I'm going to do my best to ignore the Orange Man and Operation Tariffs today and thought the best way was to try and find some new nanocap ideas for the Strawman community.

Anyone who invests or casts an eye over the nanocap (<$50m market cap) space doesn't need to be told how brutal the sector has been for a few years now. While there is a sector wide malaise, the fact is most companies in the space aren't worthy of an investment dollar and the current market conditions are only quickening an inevitable death.

That said, there are always decent businesses that get overlooked. I recently wrote about Racing and Sports (RTH) here which I think is a nanocap who reported an exceptionally strong 1H25 result that quickly got ignored due to macro conditions. Another one in a similar position that I have nibbled away at and now have a small position in is Motio (MXO).

MXO has a rocky operating history (nanocap veterans will remember it as the old XTD), but the business as it exists today effectively began in 2019 with the appointment of Adam Cadwallader as CEO who brought with him nearly two decades of experience in the out of home advertising space. Prior to the appointment as MXO CEO he led oOh!media's (OML) "place based" media division, which is a fancy way of saying digital advertisements in locations where people are more likely to spend a longer period of time to be engaged, rather than traditional billboards which capture passing traffic.

It was this experience Adam leveraged, purchasing four different operating assets over the next few years for roughly $6m. These purchases (including two assets from OML that Adam was familiar with) gives MXO digital screens in health centres, sports venues, cafes and bars. They currently operate over 1500 screens in 1000 locations around the country and if you have ever sat in a doctor's office that has a television looping information and the occasional advertisement then you have a pretty good idea what the product is.

But while the acquisitions gave MXO an immediate footprint, work had to be done. Some assets were aged and needed refreshing, some customer relationships had been ignored and needed re-engaging and MXO themselves had to build up the internal team to target advertising customers and convince them of the benefits of using their place based media channels.

That work took a few years but it was at the FY24 result where the tone from the business changed and the strategy for FY25 shifted:

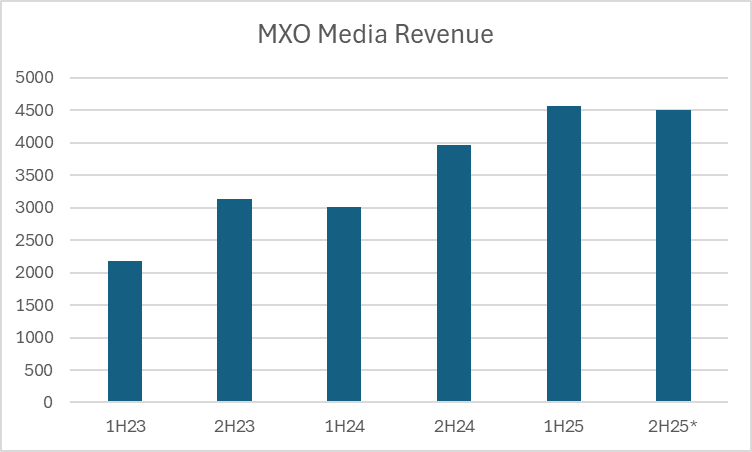

With the "ideal network size", growth would come from optimising and re-pricing customer campaigns and driving revenue per location which has grown steadily:

The momentum of the business has also been captured through continued upgrades to FY25 guidance, though there is some opaqueness we have to work through as the business recently spun out a non-core asset that needs to be pro-forma'd out. My best efforts to do that sees a guidance timeline that looks like this:

10 May 2024 - FY25 revenue $7.5-7.9m, cash EBITDA $800k

18 Sep 2024 - FY25 revenue $7.9-8.3m, cash EBITDA $800k

14 Nov 2024 - FY25 revenue $8.2-8.4m, cash EBITDA $1m

26 Feb 2025 - FY25 revenue $8.4-8.8m, cash EBITDA $1.2m

The non-core asset that has been spun out was Spawtz, which despite the name is not a pets focused recreational activity platform but a piece of software used by indoor sports centres to run casual leagues. It does player registration, team management, accept payments, etc. Spawtz came as part of the acquisition with digital screens in indoor sports centres and while it has been steady since acquisition, it hasn't really grown or been able to embed itself beyond the sports niche.

The spin out was to existing MXO management who were running the segment for $1.35m cash and includes five employees (including management). Importantly, MXO still own the digital screens, it is only the software part of the business that is being sold.

