Pinned straw:

16th April 2025: Genesis Minerals (GMD) Quarterly Activities Report - March 2025

Another cracking quarterly from Genesis, who are, IMO, the best growth story in the Australian Gold Sector in terms of decent sized multi-mine producers, and all of their assets are concentrated around Leonora and Laverton in the WA Goldfields.

Excerpts from the first three pages:

Importantly, they are still finding more gold across their tenements:

Which will also be added shortly here: https://genesisminerals.com.au/investor-centre/company-reports/quarterly-reports/

See also: https://genesisminerals.com.au/about-us/

The market clearly liked this latest quarterly report from GMD:

GMD made another new all-time high share price this morning - this time it was $4.31/share. Their 12 month low, almost a year ago, was $1.67. It's a good looking chart! They're not Robinson Crusoe - they DO have company - but Genesis (GMD) are certainly one of the better performers in the past year!

And they weren't even the best performing Aussie gold company this morning, although they are certainly in the mix.

[Only the top performers - with over +3% SP gains today so far - are shown above - that snapshot was taken at 10:52am today]

The gold price is providing a continuing strong tailwind to the sector:

Note: It's interesting that A$ gold has now outperformed US$ gold in terms of percentage returns for every time frame from 30 days up to 20 years, as shown in the side-by-side comparison tables above.

Disc: I hold GMD shares. In the Aussie Gold Sector I also currently hold NST, RMS, EVN, CMM, SPR, BGL, BC8, NMG, PLC, MEK and CYL. Some of those are held for shorter-term trades, others as longer term investments.

NewbieHK

@Bear77 you are our resident Gold expert. Your write ups have allowed me to get a better understanding of the sector and realise one does not need to focus on speculative gold explorers, to achieve a decent return in this area. Thanks for your contributions.

Bear77

Thanks @NewbieHK - agreed, you don't have to go up the risk curve to explorers to make good returns in the Aussie gold sector when the gold price is rising at a good clip.

Here's a very brief run-down of the gold companies I'm holding in my real money portfolios right now, keeping in mind that my SMSF can only hold ASX300 companies, so that's why I have to hold the smaller companies in my I+SG portfolio (outside of my super). I+SG = Income focused plus speculative growth.

- NST, Northern Star Resources, held in both my SMSF + I+SG portfolios (and here), Australia's largest gold mining company, currently undergoing a major expansion at KCGM (Kalgoorlie Consolidated Gold Mines) which incorporates their largest gold mill and Australia's largest open pit gold mine - the Super Pit on the edge of Kalgoorlie. Hitting new all-time highs currently.

- GMD, Genesis Minerals, run by Raleigh Finlayson, who built up Saracen Minerals (was SAR.asx) to become Australia's 4th largest gold mining company when they were acquired by (/merged with) NST a couple of years back. Ral is well on his way to repeating that sort of success with Genesis. The main thing to note about Genesis is that while Ral is promotional and does set aspirational targets, he actually achieves those targets, in most cases ahead of schedule, sometimes by years, and both SAR in their latter years, and GMD now, were/are regularly exceeding their own production guidance. GMD is a great growth play, with only some of that future growth priced in already, but certainly not all of it. Ral thinks and acts like a shareholder because he's both a very good manager and also because he owns 2.32% of GMD, a stake that is currently worth over $100 million. Most of Ral's net worth is through his GMD holdings, so little wonder he runs it like it's his own business. There is a management premium in the GMD share price as well as some of their future growth already being priced in now, however I have confidence that GMD has plenty further to run. Held in my SMSF and here.

- RMS, Ramelius Resources, are in the process of acquiring Spartan (SPR), good bunch of gold mines, all in WA, no debt, plenty of cash, well run, often overlooked, a core position of mine now. Held in my SMSF and here.

