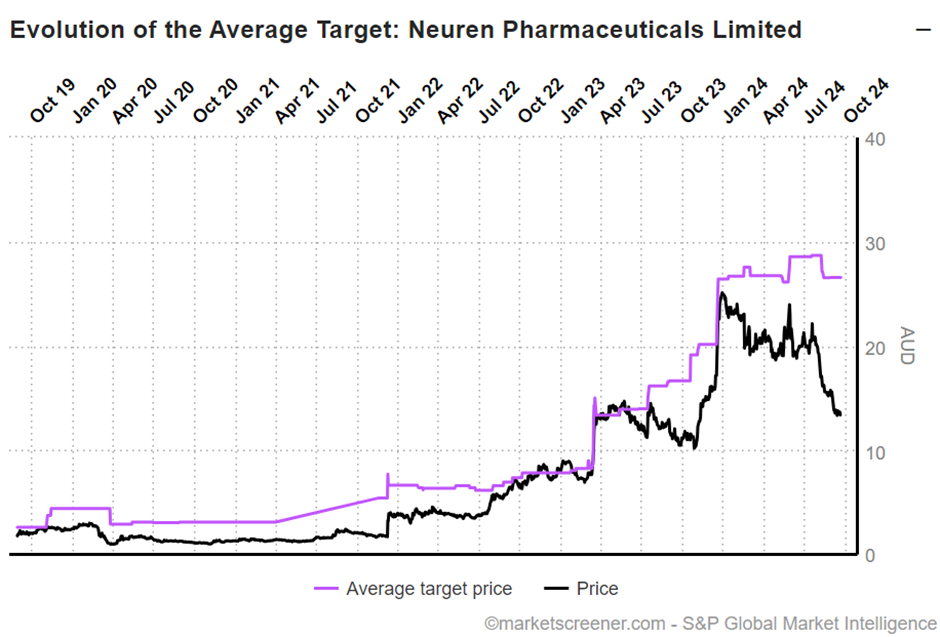

Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

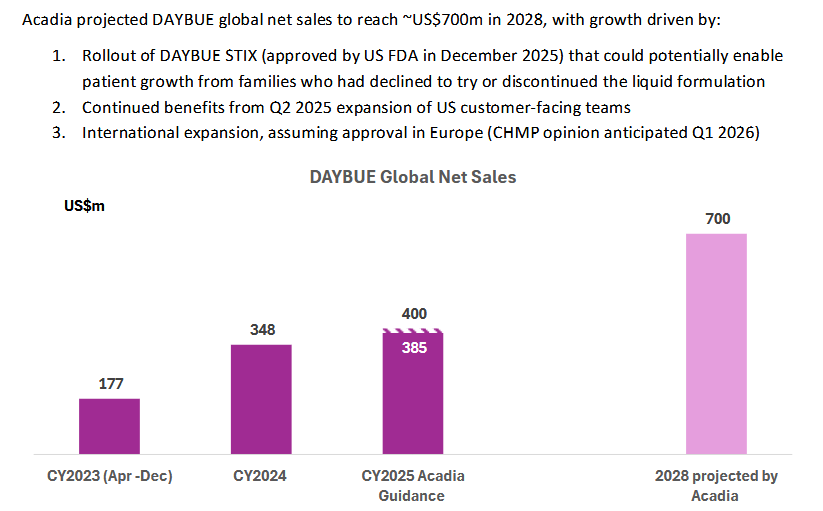

I just listened to the JP Morgan healthcare conference that Acadia presented at and it is pretty positive for Neuren. The surprise was a longer dated sales target of $700m by 2028 for Daybue. This has some pretty significant flow on effects for NEU if it is achieved in terms of milestone payments.

Three scenarios -

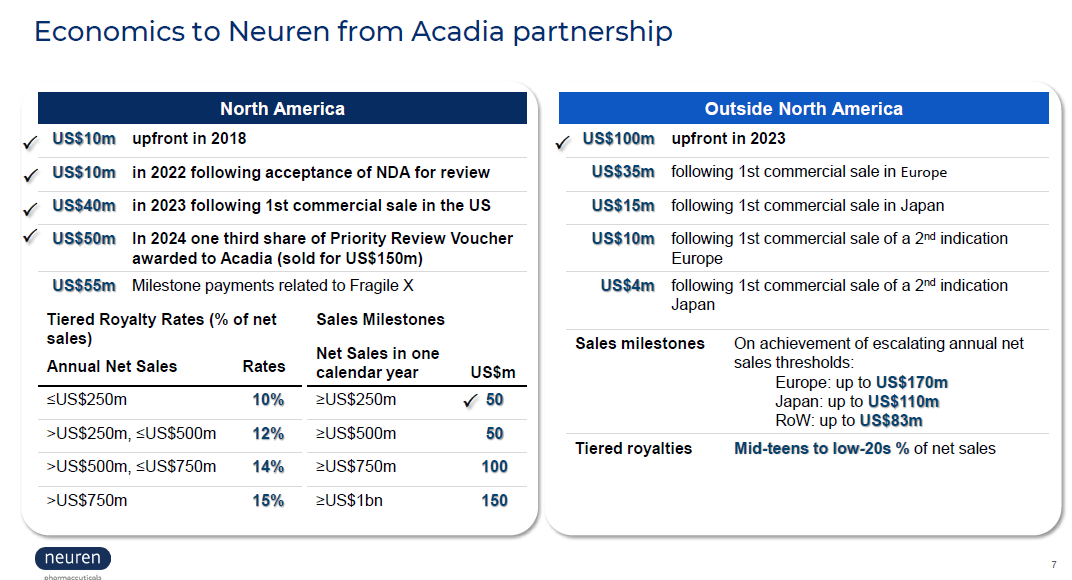

1) sales increase in the US and they manage to exceed the $500m threshold for the next $50m payment. I think this is likely as the 2000 patients that have tried Daybue of a total US population estimate of 6000 potentials (up 10% from previous estimate). So probably somewhere around 3-4000 actual patient pool. No mention of Canada approval solutions, so probably not likely to contribute anything by 2028. They mentioned the investment in sales people was having a positive effect. But to me it seems unlikely that they will get to $>750m milestone ($100m payment) from the US alone so I think this will be the final milestone payment from the US for a while and maybe forever. So then they would transition to a steady $60m or so per year of sale royalties

2) A big chunk of these sales come from outside the US, as they expect Europe approval Q1 2026 and an extra phase 3 trial for Japan will be completed in 2026. They were fairly positive on both of these. They will get $35 and $15m milestone payment for first commercial sale, which looks very likely. Then the sales milestone targets are not defined for the ROW, but are up to $170m for Europe and $110m for Japan. I am thinking the initial trigger levels of these payments will be higher than in the USA as they are getting a higher sales royalty - high teens to low twenties vs low teens in US. So I am expecting them to hit some milestone payments but what they are is largely unknown beyond its moving in the right direction.Another unkown is the actual pricing for these jurisdictions haven't been determined as far as I can tell, and this could impacted the sales quantum.

