Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Looks like NWL has caved and followed MQG to pay out $101M. A bit surprised but after Macquarie I guess had no choice.

I guess this puts it behind them and this gives them the moral high ground too whilst the comments limit them to having to do so in the future for a similar event. Well played in the circumstance.

Discl: NWL Held IRL, HUB Not Held

CONTEXT

One of my to-do’s for NWL coming out of the reporting season was to do a quick high-level comparison with HUB24, NWL’s closest competitor. The objective of this exercise was to get a sense of where NWL was relative to HUB and confirm that staying invested in NWL continues to make sense.

Have kept the comparison at a superficial high-level based on info obtained from the ASX website + the FY reports from FY22 to FY25. While both are in the exact same FinTech Investment Platform space, they have different products, different metrics etc such that any attempt to compare at any lower level of detail than this is probably not going to provide any more insights.

Haven’t done a comparison like this before. Would really appreciate any feedback if the conclusions below are flawed ...

SUMMARY

- At roughly the same Funds Under Administration market share as at Mar 2025, it feels like NWL is significantly more efficient/productive/profitable than HUB

- HUB’s revenue is significantly higher than NWL and the gap appears to be widening

- BUT on Statutory NPAT and EBITDA (these being the 2 “directly comparable” profitability metrics), FCF Yield and Dividend Yield, NWL is clearly ahead of HUB, despite having much lower revenue

- So while NWL and HUB are running neck-to-neck in terms of current market share (HUB might be slightly ahead, I suspect) and running hard to increase market share, it does feel like HUB is some ways behind NWL in terms of generating shareholder returns

Based on this simplistic view, it gives me good confidence that staying invested in NWL is absolutely the right thing to do.

The sharp PE difference HUB PE = 108x, NWL PE = 64x, is what throws me out a bit. Given the above, I expected the HUB PE to be lower, not sharply higher than NWL, which perhaps could be a sign that the market is more confident of HUB emerging as the eventual top dog? Not sure if I am interpreting this correctly.

CHARTS

Discl: Held IRL

Nice 1QFY2026 update from NWL today.

- Positive momentum across all products & services sums up the quarter.

- First Guardian update is cautious - FY26 guidance now includes a caveat against unexpected First Guardian costs

The commentary in the update is littered with the usual “record-this-and-that” which I find quite confusing as it is mostly against the prior corresponding period 1QFY2025. As NWL expects to grow each quarter, referencing and gloating about the pcp comparison seems quite pointless other than to generate the buoyant headlines. While there is some seasonality, I prefer to focus on the underlying QoQ trend instead.

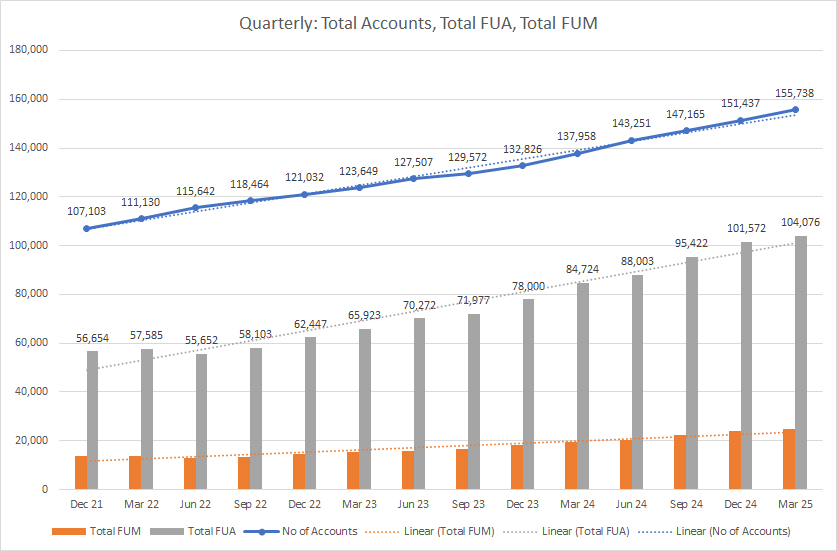

- Total Funds Under Administration hit $120.8b, increasing $8.0b QoQ, an above trend increase, building on momentum in the previous quarter - up 7.1% QoQ

- The Quarterly Increase in new accounts of 5,146, up 3.2% QoQ, reverted to trend following the sharp spike in the June 2025 Quarter - the accounts growth is now in short-term acceleration mode - very nice

- Total Funds Under Management was $29.5b, up 0.2% QoQ, driven by growth in (1) Managed Accounts, up 32.6% on pcp to $25.7b (2) Managed Funds, up 23.0% on pcp to $3.8b

FUNDS UNDER ADMINISTRATION

- Continued on-trend increase in Total FUA Net Flows of $4.0b, slight exceeding 1QFY25 and improving on 4QFY25

- Continuing to benefit from ongoing transitions from existing financial intermediaries as well as new accounts from new intermediaries

- Non-Custodial FUA hit $1.0b for the very first time - a pricing increase kicked in on 1 Oct 2025

FUNDS UNDER MANAGEMENT

Sharp uptick in FUM Net Flows of $1.8b, up 63.3% QoQ - a (noticeable!) record as it towers over previous quarters FUM Net Flows.

