Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 4.56% and in SM

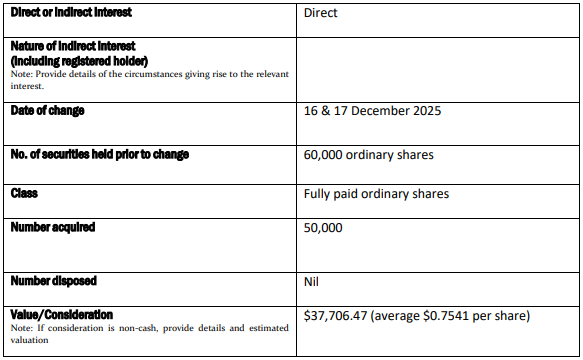

Very nice to see Brad Bender, one of the 2 high-profile-ish US-based directors AIM appointed in Oct 2024, top up his shareholding of AIM by ~83%. He added 50,000 shares to his initial 60,000 holdings from Dec 2024.

The value of $37.8k is small coin in USD, but better to see him buying than not.

Discl: Held IRL 5.16% and in SM

This came from AIM Investor Relations via email as I signed up to the AIM Investor Hub.

The spread of AIM information is a bit inconsistent right now. This email came direct. There is no announcement of this on the ASX nor on the Investor Hub itself. Tony has not posted on Linked In, but I expect him to do so shortly.

Looks like @Strawman and Tony are becoming/are best buddies!

Product & Market Webinar

Join CEO Tony Abrahams and CFO Jason Singh as they provide an overview of the Company’s current product suite alongside consolidated feedback from recent executive visits to Europe and the USA. The Company will outline how this international market feedback aligns with its existing strategy and product roadmap priorities.

The webinar will be moderated by Strawman's Andrew Page and investors are encouraged to ask questions on AIM's growth strategy and geographic expansion.

Webinar Details are as follows:

- Event: AI-Media Product & Market Update Webinar

- Date / Time: Wednesday 3 December 2025, 10AM (AEDT)

- Registration link: https://investorrelations.ai-media.tv/webinars/drLvQy-product-and-market-fit-webinar-dec-2025

The Company notes that this webinar is not a trading update. No financial performance, outlook, or guidance information will be provided, and questions will be strictly limited to product and market topics.

Ongoing demonstration of the growing momentum behind our LEXI AI captioning and translation platform

From planetariums to global media summits, broadcasters to local government, organisations worldwide are choosing AI-Media to deliver real-time accessibility and multilingual engagement, affordably, reliably, and at scale.

Recent wins highlight the versatility of our end-to-end ecosystem and why customers continue to displace legacy human-only solutions with AI-Media.

Scitech (Western Australia) – Making Live Science Truly Inclusive

Scitech, Australia’s leading hands-on science center with 300,000 visitors annually, faced a classic “impossible” captioning challenge: unscripted, fast-paced shows featuring complex astronomical terms inside a dome planetarium.

The Solution:

- LEXI Viewer deployed across the Planetarium, Chevron Science Theatre, and a fully portable mobile trolley for outreach events.

- Real-time AI captions handled terms like “Zubenelgenubi” and “Alpha Centauri” with ease.

Outcome:

What was once considered impossible is now seamless. Deaf and hard-of-hearing staff and visitors have praised the accuracy and responsiveness. Scitech is now more accessible than ever before.

“I’m impressed at how accurate and easy to use the LEXI Viewer is. This is a great step for making our venue more accessible.” – Leon, Planetarium Lead, Scitech

APOS 2025 (Bali) – Asia’s Premier Media & Entertainment Summit Goes Fully Multilingual

For the second consecutive year, Media Partners Asia selected AI-Media as the exclusive live captioning and translation partner for APOS – the region’s most influential media, telecom, and entertainment summit.

Solution:

- Large-screen English captions in the main hall

- Real-time translations into Korean, Vietnamese, Chinese, Thai, and Japanese delivered via the APOS app

- LEXI Voice AI dubbing streamed to foyer spaces and headsets

- Captioned live interviews broadcast from our on-site booth

Outcome:

550 delegates and 80+ global speakers experienced a completely inclusive, tech-forward event.

“AI-Media’s live captioning solution added a vital layer of clarity and inclusion… The live translation… further amplified access and engagement across APOS.” – Lavina Bhojwani, VP & GM, Media Partners Asia

Want to hear more about recent activity?

Discl: Held IRL 4.84% and in SM

The AIM chart is looking very interesting from a top-up perspective.

- Fell right through the 74.5c to 80c level which I thought would be decent support

- 72c is the 50% retracement level - “usually” a decent place to top up

- But better support could come at ~68c which is looking to be at the confluence of (1) support from the 1 year + uptrend line (2) the 200 Simple Moving Average and (3) ~60% retracement

- Failing which, there should be decent support at 61.5c to 65.5c

I suspect I will start nibbling at around 68c at this stage ...

Discl: Held IRL 5.23%, and in SM

Just watched a Tony Abrahams interview on MediaTechTalk released a day ago.

As with all Tony interviews, 95% of the story is familiar, but I still end up walking away engaged throughout the interview, and with some new nuggets of information that I find valuable in further entrenching my already-high conviction:

He ended the session with this quote from the late Leonne Jackson, AIM co-founder:

Accessibility benefits everyone - access to communication should never be a privilege - that conviction is in every product that we ship today.

This point alone resonated with me as this is what David Gardner talks about in the 4th Habit of a Rule Breaker Investor - Follow the Four Tenets of Conscious Capitalism where the 1s tenet is “Invest in companies who put purpose over profit and the Snap Test (would anyone notice or anyone care if the company disappears overnight)”. I think I just found clarity in AIM’s purpose and Snap Test ....

Other Points:

- 86% of 18-24 year olds watch everything with captions - this emphasises the necessity of the AIM product. I absolutely see this in my 17 year old daughter (I can’t stand the captions!)

- Aust had Disability Legislation mandating captioning in 2000, which gave rise to AIM, Europe passed the European Accessibility Act legislation in June 2026, AIM now does not have the same growth constraint that it had with re-speakers, to meet this European legislative-driven demand

- Emphasised the deep integration to each customers media-management systems to provide the customer-centric context for the captioning and translations - this was built during the re-speaker period

- Spent ~$40m to build the technology between 2010 and 2020 - always knew that AI would appear, but did not know WHEN that would happen - the re-speakers were an intermediary solution

- This is another key attribute that I like in my companies - investing to build the capability to scale up ahead of time, so that the technology stack readiness to scale is not a hindrance, there is no catch up, it is execution

- CAT did the same thing when Will Lopes came onboard, as did SDR during Covid

- We are not re-building any core technology that is out there - we are reapplying that technology to B2B workflows in a live environment - this is really worth re-emphasising with respect to competition

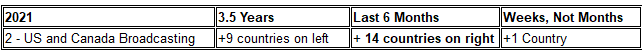

- Growth of EEG encoder country’s - took 18M to get the 1st country outside of the US to work, 6M to the second country working, 4 years later in 39 countries - core broadcasting standard differences that needed to be overcome between the US and the Rest of the World

- US Broadcasters are coming to AIM - spending 4x more than what they were spending 4 years ago, but saving $3-$5m per year from eliminating humans in the loop, every other country, need to knock on doors

AIM valuation based on FY25 Financial results,FY26 outlook and the company's FY29 revenue targets.

AI-Media Technologies Limited (‘AI-Media’ or the ‘Company’) (ASX: AIM),is a global provider of AI-driven captioning, transcription and translation services.

