Media Release: https://announcements.asx.com.au/asxpdf/20240829/pdf/0676bss606c3jj.pdf

FY24 Annual Report: https://announcements.asx.com.au/asxpdf/20240829/pdf/0676bnpw5ms0lw.pdf

FY24 Presentation: https://announcements.asx.com.au/asxpdf/20240829/pdf/0676bzwbglkvw6.pdf

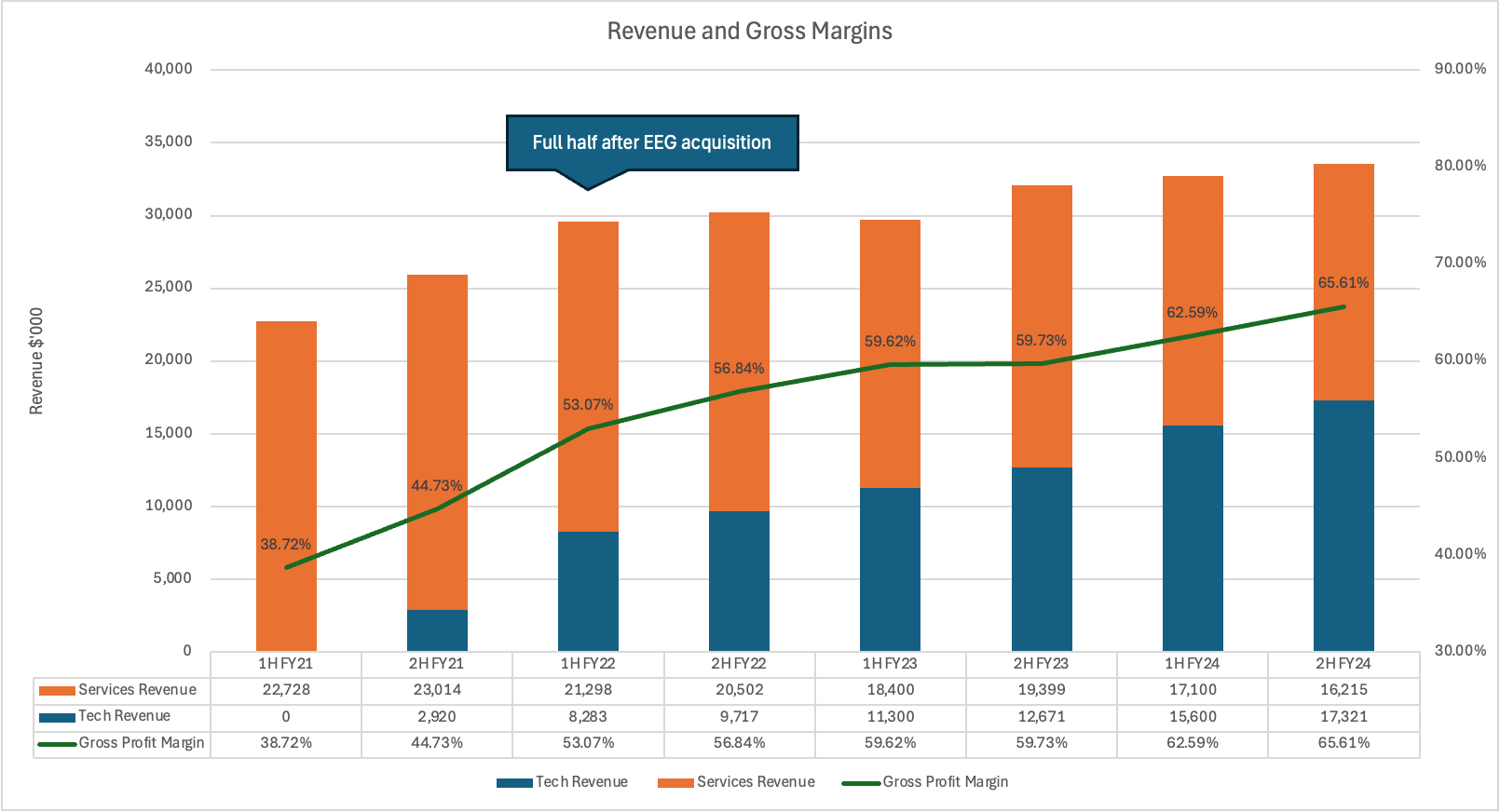

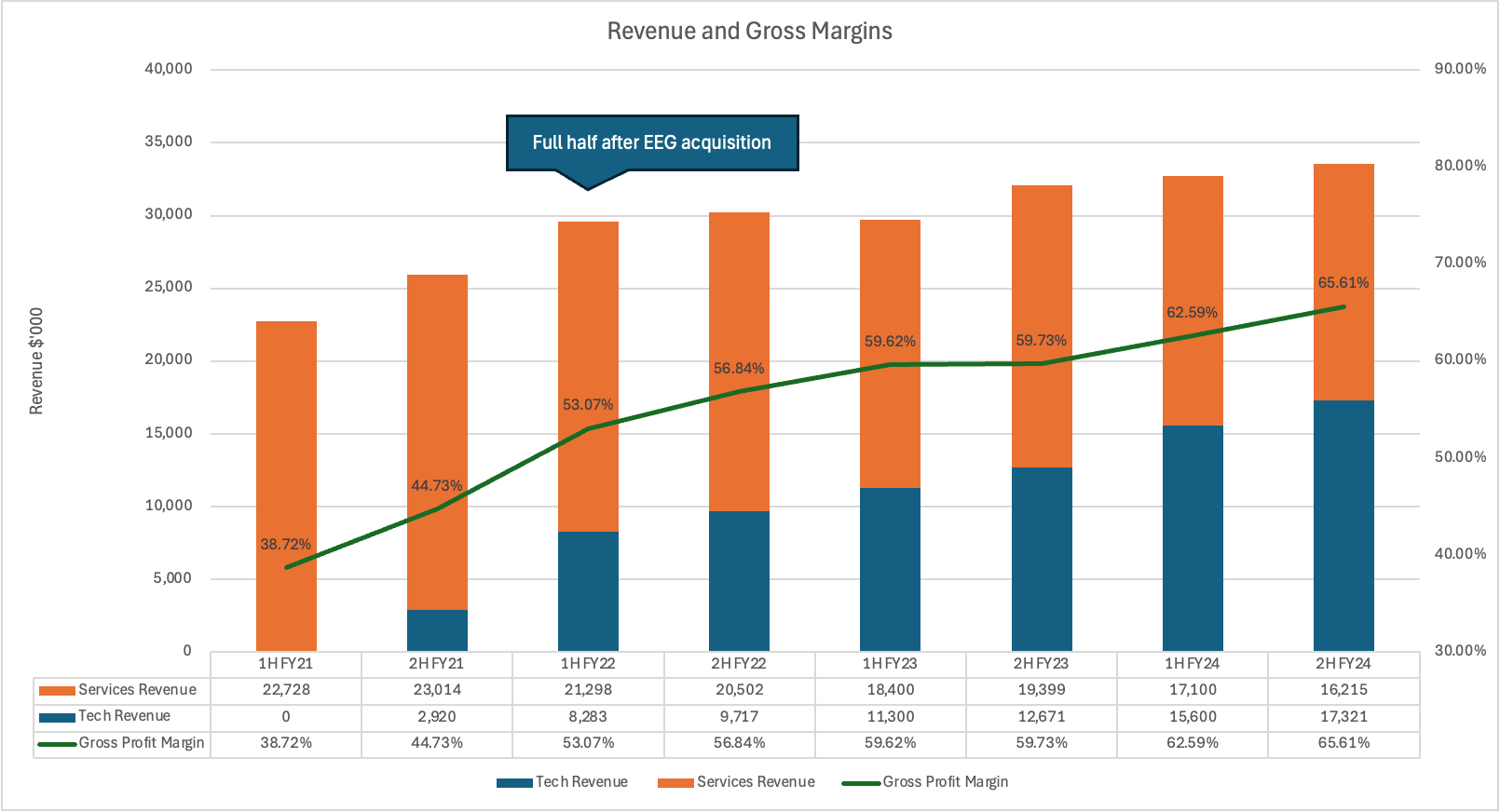

FY24 results were released today and once again the top line results were a yawn-fest with revenues growing by 7% to $66.2m. However, the real story lies beneath the surface, where the company’s dynamics are shifting. Ai-Media’s fast-growing Technology division (good co) contrasts with its declining Services division (bad co), leading to significant changes behind the scenes.

