Pinned straw:

Well done team! This discussion is a perfect example of why I love the Strawman platform. The combined brains of the likes of @Strawman , @jcmleng , @mikebrisy and @Shapeshifter for this thread (and of course others for other threads) helps me to understand companies and topics I wouldn't think twice about because they are so complex. It is truly an honour to ride on the shoulders of the many champions in this group.

Nessy

(likely to hold after reading all this!)

Thank you @Strawman for the summary of the meeting. These are quite helpful as I often don't have time to catch a lot of things like this (however I really hope to change that soon when things slow down).

I want to ask about these comments:

"Replacing them (encoders) isn’t simple; it would require reconfiguring entire tech stacks, including broadcast automation systems."

"..And the encoder industry is very niche, and far too small for a large challenger to enter and compete."

When I take note of how others speak about Mr. Abrahams (i.e.- overly enthusiastic, great salesman; passionate CEO; visionary; storyteller; all of the above?), I read the above quotes and question how much truth they hold? Does anyone else here know if replacing encoders in customer workflows would actually be so difficult and painful that they would simply opt to stay with $AIM? Why wouldn't a large challenger enter and compete in a niche market if it meant making large profits?

Being able to pass on your enthusiasm is a terrific quality in a CEO; however, taking everything at face value is a risk of confirmation bias and I want to understand everything Tony is saying before assigning more of my wealth to this company.

Disc: Held (small amount).

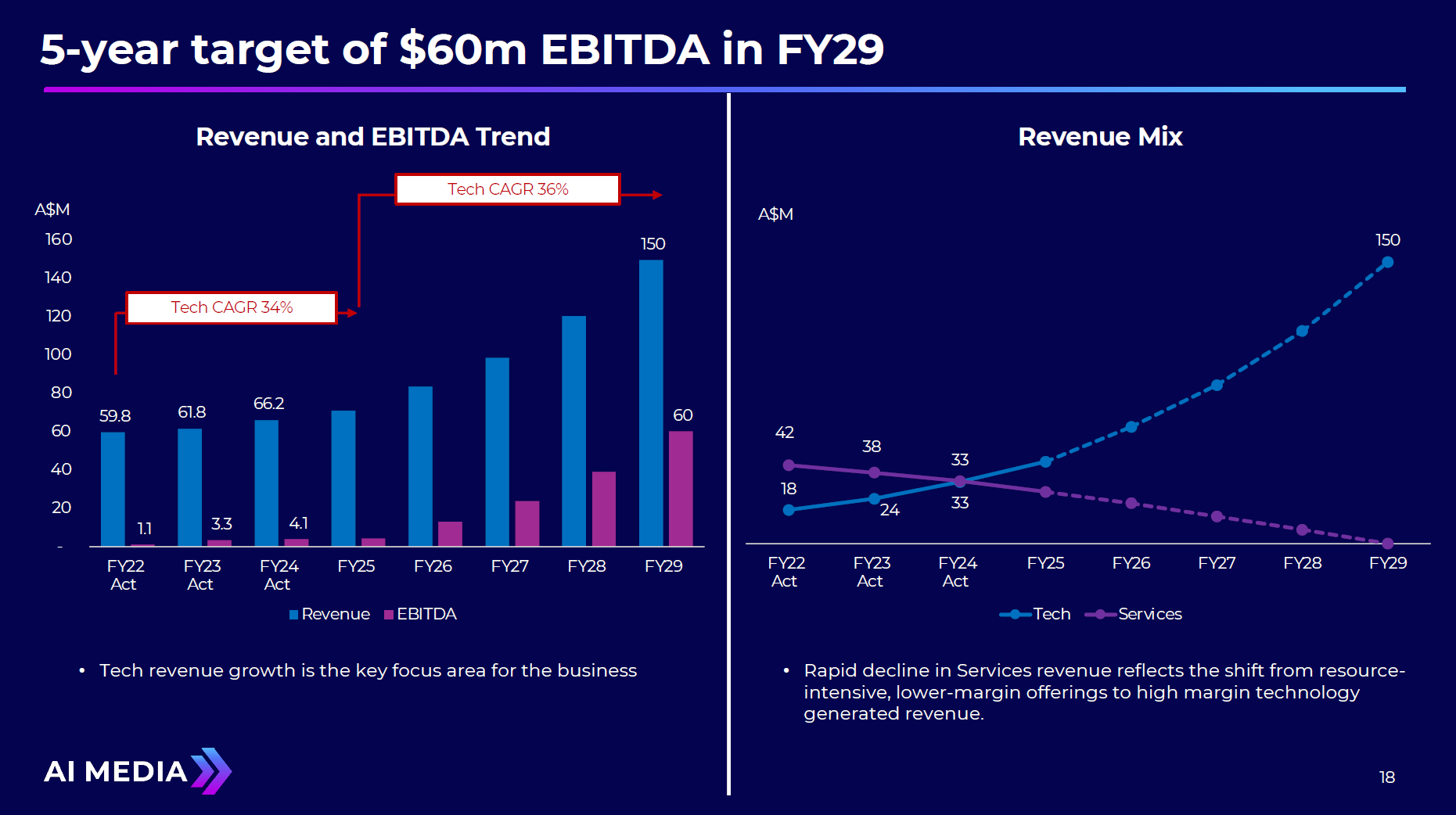

Following the SM interview yesterday, I've gone back and looked at my valuation work as well as valuations posted by @wtsimis ($1.92) amd @Travisty ($1.61) in the context of the chart below.

