Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 4.56% and in SM

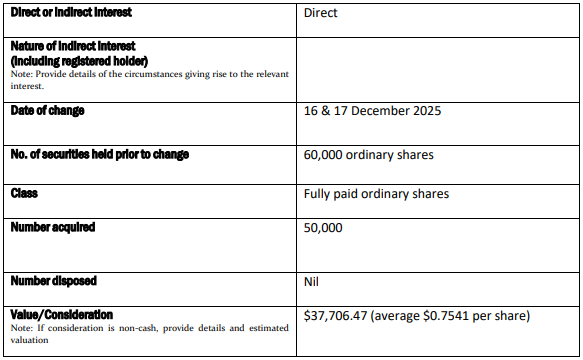

Very nice to see Brad Bender, one of the 2 high-profile-ish US-based directors AIM appointed in Oct 2024, top up his shareholding of AIM by ~83%. He added 50,000 shares to his initial 60,000 holdings from Dec 2024.

The value of $37.8k is small coin in USD, but better to see him buying than not.

Discl: Held IRL 4.84% and in SM

The AIM chart is looking very interesting from a top-up perspective.

- Fell right through the 74.5c to 80c level which I thought would be decent support

- 72c is the 50% retracement level - “usually” a decent place to top up

- But better support could come at ~68c which is looking to be at the confluence of (1) support from the 1 year + uptrend line (2) the 200 Simple Moving Average and (3) ~60% retracement

- Failing which, there should be decent support at 61.5c to 65.5c

I suspect I will start nibbling at around 68c at this stage ...

Discl: Held IRL 5.23%, and in SM

Just watched a Tony Abrahams interview on MediaTechTalk released a day ago.

As with all Tony interviews, 95% of the story is familiar, but I still end up walking away engaged throughout the interview, and with some new nuggets of information that I find valuable in further entrenching my already-high conviction:

He ended the session with this quote from the late Leonne Jackson, AIM co-founder:

Accessibility benefits everyone - access to communication should never be a privilege - that conviction is in every product that we ship today.

This point alone resonated with me as this is what David Gardner talks about in the 4th Habit of a Rule Breaker Investor - Follow the Four Tenets of Conscious Capitalism where the 1s tenet is “Invest in companies who put purpose over profit and the Snap Test (would anyone notice or anyone care if the company disappears overnight)”. I think I just found clarity in AIM’s purpose and Snap Test ....

Other Points:

- 86% of 18-24 year olds watch everything with captions - this emphasises the necessity of the AIM product. I absolutely see this in my 17 year old daughter (I can’t stand the captions!)

- Aust had Disability Legislation mandating captioning in 2000, which gave rise to AIM, Europe passed the European Accessibility Act legislation in June 2026, AIM now does not have the same growth constraint that it had with re-speakers, to meet this European legislative-driven demand

- Emphasised the deep integration to each customers media-management systems to provide the customer-centric context for the captioning and translations - this was built during the re-speaker period

- Spent ~$40m to build the technology between 2010 and 2020 - always knew that AI would appear, but did not know WHEN that would happen - the re-speakers were an intermediary solution

- This is another key attribute that I like in my companies - investing to build the capability to scale up ahead of time, so that the technology stack readiness to scale is not a hindrance, there is no catch up, it is execution

- CAT did the same thing when Will Lopes came onboard, as did SDR during Covid

- We are not re-building any core technology that is out there - we are reapplying that technology to B2B workflows in a live environment - this is really worth re-emphasising with respect to competition

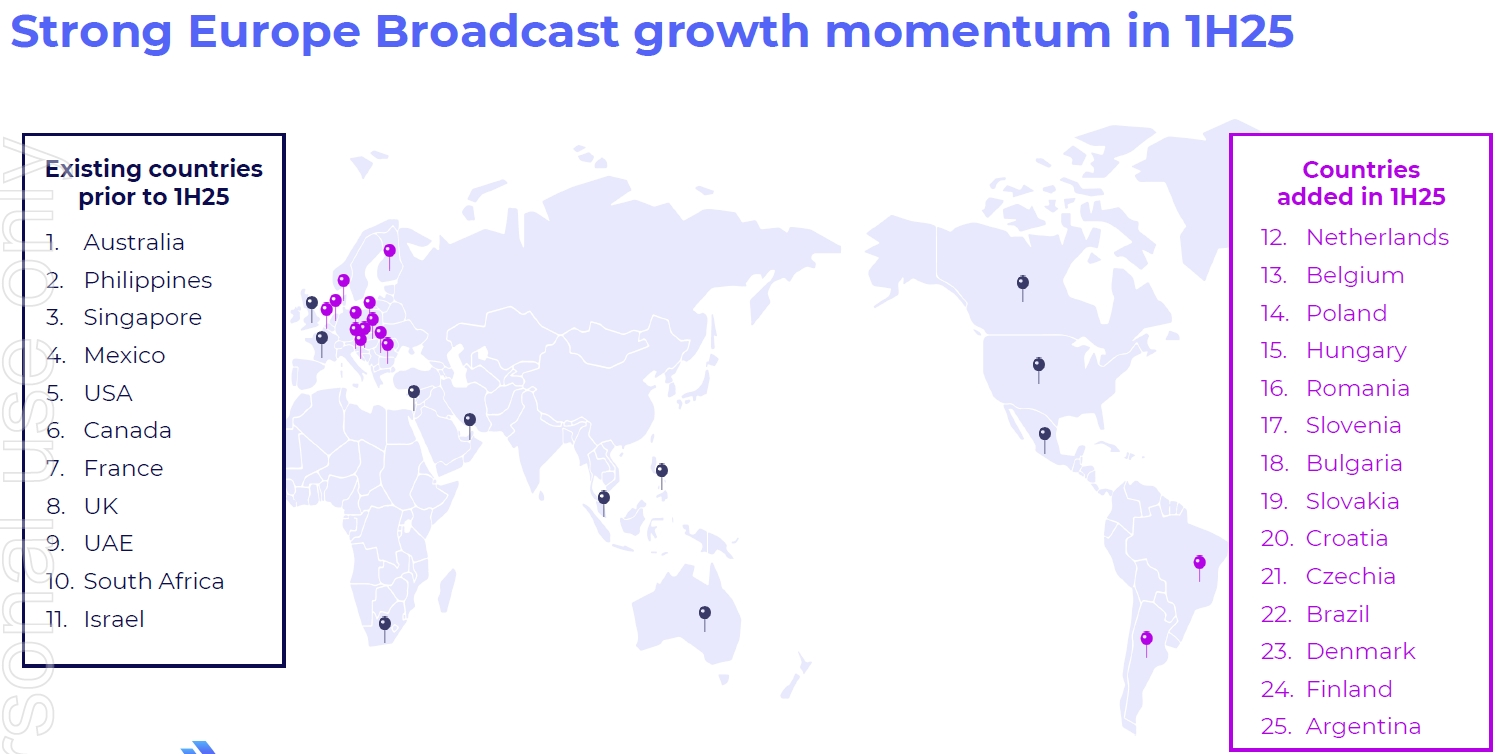

- Growth of EEG encoder country’s - took 18M to get the 1st country outside of the US to work, 6M to the second country working, 4 years later in 39 countries - core broadcasting standard differences that needed to be overcome between the US and the Rest of the World