FY25 Financial Results Highlights

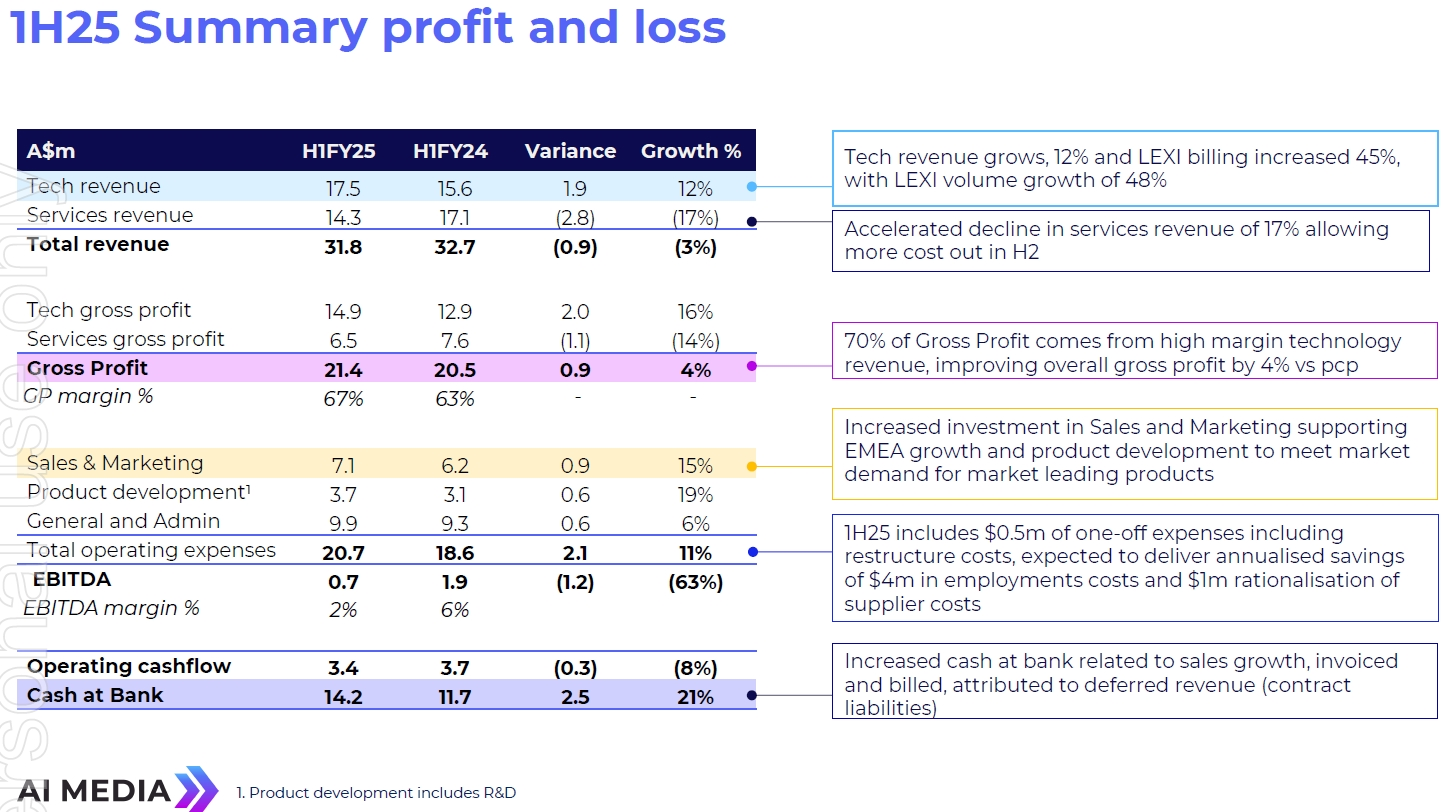

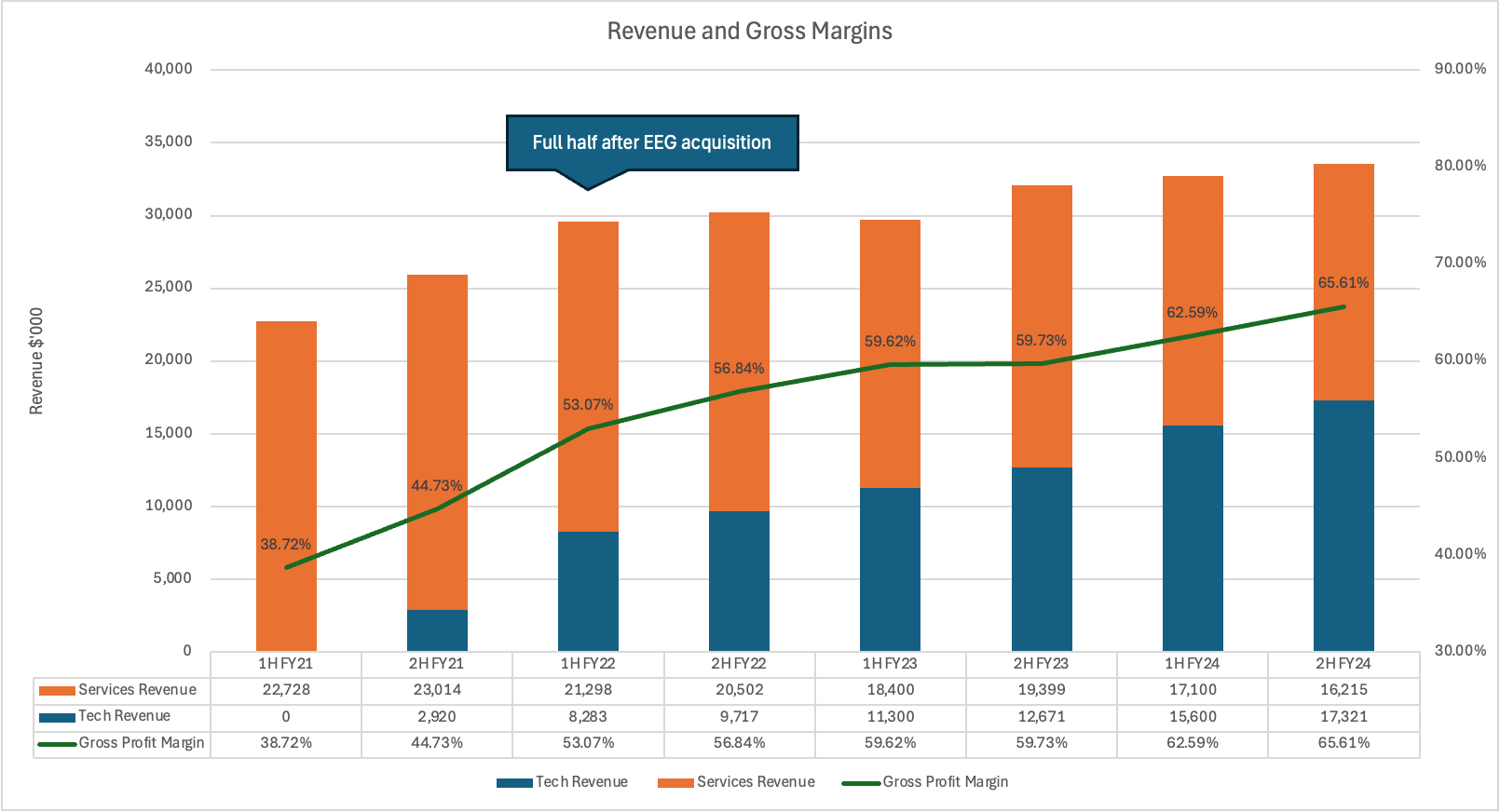

• Technology revenue grew by 19% to $41.1M, now representing 63% of total revenue (H1 $17.5M; H2 $23.6M)

• Annual Recurring Revenue (ARR) of $17.0M, with technology gross margin of 86%

• ARR growth guidance of ~35% to ~$23.0M in FY26

• Total Revenue of $64.9M, down 2% on the previous corresponding period (pcp), reflecting a deliberate 25% reduction in low-margin legacy Services revenue

• Gross profit of $45.1M, an increase of 6% on the pcp with total gross margin improving to 69% from 64% in FY24

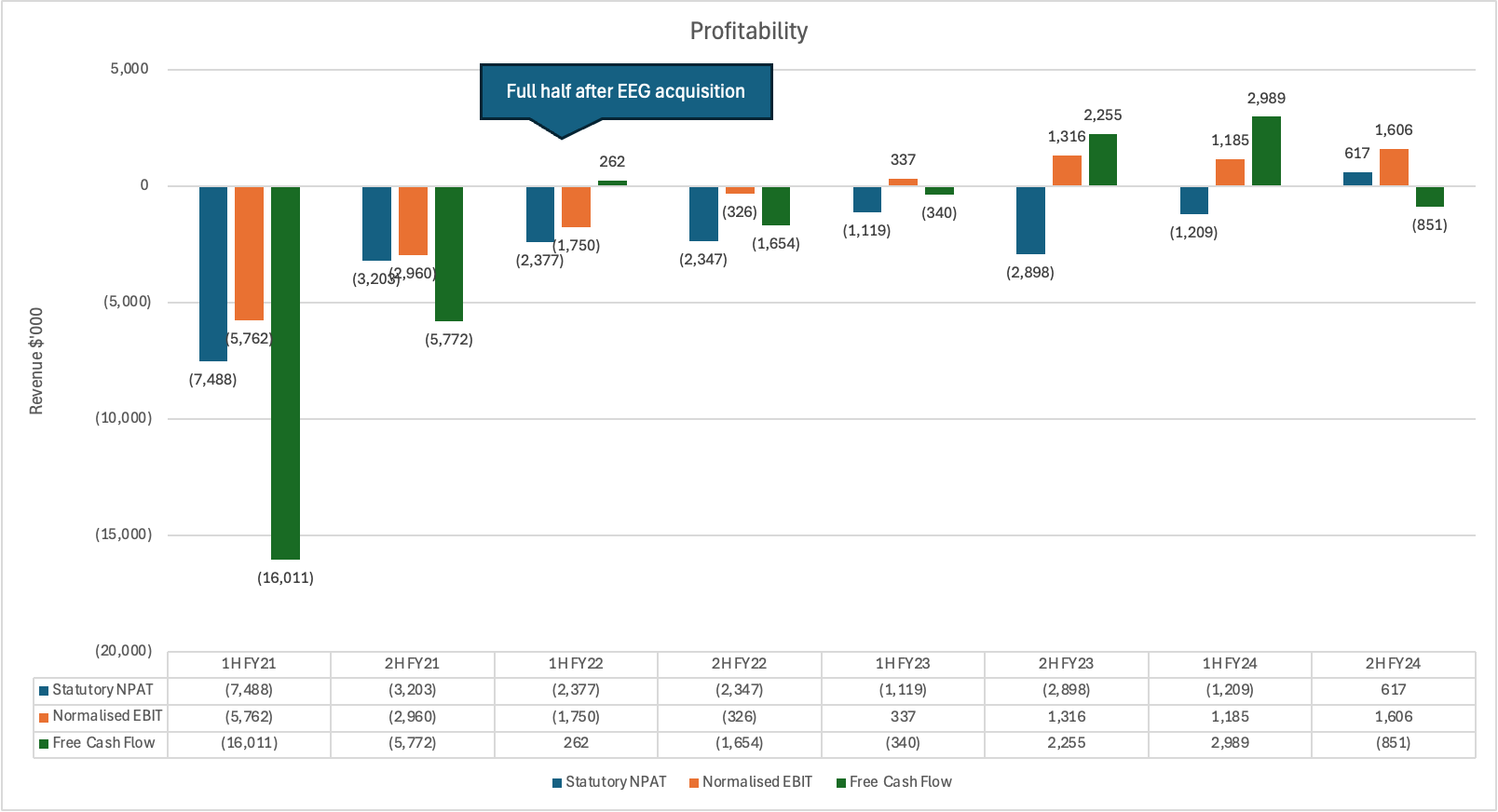

• An 11% increase in underlying EBITDA on the pcp to $4.6M, includes $3.5M of LEXI Voice and LEXI AI R&D expensed pre-revenue (not capitalised)

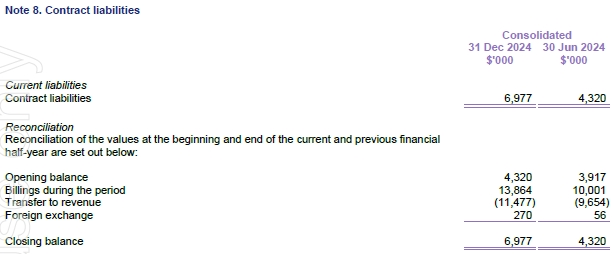

• Growth in operating cash flow of 48% on the pcp to $5.3M, with deferred revenue increasing by 144% from $4.3M to $10.5M highlighting the strength and sustainability of our LEXI Suite

• Cash balance of $14.7M as at 30 June 2025

AI-Media Co-Founder and CEO Tony Abrahams said:

“FY25 was the year AIM became a technology-led business with technology products that began at zero at IPO in 2020 now accounting for 63% of revenue, at an 86% gross margin and delivering $17M in annual recurring revenue.

“Underlying EBITDA of $4.6M in FY25 includes $3.5M of LEXI Voice and LEXI AI R&D expensed pre-revenue (not capitalised).

“The AIM Board endorsed a 60% increase in FY26 LEXI product funding to accelerate commercialisation of LEXI Voice and launch LEXI AI in 2026. AIM’s newly formed Product & Technology Committee is co-chaired by experienced US product and Go-To-Market leaders, AIM’s Non-Executive Directors Otto Berkes and Brad Bender.

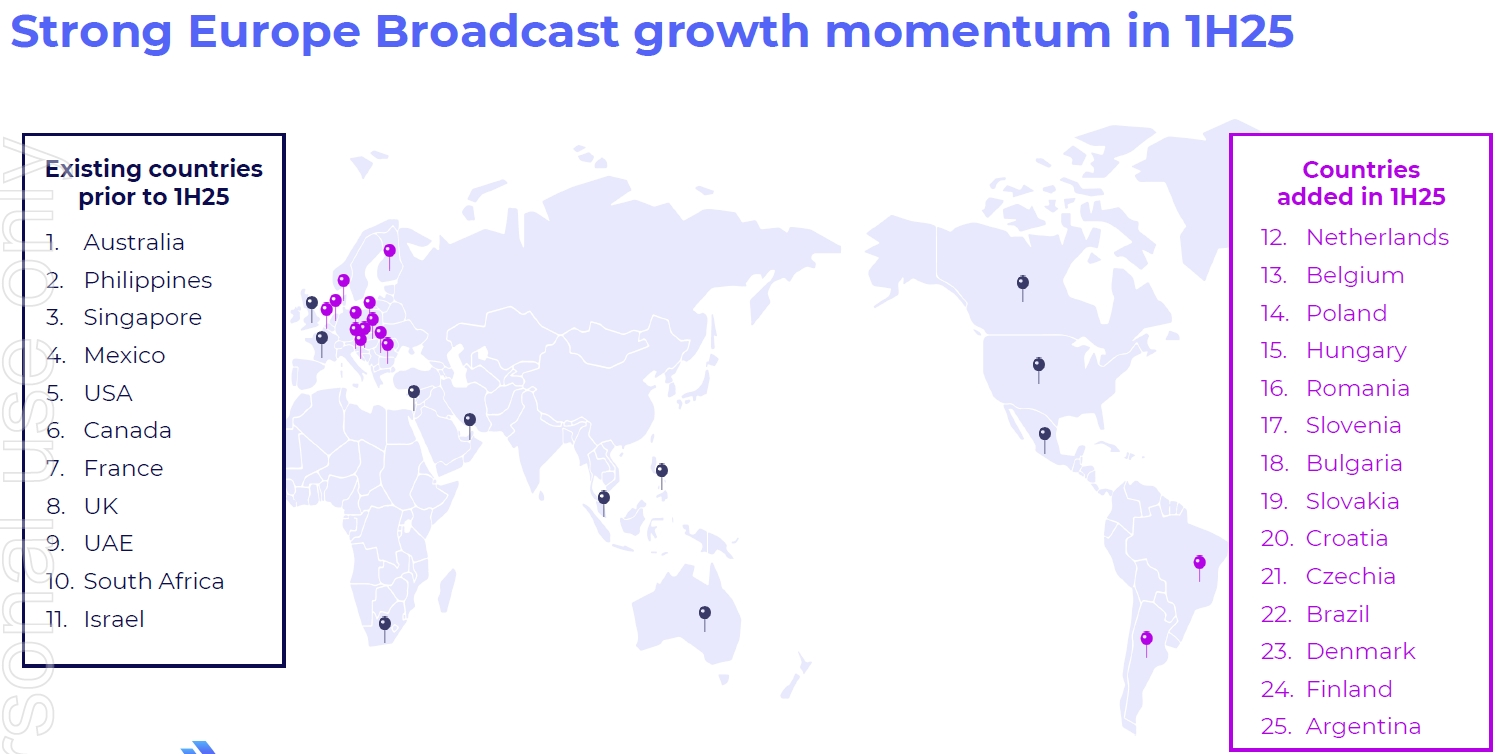

“We are pleased with our trajectory towards meeting our FY29 Revenue Growth target of $150M. We grew EMEA Encoder sales to 315 units vs 55 units in FY24, added 23 new countries to increase our geographical footprint to a total of 36 countries.”