3) Have overpromised, and the new STIX formulation doesn't address the problems that some patients have with the oral liquid, so potential patient pool is still limited to those who tolerate it or perceive it to work. I can't assess this but from what they say about STIX it sounds like a good option, it can be mixed with any liquid (apple juice to gatorade) so should be more palatable, I still shudder at the thought of the unpleasant cherry flavored medicine from when i was a kid. STIX is lower in carbohydrates, which is impoartant as many of the patients follow a KETO diet and limit sugar intake. STIX is also more convenient- doesn't need to be refrigerated, much easier to travel with etc. Overall it does sound like it could be an accelerator but will watch and see. So from what I have seen it looks like a product improvement, they will start selling in Q1 but wont ramp up to full availability til Q2, they also said they will sell each version, but its hard to see why anyone would want the oral solution given the benefits of the STIX formulation.

Its likely to be some combination of these scenarios but I still like NEU, the ability to get a steady income while your developing a pretty exciting drug in NNZ2591. Happy to keep holding this one.

There are a number of positives in this announcement. Firstly, the 700m sales (admittedly in 2028) is higher than expected. Second, the persistency rate increasing is obviously great (and presumably feeds into the higher sales projection). And thirdly, the timeline for results in the Japanese trial is reassuringly early.

SP up over 6% so far today

Today NEU announced:

“Melbourne, Australia: Neuren Pharmaceuticals (ASX: NEU) today received notification from the US Food and Drug Administration (FDA) of an administrative delay to the scheduled pre-IND meeting for NNZ 2591 in hypoxic ischemic encephalopathy (HIE), which is now expected to occur in late January 2026 rather than in December 2025.”

The change of FDA administration (Robert Kennedy & Co) and the staff cuts of around 20% have been well telegraphed. Even if you subscribe to the view that the FDA was loaded with bureaucrats and loafers, it is hard to believe you can take out 20% of the staff and it will still function normally. Add to this trouble the recent Government shutdowns.

The FDA is hyper politicised, and you wonder just what pull the likes of small fry like Neuren, Clarity Pharmaceuticals (ASX:CU6) or PYC Therapeutics (ASX:PYC) would have with the FDA compared to the likes of a Merk or Eli Lilley as they fight it out for FDA time slots. Overseas biotechs may face an underlying bias of the current administration around prioritising American business. If things are getting tighter at the FDA it is likely bad news for Australian biotech.

NEU with net cash of $300m and ongoing royalties from Daybue of around $100m/yr is likely to be able to weather this situation better than most.

But for a CU6 that is tearing through around $90m a year, and even with $190m currently in the bank, say a 6 month delay to the lead product caused by FDA delays would be very damaging . That bag of cash is suppose to get CU6’s lead diagnostic to commercialisation. PYC is another high stakes biotech with cash flooding out the door and sweating on hitting clinical and FDA milestones.

These biotechs like to rabbit on about FDA “Accelerated Approvals”, “Fast Tracks”, Breakthrough Therapy” and “Priority Reviews”. However if the FDA is not functioning like it should there is FA they can do about it.

With the "Canada issue" out of my system in Part 1, here is a summary of last week's $ACAD (Acadial Pharmaceuticals) 3Q Results call.

1. Commercial Performance and Market Dynamics

- Net sales: US $101.1 million in Q3 2025, up 11% year-over-year, marking Acadia’s largest quarterly sales for DAYBUE. This was the highest quarter for net product sales overall

- Market penetration: Approximately 40% overall in the U.S. Rett syndrome market, with 27% penetration in community settings

- Referral growth: Achieved the largest quarter-over-quarter increase in referrals since launch, driven by expansion of the field team and outreach to community prescribers.

- Community prescribers: Now account for 74% of new prescriptions, up from 64% the prior year.

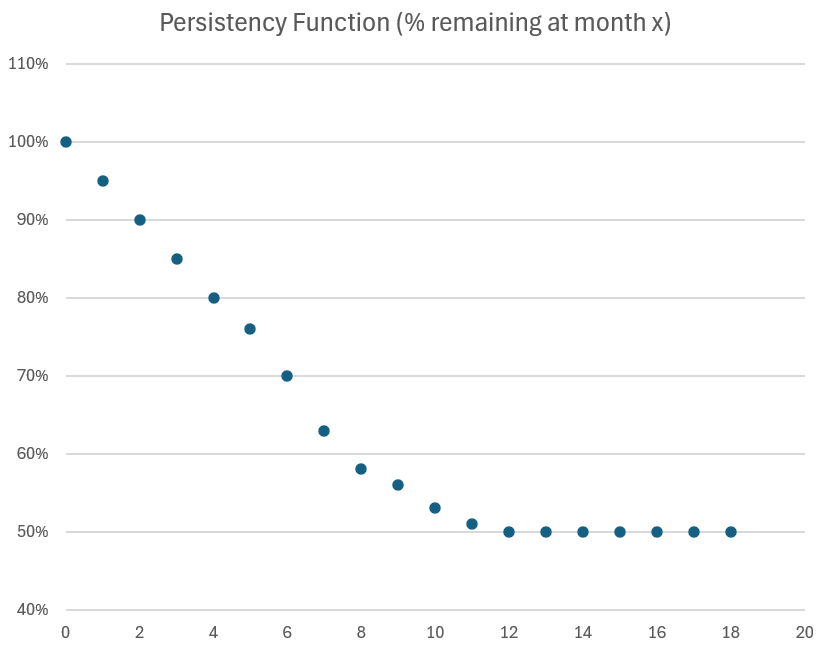

- Persistency: > 50% of patients remain on therapy at 12 months, and > 45% remain on therapy at 18 months, indicating durable adherence.

- Global access: Named-patient supply programs are expanding in Europe, Israel, the Middle East, and Latin America, with 1,006 patients treated worldwide to-date

- Guidance (FY 2025): DAYBUE net sales forecast US$385 – $400 million, with gross-to-net 22.5 – 23.5%, reaffirming momentum

(From Q&A)

- Management reiterated that growth was broad-based across both academic and community prescribers, with community uptake now sustaining most new patient starts. (Note: some 75% of the addressible market is treated by community prescribers, and this segment remains relatively under-penetrated)

- They emphasized that the larger field force deployed earlier in 2025 directly contributed to improved referral rates.

- No change was announced to 2025 guidance, indicating confidence in continued double-digit growth.

2. Regulatory and Geographic Expansion

From presentation

- DAYBUE (trofinetide) is approved only in the U.S. and Canada for treatment of Rett syndrome in adults and pediatric patients ≥ 2 years

- A Phase 3 trial of trofinetide in Japan has been initiated, marking Acadia’s first pivotal trial outside North America

- The company filed a Marketing Authorisation Application (MAA) with the European Medicines Agency (EMA), with an anticipated CHMP opinion in 2026

- Named-patient supply programs already operate in multiple regions (EU, Israel, Middle East, Latin America).

(From Q&A)

- Executives stated that the EMA filing was accepted in Q3, and the CHMP opinion is expected mid-2026.

- They confirmed that Japan’s Phase 3 trial uses the same dosing and endpoints as the U.S. approval study, designed for regulatory alignment.