- US Broadcasters are coming to AIM - spending 4x more than what they were spending 4 years ago, but saving $3-$5m per year from eliminating humans in the loop, every other country, need to knock on doors

Firstly, apologies for the effusive flattery and praise towards Tony on my part during the interview. Very poor form, and not the kind of neutral, objective style that best serves your interests. So please keep my bias in mind, and be sure to push back in any areas that are warranted.

I just give a lot of credit to a business leader than can deliberately disrupt their own business when the structural winds of change are blowing, especially when such a move will hit revenues and free cash flows in the interim, and also when the payoff for the pivot and associated investments are uncertain.

Also, and Tony himself made this point, it's noteworthy that he's been pretty consistent in what he has said previously, and what he has delivered. That's not too common on the ASX, so credit where it is due.

Anyway, I wont rehash some of the key observations with this business. They've been made before (see past interviews and the company page).

A few of the key points from this discussion:

- R&D and product development is largely complete. They are now firmly focused on the ongoing commercialization of the product.

- No acquisitions are on the radar, and in fact Tony was very forthright on this.

- Their partner sales model will allow them to grow much faster and much cheaper than any direct sales model, and speed is critical given the land grab that is underway

- Voice is a far larger market than text (transcription), about 30x larger, which is a big part of how they arrive at their ambitious FY29 targets.

- They have some impressive directors on the board, which should not only add great experience, but also open doors.

- Looks like a NASDAQ listing is on the radar, and they have been moving towards this for some time. Most of their business is there and they have been presenting their accounts in a US friendly manner for this exact reason.

- AI adoption in live translation has hit an inflection point -- “voice is where text was 23 months ago.”

- ASX liquidity has significantly improved. This is interesting only in the sense that it puts AIM in play for larger institutional investors.

It feels like there's a lot of upside if the company can indeed deliver on their FY29 targets. But let's say they only get halfway there ($30m in EBITDA, or lets call it $15m NPAT) at a PE of 20, that's a market cap of $300m, compared with $180m today. Not a terrible margin of safety.

[Held]

Discl: Held IRL and in SM

Looks like Tony's hard sell on the AIM results to the market is paying off ... not sure what drove the 12.4% pop today, but a few things to note from the charts:

- It hit the 52 week high today at 0.95 - it was last here in Dec 2024

- Always nice to see a pop on decent volume - today's volume looks really good

Zooming out, the price is now firmly in the 90.5c to 99.0c zone - lots of history in this zone going back to 2021/2022, which it will have to digest before moving higher.

I do expect it to churn around at these levels for a bit.

But thats one hell of a journey in these 4-5 years-ish - went to hell, literally, it looks like it is moving towards the Heavens now ...

Interesting long format interview on Investorhub with Tony Abrahams.

While a lot of the content will already be familiar to investors, there were several new insights I found interesting, including Tony's articulation of the changing of the guard on the investor register, as well as aspects of how he has led the required transformation within the business, and also more examples of use cases for the tech.

On thing is clear to me, FY26 is going to be an important pivotal year as in 1H "old" services transition to zero, and in 2H we see the emergence of the tech business on its own.

Analogous to the "capital sales to SaaS revenue" transition that many of us have played to great benefit over the last 5 years in several businesses, will we see the same value creation from the Services-to-Tech transition here? Answer = yes, if the tech trajectory is as strong as Tony thinks it will be.

While I am still getting up the learning curve on this one, having held in RL for only 1 year and 8 days (!) - this is one of the small number of stocks in my portfolio for which I have real excitement. (... not necessarily a siccess indicator!)

I love a founder CEO with a bold vision.

Disc: Held in RL and SM

Interesting to see Salter Brothers sold down 2.505m of their 12.08m share holding recently. I would be interested to know why they sold down some of their holdings given the glowing endorsement Gregg Taylor gave to Tony's FY29 target plan in an Aus Biz interview only 10 months ago.

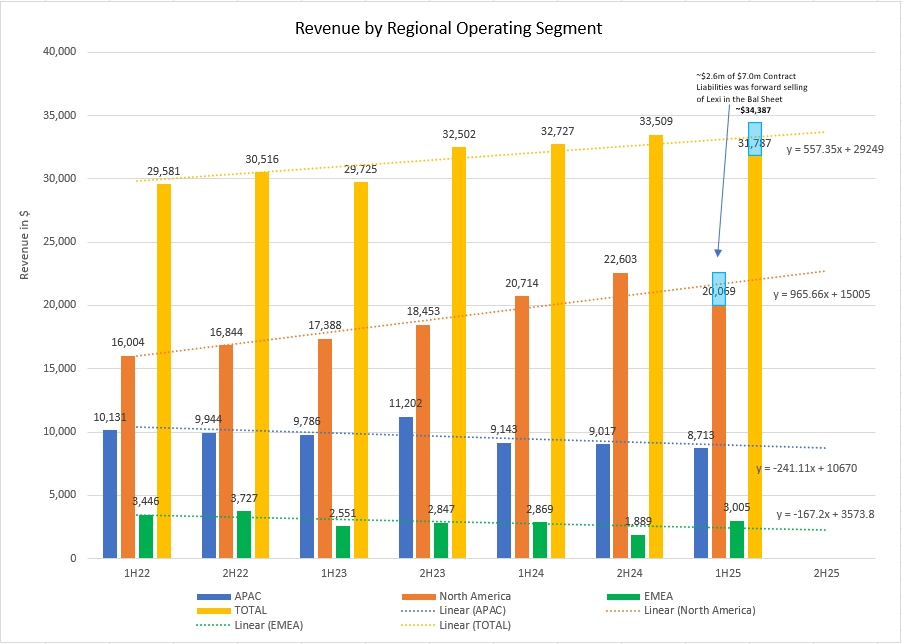

Some may wonder why $AIM SP opened up strongly after the release of the results this morning, but then has actually dropped significantly after the investor call.