- EVN, Evolution Mining, built up to now be Australia's second largest gold miner (behind NST) by their Executive Chairman, Jake Klein, who has recently said that he views EVN as now being in cash harvesting mode, as he believes in counter-cyclical M&A, so he'd only be selling up here, not buying, although, as always, that would depend on just HOW good any future acquisition opportunities are. Jake is planning to retire as Chairman soon, and is transitioning to a more hands off role at EVN. It pays to note that of all the major gold mining companies on the ASX, EVN produce the most copper, so they are really a gold/copper producer rather than just a gold producer. Great play if you want exposure to both gold and copper, IMO. Held in my SMSF only.

- CMM, Capricorn Metals, has some of the best management in the sector, with multiple people who built up Equigold then early-Regis, and now Capricorn, so they know how to get gold projects built and into production on or under budget and on or under time. Has a significant management premium in the price, but I don't see why that would evaporate unless they do something stupid. One producing mine and one major development project, so cashflow plus growth. The main players from Equigold and early-Regis Resources who did NOT end up at CMM ended up instead at Emerald Resources (EMR), who are active in Cambodia and have a development project they are progressing in WA also (which they acquired by buying Bullseye Mining, an acquisition which took them over 2 years to complete). I have held EMR off and on, currently not holding EMR. Holding CMM in my SMSF and here.

- SPR, Spartan Resources, formerly Gascoyne Resources, currently being acquired by Ramelius Resources (RMS) - I own SPR in my SMSF as a shorter-term trade and an arbitrage play. SMSF only.

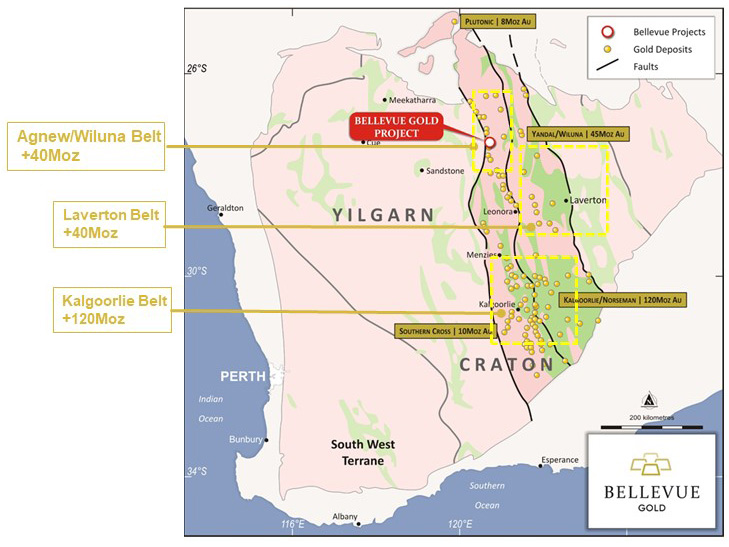

- BGL, Bellevue Gold, just emerged from 2 weeks suspended from trading due to a horror March in terms of gold produced being well under expectations and costs being too high, which meant a poor quarter and now a reset of expectations with lower and far more achievable future guidance and a slow down in mine development expectations that will allow more of the good stuff to be mined and less of the rubbish around it that has bugger-all gold. I loaded up on them yesterday in my SMSF at 90 cps (cents per share) after they emerged from that suspension. Their underground mine is one of the highest grade gold mines in Australia, and while they have had multiple issues to date, I believe that the odds are in my favour now that they will stage a recovery from here or else they'll get taken out by a larger player who would love to own that Bellevue deposit. I also added BGL to my SM portfolio yesterday at their closing share price of 89.5 cps. As well as their ore being high grade, Bellevue are on track to be 100% carbon neutral in terms of generating all of their power from renewables in the 2026 calendar year, so once they sort out their production issues, which I think they're getting very close to now, they are likely to attract more attention from ESG-type investment funds and individual investors who like that sort of thing, in addition to the usual goldbugs. Biggest drawback is that the ground conditions in their underground mine seem to vary, with most of it being very hard rock (that slows down development and production) and some of it being a lot softer, but well worth the effort because of the high grades.

- BC8, Black Cat Syndicate, have had a phenomenal run in the past year, an emerging producer, got this one in my I+SG portfolio as a trade at this point.

