Pinned straw:

RPM Global (RUL) is a company I've liked for a few years and have held on and off (currently not holding). I was looking at their share price graph yesterday (Sunday March 16th) and their P/E ratio, which is still very high despite their share price having come down from around $3.35 to $2.57:

Commsec has RUL's P/E ratio listed as 62.35 and their market cap was $575.12m according to the ASX website, which tends to be more accurate with market caps than Commsec is. The ASX site has RUL's P/E ratio listed at 87.47 Their actual market cap should be 222,055,199 (shares on issue or SOI) x $2.55 (Friday's closing share price) = $566.24 million, so their true PE ratio based on their last full year NPAT ($8,656,000 - see here: RUL-Appendix-4E-year-ended-30-June-2024.PDF) should be $566.24 (P) divided by $8.656 (E) (with both figures in millions of dollars) = 65.42.

So a trailing P/E ratio of 65.42 based on their FY24 earnings.

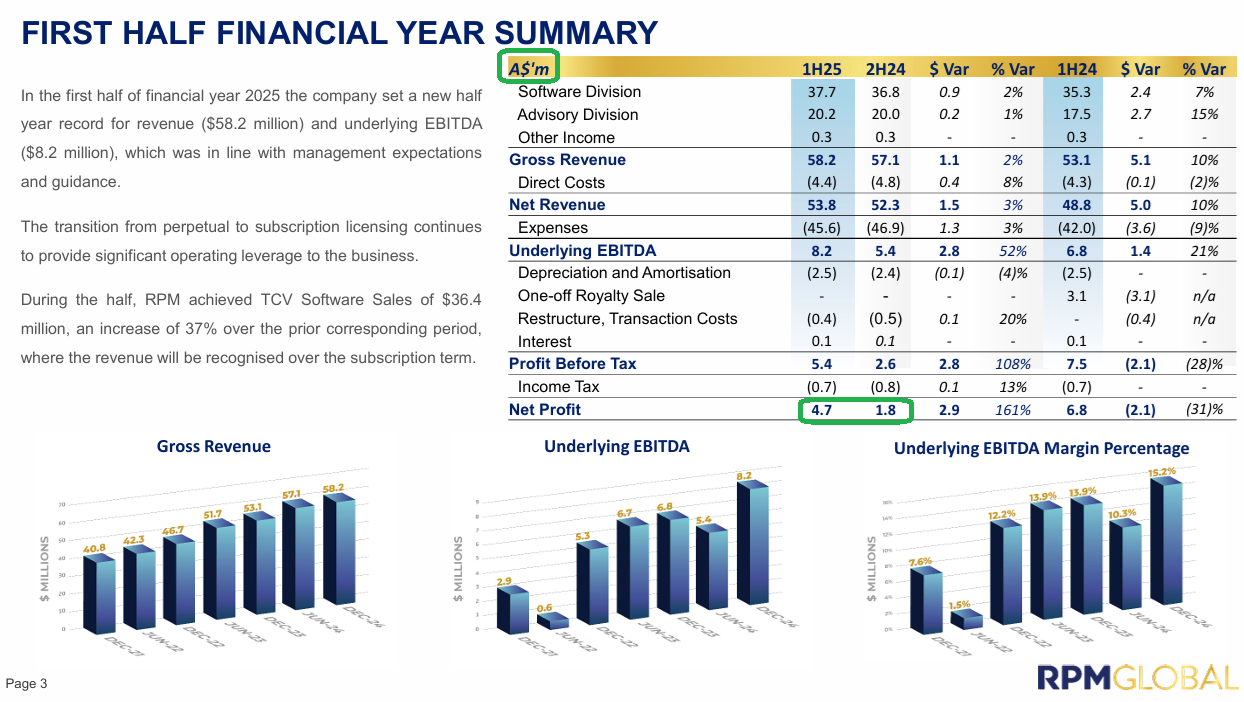

What the ASX appear to be doing is adding together their two 6-month NPAT numbers from their two most recent halves to arrive at the "E" (earnings), so their recently reported FY25 H1 NPAT of $4.734m added to their previous half (H2 of FY24) NPAT of $1.813m to get $6.547m for the 12 months ending 31 December 2024, and that would give us a PE ratio of 86.49 (566.24 / 6.547), which isn't far from the ASX's trailing P/E ratio for RUL of 87.47.