Before explaining why I think this has happened, I want to say that, in my opinion, $AIM gave a reasonable update today. I haven't gone through it in detail yet, but I'll jot down some of the highlights at the end of this straw.

So What's the Big Deal?

I wonder if anyone else noticed the sleight of hand which - to me anyway - is a significant change in strategy? (I wrote this sentence when the SP was still up amost 10%, and I guess the answer is "yes" lot's have noticed!)

Spot the difference in the following 2 slides: the first is today's at FY25, and the second from 1H FY25.

From today at FY25

From 1H FY25 6-months ago

Put simply, the target for FY29 Tech revenue has come off from $150m to $120m in 6 months.

And so, a continuing Services revenue (being new professional services to help clients embed new products) has been created.

Magically, $30m revenue is targeted for this new Services product, so the $150m overall revenue target remains, but presumably the previous $60m EBITDA will be reduced. However, what the $60m has become was not communicated (but can easily be calculated).

I was a bit slow at picking up this difference (didn't realise until it came up on the Q&A), and so I consider that Tony and his CFO were less clear in explaining the change in thinking.

My Assessment

For those of us who have modelled what a $150m revenue tech business in FY29 looks like in terms of value, the SP today does not reflect this value. In fact, the margin of safety is so large, that there is ample room for several more "downgrades" like today.

If you want to have a quick look, consider @Travisty's recent valuation (noting the discount rate as well as margin of safety applied!)

Pending a deeper analysis of today's result, I think $AIM is making progress. But this material change in just 6 months is - to my way of thinking - a clear demonstration of why a high discount rate and/or factor of safety is warranted for this business.

My assessment of risk also means I will maintain my current position size of 5%.

Should, in future reports, $AIM demonstrate that it can scale towards its lofty ambition, there will be ample opportunity to add more.

Selected Other Highlights

Above, I have focused on the big shift of the day, there is also a lot to like in the FY delivery, including:

- Encoders growing by +39%

- Tech revenue up +19%, accelerating +$23.6m in H2 from +$17.5m from 1H

- Cash balance up by +$3.8m to $14,2m and no debt - aided by change to structure of contracts

- Investment in product fully expensed ($3.5m off EBITDA)

- Expanded from 11 to 25 countries, driven by EU

- LEXI Voice is now being implemented in initial customers, with revenue expected in H2 FY26

- LEXI AI is targeted for launch at the NAB show in April 2026

There are a few technical revenue issues that I need to work through, including it sounds like some restatement of last year. (Note to self to have a closer look.)

Tony peppered the presentation with progress at several high profile clients. A few examples:

AWS is switching off its human services and moving fully to Lexi, one of $AIMs largest enterprise customers, for the live events it hosts. (Breaking news today,....based on accuracy of the AI being better than humans.)

Wins in the US Government (US Congress and US Senate, leveraging a reference case from the US) and Canadian parliament - indicating progress on the Government row of the 9x9..

Conclusion

Long term aspirational targets are a double-edged sword, Initially last year we saw the $AIM SP benefit from them, and today we are seeing it suffer. However, overall, this business is executing its strategy, and is growing strongly, with the new products moving into commercialisation phase and potentially opening up the addressible market.

While the aspiration has been reset, from my perspective, the overall thesis is intact and the changes are relatively minor within the margin of safety.

Disc: Held in SM and RL

SCROLL DOWN FOR UPDATE....

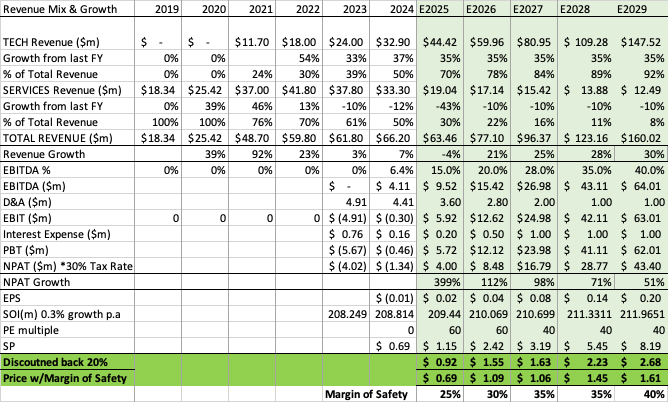

RePost of initial valuation so it's easier to read. Thanks @Bear77 for your guidance on copy & pasting. it worked perfectly!

Hello Straw People!

My name is Travis, and this is my first ever company valuation. I am newbie "premium" member but have been a "free" member for a couple of years now and have thoroughly enjoyed reading through the various forums, straws, and valuations of others, albeit 4 weeks delayed.

My background in finance is limited to some minor study alongside a huge passion for reading and self-education, which is why I decided to become a premium member, as the collective thoughts, experience and truthful and honest feedback provided here I know I will find most valuable in the process of trying to make a rational investment.

*Please note, I was very hesitant to put my valuation and thoughts out there as I am a novice investor and far less experienced than many here and I assume off the bat that I will have errors in my judgement and analysis that will be highlighted, for which I am ready for and implore you to provide constructive critic and highlight were I may be biased in my thinking!

Before I start, please let me apologise if I babble on, repeat myself or just plainly confuse some with my explanations.

The aim of my valuation (no pun intended) and time of posting was to get It out there prior to the release of the Annual Report on Thursday.

Ok, back to my valuation. I have been a shareholder of AI-Media for just over 12 months and found out about the company here first, alongside @Wini’s previous appearances on the Coffee Microcaps webcast. Which alongside the Meetings on Strawman (which I finally have access too) I find this to be a great way to discover and hear from Small Cap companies.

I hope to write at length about the specifics of my thesis in time, however at this stage the valuation is based on a few important factors that I believe the company has in place and the opportunities in the future.

1. Founder led company, with Tony being extremely passionate and knowledgeable about the company and how Ai-Media’s product suite fits into the workflows of its customers.

2. He has considerate Skin in the Game, which should align our goals of increased shareholder value.

3. They have a product suite in which the Falcon Encoders are imbedded into the workflow of customers, with Lexi sitting on top to provide a captioning service that is faster, more accurate and 90% cheaper than current Human in the Loop captioning.