Discl: Held IRL

$33.41 (between $21.29 and $45.06)

Tricker valuation to do given the much higher PE multiples involved, NWL's strong EPS trend and the "exceptional" FY25 EPS jump.

Any comments/feedback would be much appreciated.

Interesting to see if NWL ponies up and pays too - Macquarie to repay Shield investors after super platform failures - ABC News Not sure what their exposure was. Equity Trustees looks like they're going to court and not caving.

Was always a risk for NWL when they add almost every Fund. It is why a lot of advisers/ fund managers preferred them as they're easy to deal with compared to the legacy funds that were burnt in the Royal Commission.

Some insider buying on this name with Director Sarah Jane Brennan purchasing nearly $100k worth on market.

Chair and CEO say: FY25 was an exceptional year for Netwealth across all key operating and financial metrics. Our Funds Under Administration (FUA) grew by 28.2% or $24.8 billion to reach an all-time high of $112.8 billion, significantly outpacing the Australian wealth management platform market growth of 7.3%.

https://hotcopper.com.au/threads/ann-2025-full-year-results-presentation.8722852/

Return (inc div) 1yr: 58.32% 3yr: 41.18% pa 5yr: 22.03% pa

Annual Report:

https://hotcopper.com.au/threads/ann-2025-full-year-annual-report-appendix-4e.8722825/

Message from the Chair: “Over nearly a decade as a Netwealth director and four years as Chair, I have had the privilege of witnessing extraordinary growth, from $7.0 billion in FUA and fewer than 200 staff to over $112.8 billion and a team exceeding 700 today. As I prepare to retire on 31 August 2025, I am confident in the leadership transition we have established. The Board welcome Michael Wachtel as our incoming Chair, whose extensive board and business experience will bring outstanding governance capabilities as we continue to scale. This transition, combined with our strong executive team, Board and robust governance frameworks, provides continuity and operational excellence.”

Just had a chance to review the NWL June 25 Trading Update released on 10 July.

SUMMARY

- A good business-as-usual update and positive commentary on FY26 - no immediate concerns

- Nice above trend QoQ growth on New Accounts - this sets it up nicely for FY26

- FUA and FUM both grew QoQ in line with the prevailing quarterly growth trajectory

- Should translate into a good full year FY25 result

Discl: Held IRL

Nice above-trend increase in Total Accounts and Quarterly Increase in accounts

Funds Under Administration

On-trend Q-on-Q increase in FUA Net inflows - management commentary that “FUA outflows were at slightly elevated levels due to partial withdrawals from larger accounts following increased market volatility. These outflows were primarily from non-fee paying FUA, and as such the financial impact was modest”.

Good positive FUA market movement.

Funds Under Management

FUM net flows of $1.1b for the quarter, 16% higher than pcp, moving back to the long-term FUM Net Flows trendline

FUM Growth was concentrated in Managed Account products - 34% higher than pcp, and accounting for 96% of all FUM net flows.

I am in the midst of (finally) taking stock of my NWL position. I blindly followed MF Pro’s direction to open the position back in 2018, understood the thesis, sort of understood what it was about, but never deep dived until now. It is now my 2nd largest IRL position at 10%+ and 2nd largest winner - living proof that the coffee can investment approach does work, particularly if the company was picked by the great MF Pro combo of Joe & Matt.

After deep diving the financials, I struggled to clearly understand the products. So I signed up for a product demo last week through the NWL website to better understand the Personal Investor products, as I did also want to explore what was available (and at what cost) vs my current eSuperfund SMSF setup. Here are my notes, of both the SMSF-related products, as well as my takeaways from a “better understand NWL” perspective. A lot of the points should be intuitive, but having the conversation and the ability to ask questions made a huge difference to the understanding.

What I understood, the chart of the key NWL platform metrics at the end of this post and what I thought was an excellent article by A Rich Life’s Patrick Poke sums up why the MF Pro pick of NWL was an outstanding one and why I should absolutely stay invested with a high portfolio allocation.

