Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

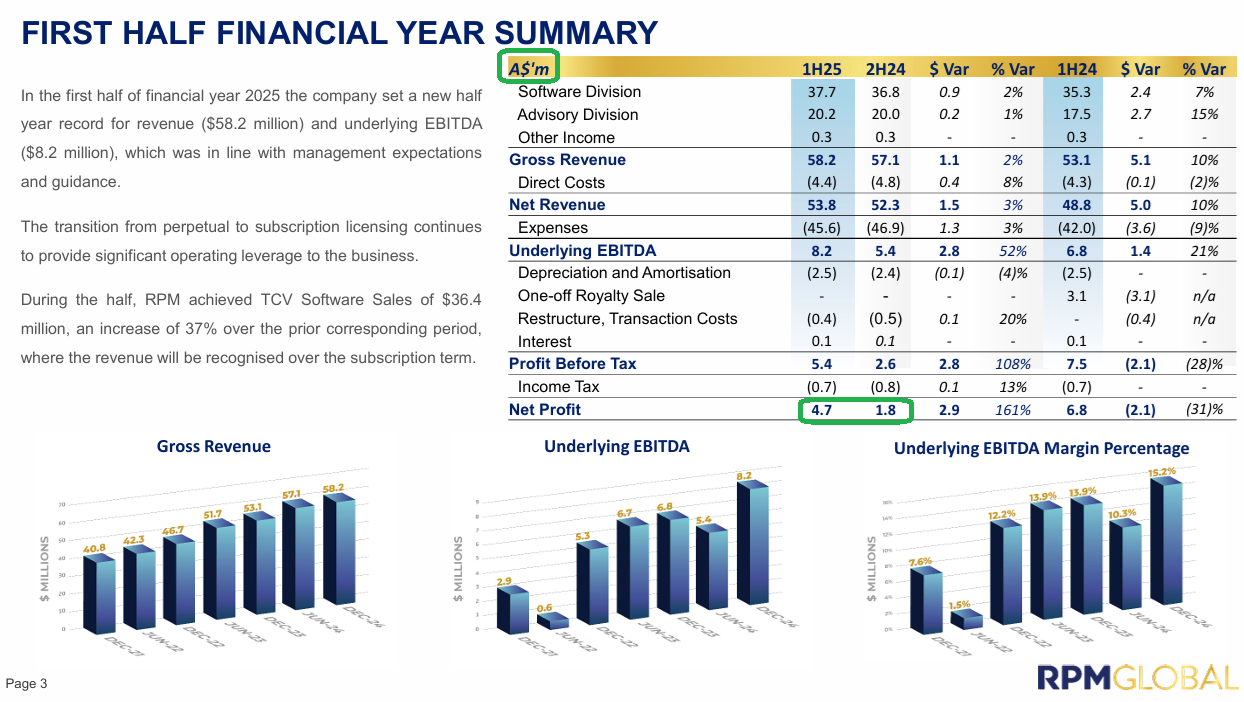

RPM Global (RUL) is a company I've liked for a few years and have held on and off (currently not holding). I was looking at their share price graph yesterday (Sunday March 16th) and their P/E ratio, which is still very high despite their share price having come down from around $3.35 to $2.57:

Commsec has RUL's P/E ratio listed as 62.35 and their market cap was $575.12m according to the ASX website, which tends to be more accurate with market caps than Commsec is. The ASX site has RUL's P/E ratio listed at 87.47 Their actual market cap should be 222,055,199 (shares on issue or SOI) x $2.55 (Friday's closing share price) = $566.24 million, so their true PE ratio based on their last full year NPAT ($8,656,000 - see here: RUL-Appendix-4E-year-ended-30-June-2024.PDF) should be $566.24 (P) divided by $8.656 (E) (with both figures in millions of dollars) = 65.42.

So a trailing P/E ratio of 65.42 based on their FY24 earnings.

What the ASX appear to be doing is adding together their two 6-month NPAT numbers from their two most recent halves to arrive at the "E" (earnings), so their recently reported FY25 H1 NPAT of $4.734m added to their previous half (H2 of FY24) NPAT of $1.813m to get $6.547m for the 12 months ending 31 December 2024, and that would give us a PE ratio of 86.49 (566.24 / 6.547), which isn't far from the ASX's trailing P/E ratio for RUL of 87.47.

In the following slide from their latest results release, you can see that RUL have rounded down those two NPAT numbers to $4.7 million and $1.8 million, so together that's $6.5 million. If you use that rounded down number ($6.5m instead of $6.547m) it results in a slightly higher P/E ratio of 87.11 (566.24 / 6.5).

If you instead use these numbers on a "per share basis", which also works out the same, the "P" is the current share price of $2.55 (Friday's closing price) and the earnings per share per year have been 2.948 cents/share or $0.02948/share ($6,547,000 NPAT divided by 222,055,199 SOI) for the 12 months ended 31 December 2024, so the P/E ratio is 2.55 / 0.02948 = 86.49.

For the 12 months ending 30 June 2024, the per share earnings are 3.898 cents/share or $0.03898/share (8,656,000 / 222,055,199) so the P/E ratio would be 2.55 / 0.03898 = 65.42.

So on the basis that a P/E ratio is designed to provide a number that represents how many years it would take for the company to earn the amount that you paid for the shares, it would take more than 65 years for them to earn (in NPAT) the amount that you paid for the shares, if you bought them at Friday's closing price of $2.55, and on that basis RUL look very expensive. This is however fairly typical for capital light software companies who are considered leaders in their field. Consider the following:

Company, P/E ratio according to Commsec / P/E ratio according to the ASX website

- Xero (XRO), 108.88 / 123.69

- WiseTech (WTC), 84.69 / 88.45

- TechOne (TNE), 72.81 / 77.44

- Hansen Technologies (HSN), 31.24 / 280.18

- Objective Corporation (OBJ), 58.79 / 44.70

- RPM Global (RUL), 62.35 / 87.47

These are all trailing PE numbers and that's important (more on that in a minute). It appears that Commsec uses the earnings number for the last full completed financial year and the ASX uses the earnings number from the last two 6 month periods added together - such as H2 of FY24 plus H1 of FY25, which is why the P/E numbers can be so different if there's a particularly weak or particularly strong half in there that the other mob are not including. Point is though, that these are all high P/E numbers.