4. They have a tailwind with advancement of Ai technology, while also having several additional markets to build on. The market matrix of 9 sections was a highlight of the growth potential Americas/Broadcast (currently the biggest Rev generator), Americas/Government, Americas/Enterprise, EMEA/Broadcast, EMEA/Government, EMEA/Enterprise, APAC/Broadcast, APAC/Government, APAC/Enterprise.

5. The market may not be entirely aware of the Tech growth part of the company’s Revenue and how that transition of revenue mix is going accelerate their revenue growth, their margin expansion and EBITDA to get to the FY29 target of $150m in Revenue and $60m in EBITDA.

Which brings me back to my valuation. While it is detailed, I have tried to use as many numbers as possible that are historical, not too outrageous as well as any information I could obtain from the financials both in the reports and from the webinars that Tony and John Bird (outgoing CFO) have held over the past 3-4 years.

Below is my DCF for the company out to FY29 to see what is required for them to get to the target Tony has spoken about. Please note, DCF’s aren’t my forte and I’m sure I’ve made glaringly obvious mistakes, so please point them out to me as I need as many honest minds to provide me with feedback.

NOTES to my DCF:

- EBITDA Margin is based on a progression to 40% by FY29 to get the $60m target amount.

- SOI growing by 0.3% based on the growth from FY23-FY24. Tony and John have said they have no intention to capital raise, which should limit SOI growth.

- D&A future estimates based on CFO (John Birds) comments in FY24 results webinar. See at 1h5min mark here. Although he expects D&A to drop to around $0.5m in 3-4yrs. I’ve kept it higher in case of future acquisitions that they decide to capitalise on the balance sheet.

- Interest Expense based on a conservative future amount. I don’t foresee AIM requiring any debt to fund future growth, as Tony and John have said numerous times that it will be funded with cashflow. However, I thought I would include some interest expense just in case.

- PE is the most difficult variable to add in the mix. I went with a 40x multiple in FY27-FY29 based purely on a conservative multiple for a company averaging 146%pa NPAT growth between FY25-29.

- I’ve used a 20%pa. discount rate as well as a tiered Margin of Safety to account for the risk projecting so far into the future.

So, there it is! My first ever Strawman Valuation for $1.61 for Ai-Media (AIM).

Please let me know where I might be wrong in my calculations, or where I may have stated lofty or incorrect numbers that could have affected my valuation.

Disc. I hold shares in RL & on SM.

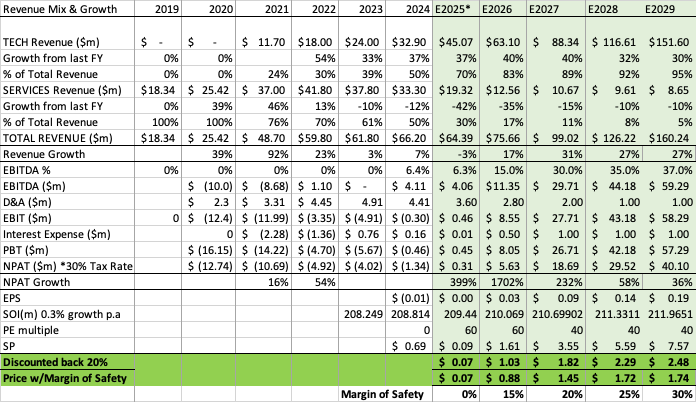

UPDATED VALUATION Ahead of FY25 results (AUG 24th 2025) of $1.74

I forgot to update my valuation and projections post HY25 results in Feb, but I wanted to get ahead of the full year results. Below is an updated valuation table, mainly to the estimated FY25 result.

I know there are a lot of numbers in my projection and only small deviations can change things dramatically. However my thesis is this, at least for the upcoming FY as the first step to the 2029 target:

- Tony has stated many times in interviews over the past 6 months that they expect the transition of TECH to SERVICES REV composition will continue and expect TECH to be at 80% of total REV by Dec 2025. So, I have estimated a 70/30 split between TECH and the declining (on purpose) SERVICES sections for this FY, then at 80/20 split from HY26. *Please note if this is achieved and considering a similar growth in Tech Rev of 37% for FY, then the H2 REV for Services would drop from $14.3m in 1HY25 to ~$6.7m in the 2HY25. A huge drop that may not happen and therefore may surprise on the top line.

- Tony has also mentioned multiple times, including on his most recent @Strawman interview that they project $4m in EBITDA, which I have included in my FY25 projection.

- D&A are estimated based on the run rate from HY25 and also comments from previous CFO (John Bird) on the FY24 earnings call. Only thing that would blow this out is if AIM send big on PPE or some intangibles during the 2nd half, but as Tony has said numerous times, they like a "clean balance sheet" and therefore don't like to capitalise asset purchases onto the balance sheet, they prefer to expense it on the P&L.

- While my projection goes out to FY29 to see how things could possibly move towards the stated target of of $160m in REV & $60m in EBITDA (mainly through organic growth using the 9 box matrix outlined as their focus), I have used a very conservative discount rate of 20% as well as using incrementally larger margins of safety on the future years to reflect the additional execution risk.

I'm eager to see how the numbers look and hear what Tony and Jason have to say on Thursday!

Disc. HL in RL & on SM. (one of my largest Small/Micro Cap positions)

Im not completely convinced we are seeing the turnaround of the bottom of what could be the last Super W2 down. There maybe a little further to drop. It all depends on weather the next retrace of a small w2 drops lower than the last recent major low, which would then open the door for five waves down. Sorry about the rambling or repeating myself.

See my Google drive for todays screen recording of the chart update and thoughts

Shout out to @Shapeshifter who put me on to AIM's involvement in Infocomm 2025.

Some scrolling put a couple of videos in front of me.

I have been keen to see AIM's services in operation and get an understanding of the real world uses.

This interview was billed as " the first-ever trilingual live broadcast in English, Spanish, and German" a live translation from English to German and from English to Spanish. The presentation came across a little clunky to me. Maybe as a result of the TV production teams work?Interesting non the less.

The following is part one of a three part interview with Pete "Tea Man" Connan and Tony Abrahams in New York recently:

Next an interview with AIM's Russ Newton. In the bottom left of the screen LEXI is transcribing and translating the interview live, with a lag of approximately six seconds:

https://www.linkedin.com/feed/update/urn:li:activity:7342959259493593089/

24th June 25

My thoughts on AIM from a technical point of View

I think we are close to the turn around

See My Google drive for the screen recording (recording avail for 1 month from posting date, I need the storage space)

Here are some notes from today's meeting with Tony.

