Number of Shares on issue = 245m

Insider ownership roughly 50% ( Founder family operates the business )

Revenue = 124m ( FY20), 144.8 (FY21) 84.7m ( 1H FY22)

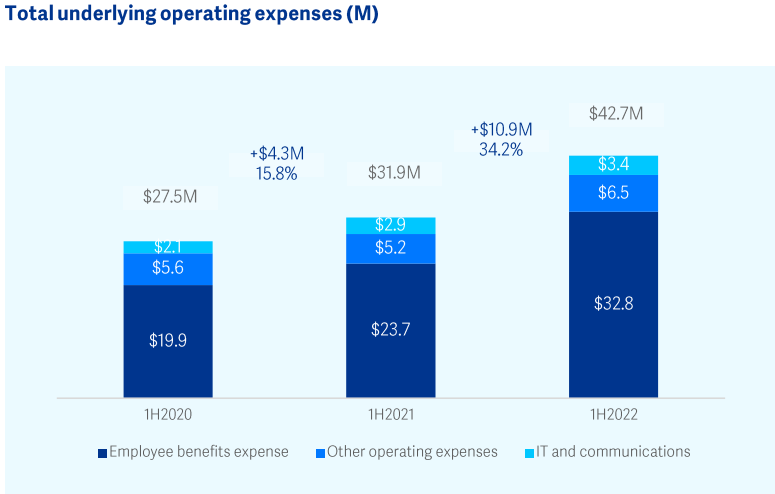

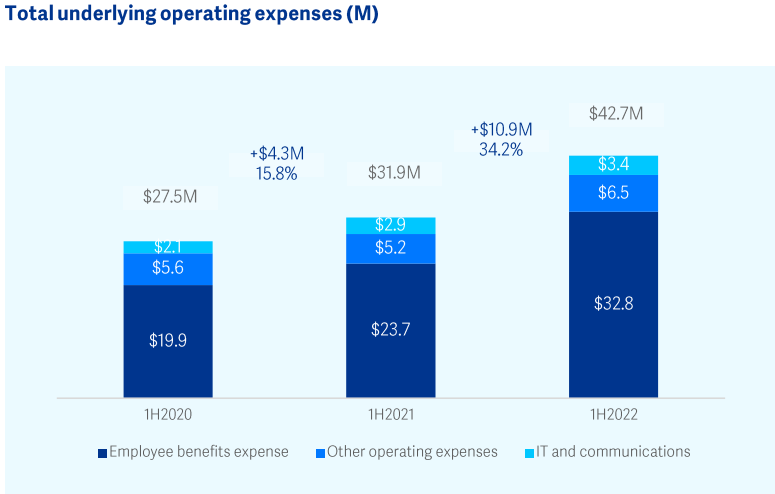

Expense = 61.2m (FY20), 67.6m (FY21), 44.9m (1H FY22)

EBIT = 62.7m (FY20) , 77.2 (FY21), 39.8m (1HFY22)

