Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

$RUL suspended from quotation.

Many thanks to Caterpillar for getting in before the SaaS meltdown.

Sadly for me ,... proceeds largely already reinvested in ... yup, you guess it, ... SaaS companies (and speccy biotech!)

;-)

We now have a date for implementation - Wednesday, 18 February 2026.

Note that the quotation of RPM Shares on the ASX will be suspended from the close of trading today.

Goodbye dear friend. I hope to find another like you!

The takeover of $RUL by Caterpillar has now moved from a non-binding, inidcative offer to a formal, binding and board-endorsed transaction, with the usual conditions precedent and a modest break-fee.

While, in my view, this always looked a deal that would happen (90%), this has just rather firmed things up.

Disc: Held in RL and SM

Question for the brains trust - I own RPM IRL, is it time to sell or better to wait until a more solid offer is announced after the respective companies do their due diligence? And also given the offer is $5 per share why is the share price currently sitting around $4.65? Is this the market pricing in uncertainty?

Thanks to anyone who can help a newbie out!

Just a quick comment on the $RUL results which dropped last night ... are we seeing a rapid re-rating of this business as a SaaS company this morning?

Disc: Held in RL and SM

During FY2025, the company concluded $100.8 million in new software license sales (herein referred to as Total Contracted Value "TCV"), up $23.8 million (31%) on FY2024 TCV sales of $77.0 million.

As a result, software subscription license revenue increased year on-year by 20% (FY2024: 16%). Due to the strong growth in software TCV sales, at the end of FY2025, the company had $200.0 million in pre-contracted noncancellable software licence and maintenance revenue, which will be recognised across future years, up $39.0 million from the same time last year.

ATO. If the proposed return is approved by the ATO as a capital return rather than a distribution of profits, the Board will request approval from shareholders at the company’s October AGM to distribute the $21 million to shareholders post the AGM. If the company does not receive approval from the ATO, the company will explore other capital management initiatives..

The $100.8 million of software sold during the year generated $12.5 million in new Annual Recurring Revenue (ARR) and as of 1 July 2025, the total value of software ARR was $69.1 million, comprising $62.8 million from subscriptions and $6.3 million from maintenance.

https://hotcopper.com.au/threads/ann-investor-presentation-fy2025-full-year-review.8733205/

The transition from a Perpetual to Subscription licensing model is now complete with Subscription licenses sold in FY25 representing 99.9% (FY25: $100.7 million, FY24: $75.4 million) and Perpetual licenses representing only 0.1% (FY2025: $0.1 million, FY2024: $1.3 million).

@Magneto mentioned-

On Market Buy Back : In May 2025, the Board resolved to extend the company's on-market share buyback for a further twelve months.

• During FY25, the Company spent $13.4 million buying back its shares at an average price of $2.65 per share.

• As at the close of business on 30 June 2025, the company had acquired a total of 17.97 million shares via the on-market buyback (since its inception in June 2022) at an average cost of $1.943 per share for a total cost of $34.9 million.

Return (inc div) 1yr: 39.66% 3yr: 28.23% pa 5yr: 21.50% pa

And

The Rule of 40 is a benchmark for SaaS (Software as a Service) companies, stating that their combined revenue growth rate and profit margin should equal or exceed 40% to indicate financial health and sustainable long-term potential. This metric helps investors and company leaders balance growth with profitability, as rapid expansion often comes at the cost of short-term profits, and vice versa.

How it works:

- Calculate Revenue Growth Rate: Determine your company's annual or monthly revenue growth rate.

- Calculate Profit Margin: Use a profitability metric, such as the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin.

- Add the two: If the sum of your revenue growth rate and profit margin is 40% or higher, the company is considered to be performing well under the Rule of 40.

Example:

- A company with a 25% revenue growth rate and a 15% profit margin would score 40, meeting the benchmark.

- A company growing at 30% with a 10% profit margin would also meet the 40% target.

FY26 Guidance $88m-$92m assume three scenarios Bull, Base and Bear case growth ranging from 20% down to 10% for next 5 years. Assume net margins bull case of 26% down to 17% for bear case. PE50 for bull case and down to PE25 for bear case. Assume the buyback continues and share count reduce 1% per year. Discount back to today value and blended the 3 scenarios I get valuation of $4.23.

I Do believe RUL probably get taken over before FY30.

Rpm reported a 30% increase in year on year total contracted software sales for the 2025FY. Perpetual software license software is now essentially eliminated.

great momentum although the arbitrage of perpetual to subscription is certainly done if that was your angle.

full announcement below:

10:38

74

< Update on Software Sales for F...

RPMGLOBAL

Announcement

Update on Software Sales for Financial Year 2025 (FY2025)

4 July 2025

RPMGlobal Holdings Limited (ASX: RUL) [RPM ®, Company] is pleased to provide the following update on Total Contracted Value (TCV) derived from software sales in FY2025, Annually Recurring Revenue as of 1 July 2025 and the value of pre-contracted, non-cancellable software revenue backlog (as at 1 July 2025), which will be reported as revenue in future years.

As a result of the successful divestment of its Advisory business to SLR, which was completed on 2 April 2025 and the ongoing Transition Services Agreement (TSA) with SLR, the Company will not provide an update at this time on its expected Group Revenue, Operating EBITDA, and Profit Before Tax (PBT), which will include a part. year contribution from the Advisory division on a statutory basis.

The Company sold $64.5 million in software TCV in the second half of FY2025, bringing full-year TCV sales to $100.8 million (FY2024: $77.0 million), up 30.9% on the previous year. Subscription license sales were up 33.6% to $100.7 million (FY2024: $75.4 million), and perpetual licenses sold were $0.1 million (FY2024: $1.3 million).

Given the Company's strategy and preference to sign subscription license sales (which deliver stable and predictable recurring revenue reported over multiple financial years) over one off perpetual license sales (which are fully reported as revenue in the financial year they are sold), the Company was pleased to see perpetual license revenue reduce by $1.2 million year on year.

As at 1 July 2025, the total value of ARR is $69.1 million, comprising $62.8 million in subscription fees and $6.3 million in maintenance fees. It is worth noting that the majority of subscriptions are transacted in USD, and therefore, when the USD drops sharply against the AUD during a month (as it did in June 2025), this has a negative 'point in time' impact on the ARR value month on month.

The Company now has $200.0 million in pre-contracted, non-cancellable software revenue, which will be recognised in future years, up $38.7 million (24.2%) from the same time last year (FY2024: $161.0 million).

Subject to finalisation of the audit, RPM expects to release its FY2025 full-year audited results in late August 2025.

Authorised by:

James O'Neill

Company Secretary +61 7 3100 7200

About RPM:

RPMGlobal Holdings Limited (ASX: RUL) [RPM®] was listed on the Australian Securities Exchange on 27 May 200 and is a global leader in the provision and development of mining software solutions and professional development t the mining industry.

RPM has been advancing the global mining industry through the provision of innovative software solutions and deep lomain expertise for more than 50 years. The company brings together its technology and professional development services to support mining clients extract more value at every stage of the mining lifecycle. In partnership with the industry, RPM has delivered safer, cleaner and more efficient operations in over 125 countries.

RPMGlobal Holdings Limited ABN 17 010 672 321 (ASX: RUL)

Head Office: Level 14, 310 Ann Street, Brisbane, Queensland, Australia 4000

L

Portfolio

III.

Watch

News

Markets

More

Taylor Collision maintains Outpeform with a $3.48 12m PT (reduced)

https://www.taylorcollison.com.au/wp-content/uploads/2025/05/Ex-Advisory-update.pdf

RUL-1H25-update Taylor Collison.pdf

Broker report from Taylor Collison for those interested.

RPM Global (RUL) is a company I've liked for a few years and have held on and off (currently not holding). I was looking at their share price graph yesterday (Sunday March 16th) and their P/E ratio, which is still very high despite their share price having come down from around $3.35 to $2.57:

Commsec has RUL's P/E ratio listed as 62.35 and their market cap was $575.12m according to the ASX website, which tends to be more accurate with market caps than Commsec is. The ASX site has RUL's P/E ratio listed at 87.47 Their actual market cap should be 222,055,199 (shares on issue or SOI) x $2.55 (Friday's closing share price) = $566.24 million, so their true PE ratio based on their last full year NPAT ($8,656,000 - see here: RUL-Appendix-4E-year-ended-30-June-2024.PDF) should be $566.24 (P) divided by $8.656 (E) (with both figures in millions of dollars) = 65.42.

So a trailing P/E ratio of 65.42 based on their FY24 earnings.

What the ASX appear to be doing is adding together their two 6-month NPAT numbers from their two most recent halves to arrive at the "E" (earnings), so their recently reported FY25 H1 NPAT of $4.734m added to their previous half (H2 of FY24) NPAT of $1.813m to get $6.547m for the 12 months ending 31 December 2024, and that would give us a PE ratio of 86.49 (566.24 / 6.547), which isn't far from the ASX's trailing P/E ratio for RUL of 87.47.