- NMG, New Murchison Gold, exploration play, shorter-term trade, I+SG only.

- PLC, Premier1 Lithium, have recently pivoted to gold exploration, shorter-term trade, I+SG only.

- MEK, Meeka Metals, getting close to production, refurbing the old Andy Well mill just north of Meekatharra (in WA's central goldfields) where Doray Minerals used to mine decent gold back in the day before Doray were acquired by Silver Lake (SLR, now known as Vault - VAU). Meeka are going to feed that mill from two ore sources, both close to the mill. I don't know how long I'll be holding Meeka - depends on how they perform. Because the mill worked well before (I held Doray shares at the time), and was built by GR Engineering (GNG) back in the day (who know their stuff), I see the ramp-up and commissioning phase to be relatively low risk compared to new mill builds (greenfields builds), but at some point MEK might start to look fully valued - they're not even close yet though. Higher risk, only held here and in my I+SG portfolio.

- CYL, Catalyst Metals, same deal as BC8; have had a phenomenal run in the past year, an emerging producer, holding this one in my I+SG portfolio as a trade at this point. They've been a great trade during the past year but I've only held them for brief periods, so have only enjoyed part of that run.

My core holdings are all decent sized gold producers: NST, GMD, RMS, EVN, and while CMM also fits that description, they have not been a core holding so far, but they may become one in time.

I have held plenty of others over the journey, even over the past year, but those are the ones I currently hold in my real-money portfolios.

My SMSF currently holds 11 companies, and 7 of those are goldies (NST, GMD, RMS, EVN, CMM, BGL and SPR). My other (I+SG) portfolio is more diversified, but still contains smaller positions in CYL, MEK, PLC, NMG, BC8 and a core NST position. I have much larger positions in that portfolio in LYL and GNG, who both design and build gold plants, and I also have decent sized positions in WGB, EGL and SXE in that one.

Bear77

Maybe NST @skaex, or possibly GMD, RMS, WGX or VAU, but there are some who think that Gold Fields Limited may have already expressed interest, particularly with that rift that has recently developed between Gold Fields and their JV partners at Gruyere, Gold Road (GOR) with each of them putting in rejected bids; Gold Fields putting in a rejected NBIO for all of GOR, and GOR putting in a rejected NBIO for Gold Fields' 50% share of Gruyere. Gold Fields are Bellevue's closest neighbours. [as shown below]

There is also an outside chance that Bellevue Gold Limited will still be running Bellevue in 2027.

More maps:

Those images above have been taken from old presentations so the Moz numbers are mostly old numbers. And some of the mine owners have changed also.

For More, see here:

Is this the Final Reset for Bellevue?

Apr 14, 2025 Money of Mine Podcast

"There’s only one story to chat about today… Bellevue. We go into the ins & outs of the new mine plan, the capital raise, the prospects of a takeover and a whole heap more."

CHAPTERS

0:00:00 Bellevue news revealed

0:07:37 Capital raise

0:11:27 New mine plan

0:15:04 Back of the envelope cash flow

0:21:49 The hedge book

0:27:41 Under strategic review

-------------------------------

DISCLAIMER

All information in this podcast is for education and entertainment purposes only and is of general nature only.

The hosts of Money of Mine (MoM) are not financial professionals. MoM and our Contributors are not aware of your personal financial circumstances. Before making any investment decision, you should consult a licensed financial, legal or tax professional.

MoM doesn’t operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given. MoM strive to ensure the accuracy of the information contained in this podcast but we don’t make any representation or warranty that it’s accurate or up to date. Any views expressed by the hosts of MoM are their opinion only and may contain forward looking statements that may not eventuate.

MoM will not accept any liability whatsoever for any direct or indirect loss arising from any use of information in this podcast.

-------------------------------

Disclosure: Of those gold companies that I have named above in this post, I hold BGL, NST, GMD and RMS.

skaex

Thanks for your valuable insight @Bear77, as always. It's like watching a good (gold) soap opera in this cycle, isn't it? Exciting!!! Also, got to love those guys at MoM podcast!