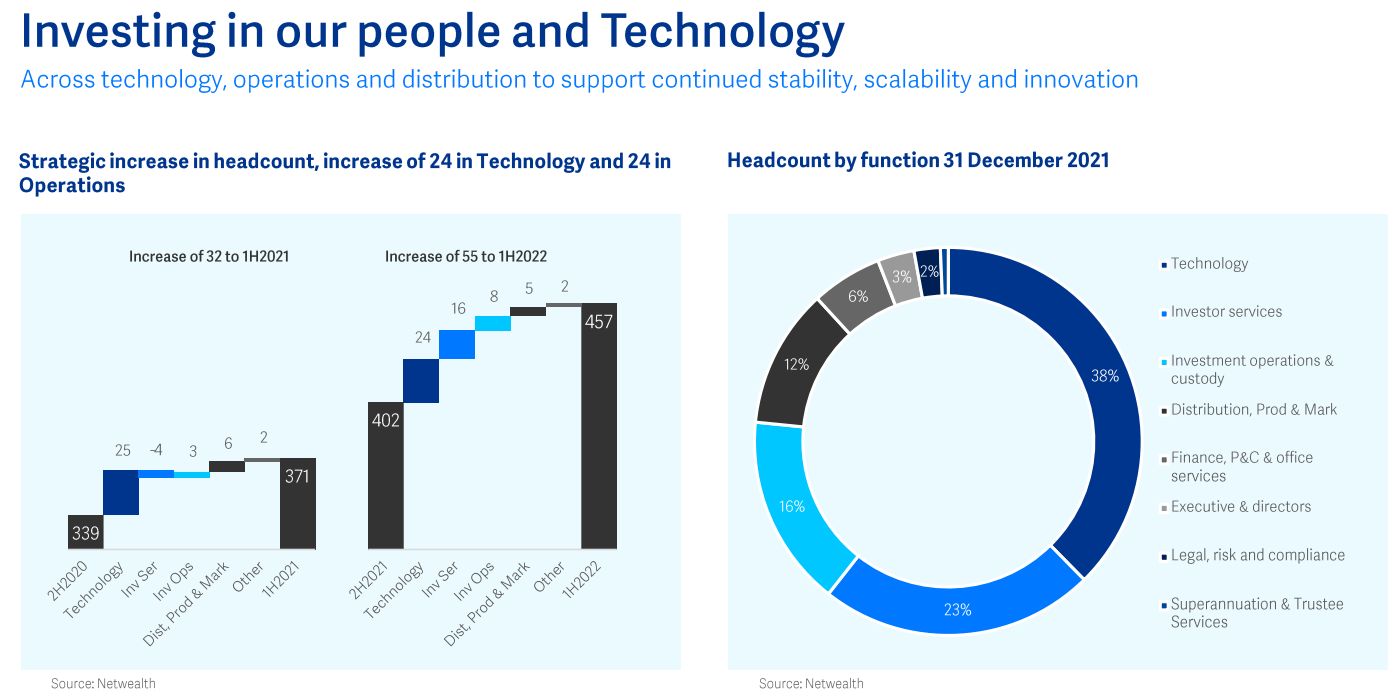

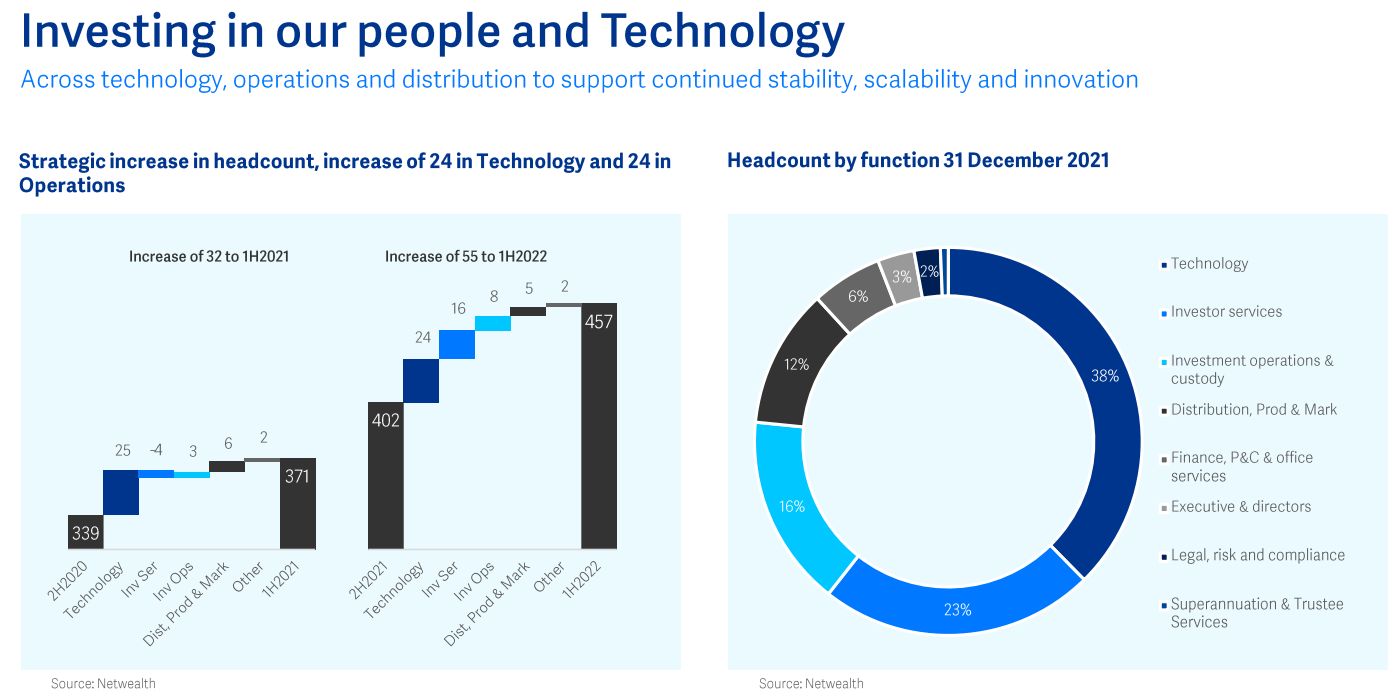

I thought 1H FY22 results were good and management flagged that they are investing in Technology, People and Infrastructure to support the growth they are getting and scale the business for future growth.