The combination of the Spawtz sale and strong cash generation in 1H25 has really cleaned up the balance sheet and made an investment far more palatable. The spectre of a potential capital raise has been removed as at the FY24 result the business had $1m cash and $2.2m debt as a result of vendor financing from OML to purchase cafe and bar assets.

Fast forward six months though and MXO has pro forma $3.5m cash in the bank with $2m debt, not only clearing up any concerns but giving them flexibility for more bolt on acquisitions of digital screen assets.

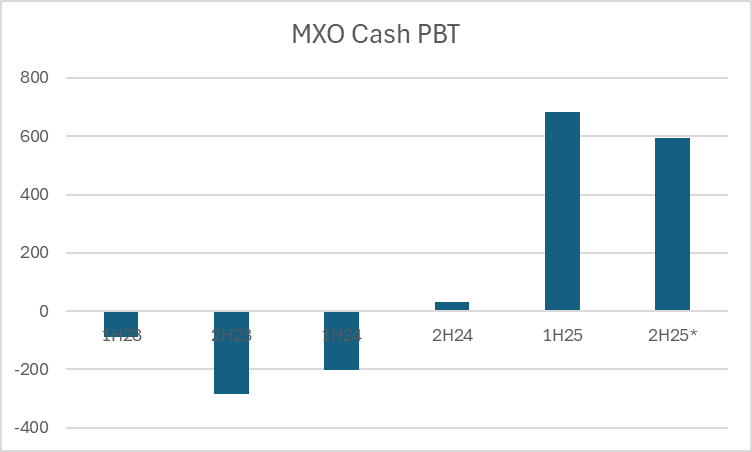

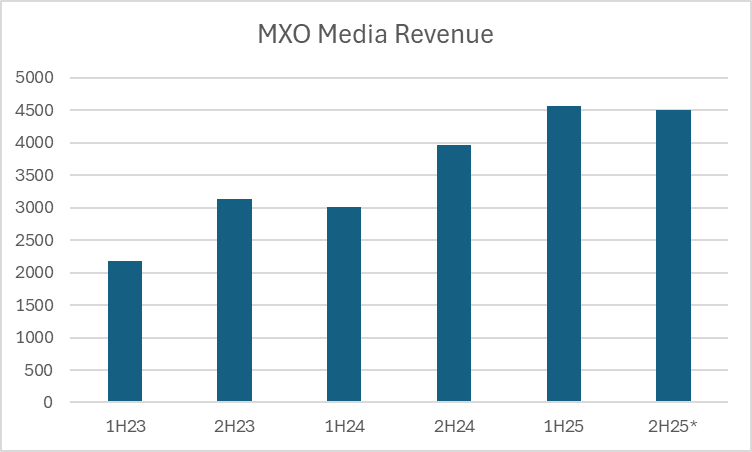

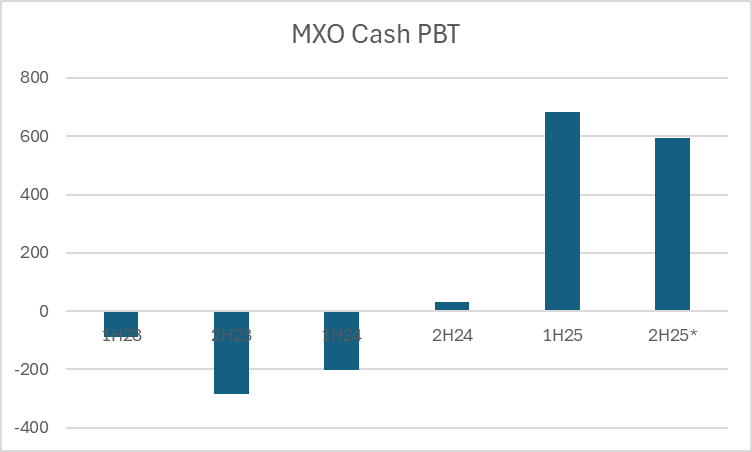

I've alluded to the strength of the 1H25 result a few times but to dig deeper revenue grew 44% to $5.3m while the company's preferred reporting metric of "cash EBITDA" grew 839% to $1m. Personally I would add back a few items to that reporting metric, primarily the interest bill which until debt is paid off is a real cost and also the cash cost of re-investment back into the business. Doing that I get "cash PBT" of $680k:

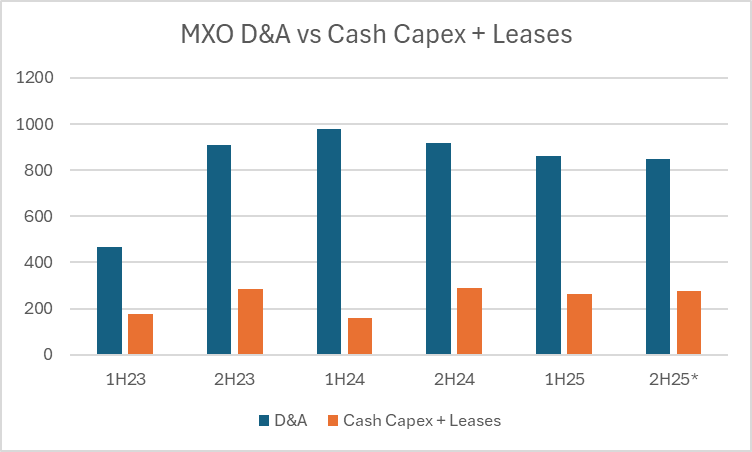

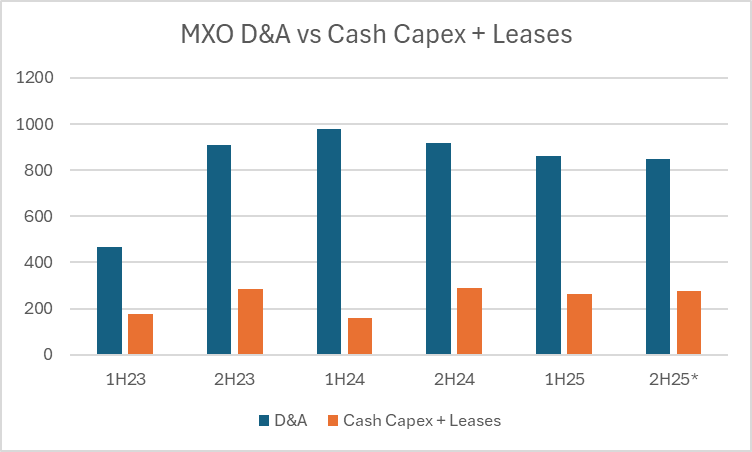

The discrepancy between cash PBT and reported is because cash re-investment is significantly lower than historical depreciation and amortisation. The main contributor is acquired customer contract rights and funky share based compensation accounting, but also with an ideal network size the historical depreciation of digital screens (over seven years) isn't being matched with the up-front rollout of new ones:

This is creating a set-up I love in nanocaps; where the reported numbers of the business are not reflective of the underlying quality or growth of the business. A scan of the profit/loss statement says MXO is a growing business but still unprofitable (-$161k) while a scan of the cashflow statement says the opposite, showing a business that generated $1.3m free cashflow in the half. Admittedly with the benefit of working capital movements but let's not let that get in the way of a good story!

So where are we today? At the time of writing the market cap is $7.5m (cue the collective grimace from my mid/large cap brethren) with $3.5m cash and $2m debt. The business did $680k operating profit in the 1H, based on FY25 guidance they appear very conservative. The history of guidance upgrades supports that view, but it could also be a general uncertainty with macroeconomic conditions and the upcoming Federal election given the cyclicality of advertising spending.

But generally speaking the second half is the seasonally stronger one for MXO:

Despite that, given the general uncertainty and the strength of the 1H25 result I am modelling 2H25 with flat revenue (which comes out slightly above current management guidance) and with modest cost inflation and no Spawtz contribution for the final three months of the year I have my preferred cash PBT metric forecast to slightly decline back to $600k (again, slightly above current management guidance).

$6m EV with the business potentially doing $1.2m operating earnings is just 5x, and with the spectre of a capital raise behind them I think MXO deserves higher. That said there are plenty of reasons for the market to be sceptical. It's small with an ugly operating history. Earnings will be cyclical, and maybe I am extrapolating a cyclical high in 1H25. Growth per location can only be pushed so far and unless MXO can find good acquisition targets growth will be hard to come by.

But at the end of the day I think it looks very cheap and it's an example of the sorts of opportunities that can be found deep in the murky depths of nanocaps. Definitely not for everyone but for those with a stronger stomach it may be worth a look!