Compare that to the much lower P/E ratios for some of the largest US Tech companies:

Company, trailing PE / Forward PE (based on projected earnings)

- Alphabet (Google), 20.58, 18.83

- Apple, 33.89, 29.15

- NVidia, 41.38, 27.10

- Amazon, 35.80, 30.03

- Meta (Facebook), 25.47, 23.92

- Broadcom, 90.53, 30.03

- Oracle, 35.28, 23.37

- Microsoft, 31.29, 30.21

Makes Google look cheap, eh!

Trailing P/E ratios, such as those I've quoted for all of those ASX-listed companies above, and the first of the two numbers to the right of those US-listed companies above, are based on historical earnings, so they are backwards looking, not forward looking. Forward P/E ratios are based on consensus estimates of current or future year earnings, and are therefore only as accurate as those earnings estimates are.

The thing about these sort of companies, particularly SAAS companies, is that they tend to be capital light and they usually scale really well without much in the way of additional expenditure, so additional revenue tends to drop through to the bottom line, because most of their costs are fixed costs which don't increase much - or at all - with additional revenue. In other words, these companies can handle more customers and increased sales without any significant increase in costs.

Because of this, if you believe that the company is going to continue to grow sales at a good clip, it's reasonable to also expect a corresponding increase in profits.

So that's one reason why quality SAAS companies that are ASX-listed tend to trade on high P/E ratios, because people can easily see a pathway for that company to keep doubling in size every few years, due to low costs, being capital light, and having a long growth runway based on these companies providing software that companies/people need.

The better ones also have low churn because switching costs can be significant in terms of both money and time, plus risks of things going wrong during a switch and negatively impacting that company's own clients.

Some other factors that should be considered are R&D and/or NPD (new product development) spending (costs). Most of those companies have a decent R&D+NPD spend every year, and they need to spend that money to both stay ahead of their competition and stay relevant, as well as to move with the times, for example to add additional capabilities that their customers either require or are likely to require in the future. Companies that do NOT continue to innovate and offer more to their customers/clients over time tend to fall behind and lose customers and/or just grow at a slower rate.

Much can be learned from studying the track record of these companies to see how they've handled these issues in prior years, looking at annual R&D spend, churn rates, etc., but over multiple years, not just one or two years.

The next major factor, as I see it, is M&A plus other capital allocation decisions by management. This is important because no matter how good and how profitable a business is, it can still be a bad investment if the management make poor capital allocation decisions, such as overpaying for assets and then booking impairments (value write-downs) in future years. Other capital allocation decisions can include dividends (including special dividends) and share buy-backs.

For instance, RPM Global (RUL) have an active share buy-back in place and they are lodging notices daily to show how many shares they have bought back and cancelled. This is often a sign that a company considers their share price to be too low, meaning they believe that their own share price does not reflect the value of the business, so buying back their own shares and cancelling them is - in their opinion - a good use of their money (or "our" money if you're a shareholder). That also has to be balanced against other opportunities, such as M&A opportunities (inorganic growth), dividends, etc.

In RUL's case, because they are a capital light business with ROE around 16.5% (according to Commsec) and an $18.7m cash balance at December 31st, with zero debt, if they truly believe their share price significantly undervalues the company, then an active share buy-back does make sense, IMO.

In general, P/E ratios tend to be higher in fast growing, capital light businesses such as SAAS companies, but the examples I have given in the lists above highlight that ASX-listed SAAS companies tend to be a lot more expensive than US tech companies, and one possible reason is that people see how succesful those US tech companies tend to be, and the share price appreciation they have demonstrated, and they extrapolate that across to our market and are looking to get exposure to similar companies on the ASX.

In my opinion, for the most part, that's not really an apples v. apples comparison.

The IT (information technology) sector on the ASX is tiny - around 3.2% of the S&P/ASX 200 index (our top 200 companies) - one of our smallest sectors, whereas over in the USA their IT sector is massive. It's their largest sector by a good margin.

Source: https://www.usbank.com/investing/financial-perspectives/market-news/investing-in-tech-stocks.html [07-March-2025]

The US IT sector, encompassing software, IT services, and related industries, contributes around 8.9% of the US GDP and accounts for a significant portion of the global IT market. And IT companies dominate the US market:

Point is, with good tech companies, there's plenty to choose from in the US, and over here, not so much, so the few decent IT companies that we do have tend to have high P/E ratios and look expensive, because there's greater demand for fewer companies.

The problem with that however is that the market is prepared to pay more for future growth, or, to put it another way, there's already substantial future growth already priced in with high PE companies, so the downside is if they stumble along the way, the share price can "correct" swiftly and the movements can be large in percentage terms. One way of looking at it is that some companies are priced for perfection, and if EVERYTHING doesn't go to plan, i.e. if ANYTHING goes wrong, that big growth and quality premium in the share price can drastically reduce or evaporate entirely.

Oftentimes, the share price will get back up to higher than where it fell from given a few months or years - as long as no further hiccups are encountered, but the ride can get bumpy.

Another consideration is that many of those giant US tech companies totally dominate the market globally, whereas our tech companies are a LOT smaller, many of them focus primarily on Australia - so have a much smaller addressable market - and do not have the same advantages that the big US tech companies have, such as massive economies of scale advantages, and being clear global market leaders.

For these reasons, I am usually only prepared to pay 40+ P/E for companies that I am very bullish on longer term and where I have a very high conviction that they will grow into their current valuation given time. I would need to have a 10 year plus timeframe for a company trading at a 60+ P/E ratio, AND be very bullish on their long term growth, AND be very happy with their management, including their track record of M&A and other capital allocation decisions.

Because, in that case, I am not expecting the company to take 60+ years to earn the equivalent of my purchase price (what a 60+ trailing P/E ratio suggests) because I am expecting that P/E ratio to reduce based on my buy price and their growing earnings. In other words, I am expecting the "E" to expand a LOT in the coming years, while my "P" remains constant (what I paid for the company's shares) so that means the ratio between the P and the E reduces quickly.