They are expensing all of this investment and hence profit is subdue for the half. The following graphs from the presentation show their investment in last year.

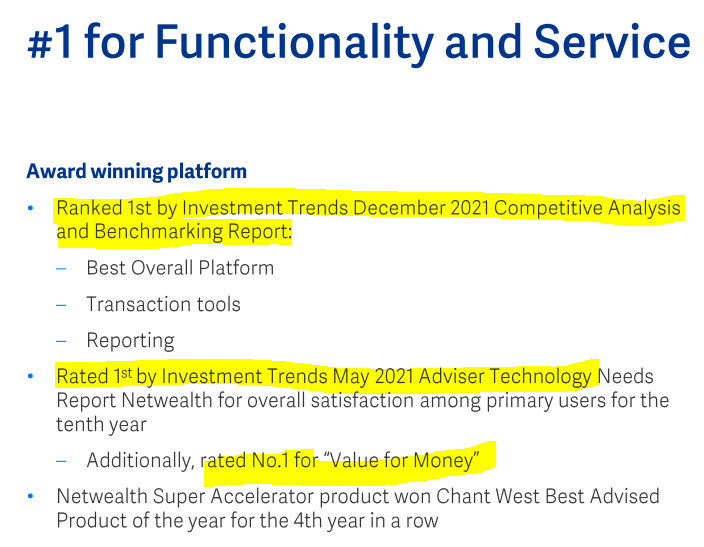

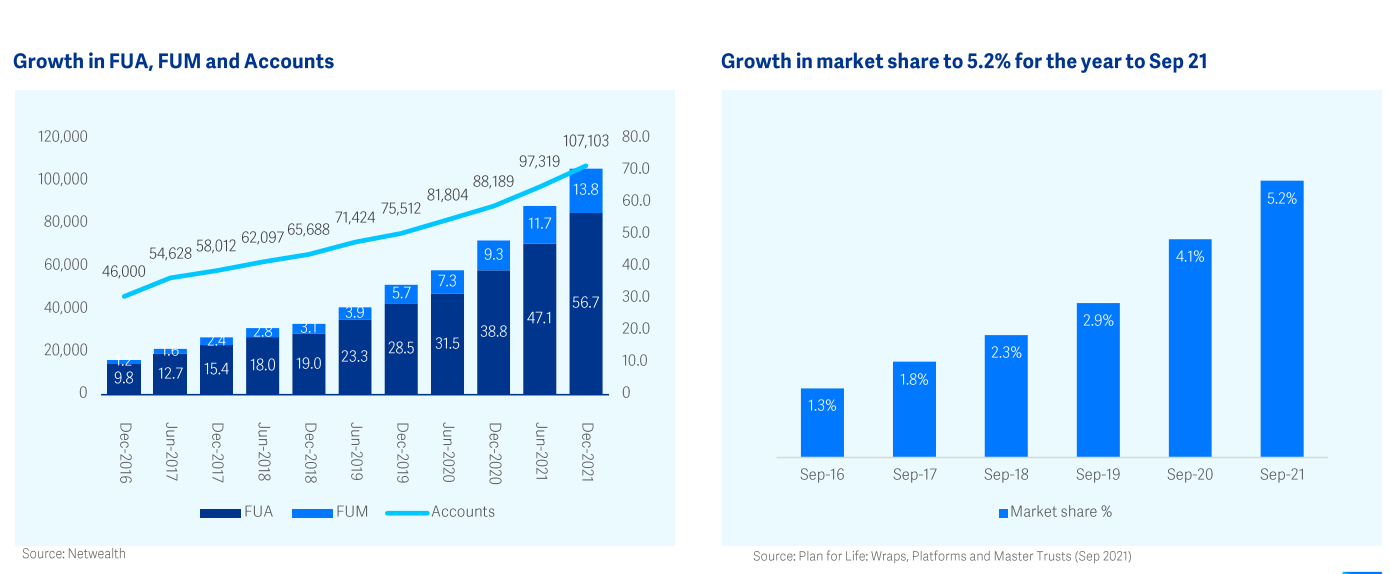

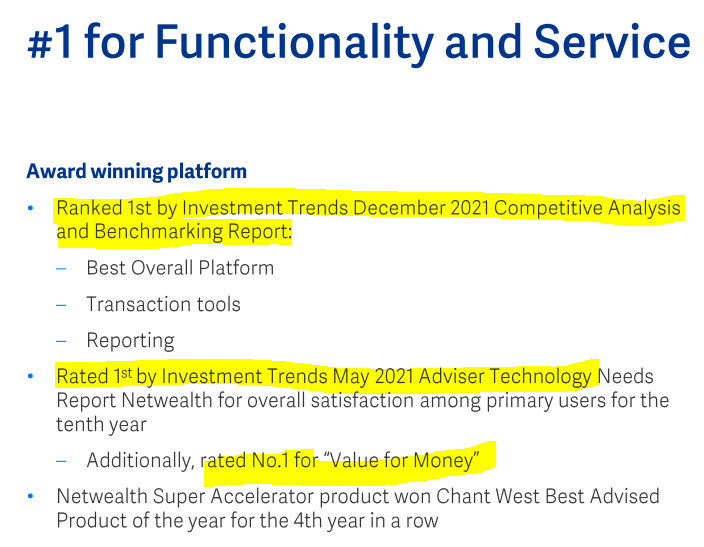

Buy investing in their technology and people they are making their product number 1 recently from number 2