In the following slide from their latest results release, you can see that RUL have rounded down those two NPAT numbers to $4.7 million and $1.8 million, so together that's $6.5 million. If you use that rounded down number ($6.5m instead of $6.547m) it results in a slightly higher P/E ratio of 87.11 (566.24 / 6.5).

If you instead use these numbers on a "per share basis", which also works out the same, the "P" is the current share price of $2.55 (Friday's closing price) and the earnings per share per year have been 2.948 cents/share or $0.02948/share ($6,547,000 NPAT divided by 222,055,199 SOI) for the 12 months ended 31 December 2024, so the P/E ratio is 2.55 / 0.02948 = 86.49.

For the 12 months ending 30 June 2024, the per share earnings are 3.898 cents/share or $0.03898/share (8,656,000 / 222,055,199) so the P/E ratio would be 2.55 / 0.03898 = 65.42.

So on the basis that a P/E ratio is designed to provide a number that represents how many years it would take for the company to earn the amount that you paid for the shares, it would take more than 65 years for them to earn (in NPAT) the amount that you paid for the shares, if you bought them at Friday's closing price of $2.55, and on that basis RUL look very expensive. This is however fairly typical for capital light software companies who are considered leaders in their field. Consider the following:

Company, P/E ratio according to Commsec / P/E ratio according to the ASX website

- Xero (XRO), 108.88 / 123.69

- WiseTech (WTC), 84.69 / 88.45

- TechOne (TNE), 72.81 / 77.44

- Hansen Technologies (HSN), 31.24 / 280.18

- Objective Corporation (OBJ), 58.79 / 44.70

- RPM Global (RUL), 62.35 / 87.47

These are all trailing PE numbers and that's important (more on that in a minute). It appears that Commsec uses the earnings number for the last full completed financial year and the ASX uses the earnings number from the last two 6 month periods added together - such as H2 of FY24 plus H1 of FY25, which is why the P/E numbers can be so different if there's a particularly weak or particularly strong half in there that the other mob are not including. Point is though, that these are all high P/E numbers.

Compare that to the much lower P/E ratios for some of the largest US Tech companies:

Company, trailing PE / Forward PE (based on projected earnings)

- Alphabet (Google), 20.58, 18.83

- Apple, 33.89, 29.15

- NVidia, 41.38, 27.10

- Amazon, 35.80, 30.03

- Meta (Facebook), 25.47, 23.92

- Broadcom, 90.53, 30.03

- Oracle, 35.28, 23.37

- Microsoft, 31.29, 30.21

Makes Google look cheap, eh!

Trailing P/E ratios, such as those I've quoted for all of those ASX-listed companies above, and the first of the two numbers to the right of those US-listed companies above, are based on historical earnings, so they are backwards looking, not forward looking. Forward P/E ratios are based on consensus estimates of current or future year earnings, and are therefore only as accurate as those earnings estimates are.

The thing about these sort of companies, particularly SAAS companies, is that they tend to be capital light and they usually scale really well without much in the way of additional expenditure, so additional revenue tends to drop through to the bottom line, because most of their costs are fixed costs which don't increase much - or at all - with additional revenue. In other words, these companies can handle more customers and increased sales without any significant increase in costs.

Because of this, if you believe that the company is going to continue to grow sales at a good clip, it's reasonable to also expect a corresponding increase in profits.

So that's one reason why quality SAAS companies that are ASX-listed tend to trade on high P/E ratios, because people can easily see a pathway for that company to keep doubling in size every few years, due to low costs, being capital light, and having a long growth runway based on these companies providing software that companies/people need.

The better ones also have low churn because switching costs can be significant in terms of both money and time, plus risks of things going wrong during a switch and negatively impacting that company's own clients.

Some other factors that should be considered are R&D and/or NPD (new product development) spending (costs). Most of those companies have a decent R&D+NPD spend every year, and they need to spend that money to both stay ahead of their competition and stay relevant, as well as to move with the times, for example to add additional capabilities that their customers either require or are likely to require in the future. Companies that do NOT continue to innovate and offer more to their customers/clients over time tend to fall behind and lose customers and/or just grow at a slower rate.

Much can be learned from studying the track record of these companies to see how they've handled these issues in prior years, looking at annual R&D spend, churn rates, etc., but over multiple years, not just one or two years.