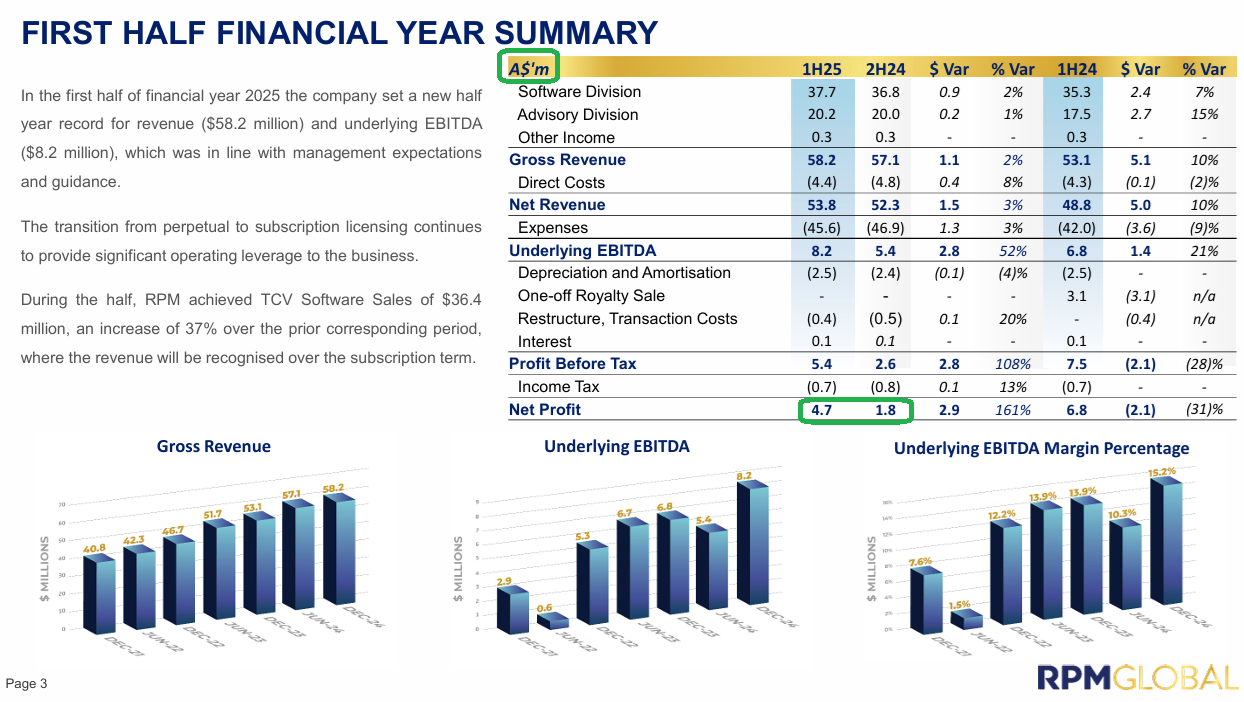

In the following slide from their latest results release, you can see that RUL have rounded down those two NPAT numbers to $4.7 million and $1.8 million, so together that's $6.5 million. If you use that rounded down number ($6.5m instead of $6.547m) it results in a slightly higher P/E ratio of 87.11 (566.24 / 6.5).

If you instead use these numbers on a "per share basis", which also works out the same, the "P" is the current share price of $2.55 (Friday's closing price) and the earnings per share per year have been 2.948 cents/share or $0.02948/share ($6,547,000 NPAT divided by 222,055,199 SOI) for the 12 months ended 31 December 2024, so the P/E ratio is 2.55 / 0.02948 = 86.49.

For the 12 months ending 30 June 2024, the per share earnings are 3.898 cents/share or $0.03898/share (8,656,000 / 222,055,199) so the P/E ratio would be 2.55 / 0.03898 = 65.42.

So on the basis that a P/E ratio is designed to provide a number that represents how many years it would take for the company to earn the amount that you paid for the shares, it would take more than 65 years for them to earn (in NPAT) the amount that you paid for the shares, if you bought them at Friday's closing price of $2.55, and on that basis RUL look very expensive. This is however fairly typical for capital light software companies who are considered leaders in their field. Consider the following:

Company, P/E ratio according to Commsec / P/E ratio according to the ASX website

- Xero (XRO), 108.88 / 123.69

- WiseTech (WTC), 84.69 / 88.45

- TechOne (TNE), 72.81 / 77.44

- Hansen Technologies (HSN), 31.24 / 280.18

- Objective Corporation (OBJ), 58.79 / 44.70

- RPM Global (RUL), 62.35 / 87.47

These are all trailing PE numbers and that's important (more on that in a minute). It appears that Commsec uses the earnings number for the last full completed financial year and the ASX uses the earnings number from the last two 6 month periods added together - such as H2 of FY24 plus H1 of FY25, which is why the P/E numbers can be so different if there's a particularly weak or particularly strong half in there that the other mob are not including. Point is though, that these are all high P/E numbers.

Compare that to the much lower P/E ratios for some of the largest US Tech companies:

Company, trailing PE / Forward PE (based on projected earnings)

- Alphabet (Google), 20.58, 18.83

- Apple, 33.89, 29.15

- NVidia, 41.38, 27.10

- Amazon, 35.80, 30.03

- Meta (Facebook), 25.47, 23.92

- Broadcom, 90.53, 30.03

- Oracle, 35.28, 23.37

- Microsoft, 31.29, 30.21

Makes Google look cheap, eh!

Trailing P/E ratios, such as those I've quoted for all of those ASX-listed companies above, and the first of the two numbers to the right of those US-listed companies above, are based on historical earnings, so they are backwards looking, not forward looking. Forward P/E ratios are based on consensus estimates of current or future year earnings, and are therefore only as accurate as those earnings estimates are.

The thing about these sort of companies, particularly SAAS companies, is that they tend to be capital light and they usually scale really well without much in the way of additional expenditure, so additional revenue tends to drop through to the bottom line, because most of their costs are fixed costs which don't increase much - or at all - with additional revenue. In other words, these companies can handle more customers and increased sales without any significant increase in costs.

Because of this, if you believe that the company is going to continue to grow sales at a good clip, it's reasonable to also expect a corresponding increase in profits.

So that's one reason why quality SAAS companies that are ASX-listed tend to trade on high P/E ratios, because people can easily see a pathway for that company to keep doubling in size every few years, due to low costs, being capital light, and having a long growth runway based on these companies providing software that companies/people need.

The better ones also have low churn because switching costs can be significant in terms of both money and time, plus risks of things going wrong during a switch and negatively impacting that company's own clients.

Some other factors that should be considered are R&D and/or NPD (new product development) spending (costs). Most of those companies have a decent R&D+NPD spend every year, and they need to spend that money to both stay ahead of their competition and stay relevant, as well as to move with the times, for example to add additional capabilities that their customers either require or are likely to require in the future. Companies that do NOT continue to innovate and offer more to their customers/clients over time tend to fall behind and lose customers and/or just grow at a slower rate.

Much can be learned from studying the track record of these companies to see how they've handled these issues in prior years, looking at annual R&D spend, churn rates, etc., but over multiple years, not just one or two years.

The next major factor, as I see it, is M&A plus other capital allocation decisions by management. This is important because no matter how good and how profitable a business is, it can still be a bad investment if the management make poor capital allocation decisions, such as overpaying for assets and then booking impairments (value write-downs) in future years. Other capital allocation decisions can include dividends (including special dividends) and share buy-backs.

For instance, RPM Global (RUL) have an active share buy-back in place and they are lodging notices daily to show how many shares they have bought back and cancelled. This is often a sign that a company considers their share price to be too low, meaning they believe that their own share price does not reflect the value of the business, so buying back their own shares and cancelling them is - in their opinion - a good use of their money (or "our" money if you're a shareholder). That also has to be balanced against other opportunities, such as M&A opportunities (inorganic growth), dividends, etc.

In RUL's case, because they are a capital light business with ROE around 16.5% (according to Commsec) and an $18.7m cash balance at December 31st, with zero debt, if they truly believe their share price significantly undervalues the company, then an active share buy-back does make sense, IMO.

In general, P/E ratios tend to be higher in fast growing, capital light businesses such as SAAS companies, but the examples I have given in the lists above highlight that ASX-listed SAAS companies tend to be a lot more expensive than US tech companies, and one possible reason is that people see how succesful those US tech companies tend to be, and the share price appreciation they have demonstrated, and they extrapolate that across to our market and are looking to get exposure to similar companies on the ASX.

In my opinion, for the most part, that's not really an apples v. apples comparison.

The IT (information technology) sector on the ASX is tiny - around 3.2% of the S&P/ASX 200 index (our top 200 companies) - one of our smallest sectors, whereas over in the USA their IT sector is massive. It's their largest sector by a good margin.

Source: https://www.usbank.com/investing/financial-perspectives/market-news/investing-in-tech-stocks.html [07-March-2025]

The US IT sector, encompassing software, IT services, and related industries, contributes around 8.9% of the US GDP and accounts for a significant portion of the global IT market. And IT companies dominate the US market:

Point is, with good tech companies, there's plenty to choose from in the US, and over here, not so much, so the few decent IT companies that we do have tend to have high P/E ratios and look expensive, because there's greater demand for fewer companies.