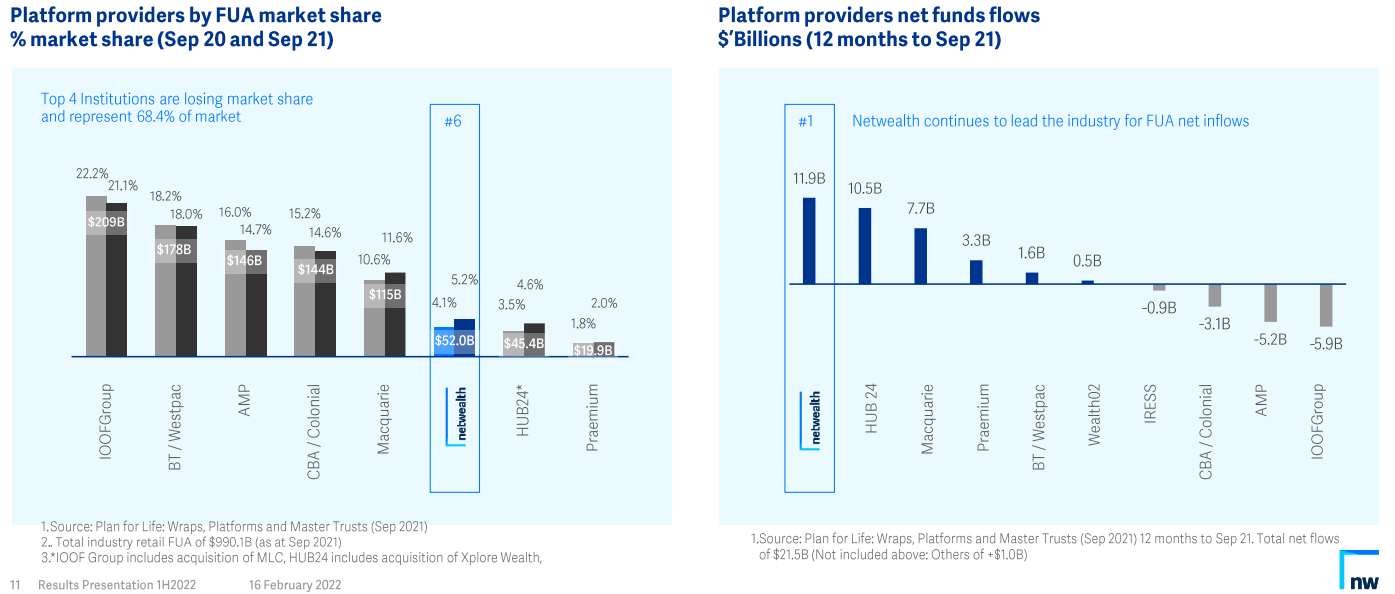

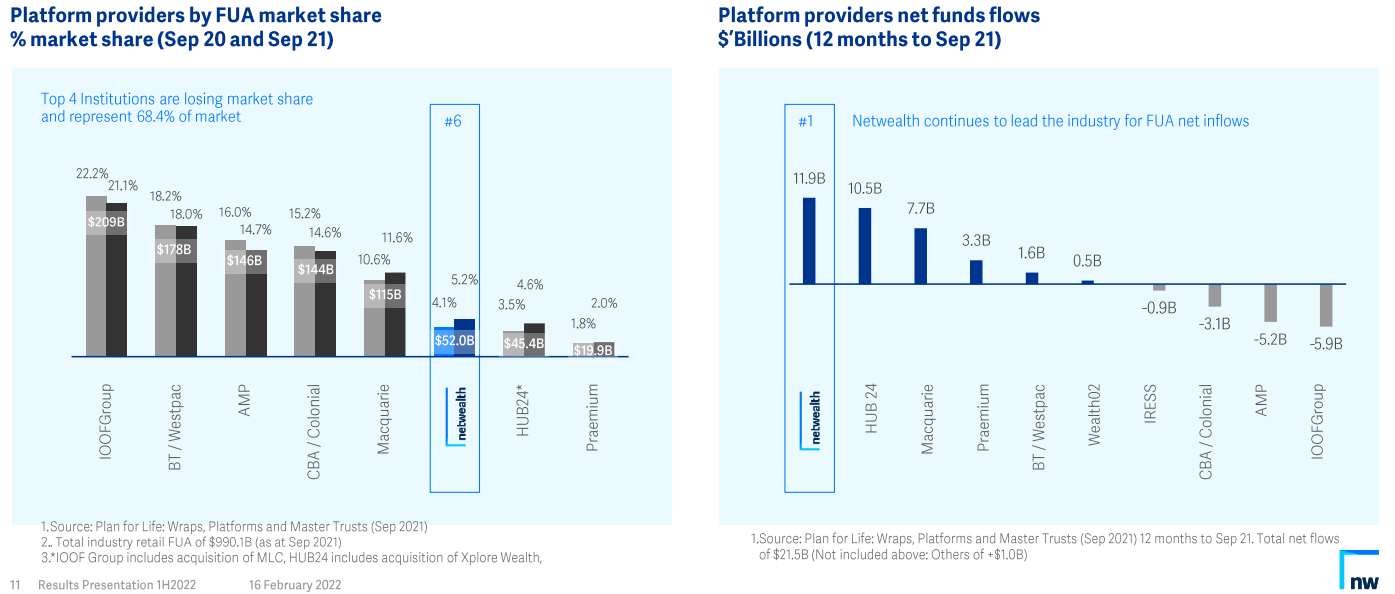

and because of award-winning products and services they are disrupting the