The next major factor, as I see it, is M&A plus other capital allocation decisions by management. This is important because no matter how good and how profitable a business is, it can still be a bad investment if the management make poor capital allocation decisions, such as overpaying for assets and then booking impairments (value write-downs) in future years. Other capital allocation decisions can include dividends (including special dividends) and share buy-backs.

For instance, RPM Global (RUL) have an active share buy-back in place and they are lodging notices daily to show how many shares they have bought back and cancelled. This is often a sign that a company considers their share price to be too low, meaning they believe that their own share price does not reflect the value of the business, so buying back their own shares and cancelling them is - in their opinion - a good use of their money (or "our" money if you're a shareholder). That also has to be balanced against other opportunities, such as M&A opportunities (inorganic growth), dividends, etc.

In RUL's case, because they are a capital light business with ROE around 16.5% (according to Commsec) and an $18.7m cash balance at December 31st, with zero debt, if they truly believe their share price significantly undervalues the company, then an active share buy-back does make sense, IMO.

In general, P/E ratios tend to be higher in fast growing, capital light businesses such as SAAS companies, but the examples I have given in the lists above highlight that ASX-listed SAAS companies tend to be a lot more expensive than US tech companies, and one possible reason is that people see how succesful those US tech companies tend to be, and the share price appreciation they have demonstrated, and they extrapolate that across to our market and are looking to get exposure to similar companies on the ASX.

In my opinion, for the most part, that's not really an apples v. apples comparison.

The IT (information technology) sector on the ASX is tiny - around 3.2% of the S&P/ASX 200 index (our top 200 companies) - one of our smallest sectors, whereas over in the USA their IT sector is massive. It's their largest sector by a good margin.

Source: https://www.usbank.com/investing/financial-perspectives/market-news/investing-in-tech-stocks.html [07-March-2025]

The US IT sector, encompassing software, IT services, and related industries, contributes around 8.9% of the US GDP and accounts for a significant portion of the global IT market. And IT companies dominate the US market:

Point is, with good tech companies, there's plenty to choose from in the US, and over here, not so much, so the few decent IT companies that we do have tend to have high P/E ratios and look expensive, because there's greater demand for fewer companies.

The problem with that however is that the market is prepared to pay more for future growth, or, to put it another way, there's already substantial future growth already priced in with high PE companies, so the downside is if they stumble along the way, the share price can "correct" swiftly and the movements can be large in percentage terms. One way of looking at it is that some companies are priced for perfection, and if EVERYTHING doesn't go to plan, i.e. if ANYTHING goes wrong, that big growth and quality premium in the share price can drastically reduce or evaporate entirely.

Oftentimes, the share price will get back up to higher than where it fell from given a few months or years - as long as no further hiccups are encountered, but the ride can get bumpy.

Another consideration is that many of those giant US tech companies totally dominate the market globally, whereas our tech companies are a LOT smaller, many of them focus primarily on Australia - so have a much smaller addressable market - and do not have the same advantages that the big US tech companies have, such as massive economies of scale advantages, and being clear global market leaders.

For these reasons, I am usually only prepared to pay 40+ P/E for companies that I am very bullish on longer term and where I have a very high conviction that they will grow into their current valuation given time. I would need to have a 10 year plus timeframe for a company trading at a 60+ P/E ratio, AND be very bullish on their long term growth, AND be very happy with their management, including their track record of M&A and other capital allocation decisions.

Because, in that case, I am not expecting the company to take 60+ years to earn the equivalent of my purchase price (what a 60+ trailing P/E ratio suggests) because I am expecting that P/E ratio to reduce based on my buy price and their growing earnings. In other words, I am expecting the "E" to expand a LOT in the coming years, while my "P" remains constant (what I paid for the company's shares) so that means the ratio between the P and the E reduces quickly.

In RUL's case I don't have that level of conviction, so I'm not holding at this point in time. I still like the company, but I don't consider RPM Global to be one of the very best risk/reward opportunities across the market for me right now.

Further Reading regarding the basics of P/E ratios:

Google says:

Average market P/E ratios, which are calculated by dividing the market capitalization by the total annual earnings, provide insight into how the market as a whole is valuing its companies, indicating whether the market is generally overvalued or undervalued, and reflecting investor sentiment about future earnings growth.