His enthusiasm is somewhat contagious, but hopefully we can distill some objective insights from what he said.

Encoders = Trojan Horse

AI-Media's encoders (acquired via EEG) are deeply embedded in customer workflows (e.g. Channel 7, Foxtel).

Replacing them isn’t simple; it would require reconfiguring entire tech stacks, including broadcast automation systems.

These encoders come with proprietary firmware and network effects. clients already have them, so switching is costly and unattractive. And the encoder industry is very niche, and far too small for a large challenger to enter and compete.

Encoder + SaaS Model = Printer + Ink

Initial encoder sale is like selling the printer (~$10K each), but the real value comes from the ongoing SaaS revenue (the ink).

That takes the lifetime value of each encoder from ~$7K to ~$50K as they now drive much higher SaaS usage.

ICAP Network as the Toll Road

ICAP is the underlying data network that connects encoders to AI/ML models in the cloud. Its critical infrastructure no one else has at scale. It acts like a "toll road," monetized regardless of which AI engine is used.

Tech-Agnostic Integration

They can easily plug in APIs from any leading LLM (OpenAI, Anthropic, etc.). They don’t build the engine; they fuel it. In Tony's words, AI-Media is the fuel injection system, not the engine.

Moat in Live Video

All the tech is optimised for live video, which is hard to do well. Real-time accuracy + speed + low cost = hard trifecta.

Most competitors are focused on recorded content, but AI-Media is entirely focused on live, where there's real defensibility.

What Most People Miss

Headline Numbers Hide the Real Story. On the surface, total revenue looks flat or down, but the mix is shifting from legacy services (people doing the work) to scalable tech (machines doing it). Margins and cash flows are actually improving as low-margin services drop off.

Strong Cash Flow Despite Transition

Still delivering positive cash flow and EBITDA, despite deliberately cannibalizing their legacy business and investing for growth. Oh, and most investment is not capitalised, but rather expensed all upfront. Tony said he prefers to have a "clean" set of financials.

Transition = Growth Hidden in Deferred Revenue

SaaS sales are growing fast, but revenue is deferred (12 months upfront) and not yet recognized. Real growth is understated in reported numbers.

Encoder Ecosystem is Portable

They've proven they can run their software stack on third-party encoders (e.g. Grass Valley, Imagine, Media Proxy).

Opens up huge optionality for future partnerships or acquisitions.

Future SaaS-Driven Growth

SaaS now includes Lexi (captioning), Lexi Voice, Lexi Brew (LLM-enabled organizational comms). Lexi Brew lets orgs use private LLMs securely—like internal ChatGPT but with data privacy.

Targeting $60M EBITDA by FY29

Organic plan in place (encoder expansion, Lexi suite, geographic rollout). But also exploring inorganic growth via M&A (especially targeting companies with large encoder bases but no SaaS layer.)

Land Grab Mindset

Acknowledges that first mover advantage matters in embedding into workflows.

Prefers low upfront M&A cost with earn-outs based on encoder conversion success.

Revenue breakdown

Two Main Buckets:

Services Revenue: Anything with a *human in the loop* (e.g. stenographers, respeakers).

- Charged hourly, recognized immediately.

- This used to be 100% of the business at IPO.

- Now shrinking rapidly, aim is for it to be just 20% of revenue, acting as a wrapper around tech.

Tech Revenue: Everything else (fully automated, AI-driven).

- Includes both **hardware sales (encoders)** and SaaS/software.

Within Tech, they break it down into:

-Hardware (e.g. encoder boxes) – paid upfront, lumpy, not recurring.

- SaaS – subscription or usage-based, recurring, higher margin.

But even SaaS Has Layers

SaaS includes:

-Encoder-based SaaS (e.g. Alta, Falcon).

-ICAP SaaS – toll-road style fees for using their data network.

-Lexi SaaS – captioning and voice AI services, true growth engine.

To isolate the “real” recurring growth engine, they exclude:

- Hardware revenue.

- Encoder-based SaaS.

- ICAP SaaS (supporting legacy workflows).

- Support services tied to hardware.

What’s left is the core Lexi SaaS, which is the cleanest indicator of long-term tech-driven success.

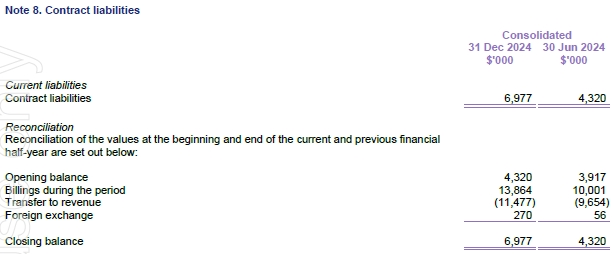

Re Deferred Revenue & Contract Liabilities:

- SaaS deals are increasingly paid 12 months upfront.

- Revenue recognition is deferred, so it doesn’t show up immediately in the P&L.

- This distorts comparisons and masks underlying growth, but cash is banked.

Accounting rules treat this as a liability, but Tony argues it’s a bit of a fiction: “It’s going to cost us $200K to deliver, but it shows up as a $2.7 million liability.”

That means the cost to fulfill is only ~10% of the deferred revenue.

He called it “completely misleading”, because it makes the company look like it owes more than it really does.

Anyway, i probably missed some stuff. But hopefully the AI helped me extract the key messages.

Have finally worked through the AIM 1HFY25 video and releases. My immediate reaction on reading the releases back then was one of uncertainty as the financial numbers did not line up with the positivity from Tony. Unpacking the content took time, but it was well worth the effort as I feel significantly more educated on AIM as a company and I remain 100% onboard.