“Our two key product growth KPIs were met with the launch of LEXI Voice in April 2025 and ongoing development of LEXI AI which is scheduled to launch in 2026.”

Financial and operating performance

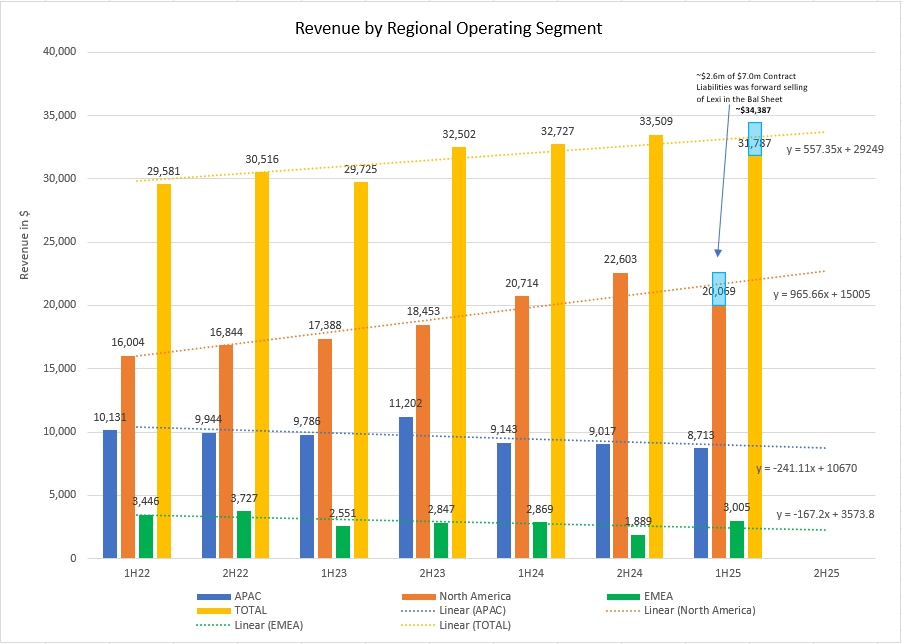

In FY25, the Company became a technology-led business with technology revenue accounting for 63% of revenue. AI-Media’s total revenue declined 2% to $64.9M, driven by a deliberate reduction in low-margin legacy Services revenue of 25% to $23.7M, while Technology revenue grew 19% to reach $41.1M. More importantly, gross profit grew 6% to $45.1M with total gross margin improving from 64% to 69%.

These improvements in gross margins were driven by the Company’s continued transition to a technology-led model, with the major structural aspect of its transition now completed. AI-Media remains on track to reach 80% Technology revenue share in December 2025.

During the financial year, recognised LEXI revenue grew 9% to $24.0M, including $17.0M in ARR at 86% gross margin, highlighting the strength of the Company’s scalable platform. Revenue from encoder hardware significantly increased 34% to $17.1M, with 1,143 encoders sold compared to 843 units in FY24.

FY25 performance was driven by the growing demand for AI-Media’s flagship LEXI solutions and encoder hardware, underpinned by increasing customer adoption, product innovation, and geographic expansion, specifically with the addition of 23 new countries, of which 17 were in Europe.

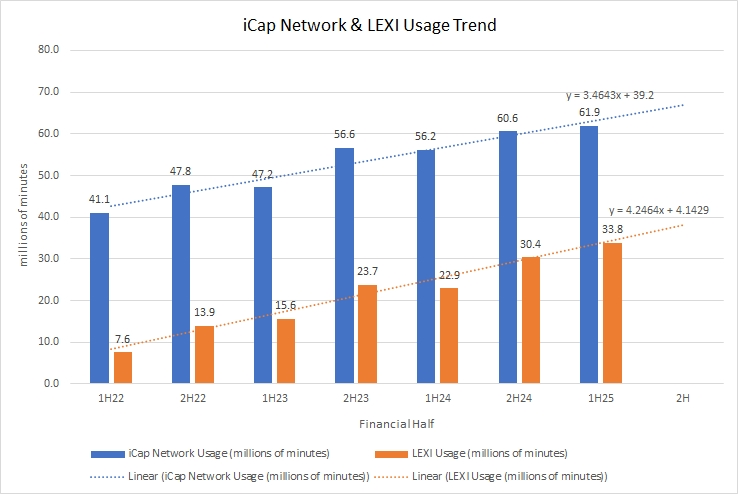

LEXI usage grew to 79.2 million minutes, a significant increase of 49% from 53.3 million minutes in FY24. Between FY21 and FY25, the usage of LEXI products grew at a CAGR of 69%. iCap network usage grew to 135 million minutes, an increase of 16% from 116.8 million minutes in FY24.

The Company continued scaling its SaaS business in the US Broadcast sector and expanded into the Government market in the US and Canada.

In APAC, AI-Media accelerated its transition away from legacy services to a tech-first, SaaS-driven model.

In line with our strategy FY25 technology growth was centred around EMEA Broadcast with a 425% increase in technology revenue from $0.8M in FY24 to $4.2M in FY25.

Underlying EBITDA for FY25 was $4.6M, with restructuring costs of $1.3M incurred relating to the cost out program of $5M in Q4 FY25.

Operating cash flow grew 48% to $5.3M, highlighting the strength and sustainability of the Company’s SaaS transition.

The year closed with cash of $14.7M as at 30 June 2025, with forward sales not yet recognised increasing by 144% on the pcp from $4.3M to $10.5M as deferred revenue. FY25 cash is up $3.8M extending a consistent 3-yr operating cashflow track record.

Product highlights

In FY25, AI-Media launched cutting-edge products within its LEXI Suite, notably LEXI Voice, an AI-powered live voice translation solution, now delivering broadcast-target latency on live paths of under 8 seconds.

The Company also accelerated R&D development of LEXI AI, its confidential and private Generative AI solution integrating real-time LEXI outputs in secure, high-trust environments. It is anticipated that LEXI AI will provide a powerful engine for future growth and value for our customers.

These innovations represent a new era for AI-Media, uniting captioning, voice translation, and secure AI to redefine global communications. The Company anticipates meaningful revenues from LEXI Voice in 2026 and LEXI AI in 2027.

FY26 outlook

Entering FY26, AI-Media’s strategic expansion revolves around three pillars:

- Product Expansion: Increasing product penetration within existing customers, particularly monetizing new offerings such as LEXI Voice and LEXI AI.

- Geographic Penetration: Building on FY25 diversification momentum to replicate our North American achievements in Europe and Asia, supported by emerging regulatory drivers and market demand.

- Segment Differentiation: Strengthening our position in Enterprise, Education, and Government sectors, building upon early successes within parliamentary and congressional institutions, specifically with the US and Canada.

Firstly, apologies for the effusive flattery and praise towards Tony on my part during the interview. Very poor form, and not the kind of neutral, objective style that best serves your interests. So please keep my bias in mind, and be sure to push back in any areas that are warranted.

I just give a lot of credit to a business leader than can deliberately disrupt their own business when the structural winds of change are blowing, especially when such a move will hit revenues and free cash flows in the interim, and also when the payoff for the pivot and associated investments are uncertain.

Also, and Tony himself made this point, it's noteworthy that he's been pretty consistent in what he has said previously, and what he has delivered. That's not too common on the ASX, so credit where it is due.

Anyway, I wont rehash some of the key observations with this business. They've been made before (see past interviews and the company page).

A few of the key points from this discussion:

- R&D and product development is largely complete. They are now firmly focused on the ongoing commercialization of the product.

- No acquisitions are on the radar, and in fact Tony was very forthright on this.

- Their partner sales model will allow them to grow much faster and much cheaper than any direct sales model, and speed is critical given the land grab that is underway

- Voice is a far larger market than text (transcription), about 30x larger, which is a big part of how they arrive at their ambitious FY29 targets.

- They have some impressive directors on the board, which should not only add great experience, but also open doors.

- Looks like a NASDAQ listing is on the radar, and they have been moving towards this for some time. Most of their business is there and they have been presenting their accounts in a US friendly manner for this exact reason.

- AI adoption in live translation has hit an inflection point -- “voice is where text was 23 months ago.”

- ASX liquidity has significantly improved. This is interesting only in the sense that it puts AIM in play for larger institutional investors.

It feels like there's a lot of upside if the company can indeed deliver on their FY29 targets. But let's say they only get halfway there ($30m in EBITDA, or lets call it $15m NPAT) at a PE of 20, that's a market cap of $300m, compared with $180m today. Not a terrible margin of safety.

[Held]

Luke Winchester from Merewether Capital and Richard Hemming from Under the Radar discussed $AIM on The Call on Ausbiz last Friday. It’s worth a listen ahead of the SM meeting with Tony early next week.

https://ausbiz.com.au/media/small-caps-|-the-call:-friday,-24th-october-|-aim-kyp-rmy-atv-cmw-atc-btr-dtr-csx-hzr?videoId=44861

Disc - Held IRL and SM

Discl: Held IRL and in SM

Looks like Tony's hard sell on the AIM results to the market is paying off ... not sure what drove the 12.4% pop today, but a few things to note from the charts:

- It hit the 52 week high today at 0.95 - it was last here in Dec 2024

- Always nice to see a pop on decent volume - today's volume looks really good

Zooming out, the price is now firmly in the 90.5c to 99.0c zone - lots of history in this zone going back to 2021/2022, which it will have to digest before moving higher.

I do expect it to churn around at these levels for a bit.

But thats one hell of a journey in these 4-5 years-ish - went to hell, literally, it looks like it is moving towards the Heavens now ...

Discl: Held IRL and in SM

Another Tony Linked-In post from 3 weeks ago that popped up in my feed.

My takeaways:

- It reinforces that LEXI Voice is NOT competing with hyperscalers as they improve the accessability to personal language translation technology.

- "Consumer “magic.” Enterprise scale. Same story, different stage." - a nice summary

- Our Tony is watching all things translation like a hawk and comments on these developments to correctly position the development against AIM - I have no quarrels with this.