- Early named-patient use is providing real-world data that will support broader access discussions post-CHMP.

- "Disappointing decision in Canada" (what??! See Part 1 Straw)

3. R&D and Pipeline Integration

From presentation

- DAYBUE remains the core commercial rare-disease asset, while ACP-2591 (cyclo-GPE analogue) is a next-generation follow-up in Rett and Fragile X syndromes

- The company is building a global Rett-syndrome franchise, leveraging DAYBUE’s success to expand to additional indications and geographies.

(Q&A)

- R&D leadership highlighted that DAYBUE’s durable efficacy data continue to inform the design of ACP-2591 Phase 2 planning, with a goal of complementary rather than cannibalistic positioning in Rett syndrome.

- Management also noted interest from academic consortia in exploring DAYBUE in combination therapies, though no new trials have yet been initiated.

4. Other Q&A Comments

- CFO Mark Schneyer confirmed that DAYBUE’s gross-to-net deduction (~23%) is expected to remain stable in 2026 given payer mix and limited rebate pressure.

- Analysts asked about inventory levels; management stated they are “healthy and in line with volume growth,” with no channel stuffing anticipated year-end.

My Assessement (thinking out loud, so apologies for the stream of consciousness format)

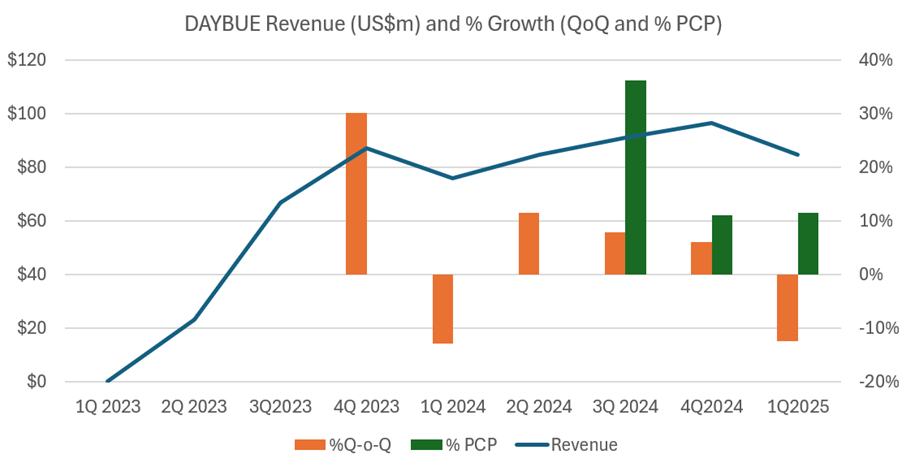

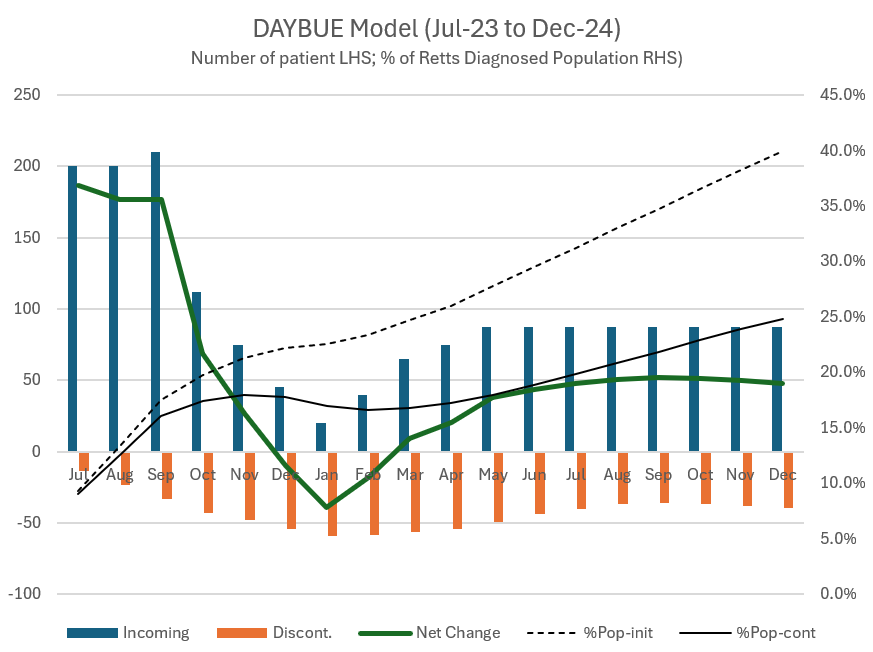

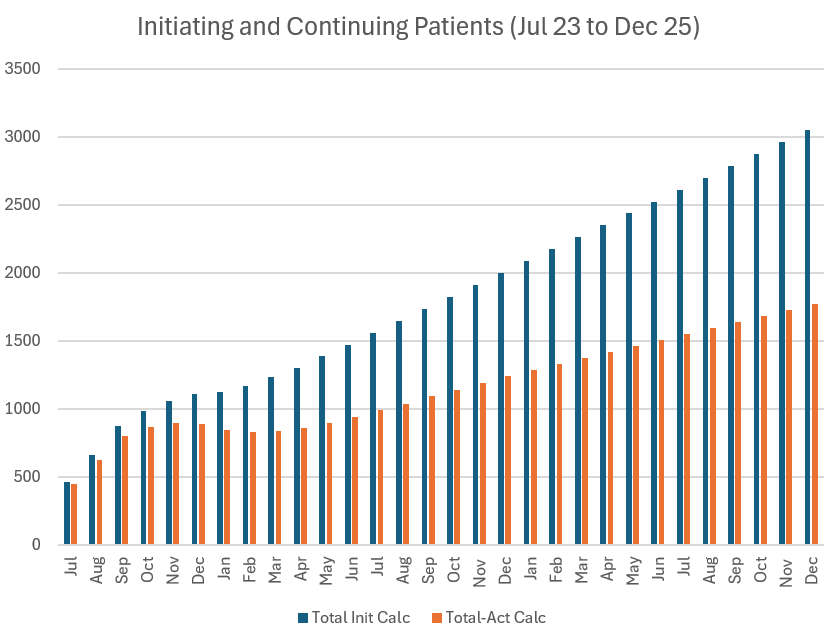

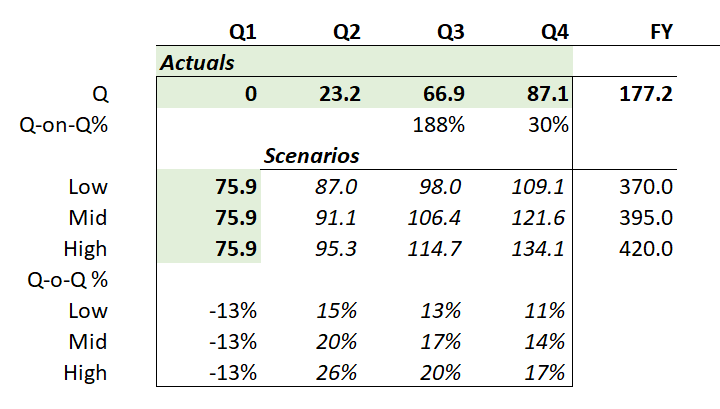

DAYBUE sales of US$101.1m for the Q came in below the low case of my model ($102.3 - $104.3 - $106.2). My model had them hitting a FY range of $388.5 - $400.5, and so with the lower number achieved in Q3, I'm expecting they'll be towards the lower end of the narrowed guidance of $385 - $400m.