The problem with that however is that the market is prepared to pay more for future growth, or, to put it another way, there's already substantial future growth already priced in with high PE companies, so the downside is if they stumble along the way, the share price can "correct" swiftly and the movements can be large in percentage terms. One way of looking at it is that some companies are priced for perfection, and if EVERYTHING doesn't go to plan, i.e. if ANYTHING goes wrong, that big growth and quality premium in the share price can drastically reduce or evaporate entirely.

Oftentimes, the share price will get back up to higher than where it fell from given a few months or years - as long as no further hiccups are encountered, but the ride can get bumpy.

Another consideration is that many of those giant US tech companies totally dominate the market globally, whereas our tech companies are a LOT smaller, many of them focus primarily on Australia - so have a much smaller addressable market - and do not have the same advantages that the big US tech companies have, such as massive economies of scale advantages, and being clear global market leaders.

For these reasons, I am usually only prepared to pay 40+ P/E for companies that I am very bullish on longer term and where I have a very high conviction that they will grow into their current valuation given time. I would need to have a 10 year plus timeframe for a company trading at a 60+ P/E ratio, AND be very bullish on their long term growth, AND be very happy with their management, including their track record of M&A and other capital allocation decisions.

Because, in that case, I am not expecting the company to take 60+ years to earn the equivalent of my purchase price (what a 60+ trailing P/E ratio suggests) because I am expecting that P/E ratio to reduce based on my buy price and their growing earnings. In other words, I am expecting the "E" to expand a LOT in the coming years, while my "P" remains constant (what I paid for the company's shares) so that means the ratio between the P and the E reduces quickly.

In RUL's case I don't have that level of conviction, so I'm not holding at this point in time. I still like the company, but I don't consider RPM Global to be one of the very best risk/reward opportunities across the market for me right now.

Further Reading regarding the basics of P/E ratios:

Google says:

Average market P/E ratios, which are calculated by dividing the market capitalization by the total annual earnings, provide insight into how the market as a whole is valuing its companies, indicating whether the market is generally overvalued or undervalued, and reflecting investor sentiment about future earnings growth.

Here's a more detailed explanation:

What P/E Ratio Measures:

The P/E ratio, or price-to-earnings ratio, is a key valuation metric that shows how much investors are willing to pay for each dollar of a company's earnings.

How it Reflects Market Valuation:

A high average market P/E ratio suggests that investors are willing to pay a premium for earnings, potentially indicating optimism about future growth and a perception of the market as overvalued. Conversely, a low average P/E ratio could suggest that investors are pessimistic about future earnings or that the market is undervalued.

Investor Sentiment:

The P/E ratio also reflects investor sentiment and expectations about future earnings growth. A high P/E might suggest that investors anticipate strong future growth, while a low P/E could indicate that investors are skeptical about growth prospects.

Comparison over Time:

Tracking the average market P/E ratio over time can help identify trends and potential valuation extremes. For example, if the P/E ratio is significantly above its historical average, it might suggest that the market is overvalued and could be at risk of a correction.

Limitations:

It's important to note that P/E ratios are just one metric among many, and should be considered in conjunction with other factors, such as industry trends, economic conditions, and company-specific fundamentals.

Example:

If the average market P/E ratio is 20, it means that investors are willing to pay $20 for every $1 of earnings, while a P/E of 10 would mean they are willing to pay $10 for every $1 of earnings.

--- ends ---

And when I ask Mr Google: What is the average PE ratio of the ASX

Google answers:

As of March 16, 2025, the average P/E ratio for the S&P/ASX 200 is around 15.7.

Here's a more detailed breakdown:

Historical Context:

The long-term trend for the P/E ratio of the Australian market is around 15.

Recent Fluctuations:

While the average is around 15, it has seen some fluctuations in recent years.

Comparison to other markets:

The ASX 200's P/E ratio is generally considered to be relatively low compared to some other major global stock markets, such as the S&P 500.

Factors influencing P/E ratio:

The P/E ratio can be influenced by factors such as earnings growth, interest rates, and investor sentiment.

Interpreting the P/E ratio:

A lower P/E ratio can indicate that a stock or market is undervalued, while a higher P/E ratio can suggest that it is overvalued.

--- ends ---

So, yes, any company trading on a PE of over 40 has a LOT of future growth ALREADY priced in, and I guess the main questions are:

- Do you agree that there's that much upside (profit growth) in this company and are you prepared to pay up for the company's shares now and then wait years for that upside to occur?

- And will it be worth the wait?

- Will the company deliver on its potential in the timeframe you expect them to?

- Are you prepared to ride out significant share price volatility if they stumble along the way?

When a company encounters a hurdle and stumbles or makes a misstep, and the company's share price drops significantly, you'll often hear people say that the market has overreacted to the downside, but those people may not realise that the market had already previously overeacted to the upside by bidding that company's share price up to priced-for-perfection levels, and so the "correction" that they are observing may be exactly that - a correction, to around where the company SHOULD have been trading, without all of that hype and euphoria priced in.

I'm not really commenting on RUL specifically here, because I haven't been following them closely lately, so I don't know their particular situation well at this point, but I'm just making general comments about high PE companies. Sometimes the earnings grow into the PE, and sometimes they don't, so the PE instead corrects by the price reducing.

RUL have commenced buying back shares the past 2 days, further extending the buyback program that began in 2022.

Propping up the price on recent weakness or just a good use of the mountain of cash they have, which will be growing following the recent divestment.

$RUL has agreed to sell its consulting business to SLR for an EV of $63.0 million before apportionment of corporate overheads.

Funds payable on completion will lead to a capital return to shareholders. Yay!

I believe this should be good for $RUL's future, as it now becomes a focused, pure-play mining software business. It also makes the residual $RUL a more attractive acquisition target for software companies (think Constellation etc.).

The only question I have is to what extent does $RUL still gain value from the consulting activity in understanding customer needs and driving product development. Perhaps not so much given that the consulting business is focused on mining ESG.

Overall, however, I like this.

Disc: Held

Taylor Collison initiation - RUL-Initiation.pdf

Very late to the game but might spark more interest. Initiation reports do give good background about the company too.

RPMGlobal (ASX: RUL)

RPMGlobal offers a comprehensive enterprise platform with 30 integrated products covering the entire mining lifecycle, from design and planning to equipment management, ESG, and financial optimization, making it a "one-stop shop" for the industry. Its flagship AMT equipment management software, which accounts for 36% of ARR, dominates the market, servicing 9 of the top 10 global mining companies and major blue-chip clients like BHP, South32, Mineral Resources, and Pilbara Minerals. Additionally, RPMGlobal extends its reach by catering to mining services providers like Worley and OEMs, with ~70% of major equipment companies such as Hitachi relying on AMT.

We bought RUL shares at the inception of the Seneca Australian Small Companies Fund with an average price around $2.00. We thought it was highly likely that RUL will get taken over at some stage. We still think that's the case, despite the share price rally.

Synergies:

Acquiring RPMGlobal offers buyers in complementary industries—such as mining equipment, ERP, or geospatial technology—the opportunity to integrate its comprehensive solutions into their platforms. This not only enhances their product offerings but also creates significant cross-selling opportunities for mining-specific tools like scheduling, simulation, and maintenance optimization software, leveraging existing customer networks for expanded reach and revenue growth.

The acquisition could also unlock cost savings through streamlined operations. By optimizing R&D efforts, buyers can eliminate duplication and leverage RPMGlobal’s expertise in mining software. Shared infrastructure, such as data centres and cloud services, could reduce costs further, while aligning sales and marketing teams would enable more effective promotion of a unified product suite and deeper market penetration.

In addition to operational efficiencies, there are strong revenue synergies. Buyers can cross-sell RPMGlobal’s products into their existing customer bases, and vertical integration opportunities—such as bundling mining equipment or ERP systems with RPMGlobal’s software—would enhance customer value while creating long-term competitive advantages.

Scarcity:

RPMGlobal has spent over a decade building and acquiring a comprehensive suite of mining software products, establishing a market-leading position that would be nearly impossible to replicate from scratch. Its extensive network of major mining customers—including industry giants like BHP, Rio Tinto, Mineral Resources, Newmont, and Anglo American—provides a significant competitive moat. The company’s transition from upfront software licenses to a recurring subscription-based revenue model further enhances its attractiveness, delivering predictable and defensive cash flows.

Now entering the cash flow harvesting phase, RPMGlobal presents an appealing opportunity for financial investors seeking stability and scalability. The recurring nature of its revenue, coupled with its entrenched relationships across the global mining industry, positions RUL as a scarce and highly valuable asset in the mining technology space.

Gettable:

CEO Richard Matthews has consistently stated that RPMGlobal has been "built to sell," with a preference for a strategic buyer willing to pay a premium for synergies and exclusivity. Matthews, who owns ~3% of the company (~6.735 million shares valued at ~$21 million), is aligned with shareholders in securing a strong price in any deal. With extensive experience in M&A, Matthews has successfully sold ~50 businesses, including Mincom for A$315m in 2007 (delivering a 52% CAGR over three years) and eServGlobal’s US division for A$113.4m in 2010, far exceeding the company’s market cap and generating a 97% return in one year. Matthews’ track record and clear alignment make RPMGlobal well-positioned for a high-value sale to a strategic acquirer.