Discl: Held IRL and in SM

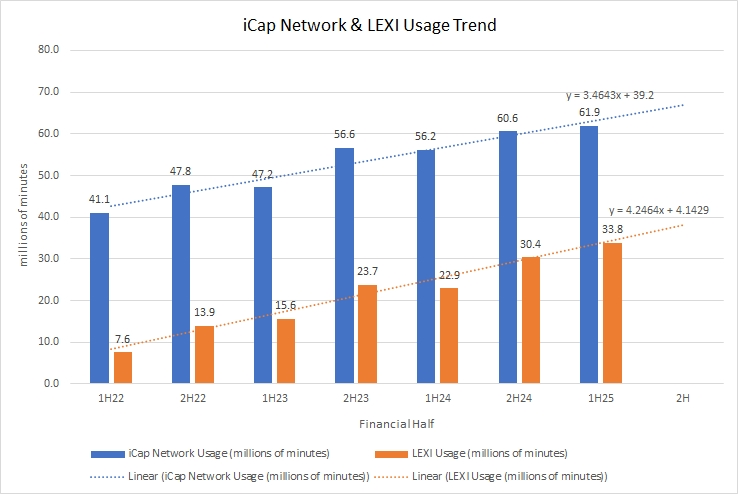

ICAP NETWORK AND LEXI USAGE ARE FIRING

Firstly, I plotted the iCap Network and Lexi Usage Trend slides from both the 1HFY25 and FY24 slide packs into a graph so that I can get a continuous HoH view (both the original slides only show pcp, which only tells half the story)

- I like what I am seeing in terms of the clear and consistent upward trajectory of both (1) the monetisation of the iCap network and (2) Lexi usage

- Revenue must, almost be definition, grow correspondingly over time - which is why upfront, the shortfall in revenue did not quite make sense

- It is clear that Tony considers this trend to be the main leading indicator of how well the business is travelling, the technology uptake etc - similar to C79’s samples processed per quarter chart, this makes sound sense to me

PRODUCT IS READY FOR ASSAULT ON EUROPE BROADCAST

The speed of iCap/Encoder product rollout has significantly accelerated:

This significant solution acceleration is impressive as different orchestration methods between the broadcast playout systems (works completely differently from the US) and different character sets was needed (particularly for the Slavic languages - Poland, Romania, Slovakia, Czechia etc)

- “We are dealing with languages that iCAP and Lexi have never actually had to produce a particular character for before - this work is now done”

European Accessibility Act comes into effect on 28 June 2025 - The Act mandates that a range of products and services such as consumer electronics (TVs, smartphones, computers, gaming consoles, etc.), ticketing and vending machines, websites and mobile acts, among others, comply with accessibility requirements for persons with disabilities

AIM has sold a technology product in each of the 14 countries on the right for the first time in this half

The full focus on opening up Europe has happened/is happening and the ability to extend the iCap and Encoder to new countries in weeks will continue to increase the pace of opening up markets outside of North America

2 NEW PRODUCTS

Lexi Voice is clearly launching 7 April 2025 - big tick

Lexi Brew - I am positively cautious on this - it uses the same iCap/ Encoder architecture/AI, it opens up new revenue streams, and I can see how it will help the Enterprise square, but it felt like it could distract from the immediate focus on the main EMEA game from a technical/product development perspective. Also, this puts AIM down the “AI Play” path, which is not quite how I saw/see AIM. Need to think about this a bit more.

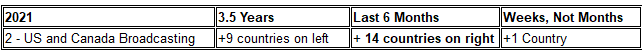

MAKING SENSE OF THE REVENUE SHORTFALL

The underwhelming revenue numbers were actually a bit of a worry as this was the first sign of inconsistency in Tony’s narrative. Plotting the revenue by regional operating segments going back to 1HFY2022 post the EEG acquisition, the 1HFY25 revenue shortfall was quite glaring against trend. This really did not make sense if the iCap and Lexi Usage numbers were climbing as they were (per above).

Dinesh made the following comments against the P&L Summary slide:

3% fall in revenue is driven by Services revenue decline, as a business we are trying get out of

Increased billing of Lexi of 45%, sales has increased 45% (this correlated to the growth outlined in the iCap/Lexi usage slide, but can’t see it manifest in the revenue numbers), invoiced the client and collected cash but is sitting as deferred revenue in the balance sheet - reflected in cash flow (this also makes sense)

Transforming into a SAAS business - billing upfront on long-term contracts, and unwinding that over a period of time

To confirm this, Note 8 in the Appendix D showed a sharp increase in Billings-During-the-Period in 1HFY25 - from $10m to $13.8m, and the closing balance rising sharply from $4.3m to $7.0m - this correlates to what Dinesh said above:

Around 1:39 of the video, Tony made the point that about $2.6 or $2.7m of the $7m Contract Liability balance was Lexi forward sales this period that will be progressively realised in the future and that it was all relating to North America

At 1:41, Tony clarified that the $7.0m of Contract Liabilities in the balance sheet all relate to Lexi forward sales ($4.3m of which were prior period forward sales which presumably still cannot be recognised this period)

I thus added ~$2.6m to the revenue chart against North America and Total Revenue - the blue bar, meaning that if AIM COULD recognise 100% of the Lexi revenue already invoiced and collected for upfront, it would seem that the revenue for 1HFY25 appears to run higher than the run rate of the actual trend line

Tony and Dinesh explained at length that AIM was transitioning from upfront recognition of revenue to periodic recognition of subscription revenue and that during this transition period, the revenue numbers will bounce around. The focus should be on Lexi usage and Lexi revenue growth as that is the true indicator of future revenue and the success of the business - from an accounting perspective, this commentary makes sense.

The challenge that AIM has is that it is not explaining this very well in terms of actual revenue sold, but recognised in this period vs the next etc - Alcidion is a good example of where they are clear with every contract signed, the TCV and the amount of the TCV that is recognised in the current period. HSN also had the same problem in 1HFY25 with lumpy periodic licensing sales in 1HFY24 distorting the 1HFY25 numbers and comparisons.

Tony’s frustration on this front is clearly evident. Telling the market to “ignore the revenue numbers and focus on iCap/Lexi sales/revenue” is not the answer though. Tony and Dinesh need to find a better way to disaggregate the Technology revenue, provide visibility of the forward sales which cannot be recognised and clearly state Lexi-related sales revenue, so that the market can then work backwards and reconcile the “true” revenue position, during this messy transition period.

The combination of (1) 45% growth in Lexi sales that has actually been invoiced and collected (2) the insight on Contract Liabilities (3) the transition from upfront revenue recognition to SAAS revenue recognition gives me confidence that the revenue shortfall is merely an accounting treatment transition issue.

OTHER TAKEAWAYS

Operating cash flow positive of $3.3m again, following slight ($0.1m) negative in 2HFY24 - contributed to a healthy cash balance of $14.1m

Key cyber security accreditations that AIM is focused on is SOC II Implementation and ISO27001, against the new Lexi platform - these are painful implementation and input processes, but once obtained, will address a significant amount of customer concerns around security

QUESTIONS TO ASK TONY

- Would like to unpack “Encoders” in the ecosystem slide - there is mention of Falcon, Alta and Encoder Pro, then “Alta everywhere” - I have thought about the encoders as an EEG box, period ...