But this is really splitting hairs, and the key message is that management have confirmed my view form earlier this year that they have a good grip on how the product is performing in the market, and sales force productivity, and so will be making good resource allocation decisions.

What we don't know is how much of the revenues came from outside the US, given that the product is being made available to patients ex-US in an increasing number of markets in early access programs. It's a high-value product, so it doesn't take for many patients accessing the drug from overseas to start to move this dial.

But I am disappointed at the growth rate, because in Jan-25 the company announced a 30% sales force expansion. This was completed in May-25, and while it will have taken some months for new starters to get traction with their accounts, the period Jul-Oct has in my view enjoyed a full quarter with the expanded field force, focused on the community-based prescribers. My range was meant to capture the full ("80%") confidence I perceived at the time.

A year ago, the 3Q-on-2Q growth rate was +7.8%, so even with the +30% expanded sales force in 2025, the sequential q-o-q growth of +5.2% indicates just how much of a headwind patient churn is. That said, Persistency seems to be holding up: c. 50% at 12 months and 45% at 18 months are again reported, and it will probably not be until next year that we get to see what this is becoming out to 24 months.

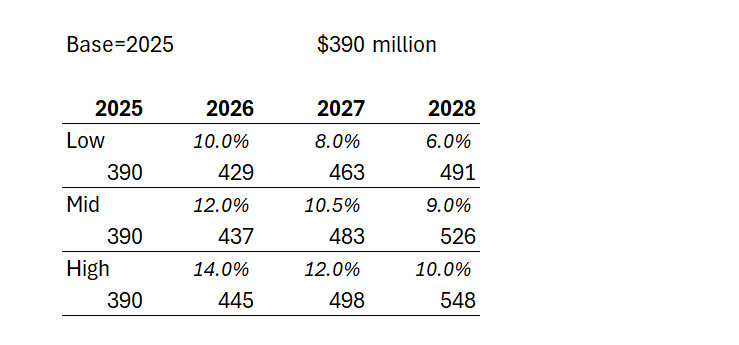

So, let's have a stab at considering US Revenue Growth from here:

Case 1: Management say they will continue double digit annual revenue growth. So giving them the full benefit of the doubt and assuming they hit 2025 revenue of $390m, at 10% for two years, that gets them to $472m in 2027, and $520m in 2028 - likely the year of plateau sales,... or maybe they'll eek out some further growth in 2029.

Case 2: Being generous, let's assume an upside QoQ growth of 4% or 17% pa for two years. That gets them $533m in 2027, and a likely plateau sales in year 5 of $623m in 2028.

But, then again, I think Case 2 is overly generous. Afterall, the 2025-2024 PCP growth rate was only 11%, and let's trim that to 10% to allow for some overseas patients. The sales force expansion has helped the last quarterly result, and so they will likely struggle to do much better than 10% p.a. over two years, even if the 2026 FY number gives a full year with the expanded salesforce cycling an earlier year before the ramp up, and so exceeding 10% in 2026 should be doable in all scenarios. But it can't be sustained IMHO. The persistency drag is just too high.

Looking at the historical trends, the rate of growth is maturing rapidly. For example, even while benefiting from a full quarter of expanded sales force, 3Q/2Q-2025 was +5.2%, compared with 3Q/2Q-2024 at +7.8%. So there is defintely a sequential decline at play towards a plateau that doesn't look that far off (s-curve).

So, in the table below I've modelled three scenarios for annual US revenue growth over the next 3 years (all in $USm):

Depending on how longer term persistency evolves, we could find either 2028 or 2029 as the plateau year for the US. And in the illustration above, in the low scenario, $NEU doesn't get anymore milestone payments, and on the other two scenarios, will get the US$50m milestone only in 2028. The $750m milestone looks well and truly off the table to me.

I haven't pulled this through my $NEU valuation model yet; however, it is a significant deterioration on my earlier projections.

So, what does this mean for $NEU?

Well, US sales of US$490-$550m in round numbers are $NEU royalties of US$54-$62m or A$83-$95m, and that's much, much lower that the analysts have for $NEU.

Why?

Because I think the analysts are including all of the following things I haven't included:

- Assume continuing growth, and not modelled an s-curve with a continuing persistency driving decline after year-5 plateau

- Added milestone payments

- Added RoW

My model is too complicated to pull through a simple set of number for the value of DAYBUE to $NEU. However, my earlier projections gave me $12 - $20/share (US growth and pro rata RoW offset by 3-4 years)

Today, I believe US DAYBUE will have a plateau in 2028 or 2029 and immediate steady decline, as new patients arrivals fail to keep pace with churn. So, if all we have is the US, then valuing $NEU at 5x peak contining royalties of, let's be generous and say, A$85m to A$120m gives A$425m - $600m, or with SOI of 126.5m shares, that's $3.35 - $4.75 /share.

Yes, that's what $NEU (US-DAYBUE only) could be, if it can't get reimbursement beyond the US and if it can't sustain growth,

Wow.

Of course, I think it will be worth more than that. But hopefully, you can see that at $18/share, NNZ-2591 is now potentially doing a lot of heavy lifting. And it might be worth it. But it also might not.

But that's not what my "2 for the price of 1" investment thesis was all about. So my thesis is well and truly broken.

BIG CAVEAT: I wasn't going to post this, because I was sure I've made an error somewhere. But I have gone through everything a couple of times, and also used a couple of independent methods, and keep getting similar results. And to be clear, I haven't accounted for $NEU's massive cash pile. But I am not doing an enterprise valuation of $NEU, but rather only the value of the royalty stream from US DAYBUE. So, as ever, this is not advice. But it is enough for me to take the decision I have already executed. Oftentimes, more analysis doesn't add more value.

That said, over the coming months, I will properly update my model. And that's because I want to know at what price I am prepared to buy back in for the value of NNZ-2591. But I don't think there is any hurry. The PMS Phase 3 trial has some way to run.

Disc. Not held

I am in the process of writing up my notes from last week's Acadia Pharmaceuticals ($ACAD) earnings call, however, one of the most important insights in the call was a reference by CEO Catherine Owen to a question from Jack Allen (Robert W Bird & Co. Incorporated) about reimbursement in Canada.

TLDR: The Canadian Drug Expert Committee of the CDA in August 2025 filed its decision: "Do Not Reimburse" for trofinetide (DAYBUE)"

I've decided to elevate this to a stand-alone straw for two reasons. First, it is bad news, and in my opinion it could have a significant bearing on the pending EU/UK approval outcome (even though these are completely independent of each other).