I've finally sold half the stake in RRL (I know, I know - I think we've talked about them in the past - but good time to take some 4x profits) and looking for a new short-term/long-term home. I have my eyes on BGL and MEK, but each for its own reason, short-term strategy. Not financial advice (for those who are not familiar with gold miners) of course.

EMR is the other one I would like to get in (I feel they've been running unnoticed), but that would be a long term affair. Always have some gold in your portfolio (and #BTC, but that's for a different topic).

Bear77

Can't argue with the gold sentiment @skaex - I'll leave the BTC discussion for another day - not my cup of chai - but back to EMR - yes, they occasionally catch a bid, but can often seem to get overlooked when the sector is running hot. Pros and cons. Pros are management, and the WA assets they got through the Bullseye acquisition, plus the second standalone gold mine they believe they can build in Cambodia. Cons (not in the con-job sense, but in the pros and cons sense) are mostly just that all of Emerald's current earnings are derived from gold mining in Cambodia and they are the first goldie to succesfully crack that country in terms of gold mining at scale, so it's new and has been considered by many punters to be high risk, despite EMR's success to date. I like Morgan Hart and his team at EMR - lots of experience and superb track records there at Emerald and with Regis before that and with Equigold before that, same as the CMM crew as I mentioned earlier today.

And I do hold EMR now and then, but when gold is running as good as it is right now, I'm trying to position myself in the companies I believe are likely to give me my best bang for each buck, and I have therefore stepped to the sidelines with EMR until they get a lot closer to production in WA to diverisfy earnings away from Cambodia, which is likely to take years. They don't rush things. They get stuff done, but they set realistic timetables. I daresay I'll be back in Emerald in future years, just possibly not this year.

Similar logic behind why I don't currently hold PRU or any other West African gold miners (PRU being the best of those). Just trying to limit the downside risk when there is so much to choose from right now.

skaex

Having been involved in the commissioning of both the Bonikro and Duketon Projects, I can only speak highly of the EMR and CMM management teams (ex-Regis, Equigold, etc.). I’ll also note that Bonikro took around 11 years from permitting to production—so mining in a different country definitely comes with some risks. But gee, it feels so good when the results line up with expectations.

I’m not a gold bug (per se), and I only have 10% allocated to gold (plus 10% in cash after exiting half my stake in RRL). Still, there’s something about gold I can’t shake—and I guess I’ve never lost money on it.

MEK is getting close to plant commissioning (June 2025) and BLG is...well...a bit of a gamble in the short term. MEK's processing plant is rather small compared to the bigger players, and I don't see any hiccups (based on my past experience). This might be priced in already (of course), but I think there is an asymmetric potential here.

Bear77

Just on RRL @skaex - I found this interesting: MoM Podcast April 22nd 2025.

Transcript from the start of that Podcast:

Do you remember when McPhillamys study came out nine months ago and it was pretty underwhelming? We were a bit unimpressed by the numbers. But when it came out, the base case scenario, development scenario, used a gold price of, in Australian dollar terms, $3,000 per ounce, which gave it an underwhelming post-tax NPV of just $451 million. Now, spot gold price is $2,400 an ounce higher than that as of today. If you chuck that gold price in the model McPhillamys NPV, it's suddenly $2.3 billion.

That is the sort of torque that these development projects have in a rising gold market.

--- end of transcript excerpt ---

Bear77 note: While McPhillamys has been shelved based on Tanya Plibersek refusing to allow RRL to build their TSF where they want(/need) to build it, that decision could potentially be reversed if our Australian Federal election this time next week (on Saturday May 3rd) delivers a change of government. Not something I'm hoping for personally, but I won't get into politics today. Suffice to say that our family has already postal voted, and we did not vote Liberal. Australia might not be in perfect shape right now, but I can't see us being better off with Lord Voldemort as our PM.

Below is a link to that MoM podcast that I scraped that transcript from (excerpt above).

0:03:19 Who’ll benefit most from gold mania?

