28-March-2025: Marcus Padley said the following in his midday email today: LNW down -4.4% following a class action against them, accused of stealing a mathematical formulae and artwork from a competitor.

I hadn't heard of this one, so I had a quick look, and can't find any recent news, however I found the class action details:

https://www.globenewswire.com/news-release/2025/2/24/3031478/673/en/Light-Wonder-Inc-Investor-News-If-You-Have-Suffered-Losses-in-Light-Wonder-Inc-NASDAQ-LNW-You-Are-Encouraged-to-Contact-The-Rosen-Law-Firm-About-Your-Rights.html

And: https://rosenlegal.com/case/light-wonder-inc/

Also: https://ggbmagazine.com/article/light-wonders-dragon-train-wins-in-australia/

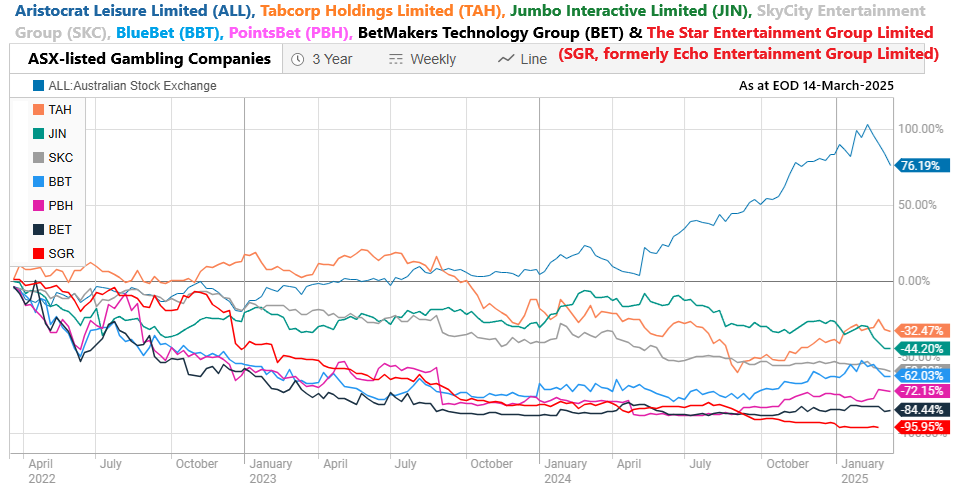

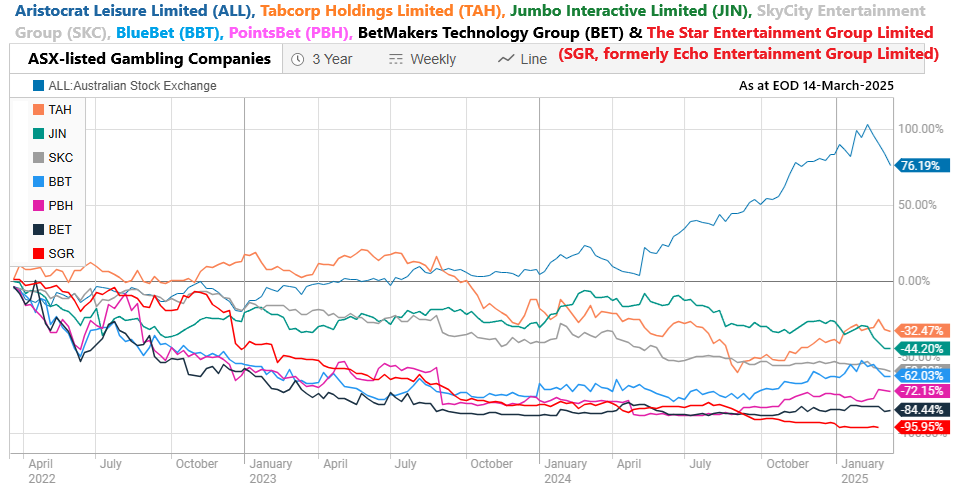

A couple of weeks ago - I posted the following graph over in a forum thread about The Star Entertainment Group (SGR.asx):

That highlights how only Aristocrat (ALL) had done well out of all of those gambling and gaming companies over three years. I forgot one, Ainsworth Gaming Technology (AGI), however they were also down -24.78% over that three year period.

I've since realised that I forgot another two, and LNW is one of those; the other is The Lottery Corporation (TLC), and while TLC also went backwards over the past 3 years, albeit only a little - they're essentially flat, LNW is actually up, although they've only been listed on the ASX for just under 2 years (since May 2023); they've been listed for the full 5 years on the NASDAQ, and their share price trajectory has been mostly up during that period, as it has been here on the ASX over the past 2 years:

LNW is almost up as much as ALL, however it is ALL that LNW are in the legal dispute over concerning their Dragon Train pokies/slot-machine game.

