Preamble/Context

I've been a bit slow to commit to a valuation on SM for $AIM, despite having held it for just over a year. It is now another core holding in my RL ASX portfolio, thanks once again to the StrawPeople who got there earlier, as well as the opportunity to hear from CEO Tony in the SM Meetings. (I wasn't convinced after the first SM Meeting, but last year September's one got me over the line.)

A second reason for holding back on publishing my valuation was that, as other holders will know, if you buy into the FY29 Targets of "$150m revenue; $60m EBITDA; a billion $ company" - a message that Tony promotes with irrepressible consistency - you get such a large valuation that you'd be tempted to back up the truck ,...if you believed it.

Although I have set out some scenarios here that fall well short of Tony's vision, everything that follows is firmly anchored on the vision. And so, insofar as the vision fails to be realised, then so too the valuation will fall short. That's why I've entitled this Straw a "Bull Case".

Going through the exercise has enabled me to unpick the business and get a better understanding of the value drivers. As such (and as is the case for all my valuations) it is as much a tool to track the progress of the business over the coming years.

The good news is that there is a lot of room for the business to fall short of Tony's targets and still be a very valuable investment. Of course, it is in a very fast-moving space, and who knows what disruptions will emerge over the next 4 years!

The final reason to push myself to do this, is as part of preparing for the next SM Meeting with Tony, on 28th October.

SUMMARY of Valuation (the TLDR bit)