Cheap:

We analysed 23 comparable software transactions, which have traded at an average EV/EBITDA multiple of 27.9x. On a like-for-like basis, RUL trades at ~21x, reflecting a 25% discount to peers due to its conservative accounting practice of expensing R&D costs, unlike most peers that capitalize these expenses.

Focusing on the most comparable transactions in the mining software space, Sandvik acquired Deswik, a mine planning software provider, at an estimated EV/EBITDA multiple of 28-32x. Similarly, mine modelling software company Micromine was nearly acquired by AspenTech in 2022 for $900m, equating to an estimated 30x EV/EBITDA, aligning with broader industry benchmarks.

With growth supported by recently signed global framework agreements with major miners—enabling streamlined product rollouts across multiple sites—and the mining sector's strong performance, RUL is positioned to attract significant interest from corporate acquirers. Additionally, as growth and operating leverage become increasingly evident over the next 2-3 years, we believe RUL’s valuation premium could rise.

In the event of a takeover, we estimate ~40% upside potential for the stock.

Who might buy it?

RPMGlobal is most likely to attract interest from strategic buyers willing to pay a premium for synergies, exclusivity, and cost-saving opportunities. Logical candidates include large software vendors like SAP and Aspentech, which could integrate RPMGlobal into their distribution networks. Mining equipment manufacturers such as Caterpillar, Komatsu, and Hitachi, which have already white-labelled RPMGlobal’s simulation software, could benefit from exclusivity and enhanced integration through an acquisition.

Mining-focused technology companies like Epiroc or ASX-listed Imdex (ASX: IMD) may also find RUL appealing, leveraging its strong recurring revenue base (~80%) and potential for revenue synergies. Orica (ASX: ORI), a leader in mining explosives, is another potential buyer, given its recent acquisitions in mine technology and demonstrated interest in expanding its digital footprint. Lastly, private equity or other strategic investors could see RPMGlobal as a platform for further consolidation in the mining tech space.

Why now / what's the catalyst?

We believe the mining sector is set to experience an upswing, creating favourable conditions for RPMGlobal (RUL). The company is also at a profitability inflection point, with impressive incremental profit margins of 47% in FY24—a figure that continues to improve, further highlighting its strong operational leverage and growth potential.

RPM Global’s growth takes flight,

With mining software shining bright.

ARR climbs, a steady stream,

In software’s rise, they stake their dream.

With guidance strong and growth in sight,

Their products poised to lead the fight.

A volatile path may lie ahead,

But long-term gains keep hopes well-fed.

28 Sep 2024

$3.20 ($2.80 - $3.60)

Time to update the valuation for $RUL. It is still early days, but I wanted to set out a basic framework for the next 5 years to FY29.

Key Assumptions

- Revenue CAGR 12.0%

- Expenses (incl. rechargable expenses) CAGR 9.0%

- Tax 30%; WACC 10%; 0% Net Interest Income (Cost)

- SOI = 221m (ignore buyback, as that will drive $/share, and calculate valuation off financials only)

Results: FY29 EPS = $0.129

Valuations at various P/Es choosing 35, 40, 45 and discounted back to start of FY25

P/E=35 gives Val = $2.80

P/E=40 gives Val= $3.20 (central case)

P/E=45 gives Val=$3.60

P/E range of 35 - 45 still reasonable for FY29, as NPAT growth is 26% at that stage. P/E could even be higher depending on the quality of growth (i.e. earnings stability)

Comment on Method and Assumptions

Still early days to see how expenses scale with revenues, as well as how much platform development can continue to be funded by client requests. Therefore, a more sophsiticated DCF approach across a range of scenarios is not really warranted.

Ideally, would want to see revenue growth above guidance in early years (>15%), to allow for some maturation in later years (c.10%). Is FY25 revenue guidance conservative or realistic?

Potential also exists to do significantly better on expense growth as inflation moderates (however, 10.7% in FY24/FY23 incl. rechargable costs means 9% probably a reasonable assumption.)

Comment on Current SP

27-Sept closing SP of $3.06 puts $RUL on a forward P/E of 59x to consensus. While this is high, eps is still very high, so P/E falls quickly y-o-y.

Conclusion

We've seen a >20% SP increase since the FY results. However, sticking to FY25 guidance can justify the high P/E being maintained.

I'll reconsider my position at >$3.60. Would likely add to my holding below $2.70 as RL holding is only 4.7%, and the business is now sustainably generating strong free cash.

-------------------------------------------------------------------------------------------------------------

Sept 2023

@edgescape has posted the latest Moelis report for $RUL

Their analysis aligns closely with my own view, so I am just going to post the key excerpt and numbers here, as the summary below is good.

Note also their recent update from 11-Jul: ASX Announcement

I'll add that the products are fundamental to their customers' core mine management activities, which means that as they become embedded in the clients processes the barriers to exit increase. As products are enhanced and add more value, there are built-in growth opportunities via pricing. It is the usual enterprise SaaS story we're well used to.

Finally, it is a great way to get exposure to the mining sector without taking commodity pricing risk.

Furthermore, they have now largely completed the transition from perpetual licence sales to SaaS, a process that has taken several years. Moving forward this should drive high quality earnings.

The Board clearly have the view that the shares are undervalued, if the buy-back program is taken at face value. Personally, I'd prefer it if they had higher return opportunities to reinvest in growth, but if the gap to their view of value is large enough, then their decision is rational. I will keep them under watch in terms of capital allocation.

Again, on capital allocation, acquisition is a core mechanism to develop capability by bolting on new functionality. The acquisition multiples appear high, but I am not too worried as they remain small in scale. Being able to leverage the acquisitions across $RUL's larger client base can also quickly add value - a strategy $WTC has also proven over the years. That said, if reducing their cash pile via buybacks stops the cash burning a hole in their pocket and making larger acquistions, then you could argue that's a good thing. As I said, something to watch.

I first held $RUL in RL during 2020, but exited in early 2021 in my review of tech firms/cash burners. While many of the calls I made then were excellent, existing $RUL wasn't one of them, but you don't win them all. I recently bought back into $RUL in RL (1.8%) and SM as I assess the risk profile to be lower than in 2021 due to two years of good execution.

Overnight, $RUL announced the following product launch at MINExpro 2024 in Nevada. This is a pretty important product for mine operations.

———————

RPMGlobal Launches Fleet Optimisation Solution

26 September 2024

RPMGlobal (RPM), a global leader in mining software technology, is pleased to announce its new fleet optimisation solution at MINExpo 2024 in Las Vegas Nevada. FleetOptimiser continues RPM’s journey towards cloud-based solutions, offering a product designed for customers to calculate and optimise their trucking requirements for a shift.

The solution combines a 3D, visual user interface with RPM’s universal fleet calculation wrapped up in a secure, web accessible, cloud-based solution.

Up until now desktop models and spreadsheets have been used to calculate the viability of the mine plan. This creates downstream issues with difficulty maintaining data, accuracy issues, and version control. Several products have provided truck limited scheduling over the years which works well in a long-term horizon, however applying the same techniques to the more detailed short-term space has always fallen short.

FleetOptimiser uses the RPM travel time calculation engine, the industry standard, that is embedded across many of their mining software solutions. It calculates productivity for trucks across a haulage network while matching truck productivity to targeted loader productivity.

According to Michael Baldwin, RPMGlobal’s Chief Commercial Officer, engineers have been dreaming about this product for years. “There has always been conflict between planners and operations with respect to what an achievable plan actually is. FleetOptimiser lets the planner optimise realistic targets for the upcoming shifts while operations can use FleetOptimiser to reconfigure fleet throughout the shift as parameters change, all through a web-based 3D intuitive user experience,” said Baldwin.

Mine planners who use XECUTE, or other execution scheduling applications, can rapidly react to changes in truck availability by simulating the impact on load productivity, and then incorporate the required changes in their plan.

The solution also provides the user with functionality to update and maintain the current road network if required. Calibrated fleet settings can also be controlled through the solution, allowing for standardisation across the entire organisation.

“The market's excitement around FleetOptimiser is clear, and the feedback from our early adopters has been overwhelmingly positive. FleetOptimiser offers planners the solution they have been seeking and promises to deliver a significant productivity shift for the industry” Baldwin concluded.

For more information on the FleetOptimiser solution or other RPMGlobal solutions, please visit www.rpmglobal.com or visit the RPM Booth, number 6163 at MINExpo for live demonstrations and presentations.

I've been wondering what's been going on with the $RUL buy back program over recent weeks, i.e., nothing.

At last results, CEO John Mathews said they'd continue to buy back shares in preference to issuing dividends as they don't have the franking credits, and within the existing program there is still ample capacity. But the last buyback announcement was 30-Aug. - which given the patterns of the last 18 months or so, is a significant pause. In the recent past, SP progression hasn't inhibited them steadily chipping away, so I wondered if the apparent pause was just that they wanted to build up some cash, but that didn't really make sense as they are well cash up.

Then this morning they posted this announcement about the fothcoming release from escrow of 0.53m shares from a 2021 acquisition on 30th Sept, and a lightbulb went off.