In RUL's case I don't have that level of conviction, so I'm not holding at this point in time. I still like the company, but I don't consider RPM Global to be one of the very best risk/reward opportunities across the market for me right now.

Further Reading regarding the basics of P/E ratios:

Google says:

Average market P/E ratios, which are calculated by dividing the market capitalization by the total annual earnings, provide insight into how the market as a whole is valuing its companies, indicating whether the market is generally overvalued or undervalued, and reflecting investor sentiment about future earnings growth.

Here's a more detailed explanation:

What P/E Ratio Measures:

The P/E ratio, or price-to-earnings ratio, is a key valuation metric that shows how much investors are willing to pay for each dollar of a company's earnings.

How it Reflects Market Valuation:

A high average market P/E ratio suggests that investors are willing to pay a premium for earnings, potentially indicating optimism about future growth and a perception of the market as overvalued. Conversely, a low average P/E ratio could suggest that investors are pessimistic about future earnings or that the market is undervalued.

Investor Sentiment:

The P/E ratio also reflects investor sentiment and expectations about future earnings growth. A high P/E might suggest that investors anticipate strong future growth, while a low P/E could indicate that investors are skeptical about growth prospects.

Comparison over Time:

Tracking the average market P/E ratio over time can help identify trends and potential valuation extremes. For example, if the P/E ratio is significantly above its historical average, it might suggest that the market is overvalued and could be at risk of a correction.

Limitations:

It's important to note that P/E ratios are just one metric among many, and should be considered in conjunction with other factors, such as industry trends, economic conditions, and company-specific fundamentals.

Example:

If the average market P/E ratio is 20, it means that investors are willing to pay $20 for every $1 of earnings, while a P/E of 10 would mean they are willing to pay $10 for every $1 of earnings.

--- ends ---

And when I ask Mr Google: What is the average PE ratio of the ASX

Google answers:

As of March 16, 2025, the average P/E ratio for the S&P/ASX 200 is around 15.7.

Here's a more detailed breakdown:

Historical Context:

The long-term trend for the P/E ratio of the Australian market is around 15.

Recent Fluctuations:

While the average is around 15, it has seen some fluctuations in recent years.

Comparison to other markets:

The ASX 200's P/E ratio is generally considered to be relatively low compared to some other major global stock markets, such as the S&P 500.

Factors influencing P/E ratio:

The P/E ratio can be influenced by factors such as earnings growth, interest rates, and investor sentiment.

Interpreting the P/E ratio:

A lower P/E ratio can indicate that a stock or market is undervalued, while a higher P/E ratio can suggest that it is overvalued.

--- ends ---

So, yes, any company trading on a PE of over 40 has a LOT of future growth ALREADY priced in, and I guess the main questions are:

- Do you agree that there's that much upside (profit growth) in this company and are you prepared to pay up for the company's shares now and then wait years for that upside to occur?

- And will it be worth the wait?

- Will the company deliver on its potential in the timeframe you expect them to?

- Are you prepared to ride out significant share price volatility if they stumble along the way?

When a company encounters a hurdle and stumbles or makes a misstep, and the company's share price drops significantly, you'll often hear people say that the market has overreacted to the downside, but those people may not realise that the market had already previously overeacted to the upside by bidding that company's share price up to priced-for-perfection levels, and so the "correction" that they are observing may be exactly that - a correction, to around where the company SHOULD have been trading, without all of that hype and euphoria priced in.

I'm not really commenting on RUL specifically here, because I haven't been following them closely lately, so I don't know their particular situation well at this point, but I'm just making general comments about high PE companies. Sometimes the earnings grow into the PE, and sometimes they don't, so the PE instead corrects by the price reducing.

27-Oct-2022: According to RUL's FY21 Annual Report, their substantial shareholders were:

- Perennial Value Management Limited with 9.75% (22,589,175 shares);

- Regal Funds Management Pty Limited with 5.93% (13,746,571 shares); and

- First Sentier Investors with 5.47% (12,677,670 shares)

...as listed at the bottom of this screenshot from Commsec today:

First Sentier Investors (formerly Colonial First State Global Asset Management) is a global asset management group that is now owned by Mitsubishi UFJ Financial Group, Inc., who also own Carol Australia Holdings Pty Limited. You will see above that Mitsubishi UFJ FG/Carol Australia reduced their RUL position from 6.69% to 5.21% on 12-Nov-2021 (circled above in orange). Regal's most recent notification was on 14-Sep-2022 to say that they were no longer substantial shareholders of RUL (circled in red above). All subs that have now ceased to be subs have been highlighted in red above. Remember that the most recent trades are at the bottom of that list, with the older ones at the top. The "Substantial Shareholders List" at the bottom left was only current back at the time of the 2021 annual report, so valid at 30-June-2021, and all of those shareholdings have since changed.

Perennial ceased to be subs on 11-Nov-2021, then became subs again on 01-Dec-2021, then increased their position through Feb, March and April this year, then bought more again in July, so Perennial now hold 10.43% of RUL.

It looks like Perennial bought a chunk of Clime's RUL shares back on 04-Feb-2022, which was when Clime Investment Management ceased to be substantial shareholders.

There is one new name there. Well, two. Comet Asia Holdings II Pte Ltd and Superannuation and Investments HoldCo Pty Ltd. They are both basically KKR - which is Kohlberg Kravis Roberts & Co. L.P., one of the largest private equity (PE) groups in the world. KKR are the majority owners of Colonial First State (CFS) - see here: Colonial First State welcomes KKR as majority shareholder and embarks on new phase as a standalone business (cfs.com.au)

...not to be confused with Colonial First State Global Asset Management, which was sold off to Mitsubishi UFJ Financial Group and rebranded as First Sentier Investments.