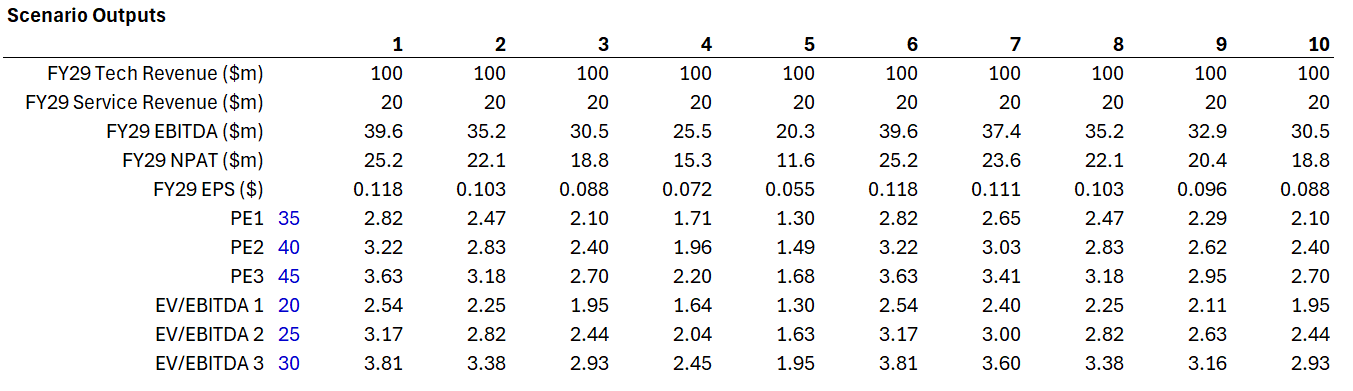

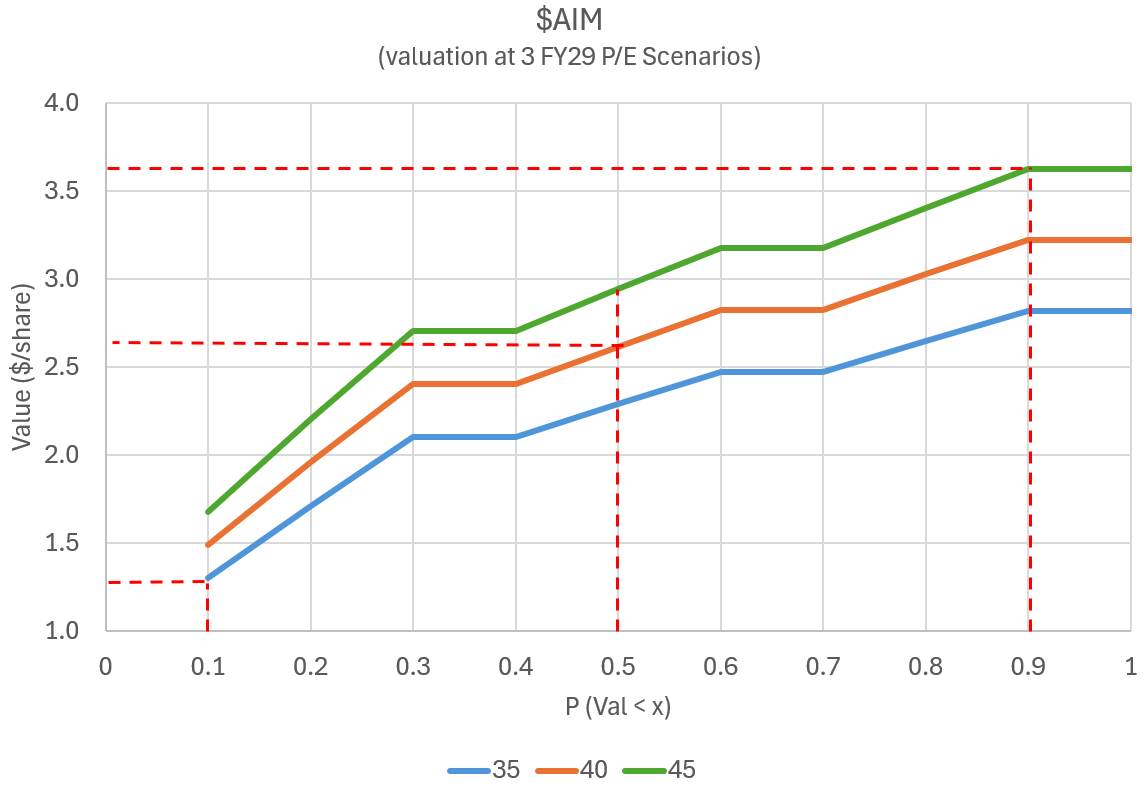

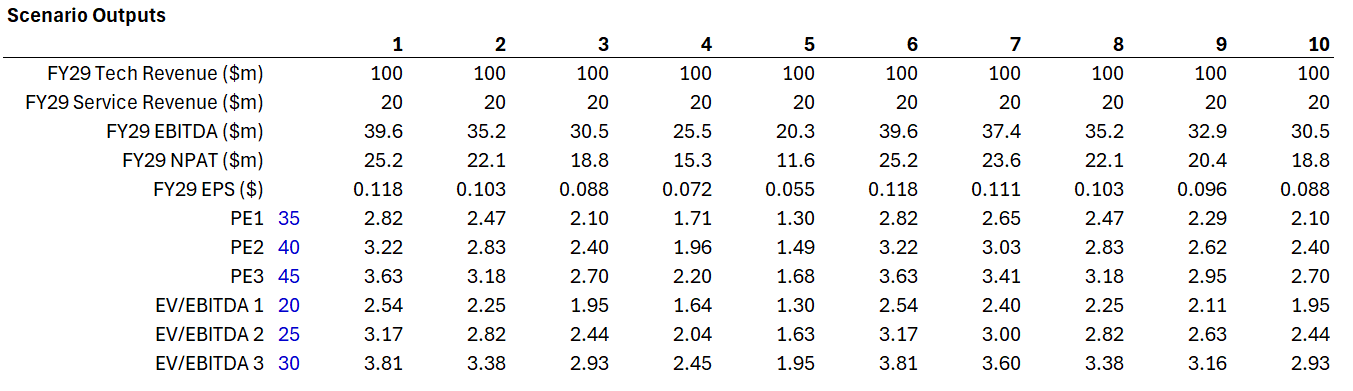

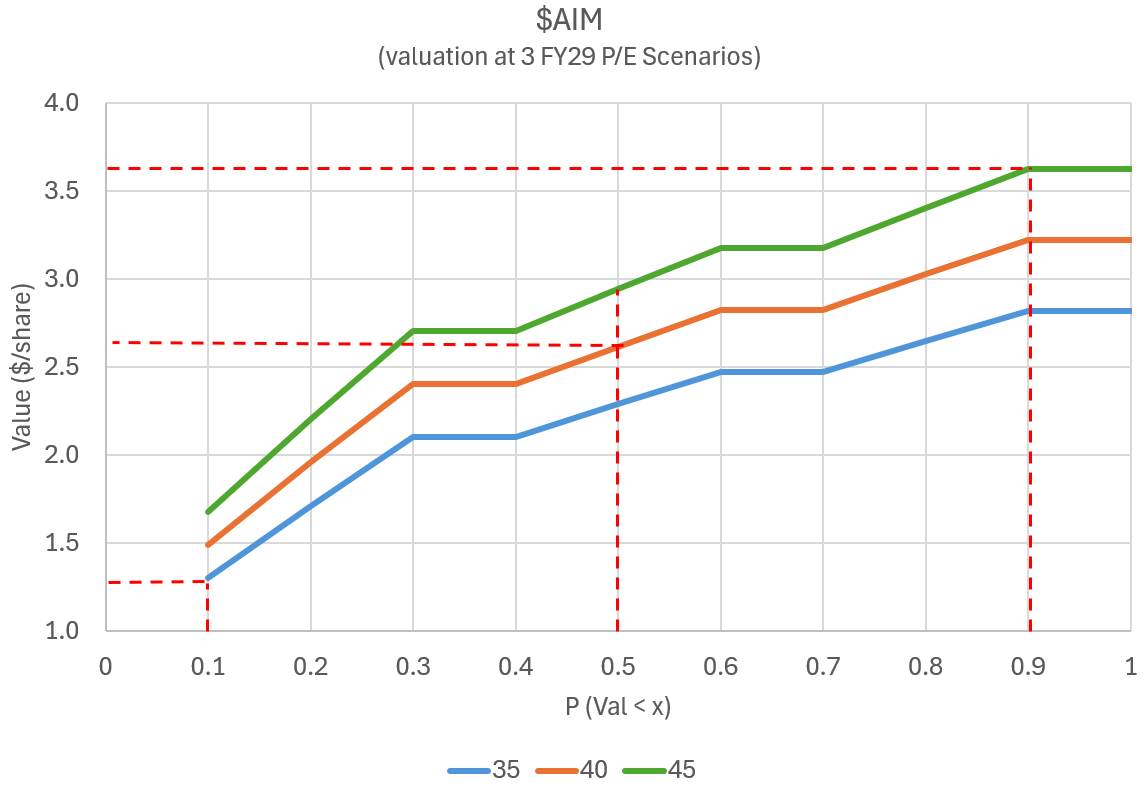

Method 1: FY29 P/Es of 35, 40, 45: $2.60 ($1.30 - $3.60)

Method 3: EV / EBITDA of 20, 25, 30: $2.40 ($1.30 - $3.80)

Note: Selected ratios considered conservative becaue EPS growth in FY29 typically in the range 55% - 80%. So there is every chance that if the market believes $AIM can achieve and sustain it's growth, we might well experience a Super Bull case, where a much higher P/E is offered by the market ... for a period of time.

Valuation Details

I start with Tony's FY29 target and I assume $AIM will fall well short of the goal. It is aspirational after all, and we are moving in a space where there will doubtless be innovation and competition.

However, there are some "Building Blocks" that I assume.

Building Block 1: Today's business with the human transcription service which is being shut down as we speak

Building Block 2: Tech Revenue, with an increase compoent of fast-growing ARR. The ARR has a %GM of 86%. Having looked at the trajectory to date, I assume the overall Tech Revenue will have a %GM that starts at around 80% today, and scales to 83% by FY29 - driven by the ARR component. This is hard-wired into all scenarios.

Building Block 3: A new services model, essentially a 50% Gross Margin professional services business to clients. Tony aspires to this delivering $30m in revenue by FY29. I am less ambitious, and have it contributing $5m in FY26 and adding $5m each year, as the business services a global existing and prospective client portfolio. This segement therefore gets to $20m revenue in FY29.

The Opex Base: Because we have the existing Opex Base, and can isolate the COGS of the two revenue streams, I am able to consider various scenarios for how the Opex scales over time. There are two sets of 5 scenarios.