- Can he and Dinesh please find a way to clearly disclose Lexi Sales booked and recognised/not recognised as a disclosure item to prevent unnecessary confusion around the revenue numbers.

- Lexi Brew - how and why this can be done in parallel without distracting the big focus on EMEA, what is the competition like

SUMMARY

Having worked through the concern areas, my conviction remains intact. With the current market volatility, will look to top up if the price dips below $0.65, the close to $0.60, the better

Great commentary on AIM @mikebrisy, Shapeshifter @Wini and others. Plenty to think about in relation to AIM and I just can't get it and this reporting week out of my mind.

A rare bird is CEO Mr Abrahams, with his white spectacles, teeth and dazzling talk. Easy to be put off by it all. And fair enough to be critical big talking CEOs given the two recent high profile examples of Chris Ellison (MIN) and Richard White (WTC). Both revealed to be very much lesser people than we were all led to believe. Along with them, last year we learnt more about the odious Brett Bandit from Woolworths (WOW), and the forked tongue Scott Diddles from Johns Lyng (JLG) . Strata companies' hidden fees, secret kickbacks and developer deals costing apartment owners - ABC News

And the septuagenarian shyster John Kelly from Steadfast (SDF) and his own special brand of strata scams. At least for his infamous 19th century forebearer there is no record of Ned having committed any white collar crime.

Or the now departed silver tongue thief from Qantas (QAN), who looted the place under the cover of espousing all and sundry social causes. Much the same playbook as the American George Tumble used at AMP 25 years ago. All the while Alan was smiled upon by his ineffectual Chair, Mr Goyder.

Or the criminal senior executive gang, serving the interests of Triad gangs at Star Casino (SGR). No wonder some investors are cynical, sceptical and pissed off.

You would hope the scammers are the minority and most CEOs are out there leading teams and genuinely working their backsides off in the interests of shareholders and the wider business. However the market this week does not appear to know what to make of it all. Neuron (NEU) was up around 6% Thursday and down 7% yesterday on half yearly reporting. And there was a lot to be optimistic about as revealed in the half yearly update. Including: stabilisation of Daybue revenue, 12 month patient persistence above 50%, Acadia hiring 30% more sales staff, market penetration of only 30% to date plus Canada and Europe opportunities being actioned + $359m of proforma cash + strong progress made with NNZ2591 + the pleasure of listening to the wonderful dedicated, smart and modest CEO John Pilcher. The share market’s twisted response was a up-down, buggered-if-I-know-what-is-going-on. Just what does the market expect? It to rain $100 dollar bills! Maybe investors are so attuned to looking for the early signs of failure / success and are so deeply cynical they do not fully consider that next to no businesses will travel in a straight line to success. (I don’t think this is a Strawman problem, with members just trying to collectively figure it all out.)

It was a similar up/down share market response for Tony Abrahams at AIM. I can’t understand and never will all the ins-and-outs of what AIM is up to and the risks being taken. Maybe sometimes it is enough to get a basic business understanding and then trust the captain. This flys in the face of the earlier examples, but what Mr Abrahams has done to date does not appear to have any elements of personal or business chicanery.

Starting a public company, and then as circumstances changed in 2021 putting it all on the line to pay $43m for the transformational EEG acquisition. Then executing on the US broadcast part of the business and with potentially much more to come. Pretty impressive. Mr Abrahams has a lot financially and reputationally at stake in AIM. And it may not all come to fruition as per his upbeat guidance provided mid last year of: “FY 2029 $60m EBITA and $150m revenue”. Even if he comes up 50% short, AIM is still not a complete disaster. That cannot be said for around 500 or so ASX mining related stocks where shareholders will in time lose the lot.

I asked Tony Abrahams in December after the 2024 AGM as to why he opened his mouth and announced the AIM 5 year sales and earnings targets. He did not answer my question directly, however said that it had an absolutely galvanised positive impact on motivating staff. Fair enough, I guess.

Like his biblical name-sake, maybe shareholders just let Mr Abrahams lead on a journey of faith through the unknown land. And like a later day Moses, maybe he can lead his flock to the promised land of milk and honey and a $60m EBITA (or better). Or from a secular perspective, believe in the likely apocryphal story of the little old Omaha spinster long since dead, who invested all he savings in Berkshire “….because she knew Warren as a little boy and liked him”. Making herself (or maybe more accurately all her surviving nephews and nieces) $20m or so.

Can’t help but think an investment in AIM (and NEU) will in time likely do just fine. We have all been burnt. Me so many times it feels like I have been cremated alive. But with some opportunities it might be best just to believe.

I'm just off the $AIM 1H FY25 Results call. I'm not going to summarise the results here. At the headline level they look underwhelming as the business transitions from a legacy people-supervised AI translation service, to a fully AI model. In fact, the market reacted to the headlines opening down 10% as - I assume - holders who don't understand the business traded out on the headline. Hopefully we'll get more opportunities like that, as I'll likely be on the other side of any such price action.

Instead this is a recommendation to any StrawPeople (whether holders in $AIM or not) to watch the recording of the call when it becomes available. My head is buzzing with everything CEO Tony shared with us and, to be honest, I'm going to have to watch the whole two hours again to really understand it.

But what stands out for me, is the evidence this presents in how the "application layer" of software leveraging AI is disrupting business processes, not just in $AIM's legacy media business, but pretty much everywhere.

Tony was very generous with his time in explaining the use cases and key metrics, and there is a lot to unpack in the presentation.

Although in RL I have taken only a modest 3.8% position in $AIM, I was asking myself over and again during the presentation the question @Strawman put to me during my SM meeting last year, along the lines of "how much would you be prepared to put behind a "fat pitch"?" I really am starting to wonder if $AIM is such a fat pitch.

Of course, it is important to temper the excitement that naturally comes from listening to Tony with the reality that there are countless other players moving to be part of the AI disruption and revolution. I have no doubt $AIM will be successful in the top row of its 9-square matrix (see below chart), but it is probably important to be somewhat more circumspect about the rest.

But with Lexi Voice and Lexi Brew, maybe they ARE moving fast enough. If they can execute successfully across the entire 9-squares, then all bets are off as to the valuation.