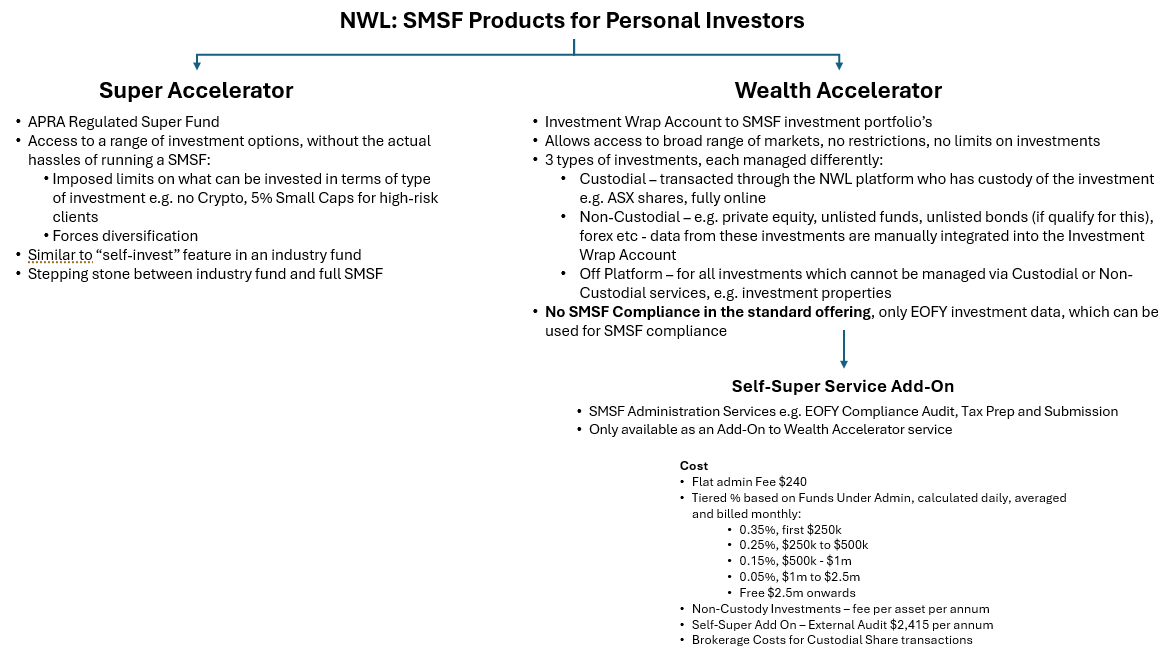

OVERVIEW OF THE PERSONAL INVESTOR PRODUCTS

THE SALES ENGAGEMENT PROCESS

- The Sales Team response’s to website enquiries - appears to be within 3 business days, which is comforting

- The Sales rep spent 45 mins talking me through the products, pricing and despite my hesitation in product suitability, continued to offer a demo - this desire to take me through the product was good - if I was not clear on what I am after, the demo would have got me

FINANCIAL ADVISOR FOCUS

- 96-97% of NWL customers operate through Financial Advisors

- Each financial advisor has its own “platform” within the NWL platform:

- Tailored functionality

- Tailored screens, reports

- Each client of the advisor has their own login to the Advisors “platform”

FEE/COST STRUCTURE

The explanation of the cost structure and the mechanism in which it is calculated (daily snapshot, averaged then x days in month) helped bring to life how the Funds Under Administration Market Movement metric, what broadly makes up the various NWL revenue lines - Administration Fees, Ancillary Feels, Transaction Fees, Management Fees, and how both these numbers will rise and fall based on how the market moves.

It also provides clues as to where and why NWL still requires a reasonable labour force.

WHAT ATTRACTS NEW CLIENTS INTO NWL

The Sales Rep commented that what attracts new clients into NWL:

- Financial Advisors - once a Financial Advisor comes onboard, their clients come onboard as well

- Detailed real-time and EOFY investment reports from the platform is a key attraction for SMSF customers who focus on the investing side rather than SMSF Administration

- Clients who want access to a range of investment options that they self-manage, without the hassles of running the SMSF administration (Super Accelerator)

HOW DOES IT COMPARE WITH ESUPERFUND

It will cost me at least 3x the eSuperfund annual fee to get:

- base Wealth Accelerator

- the “equivalent” SMSF compliance service that eSuperfund provides

- Significantly better investment information/data/performance/dashboards to manage the SMSF’s investment

- Cost will vary based on the daily balance of the Fund

- Cost will also rise further if the SMSF has off-platform or non-custodial assets

A non-starter if you are able/willing to invest time in managing the SMSF admin on a day-to-day basis.

NWL PLATFORM GROWTH SINCE FY2021

Discl: Held IRL

Netwealth (NWL) reported 1H FY25 results this morning. From their presentation:

Hard to fault these results. Continued increase in FUM, EBITDA and NPAT. Margins also increased showing its operating leverage.

The structural shift away from the legacy platforms continues:

Maybe just keep an eye on the amount of market share HUB is now taking although I don't think this will be a winner takes all market. Both NWL and HUB should continue to benefit from this shift well into the future.

Happy to continue to hold this but the eye watering valuation makes it hard to add anymore. Currently my biggest holding IRL.

Disc: Held IRL, not held on Strawman.

After HUB's update yesterday, reporting $5.5 b net funds inflow for the December quarter, Netwealth has reported $4.5 b net funds inflow. This is the second quarter in a row that HUB have outgrown Netwealth, but I'm not overly concerned. It is a huge market where the 'legacy' incumbents - the adviser networks tied to the banks - still have 56% market share, all of which is up for grabs. And the the market is still growing, with total FUA for the platform industry up 16.8% to $1.2 t in the 12 months to end of September 2024.

Netwealth grew their market share by 1% to 8.2% in the same period, whilst HUB is nipping ever closer at their heels with a 7.9% share.