9 October 2025

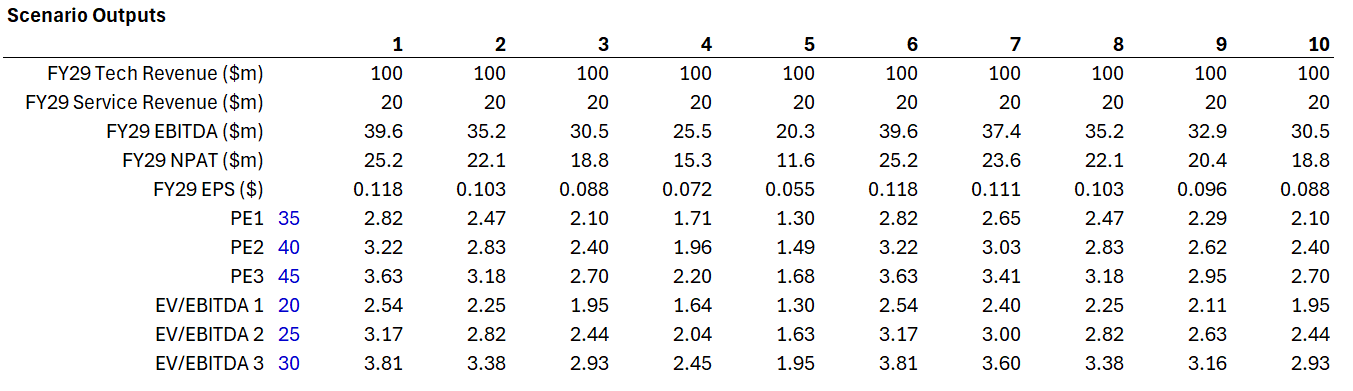

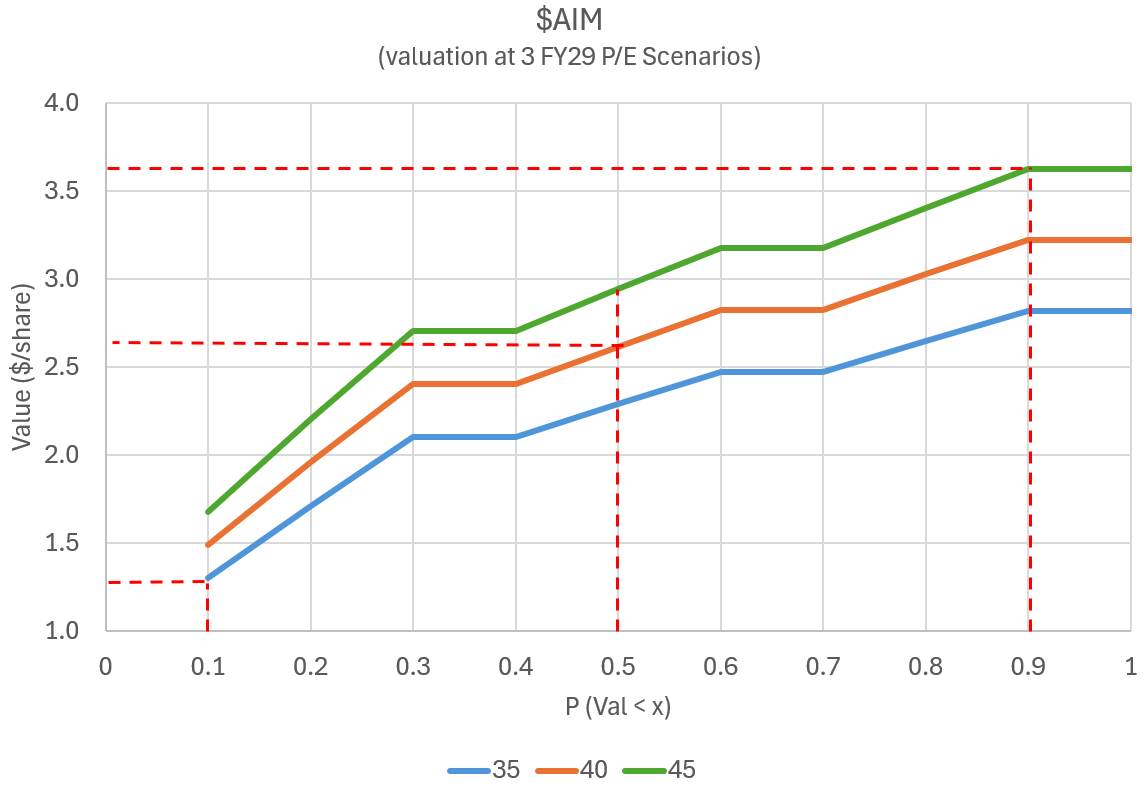

SUMMARY of Valuation (See Today's Straw for details)

Method 1: FY29 P/Es of 35, 40, 45: $2.60 ($1.30 - $3.60)

Method 2: EV / EBITDA of 20, 25, 30: $2.40 ($1.30 - $3.80)

Note: Selected ratios are considered conservative becaue EPS growth in FY29 typically in the range 55% - 80%. So there is every chance that if the market believes $AIM can achieve and sustain it's growth, we might well experience a Super Bull case, where a much higher P/E is offered by the market ... for a period of time.

Preamble/Context

I've been a bit slow to commit to a valuation on SM for $AIM, despite having held it for just over a year. It is now another core holding in my RL ASX portfolio, thanks once again to the StrawPeople who got there earlier, as well as the opportunity to hear from CEO Tony in the SM Meetings. (I wasn't convinced after the first SM Meeting, but last year September's one got me over the line.)

A second reason for holding back on publishing my valuation was that, as other holders will know, if you buy into the FY29 Targets of "$150m revenue; $60m EBITDA; a billion $ company" - a message that Tony promotes with irrepressible consistency - you get such a large valuation that you'd be tempted to back up the truck ,...if you believed it.

Although I have set out some scenarios here that fall well short of Tony's vision, everything that follows is firmly anchored on the vision. And so, insofar as the vision fails to be realised, then so too the valuation will fall short. That's why I've entitled this Straw a "Bull Case".

Going through the exercise has enabled me to unpick the business and get a better understanding of the value drivers. As such (and as is the case for all my valuations) it is as much a tool to track the progress of the business over the coming years.

The good news is that there is a lot of room for the business to fall short of Tony's targets and still be a very valuable investment. Of course, it is in a very fast-moving space, and who knows what disruptions will emerge over the next 4 years!

The final reason to push myself to do this, is as part of preparing for the next SM Meeting with Tony, on 28th October.

SUMMARY of Valuation (the TLDR bit)

Method 1: FY29 P/Es of 35, 40, 45: $2.60 ($1.30 - $3.60)

Method 3: EV / EBITDA of 20, 25, 30: $2.40 ($1.30 - $3.80)

Note: Selected ratios considered conservative becaue EPS growth in FY29 typically in the range 55% - 80%. So there is every chance that if the market believes $AIM can achieve and sustain it's growth, we might well experience a Super Bull case, where a much higher P/E is offered by the market ... for a period of time.

Valuation Details

I start with Tony's FY29 target and I assume $AIM will fall well short of the goal. It is aspirational after all, and we are moving in a space where there will doubtless be innovation and competition.

However, there are some "Building Blocks" that I assume.

Building Block 1: Today's business with the human transcription service which is being shut down as we speak

Building Block 2: Tech Revenue, with an increase compoent of fast-growing ARR. The ARR has a %GM of 86%. Having looked at the trajectory to date, I assume the overall Tech Revenue will have a %GM that starts at around 80% today, and scales to 83% by FY29 - driven by the ARR component. This is hard-wired into all scenarios.

Building Block 3: A new services model, essentially a 50% Gross Margin professional services business to clients. Tony aspires to this delivering $30m in revenue by FY29. I am less ambitious, and have it contributing $5m in FY26 and adding $5m each year, as the business services a global existing and prospective client portfolio. This segement therefore gets to $20m revenue in FY29.

The Opex Base: Because we have the existing Opex Base, and can isolate the COGS of the two revenue streams, I am able to consider various scenarios for how the Opex scales over time. There are two sets of 5 scenarios.

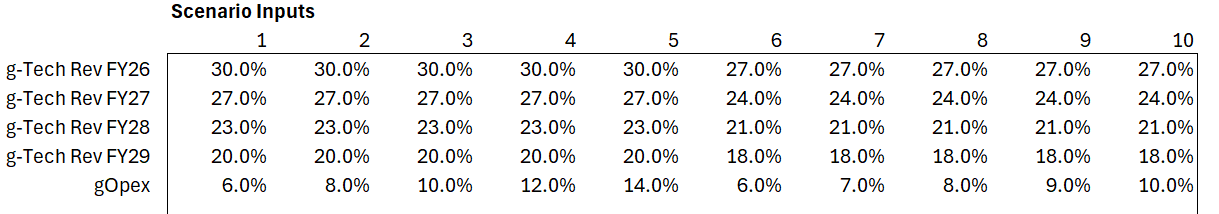

Scenarios

I have run 10 scenarios (sensitivities, really) across two dominant group.

One group is a high revenue growth and relatively high opex growth model, where scaling the revenue entails higher costs, whether in sales and marketing effort or product development, tailoring solutions to meet client needs. In this case I consider annual Opex growth scenarios of between 6% and 12% per annum. Over the next 4 years the Tech Revenue growth is sequentially, +30%, +27%, +23% and +20%.

In the second case, more cost efficient growth is achieved as revenues are not chased so hard. Opex growth ranges between 6% and 10% per annum, achieving Tech Revenue growth sequentially of +27%, +24%, +21% and +18%.

To keep the model simple, I have applied a common D&A set of assumptions, on the basis that variations in platform development costs have been included in the Opex Scenarios, and most development is expenses.

Common Parameters

The "New" Professional Services Revenue and Gross Margins (50%) are common across Scenarios: $5m, $10, $15, and $20m over the next 4 years.

Interest Income and Cost are de minimis. Tax Rate is 30% (once profit is achieved). The discount rate is 10%.

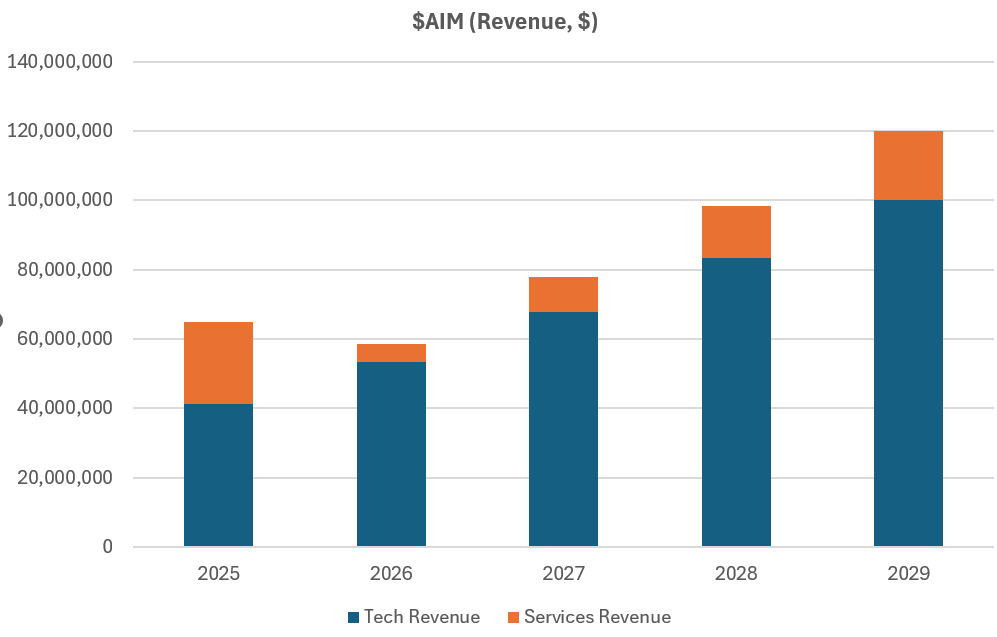

Illustrative Revenue Profile

The figure below shows the revenue build from one scenario. A few things to get your eye in. First, FY29 hits $120m, vs. Tony's $150m aspiration. Second, we should be alert to the possibility of a significant revenue fall in FY26, as the old "Services" are switch off in December. If the market hasn't been paying attention, I wonder if we really will get one last opportunity to "back up the truck" if that happens? Particularly if the reporting of it coincides with the market being in a grumpy mood towards "growth" and "tech".

What happens in FY26 isn't really important to the valuation and I am not trying to model it - so it is not my forecast - but I will use the result to update the model!

Full Table of Scenario Inputs

Full Table of Scenario Outputs

Valuations

So When Would I Sell?

