahead commercially with another partner, as $3DP doesn’t fit the descriptor of “one of the world’s largest digital data collection companies”.)

Glenn concluded the section on product and tech investments by saying that none of these things happen very quickly, but that they are very optimistic about them from a proof point perspective.

6. Why Customers Switch to $IKE

I asked Glenn if he could explain why the latest large utility customer had switched to $IKE from their legacy provider. Glenn replied that it certainly wasn’t because of price! (chuckled) The deal winner was the user experience and simplicity of using the $IKE platform. He said that when a utility has 500 engineers using a product, then simplicity is important. He said that the competitor product is great, its just complicated to use.

7. Customer Council (Slide 33)

Glenn spoke again about how important the Customer Council is in guiding the development of the next generation of Pole Foreman. The slide shows some of the huge utility companies on the Council. The new information Glenn gave is that the people involved on the council are the senior people responsible for setting standards in the utilities. Essentially, by doing this $IKE is developing their product to meet customer requirements for the evolving standards in the industry, a huge competitive advantage when procurement decisions arise.

8. Non-Exec Director Resignation

In Q&A there was a request for more information about the resignation of Eileen Healy US Telco Non-Exec Director after only two years. I'll paraphrase Ian's response:

“She’s been a very valuable board member but a mutual view just looking at the skills we’ve acquired to get to where we are … and where we’re going … and some other personal components as well … our intention is to keep building capability from a Board perspective … there is a really interesting pipeline of potential candidates but nothing imminent.”

Take from that what you will, but one interpretation would be that with things such as a powerful customer council of current decision-makers in the big utilities, perhaps the Non-Exec found they weren't adding that much value or perhaps are not current with the huge trends sweeping through utility USA. Who knows. In any event, I don't see any evidence of flags to raise of any colour.

9. Guidance

While there was no overall guidance today, Glenn flagged in the release and in the presentation that:

"We expect growth to continue in FY24, noting the potential for Q1 FY24 transaction revenue to be below the Q4 FY23 run rate because of the engineering practices of utilities in certain territories where one or two larger IKE customers are building fiber networks."

Because transaction revenues exploded from $6.4m in FY22 to $18.7m in FY23, any step back in Q1 FY24 will now have a significant impact on overall revenues. So, I wanted to dig into this in the Q&A asking what drove seasonality of revenue.

Glenn's response was as follows: "Seasonality - yes there are two parts."

"First we support people that are building and maintaining outside power and communication networks that are above ground, so that when there are big storm events, folk cannot get outside and do engineering so that slows down activity which impacts us."

"Second part of that question, ... in our update today we talked about some transaction revenue potentially slowing down through Q1 FY24. That context is different. We support a range of national communications companies that are building fibre in different markets. They're all in a race to build a fibre network in a city and then switch on the network and win customers. A couple of these customers that we support are in territories where the utility that has to support their network build-out have relatively old-fashioned engineering standards in terms of how they will approve data. And we as a digital standard don't fit those particular requirements in Kansas and in [some] other states. These groups will go to many, many other markets through the year so we may just see things slow down from a recognised revenue standpoint."

I thought this was a very insightful answer. It means that if $IKE's customer is a utility that relies on an electrical utility for access to poles, then that party needs to accept the use of the $IKE platform (presumably from an engineering standards perspective). This will definitely be the case for the broadband and 5G customers, as the poles are usually owned by electrical utilities.

Secondly, for the situtation at two customers to potentially materially impact quarterly revenue, this must mean that a significant proportion of transaction revenues is likely currently still concentrated in a relatively small number of "super-user" customers (my words). This doesn't worry me, because over time, this effect should become less of a problem as $IKE is adopted by more and more customers. But when your total annual revenue is still only $30m, a small number of "super-users" can impact revenue volatilty, so it is important to understand that and to be prepared for future volatility.

My Key Take Aways

Overall, this was another good result.

It I wanted to focus on any negatives, it would be that growth has flattened in H2 compared with H1. But given that 1H was such a massive step up from FY22, then it is good that it has at least been repeated for a second half. Quarters and halves will be variable, hence my next straw to quantify this more explicitly.

I got a lot more out of the presentation and Q&A, and I continue to appreciate Ian's candour in answering questions, even if his organisation and presentation of material would benefit from improvement to ensure consistent messages are communicated to all investors!

$IKE is tracking well and today's presentation was a good setup for the FY Financials in a few weeks time.