Over 5,000 views, Apr 22, 2025 Money of Mine Podcast

"With gold rocketing, we start the show by running through interesting undeveloped Aussie gold projects flying under the radar."

Bear77 notes: Companies I plan to have a gander at over the next week or two: Barton Gold (BGD), Astral (AAR), Antipa (AZY), Rox Resources (RXL), Medallion Metals (MM8) and Horizon Minerals (HRZ).

I've started with looking at "Subs" for these companies, and the three that caught my attention the most were:

- MM8 has Minmetals @ 6.26%, Alkane (ALK) with 6.32%, Bolong (Australia) Investment Management with 21.67%, Langyu International Holding Ltd with 6.81%, Aurora Prospects with 6.01% and Fan Rong Minerals Consulting with 7.69%, so plenty of overseas ownership as well as Alkane Resources (ALK; another ASX-listed and Australia-focused gold producer) on their share register;

- BGD has Collins St Asset Management with 14.07%, and rising, plus their CEO & MD, Alex Scanlon, holding 21.42% of the company through his company, Gocta Holdings Pty Ltd; and

- Antipa (AZY) has their neighbours Greatland Gold (who are UK listed but planning to IPO on the ASX shortly as well) owning 7.38%. Greatland recently bought the large Telfer gold-copper mine plus the nearby Havieron development project off Newmont who acquired those assets when they bought out Newcrest a couple of years ago. AZY look like a logical acquisition for Greatland at some point, but that will all depend on how much gold they end up with there.

Note: These are all early stage explorers / developers and as such they are very high risk, so if I did end up throwing any money at them, it would be small amounts, and no more than I can comfortably afford to lose. No decisions made yet anyway. Work to be done first.

skaex

Hi @Bear77 ! Hope you had a good weekend. And tanks for sharing your views on RRL and other up-and-coming opportunities.

Yes, I have listened to that episode. The numbers change significantly when you model in the current gold price and probably RRL's recent share price appreciation leveraged on some of those numbers. But do I trust the government to change their mind? At some point, yes. But not getting into politics today :), just noting that we're going through, in my opinion, some of the worst—if not the worst—political times and government/s of my life. It's a joke!!! It's minor freedom loving parties for me first, those who advocate for freedom of speech, who don't shy away from saying as it is - call it my childhood trauma :), but I've experienced communism growing up, and man, it was not nice...and that's already been on display in some major city...

Now back to the gold miners. I sold half my stake in RRL in an attempt to invest in other gold miners (short term mind you) who might have not appreciated (in $ terms) as much as others. I did a speculative buy in BGL (Bellevue) at $0.86 and MEK at $0.14. I don't really have a long therm thesis for BGL, other than what has been previously discussed here i.e. continue as is, take-over or sell the asset - so I speculate on that with money I can afford to lose. Meeka is ramping up activities with open pit mining already commenced last month and process plant commissioning activities due in the June quarter, and first gold in mid-2025. Meeka might be a medium term investment, but just a speculative buy at the moment with money I can afford to lose, just as a starter/tracking position.

I came across Antipa a few of months ago. It has been discussed on different channels, with some small-cap funds investing heavily in it due to the reasons you already highlighted.

Another one I came across recently (and I believe you mentioned them in a recent post) — being promoted by a small-cap fund (Lion Selections) — is Saturn Metals. They're proposing a different, cheaper, and, dare I say, quite uncommon method of extraction (at least for Western Australia) for their Apollo Hill Project.

Rox Resources has also been briefly discussed by MoM in one of their recent episode, can't remember which one at the moment. I don't have much knowledge of their operations at the moment.

I’m not a gold bug, but gold miners keep popping up like glitter in a craft drawer — no matter the market mood. Must be that irresistible shiny hue messing with my brain :).

Thanks @Bear77 for all your inputs. I really appreciate the time you’ve taken to analyse the data and bring other opportunities to this forum.

skaex

Also, some interesting read on Minerals 260 (ASX: MI6) Barry FitzGerald: Why Tim Goyder's Minerals 260 could be the ASX gold market's next Capricorn - Stockhead. Never heard of them.