Second, I am concerned that it demonstrates a lack of candour by both Acadia and Neuren management, given that I have conducted an extensive search and can find no proactive references to it in investor communications. (And of course, if it is proven I have missed something, then I withdraw this comment unreservedly. This is also why I am flagging the point, in case other eagle-eyed $NEU investors have picked up something I've missed.)

On the call, analyst Allen asked: "I wanted to ask about reimbursement in Europe. I know there were [... inaudible,.. line cut out] ... in Canada over the summer...."

CEO Catherine Owen replied; "Thanks, Jack. So yes, we are obviously in the middle of discussions and thinking right now around reimbursement in Europe. And you're right, we did have a disappointing decision in Canada. Tom, do you want to share a little bit more about how we're thinking about reimbursement in terms of the sequential approach to that in Europe?"

Tom Garner (VP Commercial) continued ... absolutely no reference to Canada!

Both companies have proactively disclosed and continue to communicate that DAYBUE is approved for use in Canada. And that is true. But after approval (based principally on efficacy and safety), a drug has to gain a reimbursement decision. For countries with a mixed public and private healthcare system, the reimbursement outcome by the responsible public agency, has a significant bearing on prices that will be covered by entities like health insurance payers. So the public reimbursement milestone is critical for determining the revenues that can ultimately be achieved in a market.

And yet, the only reference to the Canadian issue either verbally or in writing that I can find are the following words by Catherine Owen "we did have a disappointing decision in Canada". (Again, other $NEU shareholders, please tell me what I've missed.)

So, I've structured this straw as follows:

1. The Canadian CDA-CDEC Decision

2. How Reimbursement Works in Canada

3. Why I think there is a potential, broad "Read Across" to other Jurisdictions

4. Implications for Valuation

5. Investment Decision

----------------------

1. The CDA-CDEC Decision

I attach the link to the full CDA-CDEC decisions. These are published for transparency in the Canadian Journal Of Health Technologies. It makes for interesting reading.

My BA has summarised the document for you as follows:

Summary of Decision

Agency: Canada’s Drug Agency (CDA-AMC)

Committee: Canadian Drug Expert Committee (CDEC)

Date: August 2025

Decision: DDO NOT REIMBURSE trofinetide (DAYBUE) for the treatment of Rett syndrome in adults and children ≥ 2 years of age and ≥ 9 kg.

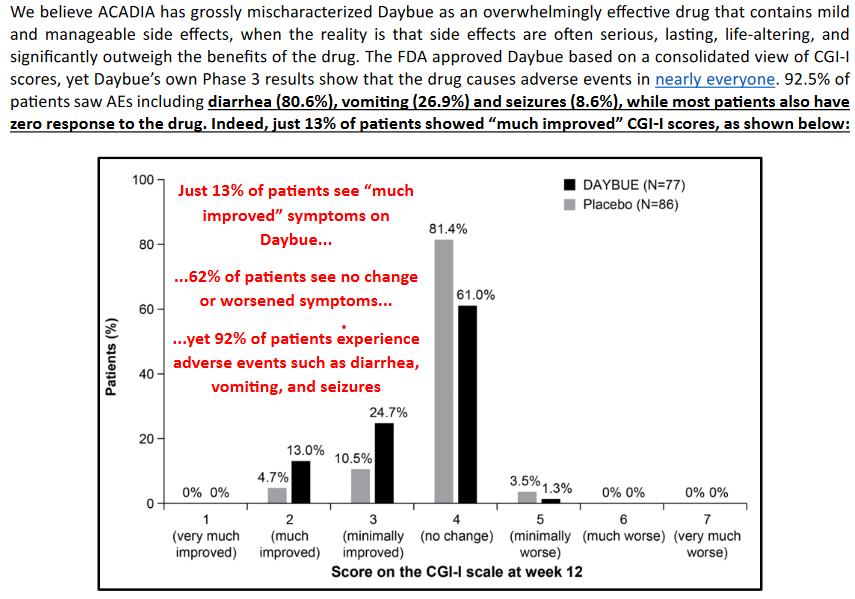

Key Reasons for the “Do Not Reimburse” Decision

a. Uncertain Clinical Meaningfulness

- The pivotal LAVENDER trial (N = 187) showed statistically significant improvements in caregiver-reported behaviour (RSBQ –3.1 points, 95% CI –5.7 to –0.6) and clinician-rated global improvement (CGI-I –0.3 points, 95% CI –0.5 to –0.1).

- However, no minimal important differences (MIDs) were established, so the committee could not determine if these changes were clinically meaningful

- The trial had high discontinuation (≈25%), missing data, and relied on outcomes not used in Canadian clinical practice.

b. Lack of Evidence on Quality of Life and Function

- The trial provided no measure of health-related quality of life (HRQoL) for patients or caregivers, and data on communication, motor skills, and caregiver burden were limited and unvalidated.

- CDEC therefore could not determine if trofinetide addresses the unmet needs identified by patients and caregivers.

c. Very Low Certainty of Evidence

- The committee rated the overall certainty of evidence as “very low” due to bias, imprecision, and indirectness between the trial population and the broader Health Canada indication.

- Open-label extension (LILAC/LILAC-2) and supportive studies (DAFFODIL, LOTUS) did not resolve these uncertainties.

d. High Cost

- Annual treatment cost estimated at CA $427,000 – $1.34 million per patient, depending on weight

e. Adverse Effects

- Diarrhea (81%) and vomiting (27%) were common, leading to 17% discontinuations in the treatment arm vs 2% with placebo.

- While manageable, these events raised concerns about unblinding and trial validity.

f. Reconsideration and Patient Input

- Sponsor Request: Acadia requested reconsideration, arguing the RSBQ endpoint was valid and that CDEC had undervalued caregiver-reported benefits.

- Patient & Clinician Feedback: Groups emphasized the severe unmet need and the importance of even small improvements in communication and daily function.

- CDEC Outcome: Acknowledged these perspectives but upheld the original decision, concluding the evidence was too uncertain to demonstrate meaningful benefit or long-term safety

2. How Reimbursement Works in Canada

Now it is important to recognise that the report is a recommendation, and not a binding decision. However, for all practical purposes, I consider reimbursement unlikely, unless $ACAD can submit further evidence that addresses the grounds for denial. Clearly, the company will be working on this, and has in fact already had one shot at it.

Let me explain why I feel this is the case, by explaining how the system works in Canada.

The CDA-AMC conducts independent clinical and economic evaluations of new drugs and medical technologies on behalf of Canada’s publicly funded health systems (federal, provincial, and territorial, except Quebec). It does not set drug prices or directly fund products, but rather provides evidence-based recommendations to help governments decide whether to include drugs on their public formularies (lists of reimbursible medicines).

The Canadian Drug Expert Committee (CDEC) is an independent panel within CDA-AMC composed of physicians, pharmacists, health economists, and patient representatives. It reviews clinical trial data, real-world evidence, cost-effectiveness analyses, and patient submissions. The committee then issues a non-binding recommendation to federal, provincial, and territorial drug plans.