My current holding in $IKE (RL 3%, 10% SM) is supersized for such a small, high-risk and unprofitable company (double what I normally hold due to my strong conviction). I didn't see anything in today's presentation that makes me want to change that position either way. My criteria to increase position size are 1) for $IKE to be sustainably profitable, and 2) growing strong year-on-year revenues and operating cash flows. For now, I am content to hold.

With a valuation of c. 4.4x revenue, today's SP seems justified given the 93% revenue growth of the last last year. However, $IKE needs to sustain strong revenue growth into FY24 and demonstrate margin expansion and operating leverage. Any valuation beyond what we have today is pure guesswork.

For now, none of my other small cap holdings are showing the promise that $IKE has demonstrated in FY23, so I am a happy HOLD.

Disc: Held

I've noticed there have been no 4Cs or quarterly cashflow reports and I understand this is a NZ listed entity. Is this normal for a NZ listed entities with negative cashflows not to release cashflow statements quarterly in contrast to ASX listed entities?

Or have they strung 4 quarters of positive cashflow in the past and somehow got into negative territory recently?

Not trying to be negative, just an observation.

@JPPicard has summarised the key issues for $IKE perfectly (from my perspective), and his deep-dive is an excellent introduction and outline of the firm. I'd like to add to this information as part of getting my own "eye in" for the forthcoming results.

If $IKE are true to form, there should be a Q4 Performance Update in about 10 days time, followed by the Annual Results towards the end of May (as IKE follows a 31 March Year End cycle).

I've included two trend analyses on recent half-year results which further underscore just how important the next HY/FY will be, and I also make an observation on revenue growth.

Revenue Growth

The last 3 HY results have shown explosive revenue growth, as existing customers have rolled out the platform, new customers have been added, and platform transaction revenue has started to make a material contribution (see Figure 1, below).

CEO Glenn Milnes has regularly pointed out the linkage between Recognised Revenue and Contracted Revenue, with the former consistently lagging the latter by about 9-months.

On that basis, we should expect to see a softening in (edit: deleted "contracted") recognised revenue growth - and perhaps that has played into the SP weakness over recent weeks as this is anticipated (SP down 20%+ since February's peak), although a selling down by insiders/major holders may be a more inportant factor here in a stock that is usually quite thinly traded (see further down in this Straw).

If the investment thesis is that utilities roll this out and increasingly use it on an ongoing basis, and if more engineers are using the platform over time, then it must follow that platform revenues build progressively over time, extending the strong recent trend. So, if we have seen a weakness in new contracted revenue, this should reveal just how strong the underlying usage by existing customers really is, and provide some first insights into the quality of the business. A potential moment of truth.

The good news is that Glenn usually gives clear updates on Contracted and Recognised Revenues by quarter at each Quarterly Performance Update, as well as reporting Transaction Revenues. (I'll be on the alert for any evidence of Ian-Olson-itis! Sorry, $3DP-holders - I couldn't resist.)

Margins

As @JPPicard has highlighted, the next insights on GM are key. As you can see in Figure 1, while the trends for financials (GP and PBT) are generally favourable, piror to the last HY result, the OpCF (incl. lease payments) trend was not good. However, there was a strong uptick in OpCF the last HY, and the key question is whether this is the start of a positive trend that takes $IKE through the inflection point?

The positive trend in FCF is already establised over four recent HY periods because the heavy lifting in building the product suite has moved onto a new phase and Glenn has been focused on conserving cash. R&E activity is now focused on developing automations for the repeat service requests coming in via the IKE Insights product, and on developing functionality that can support increased customer value captured through price increases.

Figure 2 shows that the businiess appears to be scaling well at the Expense line (S&M and R&E as % of Revenue), but GM% is a question mark (i.e., Cost of Revenue as % Revenue). We need to see that flatten and then decline to have confidence the business is scalable.

Figure 1

Source: HY and Annual Accounts

Figure 2

Source: HY and Annual Accounts

Figure 3

Source: Q3 FY23 Performance Update Presentation

Newsflow

Newsflow since the last results has been minimal, with flags raised through sell-downs of two important holders.

1. New Logo Wins

Glenn slipped into the ASX Small and Mid Cap Conference presentation that $IKE has won a large East Coast Electrical Utility off a competitor, taking $IKE from having 5/10 to 6/10 of the largest investor-owned utilities as customers in the US. This didn't lead to a formal ASX announcement, so that might indicate that the initial contract was not material. However, unlike many firms, $IKE tend not to announce every major contract and prefer instead to provide updates as part of the Quartlerly Performance Reports. Equally, initial contracts can be small, as customers trial the product in one department or team before commiting to a roll-out. I expect we will hear more about this in 10 days' time.

2. Changes in Insider and Major Holdings