I'm still a very happy holder of NWL in my RL portfolio, it is exceptionally well managed and has plenty of room to keep growing. The December quarter saw growth in FUM of 70% over PCP, for goodness sake!

I also noted that Praemium had net fund outflows (i.e. negative inflows) in the 12 months to the end of September 2024, the only platform providers growing their FUM being HUB ($17b), Netwealth ($12.8b), Macquarie ($2.5b) and DASH ($0.8b). I have a finger in the DASH pie via my holding in Bailador, so I think I have more than enough exposure to the wealth management industry.

I have a totally embarassing question to ask help on. Can anyone point me to a writeup or diagram which succintly describes what exactly the NWL platform does/manages/provides??

I have poked around Google, the NWL site, went through the Annual Report, looked at the marketing videos, read some of the PDS' but I am still struggling to clearly understand the products and services that are offered on the NWL platform. While some of the content talks about the capability and scope of the product, there is a lot of sales-y speak overlayed and a lot of ghee whizz "IT platform/reporting/data benefits" but I am still struggling to clearly understand what each product actually does for a customer or an wealth advisor. The products I have understood thus far, which is half-coherent:

- Self-Super: this is an end-to-end SMSF management/administration service akin to eSuperfund, which is my SMSF provider.

- Super Accelerator: provides the capability to invest in various products - managed funds, term deposits, fixed term annuities - there is a Super Accelerator Plus which provides more investment options

- Wealth Accelerator Multi-Asset Portfolio Service Guide - a single account which allows you to buy, hold and sell various investments

- Managed Account: access to a range of professionally managed investment portfolio's, which I gather you can invest in from either Super Accelerator or Wealth Accelerator

- Global Specialist Series Funds (GSS Funds) for NWL GSS Managed Models

- I gather it has a Share Brokerage

- NWL is also a Superannuation Fund in its own right, similar to Aust Super, HESTA etc

I am actually thinking of ringing NWL tomm and booking a demo and asking them to help me understand the platform.

For context, NWL has been a complete coffee-can investment for me. I bought the position based on the MFPro 1 recommendation back in 2018 and other than happily collecting dividends, have done absolutely nothing on NWL. That blind faith in old Joe and Matt was not misplaced, as by then, they were a proven winning team, and I had no doubt that they had done the detailed research to come up with a long-term winner.

NWL has now become my 2nd largest position (after the ALU sale, AD8 crash etc), returning 182%, proving that there absolutely IS merit in the coffee-can approach and that the less one tinkers with a position, the better the outcome.

Any help would be much appreciated!

Disc: Held IRL with total ignorance ...

A good result was reported today for FY24, but the market reaction was strangely negative, with the share price down nearly 6%.

Funds Under Administration (FUA) of $88.0 billion, up 25.2% year on year - compared to growth in prior years of 26% (2023), 18% (2022) and 30% (2021). So still a pretty healthy growth trajectory.

Funds Under Management (FUM) of $20.5 billion, up 28% year on year - compared to growth in prior years of 22% (2023), 12% (2022) and 60% (2021).

Market share has increased to 7.7% (up 0.9% from prior year).

Possibly the muted reaction is due to the evidence that HUB24 is starting to catch up with Netweatlh. This is the first time in my memory that Netwealth did not achieve the number 1 spot for largest net funds flow during the year. They achieved $10.4 billion compared to HUB24 with $12.9 billion. And although HUB24's market share at 7.3% is still slightly less than Netwealth's, it increased by 1.2% this year. This shows Netwealth is not gaining market share as quickly as HUB24.

However my high conviction in Netwealth remains unshaken - they have an excellent track record of innovation, they understand their market intimately and the transition of leadership from Michael Heine to his son Matt, after several years as joint CEOs, has been faultless.

I might have considered an each way bet by investing in HUB24, but I note that another of my RL portfolio companies Bailador has recently invested in Dash, yet another company with a wealth management platform targeted at financial advisers, so I think 2 fingers in the wealth management pie is enough for me.

Very strong results from Netwealth for the H1 to Dec 31st 2023 showing the fly wheel effect with an acceleration of revenue and most importantly widening margins as they reap the benefits of growing portfolios as markets finished 2023 on a high.

Key take outs

- Revenue and Market share growth between NWL and HUB24 not abating comparative to legacy platforms (see below)