Further Reading:

If a business has size and growth, management has a vision, and everyone executes as promised, the local market can still provide a red carpet treatment.

By Chanticleer, AFR, Mar 16, 2025 – 12.17pm

Directors and chief executives love telling us how hard life on the ASX can be – the compliance, regulatory burden, fickle investors, inflexible governance standards, nosey media and dumb things like a big superannuation fund’s ESG questionnaires. If you listened too closely, you’d wonder why any of them sit on blue-chip company boards.

The truth is life on the ASX can be great.

If a business has size and growth, management has a vision, the board is well put together and everyone executes as promised, there’s a $4.1 trillion super sector hooked on equities, a cohort of active fund managers, a full-house of institutional stockbrokers and research teams, and a sticky top-50 getting red carpet treatment and valuations for often middling performance.

Former Aristocrat duo Toni Korsanos and Jamie Odell are a big reason why their new poker machine company is such a hit with Australian investors and analysts. Dominic Lorrimer

Australian investors don’t even demand ASX-listed stocks make most/much of their money in Australia. Look at Aristocrat Leisure, for example; 80 per cent of its gaming revenue comes from North America, yet it is one of the ASX’s best long-term performers. CSL and Macquarie are similar. Management teams don’t need to live in Australia to make it work. Employees don’t need to be based here.

Australian investors are particularly welcoming for resources and gaming businesses – so welcoming compared to the US and major European markets that you’d be almost mad to be listed anywhere else.

You just need some ties to Australia, a strong listed competitor or two, a growing business and to put your back into investor relations – do the work to win over fund managers and sell-side analysts in Melbourne and Sydney (and Perth/Brisbane to a lesser extent).

Light & Wonder, the world’s second-largest casino gaming content group behind Aussie Aristocrat, has worked that out.

Nasdaq-listed Light & Wonder took a secondary listing on the ASX nearly two years ago, was in the ASX200 after six months, the ASX100 after 18 months and now has more Australian than US sell-side analysts covering the stock and more active Australian shareholders willing to appreciate its growth and pay more for its earnings. Thirty per cent of its securities now trades on the ASX, though it has never raised a dollar here.

Too big to ignore

The secondary listing, while slow at first, has gone so well that the board has called in the bankers and is considering moving here permanently via a dual-primary listing (ASX/Nasdaq) or a sole primary listing.

If they can get 60 per cent of the stock on the ASX, Light & Wonder will be promoted well inside the ASX50, have passive funds clamouring for another $5 billion of stock (or about one-third of its current market value) and become too big an index position for Australia’s active large-cap investors to ignore. That all spells creating value for shareholders.

