There's a lot about AI-Media that is easy to miss, so I wanted to try and elucidate the key aspects of the business, its offering and the competitive advantages it has -- as informed by today's conversation with co-founder and CEO Tony Abrahams.

But, to be honest, i'm not confident i've got things right so please correct me if you think I'm off base.

First, as @mushroompanda has already said, they aren't building AI models themselves. AI-Media’s technology relies on APIs (Application Programming Interfaces) to connect their software with these external AI engines.

AIM's products provide context to AI engines, such as metadata from broadcast streams (e.g., identifying speakers, locations, or specific program segments). This customization improves the accuracy of AI-generated captions by using additional data.

Their competitive edge comes from effectively embedding these AI models into a unique, customer-focused delivery system which integrates into existing workflows. It's more about ingesting audio/video feeds, extracting the relevant information, and sending it back in real-time so it cam be inserted/overlaid into the broadcast.

The acquisition of EEG (a provider of encoding hardware) was really a pivotal moment for AIM, giving it control over the critical hardware needed to feed audio data into AI models, allowing seamless integration with their cloud-based captioning services.

The total addressable market for AI language services is vast, estimated at around $70 billion annually. Tony pointed out that AI-Media’s current focus—live speech-to-text and live captioning—represents just a small fraction of this market, approximately 1%.

At the moment, around 90% of AI-Media’s operations are centered on live captioning and transcription, primarily driven by their LEXI solutions. However, Tony stressed that this is just the tip of the iceberg, indicating that the company is still in the early stages of tapping into the broader market potential.

A significant portion of the market opportunity lies in recorded media, which accounts for about 25% of the total market. This includes transcription and captioning for pre-recorded content like TV shows, movies, and online videos.

There are also considerable opportunities in broader AI language services such as voice dubbing, audio description for visually impaired audiences, and other multilingual services. This segment, which Tony identified as the larger $69 billion part of the market, involves using AI to handle voice processing, translations, and enhancing accessibility through audio descriptions.

The market for AI language services extends beyond broadcasting and includes government, enterprise, education, and entertainment sectors. Each of these industries has unique needs for language services, from live captioning and translations to complex workflows

Tony highlighted that one of the key drivers of market growth is the reduction in costs associated with AI-powered services compared to traditional human-based models. For example, automated audio description, which traditionally required 25 hours of human labor per hour of content, can now be fully automated, significantly reducing costs and making these services accessible to a broader range of content creators.

He also said that regulatory requirements for accessibility, such as mandatory captioning and audio descriptions, are increasingly pushing broadcasters and content providers toward adopting AI solutions. This trend further expands the market opportunity for AI-Media’s products.

As mentioned at the results briefing (or potentially earlier?) Tony outlined ambitious financial targets, including reaching $150 million in revenue and $60 million in EBITDA within five years.

And he said they wouldn't need to raise capital to pursue this -- all the pieces are in place and growth can be driven by organic cash flow.

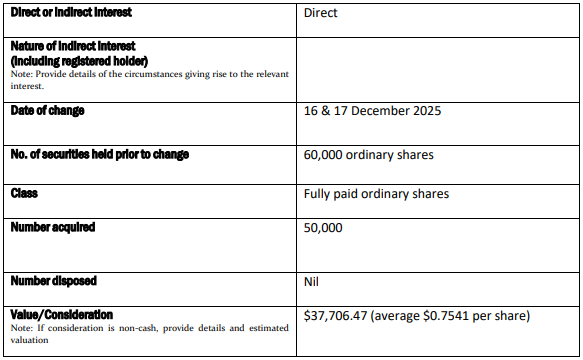

He certainly has his money where his mouth is, recently acquiring 5m more shares to lift his stake to almost 17% of the business (he bought at 31c -- not a bad trade so far!).

Anyway, it seems that AI-Media is a genuine market leader in a fast growing market that offers increased service and lower cost for its customers. It's well capitalised, cash flow positive, founder-led and expecting to 15x EBITDA in the next 5 years.

Shares are on ~27x EV/EBITDA

I don't presently hold in real life, but will be adding a watching position here on SM today.

Tracking along nicly so far though looking forward to hearing everyone’s comments once figures are released. Im figuring, this climb as far as most are concerned here, would be in anticipation of better figures at this stage, right?

Tracking along nicly so far though looking forward to hearing everyone’s comments once figures are released. Im figuring, this climb as far as most are concerned here, would be in anticipation of better figures at this stage, right?