It is unlikely the market is going to offer prices that have me selling on these valuation grounds any time soon. So it is important not to anchor on these numbers as some kind of pre-ordained truth. They are just assumptions.

For me to hold, I really need to see the Tech Revenue sustaining high growth at good margins. I couldn't really care less about the "New Professional Services", nor do I mind if Tony starts to reset his $150m in FY29.

As long as Tech. Revenue is growing strongly consistent with one or more of these scenarios, then I'm likely to hold on tight, and I might even add more.

Disc: Held in RL and SM

AIM chart looks ok. Sma 50 is set to move up through the sma 200

Wed 1st Oct 25

You may recall my last post on AIM. The chats were looking good for a set up with a divergence on the 1 day chart and other indicators also showing a positive signals. Fast foward, it looks like the signals were spot on. Its not always the case though. After reading eveyones thoughts however I decided to stay out for now (and I did agree with members thought).

Its alway a dilemma though. Do you follow the charts (market sentiment on the stock) or the fundamentals (ideally both). Im always trying to refine my investment methods. I have a number of positions (15-20K) currently that are well ahead (50%+) now and plan to loadup on their next draw downs all going well . I built these position without a reasonable positive narritve on the fundamentals, purely on chart technicals. Feels great now to have snagged a couple.

Looking back now at AIM, I feel I should have built up the same kind of position their. If i had gone ahead I would have started with 5k and increased leaving w2 on the 1d chart up another 5-10k by the time it was just breaking above the 200sma on the 1d. Currently the stock is working on the larger W(i) on the 3d chart. We should then see a pull back by 50% to approx 0.73 for W(ii). So long as their is now major news to the negative, I dont think it will drop that far. Many stocks seem to be only dropping to 23.6% or 38.2% of W(i).

Anyway for now I waiting until W(i) is finished and start to see the bottom of W(ii). That one can be tricky when the market is feeling bullish on a stock. Some times I have missed it and it has exploded up and never reached my target for getting in. Oh well there's always more opportunity’s get enter I let update you om my thoughts once we start to enter that kind of area

It looks like sentiment on this stock is very promising shown by the recent moves since the bottom. Im thinking that this could be another DRO. Lets hope so

Disc: Held IRL and in SM

Attended the AIM AGM this morning. Only picked up a few newish data points from the otherwise non-event AGM this morning. Nothing to not like from my perspective.

SUNSETING OF HUMAN SERVICES

- 3 remaining customers to transition from humans to AI - UK Parliament in Oct, then Channel 9 and Channel 7 by Dec 2025, fully completing the sunseting of old legacy translation services

- New professional/consulting services will commence 1 Jan 2026, to comprise 20% of revenue going forward - customers have requested for this to help leverage the benefits from AIM technology stack - this was a nice, simple summary to end confusion around this topic, as it should have been from the start

FUTURE SALES MODEL

- Pivot to indirect sales model to enable global scaling - this is an area I would like to better understand when we get a chance to chat with Tony again as this is going to be the key distribution model going forward

FIRST PAID LEXI VOICE CUSTOMER

Similar to Playbox Neo deal, this deal shows a few of the strategic levers that Tony talks about, in play:

- Channel Partner driven, with the Partner having opportunities in the other municipalities

- 1 of 45,000 municipalities in the US

- A win in the Government/AMER quadrant in the 9 squares model

MONITORING OF AIM SERVICES

AIM has a strong focus on collecting and monitoring of operational data on translation accuracy, latency etc - while needed for auditing etc, from an investors perspective, it gives me confidence that the operational stats that AIM presents will be factual and hence, can be relied upon

COMPETITORS

Translation Technology:

- Hyper scalers who will build and deliver themselves, GoogleMeet, MS Teams, Apple Airpods etc - these are AIM’s product competitors but they are all delivered Direct to Consumer on their devices

- AIM does this translation in an open live environment, doing the translation at source to broadcast with quality control to everyone

Human Translation Competitors:

- Other competitors are the actual human translating competitors

Encoder Competitors

- Largest competitor of encoders - Enco, 20% market vs 80% AIM,

- City of Rialto unplugged Enco to plug in AIM

Not yet seen anyone who has done the orchestration, Live thus far

TONY’S LTIP

Carried with no conversation

THE DEMO

- The Lexi Voice to translate live English to Spanish speech was demonstrated - this was to show the maturity of Lexi Voice in western languages

- Then 2 AIM employees spoke Mandarin and Hindi, respectively - Lexi Text was picking up and displaying the speech into Mandarin and Hindi text almost real time. But speech translation lagged, almost on a paragraph basis. Tony said that while accuracy was to standard, the latency of the voice translation was not - this was what they were focused on addressing in FY26

I thought the Lexi Voice to Spanish was a bit of a non-event as I am a believer that it works, and it worked well.

Having done enough live demo’s myself, the choice of Mandarin and Hindi was rather bold, I thought, as the Voice translation clearly lagged. But I appreciated that boldness and openness to publicly admin it is not yet good enough and in a perverse sense, added to my confidence that they will find a way to get it down to the right level of latency. It does feel like Tony is setting the scene up for something in the Asian-language space for later with the choice of these demo’s .... time will tell what exactly!

Discl: Held IRL and in SM

There is good value monitoring Tony Abrahams' Linked In as his announcements platform.

I can't confess to clearly understand what Playbox Neo is, even after my buddy Chat spat out the info below.

While there is no indication of deal size, I think it is a really good real example of AIM's value proposition, moat, combo of Text + Recorded + Voice product strategy, sticky SAAS revenue, European regulatory tailwind, all playing out in this single deal:

- AIM technical stack inside the PlayboxNeo technical stack - assuming PlayboxNeo feeds content to those ~20,000 channels live/recorded, AIM is plugged into that direct pipe, this could well be a moat inside a moat setup - very nice!

- Combo of Lexi Text, Recorded and Voice - the holy trinity of translation!

- New logo Europe customer with 23 human employees in 2023 who just added a no-human technical service to be European regulatory compliant

- 20,000 channels globally , 120 country reach - presents a really good upselling opportunity when AIM adds more countries to its capability - technically, they should be able to turn on each country as soon as AIM is country-ready

- Which translates into Lexi Network minutes + Lexi Text + Lexi Recorded + Lexi Voice minutes.

PLAYBOX NEO DEAL

A new deal with PlayBox Neo was announced 2 days ago.

Key components included:

- ALTA 2110 IP Encoder – Supports SMPTE ST 2110 workflows, delivering same-language and translated captions with ultra-low latency.

- LEXI Text – Automated captions with broadcast-grade accuracy, powered by AI-Media’s Topic Models for speaker names, technical terminology, and brand-specific language.

- LEXI Recorded – Pre-recorded captions produced in less than half the program runtime.

- LEXI Voice – Real-time multilingual voice translation for live and on-demand content, extending reach globally.

WHO/WHAT IS PLAYBOX NEO

Products & Services

- PlayBox Neo is a company that builds broadcast / media-playout / playout automation / channel branding and streaming solutions. Key offerings include:

- Channel-in-a-Box systems, which integrate several functions needed to run a channel: playout automation (AirBox Neo), live ingest (Capture Suite), scheduling (ListBox), graphics (TitleBox Neo), etc.

- Cloud2TV: a cloud-based virtual playout / cloud playout solution enabling remote operations / flexibility

- Media Gateway: for routing, encoding & decoding, especially in IP / hybrid SDI-IP workflows

- Capture Suite: for live ingest / content acquisition.

- TitleBox Neo / graphics solutions: for interactive graphics, channel branding, overlay, etc.

- Support services: 24/7 customer support, technical maintenance, software upgrades (ASM&TS – Annual Software Maintenance & Technical Support) etc

They provide solutions in hardware, but also software, and as “hardware or as a service” / cloud models.

They serve a broad set of types of TV/branding/plublic/OTT channels: free-to-air, FAST, local channels, corporate channels, satellite, etc.

Customers/channels/reach

They report powering over 20,000 TV and branding channels worldwide.

The geographic reach is “over 120 countries”.

So their “customer base” is fairly large in terms of channel deployments, though the exact number of unique customers (companies) is much lower.

Revenue

This is where public information is more limited. I found some clues, but no reliably confirmed figure for total annual revenue.

- The company has said it had a “record year with increased revenue growth” as of 2024.

- It is described in various sources (e.g. Tracxn) as an unfunded company, meaning it has not raised external investment.

- The number of employees: about 27 employees in 2023 (according to EMIS for the Bulgarian entity).

- Company is based in Sofia, Bulgaria.

I had a go at making some SaaS valuation metric charts. Not sure where to put this, but it's relevant to AIM.

I tried using AI to scrape the data by uploading pdfs but quickly run into free usage limits. I also had issues since I wanted forecast data and non standard metrics like EBITDA.

Once I got the data though, it was easy to create the charts. Disclaimer: completely possible some of the data is wrong, but hopefully direction-ally close enough.

The first chart is backward-looking. It compares EV/LTM (Enterprise Value divided by Last Twelve Months revenue) against the Rule of 40, which I calculated as EBITDA margin plus LTM revenue growth rate.

As we know AIM is cannibalising it's own revenue for growth in higher quality technology revenue. So LTM revenue growth was -2% plus the EBITDA margin of 5% giving a rule of 40 of 3%. It looks to be valued at low EV/LTM for good reason. This is the typical kind of automated valuation something like simply wall street or similar might do.

The second chart is forward-looking. It focuses on ARR (Annual Recurring Revenue) and includes forecasts rather than historical data. This one is EV/NTM ARR against Rule of 40, which is EBITDA margin plus NTM ARR growth rate.

A portion of the technology revenue has been labelled as ARR, which they have guided for 35% growth to $23m. Adding the current EBITDA margin of 5% we get 40%, meeting the rule of 40. Since we don't include all the other revenue in this method, we get a higher EV / ARR of 5.5. I think the median EV / Rev in Australia for SaaS is somewhere around 5.

Arguably, all this is useless, since it is so broad brush and lacking nuance. ARR is not really the same, in IKE's case I actually use Exit Run Rate and it's not so reoccurring. There can also be lots of churn but covered up by the growth of new customers. In RDY case, there a ton of D&A so using EBITDA is pretty dodgy. Perhaps most importantly, it's just a point in time and short-term focused. All that said, It can be a good starting point to understand what characterises a company vs others.

I imagine this is what investment bankers do - chuck this into a slide deck, send to their boss, then spend a few more hours adding logos and changing colours, $400/hr please!

Interesting long format interview on Investorhub with Tony Abrahams.

While a lot of the content will already be familiar to investors, there were several new insights I found interesting, including Tony's articulation of the changing of the guard on the investor register, as well as aspects of how he has led the required transformation within the business, and also more examples of use cases for the tech.

On thing is clear to me, FY26 is going to be an important pivotal year as in 1H "old" services transition to zero, and in 2H we see the emergence of the tech business on its own.

Analogous to the "capital sales to SaaS revenue" transition that many of us have played to great benefit over the last 5 years in several businesses, will we see the same value creation from the Services-to-Tech transition here? Answer = yes, if the tech trajectory is as strong as Tony thinks it will be.

While I am still getting up the learning curve on this one, having held in RL for only 1 year and 8 days (!) - this is one of the small number of stocks in my portfolio for which I have real excitement. (... not necessarily a siccess indicator!)

I love a founder CEO with a bold vision.

Disc: Held in RL and SM

Interesting to see Salter Brothers sold down 2.505m of their 12.08m share holding recently. I would be interested to know why they sold down some of their holdings given the glowing endorsement Gregg Taylor gave to Tony's FY29 target plan in an Aus Biz interview only 10 months ago.

Discl: Held IRL and in SM

The AIM price feels like it is really in a good spot today in that it is “somewhat behaving”, chart-wise.

Bit more volume(at least through the ASX, Chi-X is another story altogether - see other thread on this) as the price tries to push through the 61.5c to 65.5c resistance area. The last time it pushed through was in mid-July 2025, but failed to stay above it, then the results kicked in. As “expected”, the price hit resistance at the 200 SMA line - almost smack bang on the line today.

