$NEU have issued an ASX announcement this morning reporting on the 1Q 2025 US sales and broader progress of DAYBUE, as reported this morning by $ACAD at the end of the trading day on Wall Street.

ASX Announcement

I’ll post here $NEU’s overview and then provide my own analysis, having attending the analysts call this morning.

Their Highlights

• Q1 2025 DAYBUE™ (trofinetide) net sales of US$84.6 million, up 11% from Q1 2024

• Record number of unique patients received shipments, up 4% from Q4 2024

• Neuren’s Q1 2025 royalty income was A$13.5 million, up 17% from Q1 2024

• Acadia retained full year 2025 DAYBUE US net sales guidance of US$380 - 405 million, implying full year 2025 US royalty income for Neuren of A$62 - 67 million

• Marketing approval in Europe anticipated in Q1 2026, first shipment of DAYBUE to Europe was made in April 2025 under a Managed Access Program

• Orphan Drug designation granted in Japan

• Distribution agreements now in place to facilitate named patient supply in other regions including Latin America, Middle East and Asia Pacific

• Neuren cash and short-term investments $341 million at 31 March 2025

• Neuren is presenting at Macquarie Australia Conference on 8 May 2025

Further Details from the $ACAD Investor Call

As I will explain in the next section, understanding q-o-q revenue changes is complex. So $ACAD focused on the report that patients treated with DAYBUE in the quarter rose from 920 in Q4 2024 to 954in Q1 2025, i.e., +3.6%.

Last quarter, $ACAD announced they would expand their sales and marketing force by 30%. The reason is that the current salesforce is focused on the high-prescribing Centres of Excellence, with less coverage in the broader community-based physicians who support some two-thirds of the total market. Today, $ACAD reported that the recruitment of these additional sales reps have been completed, and they expect to see the benefit of sale force expansion in the second half of 2025.

At this stage, $ACAD believe that only one-third of the population diagnosed with Retts have tried DAYBUE.

$ACAD also report that now >65% of the 954 patients taking the drug at end of Q1 have been on it for more than 12 months, and that persistency tails off at greater than 50% after 12 months, and thereafter continues to be stable (although I note that no quantification has at this stage been given for what 18 month persistency is looking like. At the next quarterly report, we might reasonably expect to be given a 2-year persistency statistic!)

On tariff impacts, $ACAD report that they “have several years of inventory” in the US, so they are well protected in the short term.

There was some discussion on their exposure to intervention in the US market by the Trump Administration. DAYBUE is a high cost drug and it would exposed if the Administration implements a “most favoured nation” requirement on drug pricing. In essence, such a move would mean that $ACAD would only be able to receive pricing based on prices achieved in overseas markets. The key risk is that if prices in Canada or, say in 2026 / 27 in the EU, are substantially lower than the very high treatment price in the US, then US agreements would be renegotiated. Of course, this is a systemic risk facing the entire pharmaceutical industry, and we are yet to see how this plays out. (Go, the US pharma lobby!!)

Approval in the EU is still expected in 1Q 2026, and $ACAD will soon pass the key 120-day milestone, which is a point in the EMA approval process at which the initial assessment of data is complete. At this point, the EMA can choose to "stop the clock" on its approval process and issue questions to the pharmco. No "Clock Stop" would be a very positive sign for the approval process. So, we should expect a further update on the EU process in the next few weeks. (Remember, any EU approval of DAYBUE in 1Q 2026 then starts the process of country by country negotiation on pricing and reimbursement. Particularly for expensive drugs like DAYBUE, this process itself can take many months and even years!)

My Analysis

The $NEU summary above gives a good overview of what’s going on. Basically, we are seeing steady progress on new patient adds, which remains the key revenue driver.

I want to focus the remainder of this report on the patterns of revenue growth, as there are some important dynamics at play, which are now becoming clearer, and which management have done a reasonable job of explaining.

Patterns in Revenue Growth

Now, the eagle-eyed among us will note that the 1Q-on-4Q revenue decline that was predicted (based on what happened last year, and which took the market by surprise then) has indeed occurred.