Where I've circled two names together and they both have identical shareholdings, it's the same shareholding, because one of the names is the registered owner of the shares, and the other one is the majority owner of the first company, so has to lodge a mirror notification in the same way that every time Brickworks lodges a subs notice for one of the many companies they are substantial shareholders of, Washington H Soul Pattinson and Co (SOL) also has to lodge a virtually identical notice because Brickworks (BKW) is regarded as a controlled entity of SOL (SOL own 43.2% of BKW and BKW own 26.14% of SOL), but they're not two different shareholdings, they are the same shareholding that is controlled by two different companies, because one of those companies is regarded as a controlled entity of the other company.

In the examples above, Carol Australia is a controlled entity of Mitsubishi UFJ, and both Comet Asia Holdings II and "Superannuation and Investments HoldCo" (S&I HoldCo) are entities controlled by KKR, so either Comet is regarded as being a controlled entity of S&I HoldCo - or S&I HoldCo is regarded as being a controlled entity of Comet Asia Holdings II. Either way it's the same shareholding.

So according to Commsec, the current substantial shareholders of RUL are:

- Carol Australia Holdings Pty Limited/Mitsubishi UFJ Financial Group, Inc., with 5.21%;

- Superannuation and Investments HoldCo Pty Ltd/Comet Asia Holdings II Pte Ltd, with 5.27%; and

- Perennial Value Management Limited, with 10.43%.

Of those the only one worth taking any notice of is really Perennial, in my opinion.

While not a substantial shareholder, Forager Funds do currently list RUL as the largest position in their Forager Australian Shares Fund (ASX: FOR).

Both Perennial and Forager are fundies that are best described as "value investors", so they look for growth companies at really good prices. Neither seem to like to pay up for quality or growth, they prefer to wait until such companies are looking very undervalued before they buy. It is probably best to look at the prices that RUL was trading at - at the times that those guys were buying. In Forager's case, they bought either all or most of their RUL in 2019 for less than 90c/share.

You can see when Perennial have been topping up above, but they have been on the RUL share register for a couple of years now as well. The last time Perennial bought more RUL was in early July, when RUL were trading at around $1.50 to $1.60/share. Prior to that, they were buying in late April at around $1.70 to $1.80. They were also buying in early Feb and mid-March at around those same $1.70 to $1.80 levels, which is not too far from where RUL are trading now. They closed at $1.79 on Wednesday and then at $1.89 today (Thursday 28-Oct-2022) after rising 10c (or +5.59% on a positive day for our market).

Perennial have been increasing their RUL position gradually since December 1st, so for the past 11 months roughly (as it's nearly the 1st November). Back in late November/early December, Perennial was paying just over $2/share for RUL. All of their top-ups since then have been at lower levels however, mostly between $1.70 and $1.80/share and more recently at $1.50 to $1.60. Perennial do tend to play the long game, much like Forager do, so that's worth considering also. Their typical investment horizon is probably 5 to 10 years, but no less than 3 years, I would imagine.

Source: Commsec. Edited by me (to remove clickable links).

Here is what the RUL Board members own in terms of skin in the game:

Stephen Baldwin is their Chairman and Richard Mathews is their CEO and MD. They hold 3.7m and 8.2m RUL shares respectively.

Disclosure: I do not currently hold RUL shares, although I have done in the past, and have made money holding them.

27-Oct-2022. As well as the Moelis report on RUL that @Remorhaz mentioned today, there are a few other brokers and analysts who have covered RPM Global (RUL) in the past, and may still do. Here are some links to their reports from prior years:

27-Oct-2019: Taylor Collison: RPM Global (RUL) - Initiating coverage: 5 reasons to buy

10-Feb-2020: Taylor Collison: RPM Global (RUL): Recent update, accounting changes, review of competition

26-Mar-2020: Taylor Collison: RPM Global (RUL): 1H20 result review and update

2020: Sequoia also covered RUL back in 2020: You searched for RPM Global - Sequoia Direct Pty Ltd

Blackpeak Capital mention them on the last line of the table on page 80 of this report: Microsoft PowerPoint - Summary Tech Presentation - March 2022 (blackpeakcapital.com.au)

RPM Global (RUL) was on the list of "included companies" on the ASX's free broker report service for FY21 - see here: Independent broker research (asx.com.au) - but it seems that they (the ASX) don't have an archive of those reports that we can access. However, thanks to some work on my part (in prior months), you may find links to some of those free reports here.

Also, Gaurav Sodhi over at Intelligent Investor covers RPM Global. Here's a snapshot of part of his latest report on them.

For the rest of that report and more of their other fine work, try a free trial of their subscription service at Intelligent Investor.

Also, Claude Walker and Owen Raszkiewicz both cover RUL. Not sure if this is behind a paywall, but here's a link to their most recent conversation about the company: Claude Walker And Owen Raszkiewicz Chat About RPMGlobal (ASX: RUL) and Altium (ASX: ALU) - A Rich Life [19-October-2022].

Also, from Claude Walker @ "A Rich Life":

28-June-2022: Why You Should Be Watching RPM Global (ASX: RUL) - A Rich Life

25-Sept-2022: My Top 6 Fluffy Dog Stocks With Target Buy Prices - A Rich Life [RUL is #6, of 6]

12-Aug-2022: Has Forager Funds Management Changed Investment Style? - A Rich Life ["The Forager June 2022 report disclosed that the fund had 17.7% allocated RPM Global (ASX: RUL), Nitro Software (ASX: NTO), and Bigtincan (ASX: BTH) between them, and also held Whispir (ASX: WSP) and Fineos (ASX: FCL), so the overall allocation to unprofitable tech was probably around 20%, at the least."]

26-March-2022: 4 Stocks That Could Benefit From The Commodity Price Boom - A Rich Life

And from Forager Funds:

10-Dec-2019: Revving up at RPM - Forager Funds [Why they bought RUL shares]

According to Forager's latest report for their Australian Shares Fund, RPM Global (RUL) is the largest position in that fund:

Monthly Report: Australian Fund September 2022 - Forager Funds

Source: https://foragerfunds.com/news/investor_resources/monthly-report-australian-fund-september-2022/

Mining Software, Consulting & Training Solutions | RPMGlobal

https://rpmglobal.com/

Disclosure: I have held RUL shares previously, and made money from holding them, but I am not a current holder. I like the company but I see better opportunities elsewhere at this point in time. While there is probable further upside with RUL, I see more upside with a number of other companies over a 3 to 5 year timeframe.

