I am in the midst of (finally) taking stock of my NWL position. I blindly followed MF Pro’s direction to open the position back in 2018, understood the thesis, sort of understood what it was about, but never deep dived until now. It is now my 2nd largest IRL position at 10%+ and 2nd largest winner - living proof that the coffee can investment approach does work, particularly if the company was picked by the great MF Pro combo of Joe & Matt.

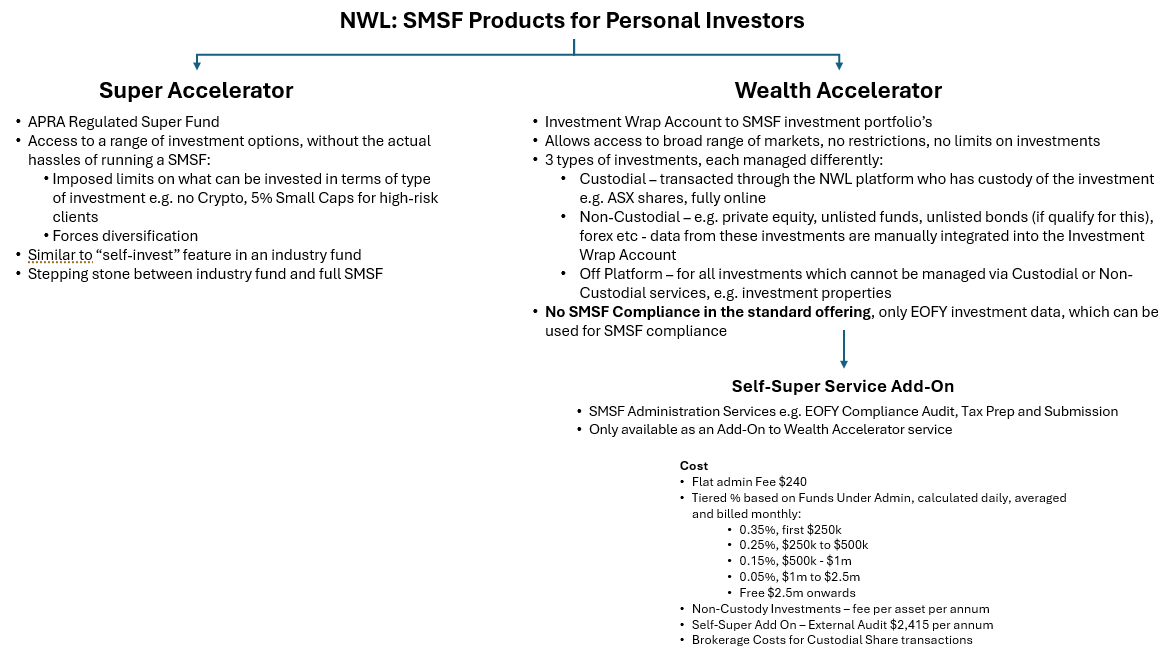

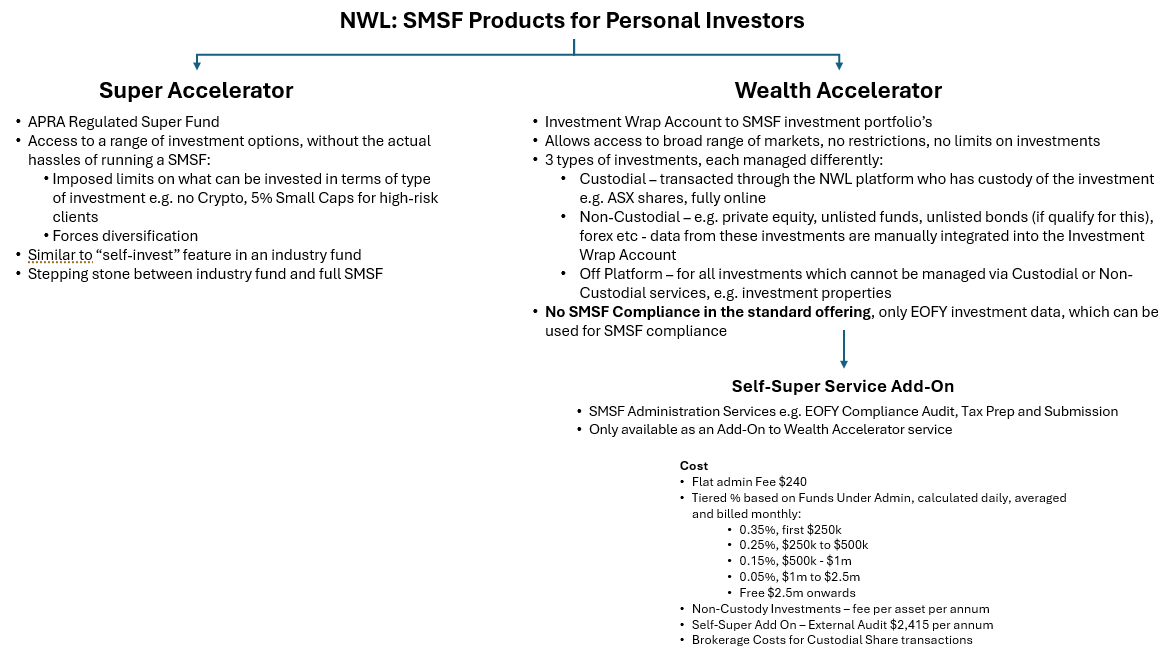

After deep diving the financials, I struggled to clearly understand the products. So I signed up for a product demo last week through the NWL website to better understand the Personal Investor products, as I did also want to explore what was available (and at what cost) vs my current eSuperfund SMSF setup. Here are my notes, of both the SMSF-related products, as well as my takeaways from a “better understand NWL” perspective. A lot of the points should be intuitive, but having the conversation and the ability to ask questions made a huge difference to the understanding.