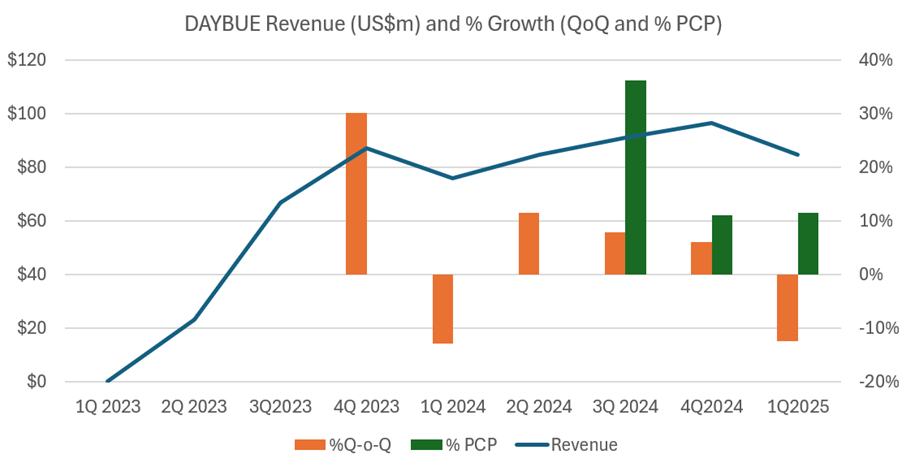

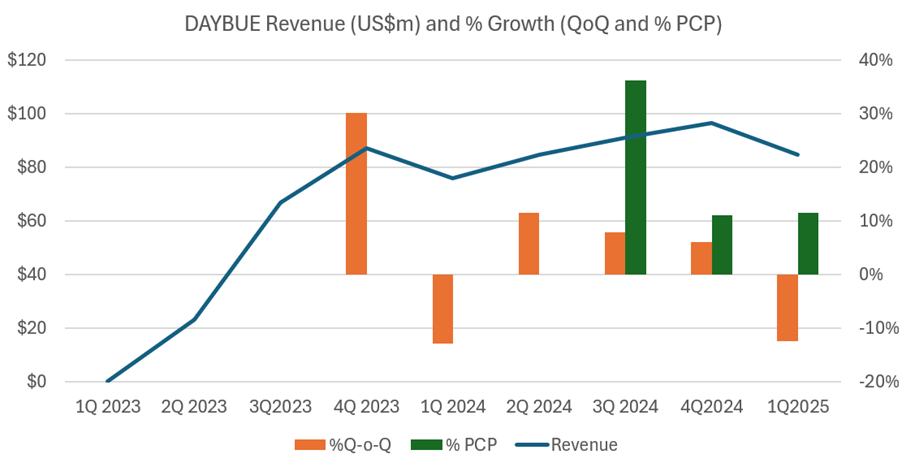

The 1Q 2025 sales of US$84.6m were down 13% on 4Q 2024. Interestingly, last year the decline was also around 13%.To provide an overall picture, I’ve plotted the quarterly revenues as well as the percentage changes Q-o-Q (orange bars) and % to PCP (green bars) in the chart below. Early values of the % growth figures are omitted, as they are not meaningful, coming off a small base.

I’d like to dig into this in some detail, as it was discussed on the $ACAD call this morning.

Three things seem to be happening consistently between 4Q and 1Q, as follows:

- Patients pull forward their refills in 4Q from 1Q – potentially ahead of holidays. Management explained that this “pull forward” effect accounted for US$3.5m of revenue being pulled from Q1 into Q4.

- Consequently, scripts and refills are down in 1Q, and there may also be a seasonal effect with fewer patient presentations to clinicians in the winter months

- Net revenue per script falls in 1Q, and this recovers in later Qs due to seasonal patterns in reimbursement, particularly for patients on hybrid Medicare-Private cover.

The first two points are simple to understand. The third requires some explanation. Here goes.

Pharmaceutical companies often see lower net revenue per patient in the first quarter of the year due to how U.S. insurance plans—including Medicare Part D—are structured. At the beginning of the year, many patients haven’t met their deductibles, which means they face higher out-of-pocket costs. This can delay prescription fills or reduce adherence, especially for expensive drugs. In response, companies may provide increased copay assistance, which reduces the revenue they recognize per patient.

Under the 2025 Medicare Part D redesign, the financial burden on drugmakers has also shifted. Manufacturers must now cover a portion of drug costs earlier in the year under the new benefit structure, even before patients reach coverage. This increases rebate obligations in Q1, further lowering net revenue per prescription.

As the year progresses, more patients move past their deductibles and into more stable coverage phases, leading to steadier prescription volumes and fewer financial concessions from manufacturers. As a result, pharmaceutical firms typically see higher net revenue per patient in the later quarters of the year.

So, this 1Q reduction in revenue is a regular feature of both prescribing/refill seasonality and reimbursement/copay dynamics, and little conclusion can be drawn from the revenue number. We’ll need to wait for the 2Q number to better assess whether $ACAD remain on track to hit the annual guidance number. This next result will provide an important baseline against which to assess the impact of the expansion of the sales and marketing force which is expected to start contributing in H2.

My Takeaways

Overall, this is a reasonable result from $ACAD on DAYBUE sales.

The 1Q number is difficult to interpret. It was a bit softer than I hoped for, however, if the expanded sales force has the intended impact, I consider it reasonable that $ACAD have left guidance unchanged. Having said that, I don't have a good quantitative understanding of the reimbursement/copay/Part D dynamics - so I am somewhat blind on that, and have to go with what management are saying. That said, under the new CEO Catherine Owen Adams, communications have been clearer and more consistent from one presentation to the next.

The 2Q number will be more telling, as the bounceback after 1Q will set the stage for the second half of the year, and we have last years number to compare with.

The market has therefore responded reasonably in my view, with SP off 3% at the time of writing. There was little news to react to, one way or the other, after all.

We may see some further reaction based on Jon’s delivery at the Macquarie Conference later today. As each quarter advances, $NEU gets closer to its next milestone payments which would come from any EU approval – or rather first commercial sales in any EU territory which could following during 2026. And, of course, the royalty rate for RoW sales are more attractive than the US.

Overall, $NEU remains on track with my “two for the price of one” thesis.

I was considering topping up after today's result, as I still have only a modest 4.7% allocation. However, even though I have some understanding of the 1Q dynamic, I can't tell to what extent it is masking a weaker overall sales growth. So, I'm going to have to wait another Q.

Disc: Held in RL and SM