Analyst: Louis Bannon, [email protected], +61 2 9238 8236

- Recommendation: BUY

- Target Price: 173cps (Initiating coverage)

- Market Capitalization: $299m

- Index: N/A

- Share Price: 131cps (133.5 cps on Fri 26-Mar-2021)

- Sector: Enterprise Software

At the coal face of technology uptake in global mining

- Overview: The mining industry has been a laggard in the uptake of software technology. Old processes – such as scheduling operations on excel spreadsheets – are surprisingly prevalent. This is changing, as the first wave of adoption seeps into the peloton. RUL has been preparing for this. Since FY13, RUL has spent ~$90m (fully expensed) on software development, and a further ~$30m on acquiring businesses to complete its end-to-end suite of products. As validation of management’s capital allocation, RUL has – on average – added 98c of free cash flow for every $1 of cash invested in the last three years. Further, ROCE has also been growing steadily to 17% (in FY20).

- RUL is the only end-to end provider of software at each stage of the mining process. Products are divisible into five segments (1) Design & Scheduling; (2) Simulation; (3) Asset management; (4) Financial Modelling; and (5) Operations. Whilst these products can be sold on a standalone basis, RUL has integrated (most of) the software such that information can flow seamlessly between the apps.

- Business quality: (1) Switching costs: churn is <5% across all products. Low churn and long-dated ARR amounts to high earnings quality. (2) IP/ first mover advantage: Whilst ‘Design and Scheduling’ is a fiercely contested segment (and 35% of ARR), we understand that RUL has a relative free kick in its ‘Asset Management’, ‘Financial Modelling’ and ‘Operations’ divisions due to the lack of competition. Combined, they contribute ~50% of ARR. (3) Complementary products (network effects): RUL has achieved interoperability between most of its software suite. This allows the flow of data between the designer, schedulers, financial modellers, maintenance teams, and management. We believe that a complementary network exists because the value of the existing products increases when users adopt new ones within the suite.

- Most logical bear case/s? (1) ‘Design and Scheduling’ is RUL’s DNA and still accounts for ~35% of ARR in software. Whilst managements acquisitions and allocations have been fruitful our research and discussions suggest that RUL are losing this battleground to competitors – specifically Deswik. (2) Exposure to thermal coal is still considerable (~25% of ARR). This exposure is somewhat alleviated by the location of exposure (developing countries), the length of time for energy transitions, and the fact that RUL sells flow products which (after installation) are contained within operating costs.

- Valuation and conclusion: Given the relative lack of competition in a majority of the segments – and RUL’s preparedness in building these solutions – we believe that RUL is well placed to capture the continued investment in mining technology. Given the high quality ARR, and incremental margin improvement, we think RUL will achieve a 6-7% FCF yield in FY22/23.

--- click on the link at the top to access the full CCZ report on RUL ---

16-Mar-2021: Software Subscription TCV and ARR Update

Update on Total Contracted Value (TCV) for Subscription Software sales

RPMGlobal Holdings Limited (ASX: RUL) [RPM®] is pleased to provide the following update on Total Contracted Value (TCV) and Annual Recurring Revenue (ARR) derived from software subscriptions sold during FY2021.

The company’s current software subscription TCV is $23.4m an increase of $8.9m from the $14.5m reported by RPM in its half year investor presentation released to the market on 22 February 2021. Further, RPM’s current Annual Recurring Revenue (ARR) from software subscriptions is AUD$18.4m per annum an increase of $2.6m from the $15.8m reported on 22 February 2021.

The business has also closed $0.8m ($800K) in perpetual software licenses since 31 December 2020.

For completeness, the company has not included a further $4.1m in contracted subscription revenue in the TCV number reported above (of $23.4m) due to the inclusion of a non-standard termination for convenience right in a recent software subscription contract that enables that customer to terminate the contract without having to pay the fourth and fifth years’ contracted subscription revenue. In the event that this contract proceeds to the full five-year term as envisaged, this $4.1m will be spread across RPM’s 2025 and 2026 financial years.

--- ends ---

[I do not hold RUL shares currently, although they are still on my Strawman.com scorecard. The market liked today's update with RUL closing up +8.26% at $1.31, being 10 cps higher than yesterday's $1.21 close. Their 12-month high was $1.40 set in January - 2 months ago - so they're not far off that - at $1.31. Their 12-month low was $0.58, set in which month? Can you guess? Yes, it was indeed March 2020 - all I needed was a lot more money and a whole lot of confidence and I could have made a killing - on hundreds of companies - they've all more than doubled. Some have tripled and some are up 4x since March. Hindsight is such a wonderful thing... But then, so is good single malt Irish whiskey. For medicinal purposes, of course.]

28-Oct-2020: Acquisition by RPM of IMAFS Inc

RPMGlobal Holdings Limited (ASX: RUL) [RPM®] is pleased to announce it has entered into a share purchase agreement to acquire 100% of the issued share capital of Quebec Canada headquartered, Software-as-a-Service (SaaS) and cloud delivered inventory optimisation management and forecasting solution company, IMAFS, Inc.

Privately-owned IMAFS has more than 20 years’ experience developing and selling its flagship IMAFS product, a cutting-edge, cloud delivered inventory management and forecasting software solution that has a proven track record of increasing the financial performance of asset intensive companies by greatly improving inventory management through state-of-the-art optimisation.

The IMAFS product has been designed and built for the sole purpose of optimising the inventory holdings of large asset intensive companies. In the mining industry, management and optimisation, specifically the Maintenance, Repair and Operational (MRO) inventory is critical to ensuring operational continuity and attainment of production targets.

The key to accurately forecasting any type of inventory is understanding future demand. Mining MRO inventory optimisation is often a unique challenge to solve due to low volume and/or erratic turnover with long lead times, high component costs and the complex logistics associated with operating remote locations leading to companies over-stocking parts inventory and tying up capital unnecessarily.