Here's a more detailed explanation:

What P/E Ratio Measures:

The P/E ratio, or price-to-earnings ratio, is a key valuation metric that shows how much investors are willing to pay for each dollar of a company's earnings.

How it Reflects Market Valuation:

A high average market P/E ratio suggests that investors are willing to pay a premium for earnings, potentially indicating optimism about future growth and a perception of the market as overvalued. Conversely, a low average P/E ratio could suggest that investors are pessimistic about future earnings or that the market is undervalued.

Investor Sentiment:

The P/E ratio also reflects investor sentiment and expectations about future earnings growth. A high P/E might suggest that investors anticipate strong future growth, while a low P/E could indicate that investors are skeptical about growth prospects.

Comparison over Time:

Tracking the average market P/E ratio over time can help identify trends and potential valuation extremes. For example, if the P/E ratio is significantly above its historical average, it might suggest that the market is overvalued and could be at risk of a correction.

Limitations:

It's important to note that P/E ratios are just one metric among many, and should be considered in conjunction with other factors, such as industry trends, economic conditions, and company-specific fundamentals.

Example:

If the average market P/E ratio is 20, it means that investors are willing to pay $20 for every $1 of earnings, while a P/E of 10 would mean they are willing to pay $10 for every $1 of earnings.

--- ends ---

And when I ask Mr Google: What is the average PE ratio of the ASX

Google answers:

As of March 16, 2025, the average P/E ratio for the S&P/ASX 200 is around 15.7.

Here's a more detailed breakdown:

Historical Context:

The long-term trend for the P/E ratio of the Australian market is around 15.

Recent Fluctuations:

While the average is around 15, it has seen some fluctuations in recent years.

Comparison to other markets:

The ASX 200's P/E ratio is generally considered to be relatively low compared to some other major global stock markets, such as the S&P 500.

Factors influencing P/E ratio:

The P/E ratio can be influenced by factors such as earnings growth, interest rates, and investor sentiment.

Interpreting the P/E ratio:

A lower P/E ratio can indicate that a stock or market is undervalued, while a higher P/E ratio can suggest that it is overvalued.

--- ends ---

So, yes, any company trading on a PE of over 40 has a LOT of future growth ALREADY priced in, and I guess the main questions are:

- Do you agree that there's that much upside (profit growth) in this company and are you prepared to pay up for the company's shares now and then wait years for that upside to occur?

- And will it be worth the wait?

- Will the company deliver on its potential in the timeframe you expect them to?

- Are you prepared to ride out significant share price volatility if they stumble along the way?

When a company encounters a hurdle and stumbles or makes a misstep, and the company's share price drops significantly, you'll often hear people say that the market has overreacted to the downside, but those people may not realise that the market had already previously overeacted to the upside by bidding that company's share price up to priced-for-perfection levels, and so the "correction" that they are observing may be exactly that - a correction, to around where the company SHOULD have been trading, without all of that hype and euphoria priced in.

I'm not really commenting on RUL specifically here, because I haven't been following them closely lately, so I don't know their particular situation well at this point, but I'm just making general comments about high PE companies. Sometimes the earnings grow into the PE, and sometimes they don't, so the PE instead corrects by the price reducing.

Mujo

Good explanatory post of what a PE ratio is and some of the limitations and also why to be wary of CommSec numbers.

The PE would probably be even higher if you back out the low multiple, but profitable advisory business which is being sold for $63M (assuming all goes well).

The basket of mature, mega cap US tech stocks may not have been the best comparison. ServiceNow (though much higher quality than RUL) is on something like 60x trailing.

Bear77

Fair point there @Mujo about the US Tech stocks I mentioned there mostly being mature companies; I just listed US tech companies I was personally familiar with, however I do still consider that many of them have plenty of growth left in them, even if much of that growth is via NPD to sell to existing customers. But yes, you are correct that another big reason why some of those ASX-listed tech companies are on higher P/E ratios is that they are young, with larger growth runways ahead of them in terms of TAM, particularly those who are globally focussed and successfully selling their software around the world, like WTC, XRO, HSN, OBJ and RUL. Outside of Australia and New Zealand, TNE has so far only expanded into the UK, but they may be able to crack some other countries in the future.