So, the combo of the 200 SMA and the 61.5c resistance area is a short term hurdle to cross - does not feel like it will cross both today, but hell, it looks like it is trying, as it did last Thurs as well.

We also know some Directors are selling, possibly selling hard. The market seems to have absorbed that selling pressure quite nicely since the results. Tony looks to have done a good job with the fundie road show because whatever the Directors give, the pumped up fundies appear to be taking, it would seem. This absorbing of selling pressure is very reassuring for me as the price is holding strong/pushing upwards, which should mean more believers are jumping onboard.

When the selling eventually abates, and assuming no other drama’s, the price looks to be in a good position to cross and stay above 65.5c, which should be a nice forward base thereafter.

If the selling continues, suspect it will keep moving sideways and bounce between 49c and 61.5c.

My 53.5c top up point on results day looks to be a decent entry point. Still waiting patiently to see if a dip to 49c occurs as I want one more top up bite before it gets out of reach ...

Creating this separate post to take it away from the FY25 results focus.

I listened to the Ausbiz interview which is on the AIM Linked-In page and picked up the following Tony comments that got lost in the FY25 results for me:

LEXI Latency Improvements

- LEXI Text LIVE - the improvement in the last 12 months has gone from "5 to 8 seconds response from a human captioner" to "3 secs minus the human"

- LEXI Voice - the improvement in the last 12M has gone from "30 seconds" to "8 seconds minus the human", Tony believes it can go down to 3 seconds in the next 12-18 months

- Takes speech in original language and translates into text in original language

- Translates original language text to new language text

- Renders new language text to speech in new language

- "This reflects the improvement in the underlying AI engines. AIM essentially plugs in and embeds the latest & greatest AI tools into the customers workflow"

While I seem to have heard these comments in the various preso's Tony has done, I did pause for a bit and went "Wow". That quantum of technology improvement is very impressive, particularly when you breakdown the actual steps as to how LEXI Voice actually works.

Which brings to the following points worth repeating that I think the market is not fully clear about, amidst anything and everything mumbled in the name of AI.

- AIM is not competing in the AI space at all.

- It is a "bring-it-on-gimme-more-AI" CUSTOMER and CONSUMER of AI technology.

- The faster and greater the technology advancements are in AI -> the faster AIM can bake these into the AIM tech stack -> the better the latency improvement -> the more efficient LEXI will be -> the more attractive the LEXI economics become

- I should cheer AI translation improvements, not fear them at all

Whatever your thoughts are on Tony, the one thing that impresses me is his ability to stay very consistently on message.

Where he needs to improve is when the story changes/transitions requiring better explanation - I use "explanation" deliberately vs a more negative connotating "transparency".

Where I myself need to improve is to listen more carefully to what he is saying, to catch and interpret that transition, rather than be caught up in the headlines - this is the only thing within my control ...

Discl: Held IRL and in SM

Post FY25 results

I’ve modelled out to FY28 using a scenario approach.

I have spread my scenarios across what I consider the key sensitivities. The base case reflects only what’s been demonstrated: moderate transcription and customer growth, but no contribution from new products.

In all three cases, I assume flat total revenue in FY26, but technology revenue increases to $49m with higher gross margin. The drag is Asia pacific, there's still cannibalising of service revenue to work through. Services is almost 3x tech revenue here - that's a big shortfall to make up. Coincidentally (or not), they have stated new products (Voice) won't be meaningful until H2 FY26. So in my bull case significant top-line revenue growth, what the market seems to focus on, is forecasted only in FY27 and onwards.

I'm assuming 80% of revenue is at 86% gross margin, with a consistent cost base across all scenarios.

FY28 valuation:

Result = weighted valuation of $0.67.

My interpretation = The market is not attaching value to the bull case, that optionally is free at circa $0.50.

Guess on timeline = Better odds on whether bull case should be known in H2FY26.

------------------------------------------------------------------------------------------------------------

Pre-FY25 results: I had conservative valuation of $0.46 (no scenarios).

Some may wonder why $AIM SP opened up strongly after the release of the results this morning, but then has actually dropped significantly after the investor call.

Before explaining why I think this has happened, I want to say that, in my opinion, $AIM gave a reasonable update today. I haven't gone through it in detail yet, but I'll jot down some of the highlights at the end of this straw.

So What's the Big Deal?

I wonder if anyone else noticed the sleight of hand which - to me anyway - is a significant change in strategy? (I wrote this sentence when the SP was still up amost 10%, and I guess the answer is "yes" lot's have noticed!)

Spot the difference in the following 2 slides: the first is today's at FY25, and the second from 1H FY25.

From today at FY25

From 1H FY25 6-months ago

Put simply, the target for FY29 Tech revenue has come off from $150m to $120m in 6 months.

And so, a continuing Services revenue (being new professional services to help clients embed new products) has been created.

Magically, $30m revenue is targeted for this new Services product, so the $150m overall revenue target remains, but presumably the previous $60m EBITDA will be reduced. However, what the $60m has become was not communicated (but can easily be calculated).

I was a bit slow at picking up this difference (didn't realise until it came up on the Q&A), and so I consider that Tony and his CFO were less clear in explaining the change in thinking.

My Assessment

For those of us who have modelled what a $150m revenue tech business in FY29 looks like in terms of value, the SP today does not reflect this value. In fact, the margin of safety is so large, that there is ample room for several more "downgrades" like today.

If you want to have a quick look, consider @Travisty's recent valuation (noting the discount rate as well as margin of safety applied!)

Pending a deeper analysis of today's result, I think $AIM is making progress. But this material change in just 6 months is - to my way of thinking - a clear demonstration of why a high discount rate and/or factor of safety is warranted for this business.

My assessment of risk also means I will maintain my current position size of 5%.

Should, in future reports, $AIM demonstrate that it can scale towards its lofty ambition, there will be ample opportunity to add more.

Selected Other Highlights

Above, I have focused on the big shift of the day, there is also a lot to like in the FY delivery, including:

- Encoders growing by +39%

- Tech revenue up +19%, accelerating +$23.6m in H2 from +$17.5m from 1H

- Cash balance up by +$3.8m to $14,2m and no debt - aided by change to structure of contracts

- Investment in product fully expensed ($3.5m off EBITDA)

- Expanded from 11 to 25 countries, driven by EU

- LEXI Voice is now being implemented in initial customers, with revenue expected in H2 FY26

- LEXI AI is targeted for launch at the NAB show in April 2026

There are a few technical revenue issues that I need to work through, including it sounds like some restatement of last year. (Note to self to have a closer look.)

Tony peppered the presentation with progress at several high profile clients. A few examples:

AWS is switching off its human services and moving fully to Lexi, one of $AIMs largest enterprise customers, for the live events it hosts. (Breaking news today,....based on accuracy of the AI being better than humans.)

Wins in the US Government (US Congress and US Senate, leveraging a reference case from the US) and Canadian parliament - indicating progress on the Government row of the 9x9..

Conclusion

Long term aspirational targets are a double-edged sword, Initially last year we saw the $AIM SP benefit from them, and today we are seeing it suffer. However, overall, this business is executing its strategy, and is growing strongly, with the new products moving into commercialisation phase and potentially opening up the addressible market.

While the aspiration has been reset, from my perspective, the overall thesis is intact and the changes are relatively minor within the margin of safety.

Disc: Held in SM and RL

AI media reported a 2% decrease in revenue- the market doesnt like it- however as has been laid out here before this misses the fact that tech SaaS revenue is growing whilst the old revenue model is deliberately being phased lower.

tony reiterated his FY29 outlook which may be overly optomistic however there is a large margin of safety at todays current market cap!

encoder sales are increasing

tech sales are increasing

LEXI voice and LEXI AI are expected to contribute to revenue over the next 1-2 years.

i think the market is missing a trick here and i have topped up on todays weakenss making AIM my second largest holding in RL

keen to hear the brains trusts opinions on todays results

Thursday 28 August 2025 Registration link: https://us02web.zoom.us/webinar/register/WN_6mTAMpSbS1W3SgXHuDjzCg Investors will be able to use the Q&A function on Zoom during the webinar, or can submit their questions ahead of the webinar to [email protected] This announcement has been approved for release by the Company Secretary

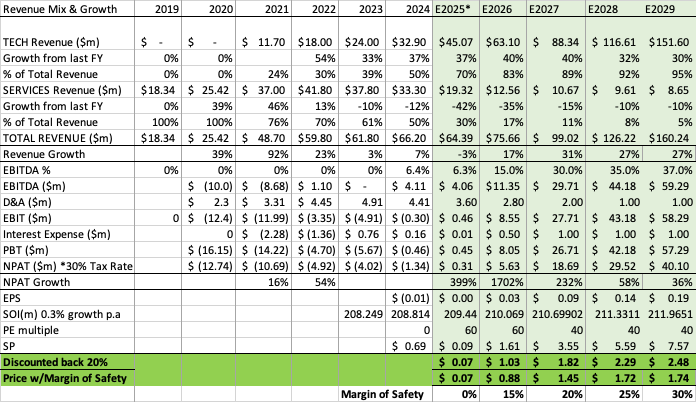

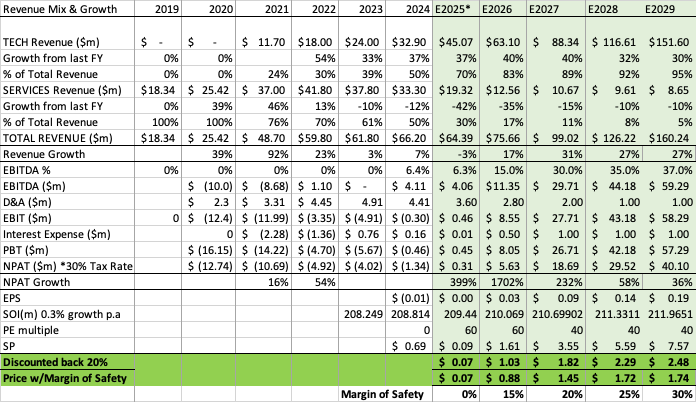

UPDATED VALUATION Ahead of FY25 results (AUG 24th 2025) of $1.74

I forgot to update my valuation and projections post HY25 results in Feb, but I wanted to get ahead of the full year results. Below is an updated valuation table, mainly to the estimated FY25 result.

I know there are a lot of numbers in my projection and only small deviations can change things dramatically. However my thesis is this, at least for the upcoming FY as the first step to the 2029 target:

- Tony has stated many times in interviews over the past 6 months that they expect the transition of TECH to SERVICES REV composition will continue and expect TECH to be at 80% of total REV by Dec 2025. So, I have estimated a 70/30 split between TECH and the declining (on purpose) SERVICES sections for this FY, then at 80/20 split from HY26. *Please note if this is achieved and considering a similar growth in Tech Rev of 37% for FY, then the H2 REV for Services would drop from $14.3m in 1HY25 to ~$6.7m in the 2HY25. A huge drop that may not happen and therefore may surprise on the top line.

- Tony has also mentioned multiple times, including on his most recent Strawman interview that they project $4m in EBITDA, which I have included in my FY25 projection.

- D&A are estimated based on the run rate from HY25 and also comments from previous CFO (John Bird) on the FY24 earnings call. Only thing that would blow this out is if AIM send big on PPE or some intangibles during the 2nd half, but as Tony has said numerous times, they like a "clean balance sheet" and therefore don't like to capitalise asset purchases onto the balance sheet, they prefer to expense it on the P&L.

- While my projection goes out to FY29 to see how things could possibly move towards the stated target of of $150m in REV & $60m in EBITDA (mainly through organic growth using the 9 box matrix outlined as their focus), I have used a very conservative discount rate of 20% as well as using incrementally larger margins of safety on the future years to reflect the additional execution risk.

I'm eager to see how the numbers look and hear what Tony and Jason have to say on Thursday!