Mining by its very nature means carrying high levels of inventory, spare parts, and consumables. Major Enterprise Resource Planning (ERP) products are good at managing ‘steady use’ inventory, based predominately on historic patterns of use and trends. The challenges arise in managing and forecasting inventory for maintaining large complex, fixed and mobile assets which are not always scheduled or easily forecast based on history. When it comes to mining, properly managing MRO inventory is vital. If the plant, or key pieces of equipment (Loaders, Trucks, Conveyors etc.) stop operating because spare parts are not available, you have a costly operational problem. A poor inventory optimisation process can result in a company ordering inventory urgently due to reactive (poor) inventory processes rather than predictive (good) inventory processes.

IMAFS have developed a hosted subscription service that allows inventory data to be extracted from a company’s ERP product or Computerised Maintenance Management (CMM) system and analysed programmatically. IMAFS’ proprietary and cutting-edge algorithms also include Artificial Intelligence (AI) logic which incorporates parameters such as transport mode, carrier, weather, customs, seasonality, holidays, availability and many other data points. IMAFS will also identify excess or obsolete stock that can be returned or disposed of.

Commenting on the acquisition, RPM CEO and Managing Director Richard Mathews said “we are very pleased to have concluded negotiations to acquire IMAFS and are really looking forward to welcoming the Quebec based IMAFS team into the wider RPM family. This product is a great fit with the existing RPM product suite and further builds on our cloud and optimisation offerings”.

“Four years ago, we acquired iSolutions because we understood the importance of planning maintenance in parallel with production. AMT sales have been strong and the adoption rate within our customer base has been pleasing. AMT stands alone when it comes to forecasting the lifecycle cost of an asset using its dynamic lifecycle costing engine (DLCC). This real time engine accurately predicts when customers will require major parts and components. In other words, by going back to first principles (as AMT does) we can predict the future demand that can be factored into IMAFS’ advanced AI algorithms. That future demand is the critical piece of the puzzle so that IMAFS can optimise procurement and management of critical parts and components.”

“Our AMT solution is also used by the major OEM’s and their dealer network. These organisations can take forecasts from their customers into the IMAFS product thereby assisting them in optimising their massive spare parts inventory. While we haven’t had a product to do this in the past, we have been involved in a number of discussions with dealers and miners to do exactly this.”

“Whilst IMAFS can be sold stand-alone, we also intend to provide IMAFS integrated with the AMT suite as a parts and inventory optimiser. It will also be sold as part of our AMT4SAP suite.”

IMAFS has a number of active customers with committed annually recurring subscription revenue of CAD$500k per annum.

Robert Lamarre, IMAFS founder said “It is immensely pleasing to see the passion emanating from the team at RPM to championing inventory optimisation and cloud driven enterprise integration. We are convinced that the IMAFS product suite will benefit from increased investment and the sales and marketing support that RPM can offer these products right around the world.”

Following completion Robert will continue his involvement with promoting IMAFS through a third party business partner authorised to market and distribute IMAFS products to customers in North America outside of mining and resources. Mr Lamarre continued by saying “Knowing that IMAFS is in great hands with mining and resources customers right across the globe, I am proud to continue to work as a partner with RPM to market and distribute IMAFS for non-mining clients in North America.”

Following completion of the transaction, IMAFS’ employees will move across into the RPM business where they will continue to be focused on transforming mining operations through innovative software solutions.

The transaction is comprised of a once-off payment of CAD$1,300,000 paid on completion plus post completion payments of between CAD$200,000 and CAD$700,000 contingent upon new subscription customer contracts being concluded prior to closing of the acquisition and a working capital adjustment three months after completion, and is entirely funded from RPM’s existing cash reserves.

The acquisition is expected to close on 25 November 2020 (Canadian Eastern Time) subject to a number of conditions precedent and customary completion events.

--- ends ---

[I do not hold RUL shares directly, although they are on my Strawman.com scorecard. I do currently hold FOR shares, and the Forager Australian Shares Fund (ASX: FOR) does have a large position in RUL - it was FOR's largest fund position at September 30, representing 8.2% of their fund, so I have indirect exposure to RUL via FOR. I like RUL a lot.]

15-Oct-2020: RPM's first Software as a Service (SaaS) offering

RPMGlobal Holdings Limited (ASX: RUL) [RPM®] is pleased to announce the launch of its first Software as a Service (SaaS) product, providing mining companies with the capability to undertake haulage calculations in a cloud environment.

With more and more operations choosing to move business-critical operations into the cloud, RPM has leveraged the growing shift from the “desktop” by collaborating with industry partners to launch a service-based approach to Haulage calculations, known as Haulage as a Service (HaaS).

This cloud enabled service-oriented approach to haulage analysis means users are no longer confined to one application on the desktop. Under the new SaaS model, customers are able to write their own applications to interact with HaaS. Users can then configure haul traces, haul routes, settings and trucks to run travel time calculations automatically in the cloud.

HaaS leverages the travel time calculation engine contained within RPM’s TALPAC® product which has been the de-facto standard for simulation within the mining industry for more than 40 years. This calculation engine enables users or customer applications to undertake travel time calculations on demand.

Commenting on the release of RPM’s first SaaS offering, RPM’s Chief Executive Officer Richard Mathews said “HaaS is tailored to the current requirements of our customers to cloud enable their operations and enable their businesses to be conducted remotely no matter where they or their people are physically located.”

“Providing our customers with flexible and scalable ways to use RPM’s software is a key part of our customer service promise and cloud-hosted options enhance our ability to support our customers through an internet enabled cloud access to the hosted application.”

“Making our innovative software available through a variety of delivery methods will remain critical moving forward and with a number of our customers undergoing the transition to cloud environments, we are proud to be at the forefront of this migration.”

The reporting and calibration benefits within the cloud HaaS offering are already resulting in miners requesting access to HaaS. Miners are using HaaS as a way of measuring haulage performance and identifying areas of haulage improvement, including being able to automatically compare the actual values out of their Fleet Management Systems (FMS) against calculated values, straight after the haulage route is complete on a consistent basis.