Top 4 institutions and also no.1 providers for net funds flows

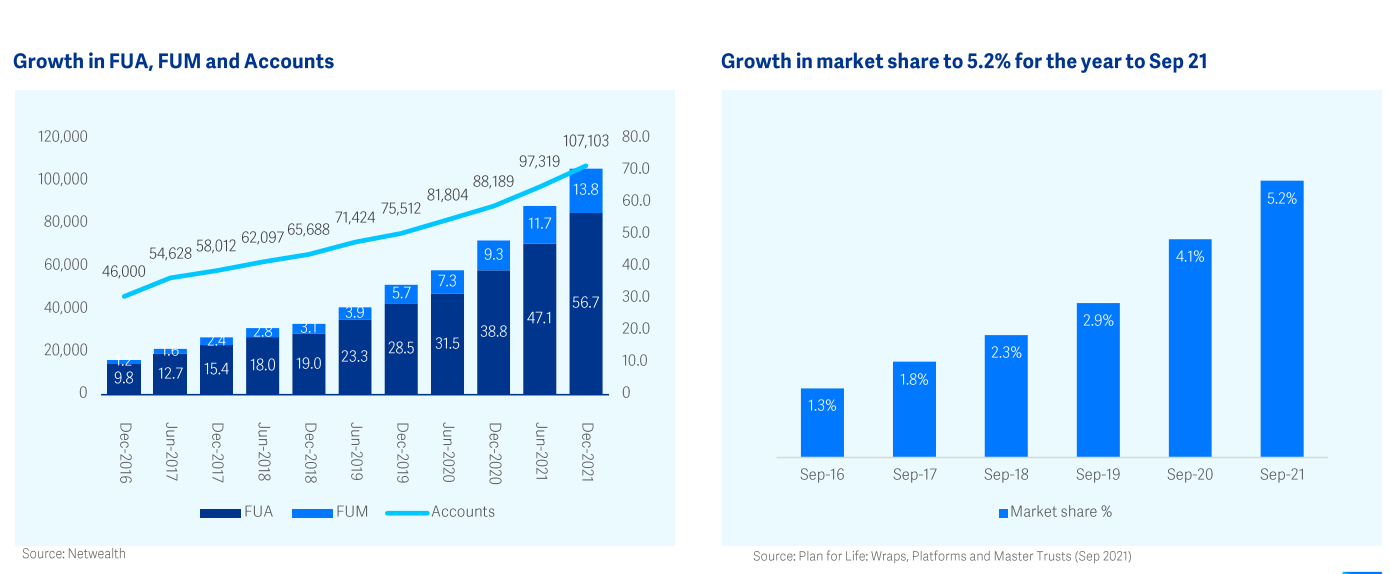

The following chart shows the growth and market share