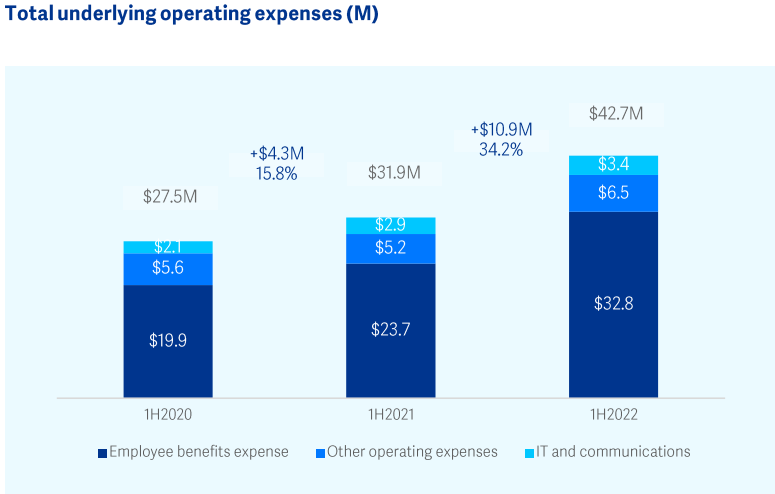

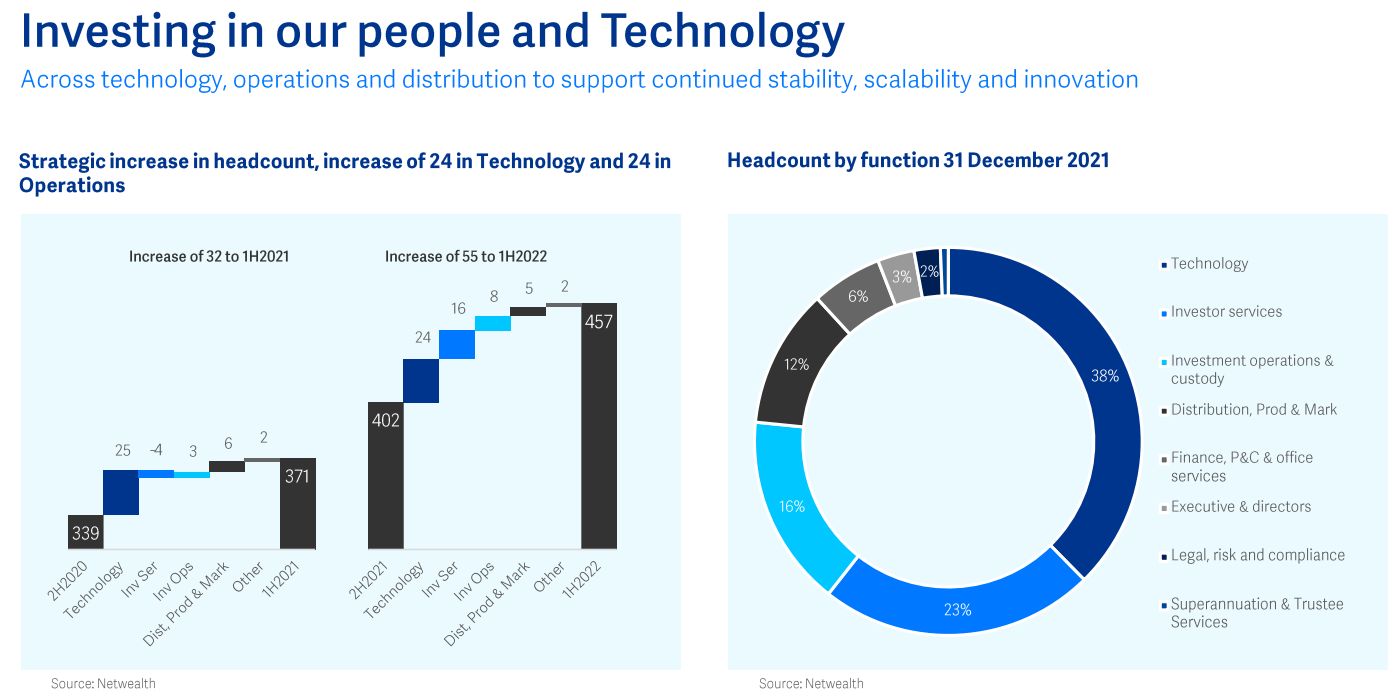

- Operating Cost growth of 13.9% well below revenue growth and showing discipline management of capital

- Net profit margins expanding to 31.9%

- ROE over 50% past 5 years

- Rock solid balance sheet with no debt and $115m in cash and 57.4m FCF

- Insider ownership of just under via Heine Family 50% ensuring alignment with shareholders

- 86% of EPS paid out as dividend (14c FF)

Priced to perfection at 50x forward earnings so one to watch as movements in SP present opportunity to enter or top up on existing holdings.

Disc - Held in RL, not on SM.

Update (20/02/2024)

- Revenue increased 20% to $123.3m

- NPAT increased 28.3% to $39.3m

Using similar assumptions as below but inputting a 25% growth for FY24 gives a valuation of around $15.

Disc: Held IRL, not held on Strawman.

Update (19/08/2023)

Updating my valuation based on FY23 results. NWL has seen strong NPAT growth since IPO with CAGR of 21.6%.

Being a bit more conservative with ongoing growth, if we assume 15% NPAT growth for the next 5 years and a terminal PE of 40x, then to achieve a 10% return, the valuation would be $13.76.

Historically NWL has traded on a PE range of between 45x and 80x, so a terminal PE of 40x could be seen as reasonable if they can continue to maintain their growth. However given the current high multiple, dropping the terminal PE to 30x would see the valuation fall to $10.32.