Disc. HL in RL & on SM. (one of my largest Small/Micro Cap positions)

SCROLL DOWN FOR UPDATE....

RePost of initial valuation so it's easier to read. Thanks @Bear77 for your guidance on copy & pasting. it worked perfectly!

Hello Straw People!

My name is Travis, and this is my first ever company valuation. I am newbie "premium" member but have been a "free" member for a couple of years now and have thoroughly enjoyed reading through the various forums, straws, and valuations of others, albeit 4 weeks delayed.

My background in finance is limited to some minor study alongside a huge passion for reading and self-education, which is why I decided to become a premium member, as the collective thoughts, experience and truthful and honest feedback provided here I know I will find most valuable in the process of trying to make a rational investment.

*Please note, I was very hesitant to put my valuation and thoughts out there as I am a novice investor and far less experienced than many here and I assume off the bat that I will have errors in my judgement and analysis that will be highlighted, for which I am ready for and implore you to provide constructive critic and highlight were I may be biased in my thinking!

Before I start, please let me apologise if I babble on, repeat myself or just plainly confuse some with my explanations.

The aim of my valuation (no pun intended) and time of posting was to get It out there prior to the release of the Annual Report on Thursday.

Ok, back to my valuation. I have been a shareholder of AI-Media for just over 12 months and found out about the company here first, alongside @Wini’s previous appearances on the Coffee Microcaps webcast. Which alongside the Meetings on Strawman (which I finally have access too) I find this to be a great way to discover and hear from Small Cap companies.

I hope to write at length about the specifics of my thesis in time, however at this stage the valuation is based on a few important factors that I believe the company has in place and the opportunities in the future.

1. Founder led company, with Tony being extremely passionate and knowledgeable about the company and how Ai-Media’s product suite fits into the workflows of its customers.

2. He has considerate Skin in the Game, which should align our goals of increased shareholder value.

3. They have a product suite in which the Falcon Encoders are imbedded into the workflow of customers, with Lexi sitting on top to provide a captioning service that is faster, more accurate and 90% cheaper than current Human in the Loop captioning.

4. They have a tailwind with advancement of Ai technology, while also having several additional markets to build on. The market matrix of 9 sections was a highlight of the growth potential Americas/Broadcast (currently the biggest Rev generator), Americas/Government, Americas/Enterprise, EMEA/Broadcast, EMEA/Government, EMEA/Enterprise, APAC/Broadcast, APAC/Government, APAC/Enterprise.

5. The market may not be entirely aware of the Tech growth part of the company’s Revenue and how that transition of revenue mix is going accelerate their revenue growth, their margin expansion and EBITDA to get to the FY29 target of $150m in Revenue and $60m in EBITDA.

Which brings me back to my valuation. While it is detailed, I have tried to use as many numbers as possible that are historical, not too outrageous as well as any information I could obtain from the financials both in the reports and from the webinars that Tony and John Bird (outgoing CFO) have held over the past 3-4 years.

Below is my DCF for the company out to FY29 to see what is required for them to get to the target Tony has spoken about. Please note, DCF’s aren’t my forte and I’m sure I’ve made glaringly obvious mistakes, so please point them out to me as I need as many honest minds to provide me with feedback.

NOTES to my DCF:

- EBITDA Margin is based on a progression to 40% by FY29 to get the $60m target amount.

- SOI growing by 0.3% based on the growth from FY23-FY24. Tony and John have said they have no intention to capital raise, which should limit SOI growth.

- D&A future estimates based on CFO (John Birds) comments in FY24 results webinar. See at 1h5min mark here. Although he expects D&A to drop to around $0.5m in 3-4yrs. I’ve kept it higher in case of future acquisitions that they decide to capitalise on the balance sheet.

- Interest Expense based on a conservative future amount. I don’t foresee AIM requiring any debt to fund future growth, as Tony and John have said numerous times that it will be funded with cashflow. However, I thought I would include some interest expense just in case.

- PE is the most difficult variable to add in the mix. I went with a 40x multiple in FY27-FY29 based purely on a conservative multiple for a company averaging 146%pa NPAT growth between FY25-29.

- I’ve used a 20%pa. discount rate as well as a tiered Margin of Safety to account for the risk projecting so far into the future.

So, there it is! My first ever Strawman Valuation for $1.61 for Ai-Media (AIM).

Please let me know where I might be wrong in my calculations, or where I may have stated lofty or incorrect numbers that could have affected my valuation.

Disc. I hold shares in RL & on SM.

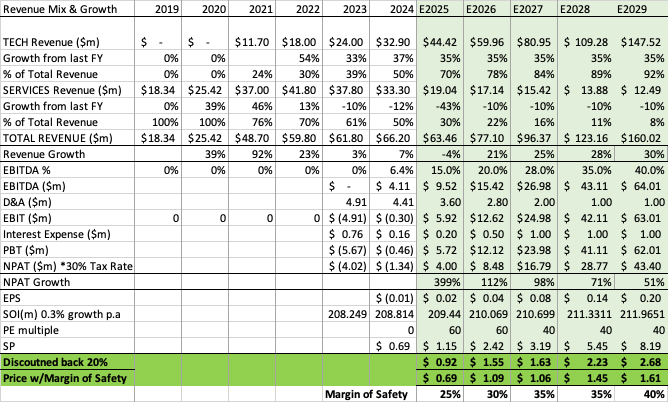

UPDATED VALUATION Ahead of FY25 results (AUG 24th 2025) of $1.74

I forgot to update my valuation and projections post HY25 results in Feb, but I wanted to get ahead of the full year results. Below is an updated valuation table, mainly to the estimated FY25 result.

I know there are a lot of numbers in my projection and only small deviations can change things dramatically. However my thesis is this, at least for the upcoming FY as the first step to the 2029 target:

- Tony has stated many times in interviews over the past 6 months that they expect the transition of TECH to SERVICES REV composition will continue and expect TECH to be at 80% of total REV by Dec 2025. So, I have estimated a 70/30 split between TECH and the declining (on purpose) SERVICES sections for this FY, then at 80/20 split from HY26. *Please note if this is achieved and considering a similar growth in Tech Rev of 37% for FY, then the H2 REV for Services would drop from $14.3m in 1HY25 to ~$6.7m in the 2HY25. A huge drop that may not happen and therefore may surprise on the top line.

- Tony has also mentioned multiple times, including on his most recent @Strawman interview that they project $4m in EBITDA, which I have included in my FY25 projection.

- D&A are estimated based on the run rate from HY25 and also comments from previous CFO (John Bird) on the FY24 earnings call. Only thing that would blow this out is if AIM send big on PPE or some intangibles during the 2nd half, but as Tony has said numerous times, they like a "clean balance sheet" and therefore don't like to capitalise asset purchases onto the balance sheet, they prefer to expense it on the P&L.

- While my projection goes out to FY29 to see how things could possibly move towards the stated target of of $160m in REV & $60m in EBITDA (mainly through organic growth using the 9 box matrix outlined as their focus), I have used a very conservative discount rate of 20% as well as using incrementally larger margins of safety on the future years to reflect the additional execution risk.

I'm eager to see how the numbers look and hear what Tony and Jason have to say on Thursday!

Disc. HL in RL & on SM. (one of my largest Small/Micro Cap positions)

25th July 25

Tracking along nicly so far though looking forward to hearing everyone’s comments once figures are released. Im figuring, this climb as far as most are concerned here, would be in anticipation of better figures at this stage, right?

Tracking along nicly so far though looking forward to hearing everyone’s comments once figures are released. Im figuring, this climb as far as most are concerned here, would be in anticipation of better figures at this stage, right?

Im not completely convinced we are seeing the turnaround of the bottom of what could be the last Super W2 down. There maybe a little further to drop. It all depends on weather the next retrace of a small w2 drops lower than the last recent major low, which would then open the door for five waves down. Sorry about the rambling or repeating myself.

See my Google drive for todays screen recording of the chart update and thoughts

Herein lies a three part interview by Pete "Tec Man" Coman with Tony Abrahams, Filmed at Infocomm 2025

Part One:

Part Two:

Part Three:

Very Similar Approach to @DrPete

Assume 3 future growth outcomes from Tony ambitious FY29 $150m down to rate growth 7% per year ($93m). Assumed share count will growth 5% per year and Net margins of 8% like @DrPete did in his valuation. PE for highest growth of 25 and 15 for low growth scenario of 7% per year. Blend 3 scenarios discounted back at 10% per year gives me $0.365.

Note: Deanne Weir no longer on the board and has recently sold AIM shares refer annoucement https://announcements.asx.com.au/asxpdf/20250317/pdf/06gqbgly00tqbn.pdf

Current Market Cap of Ai-Media at $0.53 is $110.6m

Recent Management Buying Summary

Buy

Otto Berkes

· 13 June 2025

26,315 price $0.57 per share ($15,003.74)

Brent Cubis

· 10 June 2025

35,000 price $0.555 per share ($19,425)

Anthony Abrahams

· 16 December 2024

312,500 price $0.80 per share ($250,275)

Cheryl Hayman

· 9 December 2024

50,000 price $0.86 per share ($42,887.39)

Management Bio's

John Martin - Non-Executive Chair (appointed February 2024)

John joined the Board in 2010 and served as Chair until 2013, NED until 2024 and has been re-elected as Chair in February 2024. He is an experienced company director and business executive, having served as CEO and director of ASX-listed Babcock & Brown Communities, Primelife and Regeneus. He is a former corporate and commercial partner of law firm Allens. John is a Non-Executive Director of Australian law firm Sparke Helmore; Sydney biotech company Biopoint; US internet services company Lokket and Melbourne not for- profit CCRM Australia. He is also a member of the Australian Institute of Company Directors.

Alison Loat - Non-Executive Director

Alison is the Managing Director, Sustainable Investing and Innovation at OPTrust, a Canadian public pension plan. Previously, she was the Senior Managing Director of FCLTGlobal, a long-term investing organization, the CEO of a think tank and a consultant at McKinsey & Company. She’s also on the board of two Canadian educational institutions and a privately held media company. Alison received the Queen’s Gold and Diamond Jubilee Medals and was named one of the 100 Most Powerful Women in Canada. She received the ICD designation from Canada’s Institute of Corporate Directors. She has degrees from Queen’s University and the Harvard Kennedy School.

Cheryl Hayman - Non-Executive Director

Cheryl joined the Board in March 2022. Has extensive experience working as an independent Director across multiple sectors including ASX-listed companies as well as industry bodies and not-for-profit organisations. Cheryl is currently on the board of Silk Logistics Holdings (ASX:SLH) [Chartered Accountants ANZ and Guide Dogs NSW/ACT]. Cheryl’s corporate experience encompasses a range of senior strategic technology, digital strategy roles and global marketing roles including Head of Marketing and Innovation at Sunrice, George Weston Foods, Unilever Australia, NZ and UK, Yum Restaurants International and Who Weekly magazine. Cheryl is a Fellow of the Australian Institute of Company Directors and a Fellow of the Governance Institute of Australia, and serves as Chair of AIM’s Remuneration and Nomination Committee and member of the Audit and Risk Committee .

Brent Cubis -Non-Executive Director

Brent joined the Board in July 2024 and is Chairman of the Audit and Risk Committee. Brent is a highly experienced Non-Executive Director and CFO with over 30 years of board level experience in senior finance roles for global businesses in Health, Medical Devices, Media, Property, Tourism and started his career at Deloitte. Brent has been the Chair of the Audit and Risk Committees for all the public and private companies outlined below. His previous executive roles have included CFO of Cochlear Ltd and Nine Network Australia and for various other private companies.