Provincial/Territorial Decision-Making: Each province/territory makes its own final reimbursement decision, typically following the CDEC recommendation. In practice, a “Do Not Reimburse” recommendation from CDA-AMC almost always results in non-listing (no public coverage) across the provincial drug plans.

Private insurers may make separate decisions but usually reference the same HTA findings.

Reconsideration and Transparency: Manufacturers can request reconsideration (as Acadia did for DAYBUE). The CDA-AMC publishes both the original recommendation and any reconsideration outcome on its website and in the Canadian Journal of Health Technologies for public transparency.

3. Why I think there is a potential broad "Read Across" to other Approvals

My reading of this situation starts to answer a question I always had on my "issues" list. DAYBUE is by any measure an expensive drug, and it was a question for me how jurisdictions would deal with it in places where cost-benefit analysis has a stronger bearing on the reimbursement decision. While the US is increasingly alert to healthcare economics, there is no question that it is more permissive of reimbursing high cost drugs where the cost-benefit is open to challenge.

It seems the Canadians have issues with both the strength of the effiicacy data, the side effects, tolerability and low persistance of the drug (all indications impacting Quality of Life) and the high cost.

The EU process will follow a similar path to Canada. The EMA-CHMP will make its decision on scientific grounds, whereupon each countries HTA (Health Technology Assessment) process will kick in, leading to the reimbursement decions. In the EU/UK, public medicine is a much larger share of the drug budget than North America, so the single-buyer country agencies will have a lot of clout in the pricing decision. And European countries have even greater pressures on public health budgets, given weak economies, unfavourable demographics, and a greater taxpayer contribution to the healthcare spend.

All European HTAs consider cost-effectiveness, clinical value, budget impact, and comparative benefit (albeit there is no other treatment for Rett). And so I believe the Canadian decision is a potential canary in the coalmine for Europe. Even though the European process is completely independent, I imagine all the European decision-makers will read the Canadian document. In Europe, there is also greater political pressure than in the US for challenging high cost drugs, and even more so when there are clear question marks on quality of life benefits.

In the best case scenario, I anticipate this will result in European prices heavily discounted to the US price. By heavily discounted, I mean 40%, 50% and even up to 70% or more!

4. Implications for the Valuation of Neuren

The Canadian "canary in the coalmine" puts a questionmark over the remaining value in the right-hand slide above. While RoW paitents may be given access to the drug on special grounds ("early access programs"), these are unlikely to trigger the "commercial sale" milestone payments. Privately-funded patients might also find ways to get access to the drugs.

The Canadian decision also indicates to me that negotiations towards an acceptable reimbursement decision could be protracted. $ACAD needs to hold out for a good enough price that make sense, given that it is on the hook for the initial milestone payments irrespective of the value of the commercial sales. So, in Europe, it will have to see revenues that cover: US$35m royalty + "mid teens to low-20's" tiered royalties + distributors margin (or fixed cost of sales force, if direct).

So with potentially a much lower price, a relatively high fixed royalty, and a lower Gross-To-Net, $ACAD will need to see material revenues, before agreeing to launch.

The reimbursement negotiation is therefore likely to be protracted. $ACAD will marshall all the real world data that they can from the US, as well as the continuing open lable trial data on long term persistency (now down to 45% at 18 months, down from 50% at 12 months) potentially pushing RoW cash flows further into the future.

5. Investment Decision

I haven't crunched this all in my model. However, on a risked view, I am materially marking down my Outside North America DAYBUE revenues (start, ramp, peak), and therefore also the royalties to $NEU (note: the percentage tiered royaties here are significantly higher than the US.)

By eyeballing my current model my "2 for the price of 1 thesis" is blown for $NEU at $18.

In round numbers, my valuation of DAYBUE ($12-$20), has clearly fallen to the lower end, with a significantly lower downside case if DAYBUE cannot achieve significant commercial traction outside the US.

Which means that much more of the current share price rests on the development of NNZ-2591. I had given NNZ-2591 $8 of value at a 50% risking (from $16). Perhaps that is harsh, but until I have a better view, then that is my number.

Which means that at a SP of $18, I need to see $10 of value in DAYBUE, and I don't see that with confidence, as I will make clear in my next write-up on the $ACAD results.

For me, the bottom line here is that more of the value in this business lies in drug development risk, rather than commercial execution. Looking across my entire portfolio, I am carrying quite a bit of this risk, and I am not confident that I have a good grip on the outlook for $NEU. I'd therefore like to take 2-3 quarters to evaluate DAYBUE's progress from the sidelines. And that's because I think there is a reasonable chance that we will soon have visibility of US DAYBUE plateau sales below US$500m (downside) and not much more (upside). I'll sketch this out in more detail in my next note.

Accordingly, I have sold my shares in $NEU.

Disc: Not held

Just wondering if anyone (@mikebrisy @Nnyck777 @BendigoInvesto) had any comment on their latest update?

Thanks

C

Record DAYBUE™ net sales of US$101.1 million in Q3 2025, up 11%

from Q3 2024

Q3 Highlights:

from Q2 2025

• Q3 2025 DAYBUE™ (trofinetide) net sales of US$101.1 million, up 11% from Q3 2024 and up 5%

• For the first time more than 1,000 patients received shipments

• Largest quarter-over-quarter increase in referrals since launch driven by expanded team

• 74% of prescriptions to new patients were written by physicians in the community setting outside

centers of excellence

• Named patient supply programs active across multiple regions outside North America

• Neuren earned Q3 2025 royalty income of A$16.4 million, up 24% from Q3 2024 and up 12% from

Q2 2025

• Acadia narrowed full year 2025 DAYBUE US net sales guidance to US$385 – 400 million (previously

US$380 - 405 million), implying full year 2025 US royalty income for Neuren of A$63 – 66 million

(previously A$62 - 67 million)

Another step forwards for Neuren on their journey to address new syndromes

$NEU have announced that their first site for the phase 3 trial of NNZ-2591 in Phelan-McDermid Syndrome (PMS) is underway.

Here's the short text:

"Neuren Pharmaceuticals (ASX: NEU) today announced initiation of the first investigational site in the United States for its Phase 3 clinical trial of NNZ-2591 in Phelan-McDermid syndrome (PMS), after receiving Institutional Review Board (IRB) approval. Other trial sites in the US are at various stages of the initiation process. This is the first ever Phase 3 trial in PMS, a serious neurodevelopmental disorder with no approved treatments. The randomised, double-blind, placebo-controlled trial will assess treatment for 13 weeks in approximately 160 children aged 3-12 with PMS. All participants may be eligible to continue treatment with NNZ-2591 for 12 months in an open-label extension trial. The trial program is fully funded by Neuren’s existing cash reserves. Neuren conducted an End of Phase 2 Type B meeting and a subsequent Type C meeting with the US Food and Drug Administration, at which alignment was reached on the design of the Phase 3 trial, including the primary efficacy endpoints."

My comments

So this is the Phase 3 trial for the first of several rareneurological conditions for NNZ-2951, and likely the most consequential for thbusiness. If success is achieved here, it increases the likelihood that treating the bioavailability of IGF-1 may hold the key to treatment of several conditions.