However, I still think that some of those larger US Tech companies, despite being more mature, still have significant scale, reach and brand-awareness advantages over our much smaller Aussie tech companies. For instance, I would consider investing in Alphabet (Google) at their current sub-20 forward P/E to be a much safer bet than investing in RUL at a P/E of over 60.

thunderhead

There is no doubt at all that the largest and market leading technology companies in the US offer a far better risk/reward proposition than their local equivalents, for many of the reasons you have already covered in your original post @Bear77.

mikebrisy

@Bear77 @Mujo I personally don't look at the P/E of $RUL yet.

It is too close to the infection point, at which stage EPS is growing very rapidly and a very high P/E is justifiable if you use that metric. After all, what P/E ratio are you prepared to pay up for, for a company that has an EPS growth rate of 135% (FY24 / FY23)?

However, it is not the right question to ask because, near the inflection point, small changes from year to year in both revenue and expenses can make big impacts on the profit growth rate from one period to the next. Also, the EPS growth rate really has little meaning because, at this stage, it is likely changing (i.e. falling) pretty quickly.

This is a fundamentally different proposition to a company like $TNE, where management says EPS growth will be >15% p.a., and they aim to double the size of the company every 5 years. (And yes, arguing, whether $TNE is over-valued at today's SP is a much easier conversation to have!)

So, P/E is a helpful guide to value more mature companies, where EPS growth is more stable from one year to the next. Of the many things I don't know about $RUL, I'm pretty well certain the EPS growth rate of the continuing business in FY25 is not going to be 135%!

My preference is to run scenarios for the business financials out 5 years, and see what kind of share price is justifiable for a range of P/Es appropriate for the terminal EPS growth.

When I last did this at the FY24 result I got a valuation for $RUL of $3.20 ($2.80 - $3.60), discounted back to the start of FY25.

The lower bound of the range was for a P/E of 35 at and the upper bound for 45, where my terminal eps growth rate in FY29 is 26%.

Now, you can argue my 2029 P/E's are aggressive, and that a better range would be to apply a lower PEG = 0.8 and and upper PEG = 1.5. Doing that would give a valuation range of $1.66 to $3.12 (from a P/E range of 21-29). Of course, you'd have to buy into all my revenue and margin assumptions to get these numbers, and that's not the point of this post.

From MY perspective, at today's SP of $2.56 on a more conventional range of P/E arguments (PEG of 0.8 to 1.5), I think $RUL is fairly valued.

As a pure software company, with what I believe willl prove to be sticky customers leading to stable earnings, I think $RUL will continue to command a P/E premium and I am more comfortable with my more aggressive FY29 P/E range of 35-45. Today, if I didn't have an adequate position in $RUL (RL=4.7%) I would definitely be buying.

However, the point of this post is not to argue my valuation, as everyone has to decide their own, but rather to explain why I don't look at the current P/E ratio when a firm is within a couple of years of first becoming profitable.

I'll update my valuation once FY25 is in, and I probably wouldn't consider selling at much less than $3.40-$3.50, depending on what else is going on in my portfolio.

Bear77

Agreed @mikebrisy and I reckon @Mujo was inferring something similar this arvo, that P/E ratios are far less useful with younger companies that have only recently become profitable, and a far more useful metric with more mature companies. Instead I was focused on the growth rates, with fast growing companies often having high PE ratios in anticipation of them growing into that PE (& the PE coming down as they do) through rapid earnings growth in future years, but you make a very good point, that growth rates with a company like RUL are hard to predict in the short term (next couple of years), and the nature of their close proximity to that profitability inflection point makes trailing PE ratios fairly useless as a valuation metric - because of their rapidly changing growth rates.

And I certainly should have mentioned that P/E ratios are a totally useless metric with companies that are not yet profitable because their "E" is not a positive number.

So P/E ratios certainly have their limitations, and yes, agreed, they should probably be largely ignored with companies in RUL's position, for the reasons you gave.

RogueTrader

An interesting new discussion on RUL (among other holdings) by the Seneca guys, "Screening tools won't find this stock, it's going to look like it's trading on 80-100x EBITDA. Relative to peers, we think it's one of the cheapest, decent software stocks on the ASX." They also feel that XRF is greatly undervalued: https://www.youtube.com/watch?v=Kg8RQKG72xQ&ab_channel=Rask

feteguru

Seneca chap Luke Larity also mentioned RUL on Equity mates podcast recently as being at a point of infection