Having held back from repurchases, they are probably poised to snap up all these shares if ESG (the owners of the $RUL shares that were put in escrow as part of the deal) decide to offload them.

What do other holders or watchers think?

This is not material in any way to my investment thesis for $RUL, but just some idle speculation. On Friday's when I've achieved my priority work around my portfolio for the week, I usually take some time generally catching up on less significant developments in my portfolio and my watchlist. A nice gentle way to wind down for the Great Australian Weekend. (I don't do lunchtime drinking!)

$RUL pretty consistently buys back $50k shares per day (apart from the mini-tech correction we had recently when they opportunistically grabbed a lot more).

But the last two days are $200k and $200K.

Looks like they are trying to fight the emerging downtrend.

Up 7% in afternoon trade on no update?

Did the market assign value after the Friday lunch beer which strawpeople have known for over a year. Or is there a big announcement in the works early next week and someone knows more than we do?

RPM just announced that they are extending their existing buy back further till 13 June 2025 ( and intend to purchase further ~11m shares )

It started buy-back program in June 2022 and so far purchased 12.5m shares at an average price of $1.63.

Another bit of news is that their cash balance is 32.2m as of 27th May 2024 ( their cash balance was 23.2m at the end of 1H2024). [ They also continued purchasing shares on the market from 1H to today so considering that operation is as usual second-half weighted and business is as usual in my opinion]

We will pass a milestone today in the $RUL buy back program. Based on Friday's report, today will see the cumulative buy back reach $20 million paid for 12.3m shares. There remain a maxiumum of 10.5m to go (22.8m total or 10% total SOI).

About $12m worth has been bought back over the last 12 months.

My reason for posting is that over recent months the behaviour of the buy back has changed. For much of last year, the buyback were more stop-start, dialling up when the SP fell below $1.55 and slowing or even stopping above about $1.60.

Now, with the SP right up at $2.45, they are pretty much buying $50,000 worth every day. On some days, they do buy fewer, and I think these are lower liquiduty days, when there are low volumes with offers close enough to the current SP. But I have been monitoring for a few months and $50,000 days are pretty much the norm. So $1m a month.

The buy-backs are typically 5-6% of average daily total volumes - although this varies hugely. Highest price paid is $2.60.

If the SP was to stay flat at $2.45, and if they keep buying $50,000, then the current announced program would run for another two years. Of course, SP likely to continue to rise, so it would go for even longer. Equally, there may come a point at which they stop as there is no obligation to execute the program announced.

I'm still puzzled why at $2.60, the highest return opportunity the board can see is eating themselves.

In the short term, I'm not complaining - as this level of buyback is continuing to put some support under the SP, and of course will directly drive EPS.

Disc: Held in RL and SM

I have published RPM Global thesis at https://growthgauge.substack.com/t/asxrul

01/04/2024

Re-running the numbers.

Assuming $110M in Revenue this year and subscription revenue continuing to grow at 20% to 2028 (Driven mainly by re-entering into the Americas), while assuming services, advisory and other remains flat implies:

2028 Revenue: $162M

Assuming marginal opex growth to get here ~3% - 2028 Opex: $105M =>

2028 EBT: $56M

Assuming share count remaining flat at 230M shares and a 20 X P/EBT =>

2028 SP: $5

Discounted to today at 10%

2024 SP: 3.35

06/08/2023

Trying to be much more conservative with my valuations. I still struggle to estimate the future value of the services division of RPM Global.

20% CAGR in subscription revenue => 2027 rev:$80M

2027 services remains flat: $59

2027 total rev: $140M

2027 Opex: $100M

=> 2027 EBT $40M

Assuming 230M shares and a 20 P/EBT and discounting back at 10% to 2023 gives SP: $2.40

Really difficult to create a valuation as the change in business model to subscription from perpetual license is still in progress. Updated based on FY 2021 results Valuation based on: 50% YoY growth in subscription revenue => 2026 subs rev: $114M 2026 services and software consulting revenue (remains flat): $28M Software opex increases 10% YoY, consulting opex remains flat, Dev (R&D) expense increases 10% YoY => 2026 Opex: $84M => 2026 EBITDA: $58M Assuming share dilution of 6% YoY and a 30X EV/EBITDA multiple => 2026 Price: $6 Discounted at 10% => 2021 Price: $3.5

To be clear I'm not sure they are actually bogans and probably not fair to classify them as such - but is entirely meant in jest as this was the most amusing earnings call I have listened to.

It felt that they were doing this somewhat begrudgingly at request of shareholders, but since they were doing it, it they would very much do it in their own way, on their own terms, and try to enjoy themselves.

Highlight for me was, 25 minutes in, one of the senior managers said: "Oh shit, I'm not supposed to be talking about the big deals; Scrub that you didn't hear anything!".

Saying that, it actually felt well prepared and I'm sure nothing was unintentionally let slip.

Note they have not linked the recording of the call directly on their website - but you can still follow the link from the initial announcement to find the recording.

Summary

Software

- Their software is very expensive so only Tier 1 and 2 miner can afford it. They view a few of their products as, quote, "the de-facto standard" in the space (particularly among the Tier 2 miners). Namely:

- Operational software (XECUTE) the only software in it space and had become the standard for Tier 2s. Gaining traction among the Tier 1s.

- Simulate was the standard among OEMs like Hitachi and Komatsu and gaining traction elsewhere. AMT also largely in use by OEMs

- They believe they are the only enterprise solution - any of their competitors in the space are either internally built systems or separate desktop software

- They have spent the time to build out what they call their Enterprise Planning Framework - the integration layer that connects all their software - and allows 3rd party integrations as well.

- Explained the continued 2nd half weight of revenues as legacy software users tend to roll over to the subscriptions at the same time of year (Jan and Feb).

Business Fundamentals

- Focus on rebuilding the US/Americas business and expect this to become the biggest sector again (did not specify when tho).

- They got the first sale to Vale, which has been the Tier 1 they haven't been able to get across the line. Expecting further sales here.

- Churn rate of only 4% of customers (covering 3% of revenue) highlighting the stickiness of their product. They suggested this was mostly due to mine closures as the software was no longer needed - as opposed to loss to competitors

- Customers wanting to lock in long contract terms: 3-5 years with the larger customers even going to 7 year contracts

- Stability of their management: 4 senior managers have been there for 10+ years (this was a specific request of share holders to explain/highlight)

- They are focused on software for mining (and closely related OEMs and consultants) are not interested in adapting their software outside of their core competency.

- Had good examples of them making major sales of software they had acquired. Mentioning:

- Environmental Data Vault

- MinVu

- Shift manager

Financials and Capital Allocation

- Gave good explanation (at least in my mind) of the 2 one-off adjustments to the financials and admitted they could have been clearer sooner on the pull forward of the subscription revenue due to the client cancellation.

- Richard, the CEO, went to some lengths to explain that the client used other pieces of software, but this cancelling was due to the project needing AMT getting cancelled and he was expecting more work to come from that particular client.

- In relation to their peers (did not specify who they were) they think they are cheap so will continue to buy back shares

- Would be open to more acquisitions but say there is nothing out there at the moment - they are the "last man standing" in a lot of their niche.

- R&D to tick down over time. Interesting quote: "The thing with R&D is you have to know when to stop, otherwise the devs will just keep developing."

- They are getting more requests for bespoke developement (presumably as they start working with bigger players) which they keep the IP of and allows them to get paid for some of the R&D.

- They have mostly moved to their software to the cloud but still have some remaining (some products) work there.

- Pricing - Richard gave out these numbers in terms of their software - I am assuming it is the annual cost but that was not clear:

- Simulate: $120k

- Scheduler: $500k

- AMT: $1.3M

- ?? not sure - am guessing XECUTE: $500k

Advisory

I did not take notes on this part of the call. It is the piece I have the least interest in as:

- I suspect it is the most cyclical - it is quoted on a project by project basis and as such probably has little recurring revenue

- Is the least scalable - Advisory/Consultancy is dependent on the quality of the people working in it and usually takes years of experience.

A good chunk, perhaps the bulk, of the advisory was assisting companies to raise financing/capital.

Lastly, another good quote, when asked about possible takeovers, Richard said:

"Nothing to do with me there - we are for sale on the market so what will happen will happen, we'll just keep doing what we do".

What I liked

- Reaffirmed guidance and pointed their main growth driver (Americas) for the future. Will be something to watch.

- Seemed down to earth but also confident about their competence in their niche (with good the justification for it).

- Pragmatic about their use of R&D

- No mention of AI - they weren't there to sell you on pipe dreams

What I didn't like

- No mention of AI - They don't seem to want to spend money where they don't see immediate benefit (by immediate, I mean they know they be able to sell it once built). Which is probably a good thing - until a competito with a better product comes along

In general, I thought it was a very good call. The only thing in the back of my mind is maybe they sold me with their slightly brash, slightly over-honest easy going Brisbane ways. I believe they have earned the confidence in their business - but if things slowly start turning against them will they notice or will their confidence turn to hubris.