For those StrawPeople who are Trekkies, during the call, I whatsapp'd my daugher in London a picture of Lexi Voice, with the message "The Universal Translater is Launching on 27th April, with an initial 125 languages".

Related to discussions here today and yesterday about another Strawman favourite, Tony is the exact opposite in terms of communication. He is clear, deliberate, almost to the point of painful detail of explaining what they are doing and what the key metrics are to track. Every question got answered ... in detail ... with supplementary questions returned to as well. A full 2-hour call.

I'm not going to do anything rash or hasty here. But I do wonder whether this is a "fat pitch".

Disc: Held in RL and SM

At the Integrated Systems Europe (ISE) 2025 conference held from February 4–7 in Barcelona, Ai-Media provided an exclusive first look at their upcoming real-time voice translation technology, LEXI Voice. This innovative solution is designed to transform the industry upon its release later this year.

Check the video:

https://www.linkedin.com/posts/ai-media-tv_ise-ise25-ise2025-activity-7293379777544036352-Gvqb

Market doesn't seem to like the sell down from EEG, who have been shareholders since July 2021.

They may not be done yet if their intention is to liquidate all of their holding, so perhaps the selling pressure may continue.

Last night I came across the announcement from CES in Vegas last week that VLC (the not-for-profit, open source media player) has now built in a FREE AI Powered Subtitle and Language translator into its media player that will even translate and subtitle videos into 100 languages while the user is watching videos offline!

https://www.facebook.com/reel/8974527792583812

https://www.pcmag.com/news/vlc-media-player-to-use-ai-to-generate-subtitles-for-videos

I don't know enough about the product or industry to know if free, open source advancements like this eventually disrupt AIM's live broadcast niche, but it doesn't seem like a huge leap.

In Strawman's notes after interviewing the AIM CEO he mentions the company is in the early stages of tapping into the broader market potential and that 25% of the total market is subtitling pre-recorded media. Assuming the quality of VLC's FREE translator and subtitling engine is similar, surely that whole segment just went the way of Appen?

AIM is on my watchlist... I think I'll sit tight and watch a while longer..

I note this morning EEG Video holdings LLC principal Philip McLaughlin sold 5.3m shares for around $4.1m. EEG is no longer substantial, though looks like it still has around 9.3m AIM shares.

Philip sold EEG, the AIM company maker (so far anyway) in April 2021 for around $34m. To fiancé the purchase AIM raised capital at 80 cents.

It is interesting his recent sale is at around 78 cents, so maybe he is just getting some of his sale proceeds back. I would not read too much into it all. Though judging by his pile at Long Island maybe he needs the money to pay his gardener.

The appointment of Otto Berkes and Brad Bender seems to be a great move, when you look at their CV's. These fellas have some decent experience, by the looks of things.

AI-Media appoints two US-based directors

AI-Media Technologies Limited (‘AI-Media’ or the ‘Company’) (ASX: AIM), a global technology provider of captioning, transcription and translation solutions, today announces the appointment of two new US-based non-executive directors, Otto Berkes and Brad Bender, completing its process of board renewal announced earlier in the year.

AIM Chair John Martin commented “A key priority was to strengthen the board’s expertise in advanced and emerging technologies and experience in scaling a global technology business. We were also seeking candidates with strong connections in the United States as this is a key growth area for us. We are delighted to announce that we have found two highly experienced US-based directors, providing the board with complementary and diverse additional skills in engineering and product development.”

Otto Berkes brings over 30 years of senior technology and business leadership together with over 15 years of director-level experience. An Xbox founder, Otto’s previous roles have included General Manager at Microsoft, Chief Technology Officer at HBO, where he led building HBO’s streaming services, and Chief Technology Officer at CA Technologies, where he drove the company’s technology strategy and innovation efforts. He was also CEO of HireRide, an end- to-end analytics-based hiring platform he created through both acquisitions and organic development. Otto has a BS in physics and an MS in computer science and electrical engineering. He is currently a non-executive director of Integral Ad Science (NAS: IAS), a global digital advertising measurement and optimization platform, and an advisory board member for IntelAgree, an enterprise-scale AI- enabled contract management system.

Brad Bender brings over 25 years of global product and management experience together with over a decade of director-level experience. As Vice President of Product Management at Google, Brad most recently led Google News and Search Ecosystems, delivering AI-driven initiatives serving billions of people

worldwide. Brad previously led Display and Video Advertising at the company, where he founded the Google Display Network and drove its growth to become a multi-billion-dollar business. Prior to Google, Brad was most recently a Vice President at DoubleClick. He has a BS from Cornell University, and currently serves as an independent board director of Entravision (NYSE:EVC) and an advisory board member for OutcomesX.

Alongside the appointment of Brent Cubis as non-executive director and Chair of the Audit & Risk Committee in July, we believe we now have a board with the expanded mix of skills and experience to steer AI-Media to its next stage of product development, growth and international expansion.

The appointment of Otto Berkes and Brad Bender is intended to take effect from 1 December 2024 and is subject to the Company obtaining shareholder approval for an increase to its aggregate remuneration of non-executive directors at its 2024 annual general meeting to be held on 27 November 2024. The Company will despatch is Notice of Meeting later today.

A couple of days ago, AIM released the following PR announcement regarding winning ITV (UK) as a customer: https://www.ai-media.tv/knowledge-hub/insights/ai-media-and-itv-announce-landmark-partnership/

ITV is the UK’s biggest commercial broadcaster – so think a Channel 7 or 9 here in Australia, scaled to the UK population. Even large-ish customer wins are no longer price-sensitive for this company, so there’s no associated ASX announcement. It might be worth following Ai-Media’s LinkedIn or Twitter accounts for those who follow this company.

A couple of points that were of note to me:

- Europe and UK expansion was a big priority this year. Tick.

- The ITV director quoted spent 8 years at Red Bee, which is a competitor to AIM. If this is an indication of Red Bee’s competitive position, given the director knows them so well, then it bodes well for Ai-Media. Red Bee currently holds the captioning contracts for ABC (Australia) and SBS, which I understand are up for renewal in the next year or two.

- This announcement confirms AIM’s competitive strengths – able to be embedded in a customer’s complex workflow and its reputation. I had to ChatGPT what “VANC embedded data” is, and it demonstrates how specialized captioning workflows can be for large broadcasting customers – it’s a headache no new entrants would want to deal with.

Post a valuation or endorse another member's valuation.