I am not a fan of updating the entire presentation and release - I would prefer them just to announce what has been changed. I had to compare the two presentations to find the delta (Although they pointed it out in small letters at the end of the slide as New Slide- 21 March 2023) I had to compare to make sure they haven't sneakily submitted something.

They have updated the following two slides.

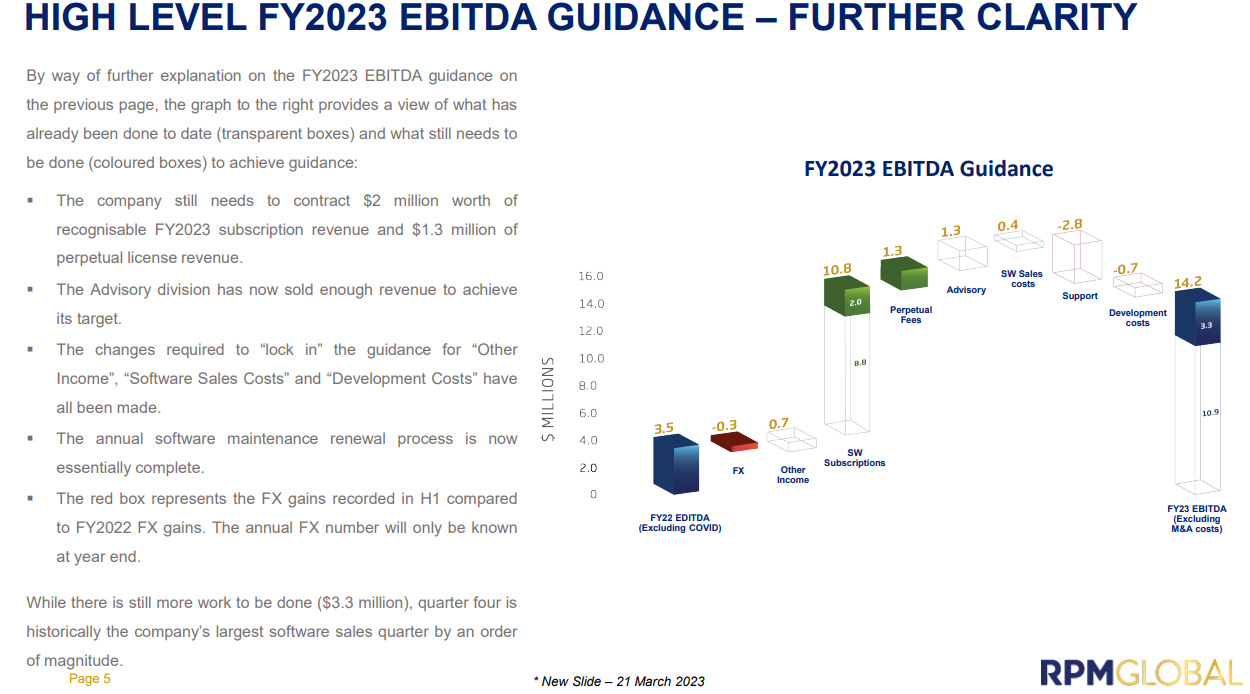

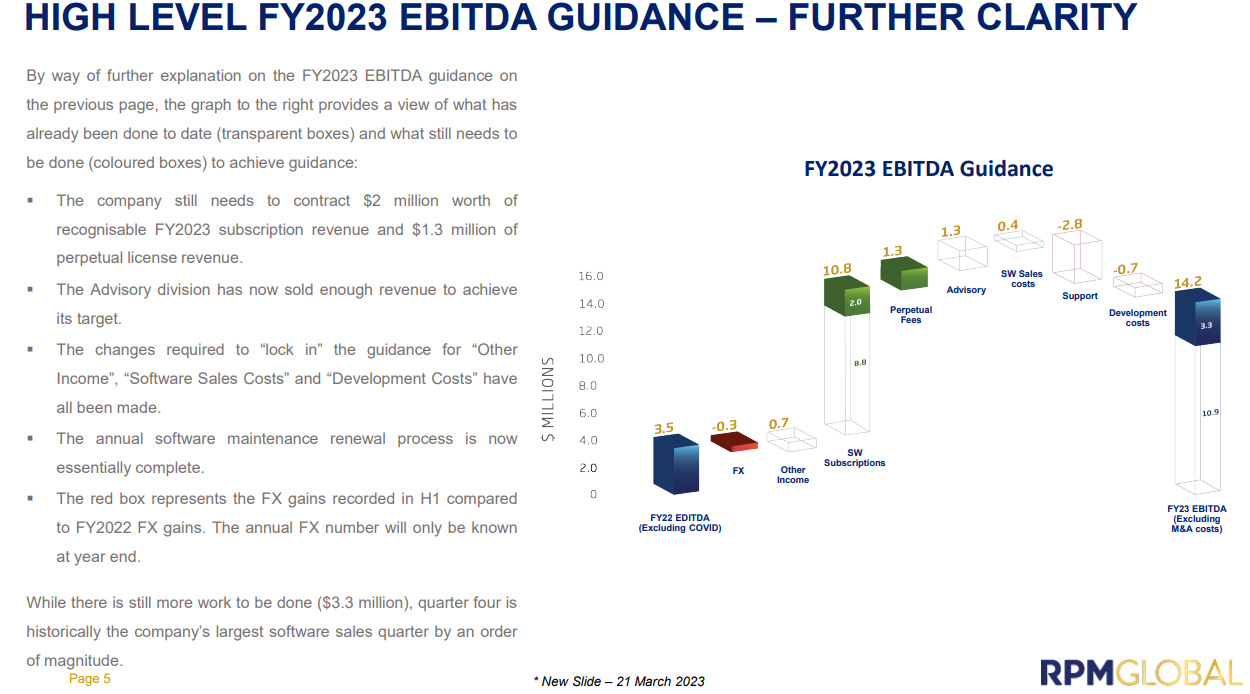

Take away for me in the following slide is that, the Advisory division already achieved its FY23 target with the 4th Q to go. and to achieve the target Software division needs to do a further 3.3m EBITDA ( RPM Global thinks it is very much achievable based on historical evidence that their largest quarter by an order of magnitude is 4th Q) - So think this is positive.

So in total, they have done 10.9m in the first 3 Qs which equates to 3.6m per Q and they need to get 3.3m in Q4 to reach their target and also points Q4 is the largest software sales quarter by an order of magnitude..-- I will take it as a positive and potential to outperforming the target.