With HaaS miners have increased operational agility to undertake haulage calculations from any location. Because there is no desktop application, the calculations can be delivered via the web or mobile apps instantly.

Mr Mathews continued by saying “RPM’s cloud enabled SaaS solutions help to solve several key industry challenges, including the problem of siloed data. With HaaS, data is no longer trapped within individual desktop applications or siloed with individual users. This cloud enabled approach enables operations to get the best overall haulage performance right across their operations irrespective of where the users or applications calling the cloud service are physically located.”

“Mining is a dynamic and fluid environment, often making it difficult to benchmark the performance of trucks. Miners have had to use KPIs such as Effective Flat Haul in an attempt to normalise data. HaaS addresses this challenge by allowing miners to compare every haul against a benchmark calculated value”

“RPM has been providing customer hosted solutions for some time and the company’s investment in enterprise software development has paved the way to unlocking siloed data through cloud delivery methods, such as SaaS.”

“We are committed to investing in taking our software products to the cloud and we have introduced a dedicated team to work closely with our customers to ensure a smooth transition from where they currently are to the cloud. RPM’s heavy development investment over the past seven plus years in moving our products from the “desktop” to the “enterprise” has enabled us to move our applications into the Software as a Service environment. This investment has resulted in RPM being many years ahead of traditional software suppliers to the mining industry and we intend to use our strong balance sheet to retain our first mover advantage.”

Mr Mathews concluded by saying “If there can be one positive thing to come out of the global challenges of COVID-19 it is an understanding that companies need to be able to operate their businesses remotely no matter where they or their people are physically located and being able to utilise Software as a Service applications means they can do exactly that.”

--- ends ---

[I no longer hold RPM Global [ASX:RUL] shares directly, but I still hold FOR shares, and the Forager Australian Shares Fund's (FOR's) largest position (8.7% of their fund) was RPM Global at last notice (being on August 31, 2020), so I have indirect exposure to RPM (RUL) through FOR.]

About RPM: RPMGlobal Holdings Limited (ASX: RUL) [RPM®] was listed on the Australian Securities Exchange on 27 May 2008 and is a global leader in the provision and development of mining software solutions, advisory services and professional development to the mining industry. With history stretching back to 1968, RPM has been trusted by mining companies of all sizes and commodities to support their growth. Their global expertise has been achieved over the past 50 years through their work in over 125 countries and their approach to the business of mining being strongly grounded in economic principles.

24-Aug-2020: Investor Presentation - 2020 Full Year Review and Annual Report FY2020 plus Appendix 4E year ended 30 June 2020

- Group revenue finished the year up $1.2m to $80.7m (FY2019: $79.5m).

- The Total Contracted Value (TCV) of software subscriptions sold during FY2020 increased by $24.2m (235%) to $34.5m (FY2019: $10.3m). Of the total $34.5m only $6.1m was recognised in this year's financial accounts with $28.4m from this year plus $6.3m from prior years (i.e. $34.7m total) to be recognised across the remaining duration of the committed term customer contracts which in most cases is 3 years.

- This $24.2m year-on-year increase in subscription TCV resulted in a $1.3m increase in commissions/incentives in the FY2020 annual accounts. We believe the 235% increase in subscription TCV was the major driver for the 78% increase (from 59 cents to $1.05) in company share price and resultant $108m (86%) increase in market capitalisation over the twelve months.

- The Company’s Operating Contribution (EBITDAR* before Foreign Exchange and one-off COVID-19 costs/provisions) finished the year at $8.4m (FY2019: $8.5m).

- Due to COVID-19, the company incurred $0.4m in retrenchment costs and increased its accounts receivable provisioning by $0.4m.

- The company’s Loss After Tax for FY2020 was $0.7m a $5.2m (88%) improvement over FY2019 (Loss after Tax $5.9m).

- Cash inflows from operations for the year totalled $15.8m (FY2019: $7.3m) and as at June 30, 2020 the company had $40m in cash (and no debt).

- The company made the final acquisition earnout payments ($2.6m) for the iSolutions and MinVu acquisitions during the year and therefore will not be required to share revenues from these products going forward.

* EBITDAR = Earnings Before Interest, Tax, Depreciation, Amortisation and Rent

--- click on links above for more ---

[I do not curently hold RUL, but they are on my Strawman.com scorecard, and I do hold FOR shares, and the Forager Australian Shares Fund (FOR) had a 6.7% position in RUL up until July when they sold almost 2m shares, then sold another 1.5m shares on August 12th, so have now ceased to be substantial holders - they now own less than 5% of RUL. I was holding RUL directly earlier in the year, then decided that my exposure via FOR would suffice, so I sold at a profit some months ago.]

09-July-2020: Acquisition by RPM of Revolution Mining Software

Acquisition of Revolution Mining Software Inc

RPMGlobal Holdings Limited (ASX: RUL) is pleased to announce it has entered into a share purchase agreement to acquire 100% of the issued share capital of Sudbury, Canada headquartered mine scheduling optimisation company, Revolution Mining Software.

Privately-owned Revolution Mining Software has more than six years’ experience developing and selling its flagship Schedule Optimisation Tool (SOT)®, a cutting-edge mine scheduling optimisation software solution for tier one miners around the globe.

RPM has also acquired Revolution Mining Software’s Attain® and SurfaceSOT® software solutions.

SOT emerged out of research undertaken by Mining Innovation, Rehabilitation and Applied Research Corporation (MIRARCO), a not-for-profit corporation of Laurentian University in Canada that is well known for solving complicated mining industry problems through innovative thinking.

SOT is the industry’s only strategic financial optimisation tool for underground mines that enables mine planners to improve productivity and profitability by optimising the net present value (NPV) of the mine schedule.

This scheduling program adds value to mining operations in several ways, including by generating life-of-mine schedules that adhere to all specified precedence and operational constraints, optimising NPV based on the user’s financial model.

Attain® is a software solution which ensures operational mine planning is systematically aligned with the long-range plan. This approach ensures the company has optimised short-range schedules that are feasible and aligned with the long-range schedule.

SurfaceSOT® is a solution that will work for all types of mining operations to maximise their NPV by optimising their long-range schedules including management of stockpiles and product blending while minimising the re-handling of materials.