Given the long track record of management's ability to grow their business and FUM. I will give them the benefit of doubt that they can continue to grow the bottom line at a good rate.

For reference, the current share price of around $15.00 would require a CAGR of around 20% for 5 years and a terminal PE of 35x.

Disc: Held IRL. Not held Strawman.

Original Valuation

Netwealth is a business which provides a platform for wealth management. It was founded by the Heine family who continue to manage and be majority shareholders of the business.

- FY21 NPAT = $54.1m

- FY21 EPS = $0.226

NWL have grown NPAT by around 20% in the last 4 years since listing. Applying a long term 20% growth to NPAT for 5 years:

- FY26 NPAT = $134.6m

- FY26 EPS = $0.48 (assuming increase of shares outstanding to 280m)

If we apply a PE of 45x that gives a price target of $21.64 and discounting back 10% a year becomes $14.77

A more bear case of 35x gives a valuation of $11.49 after discounting

A more bull case of 55x gives a valuation of $18.06 after discounting

The above does not take into account the current takeover offer for Praemium which may disrupt the calculations.

Disc: Not held but may look to buy if there is further weakness in the coming few weeks. I would likely look to entry between my valuation and my bear case for more margin of safety.

Netwealth reported 1H FY24 results this morning. From their presentation:

Personally, I thought this was a great result for Netwealth. Operating leverage really starting to come through. It seems the increased investment in their platform that occurred in FY22 and FY23 is starting to show through now.

Still plenty of growth potential as shown by this graph from their presentation:

When will the growth start to taper off? Hard to say at the moment but until then I think the thesis remains intact.

Will update my valuation later.

Full presentation here

Disc: Held IRL and on Strawman.

Netwealth released their FY23 results yesterday. From their presentation:

I thought this was a pretty solid result with a return to bottom line growth of over 20%. They are taking advantage of a structural shift away from the legacy funds management platforms. Still only a 6.7% market share currently.

Disc: Held IRL. Not held on Strawman.

Netwealth (NWL) released their results for 1H 2023 this morning. From their presentation:

Good to see them back on the growth trajectory after several years of investment into their platform.

Management have stated that they believe the investment phase is over and they should start to see some operating leverage kick in.

First time that they have hit over $100m in revenue in a half. Benefitted from increasing interest rates.

From a market share perspective, they are at about 6.3% of the total market share with plenty still to be gained from the top 4 large institutions.

Full presentation here

Half year report here

Disc: Held IRL, not held on Strawman.

Article on FUM flows - Super industry flows: AustralianSuper, HUB24 lead the way - Professional Planner

Netwealth released Dec 2022 quarter inflows and fair to say a mixed bag.

Short term there are some points to keep an eye on in terms of growth of inflows.

- December qrt 2022 funds under administration growth rates slowed to 7.4% to 62.4billion for the Dec quarter which below the 2022 full year growth rate of 10.2%. Not a trend i like to see

- The call out of the withdrawal of funds by high net worth investors was noted and something to watch in 2023 as economic landscape evolves

- Due to trading at high PE netwealth can be volatile both to the downside and upside as is reflective with today's 9% fall.

Long term the move to recruit and attract key personnel in IT / communication services and Sales and Marketing is contrary to industry trends but clearly earmarked to maintain the advantage NWL have in the industry. This also reflects the financial strength the business upholds and confidence in the future.

Netwealth is aiming for inflows to financial year 2023 to be 11billion and is optimistic on new licenses which are set to convert in the current half.

Additionally the piloting of multi asset portfolio service as well as Xeppo (mobile integration) will further assist.

Overall Netwealth is a long term hold for me for the following reasons:

- NWL ranked 6th in size to 6.3% of all inflows having grown from 4.1% in 2022 or over 50% in 2 yrs

- (AMP over same period has 15.8% in 2020 to 14.2% in 2022)

- EBITDA 50% plus

- Net profit 33-38%

- No debt

- 80% plus dividend payout ratio

- 52.5% inside ownership with 3% dilution occurring in past 6 years

Along with HUB24 was able to purchase stock at single figures in real life pre 2020 and look forward to standing aside and allow compounding to do its thing .....

NWL December-2022-Quarterly-Business-Update.pdf

Netwealth is still sitting on a hefty PE of over 50 but their growth trajectory is still heading in the right direction. There were Funds under management net inflows of $2.9B for the September quarter which I think is strong given current market volatility. Total FUA is now at $58.1B. Their mobile integration with Xeppo is due to be launched in Q2 of 2023 which will hopefully provide a kick along to grabbing further market share from the big boys.

Netwealth have provided the market with their full year results and the depressed share price on offer earlier in the year looked to have been a solid opportunity to get into a nicely growing business at an attractive price. You can find their announcement here but the graphs that really standout for me are below. Rated number 6 in the industry by market share with 5.8% but tops with net fund inflows means their is still plenty or runway for growth (also highlights how well HUB24 are travelling too).