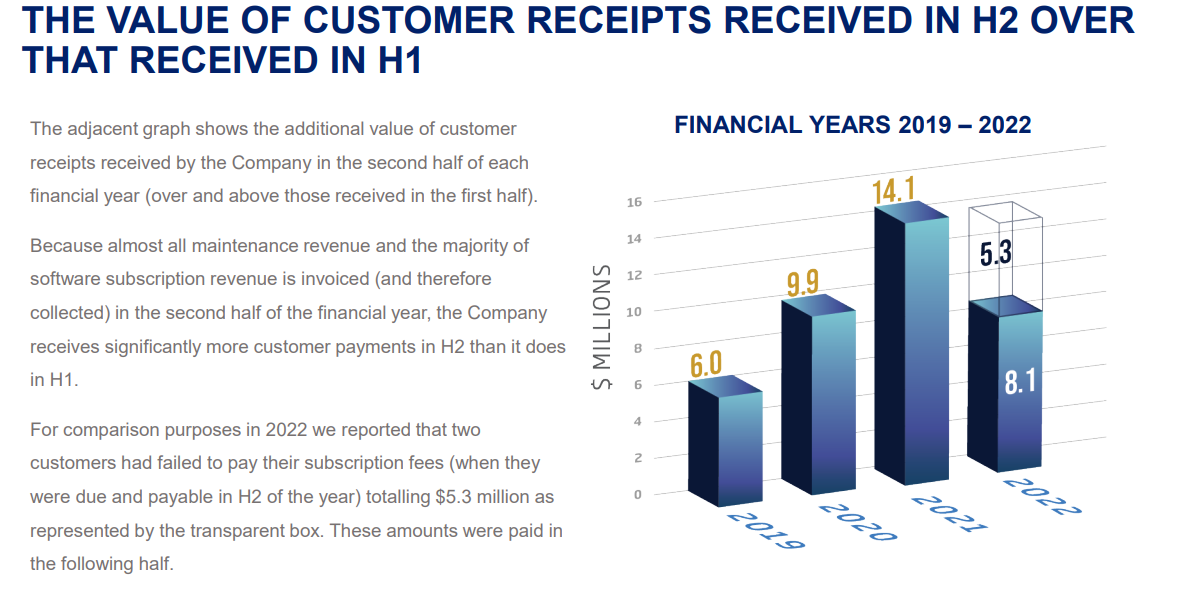

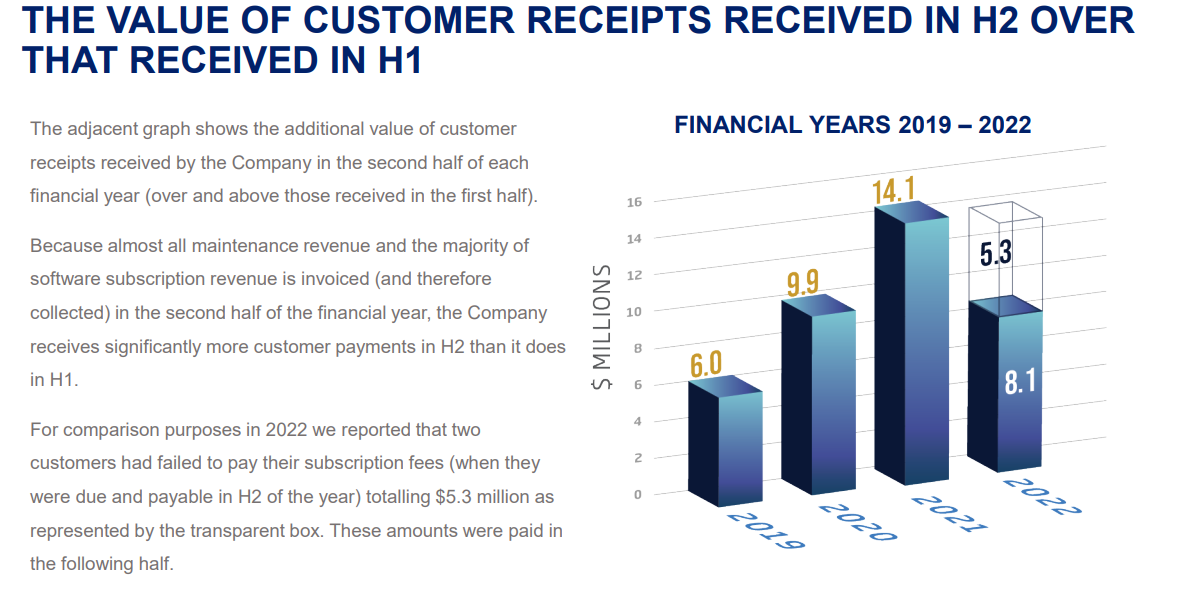

2nd new slide, in my opinion, just trying to say that their customer cash collection is heavily weighted towards H2, and the graph shows the tilt towards H2 as compared to H1 (the only exception was FY22 H2 when two customers failed to pay on the due date).

Not sure why the clarification, as this was very well known - but if they are confirming I would take it as a positive.

Overall, this is positive only. but this is a convoluted way of releasing positive news and that's why I am a bit suspicious.