The company continues to recomposition itself from Services to Technology leading to increased gross margins

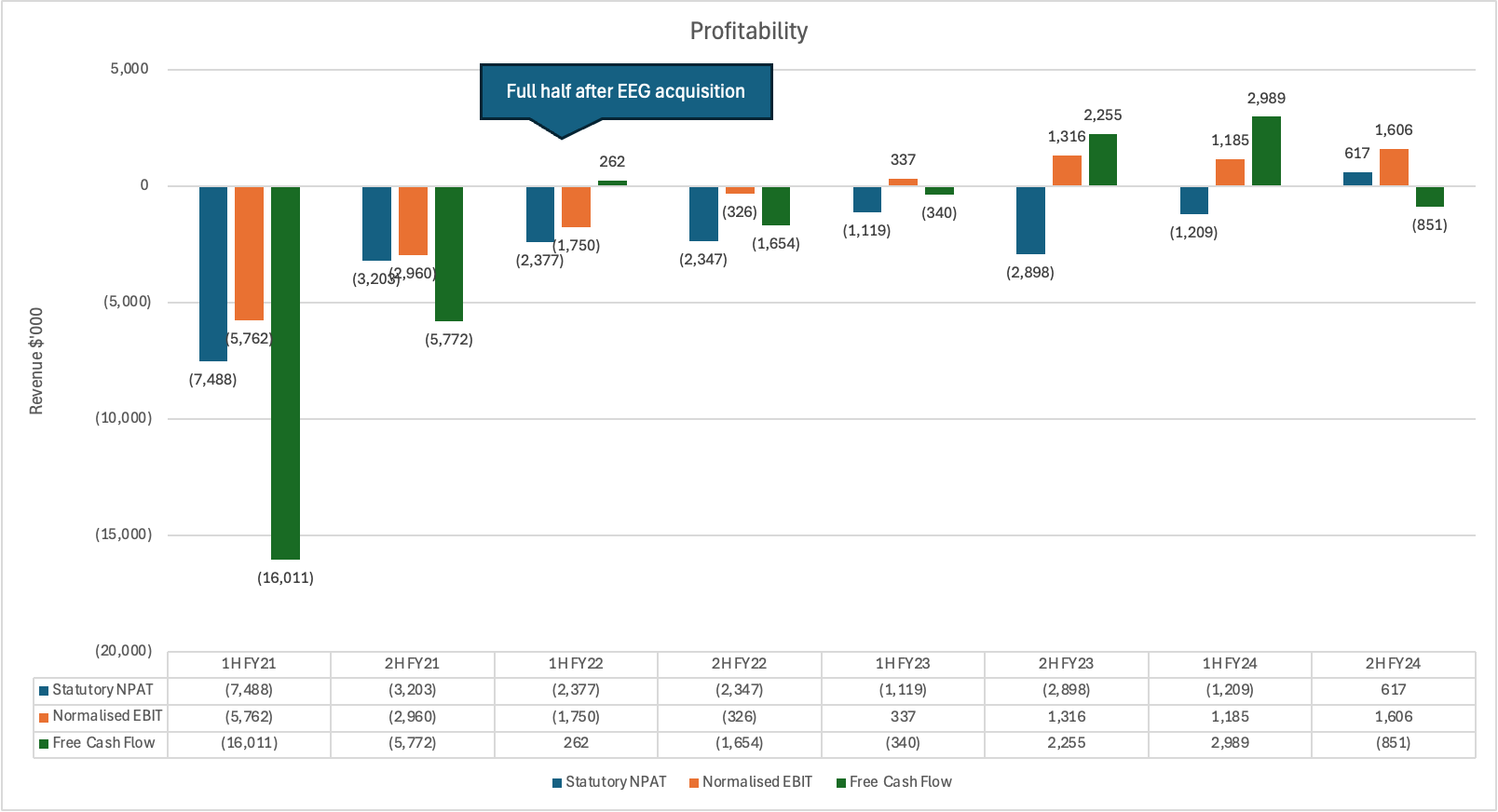

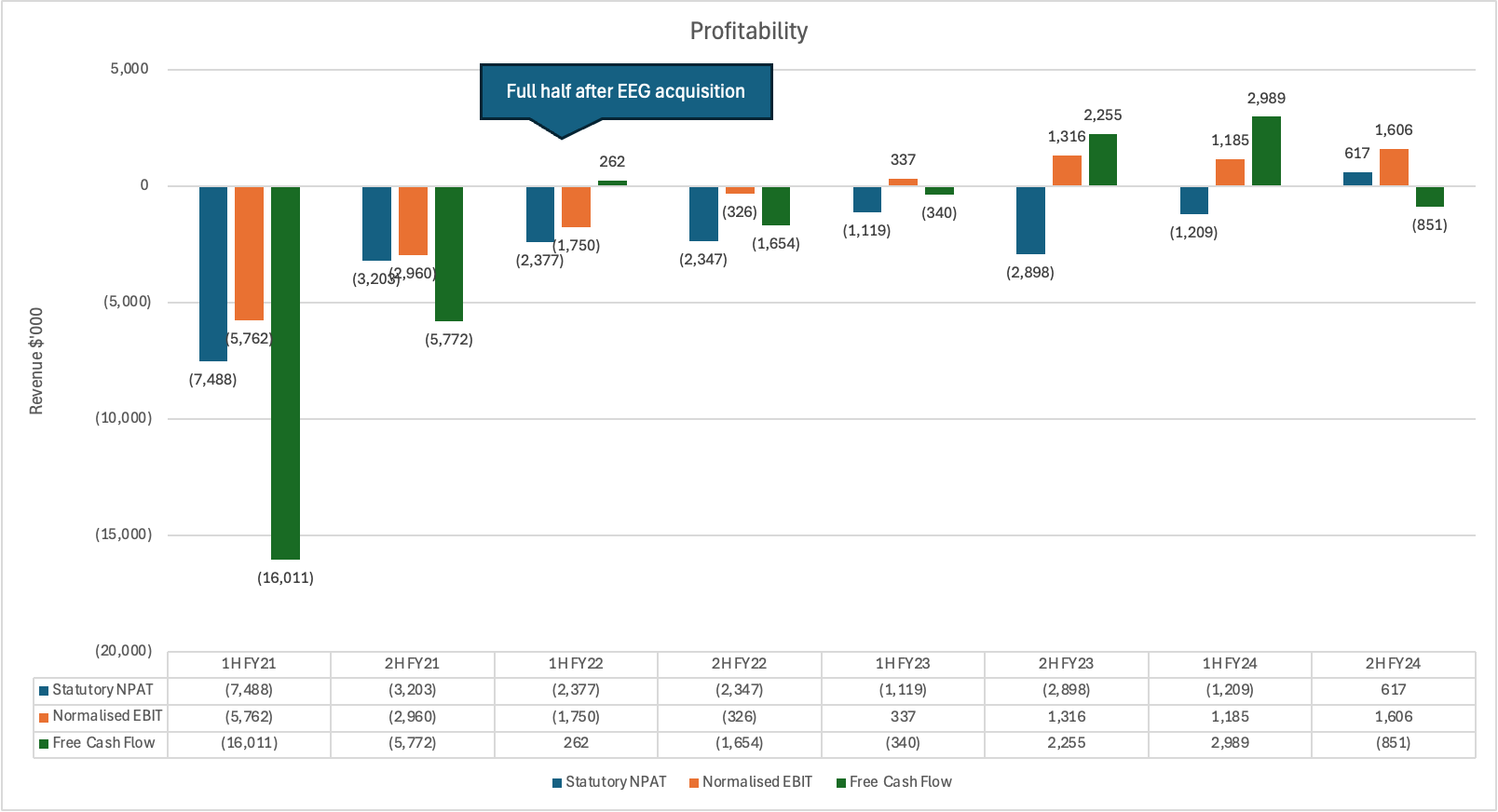

The positive trend in profitability continues

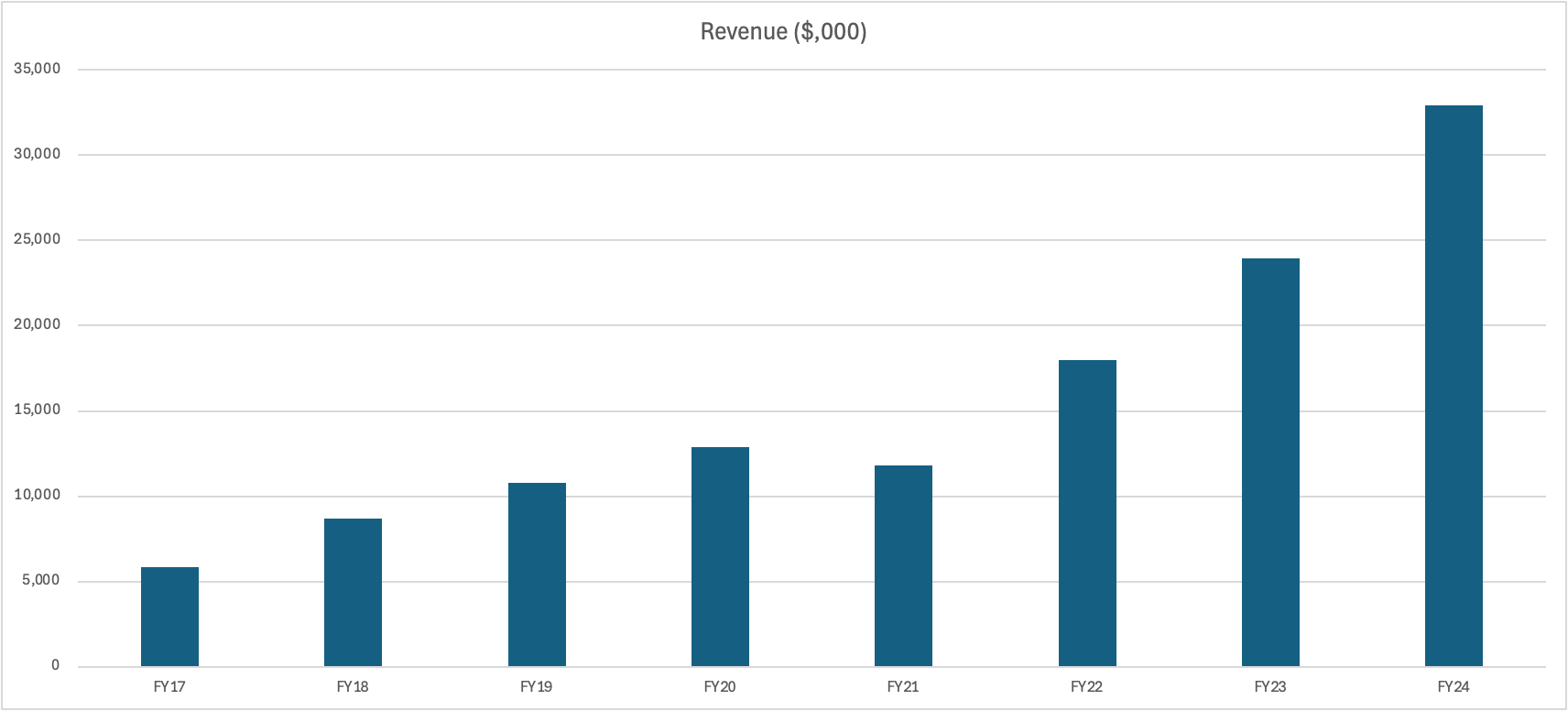

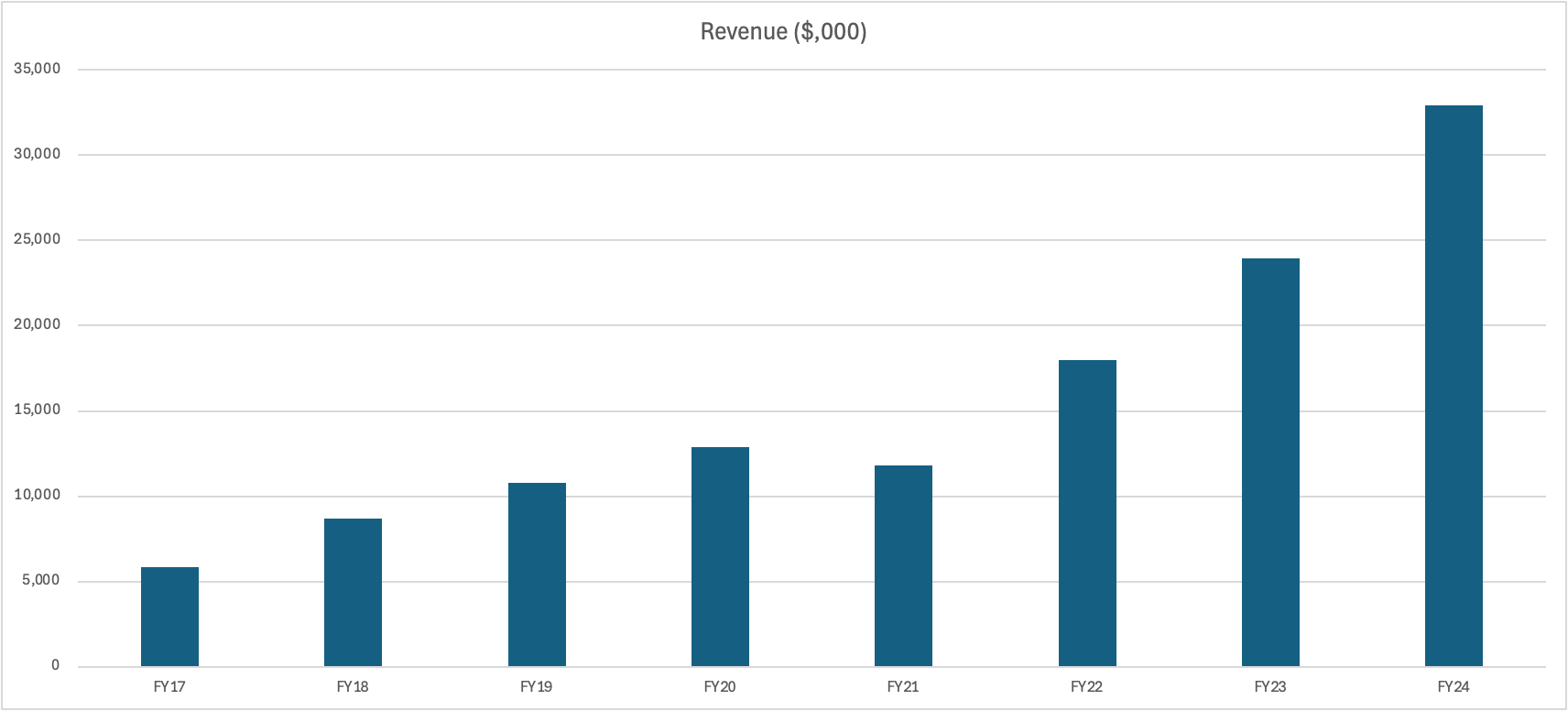

Technology revenue grew by 37% over the year and now run-rating at 52% of the group’s revenue and 68% of its gross profit. Ai-Media is rapidly transforming from a people-driven captioning service company into a caption technology and AI company. Management anticipates that Technology revenue will comprise 80% of the Group’s revenue by December 2025. If anyone needs a reminder of how well the Technology division has grown over the years, just take a look at the revenue chart below.

EEG was acquired by AI-Media in 2H FY21

This is one where I’ll need to go back and review my notes and old transcripts, but as my memory stands right now, there appears to be a distinct shift in management’s optimism during the conference call.