Scenarios

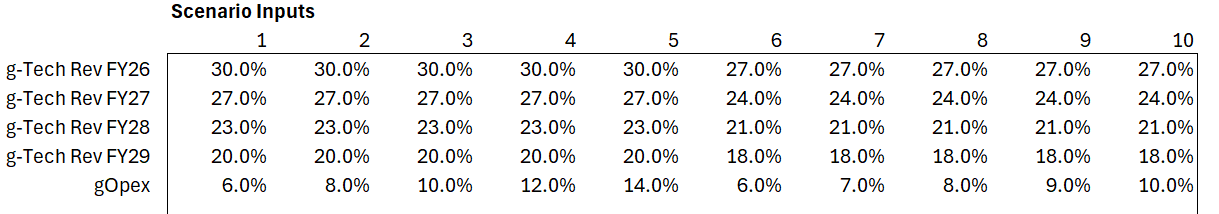

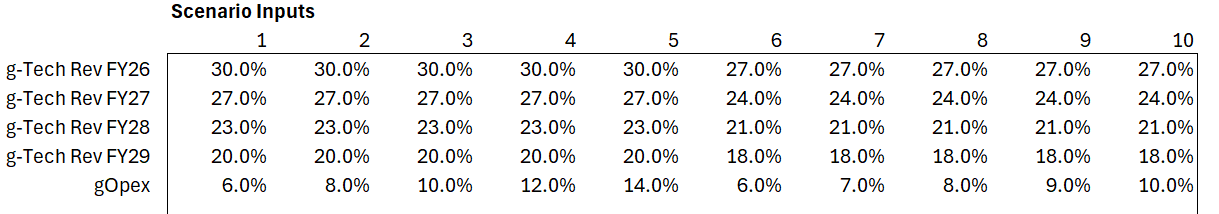

I have run 10 scenarios (sensitivities, really) across two dominant group.

One group is a high revenue growth and relatively high opex growth model, where scaling the revenue entails higher costs, whether in sales and marketing effort or product development, tailoring solutions to meet client needs. In this case I consider annual Opex growth scenarios of between 6% and 12% per annum. Over the next 4 years the Tech Revenue growth is sequentially, +30%, +27%, +23% and +20%.

In the second case, more cost efficient growth is achieved as revenues are not chased so hard. Opex growth ranges between 6% and 10% per annum, achieving Tech Revenue growth sequentially of +27%, +24%, +21% and +18%.

To keep the model simple, I have applied a common D&A set of assumptions, on the basis that variations in platform development costs have been included in the Opex Scenarios, and most development is expenses.

Common Parameters

The "New" Professional Services Revenue and Gross Margins (50%) are common across Scenarios: $5m, $10, $15, and $20m over the next 4 years.

Interest Income and Cost are de minimis. Tax Rate is 30% (once profit is achieved). The discount rate is 10%.