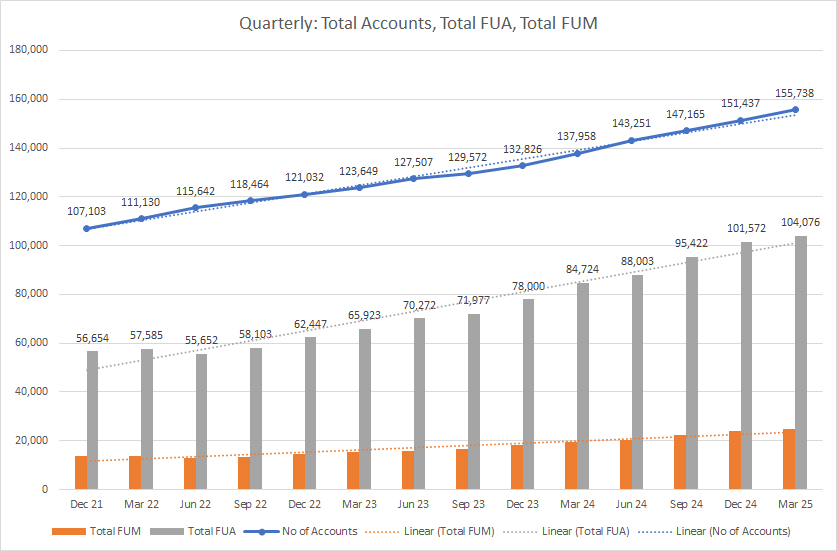

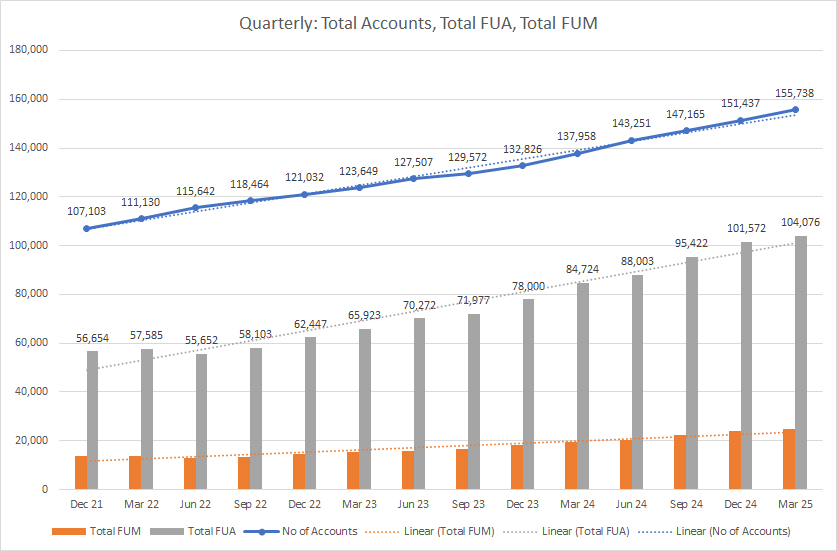

What I understood, the chart of the key NWL platform metrics at the end of this post and what I thought was an excellent article by A Rich Life’s Patrick Poke sums up why the MF Pro pick of NWL was an outstanding one and why I should absolutely stay invested with a high portfolio allocation.

OVERVIEW OF THE PERSONAL INVESTOR PRODUCTS

THE SALES ENGAGEMENT PROCESS

- The Sales Team response’s to website enquiries - appears to be within 3 business days, which is comforting

- The Sales rep spent 45 mins talking me through the products, pricing and despite my hesitation in product suitability, continued to offer a demo - this desire to take me through the product was good - if I was not clear on what I am after, the demo would have got me

FINANCIAL ADVISOR FOCUS

- 96-97% of NWL customers operate through Financial Advisors

- Each financial advisor has its own “platform” within the NWL platform:

- Tailored functionality

- Tailored screens, reports

- Each client of the advisor has their own login to the Advisors “platform”

FEE/COST STRUCTURE

The explanation of the cost structure and the mechanism in which it is calculated (daily snapshot, averaged then x days in month) helped bring to life how the Funds Under Administration Market Movement metric, what broadly makes up the various NWL revenue lines - Administration Fees, Ancillary Feels, Transaction Fees, Management Fees, and how both these numbers will rise and fall based on how the market moves.

It also provides clues as to where and why NWL still requires a reasonable labour force.

WHAT ATTRACTS NEW CLIENTS INTO NWL

The Sales Rep commented that what attracts new clients into NWL:

- Financial Advisors - once a Financial Advisor comes onboard, their clients come onboard as well

- Detailed real-time and EOFY investment reports from the platform is a key attraction for SMSF customers who focus on the investing side rather than SMSF Administration

- Clients who want access to a range of investment options that they self-manage, without the hassles of running the SMSF administration (Super Accelerator)

HOW DOES IT COMPARE WITH ESUPERFUND

It will cost me at least 3x the eSuperfund annual fee to get:

- base Wealth Accelerator

- the “equivalent” SMSF compliance service that eSuperfund provides

- Significantly better investment information/data/performance/dashboards to manage the SMSF’s investment

- Cost will vary based on the daily balance of the Fund

- Cost will also rise further if the SMSF has off-platform or non-custodial assets

A non-starter if you are able/willing to invest time in managing the SMSF admin on a day-to-day basis.

NWL PLATFORM GROWTH SINCE FY2021

Discl: Held IRL