As a rare condition, recruitment will take a while, although Neuren will have maintained involvement with the relevant patient advocacy groups. A clear motivation for patients to join the trial, is the possibility of continuing on after the trial period is complete.

Over the coming months expect newsflow like: 1st patient in, 50% patients in, 100% patients in, trial complete, preliminary readout.

Disc: Held in RL and SM

Jon Pilcher has been teasing investors for some time that $NEU are investigating other conditions that might be treated with NNZ-2591. Today, he's revealed the next target is the SYNGAP1-related disorder (SRD), another rare and intreated neurological condition.

SRD is caused by a genetic variation and patients affected suffer "intellectual disability, low muscle tone, global development delay, epilepsy, sensory processing disorder, gross and fine motor skill delays, coordination disorder, speech delay, sleep and behavior disorder and autism spectrum disorder."

The prevalence is reportedly 1 in 16,000 individuals, which would offer a potential population in theUS of 21,000. Given that there once again no existing condition sets up the product for a high cost of treatment per patient. (Recall, the Rett prevalent population is 5,000-6,000, and DAYBUE looks like it will make peak sales in the US of c. $500m.)

The nature of the condition and the fact that there is currently no treatment marks it out as another potential candiate for orphan designation and priority review. But I am getting ahead of events now.

NNZ-2591 in SRD alone could potentially be a blockbuster (a term from my heyday in pharma in the '90s for a drug that achieves $1bn revenue). Of course, there is likely 4-5 years of clinical development ahead, with all the risk that entails, so don't give up your day job yet if you have one!!

And of course there is also competition risk, with NNZ-2591 more generally being susceptible to any breakthroughs in gene therapies.

But today is a day not to focus on the risks - that will surely come - but to celebrate the fact that NNZ-2591 is truly starting to turn into a single molecule product pipeline.

I'm looking forward to hearing more from this, and from yesterday's news, at the $NEU HY results in a couple of weeks. (They report on a Jan-Dec calendar.)

Of course, the key incremental value-driver is the prgress of the NNZ-2591 Phase 3 trial for PMS (Phelan-McDermid Syndrome). That should keep us all entertained (one way or the other) through 2026!

A good week for $NEU. Yesterday shored up the base(DAYBUE) of my "two for the price of one" investment thesis. Today, has just added a new slide to the upside (NNZ-2591).

Disc: Held in RL and SM

US Pharma company (licensee for DAYBUE) announced 2Q results including DAYBE Sales. The key results are shown below:

I'll give a more complete assessment of the data from the call later this morning, but the bottom line is, this is an excellent result.

In the words of CEO Catherine Owen, DAYBUE is moving "through stabilisation and back into growth".

$ACAD are holding to guidance for the year, but according to my analysis they should comfortably now hit the midpoint of guidance and may well get to the upper limit of even exceed it. They were pressed on this in Q&A and said any modification of guidance will come at 3Q. (There is a history with this product of disappointment, so I think they are being cautious. Catherine clearly is in the "under promise and over deliver" camp. Which is fine with me.)

More later. Also, we should expect a related ASX announcement from $NEU before the market opens and likely a conference call to get Jon Pilcher's take. I imagine he'll be delighted and upbeat.

As for SP action, $NEU has run quite hard over recent months. I'm not sure if this is because any of the instos have insights into the sales via channel checks. Persoanlly, I've not read any research on this. If that is the case then today's sales results explain the SP action.

From my perspective, today's result shores up the base of my "two for the price of one" investment thesis (i.e. de-risks the downside) but probably not enough to justify a valuation update. I'll reconsider this after the $NEU results later this month,

I remain a happy hold here. More detail and analysis later.

Disc: Held in RL and SM

$NEU are holding their AGM today. I was surprised to see the disclosure marked as price sensitive, and so have done a bit of digging to try and figure out the new disclosures.

1. Confirmation of Phase 3 Trial Design and Timing for NNZ-2591 in Phelan-McDermid Syndrome (PMS)

- New detail: The Phase 3 trial will commence mid-2025, and is described in detail:

- 160 children aged 3–12 years, randomized 1:1 to NNZ-2591 or placebo

- 13 weeks double-blind period, followed by 12 months open label

- Two co-primary endpoints aligned with FDA

- Estimated total cost: US$80–90 million, fully funded from existing cash

- Significance: While earlier announcements referenced planning for Phase 3 and FDA discussions, this is the first disclosure of full trial design, size, timing, and funding details.

- Next milestone will be commencement of the Phase 3 trial. (Pending final review and approval of the protocol by FDA. Expected "mid-2025")

2. Hypoxic-Ischemic Encephalopathy (HIE) – Expanded Program and Regulatory Plans

- New detail: Neuren confirms it has planned a Pre-IND meeting with the FDA in Q4 2025 for NNZ-2591 in HIE.

- Also disclosed: the company is exploring a Phase 2/3 trial and identified HIE as a potential in-hospital channel with a repeating pool of patients.

- Significance: While HIE was first disclosed as a new indication in an April ASX announcement, this is the first time Neuren has confirmed regulatory timing, trial strategy, and commercial positioning.

3. Named Patient Supply Expansion Outside Major Markets (Announced by Acadia on 20-May)

- New detail: Acadia has appointed a distributor to facilitate named patient supply for DAYBUE outside North America, Europe, and Japan, potentially including the Pacific region.

- Significance: This specific geographic detail and execution step had not been previously disclosed in ASX filings.

4. Expanded Potential Indication List

- New detail: Neuren explicitly states it is now advancing Prader-Willi syndrome and/or an undisclosed indication, suggesting further pipeline expansion beyond those currently in trials.

- Significance: This is new information indicating potential pipeline expansion beyond the current four NNZ-2591 indications.

My Key Takeaways

There is nothing earth shattering here, however, all the reported developments are positive, so in aggregate, I guess they warrant a positive SP response.

If pressed, I'd say the potential strength of NNZ-2591 as a multi-indication drug appears to be growing over time. Should it be successful in PMS, then that will be the major catalyst for the company. However, patience is required.

I'll admit to be slightly annoyed at the amount of time the Chairman spent bemoaning the share price. The market is the market, and the timelines in clinical development are long.

Disc: Held in RL (5.7%) and SM

The Q1 update from Acadia was very positive. They had previously flagged that Q1 would be a slowdown relative to Q4, based on seasonal effects, so hitting $84.6m revenue from Daybue was pretty positive and sets them up well to hit their annual guidance of between $385-405m. While the revenue chart below looks like an asymptote has been reached, I am expecting this to start increasing again given the commentary around some of the drivers of revenue.

While I consider the numbers to be solid the positive for me were the updates around persistence which is now running at 50% of new starts and has improved considerably since the trials and the commerical launch. It looks like they will have a fairly stable patient population once they get past the 12month mark, with 65% of patients (around 620) have now been on Daybue for >12 months. This is a positive for NEU's continued royalty payments and the likely potential for them to get the $500m sales milestone payment.