Of course, the above chart is highly aspirational, particularly given how early we are in the journey of the tech. revenue.

If you were to look at the FY29 Revenue, EBITDA and infer a reasonable NPAT (say, $30-35m), and if you were also to then look at the EBITDA and EPS growth rates at that time (FY29), you'd be forgiven for applying pretty high EPS and EBITDA multiples,... and even discounting back at whatever discount rate you like, you're going to end up with some pretty crazy valuations.

So, I'm not going to add my own valuation. And very happy to go with those by @wtsimis and @Travisty.

But my conclusion is that for as long as Tony can stick to keeping this chart as the roadmap for $AIM, the SP upside in the medium term is very significant indeed. Because once the market starts to get anywhere near thinking about the FY29 numbers shown, or even numbers on that path for FY27 and FY28, then a SP today of $0.75 is compelling value.

The margin of safety is large. For example, even if they can "only" achieve FY29 Revenue of $100m and EBITDA of $20-25m, you're still going to get fair value today of between $1.00-$2.00, which is where my fellow StrawPeople are.

This is what I like about long term targets - it gives you a reference point in doing valuations and at each report asking "Is progress in delivering the long term outcome still on track? Does the latest result make that more likely or less likely?"

Today, I've added to my $AIM holding in RL, taking it to 4.85%, which is as far as I'll go, because I still think there is a pretty high risk around delivery. But the potential reward is there, so I think it is a risk worth taking.

Disc: Held in RL

Had a good listen of the very good call with Tony. Great summary from @Strawman , thanks! Rather than being "promotional", I have found Tony to be highly passionate with a deep conviction of the direction of the business, is clearly on top of all aspects of the business and is one heck of a clear story teller. So there is always something new to pick up and digest, even though I have heard this story 4-5 times now

My key takeaways over and above the notes thus far:

LIVE VIDEO

It is all about Live Video, fast, accurate and cheap - doing translations, captions in Live Video that has been done to recorded video in the last 18M.

Competitors were not focused on Live Video, which is what the EEG Encoders/iCap/Lexi provided AIM with - without the encoders, they have no moat, because public AI technology can do all of this captioning on recorded video.

AIM DOES NOT HAVE A MOAT OUTSIDE LIVE - this is quite a key point for me. Any threats to AIM thus needs to be evaluated against the impact on Live Video for it to be of concern.

ENCODERS

Encoders from the EEG acquisition are physical hardware encoders.

Alta, Falcon are software encoders, sold as a SAAS offering - customers who are on the 2110 IP standard, do not use the Encoder Pro hardware, they use the Alta encoder, which is software that is installed into the customers hardware.

- SMPTE 2110 is a suite of standards from the Society of Motion Picture and Television Engineers (SMPTE) that describes how to send digital media over an IP network. SMPTE 2110 is intended to be used within broadcast production and distribution facilities where quality and flexibility are more important than bandwidth efficiency

- As US broadcasters move to the 2110 standard, more customers buy Alta encoders, less and less buy Physical Encoders - SAAS revenue headwind as go through this transition period

Think of the iCap/Lexi system as the operating system, like Microsoft Windows - can put this operating system on other people’s software.

- The smarts is not in the hardware, it is in the iCap/Lexi operating system

- AIM has proven at the technical level that it can develop and have an SDK applied to someone elses encoder network - Media Proxy, Grass Valley, Imagine. There is thus confidence that this will work on any other encoder network ie. read the files, data coming from the customer end, AIM can then lay over whatever is required to put captions and voice on top of that

It is not the encoders themselves, but rather the EEG proprietary software sitting inside an encoder (can be EEG Encoder Pro, Alta or Falcon) , which has the pipes into the iCap network, that is the technology stack moat.

What am I now not so clear on is whether the Total Encoders metric is actually referring to pure EEG Encoder Pro hardware encoders OR a combination of EEG, Alta or Falcon, something I would like to clarify later

REVENUE NUMBERS

Sales staff will be rewarded when cash is received, this has encouraged everyone to sell 12M upfront AND collect cash early, hence the increase in the Contract Liabilities number.

Contracts have always been 3-5 years, now just getting more cash upfront, due to Sales incentives, which adds to Contracts Liabilities in the Balance Sheet. Thus, need to add the full Contract Liabilities on the balance sheet to revenue to get the full revenue growth picture

Discl: Held IRL and in SM