Netwealth continues to grow funds under administration at the fastest rate in Australia. Feel like this stock deserves its premium (although I note it’s PE of 59 according to yahoo finance). Other thoughts?

Netwealth continues to grow funds under administration at the fastest rate in Australia. Feel like this stock deserves its premium (although I note it’s PE of 59 according to yahoo finance). Other thoughts?

I had this company on my watchlist for well over a year before I pulled the trigger when their share price was punished after their results announcement back in February. Give next month they will unveil their latest quarterly update, today I purchased my full allocation of shares IRL. Netwealth's market share sits at roughly 5-6% but their inflows sit comfortably higher than their current market share. There appears to be heavy investment back into the business (which I like for the long term) specifically around their launch of their app and once rolled out has a strong potential to supercharge growth.

I still am a little perplexed by the large pullback they suffered but if the next quarterly update surprised to the upside, which management have a history of doing, I don't believe the share price will be seeing these levels for quite some time. No debt, growing and a healthy little div of roughly 1.3% this is a business I'm comfortable having in my portfolio for some time.

Assumptions:

FY26 Revenue $320m

FY26 Expense $120m

FY26 NPAT: $200m

Giving 40 PE gives FY 26 price of $23.07 and discount back to today and comes to ~$15.10

Number of Shares on issue = 245m

Insider ownership roughly 50% ( Founder family operates the business )

Revenue = 124m ( FY20), 144.8 (FY21) 84.7m ( 1H FY22)

Expense = 61.2m (FY20), 67.6m (FY21), 44.9m (1H FY22)

EBIT = 62.7m (FY20) , 77.2 (FY21), 39.8m (1HFY22)

I thought 1H FY22 results were good and management flagged that they are investing in Technology, People and Infrastructure to support the growth they are getting and scale the business for future growth.

They are expensing all of this investment and hence profit is subdue for the half. The following graphs from the presentation show their investment in last year.

Buy investing in their technology and people they are making their product number 1 recently from number 2

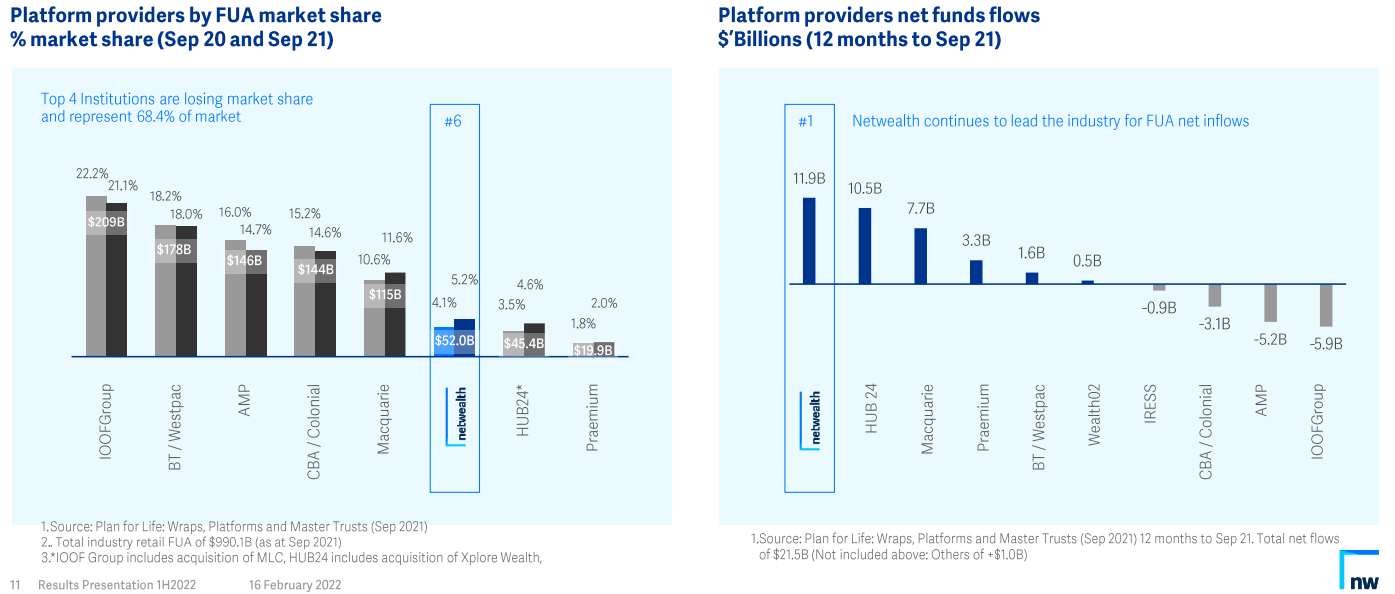

and because of award-winning products and services they are disrupting the Top 4 institutions and also no.1 providers for net funds flows