I find it interesting that $RUL are still buying back shares - albeit low volumes. The program was a non-brainer at $1.40-$1,60, given that they aren't spending a lot on developing the platform,which would be my preference, and are focused on deployment.

I assume momentum traders are at work, with 5 buyers to every seller at the moment.

However, SP has run up hard in the last 4 months, so I wonder what view on value the Board has? Some StrawPeople see further to go. Guess I need to go back and do my own valuation.

Not complaining, just observing.

Disc: Held in RL and SM

Main Thesis for RPM Global is that as it migrate completely to Software subscription as opposed to maintenance, reliability of revenue will be strong and I expect they keep growing subscription revenue half on half.

This time that trend has gone little reverse.

The reason for this given was below

Now if we trust management and apply adjustment for $2.4m ( i.e remove 2.4m revenue from 2HFY2023 and add it back to 1HFY24), the graph looks like below, which is what I would like to see.

Management didn't flag that in FY23 result there is an extra $2.4m in the numbers. If they would have flagged that then probably there isn't any concern.

I attended the call and heard CEO admit that their communication should have been clear and I got the impression that there was no intent to mislead shareholders here. In fact, CEO said that he is quite happy for share price to be low so they can keep buying shares and increase EPS by reducing share count as well as increasing earning.

So although it was poor from management but I am happy to keep it aside and consider that thesis is still intact and I quite like the frankness of Management on the call FWIW.

Happy to hold.

Totally don't get the SP reaction on $RUL at open this morning. As @Chagsy reported yesterday evening, the result is fine.

I am still in accumulation mode for $RUL, so will be picking up some "cheap" shares this morning.

Disc: Held in RL and SM

RPM reported this evening and it was good:

We are starting to see the benefits of the transition from selling contracts as a one-off, to a SaaS model.

It takes a few years for the waters to clear and the true picture to emerge.

The slide showing financial guidance for NPAT demonstrates it best.

They have a habit of under-promising, but if we take the full year NPAT to conservatively be $17m that should give an ROE of ~30%.

Using McNiven's formula using a required return of 10%, gives a valuation of $2.43.

If we assume they over-deliver and beat guidance, say $20m, using the same required return of 10% you can get a valuation of $3.31.

Happy holder.

The central bank of Norway just bought 5.001% of RPM.

An updated broker report from MA Moelis, mild upgrades, still target price over 2 bucks

RUL broker report Nov 20 2023.pdf

Nessy

not held but interested

MD's address:

$RUL quick out of the blocks with their 1Q FY24 Trading update including an upgrade on guidance.

Highlights include:

- Q1 TCV from software sales of $13.2m up $8m (154%) from pcp

- ARR from software licence and maintenance at end of Q1 was $56.0m

- Pre-contract, non-cancellable software licence and maintenance revenue to be recognised across future year at end Q1 was $133.4m

- Signed a framework agreement to facilitate future purchases from a Tier 1 global miner, with significant term volumes within this contracted

- Advisory also starting strongly with a lot of work coming from battery and critical minerals sectors

- FY24 revenue upgraded to $107-112m (from $105-110m; FY23 $98.4m)

- Underlying FY24 EBITDA upgraded to $18.5-20.5m (from $17.5-19.5m; FY23 $15.0m)

- FY24 PBT upgraded to $13.5-15.0m (from $12.5-14.0m; FY23 $9.2m)

My Key Take Away

Off to a strong start to FY24; steadily grinding higher.

Disc: Held in RL and SM

Interesting, might increase demand for mine design but perhaps not if it's only new mines but may also increase the demand for RUL's AMT if more trucks to track.

AFR - Energy transition: Electric trucks will be 19 per cent less productive (afr.com)

Battery-powered mine trucks would haul less ore and spend less time on the road than diesel-fuelled alternatives, delivering a productivity hit of between 19 per cent and 33 per cent to Australia’s biggest export industry.

A study of the most viable truck decarbonisation options found miners producing bulk commodities such as coal or iron ore would need to spend more money deploying a higher number of trucks plus recharging infrastructure if they wanted to maintain output volumes when switching to a zero emissions fleet.

Mining technology consultancy Idoba said the switch to electric mining trucks was unlikely to be seamless and the next generation of mines could be designed differently to better suit the charging needs of electric trucks.

Idoba head of mine automation and technology Craig Rodgers studied the viability of switching to electric mine trucks with batteries that would either need to be recharged, swapped or supported by overhead power cable networks, known as “trolley assist”.

The study found that battery charging would consume more time than diesel refuelling and reduce the availability of a typical mine truck by 12.5 per cent.

The weight of batteries would also reduce the amount of ore carried by trucks; the study found the type of battery needed for a typical 230-tonne truck would be at least double and potentially three times heavier than diesel fuel tanks and engines.

.....

Mr Rodgers said the productivity hit from electric trucks would not necessarily mean lower export volumes of Australian commodities.

“I think the big miners would probably throw more trucks at the problem, which would effectively require more capital to do that, so there is an argument you would see a modest reduction in terms of return on invested capital for the miners,” he told The Australian Financial Review.

There were a number of references for Share price - which I think is odd

RPM Global released its FY23 result this morning.

Revenue:

Customer Receipts:

Expense:

Operating Cash

Migration from Maintenance to Software

Software subscription as % of overall revenue

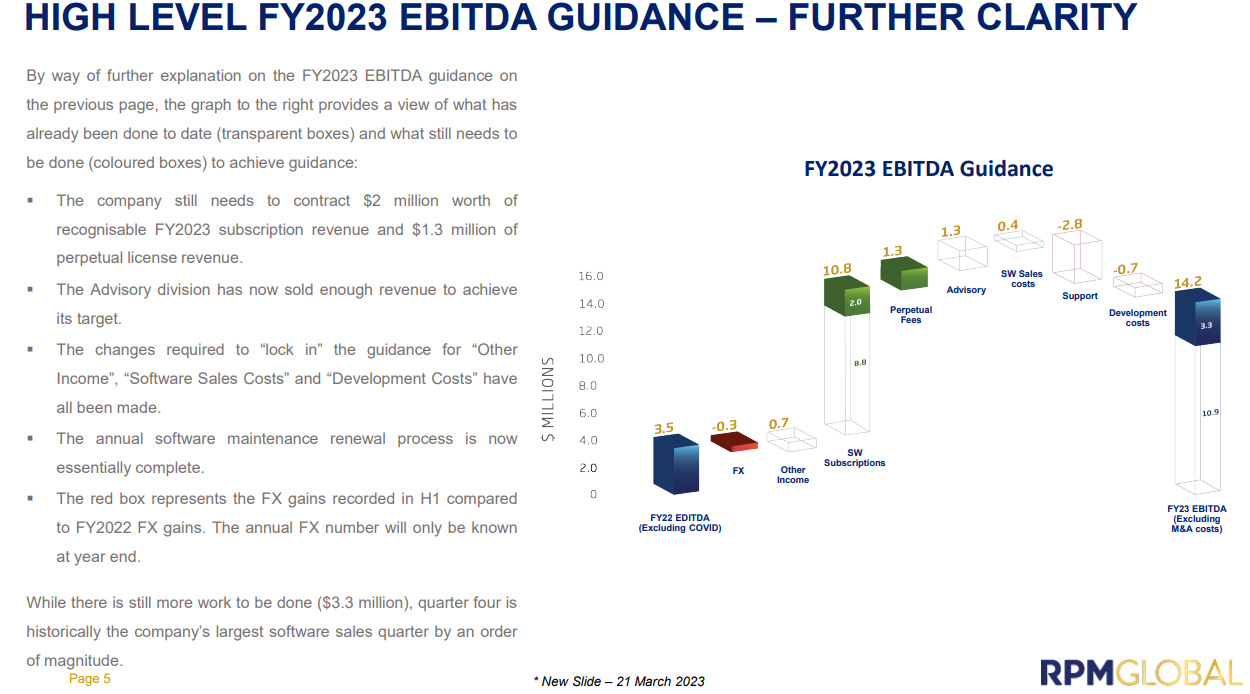

I am not a fan of updating the entire presentation and release - I would prefer them just to announce what has been changed. I had to compare the two presentations to find the delta (Although they pointed it out in small letters at the end of the slide as New Slide- 21 March 2023) I had to compare to make sure they haven't sneakily submitted something.

They have updated the following two slides.

Take away for me in the following slide is that, the Advisory division already achieved its FY23 target with the 4th Q to go. and to achieve the target Software division needs to do a further 3.3m EBITDA ( RPM Global thinks it is very much achievable based on historical evidence that their largest quarter by an order of magnitude is 4th Q) - So think this is positive.

So in total, they have done 10.9m in the first 3 Qs which equates to 3.6m per Q and they need to get 3.3m in Q4 to reach their target and also points Q4 is the largest software sales quarter by an order of magnitude..-- I will take it as a positive and potential to outperforming the target.