The key talking point was their “aspirational” five-year organic growth target: $150m in revenue and $60m in EBITDA. This translates to CAGR of 17.8% for revenue and 70.9% for EBITDA over five years. This is a significant leap from the single-digit top-line growth rates of recent years. However, it’s also quite attainable, given the rapid expansion of the Technology business, which now accounts for a much larger share of revenue and gross profit. Management believes they can achieve this by expanding beyond their core US broadcasting live caption market, targeting new geographies (with Europe and the UK as key areas), sectors (focusing on Government and Enterprise), and product offerings (including new AI-enabled language services).

The prevailing sentiment is that Ai-Media is positioned at the right time and in the right place. They provide the industry-standard captioning infrastructure used by US live broadcast companies, and there is surging demand for AI technologies to reduce captioning costs and extend reach, especially since the rise of generative AI tools like ChatGPT in recent years. The company has already demonstrated high-profile, high-stakes use cases for fully AI-generated live captions, such as during the recent Paris Olympics for broadcasters in the US (NBC in English and Telemundo in Spanish!) and Australia (Channel 9). Moreover, access to new large language models and machine learning advancements is making it increasingly feasible to develop additional automated services beyond traditional live captioning. Over the next 12 months, the company plans to roll out human-level language translations, voice dubbing, audio descriptions, topic models, and sound effect recognition.

In a recent, and super awesome, episode of Invest Like The Best with Gavin Baker, there’s a segment on “AI First” companies. It’s around the 56min mark: https://overcast.fm/+ABA27uWiTk8/56:00. I immediately thought about Ai-Media. They act as a thin wrapper around AI models (leveraging transcription services from Microsoft, AWS, and Google), delivering what feels like magic to their customers and not only going after software budgets but labour budgets. Gavin also asserts that although AI First companies are experiencing rapid growth, it’s very challenging to build long-term defensibility around their business models.

But this is where the comparison ends. Ai-Media isn’t an AI First business; it’s a labor-based company that has transformed into an AI business. The company dominates the North American live broadcast market, with its hardware and software encoders deeply embedded into their customer’s workflows. Additionally, Ai-Media still offers a labor component for customers who require that extra peace of mind. This integration provides a level of defensibility that the vast majority of pure AI First companies lack.

Despite the bump today, it’s still trading at trailing 1.4x sales and 34x Normalised EBIT. The market is still skeptical that a 30%pa growing Technology division with a 80%+ gross margin will become the vast bulk of the business going forward.

EDIT: I had a EBIT multiple wildly wrong