Pinned straw:

I’ve never used NWL, so I can’t really comment on them, but I also use eSuperFund and I’ve found it to be a great platform if you’re looking to go down the SMSF path. It’s really affordable, and while you do need to do a bit of the work yourself, I’d say the time commitment is pretty minimal.

(I hope this comes across the right way…) but if you’re not up for that little bit of work, then maybe an SMSF isn’t the best option anyway. Just to be clear, I don’t mean that in a rude or condescending way, it’s just that SMSFs aren’t for everyone. If doing a bit of admin sounds like too much, you’re probably better off with another setup.

I guess there are so many options out there in how to structure your investments because everyone has a different approach to their investing journey. Finding the right one for you might take a bit of effort (kind of like researching companies), but that time investment is totally worth it, and honestly, pretty important.

@jcmleng , echoing your comments on Netwealth’s customer service. I looked into their super products in early 2023 and had multiple questions. Each time, I received detailed responses within a day, which really impressed me. Based on my customer interactions, I thought I should look at NWL as an investment, but never got around to it.

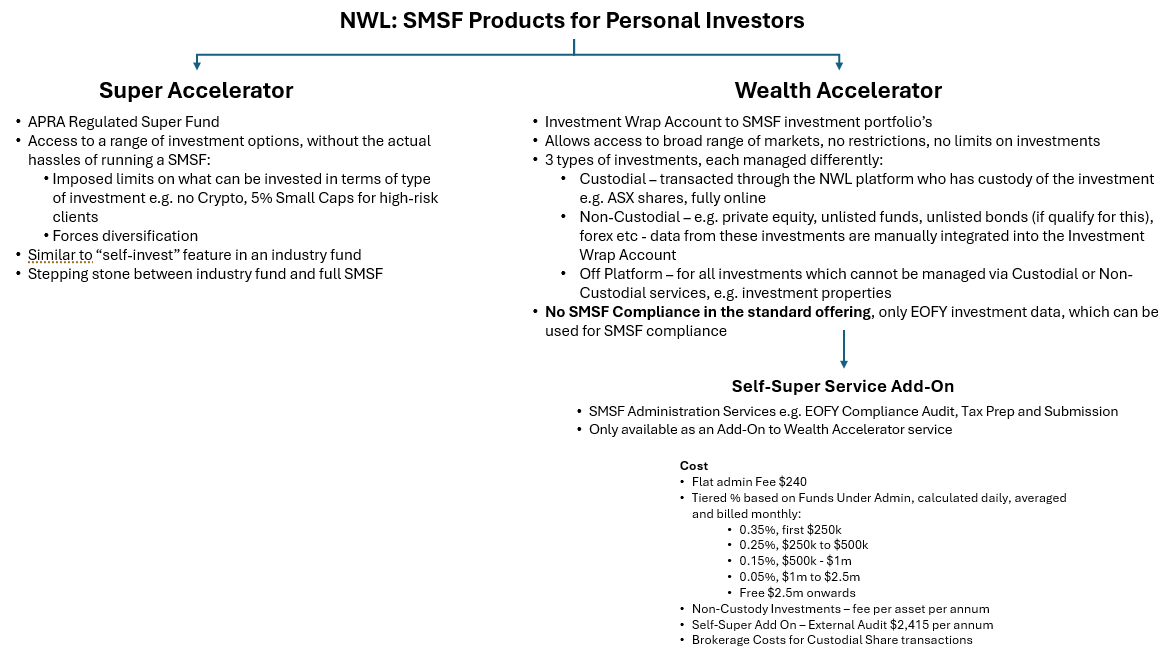

From my experience, DIY investors seem to be more of an add-on to their main client base of financial advisers using the platform. I was strongly encouraged to use Netwealth through a financial adviser, which I suppose is part of their duty of care.

Ultimately, it was the higher fees that put me off.

With new super products from Pearler and Stockspot, there are now good alternatives for people who want more control and a simple portfolio, without moving to a full SMSF. That said, I doubt these new products will have much impact on Netwealth’s core customer base.

Also, if you are unaware, Matt Heine has a podcast called “Between Meetings with Matt Heine.” It’s not specifically about NWL, but it does give some useful insights into the industry at times.