Commenting on the acquisition, RPMGlobal CEO and Managing Director Richard Mathews said “we are very pleased to have concluded negotiations to acquire Revolution Mining Software and are really looking forward to welcoming Lorrie and the rest of the Revolution team into the RPM family. We will invest in their industry leading scheduling optimisation tools to deliver innovative solutions that add real value to our customers.”

“RPM was born from the understanding that mine planning needs to be built on sound economics and the Revolution Mining product strategy is completely aligned with that core value”.

Lorrie Fava, Revolution Mining’s President said “The entire Revolution Mining team is so passionate about the solutions we have delivered to the industry, so it was important to us that RPM also shared our vision and passion, which they clearly do.”

“To be able to be a part of a company with RPM’s pedigree and history is a very exciting prospect for the team at Revolution Mining. We look forward to joining the RPM team and are convinced that the Revolution Mining Software product suite will benefit from increased investment and the sales and marketing support that RPM can offer these products right around the world.”

The acquisition of the SOT, Attain® and SurfaceSOT® solutions extend the strategic capability of RPM’s scheduling solutions. RPM’s sophisticated mathematical modelling tools for short and mid-range planning amplify the benefits its customers receive from the optimisation and schedule alignment tools.

Following completion of the transaction, all of Revolution Mining Software’s employees and management will move across into the RPM business where they will continue to be focused on transforming mining operations through innovative software solutions.

The transaction will be funded by RPM’s existing cash reserves and comprises an upfront payment and two year earn-out. The acquisition is expected to close on 31 July 2020 subject to customary completion events.

--- ends ---

About RPM:

RPMGlobal Holdings Limited (ASX: RUL) [RPM®] was listed on the Australian Securities Exchange on 27 May 2008 and is a global leader in the provision and development of mining software solutions, advisory services and professional development to the mining industry.

With history stretching back to 1968, RPM® has been trusted by mining companies of all sizes and commodities to support their growth. Our global expertise has been achieved over the past 50 years through our work in over 125 countries and our approach to the business of mining being strongly grounded in economic principles.

[note: where they have used the "TM" hypertext abbreviation for "Trademark", I have replaced it with the ® symbol, which means "Registered Trademark", because that "TM" hypertext can not be replicated in a straw here.]

Disclosure: I have RPM (ASX: RUL) on my Strawman.com scorecard, and it's done quite well, however I don't hold their shares directly. I own them indirectly via Forager's Australian Shares Fund LIT (ASX: FOR), which I do hold. RUL was FOR's largest position at the end of May, representing 12.5% of their portfolio - see here.

14-Apr-2020: Software Subscription TCV and ARR Update

Every month, RUL update us with their Total Contracted Value (TCV) derived from software subscriptions sold during the current FY (financial year) as well as their Annual Recurring Revenue (ARR) from software subscriptions. Following these announcements is a good way to see how they are tracking.

The Company’s TCV is now $30.0M, an increase of $4.6M from RPM’s previous announcement on 11 March 2020. RPM’s ARR from software subscriptions is now A$12.8m per annum.

Last few market sensitive announcements:

11-Mar-2020: Software Subscription TCV and ARR Update

06-Mar-2020: New Product - TALPAC-3D

24-Feb-2020: Half Year Investor Presentation

26-Mar-2020: Taylor Collison: RPM Global (RUL): 1H20 result review and update

Highlights:

Our View: We are retaining our Outperform recommendation. RPM is well positioned to deal with the tougher economic conditions; given $24.6m net cash on the balance sheet (and at late February 2020 c$32.9m) and the movement towards subscription software model. RPM is helped by the mission critical nature of the software that RPM provides to its diversified mining clients (who are generally the larger miners that are in production). RPM’s software is used in improving mining productivity and digitalizing the mine site and this also provides insultation from the current economic environment.

[click on link above for more]

10-Feb-2020: Taylor Collison: RPM Global (RUL): Recent update, accounting changes, review of competition

TC's call on RPM (ASX:RUL) is still "Outperform" with an unchanged valuation of $1.07 based on a blended DCF and EV/Sales (SOP) and EV/EBITDA methodology, but they note further upside is potentially emerging and they will review their valuation upon the 1H20 result release.

"We retain our Outperform. The rationale behind the positive stance includes: -

- Heavy reinvestment into new products opening new markets.

- Past absorption of costs of moving to the subscription model.

- Less one-off costs into FY20 – assisting reporting earnings and cashflow.

- R and D has likely peaked and should fall into FY20 and has been expensed. Strong balance sheet also is appealing.

- Industry conditions are reasonable (compared to past periods of extreme adversity) and the desire to reinvest in technology within the resource industry remains very strong."

This note (link above) also reviews RPM Global’s competition in some detail.

RPM (RUL) closed on Friday (Feb 14, 2020) at $1.07 (bang on TC's valuation), being up almost +26% since Jan 9 (just over 5 weeks ago - when they were 85 cents per share) and up a whopping +94.5% since their 55 cps close on August 23 (only 6 months ago).

Steve Johnson's Forager Fund (ASX: FOR, their Australian shares listed investment trust - or LIT) holding RUL as a top-10 holding and highlighting the company in their newsletters and videos hasn't done the RUL share price any harm.

Disclosure: I did hold RUL, but don't now. I don't see the upside from here as being compelling enough to hold them. I think the easy money has probably already been made. However, I do hold FOR shares, so I have exposure to RUL via FOR anyway.

27-Oct-2019: Taylor Collison: RPM Global (RUL) - Initiating coverage: 5 reasons to buy

TC's call on RPM (ASX:RUL) is "Outperform" with a valuation of $1.07 based on a blended DCF and EV/Sales (SOP) and EV/EBITDA methodology. They believe earnings are set to grow from a low base. The net cash balance sheet is also appealing. RPM has made the astute and tough decision to heavily reinvest in its products and transition towards a subscription model. This set of patient and disciplined decisions is now bearing fruit.

RPM (RUL) closed on Friday at 83.5c ($0.835).

Post a valuation or endorse another member's valuation.