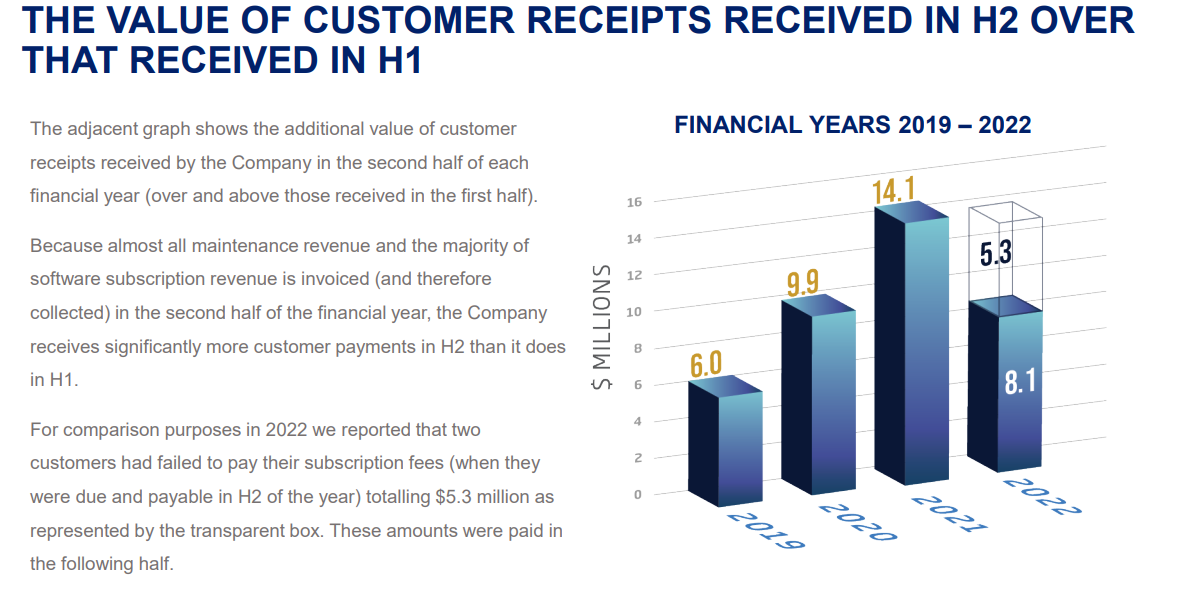

2nd new slide, in my opinion, just trying to say that their customer cash collection is heavily weighted towards H2, and the graph shows the tilt towards H2 as compared to H1 (the only exception was FY22 H2 when two customers failed to pay on the due date).

Not sure why the clarification, as this was very well known - but if they are confirming I would take it as a positive.

Overall, this is positive only. but this is a convoluted way of releasing positive news and that's why I am a bit suspicious.

Inside Ownership Ordinary Shares % RUL Issued Net Value at $1.42

Richard Mathews 8,220,138 3.59% $11.7m

Stephen Baldwin 3,272,987 1.42% $4.65m

Angeleen Jenkins 25,000 - $35.5k

Paul Scurrah 26,741 - $37.9K

Ross Walker 1,200,000 0.52% $1.7m

Total 12,744,866 5.56% $18.1m

Richard Mathews Appointed Managing Director 28 August 2012. Richard’s previous roles includes Senior Vice President, International at J D Edwards, CEO of Mincom Ltd, Chief Executive Officer and then Non-Executive Chairman of eServGlobal Limited.

Stephen Baldwin joined the Board effective 1 July 2020 and was appointed Chairman of the Board in March 2021. Stephen is a professional company director and currently sits on the Board of three other companies (Taumata, Tiaki and Lignor). Other recent Board roles have included ASX-listed Wameja (sold to Mastercard in September 2021) and Axicom (sold to Australian Tower Network in May 2022).

Angeleen Jenkins joined the Board on 1 July 2021. Angeleen worked extensively in high risk commercial engineering & construction contracting throughout her executive career, including almost 25 years in the multi-national construction sector as a Director and Executive of a major construction group that delivered infrastructure projects to heavy industry clients (mining & metals and oil & gas sectors) throughout Australia, Asia, NZ/Pacific, and the Middle East.

Paul Scurrah joined the Board in December 2020. Paul has been involved in the transportation, logistics, travel and aviation industries for over 25 years at both executive and non-executive levels. Paul is currently the Managing Director & CEO of Pacific National, Non- Executive Director and Chairman at Whizz Technologies and Non- Executive Director of the Gold Coast Suns AFL Team. Previous Director of Virgin Australia Holdings Limited.

Ross Walker Joined the Board in March 2007. Joined Pitcher Partners Brisbane in 1985, Managing Partner from 1992 to 2008 and again from 2014 to 2017. Predominantly involved in corporate finance, auditing, valuations, capital raisings and mergers and acquisitions for the past 20 years.

Inside Buying Last 6 months

Ross Walker

· 27 September 2022

Indirect 100,000 shares price $1.4996 per share ($149,960.00)

· 2 September 2022

Indirect 100,000 shares price $1.4983 per share ($149,830.00)

It's always important to evaluate a company's revenue model and understand its long-term sustainability. RPM Global has been shifting its revenue mix from perpetual licenses to a subscription-based model in recent years.

While this shift may not be reflected in immediate revenue growth, it is a positive move in terms of the quality of revenue. Perpetual license sales provide upfront revenue, but maintenance fees can decline over time. On the other hand, SaaS models provide a recurring revenue split over the contract period, resulting in a more predictable revenue stream.

RPM Global's shift towards SaaS is evident in its declining perpetual license and maintenance revenue, as it focuses more on SaaS services and converts existing customers to the subscription model. This transition may take time to fully reflect in financial statements, but it could lead to a more sustainable revenue model in the long term. I am putting this table and graph which illustrate this transition beautifully.

Following chart shows, How Software subscriptions and maintenance trending in last few years

Below graph shows, what % of revenue contributed by Software subscriptions ( which is recurring in nature)

So far so good, If RPM convert all his Perpetual customers to Subscription customer in next few years and as SaaS Revenue becomes higher % of total revenue, this transition will be evident in financial. I shall closely monitor it's execution in this transition and keep an eye on any potential challenges that may arise.

Acquisitions/ Divestment History

· December 2021 Acquisition of Three Underground Mine Optimisation Products A$165k from Laurentian University, a leading Canadian mining University. MIRARCO has developed three separate but complementary underground mine planning optimisation software products, which RPM has under this agreement agreed to acquire and commercialise. These products extend and complement the functionality of RPM’s mine optimisation software solutions in the areas of Advanced Valuation, GeoSequencing, and Ventilation. https://www.asx.com.au/asxpdf/20211217/pdf/4548m11zq6qwwn.pdf

· December 2021 Acquire a copy of Eden Suite A$400K - Environmental Data Management and Reporting Software. Eden Suite software used in the mining and quarrying industries along with the ability to extend and integrate use of the software inside RPM’s suite of software products. https://www.asx.com.au/asxpdf/20211216/pdf/4546z19349d127.pdf

· September 2021 Blueprint Environmental Strategies Pty Ltd A$3.5m - Perth headquartered Environmental Social and Governance (ESG) services company. https://www.asx.com.au/asxpdf/20210921/pdf/450py4c2c3xr9b.pdf

· August 2021 Divestment of GeoGas $500K - entered into a share sale agreement to divest 100% of its shareholding and control of the GeoGAS Pty Ltd coal gas testing business to the existing GeoGAS management and staff via a management buyout (MBO). The GeoGAS laboratories in Mackay and Wollongong carry out coal gas compliance and exploration content testing services for underground coal mining companies on the East Coast of Australia. https://www.asx.com.au/asxpdf/20210816/pdf/44zbk4g9dlv2vy.pdf

· June 2021 Nitro Solutions Pty Ltd A$2.1m - Australian headquartered Environmental Social and Governance (ESG) services company. Privately-owned Nitro was founded in July 2015 by Ngaire Tranter who along with her experienced team of ESG professionals pride themselves on providing the mining industry with a quality focused ESG service in the areas of environmental approvals, impact assessment, regulatory advice, environmental audits, compliance reporting (due diligence) and environmental economics, policy & legislation advice. https://www.asx.com.au/asxpdf/20210616/pdf/44xdsxs417flfm.pdf

· October 2020 IMAFS CAD$1.3m A Canadian based software company. Its main product is IMAFS a cloud delivered inventory management and forecasting software solution that has a proven track record of increasing the financial performance of asset intensive companies by greatly improving inventory management through state-of-the-art optimisation. The IMAFS product has been designed and built for the sole purpose of optimising the inventory holdings of large asset intensive companies. In the mining industry, management and optimisation, specifically the Maintenance, Repair and Operational (MRO) inventory is critical to ensuring operational continuity and attainment of production targets. https://www.asx.com.au/asxpdf/20201028/pdf/44p632xhg2vv55.pdf

· July 2020 Revolution Mining Software CAD$500,000 Privately-owned Revolution Mining Software has more than six years’ experience developing and selling its flagship Schedule Optimisation Tool (SOT), a cutting-edge mine scheduling optimisation software solution for tier one miners around the globe. RPM has also acquired Revolution Mining Software’s Attain and Surface SOT software solutions. https://www.asx.com.au/asxpdf/20200709/pdf/44kct9k3mfj1cj.pdf