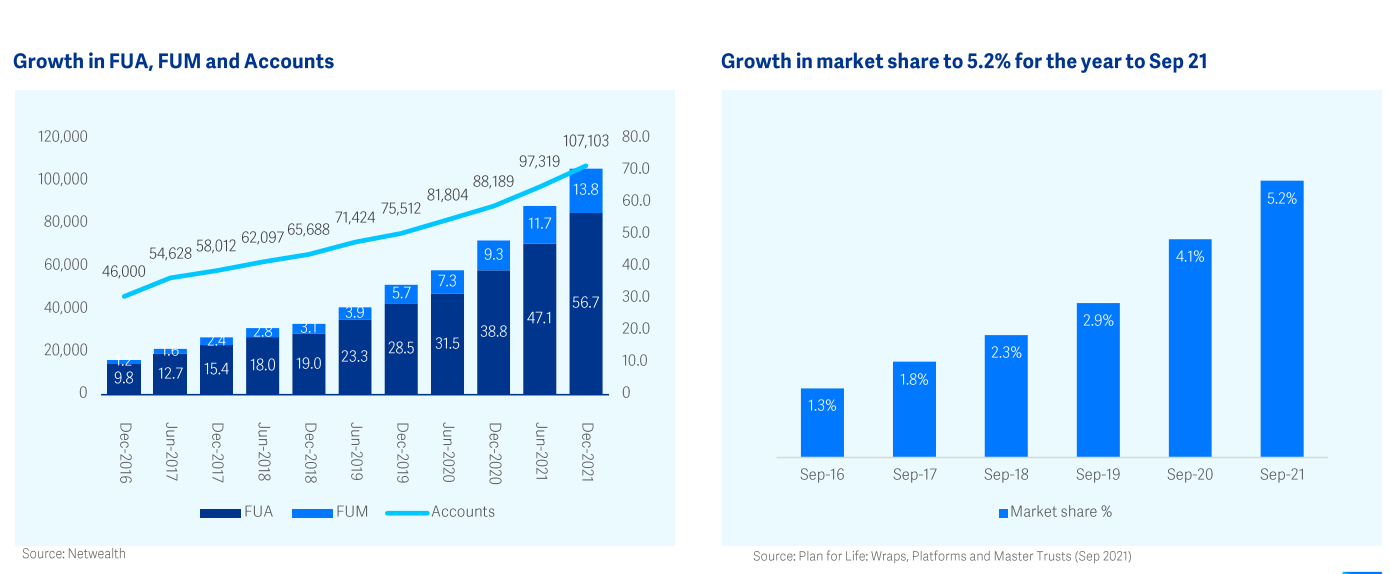

The following chart shows the growth and market share

How to hedge against increasing rates environment? Buy business that will benefit from rates increase.

Very solid results, received somewhat negatively by the market perhaps due to a modest decline in NPAT and EPS in this half compared to prior half. In the long term however - the only one that counts - the trajectory of revenue and NPAT continues inexorably from bottom left to top right. EPS growth is less impressive.

I admit to bias, since I have had part ownership in NWL for 3 years, I know the company extremely well, it has delivered me a 29% annual return and it has the maximum allocation I permit in my portfolio. It mystifies me why the company doesn't get more coverage by the analyst community. My confirmation bias is boosted by the fact NWL is also the largest holding in the Lakehouse Small Companies fund.

Netwealth is the biggest beneficiary of the industry transition to independent financial advice. It has been the recipient of the highest value of funds inflow of any platform provider, for 13 straight quarters, taking market share from the banks and growing to be the 6th largest platform provider, behind the 4 banks and Maquarie. It is widening the gap on HUB, and Praemium looks like it is falling by the wayside.

Netwealth delivers 34.5% NPAT growth and current FUA1 $40.7 billion

1H2021 financial results highlights (PCP2 )

~ EBITDA of $40.5 million ($31.1 million), increase of 30.1% to PCP.

~EBITDA margin of 56.0% (53.1%) for 1H2021.

~ NPAT of $27.6 million ($20.5 million), $7.1 million increase or 34.5% increase to PCP.

~ Total Income of $72.4 million ($58.7 million) an increase of $13.7 million or 23.4% to PCP. Platform Revenue of $71.2 million ($57.3 million), an increase of $13.8 million or 24.1% to PCP.

~ Total Operating Expenses of $31.9 million ($27.5 million), an increase of $4.3 million to PCP, up 15.8% (including increase in employee benefits of $3.9 million, up 19.5% to $23.7 million for 1H2021). Headcount at 31 December 2020 of 371 with an additional 32 roles added in 1H2021.

~Operating net cash flow pre-tax3 of $40.5 million ($31.3 million), an increase of $9.1 million or 29.2% to PCP.

~EPS of 11.3 cents (8.4 cents), an increase of 2.9 cents or 34.5% to PCP.

~ On 17 February 2021, the board declared a fully franked interim dividend of 9.06 cents per share totalling $22.1 million for 1H2021. The dividend is payable on 26 March 2021. The exdividend date is 22 February 2021.

~ On 17 February 2021, Jane Tongs retired from the board and Tim Antonie was appointed as Chairman. On 1 February 2021 a new independent non-executive director, Kate Temby, was appointed.