Illustrative Revenue Profile

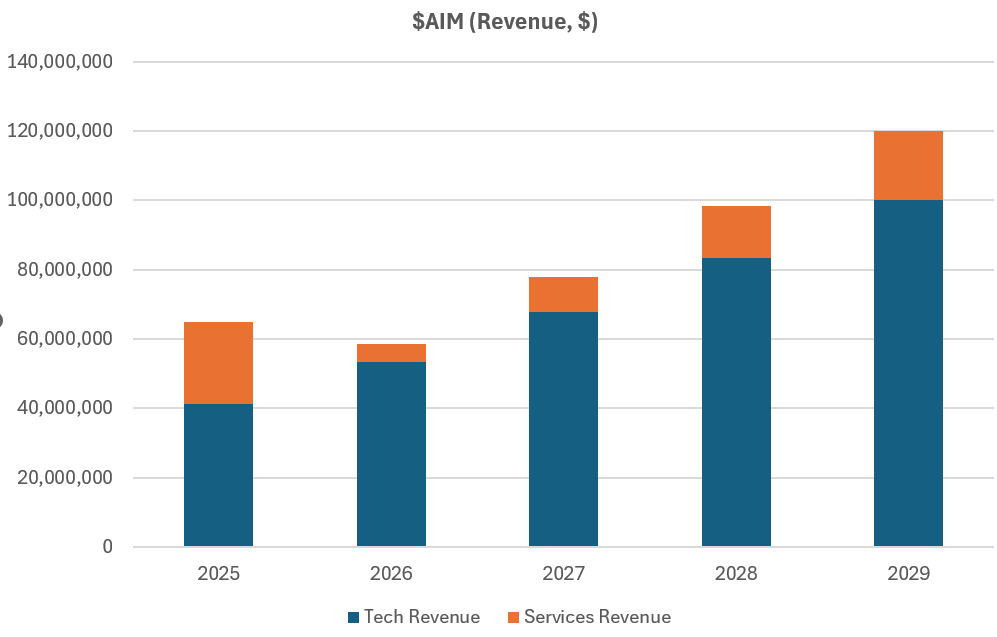

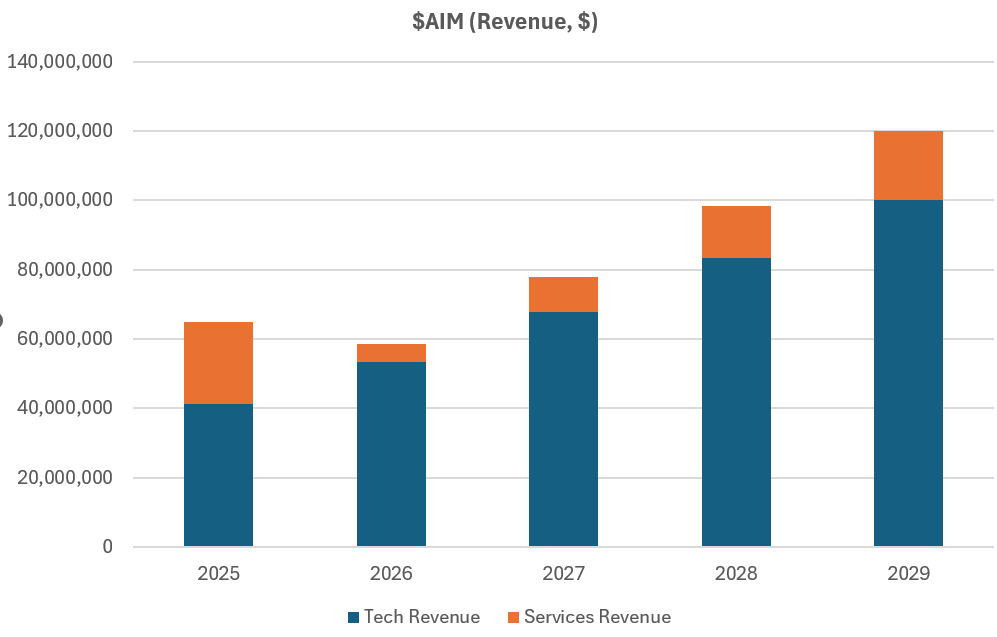

The figure below shows the revenue build from one scenario. A few things to get your eye in. First, FY29 hits $120m, vs. Tony's $150m aspiration. Second, we should be alert to the possibility of a significant revenue fall in FY26, as the old "Services" are switch off in December. If the market hasn't been paying attention, I wonder if we really will get one last opportunity to "back up the truck" if that happens? Particularly if the reporting of it coincides with the market being in a grumpy mood towards "growth" and "tech".

What happens in FY26 isn't really important to the valuation and I am not trying to model it - so it is not my forecast - but I will use the result to update the model!

Full Table of Scenario Inputs

Full Table of Scenario Outputs

Valuations

So When Would I Sell?

It is unlikely the market is going to offer prices that have me selling on these valuation grounds any time soon. So it is important not to anchor on these numbers as some kind of pre-ordained truth. They are just assumptions.

For me to hold, I really need to see the Tech Revenue sustaining high growth at good margins. I couldn't really care less about the "New Professional Services", nor do I mind if Tony starts to reset his $150m in FY29.

As long as Tech. Revenue is growing strongly consistent with one or more of these scenarios, then I'm likely to hold on tight, and I might even add more.

Disc: Held in RL and SM