@actionmanI agree it would be great to get some "Field Reports" from the StrawPerson or StrawPeople who attended.

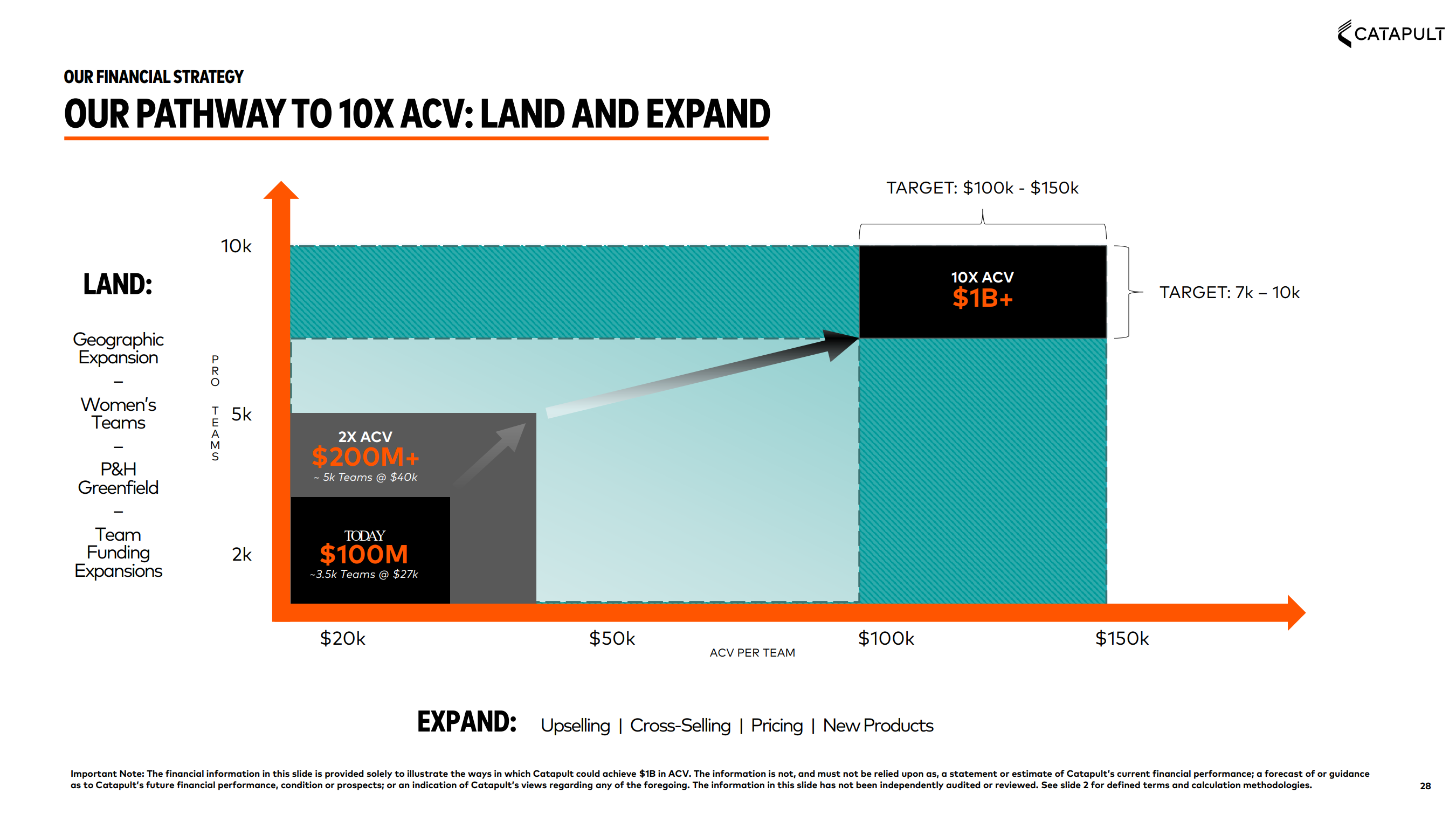

I've had a quick look through the slide deck and in addition to their TAM and long term-financial framework, they've added a new framework for how they get to 10X, via land and expand. (At least, I think this is the first time I seen this one).

Of course it is very aspirational and long term (read the fine print), but I have to say that it is not inconsistent with the strong tailwinds blowing in sports + technology + entertainment.

The track record, financial framework, industry trends and TAM and this slide really capture the core elements of my thesis for $CAT.

I think it also puts to rest the question we've raised again in the last couple of days .... I don't think we're going to see a resurgence of Prosumer any time soon. It will take all of their energies and every ounce of resource to crack this Pro Sport opportunity. Why mess around where Apple, Garmin, Fitbit are going to play?

As to the SP reaction today,... I just see it as completely in line with the risk-off, NASDAQ-led, Trump-inspired-tariff-tantrum, and nothing company specific.

Maybe some added grumpiness about the lack of specificity in guidance. Go figure!

But I am happy to be corrected by those who were in the room today!