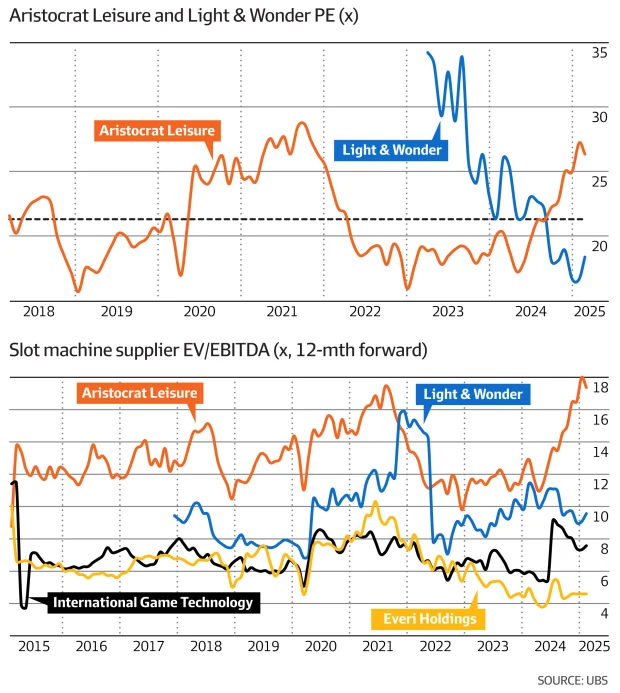

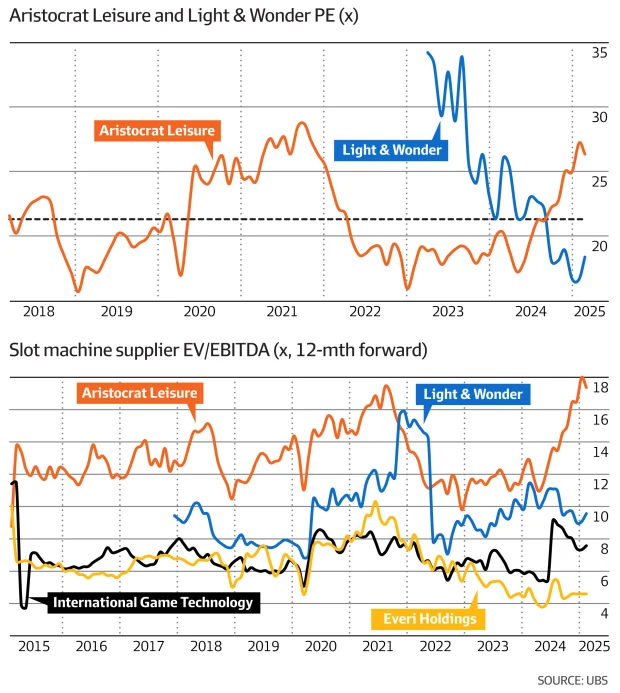

It is all possible because its arch-rival Aristocrat, a top-20 stock, has been such a rip-roaring success for Australian investors. It dominates gaming software globally and particularly in North America, increasing post-tax profit and earnings per share about sixfold in the past 20 years. It trades at 26.6 times forward earnings per share and 17.2 times EBITDA, according to S&P Capital IQ data, about a 50 per cent premium to the ASX200 average earnings multiple.

If the ASX was no good – and Aussies didn’t appreciate its story and/or know how to value it – Aristocrat would’ve shifted its listing to the US years ago. But it hasn’t. And its trading performance and multiple runs rings around its US-listed opposition (what is left of its listed opposition anyway, with private equity swooping).

Some of the Aristocrat magic is in play at Light & Wonder, the group nipping at its heels in the US gaming market.

Light & Wonder is overseen by former Aristocrat duo Jamie Odell (chairman) and Toni Korsanos (vice chair), who grew Aristocrat revenue five times and EBITDA eight times, and took its share price from $4 to more than $30 (it is now $67). Odell and Korsanos shifted to Light & Wonder as part of a buyout spearheaded by Australia’s Caledonia (Private) Investments, a former Aristocrat investor, in 2020.

Light & Wonder was saddled with debt (more than 10 times EBITDA), but Odell and Korsanos reorganised and restructured it, hired a bunch of former Aristocrat people to run it, including the CEO Matt Wilson, sold assets to pay down debt, bought back stock and have it humming.

The company is on track to exceed its $US1.4 billion EBITDA target for 2025, which would represent 15 per cent compound annual growth since the turnaround kicked off four years ago.

However, its shares still trade at a meaningful discount to Aristocrat, which has greater market share but is growing less quickly. The difference is about eight turns on a price-to-earnings basis. If Light & Wonder traded at Aristocrat’s multiple, shareholders would be about $5 billion richer.

Would making the ASX its primary or dual-primary listing help bridge the gap? The company and its advisers certainly think so – that’s the whole point of the review.

They reckon it would unlock passive buying from Australia’s big super funds, get more money out of large-cap active investors and they saw first hand the interest in large-cap gaming stocks when they tried to float SG Lottery on the ASX in October 2021. (Although they’d be better off not bringing that up, with those fund managers prepared to underwrite it at a $US1 billion premium to the eventual sale price, only to miss out on it).

Potential danger

Light & Wonder and its bankers at Jarden and Goldman Sachs have started meeting shareholders and are trying to work out how much flow-back there could be from US shareholders should it elevate the ASX listing – that’s a potential danger. The other question is how to get more of that US stock on to the ASX to qualify for maximum index treatment.

For Odell and Korsanos, strategically at least, it doesn’t really matter where Light & Wonder is listed. The company makes most of its money in the US, its management is in the US, and it develops games globally (including in Australia), but they know just how good Australian investors can be to growing gaming companies and so are throwing their weights behind the listing review. Australians love their pokies.

Expect to hear more about it in coming months – those that know Odell well say the fact he has announced the review means he probably wished it was implemented yesterday. He doesn’t normally muck around. Light & Wonder’s next big outing is supposed to be an investor day in May, where analysts expect it to unveil new earnings targets.

After that, it could well flick the switch on the primary ASX listing. If it does, the ASX should send Odell, Korsanos, Caledonia and everyone else involved a dozen Christmas cards each this year – Australia snatching a $15 billion company off the US boards has never happened before. Hopefully, for Australian investors it can happen again.

--- ends ---

Source: https://www.afr.com/chanticleer/this-15b-nasdaq-group-wants-to-shift-its-primary-listing-to-the-asx-20250315-p5ljv4

--- --- ---

This is not a space I invest in myself, so I have no direct exposure to these companies, however I do find it interesting that the picks and shovels plays, (building the machines for the clubs and casinos) is where the real money is made in the industry.

Here's what ALL vs LNW looks like over 3 years:

That's 3 years of ALL (blue line, +68.83%) on the ASX, 3 years of LNW on the NASDAQ (orange line, +58.65%), and almost 2 years of LNW on the ASX (the green line, +66.26%).

Considering that every other gambling company on the ASX is underwater over the same time period, those two have done well.

Disc: Not holding these.