· December 2017 Minvu $1.2m upfront followed by further post completion earn out payments over a two year period up to $1.28m. Leading global provider of mine-wide operational reporting and analytics software solutions to the mining industry. https://www.asx.com.au/asxpdf/20171218/pdf/43q7xvlv7mylkf.pdf

· August 2017 MineOptima a private company developing software applications which design the optimal equipment access layouts for underground mines. MineOptima are the exclusive developers and intellectual property owners of the Decline Optimisation Tool (DOT), Planar Underground Network Optimiser (PUNO), Large-scale Underground Network Optimiser (LUNO), Gas Gathering Network Optimiser (GGNO) and Underground Mine Optimal Infrastructure Designer (UMOID) software solutions. https://www.asx.com.au/asxpdf/20170801/pdf/43l2k89vqlb39k.pdf

· December 2016 Acquire a copy of the source code and intellectual property rights of the Fewzion Short Interval Control (SIC) and work management software product. The Fewzion platform is designed for planning and managing frontline work, it replaces old fashioned spreadsheets, whiteboards and paper based tools with a modern, easy to use integrated management system and short interval control toolkit. This innovative system integrates high-level planning tools and empowers those working on the frontline to plan and track progress to ensure goals are met in a transparent and consistent manner. https://www.asx.com.au/asxpdf/20161221/pdf/43dwkdtcr990ty.pdf

· June 2015 Acquire a copy of FlexSim Software Products simulation software. FlexSim and RPM have been working together since February 2014 when RPM incorporated FlexSim’s simulation engine into HAULSIM, RPM’s haulage simulation product. HAULSIM gives users the ability to accurately model complex mine haulage systems in an interactive visual 3D environment so they can easily identify and remove operational bottlenecks. This acquisition provides RPM with the underlying infrastructure capability to both extend the HAULSIM Desktop product and develop an Enterprise version of the product. https://www.asx.com.au/asxpdf/20150622/pdf/42z9x4v9k5s29h.pdf

· January 2015 Software code of Geospatial management software from PrimeThought Software Solutions CK. RPM has acquired unrestricted rights to rebrand, commercialise and exploit the Geospatial management software code and any successor products developed by RPM. RPM’s enterprise mining software products address the transactional integration between the operational mining environment and the corporate systems. While this is a major step forward for the industry, it does not address the sharing of spatial data across the enterprise which changes every time an operational event occurs in the mine. https://www.asx.com.au/asxpdf/20150127/pdf/42w5l5hjzsbffv.pdf

· July 2014 Software code of the Mine2-4D mine design application from South African mining technology company MineRP. RPM undertook a review of the alternatives (build, buy, partner) to obtain mine design capability, including diligence on a number of trading entities. The Mine2-4D design tool is well known across the mining industry and has recently undergone a complete rewrite, using next generation development tools, to provide superior levels of enterprise integration and processing capacity. The opportunity to fast track a specific RPM design solution, by building upon the foundations of Mine2-4D, provided the lowest risk and quickest approach to progressing RPM’s software roadmap. The acquisition of a copy of the Mine2-4D software code will allow RPM to develop its own mine design capability. https://www.asx.com.au/asxpdf/20140703/pdf/42qmczgwh60wtd.pdf

Note: Haven't included acquisitions before 2013.

Based on P/S assuming revenue growth of 1.5 - 3% over the next 5 years. Range of $1.12 to $1.20. Rough value somewhere in the middle but current value ($1.67 at time of writing) appears overvalued.

rul-mamoelis-initiation-181122.pdf

For those who would like to read the Moelis case for RUL and compare to your own notes from the deep dive.

Results from the survey we did during the Company Deep Dive

27-Oct-2022. As well as the Moelis report on RUL that @Remorhaz mentioned today, there are a few other brokers and analysts who have covered RPM Global (RUL) in the past, and may still do. Here are some links to their reports from prior years:

27-Oct-2019: Taylor Collison: RPM Global (RUL) - Initiating coverage: 5 reasons to buy

10-Feb-2020: Taylor Collison: RPM Global (RUL): Recent update, accounting changes, review of competition

26-Mar-2020: Taylor Collison: RPM Global (RUL): 1H20 result review and update

2020: Sequoia also covered RUL back in 2020: You searched for RPM Global - Sequoia Direct Pty Ltd

Blackpeak Capital mention them on the last line of the table on page 80 of this report: Microsoft PowerPoint - Summary Tech Presentation - March 2022 (blackpeakcapital.com.au)

RPM Global (RUL) was on the list of "included companies" on the ASX's free broker report service for FY21 - see here: Independent broker research (asx.com.au) - but it seems that they (the ASX) don't have an archive of those reports that we can access. However, thanks to some work on my part (in prior months), you may find links to some of those free reports here.

Also, Gaurav Sodhi over at Intelligent Investor covers RPM Global. Here's a snapshot of part of his latest report on them.

For the rest of that report and more of their other fine work, try a free trial of their subscription service at Intelligent Investor.

Also, Claude Walker and Owen Raszkiewicz both cover RUL. Not sure if this is behind a paywall, but here's a link to their most recent conversation about the company: Claude Walker And Owen Raszkiewicz Chat About RPMGlobal (ASX: RUL) and Altium (ASX: ALU) - A Rich Life [19-October-2022].

Also, from Claude Walker @ "A Rich Life":

28-June-2022: Why You Should Be Watching RPM Global (ASX: RUL) - A Rich Life

25-Sept-2022: My Top 6 Fluffy Dog Stocks With Target Buy Prices - A Rich Life [RUL is #6, of 6]

12-Aug-2022: Has Forager Funds Management Changed Investment Style? - A Rich Life ["The Forager June 2022 report disclosed that the fund had 17.7% allocated RPM Global (ASX: RUL), Nitro Software (ASX: NTO), and Bigtincan (ASX: BTH) between them, and also held Whispir (ASX: WSP) and Fineos (ASX: FCL), so the overall allocation to unprofitable tech was probably around 20%, at the least."]

26-March-2022: 4 Stocks That Could Benefit From The Commodity Price Boom - A Rich Life

And from Forager Funds:

10-Dec-2019: Revving up at RPM - Forager Funds [Why they bought RUL shares]

According to Forager's latest report for their Australian Shares Fund, RPM Global (RUL) is the largest position in that fund:

Monthly Report: Australian Fund September 2022 - Forager Funds

Source: https://foragerfunds.com/news/investor_resources/monthly-report-australian-fund-september-2022/

Mining Software, Consulting & Training Solutions | RPMGlobal

https://rpmglobal.com/

Disclosure: I have held RUL shares previously, and made money from holding them, but I am not a current holder. I like the company but I see better opportunities elsewhere at this point in time. While there is probable further upside with RUL, I see more upside with a number of other companies over a 3 to 5 year timeframe.

Looking through the CZZ report @Bear77 posted.

Noting that CZZ saw RUL losing market share to Deswik in design and scheduling.

RUL drew attention to the fact Deswik was acquired last year (completed early this year) by Sanvik ($26B swedish company) for around $700M. Deswik had 79M in revenue (with only 45% I take to be recurring SAAS like) for over 10x revenue! Of course at the market peak.

If you took the same multiple to RUL software ARR that would be valued at over $550M. Software isn't the same and a lot of caveats but seems RUL could be undervalued... then again a pressimistic view would be that they are competing against some aboloute gorillas and they were passed over for being acquired so their software may not be as great despite it being end to end. The advisory division may also be off putting.

Sandvik announcement below

Deswik will form one of three cornerstones in the newly-created division Digital Mining Technologies, established to accelerate the execution of Sandvik Mining and Rock Solutions’ strategic priority to lead the industry development of underground sustainability and productivity solutions in electrification, automation, digitalization and end-to-end optimization. The new division also includes Sandvik Mining and Rock Solutions automation solutions and the Newtrax telemetry and collision avoidance solutions.

Privately-owned Deswik, established in 2008 and headquartered in Brisbane, has approximately 300 employees and operates 14 offices in 10 countries. The company has demonstrated strong and profitable growth over the past decade in the large and growing mining software market.

Deswik’s revenue per October 2021, on a rolling twelve month basis, totaled AUD 79 million, of which the share of recurring revenue was approximately 45 percent, and with an EBITA margin of approximately 30 percent. Impact on earnings per share (excluding non-cash amortization effects from business combinations) will be accretive. The parties have agreed not to disclose the purchase price.

Taking a look at RUL which is like by some smart investors. It is owned by Forager, and the business is liked by Gurav at Intelligent Investor and Claude from A Rich Life albeit issues around the current valuation. Alex Hughes (now at Maven) liked it back in the day – not sure about now.

Why is it interesting now?

RUL began the transition from perpetual license sales to SAAS sales in 2017 and now 5 years later in 2022 the transition is now complete. This has acted as a headwind to revenue and profit albeit RUL has managed to keep both relatively stable throughout the period and now looks set up for growth now this headwind is gone as seen below. The company has also now built out the software product suite so R&D should stop growing keeping costs in control. In essence and inflection point seems to about to occur as operating leverage and revenue growth kicks in.

Split in FY22 was 32% advisory and 68% software by revenue.

RUL clearly sees value in the shares and is currently doing an on-market buyback (they see themselves as undervalued compared to private peers).

The business