Brad Bender - Non-Executive Director

Brad was appointed as a Director in November 2024 and brings over 25 years of global experience in technology, product innovation, and general management. As Vice President of Product Management at Google, he led AIdriven initiatives for Google News and Search Ecosystems, including the transformation of Google’s News experience and AI-driven initiatives reaching billions of users worldwide. Earlier in his career at Google, he founded the Google Display Network, growing it into a multi-billion dollar business. Before Google, Brad was Vice President of Product Management at DoubleClick. Brad’s expertise spans product innovation, AI-driven solutions, and scaling global technology platforms. A holder of multiple patents in data and privacy, Brad was named a Crain’s New York Business "40 under 40" leader in 2012. He holds a Bachelor of Science degree from Cornell University and is currently an advisor, investor, and board member to a range of start-ups, businesses, and nonprofits across the tech, media, entertainment, and services industries, including currently serving as an independent board director at Entravision (NYSE:EVC).

Otto Berkes - NON-EXECUTIVE DIRECTOR

Otto Berkes received a BA in Physics from Middlebury College and an MS in Computer Science and Electrical Engineering from the University of Vermont. He was an Xbox co-founder at Microsoft where he drove groundbreaking hardware and software innovation in computer graphics, home entertainment, mobile devices, and cloud services. After an 18-year tenure, he moved to HBO to build their video streaming services, and, as CTO, to lead their technology division and to champion the company’s digital transformation. He subsequently joined CA Technologies as EVP to spearhead new product incubation and to direct the company’s shift to cloud services and subscriptions. After the company’s acquisition by Broadcom, he joined Acendre’s board and later accepted the CEO role. Through a combination of acquisitions and organic development, be created HireRoad, an end-to-end analytics-driven talent platform. Otto is coinventor on thirteen patents, a recipient of Microsoft’s Xbox Founder Award, an Emmy Award, and an Edward R. Murrow Award. He is the author of Digitally Remastered: Building Software into Your Business DNA, a book about digital transformation in the enterprise and the new role of software. He recently completed a six-year term as a trustee for the University of Vermont and is a member of the board at Integral Ad Science, a leading advertising technology business, Intelagree, an AI-driven contract management solution, and AI Media, a global provider of AI-powered captioning services. Otto currently pursues his passion for software engineering writing apps for weather enthusiasts that are available in Apple’s App Store.

Tony Abrahams - CO-FOUNDER AND CEO

Tony Abrahams co-founded AI-Media in 2003 and has led the company as CEO from inception, through a period of significant transformation. Driven by a passion for technology and inclusion, Tony has steered AIMedia from its origins in human-based captioning to becoming a global leader in AI-powered language solutions. He was the force behind the acquisition of EEG, a U.S.-based tech company whose innovations - including the LEXI automatic captioning engine and iCap delivery network - have been central to AI-Media’s shift toward real-time, scalable captioning and translation technology. Today, AI-Media’s solutions help broadcasters, enterprises, and governments deliver accessible content to audiences worldwide. Tony holds a Bachelor of Commerce (Honours) and Bachelor of Laws from the University of New South Wales, where he was awarded the University Medal in Accounting. As a Rhodes Scholar, he completed both an MPhil in Economics and an MBA at the University of Oxford. While at Oxford, he contributed to the establishment of the Oxford Internet Institute, which researches the societal impact of the internet. Tony’s commitment to social impact extends beyond AI-Media. He served as a Director of Northcott Disability Services from 2010 to 2018 and was named a Young Global Leader by the World Economic Forum in 2013. A member of the Australian Institute of Company Directors since 2006, Tony continues to advocate for technology that drives both innovation and meaningful inclusion.

TLDR

- Despite the recent share price decline, there is still a lot of hope built into the current share price. To generate a reasonable risk-adjusted return, the current price assumes the company can sustain 15% growth over the next 5 years and hit a high NPAT around 8%. That might be achievable, but it is a big ask.

- The current market cap around $100m is pretty generous for a company still generating a statutory loss, with revenue fairly flat over the last 3 years, facing existential risk with technology transformation.

- I think a more likely outcome is around 10% pa growth, reaching 6% NPAT in FY30. With a still generous PE of 20, that’s a market cap in 5 years of $128m. That’s not a lot higher than the current market cap of $106m, especially factoring in share dilution over the next 5 years.

- At current share price ($0.53 at time of writing), I get an expected and disappointing ROI of 4% pa over the next 5 years.

- Applying a 15% discount rate (needed, I believe, to justify AI-Media’s size, risk and illiquidity), and weighting across bull and bear scenarios, I get a current fair price of $0.32. Or if I use a 10% discount rate, a fair price around $0.40.

- I realise I’m at odds with the current high valuations from others on Strawman. But based on my expectations and perceived risks, I have to call the company a Sell. I’ll maintain my current small holding until the FY25 results come out. But unless they boost my confidence, I’ll then back out.

Bull case

- AI-Media is in the middle of an aggressive transformation from services to technology-driven solutions.

- Despite being a long-established business (22 years), the company has shown impressive willingness to cannibalise its old service-heavy operating model and experiment rapidly with emerging AI technologies. AI-Media may be an early strong example of the transformational power of AI.

- The business appears to be at a profit inflection point. Statutory losses were substantially reduced in FY24 and the business now has positive operating cashflows which will grow quickly with increasing high-margin technology solutions.

- Cash was up $3.6m in FY24 and another $3.3m in H1FY25.

- Has no meaningful debt.

- We’re starting to see the wisdom behind the purchase of EEG in 2021. Being the market leader in encoders looks like a huge advantage for growing market leadership in transcription.

- Its 22-year successful history in the industry gives AI-Media a strong footprint, network and positive reputation.

- There has been a swag of products released in the last couple of years under the Lexi brand (eg, Recorded, Disaster Recovery, Voice Brew). Also, the iCap cloud platform, used by all major industry players has now been monetised, generating revenue from all 3rd party users.

- AI-Media can capitalise on the rapidly growing power of AI, without the capital costs of developing AI models or locking into a single AI model. As AI models improve, AI-Media can switch models to ensure the best outcomes.

- Tony has an aspirational target of $150m in revenue (vs $66m in FY24) and $30m EBITDA in FY29 (vs $4m in FY24 and $4m also forecast for FY25). Getting only 75% of the way to the FY29 EBITDA target will produce a healthy ROI for investors.

- At the recent InfoComm 25 conference (a massive international conference) AI-Media won 4 “best in show” awards as well as a “best AI solution” award.

- AI-Media has been working with some great customers and partners. Amazon, with all its AWS AI grunt, uses AI-Media for its own event broadcasts, openly spruiking the benefits of AI-Media in a LinkedIn article, posting images of EEG/iCap encoders, and explaining how they are going to expand their transcription offerings at subsequent events.

- Tony, the CEO, is a passionate and knowledgeable advocate for the business; he is a strong communicator and networker.

- While cheap and free transcription services are ubiquitous, there is still a business case for clients paying for a market leading provider to deliver these technologies to ensure maximal security, redundancy, speed, accuracy, tailoring to unique contexts, installation, oversight, etc.

- Valuation:

- I think we should take Tony’s FY29 targets with a large grain of salt. Even he is calling these “aspirational”. But let’s say he can achieve 75% of these targets. So let’s assume FY25 revenue is flat at $66m (given H1FY25 showed a small decrease), with 5-year revenue CAGR around 14%, NPAT of 8% and terminal PE of 25. That gives an FY30 market cap around $260m.

- I’ll allow for 15% dilution along the way (there is already 5% dilution locked in from retention incentives; it seems reasonable to assume another 10% for incentives, acquisitions or just financial support across 5 years).

- That will give an ROI around 15% pa over the next 5 years.

Bear case

- The transformation case for AI-Media is not yet proven. H1FY25 revenue declined marginally as lower-revenue technology solutions cannibalised previous higher-revenue services. Guidance is that EBITDA for FY25 will match FY24. This lack of short-term growth in revenue and margins doesn’t provide great confidence in the ability of the business to achieve its long term aspirational targets.

- The recently introduced generous retention schemes for the CEO and key leaders, with no performance contingencies attached, seem excessive and not well justified.

- The Board members are excessively paid for the size and success of the company, with the Chairman earning around $150k and other Directors around $100k.

- Based on publicly available demos, the AI-only live transcription models are of questionable quality. The better demos still involve some level of human input in the form of oversight of AI output and/or context-specific tweaking of the AI-models. I’d like to see higher quality AI-only demos to develop greater confidence in the product on which the future of the company depends.

- If the AI-Media models aren’t yet strong, and don’t improve quickly, AI-Media will still rely on human-based captioning and won’t hit its target of 80% technology solutions by Dec 2025. In which case it won’t be on track to hit anywhere near its ambitious FY29 targets of $150m revenue and $30m EBITDA.

- I don’t understand how some of the reported statistics match the financial measures. Eg, Tony has said output has increased from 1 million minutes in 2020 to 120 million minutes in 2025. How does this reconcile with revenue roughly doubling in that time (and flat over the last 3 years)? Why has 120x in output resulted in only 2x in revenue and still unprofitable? Perhaps the result of an extremely competitive market? Is the increased output much lower quality and hence worth less? Seems like customers have benefitted much more than AI-Media from the technology transition.

- The technology for transcriptions and translation is changing rapidly. It is possible that the value delivered by AI-Media gets captured by other big or small providers, or gets commoditised into a low or negative margin offering. The ultimate test of whether AI-Media delivers unique value will be shown when it can grow revenue, which right now it isn’t doing.

- Valuation:

- H1FY25 results weren’t overly inspiring for growth, with revenue and EBITDA declining. We could see FY25 results largely mirror FY24 results. The financial boost Tony is spruiking may be harder to achieve than expected. It’s possible that revenue growth is a sluggish 5% pa over the next 5 years (which will be better than it has achieved over the last 3 years).

- With slower growth, and a higher than desired percentage of revenue coming from services, margins will be slow to improve. Perhaps they achieve 4% NPAT in 5 years.

- With a terminal PE of 12, that’s a market cap of $40m in 5 years, less than half what it is today.

- Assuming 15% dilution along the way, that gives an ROI of -21% pa over the next 5 years.

Base case

- Valuation:

- Assuming the future is somewhere between the above bull and bear cases, I’ll guess 10% pa growth over the next 5 years. With a still-healthy NPAT of 6%, and a solid PE of 20, that’s a market cap of $128m in FY30.

- Allowing for 15% dilution, that will be 0% ROI pa over the next 5 years.

- Given a slight asymmetry in the bull and bear scenarios, when weighting across scenarios, I get a slightly higher $156m market cap in 5 years, giving 4% ROI pa.

- Given the size, risk and illiquidity of AI-Media, I’d want 15% return. If I use this as my discount rate, I get a fair current price around $0.32. I know others like using a standard 10% discount rate, in which case the fair price is $0.40.

- I have to admit I was disappointed when I ran these numbers. I am intrigued by AI-Media, and had started accumulating a position while I was doing my research on the company. My instinct was that it presented a good opportunity.

- But in reality, despite the recent share price decline, there is still a lot of optimism built into the current share price. At the current price, to achieve a 15% pa return over the next 5 years (a return that I think is the threshold to justify the risk), the company has to grow at 15% pa, reach an impressive NPAT of 8%, be granted a PE of 25, and not dilute more than 15%. Those are lofty expectations, especially given the current lack of growth.

- AI-Media is a $100m company that is still running at a statutory loss with revenue fairly flat over the last 3 years.

- Despite having recently started accumulating AI-Media, based on the above numbers I have to call the company as a Sell. In reality, I’ll hold until the FY25 financials come out. If the results increase my confidence in my bull case, I’ll continue to build. If not, I’ll wind down.

Stock Ideas

Shout out to @Shapeshifter who put me on to AIM's involvement in Infocomm 2025.

Some scrolling put a couple of videos in front of me.

I have been keen to see AIM's services in operation and get an understanding of the real world uses.

This interview was billed as " the first-ever trilingual live broadcast in English, Spanish, and German" a live translation from English to German and from English to Spanish. The presentation came across a little clunky to me. Maybe as a result of the TV production teams work?Interesting non the less.

The following is part one of a three part interview with Pete "Tea Man" Connan and Tony Abrahams in New York recently: