Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

if you’re wondering why CAT is down 4.6% today below its $4 support level it might have something to do with this AFR article on short selling of ASX tech stocks. This could create a buying opportunity for the long term? https://www.afr.com/markets/equity-markets/short-sellers-are-targeting-asx-tech-stocks-on-distorted-prices-20260114-p5ntvc

Here are a few excerpts from the article:

“Short sellers are ramping up their bets against technology stocks on the ASX amid toppy valuations and lingering inflation concerns in Australia that have left the possibility of an interest rate hike on the table.

While technology companies are typically more sensitive to higher borrowing costs, Plato Asset Management’s David Allen said the main driver behind the growing short interest was the limited number of growth companies listed on the ASX.

In other words, local investors looking to ride the global tech rally have chased a handful of perceived winners, such as buy now, pay later group Zip; Catapult; WiseTech Global; and DroneShield, which has inflated share prices.

“Australia has a shortage of genuine growth companies and this is creating, frankly, distorted valuations in the domestic technology sector,” Allen said.

“With too much capital chasing too few opportunities, scarcity is driving prices well beyond fundamentals. This is why you see this increased short interest across the sector.”

Allen, who runs Plato’s $3 billion Global Alpha Fund, noted that just three local tech companies grew revenue by more than 20 per cent in the past year. The hedge fund initiated a short position – that is a bet that the share price will fall – on sports analytics company Catapult in December. The stock has fallen nearly 20 per cent since then.”

“Similarly, short interest in Catapult has tripled since late November, from 1.25 per cent to 3.82 per cent. This comes after the stock price doubled last year to a high of $7.72 in late October. It’s now buying $4.13 and has a forward PE ratio of 57.14.”

Disc: Took a nibble today

I don’t hold CAT, however I have it on my watchlist given it is a Strawman favourite (currently #3), and the recent pull back in the share price. I was curious to why there was a 9% fall today when the share price seemed to be trending upwards once again.

I came across this article shared by the team at The Motley Fool which uncovered an announcement out of Fujitsu today. Fujitsu announced the launch of "Fujitsu Accelerator Program for SPORTS," a global partner co-creation program aimed at fostering new innovation in the sports sector. https://global.fujitsu/en-global/pr/news/2025/12/01-03

I don’t know if Fujitsu has the potential to eat Catapult’s lunch or not, but it certainly has the market worried.

Discl: Held IRL 8.85% and in SM

A short 22 min Livewiremarkets interview with Will from 18 Nov 2025. The headline was a really good summary of where CAT is at:

"Product ready and cash rich, Catapult targets $1 billion in annual contract value"

Key Takeaways

1. Importance of Impect acquisition - that this solved a real hurdle to cross-selling video into wearables customers, and raising the upsell value from 2x for video-into-wearables to 5x when bundled with Impect.

2. Positive signs from the Perch acquisition - signing some really big deals in Europe, Asia, to the AFL, even in sports which are not big weight training intensive eg. Volleyball

3. Vector 8 Platform - there is an underlying software component that exists completely in the cloud - do not have to wait season-to-season to bring features to market, have the capability to bring new features to market week-to-week

4. The concept of “perpetual insights” - that the combination and bringing together of wearables, data in the gym, on-field, and connecting that to the TACTICAL decisions that a team must make, is giving customers insights that no one else can give them

5. Cash on Hand ~$60m - Wanted to have capital to do more acquisitions without having to go back to the market again - have enough firepower to react positively to an opportunity - a sure sign that more M&A is on the way

“Our goal has always been, if we get to around 6,000-8,000 clients giving us somewhere between a $100,000-150,000 annually, we'll be well on our way to a billion dollars of ACV.”

You'd think the results were terrible based on the market's reaction (down nearly 10% at time of writing), but at first glance they dont seem terrible to me.

There were some FX headwinds, but on a constant currency basis you're looking at 19% ACV growth, 16% revenue growth and a 50% lift in management EBITDA. Gross margins held steady at 75%.

Churn did tick up slightly, although has been noted they did exit from Russia which explains that.

Maybe the drop is more a concern over valuation? Even after the drop, and if you annualize first half revenue, CAT is on a P/S of ~6.4x. I know that;s a simplistic way to look at it, but just trying to rationalise the market reaction.

Honestly, I cant see anything that changes the thesis for me, but this is just my initial take after a quick look. What am i missing?

Johnson from Forager nailed the exit

https://www.livewiremarkets.com/wires/moving-on-from-catapult

Mark Seymour's song is an appropriate title for this too!

News Summary DJ Catapult Bull Sounds Positive on 1H Result -- Market Talk CAT $5.00-$0.46 (-8.4%)$4.99$5.00

18 Nov 2025 10:11:131 View 0 comments

2308 GMT [Dow Jones]

Catapult Sports' bull at Jefferies sounds reasonably positive about the athletic-tech provider's fiscal first-half performance.

Analyst Wei Sim tells clients in a note that results reported Tuesday are at or above the mid-point of guidance ranges published last month.

While churn rates were higher than a year earlier, Sim points out that this was driven by Catapult's previously flagged exit from Russia.

Stripping out that move, churn was flat compared with a year earlier, and down on the prior half year.

Jefferies has a last-published buy rating and A$8.60 target price on the stock, which is down 7.0% at A$5.08. ([email protected])

(END) Dow Jones Newswires

Article Date: Oct 8th 2025

Sony Corporation today announced that Sony welcomed STATSports Group, one of the industry leaders in athlete monitoring solutions and performance analysis, into Sony’s sports businesses, with the acquisition through a majority share of STATSports.

https://statsports.com/article/sony-acquires-statsports-group-to-bolster-its-sports-data-business

$CAT SPP results are in.

SPP applications for A$13.3m (US$8.6m) were accepted, with shares issued at A$6.39, compared with the $130m at $6.68 for the institutional placement. Nice to see retail shareholders doing better than the instos.

Earlier, I exited 50% of my RL position for as much as $7.46. When the SP fell back to the mid range of my valuation, I've bought most of that back around $6.10 - $6.20, over the last few days. So, in RL $CAT is back to my 4th largest position at 8.2%.

Interesting chat from Adir Shiffman who co hosts the contrarians podcast around catapults cap raise

CAT Valuation based on Trading Update and Investor Presentation provided on 13th October 2025.

TRADING UPDATE

Catapult provided a trading update for the six months ended September 30, 2025 (1H FY26). The trading update is preliminary, and remains subject to auditor review.

US$M 1H FY26 1H FY25 Change

ACV 115.3 – 115.6 96.8 19% CC

Revenue 67.2 – 67.5 57.8 15 – 16% CC

EBITDA 9.0 – 9.5 6.2 45 – 53%

Free Cash Flow 3.7 – 4.0 4.8 (1.1) – (0.8)

Free Cash Flow 7.2 – 7.5 4.8 2.4 – 2.7 (Ex-transaction costs)

ACQUISITION HIGHLIGHTS

IMPECT

Leading innovator in soccer analytics for scouting and tactical insights

Proprietary Packing metrics are globally recognised as the industry-benchmark

Scalable design and software for creating advanced insights for all team stakeholders

Strong historical ACV growth and profitability with 73% on Rule of 40

STRATEGIC FIT

Expands the CAT platform with scouting and tactical insights

Modular, high-value solution supports land and expand strategy

Accretive to Catapult’s ACV growth and Rule of 40 metrics

Scalable technology foundation to extend into other sports

TRANSACTION

Upfront consideration of €40M (US$46M) plus up to €38M (US$44M) deferred and contingent over 4 years

IMPECT founders to join Catapult and support next phase of strategic growth

Underwritten institutional placement of A$130M (US$84M) to fund upfront consideration

Incremental proceeds to strengthen balance sheet and provide capacity to pursue future strategic M&A opportunities.

This looks like a sizeable deal -- US$91m for IMPECT, essentially analytics software focused on soccer, which equates to roughly 11x ACV.

That's not an insignificant multiple, but the upfront cost is US$46m, with the remainder contingent on performance targets and paid over four years.

The rationale is that IMPECT adds scouting and tactical insights to Catapult’s existing platform, provides a new upsell opportunity to the current customer base, and is immediately accretive to growth metrics.

CAT is raising US$84m via an institutional placement and up to US$13m through an SPP. With only US$11m in cash pre-deal, the raise was necessary, and given the current share price strength, arguably prudent to raise more than the minimum required.

My initial reaction is that it seems reasonable, even if the multiple is on the higher side. The acquisition strengthens the product suite and leverages Catapult’s distribution footprint. IMPECT’s economics look appealing: ACV has grown at a 68% CAGR over the last two years, and the business scores 73% on the Rule of 40, which is a key focus for CAT.

I wont be participating in the SPP though, mainly because i have a very high weighting already and dont see shares as great value at present.

Slide deck is here

Looks like $CAT is leveraging it's lofty SP to raise capital and make an acquisition.

Good timing.

Let's remember what Will Lopes has said recently about M&A:

He said Catapult is in a privileged position, fielding “one or two pitches a week” from startups and midsize companies across the sports technology space. However, he emphasised discipline and selectivity, stating that Catapult sets a “high bar” for potential acquisitions and has remained cautious for 24–36 months, despite being approached frequently

He outlined three clear M&A criteria:

- Accretive to the Rule of 40 – any deal must improve Catapult’s growth + profitability balance.

- Expand technology capabilities – acquisitions should strengthen Catapult’s product or data advantage.

- Leverage Catapult’s scale – the target must be something Catapult can “scale and accelerate” using its global reach.

So, hopefully the acquisition will live up to these crtieria.

Disc: Held in RL and SM

If anyone is scratching their head wondering about the price action for $CAT, then one possible source is as follows:

Catapult Group's Acquisition of Sports Tech Firm Provides 'Significant Opportunity' to Sell Existing Platform to New Clients, Jefferies Says

Published on 10/06/2025 at 02:47 am EDT

MT Newswires

(MT Newswires) -- Catapult Group International's (ASX:CAT) acquisition of sports tech company SBG provides Catapult with enhanced video technology to offer its existing client base and presents a "significant opportunity" to sell its existing platform to new clients and markets, according to a Monday note by Jefferies.The firm holds a market-leading position, with high barriers to entry, the analysts noted.

The investment firm set a recommendation of buy for Catapult and raised the price target to AU$8.60 per share from AU$7.10 per share.

My Assessment

Even updating my upper valuation limit for the passage of 4 months, I can only get to $7.00. So Jeffries are well ahead of me.

Disc: Held in RL and SM

22nd Sept 2025: CAT to be added to the S&P/ASX 200 Index effective from prior to the open of trading on Monday, September 29, 2025.

CAT replaces Gold Road (GOR) which will be removed from the index and from the ASX subject to the scheme meeting held today and final court approval whereby the company will be acquired by Gold Fields Limited (XJSE: GFI).

Source: ZSP-Gold-Road-Resources-Ltd-to-be-removed-from-SPASX-200 (1).PDF

Disc: I hold GOR, not CAT. Wish I held CAT!

CAT announced today that Will Lopes was awarded his FY26 rights, 455,737 rights. Had a quick poke around Will's shareholdings history to see how it has evolved.

In summary, since Will was made Director in Sep 2023, he:

- only has had STI and LTI rights convert into shares

- only disposed shares which was automatically forced to cover taxes and fees on conversion of rights

- holds 1,606,305 shares today, 0.56% of the CAT register

- holds another 2,185,098 TIP Options, which if converted, would take his shareholdings to 1.33% of the CAT register

- will continue to grow his holdings as STI and LTI's convert annually

It looks like decent and continuosly growing skin in the game for Will. And he hasn't yet cashed out any yet - a good sign.

Discl: Held IRL and in SM

Not a lot of new info in today's AGM speeches, but good to see FY26 guidance reaffirmed. The ACV growth range is pretty wide (15 to 30 percent) but that is fair enough, a year's a long time and hard to predict with precision. Personally, if they hold near 20 percent, I'll take that as a sign of continued momentum.

Also encouraging to see another year of free cash flow expected, and to a decent degree, around US$5 million. Beyond that, it's business as usual: keep signing up elite teams and upsell the full suite of products. That model seems to be working and now in a self funded way.

In chart review mode tonight. The CAT price action is as textbook classical technical analysis patterns as they come ...

- Sideways consolidation rectangle from Nov 2024 to mid-May 2025

- Then following the results release, breaks out above the rectangle, minor pullback to the rectangle, then off north it goes again

- A textbook 6 day bullish pennant is formed, followed by a nice, decisive breakout

- A descending triangle, consolidating for about 6-7 weeks

- Then off it breaks out again to continue the bullish momentum, where every day in the past 4-5 days, a new 52-week high is made as CAT continues to chart new heights ...

Discl: Held IRL and in SM

I was just having a look at the latest annual report, mainly to see whether there have been any significant changes to Will's remuneration structure.

Rem reports don’t usually get a lot of scrutiny, but I think it's worth knowing exactly how boards incentivise management -- as Mr Munger was fond of saying, "Show me the incentive, and I'll show you the outcome."

The first thing to note is that he got an 8.3% pay rise to US$650k for the coming year, after it being flat for the prior three years. Not a bad wicket, but not egregious relative to current standards. (According to the Australian Council of Superannuation Investors (ACSI), that's about bang on the average for CEOs in the ASX200–300 range.)

He can earn up to 150% of that (US$975k) if he meets his short-term targets for FY26; specifically:

- 40% weighted on Free Cash Flow (FCF):

- Threshold: US$10 million

- Stretch: US$13 million

- FCF was US$11.4m in FY25, so he just needs to ensure it doesn’t go too far backwards.

- 30% weighted on Management EBITDA:

- Threshold: US$9 million

- Stretch: US$12 million

- This was US$10.8m in FY25.

- 20% weighted on Annualized Contract Value (ACV) Growth:

- Threshold: 10% YoY

- Stretch: 20% YoY

- This was 11.5% in FY25.

- 10% based on personal and strategic goals:

- Qualitative assessment by the board (e.g., leadership, customer success).

- (Never a fan personally of loosely defined qualitative measures.)

Things scale linearly between the threshold and stretch (e.g. if CAT does US$11m in FCF for FY26, that would be one-third through the range, and the FCF component is 40% of the STI pool. So 40% of US$975k = US$390k, and one-third of that is US$130k, the bonus relating to the FCF component).

In prior years, Will’s STI was very loosely defined against vague measures which were subjectively judged by the board. So this is a big improvement, and I think the board is focusing on the sensible things (FCF, EBITDA, and ACV)

If I were being picky, I’d have liked to see "stretchier" stretch goals.

As for the long-term incentives (LTIs), Will will receive up to US$975k annually in shares (specifically performance rights), which will vest as follows:

- ACV Growth:

- 50% vests if Catapult achieves 12% compound annual growth in ACV over three years; 100% vests at 22% CAGR.

- This figure has been 11.5% over the past three years.

- Relative TSR:

- 50% vests if Catapult ranks at the 50th percentile of a SaaS peer group; 100% vests at the 75th percentile or higher.

Again, vesting scales linearly between these points, and each half is assessed independently.

I have an issue with a non-disclosed “peer group.” Objective, absolute return thresholds would have been better, or at least a broadly tracked index benchmark.

I’d have also preferred an EPS target, or at least a management EBITDA per share target.

Anyway, if he achieves all his stretch goals, he’ll get US$2.6m per year. A lot for us mere mortals, but not obscene. And certainly not relative to what US-listed CEOs of similarly sized companies get (which I’m sure is a more pertinent comparison for Will, a US citizen and resident).

Also, if he achieves all of that, shareholders will likely have done very well too.

OK, there's no great insight here, but thought I’d share having looked at it this morning. All up, I think it’s reasonable, and I’m glad they’ve sharpened up the performance metrics. It could be better, but that’s almost always true. And relative to what you see as the established norm, it ranks better than most.

As a company moves from micro-cap to small-cap and beyond, a lot of things change but i increasingly think liquidity is a big one. When both price and volume pick up, sustainably, the amount of money changing hands each day really explodes. That’s exactly what we’ve seen with Catapult over the past year.

Using the 60 moving average, daily value traded has gone from $1.7 to $9m in 10 months.

As liquidity grows, the stock becomes easier to buy and sell, which brings in more and bigger investors. Which pushes the market multiple up (in general)

It took me a while to get why bigger companies usually have higher multiples -- i mean, just by virtue of their size you tend to think growth would be more limited. But it’s just that big money values being able to move big chunks without messing with the price. Even us small fry benefit from a liquid and deep market.

For the company, that bigger multiple ultimately means a lower cost of capital. And if they know how to use it, can really help turn a small edge into a solid moat.

All of which is to say, to myself as much as anyone, that across all of the risk/reward spectrum on the ASX, the best options (i reckon) are companies that have a decent shot at graduating from promising, cash-burning hopeful to a viable, credible business with genuinely good prospects. Because as that happens the share price not only gets boosted by the underlying fundamentals, but the liquidity kicker as well. Which can translate into a funding edge. which can help growth, which is a boost to the fundamentals and so on and so forth..

Anyway, have a happy weekend all!

The recording for our chat with Will Lopes is now up on the meetings page, or you can access it here

You can also find the transcript here CAT Transcript.pdf

I was encouraged by Will’s focus on customer success, and particularly how that’s being balanced with cost management. What stood out was the emphasis on efficient profit generation -- not just chasing growth for its own sake, but doing so in a way that’s sustainable and cash-generative. Hitting profitability while continuing to innovate isn’t easy, and it’s clear that’s been a deliberate part of the strategy.

The shift to a true platform model is also a big deal. The product suite has been reengineered not just to be better, but to be broader. It's able to integrate a wider array of data sources (he mentioned things like hydration sensors or smart footwear) and designed for remote monitoring. This opens up a lot more possibilities in terms of what Catapult can measure and how it can support teams.

It was also interesting to hear Will describe the business as still being in “year one” of data-driven sports science. That’s a strong signal that he sees a long runway ahead, not just in signing new teams, but in deepening the value proposition for existing ones. There’s clear greenfield opportunity, and the upsell potential from layering on more data and video capabilities looks real.

At this stage, it feels like the heavy lifting (ie. the foundational restructuring and the product overhaul) is largely done. What’s left now is consistent execution and scaling what’s already in place.

All up, there’s still plenty of growth ahead, strong product optionality, and a much firmer financial base to build from.

[held]

So this probably explains why Will had to postpone our meeting this week.

Catapult will be acquiring Perch, a U.S.-based sports technology company spun out of MIT. It provides AI-driven, computer vision tools for real-time strength training monitoring in gyms, using a small 3D camera mounted on weight racks to track athlete movement, automate data collection, and deliver actionable performance insights.

Perch has an annual contract value (ACV) of ~US$2.5 million and will be acquired for US$18 million (US$3M in cash and US$15M in shares, issued in four tranches through to June 2026, with various lock-up periods).

There’s also an earn-out of up to US$10 million in shares, contingent on ACV growth milestones between June 2027 and May 2028.

No capital raise is required.

Catapult reckons it will enhance its Performance & Health vertical and should be accretive to its Rule of 40 goal.

Seems like a decent tuck-in acquisition. It'll boost ACV by only 2% or so, but it will strengthen the offering, and good to see no dilution.

Full announcement here

Just saw a tweet from Andrew Brown which shared Nelnet Inc.'s 2024 Shareholder Letter -- these guys own HUDL, which is a competitor to Catapult. And it looks like yhey are doing pretty well.

Of course, that doesnt mean both companies cant succeed, but given the recent surge in Catapult bullishness, I thought it worth sharing.

You can read the full thing here:

1497956_Shareholder_Letter_2024_022725_FINAL.pdf

Here's a AI summary that focuses just on the HUDL part:

Hudl, in which Nelnet holds a 22% preferred equity interest, is a leading vertical SaaS company that serves the global sports ecosystem—including coaches, athletes, analysts, recruiters, fans, and parents—across all levels of play. In 2024, Hudl made significant progress by acquiring Statsbomb, a move that enhanced its advanced analytics capabilities for soccer and football. The company also expanded into high school content and launched new tools to streamline communication and scheduling between teams and parents, addressing a fragmented and frustrating process for many.

Hudl’s streaming service, Hudl TV, and its ticketing platform both saw strong adoption, with more than 10,000 organizations using them last year. The company also expanded its connected hardware ecosystem—such as automated cameras and wearables—to make data and video capture seamless. Hudl now serves over 300,000 teams across 40+ sports in 180 countries and distributes content to more than 85 million fans and parents. It holds a dominant position in U.S. high school football, with more than 90% market share, and has built a balanced presence across both the “Competitive” (high school and club sports) and “Elite” (college and professional) segments.

Looking ahead, Hudl aims to grow its total addressable market by extending its platform with new solutions, continuing its acquisition strategy, and enhancing the value of its ecosystem. Nelnet sees Hudl as one of its most impactful investments to date, with a long runway for continued expansion and innovation.

An interesting article on an alternative use of historical data and AI solution by Cricket Australia outside of the CAT platform. This was interesting as Cricket Australia has been a long-time customer of CAT, but yet, is using other vendors for another “AI” solution using “player data” and being very public about it.

As I think about it more:

This is a good example where other solutions will continue to co-exist with, and in-and-around CAT, using “data” and “AI”;

This Insight Enterprise solution appears more historical cricket player stats-focussed, rather than day-to-day, current player performance related - the raw data will be the normal publicly available player performance data that is recorded at every game, and is used, analysed and debated to death by fans, in commentary, cricket websites etc. The solution will likely scrape and ingest the available public data, then “AI” is used to make sense of and present the data. Other than for fans, this could perhaps be being used by the team management and players to work out player-centric tactics;

This is also “other team” and “other player” data, that the Cricket Australia CAT platform will almost never capture, of if captured by CAT (if the ECB or the BCCI are CAT customers), will never make it available to Cricket Australia as the data will be proprietary to the source team;

It will co-exist with, and should be no threat to, the underlying CAT platform, which manages the end-to-end of a player, captured by wearables, video, the team performance etc, way more detailed, beyond player stats that ;

It is a good reminder that there needs to be ongoing vigilance on possible competition. But there is also a need to also properly “position” the app/data against the CAT platform to properly determine if a competitive threat exists to the CAT platform.

Discl: Held IRL and in SM

------

AFR 4 June 2025

I’s 9.37pm on March 4 (AEDT) and Indian bowler Ravindra Jadeja delivers the 10,000th ball of his career. Better yet, it’s his 59th career maiden, a term used to describe an over in which no runs are scored against the bowler.

At 1.30am on March 5, Australian bowler Adam Zampa reaches his 186th career ODI wicket at an economy rate of 4.12, well below average.

Virat Kohli of India leaves the field after being dismissed by Australia’s Adam Zampa during the ICC Men’s Champions Trophy semi-final in March. Getty

These facts, delivered during the ICC Men’s Champions Trophy match between Australia and India, would normally take time for a commentator to gather. On Cricket Australia’s app, the information is delivered as it happens.

The governing body has achieved this through a new artificial intelligence tool known as AI Insights, which was built with data and technology from Insight Enterprises, Microsoft and HCLTech.

Cricket Australia, with Insight Enterprises, is a finalist in the Creativity and entertainment category of the inaugural Financial Review AI Awards.

AI Insights aggregates millions of data points to deliver information about the game and its players as a match happens. It launched just before the Women’s Ashes series in January and gained more than 250,000 unique users in its first month.

Kieran McMillan, head of customer experience at Cricket Australia, is hoping the 1.1 million app users will interact with the product more as extra data is integrated into the system.

“We already know so much, each minute, every ball – from where a bowler pitched a ball all the way to how many cumulative days Steven Smith has spent out in the middle,” McMillan says.

“The challenge is finding the rich insights from the sheer volume of data that is captured, which is where AI has such powerful capabilities.”

AI in sport is not a new phenomenon. For the past decade, it has provided athletes and coaches with better insights into individuals and team performance, allowed players to personalise training plans suited to their needs, and helped referees make decisions.

At the Paris Olympic Games, artificial intelligence-based technology tracked the abusive sentiments towards athletes on social media and prevented 4000 individually targeted threats towards competitors in the first week.

AI is also an essential part of how one of the world’s biggest cricket tournaments, the Indian Premier League, operates. It is used in matches, training sessions and scouting of potential prospects.

Cricket Australia has been using AI technology since 2017 to produce highlights packages for its digital platforms but took the investment one step further this year with the launch of the AI Insights tool.

Cricket Australia’s AI Insights app offers real-time data on players and the game.

McMillan says the idea came from a need to spark curiosity in the sport.

“AI provides the opportunity to do this in a unique way, allowing us to process a significant amount of data in real time to identify stories and insights about the game that would otherwise have been left untold,” he says. “We sharpened the initiative through a number of workshops with our technology partners.”

It isn’t just professional cricket where the governing body sees an opportunity. Cricket Australia’s annual census data saw a 5 per cent increase in the 2023 to 2024 season in the number of children between five and 12 registering to play. Registrations for Woolworths Cricket Blast, a program for kids up to 10, grew 19 per cent.

McMillan believes the tool can be deployed at a grassroots level in a way that will ultimately assist coaches and improve player development. He says this could evolve to additional editorial content such as match reports and player biographies.

“AI will be a critical tool to providing tailored experiences to the hundreds of thousands of players and parents, and the 3500 clubs at a local level – making the game more enjoyable to play and easier to volunteer,” he says.

Old video content

The beta version of the tool has absorbed about 15 years’ worth of data, but the plan is to expand the dataset to close to 100 years. Sonia Eland, executive vice president and country manager of HCLTech Australia and New Zealand, says the use of data has allowed cricket to engage more effectively with fans.

“This collaboration leverages GenAI to uncover stories from over 15 years of cricket data and deliver personalised experiences to grassroots players and fans,” she says.

Veli-Matti Vanamo, chief technology officer at Insight APAC, says cricket is an ideal sport for AI innovation.

“Cricket is one of the most data-intensive sports, with over 30,000 data points per match and 50 statistics per ball,” he says.

McMillan says Cricket Australia is also planning to introduce old video content into the app to allow fans to relive past moments.

He also says the investment in artificial intelligence will eventually allow sport to personalise experiences for fans.

“We can differentiate experiences based on levels of fandom, or your behaviours and preferences,” he says. “Imagine a Big Bash match report that empathises with the Renegades fan for a close loss, at the same time as celebrating with the Sixers fan for an incredible win. Multi-language capabilities are also exciting.”

I’m setting out my valuation of $CAT here, which I’ve been working on since the FY results were announced.

I’m not going to go back over the results or over my investment thesis, but definitely read @Strawman s “Bull Case” straw of three weeks ago (for the thesis) and the FY25 Results Forum Topic initiated by @BendigoInvesto, and the forum post by @Valueinvestor0909 (his Arichlife article) for some great analysis of the results.

I also recommend watching last week's video discussion between Claude Walker and @Strawman. Some really great insights here, and I found myself nodding furiously to most of it while cooking dinner last night.

In this valuation, I explore some of the key value drivers and sensitivities. My conclusion is that, despite $CAT’s tremendous SP progression (up around 60% YTD 2025), there remains significant upside potential that is not yet recognised by the market.

My overall view, is that in this particular race, $CAT has a long way to run and that it can comfortably keep delivering 15-20% annual returns from here for the foreseeable future. I would see any significant pullback from today’s price as a buying opportunity.

Valuation

My first detailed view on valuation is A$5.50 (A$4.50 - A$6.50). However, I must stress that this does not recognise the significant upside potential that may exist within the business today, and I point to some of this later in this straw.

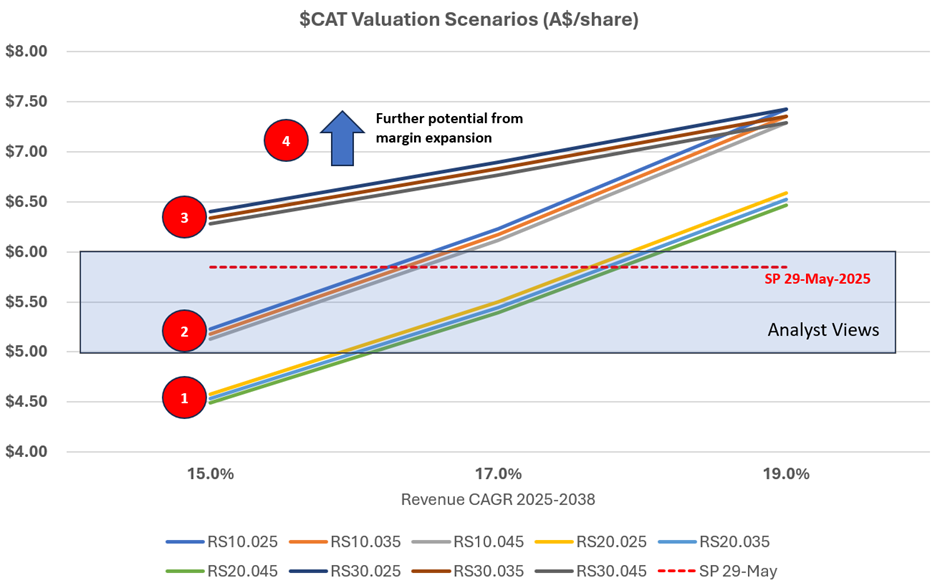

The chart below captures my analysis, and I will explain what each of the elements means in the remainder of this straw. I'm sorry it is so complicated, but I will step through it.

The easy bits to see are Friday’s closing price (A$5.85) and the range of analyst views (www.marketscreener.com; n=6) of $5-$6.

An important motivation for me to do this analysis is to properly understand the upside potential in this business. It is clear the market has reacted positively, and the business is gaining increasing analyst coverage. I felt I wanted to have a point of view on risk/reward around the SP, partly to temper any tendency to take some profits if the SP continues to appreciate.

Another prompt is @Strawman's valuation of A$3.51, which is a simple calculation which asks: how long does it take $CAT to get to Will’s US1bn revenue at his target margin structure, and what would such a business be worth today, using an EBITDA multiple? I replicated a similar analysis (getting a similar number). My main concern with that valuation, is that at the terminal point, the business is still growing FCF at 19% annually, so an EV/EBITDA multiple of 12 seems low. Using multiples of 15 and 20 yields SP’s of $4.35 and $5.22, respectively, using similar assumptions to @Strawman .

Conclusion for My Investment Decisions

What emerges from my analysis detailed below is a view that:

- Should the SP fall back towards my lower range of A$4.50, I would be willing to add more to my existing 8% RL ASX holding.

- I won’t countenance selling in the short term at anything less that $7.00.

To unpack the analysis leading to the above chart, I’ve structured this straw as follows:

1. Approach of Valuation

2. Revenue Growth Scenarios

3. Margin Evolution Scenarios

4. Impact of Share Based Compensation

5. Discussion of Valuation Results (Referring to the Graph)

6. Further Upsides Not Quantified

7. Risks and When I’d Sell

8. Other Assumptions Used

1. Approach to Valuation

CEO Will Lopes have given us a nice framework for valuation.

Basically, what he calls “Management EBITDA” is simply Free Cashflow before Interest and Tax.

This has then enabled me to run a simple DCF where I have the starting point of FY25 and simply then have to make four assumptions:

1. By what year are the target margin ratios achieved?

2. How do margins evolve from today until the target ratios are achieved?

3. What is the revenue growth each year?

4. What is the rate of ongoing dilution due to share based compensation?

Of course, there are all the other assumptions that needed for a DCF, which I list at the end of this straw.

In line with @Strawman’s valuation, I run the DCF out to 2038, as this is notionally the period over which $CAT can grow strongly to achieve the ballpark $1bn revenue.

2. Revenue Growth

Total revenue growth in the last two years has been 18.5% and 16.5%, however the key value driver has been subscription growth, which has been higher, and there has also been the current headwind of a strengthening US dollar. As @Strawman points out, growing at 20% CAGR means it will take c. 13 years to hit $1bn revenue.

As @jcmleng picked out of the recent Livewire interview, Will has said he aims to get current ACV of $26-$27k per team up to $100-$150k, driven largely off product enhancements currently in development, and continuing to get more teams onto multiple products. In this interview he made clear that this won’t just be the preserve of the top elite pro teams, but that the capabilities in the platform will enable less well-off pro teams to make more productive use of their staff. So $CAT is to the coaching and fitness staff of a pro sports team what Cargowise at $WTC is to workers in a logistics firm, or $XRO to an accountancy practice. The software does more of the repetitive tasks, freeing staff up for higher value staff or allowing an operation to run a leaner crew. This cost saving agenda for clubs is in addition to helping them manage the players better, which is likely a much bigger prize.

This is going to be really important to drive the adoption of $CAT in pro sports teams. For the richest teams with budgets of $100m to $500m p.a., the spend on $CAT is peanuts. Once it is embedded in their workflows, the pricing power will be strong. However, in smaller clubs, with budgets of a few millions, investing in $CAT will be carefully justified. So running with a support staff of 6-8 instead of 8-10 is what will be needed to justify Will's vision of a broad capture of $100-$150k ACV deep into the subscriber base. It seems plausible.

So what's the revenue runway?

There are 3x-4x in the number of teams ahead of it, 4x-5x of multi-vertical conversion ahead, and with further enhancements drived by ongoing R&D spend at a solid 15% of revenue, ongoing, it does not take a leap of faith to believe that $CAT can grow strongly for many years to come. 10x to 15x in revenue seems very plausible.

In fact, in the early years, given the money going into pro sports, the strong growth of video in T&C, and the availability of Vector 8 which offers many improvements, there is every chance we could see revenue growth start to accelerate from the 18%-20% of where we currently are.

So this then leads me to my revenue growth scenarios for the next 14 years:

Within the series of curves on the graphs shown above, in Red Circles 1 and 2, I simply assume constant, annual revenue growth rates of 15%, 17% and 19% from 2026 out to 2038.

But growth won’t be linear, so in the Red Circle 3 lines, I’ve assumed revenue growth starts at today’s c. 19% p.a. and then exponentially decays each year to reach the values on the horizontal axis, i.e., 19% (no change), 17% and 15%. So the Red Circle 3 lines represent the upside to valuation that revenue growth stays "stronger for longer".

3. Margin Evolution

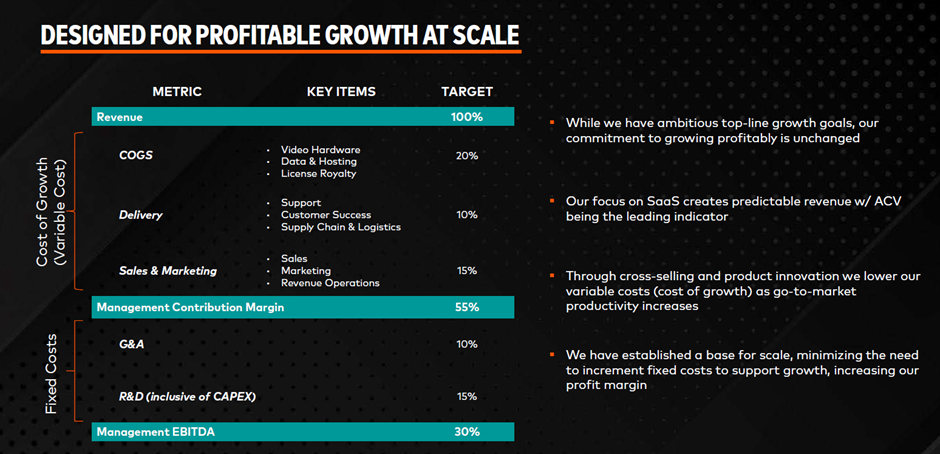

I’m comfortable with Will’s proposed target margin structure shown above, simply because of the track record over the last few years.

But what made me sit up and take notice in the FY results call, was Will’s statement that he believes $CAT can get to this structure by the time revenue hits $200m.

What!? That’s not FY39 but FY29. Wow. Of course we don’t know when that margin structure will be achieved, but it is a very important valuation parameter.

So, in the curves shown by Red Circle 1, I’ve assumed that the target margin structure is achieve in FY38, and that between FY25 and FY38 the gap between the current margin structure and the target closes linearly.

But, Will believes they’ll get there much earlier. And this is consistent with the current trajectory. Therefore the curves shown by Red Circles 2 and 3, assume the gap to the target margin structure is closed progressively between FY25 and FY29. Thereafter I’ve assumed the target margin structure is maintained. (I’ll come back to this later.)

So, now we can see across the three groups of lines how revenue growth and margin evolution drive valuation.

4. Share Based Compensation

I’ve done a deep dive to understand the impact of share-based compensation. It is tedious, but important. In the last three years, SOI have increased by 6.9%(FY23), 6.2%(FY24) and 2.7%(FY25). However, there are some important factors to be considered.

First, in FY23 and FY25 parts of the increase in shares was due to the earnout of the SBG Sports Software acquisition. And in FY24, when the SP was in the toilet, the Board seemed to double-dip, offering a second round of compensation, presumably because retention was at risk as staff shares were worth not very much and options were being cancelled.

So, with this understanding in mind, I’ve run scenarios for ongoing share-based compensation levels of 2.5%, 3.5%, and 4.5%. And that explains why for each set of curves, there are three closely stacked curves. The impact of dilution across this range has a SP impact of around A$0.10 at the lowest valuations up to A$0.15 at the highest.

5. Discussion of the Valuation

The above sections explain all the variables plotted in the chart above.

In choosing my valuation range of A$4.50 - A$6.50 I have been conservative. I believe that the target margin structure will be achieved over the next 4-5 years. And I also believe that revenue growth will be more in the range of 17%-21% p.a. over the next 5 years. Taken together, these will result in upwards revisions to my valuations over time, and the analysis presented gives an indication of the scale of sensitivity.

6. Further Upsides

I am going to explore some further upsides, not included in the model.

6.1 Revenue

Will has established a disciplined resource allocation model that appears to be driving c. 20% annual subscription growth, without pulling the pricing lever. I think that’s the right strategy – driving innovation to maintain the product’s industry leading position, and encouraging more and more of the target market to adopt, all-the-while achieving strong growth in free cash flow.

There are three potential future revenue opportunities:

· Providing more services to broadcasters to enhance viewer experience

· Leveraging the vast database of player data and enhancing predictive analytics

· Connecting third party devices and services into the platform.

And, as I explain at the end, my DCF Continuing Value growth rate in 2039 is 3.0%. Obviously, if $CAT is still growing revenue at 15%, 17% or 19% in 2029, then this is a conservative assumption.

I’ve not modelled any of these revenue upsides.

6.2 Margin

In my modelling I’ve assumed Will can hit the target margin structure and that when he does, the business stays there into the future. So, this is worth a deeper dive.

First Gross Margin. The target %GM of 80% has already been exceeded in the last two years. And with the transition to subscription now complete, and the focus firmly on software rather than hardware development, it seems entirely plausible that as the business scales, higher %GMs will be achieved. It doesn’t seem a leap of faith to consider that a $1bn revenue $CAT could have a %GM of 85%. One to keep an eye on over time.

“Delivery” and “S&M” will probably scale proportionately as the business scales. A target spend of 15% for S&M is comparable with Microsoft (c.12%) and Oracle (16%). Firms in more competitive markets can spend a lot more - Salesforce (33%), Intuit (27%) Adobe (30%). As $CAT scales to $1bn revenue, its reputation in the sector will be well and truly cemented, and so a relatively low 15% S&M spend sounds reasonable.

Equally, spending 15% on R&D is both wise and appropriate. For $CAT to maintain its industry-leading position, it will need to innovate continuously. I see only downside risk to scaling back on innovation.

A final upside is G&A. Here 10% has been assumed. As the business scales, provided it retains a clear focus on pro sports, its should be possible to retain a focused overhead structure. Upsides to 6% to 8% are conceivable.

In conclusion, considering both Gross Margin and G&A opportunities, it is conceivable that $CAT could expand its “Management EBITDA Margin” from 30% to 35%.

Again, I’ve not included this upside in today’s valuation. But it is one to bear in mind over the coming years.

7. Risks and When I’d Sell

Competition & Innovation

The global pro sports industry is vast and is attracting a lot of capital and technological innovation. While $CAT has a clear lead over its much small and less developed rival Statsports, it is worth keeping an eye on the competitive playing field. Of course, the industry is so large that there is room for multiple players. As importantly, is the need for $CAT to innovate, and bring more and more capabilities and features of value to its customers. Maintaining a consistent watch on both its innovation progress and the competition is key.

Management

The more I get to hear Will the more I am impressed with his leadership. Few businesses put out such an explicit, value-based, economic framework against which progress can be tracked. As far as I am concerned, $CAT has no need to offer guidance. They simply have to explain their results in the context of progress against this framework – and this includes periods when progress won’t be linear. I think it is easy to under-estimate the value that Will has personally brought to this business over the last few years. I don’t yet see this as a business that any professional manager can run, and I’d be very concerned if Will were to leave. It would be good to understand more about the bench below him.

Customers

It is important to see $CAT firing on all dimensions of customer value: low churn, increase multi-verticals %, new customer adds, rising ARPU. While growth won’t always be linear, I’d become concerned if during two consecutive years revenue growth fell back to 15%.

8. Other Assumptions Used

All values are $US unless states as $A.

Discount rate: 10%

Tax Rate: 30%

Capital Structure: No LT Debt; net finance cost of 2% of (Variable Costs + Fixed Costs)

AUD:USD: 0.65

CV Growth rate: 3.0%

Disc: Held in RL and SM

31- May-2025

$5.50 ($4.50-$6.50)

Details set out in my "Valuation" straw.

Disc: Held in RL and SM

Catapult stocks soar after Morgan Stanley upgrade

8:46am today

The news: Shares in Catapult have hit an all-time high after Morgan Stanley raised its price target by 35% a week after the sports technology company posted a big increase in full-year revenue.

The numbers: Catapult shares hit an all-time high price of $5.88 at 3:20pm before easing to $5.85 at 3:59pm, 11.12% higher than last close.

The context: On 21 May, Catapult reported that its revenue for the full year to March 2025 rose 19% to US$116 million ($180 million) and its net loss after tax narrowed 55% from US$19.1 million to US$8.56 million.

Catapult has now posted three consecutive halves of revenue growth. Morgan Stanley analysts on Friday morning said it forecasts revenue to grow at a three year compound annual growth rate of 16% and EBITDA at 40%.

The analysts said that “CAT presents as an attractive structural growth story, servicing a large and growing global [total addressable market], and is on track to become meaningfully profitable”.

Great set of results from Catapult once again. Continues to deliver.

Full results presentation:

https://drive.google.com/open?id=1HMthZNAt7oIM8v_Sra3JkzxLhEljRiMk&usp=drive_fs

The value prop for Catapult is pretty straightforward: it lets sports teams turn performance data into competitive advantage. At the top levels of professional sport, decisions are increasingly data-driven (see: Moneyball). Player load, tactical strategy, and return-to-play timelines can make or break seasons, and there are millions of dollars on the line. Pro sports is big business.

Catapult’s platform (built on wearables, video, and analytics) gives teams the ability to monitor athlete performance in real time, analyze tactical execution, and optimize player development with objectivity and precision. For sports organizations managing multi-million-dollar athlete assets, this kind of insight isn’t just helpful, it’s essential. And it’s increasingly being recognized as such.

Catapult is both a leader and pioneer in this space. Its clients include the NFL, Premier League, Bundesliga, F1, NCAA, and numerous national governing bodies. It is at least 5x the the size of its nearest competitor (Statsports). That dominance matters because scale fuels significant network effects: as more departments across a team adopt Catapult’s tools, workflows embed, data libraries expand, and switching costs rise. Over time, Catapult becomes not just a tool, but essential infrastructure.

This stickiness is reflected in an average customer tenure of around six years and a steadily rising ACV per team. More customers mean more data, which improves the product, which attracts more customers -- it's a classic flywheel. Scale also funds a superior R&D budget, strengthening the company’s moat. Crucially, Catapult owns the data it helps generate. When players transfer between teams, those teams want the data too, which makes adoption by one club a catalyst for adoption by others.

The market opportunity is pretty sizeable. Catapult currently serves around 3,500 professional teams, which management estimates to be just 30–35% of the global addressable market. The goal is to reach 5,000 teams over the medium term. Importantly, there’s still major upside within the existing customer base: only 27% of teams currently use more than one product, meaning the majority are ripe for cross-sell.

This reflects Catapult’s deliberate “land and expand” strategy. The business typically enters with its elite wearables (Performance & Health), then grows through video and analytics (Tactics & Coaching). This model seems to be working, with multi-vertical customers growing 32% in FY24.

Financially, the company’s profile has improved significantly since the current CEO Will Lopes took over. It has completed its SaaS transition, with 92% of revenue now recurring. ACV reached US$86.8 million in FY24, up 20% YoY (constant currency), with retention of 96.5%. Gross margin hit 81%, and contribution margin expanded to 46%, up from 34% a year earlier. Free cash flow turned positive for the first time, hitting $4.6 million (a $26 million turnaround from the prior year) while more or less holding costs flat.

Catapult is now Rule of 40 compliant, combining strong growth with positive margins. And it seems to have done so without unsustainable incentives or pricing tactics. The business is also relatively insulated from macroeconomic cycles; pro sports remains in demand across all market environments, and performance tech is becoming a non-negotiable investment.

Looking ahead, the company has set clear medium-term targets. It aims to grow to 5,000 pro teams, reach 50% multi-vertical penetration, keep ACV retention above 95%, and hit a 30% Management EBITDA margin. It plans to achieve this by keeping variable costs below 45% of revenue and fixed costs (G&A and R&D) under 25%. Execution against these benchmarks is starting to show: Catapult moved from -13% Rule of 40 in FY23 to 31% in 1H FY25.

Taken together, this is a business with product-market fit, durable customer relationships, strong financial fundamentals, and a clear path to scale. Catapult is a global category leader solving a critical problem in an industry that’s only becoming more analytical and performance-obsessed. It has proven it can grow, and now (finally) it’s proving it can do so profitably, with operating leverage and strategic clarity.

Will Lopes has flagged a long-term target of reaching US$1 billion in ACV, though without a defined timeline. Since adopting the subscription model, Catapult has grown ACV at a 23% CAGR. Assuming a slightly lower 20% going forward, the business would hit US$1 billion in ACV by FY38 -- about 13 years from now.

Assuming ACV approximates revenue at that point, and that management delivers on its 30% EBITDA margin target, Catapult would be generating around US$300 million in EBITDA in FY38. Applying a 12x multiple -- which is about standardfor mature, high-quality SaaS companies -- you get a US$3.6 billion terminal value. Discounted back at 10% per year, this equates to a present value of US$1.04 billion.

Assume the share count grows at 5% annually, reaching ~470 million shares by FY38. Using a 0.63 USD/AUD exchange rate, this implies a per-share value today of around A$3.51.

That's below the current market price, but I'm hesitant to lift it much further given it's already based on some bullish assumptions. At the same time, i'm not looking to sell down as the market price is still in the ball park of value and I try not to overthink valuation when the underlying business quality is high and the prospects for sustained growth seem decent.

Informative Podcast with Catapult VP of engineering. Enjoy.

https://scienceforsport.fireside.fm/264

UPDATING to account for FX conversion and a more realistic share count.

Based on the latest investor presentation, I'm going to update my valuation for Catapult. As is my preference, I'll keep it simple.

Will reckons they can achieve $1 billion ACV, but didn't give a timeline. Since they went to a subscription model, ACV has grown at a CAGR of 23%. So let's just assume 20% growth going forward, which means they'd hit US$1b in annualised contract value in ~13 years.

Let's assume that ACV approximates revenue at that point, and that management achieve their target EBITDA margin of 30% ("management EBITDA" excludes some things that shouldn't be excluded, but rightly adds in CAPEX. But let's just go with it).

That means that in the year 2038 the business is doing US$300m in EBITDA. If we give that a 12x multiple and discount that back by 10%pa, we get a valuation of $1,042m in today's dollars. Assuming the share count grows to 470m by 2038 (a 5% annual growth rate), and applying a 0.63 AU-US FX rate the valuation is $3.51

(Funnily enough, this was the original flawed valuation -- converting to AUD and increasing the share count just cancelled each other out!)

As always, I could tweak these numbers to get a far better or worse valuation. And when you're dealing with a 13 year time frame, small changes can add up.. But I think the ones used are reasonable based on what management have said, their historical trajectory, and current market position. In fact, given growth tends to accelerate as companies move through adoption a-curve, you could argue ive been too conservative (or, too agressive in taking grandiose targets at face value!). But there it is.

Either way, i've learned through bitter experience you dont overthink valuation for companies that have strong sales momentum, dominance in a fast expanding industry, a scalable model and strong network effects.

I'm happy to retain this as a core position.

Here are some thoughts based on my live notes and recollection of the Product section of the investor day last Thursday. The focus was team sports, and some pending product updates. My live notes read like a stream of haikus, which I've tried to make some sense out of.

Going in, I didn’t have a thorough understanding of Catapult’s products or the state of the art, so this is just what I picked up or have researched since. Some of you will already be familiar with the background, but I always appreciate when others provide context, so here goes...

For team sports, Catapult product suites are built around the integration and overlaying of various sets of in-play data, so teams can harvest insights and adapt their play. The data originates from sensors on wearables, and from video feeds. It is sent to software that syncs it all and enables advanced sorting and displaying.

There are a few updates coming in April that are about making things incrementally more practical and integrated, with more insightful and user-friendly software. They are incorporating more IoT and Cloud-based applications to have it available anywhere, and available fast. Watching the presentations it was easy to believe that this is the scalable state of the art.

With wearables they collect the movement and biometric data of players. You probably know the gadget that athletes wear on their torso. Depending on the variant, these devises include a GPS tracker, heart rate monitoring and an increasing amount of on-board processing power. There are other wearables in trial phases - they partner with someone who has a shoe insole that measures foot pad pressure points, and I heard something about a sweat sensor.

Video feeds. I’m not sure if they have complete access to live stadium broadcast video on game day, but they do have mobile sideline cameras which are also used on training days. The systems these are part of are being adopted into live in-game coaching decisions, via tablets in the coaches hands.

Software for reviewing. Depending on the use case, dashboards can display player movements or biometric changes synced to video. Presumably there is an evolving range of product formats and uses cases, including a compact tablet version for sideline and ‘on the bus’ use.

Connectivity. Linking it all together involves docking stations for the wearables, relay stations to extend the range of the wearable transmission while in use (soon to be with a 400m range), and the IoT and cloud computing infrastructure to transmit data and update software.

Product updates April

The end users do include analysts, but most important are the coaches and players. They have spent their lives playing sport, and need an intuitive software interface.

So one coming update is a video analysis software refresh to replace Thunder which is what American Football and Hockey have been using for 10 years. One use case is when a coach wants to find and replay on the sideline, while another is when a player needs to study something on the bus. The update includes a search wizard for isolating play types for study, and the ability to view multiple angles simultaneously. They’ve been in conversation with teams since January. Users were nervous about change but excited once they saw it.

They are integrating broadcast quality graphics such as spotlights, to make it easier to keep the attention of teenage athletes.

One of the pain points is data upload time, so they are increasing use of IoT and cloud to make it faster and then available anywhere. I guess the global pain point is ‘I want it now’, so they are making more replay capabilities available ‘live’.

On Friday they also announced Vector 8, an impressive sounding wearable iteration.

Sales cycle and upgrade round: Teams will talk and try all throughout the in-season, and then buy and adopt quickly during off-season. So rollouts will often be in a particular sports off-season.

Sports tech macro view: They outlined the industry disruption arc from other tech companies like Netflix - First digitise, next optimise for the new format, Lastly, transform the industry. They view sport tech as being somewhere in optimise. Someone will eventually have a ‘Moneyball moment’, when they figure out how to use this tech to win their league against all the odds. That will signal the transformation stage.

Competition

Wearables: No one is at their level on the wearables front. The sum of all their competitors’ market share is a fraction (A fifth??) of theirs. A new sale is usually a team who has never used an integrated wearables system.

Data: They have a huge lead in the size of their data lake and the insights gleaned across multiple sports.

Video analysis: Every team already uses some kind of video analysis. So every new sale is a conversion from a competitor. The Catapult edge is the integration of the data from the wearables and the appeal of the platform ecosystem. Coaches move, and coaches who are familiar request their tech at the new place.

Partner verses acquire: They will need to stay at the front with technology. They are wary of becoming a king-maker with their platform, so acquisitions would be made as required, partnerships where acceptable.

This will be a winner takes most market, but never a winner takes all. They have 20% of professional teams, and I think I heard 60% is achievable. Why not 100%? Because sports is by nature competitive, and teams will always be experimenting with new ideas to find an edge.

An equity analyst at the seminar asked a question about ’the threat of LLMs’ and the CEO response was - not worried, it’s about the data collection at one end, and the user-friendly interface at the other. A coach doesn’t want to have a ‘natural-language’ conversation with a computer. He wants to scroll forward and backwards, and in the latest update, click through a tailored filtering wizard to isolate categories of in-game situations and then bring up relevant recordings. LLMs will be happy to partner with Catapult.

So it looks like they've got a solid lead, but we should keep an eye on the competition especially in some corners of the market. There are some corners that are naturally… harder to corner….for example, one equity analyst asked something about scouting (for talent) software and while I didn’t catch the answer I imagine this mostly falls into video analysis, since you can’t have your wearables on every prospect.

I had a closer look at the CAT Investor Day presentation pack. It was a good opportunity to step back from the usual results-announcement pack, look at the bigger picture, and confirm that the overall story and thesis still makes sense. The slides in the pack were useful - have pasted the slides which helped frame the story for me.

SUMMARY - THE STORY REMAINS HIGHLY COMPELLING

- CAT has one hell of a moat in an industry where each of the teams & leagues have every incentive to use technology to create a competitive edge to win

- CAT has many ways to win - Land new logos in an under-penetrated TAM and simultaneously expand/upsell into existing customers, 80%+ of which are single vertical - the business is really CAT’s to lose

- There is a clear strategy on how to win

- Results are showing as the financial metrics not only trend, but are accelerating, in the right direction

- CAT has warmed up nicely and I am eagerly looking forward to the game ahead (pun absolutely intended)

Discl: Held IRL and in SM

THE WHY

- Sports is big business - Large Market > $500b, massive audience, growing value

- Compared to other sectors, tech adoption is still in its early stages

- Teams are transforming everything that creates competitive advantage

And this will set off a Technology Arms Race which CAT is right in the middle of.

COMPETITIVE ADVANTAGE - THE MOAT

3 dimensions to the Moat:

- Vast Global dataset of athletes

- Multi-Sport learnings -> Proprietary Algorithms -> One Stop Multi-Solution Platform

- Specific Team Data used within a team across ALL stakeholders in a one-stop multi-solution platform

THE MARKET

- CAT remains under-penetrated across the globe

- Only 19.1% of CAT’s customer base is multi-vertical - 80.9% of Customer base is single vertical, massive opportunity to upsell

- Both these drive the $1b ACV goal - CAT is thinking big and going for it

PATHWAY TO $1B ACV - THE HOW

- Plan forward is clear - Land, then Expand

- Cross-selling strategy is trending in the right direction

- Clear Mid-Term milestones have been defined - (1) 5,000 Pro Teams (2) 50% Multi Vertical (3) 95% Retention Rate (4) 30% Profit Margin

FINANCIAL METRICS - THE PRIZE

- Significant progress on achieving the Rule of 40

- As revenue grows, costs growth declines - Revenue & Variable Costs, Fixed Cost % of Revenue are all falling and falls are accelerating

- Positive impact on free cash flow - not only turned positive but is increasing at a nice trajectory

This should hopefully at least mean "no negative surprises" ... otherwise, a really saying-nothing-new statement.

Not really that important, but it was fun to see this photo this morning from the back page of The Tiser (which is Adelaide's daily):

To the moon!

(Disc: happy holder)

How huge are these decisions…

CAT has been included in S&Ps ASX 300 and PME included in the ASX50, and (for example) Audinate AD8 has been dropped from the ASX 200…

Think about the weight of the “Passive” ETFs forced buying and selling between now and the 24th… or do they rebalance after the 24th?? ????

I have 3 tickets for the upcoming Catapult Investor day

Sadly I cant make it, but if any Strawpeople are keen, let me know. First in, best dressed!

Details:

Date: Thursday, 27 March, 2025

Location: Chifley Business & Event Centre, Level 6, 8 Chifley Square, Sydney NSW 2000

Time: Registration from 1:10pm

Runsheet

- Presentations from 1:30pm to 4:30pm

- Q&A from 4.30pm

- Cocktail reception concluding at 6.30pm

If you're wondering why theres a 5% share price drop today, it may be related to the fact that one of the co-founders sold $2m worth of their holdings. The announcement was put out at 6:30pm on Friday evening.

Disc: Held IRL and on Strawman.

Sorry to bang on about CAT ... working through the links from a CAT shareholder email communication received today.

Loved this ~1 minute bite-sized videos on how CAT solutions and data are literally, changing the game for teams. It very eloquently reinforces for me, how strong a competitive advantage, data flywheel and hence, data moat, CAT has.

Discl: Held IRL and in SM

Catapult has recently partnered with SportsBall, experts in creating video content to simplify the complex world of sports. By using Catapult’s data, SportsBall is creating a series of bite-sized social media posts explaining the power of data analysis and different ways it is used to gain an edge across a number of different sports around the world. The first posts analyse how far American Football players really move during a game, and how the game of rugby union has evolved to incorporate more data into the sport.

Episode 1: About CAT, the data flywheel Linkedin

Episode 2: American Football, insights from the distances that players run during a game LinkedIn

Episode 3: Rugby Union, insights from player weights flat-lining, how focus has changed from brawn to brains via data LinkedIn

My notes from the podcast that Will Lopes did with Superhero 2 months ago: https://www.youtube.com/watch?v=QsInF5JqT0M

Discl: Held IRL and in SM

SUMMARY

A good wide-ranging and relaxed 30 min podcast which helps further crystallise how strongly placed CAT is in the market, how the CAT solutions are integral to the ongoing performance success of teams, in its data moat and management approach

Perspective on AI was insightful as to how CAT thinks of, positions and uses its huge data moat

Newest insight for me was the application of the Amazon/Bezos approach/mindset in how Will Lopes runs CAT - he learnt from one of the best, and is applying what he learnt in running CAT - that is a really big tick

RECAP OF SPORTS TECH MARKET

- US$40b market, ~20k professional sports teams globally, CAT has ~4,400 teams as customers, roughly 22% of market

- Growing, last bastion of live entertainment - not many live entertainment options for advertisers to go

- CAT technology is becoming ubiquitous but it still early days

- Biggest competition is not another technology company, but the lack of information/knowledge on how to USE and harness the information from CAT’s tech - a lot of teaching to customers of how look at, and understand the dataset, how to use that to manage athlete workload, improve training session effectiveness, prevent injury, lead up to game day etc

NEW REGION, NEW LEAGUE SELLING APPROACH

- Work with, point to, 1 or 2 teams which are typically successful as use cases eg. Bayern Munich for Soccer, Alabama for College football

- These teams have long history of winning as they constantly look for new technology that can help give them a further winning edge

- Focus on them embracing what Will calls “objective data” to lead them to winning success

COMMENTS ON “AI”

- Data that CAT collected/collects is very unique and rich

- CAT has collected 5 PETRAbytes of data that is very unique to CAT, is so far ahead of everybody and is not available for LLM’s to learn from - this is a big data moat

- “AI” is becoming increasingly commoditised - the key question is what is the data behind it - LLM’s are only as good as what they are trained on

- Focus is on how to help least sophisticated teams understand:

- How hard a training session was

- What to do with that insight/objective data to plan for the next training day to minimise injury

- Who to put on the team for a future game and what training regime is needed for those players leading up to the game which minimises injury

- How hard to drive players during a game

- Provide a “sports science” answer to teams who do not have those resources

- CAT solves the hardest part of data which is to figure out how the data is correlated - the time to find answers/insights is significantly reduced. Once this is understood, then very little time is spent to work out how to fix the identified problems

- Still need humans to drive the required outcomes arising from the data as the people who need to act are the players - AI cannot replace humans for this

- What CAT is seeing is not less humans, but more specialisation on the data eg. Mercedes went from 1 data analyst working on a spreadsheet to 200 analysts, each specialising in watching a small sliver of the overall dataset and seeing how it can contribute to improving performance

- Focus is on working out how to predict more and more outcomes and the interventions required to achieve those outcomes eg. how to drive a current Academy player to becoming like player x - the platform and data allows coaching staff to make faster decisions

FINANCIAL FOCUS

Nothing new on financial goals - reiterated goals of (1) 20% revenue growth per annum through expanding wallet size, retention of contract value (2) reduce variable cost from current ~52% to 45% (3) sustain fixed cost to 5-7% increase per annum - large investments to scale the platform was completed 3 years ago, benefits now flowing

Doubling of revenue to US$200m is not a matter of how, but when - (1) mid term goal to get 5,000 wearable customers with average contract size of $20k (2) cross-sell video half of that to increase the current 1,000 video customers to 2,500. average contract size of $40k

AMAZON BEZOS MINDSET/ETHOS

Will spent significant time at Amazon, involved in growing the many Amazon offerings - Prime, Audible, Alexa etc, sounds like he had decent and direct exposure to Bezos.

Amazon’s mindset and approach is embedded into how CAT is run:

- CEO focuses 5 years out, so Will is focused on how to get to $1b revenue, no longer focused on how to get to $200m

- Direct reports focus on the next 3 years - the team knows how to deliver $200m

- Operational folk focus on current year

Work on 3 Assumptions growth rates 5 next year between 10% - 20%. Share Count growing 3% a year. PE40 for 20%, PE20 for 10%. Discounted and Convert USD to AUD, blend of the 3 outcomes came up with intrinsic value of $4.68 AUD.

Not currently held

Board Ownership

Share Holding % Of Issue Net Worth $3.38

Adir Shiffman 10,084,200 3.74% $34,084,596

Will lopes 1,160,049 0.43% $3,920,966

Shaun Holthouse 14,675,000 5.44% $49,601,500

Igor van de griendt 19,980,000 7.41% $67,532,400

James Orlando 681,907 0.25% $2,304,846

Michelle Guthrie 564,658 0.21% $1,908,544

Thomas Bogan 1,178,430 0.44% $3,983,093

Total 48,324,244 17.93% $163,335,945

Current Market Cap at $3.38 = $911,149,270

Mangement Bio

Adir Shiffman - Executive Chairman

Dr Adir Shiffman, Executive Chairman of Catapult, has extensive CEO and board experience in the technology sector. Adir has founded and sold more than half a dozen technology startups, many of which were high growth SaaS (software as a service) businesses. His expertise includes strategic planning, international expansion, mergers and acquisitions, and strategic partnerships. Adir currently sits on several boards. He is regularly featured in the media in Australia, the US and Europe. Adir graduated from Monash University with a Bachelor of Medicine and a Bachelor of Surgery. Prior to becoming involved in the technology sector, he practised as a doctor.

Will lopes -Chief executive officer and managing director

As the former Chief Revenue Officer of Audible, an Amazon subsidiary, Will brings world-class technology and growth experience from one of the world’s most successful technology businesses. Will was responsible for revenue growth and was a key leader on the executive management team responsible for overall business performance.

Shaun Holthouse -Non-executive director and co-founder

Shaun co-founded Catapult in 2006 and served as CEO up until April 30, 2017. During that time, he played a central role in developing Catapult’s wearable technology and is the author of many of its patents. Under his leadership Catapult launched and expanded sales into more than 15 countries - including establishing subsidiaries in the US and UK and becoming the dominant elite wearable company globally. Shaun was responsible for raising early capital, listing on the ASX, acquiring GPSports, XOS and Kodaplay (Playertek) and developing Catapult’s strategy to grow from a wearable only company to building out the technology stack for elite sport and leveraging this into consumer team sports.

Prior to Catapult, Shaun had extensive experience in new technology transitioning into commercial products, including biotechnology, MEMS, fuel cells, and scientific instrumentation. Shaun holds a Bachelor of Engineering (Hons) from the University of Melbourne and is a graduate member of the Australian Institute of Company Directors. He is the author of numerous patents and patent applications in athlete tracking, analytics and other technologies. He also works as a professional Director as well as providing advisory services for technology start-ups.

Igor van de griendt - Non-executive director and co-founder

Mr Igor van de Griendt has served as Chief Operating Officer (COO), Chief Technology Officer (CTO) and as an Executive Director before moving into a Non-Executive Director role in July 2019. In his capacity as CTO, he was responsible for providing strategic direction and leadership in the development of Catapult’s products, both in the analytical and cloud space, as well as with respect to Catapult’s various wearable product offerings. Igor also provided guidance and operational support to Catapult’s Research & Development (R&D), software and cloud development teams during that time. Prior to co-founding Catapult, Igor was a Project Manager for the CRC for MicroTechnology which, in collaboration with the Australian Institute of Sport, developed several sensor platforms and technologies ultimately leading to the founding of Catapult. Prior to joining the CRC for MicroTechnology, Igor ran his own consulting business that provided engineering services for more than 13 years to technology companies such as Redflex Communications Systems (now part of Exelis, NYSE:XLS), Ceramic Fuel Cells (ASX:CFU), Ericsson Australia, Siemens, NEC Australia and Telstra. Igor holds a Bachelor of Electrical Engineering from Darling Downs Institute of Advanced Education (now University of Southern Queensland). Igor is also the author of numerous patents and patent applications in athlete tracking, and other sensor technologies.

James Orlando -Independent non-executive director and chair of the audit and risk committee

Mr James Orlando has held senior finance positions driving growth and shareholder value in the United States, Asia and Australia. Most recently he was the CFO of Veda Group Ltd (VED.ASX), leading the company through its successful IPO in December 2013.

Before joining Veda, James was the CFO of AAPT where he focused on improving the company’s earnings as well as divesting its non-core consumer business.

He also served as the CFO of PowerTEL Ltd, an ASX- listed telecommunications service provider which was sold to Telecom New Zealand in 2007. James also held various international treasury positions at AT&T and Lucent Technologies in the US and Hong Kong including running Lucent’s international project and export finance organization.

Michelle Guthrie - Independent non-executive director and chair of the nomination and remuneration committee

Over the last 25 years, Michelle has held senior management roles at leading media and technology companies in Australia, the UK and Asia, including BSkyB, Star TV and Google. She has extensive experience and expertise in media management, and content development, with deep knowledge of traditional broadcasting, the digital media landscape and the transformation necessary to embrace the digital consumer.