The number of patients on the drug has again started to increase after a bit of a softer patch last year. They have 954 active patients up from 870 ending 2024, so they added around 84 in Q1. They still think around 2/3 of the potential patient population haven't tried the drug yet.

They have expanded there on the ground sales team by around 30%, as highlighted last quarter so this should result in higher patient starts now that they move out from the Centre of Excellence Rhett treatment centres. Using the above numbers (84 new starts per qtr and 50% persistence) I can get to the high end of guidance fairly easily without relying accelerating patient growth. Listening to the Acadia call the team seemed fairly comfortable with where they were at and the potential for the next few periods. I think the new CEO has a good sense of the business and has a more polished and focused feel to it than some of the earlier calls i listened too since the launch.

Good news also on the ROW expansion with first non-commercial patient access sales in Germany happening in April and orphan drug designation and a clinical trial in Japan commencing in Q3. So the initial commercial sales milestone ($35m) for Europe are likely in the next financial year and the $15m Japan payment following 1-2 years after.

Overall I'm pretty happy as this had the potential to be a much lower quarter than they achieved. I am not expecting these numbers to move the market but the continued royalty stream really gives NEU the freedom to undeetake the phase 3 trials NNZ 2591 without the potential of a cash crunch

$NEU have issued an ASX announcement this morning reporting on the 1Q 2025 US sales and broader progress of DAYBUE, as reported this morning by $ACAD at the end of the trading day on Wall Street.

I’ll post here $NEU’s overview and then provide my own analysis, having attending the analysts call this morning.

Their Highlights

• Q1 2025 DAYBUE™ (trofinetide) net sales of US$84.6 million, up 11% from Q1 2024

• Record number of unique patients received shipments, up 4% from Q4 2024

• Neuren’s Q1 2025 royalty income was A$13.5 million, up 17% from Q1 2024

• Acadia retained full year 2025 DAYBUE US net sales guidance of US$380 - 405 million, implying full year 2025 US royalty income for Neuren of A$62 - 67 million

• Marketing approval in Europe anticipated in Q1 2026, first shipment of DAYBUE to Europe was made in April 2025 under a Managed Access Program

• Orphan Drug designation granted in Japan

• Distribution agreements now in place to facilitate named patient supply in other regions including Latin America, Middle East and Asia Pacific

• Neuren cash and short-term investments $341 million at 31 March 2025

• Neuren is presenting at Macquarie Australia Conference on 8 May 2025

Further Details from the $ACAD Investor Call

As I will explain in the next section, understanding q-o-q revenue changes is complex. So $ACAD focused on the report that patients treated with DAYBUE in the quarter rose from 920 in Q4 2024 to 954in Q1 2025, i.e., +3.6%.

Last quarter, $ACAD announced they would expand their sales and marketing force by 30%. The reason is that the current salesforce is focused on the high-prescribing Centres of Excellence, with less coverage in the broader community-based physicians who support some two-thirds of the total market. Today, $ACAD reported that the recruitment of these additional sales reps have been completed, and they expect to see the benefit of sale force expansion in the second half of 2025.

At this stage, $ACAD believe that only one-third of the population diagnosed with Retts have tried DAYBUE.

$ACAD also report that now >65% of the 954 patients taking the drug at end of Q1 have been on it for more than 12 months, and that persistency tails off at greater than 50% after 12 months, and thereafter continues to be stable (although I note that no quantification has at this stage been given for what 18 month persistency is looking like. At the next quarterly report, we might reasonably expect to be given a 2-year persistency statistic!)

On tariff impacts, $ACAD report that they “have several years of inventory” in the US, so they are well protected in the short term.

There was some discussion on their exposure to intervention in the US market by the Trump Administration. DAYBUE is a high cost drug and it would exposed if the Administration implements a “most favoured nation” requirement on drug pricing. In essence, such a move would mean that $ACAD would only be able to receive pricing based on prices achieved in overseas markets. The key risk is that if prices in Canada or, say in 2026 / 27 in the EU, are substantially lower than the very high treatment price in the US, then US agreements would be renegotiated. Of course, this is a systemic risk facing the entire pharmaceutical industry, and we are yet to see how this plays out. (Go, the US pharma lobby!!)

Approval in the EU is still expected in 1Q 2026, and $ACAD will soon pass the key 120-day milestone, which is a point in the EMA approval process at which the initial assessment of data is complete. At this point, the EMA can choose to "stop the clock" on its approval process and issue questions to the pharmco. No "Clock Stop" would be a very positive sign for the approval process. So, we should expect a further update on the EU process in the next few weeks. (Remember, any EU approval of DAYBUE in 1Q 2026 then starts the process of country by country negotiation on pricing and reimbursement. Particularly for expensive drugs like DAYBUE, this process itself can take many months and even years!)

My Analysis

The $NEU summary above gives a good overview of what’s going on. Basically, we are seeing steady progress on new patient adds, which remains the key revenue driver.

I want to focus the remainder of this report on the patterns of revenue growth, as there are some important dynamics at play, which are now becoming clearer, and which management have done a reasonable job of explaining.

Patterns in Revenue Growth

Now, the eagle-eyed among us will note that the 1Q-on-4Q revenue decline that was predicted (based on what happened last year, and which took the market by surprise then) has indeed occurred.

The 1Q 2025 sales of US$84.6m were down 13% on 4Q 2024. Interestingly, last year the decline was also around 13%.To provide an overall picture, I’ve plotted the quarterly revenues as well as the percentage changes Q-o-Q (orange bars) and % to PCP (green bars) in the chart below. Early values of the % growth figures are omitted, as they are not meaningful, coming off a small base.

I’d like to dig into this in some detail, as it was discussed on the $ACAD call this morning.

Three things seem to be happening consistently between 4Q and 1Q, as follows:

- Patients pull forward their refills in 4Q from 1Q – potentially ahead of holidays. Management explained that this “pull forward” effect accounted for US$3.5m of revenue being pulled from Q1 into Q4.

- Consequently, scripts and refills are down in 1Q, and there may also be a seasonal effect with fewer patient presentations to clinicians in the winter months

- Net revenue per script falls in 1Q, and this recovers in later Qs due to seasonal patterns in reimbursement, particularly for patients on hybrid Medicare-Private cover.

The first two points are simple to understand. The third requires some explanation. Here goes.

Pharmaceutical companies often see lower net revenue per patient in the first quarter of the year due to how U.S. insurance plans—including Medicare Part D—are structured. At the beginning of the year, many patients haven’t met their deductibles, which means they face higher out-of-pocket costs. This can delay prescription fills or reduce adherence, especially for expensive drugs. In response, companies may provide increased copay assistance, which reduces the revenue they recognize per patient.

Under the 2025 Medicare Part D redesign, the financial burden on drugmakers has also shifted. Manufacturers must now cover a portion of drug costs earlier in the year under the new benefit structure, even before patients reach coverage. This increases rebate obligations in Q1, further lowering net revenue per prescription.

As the year progresses, more patients move past their deductibles and into more stable coverage phases, leading to steadier prescription volumes and fewer financial concessions from manufacturers. As a result, pharmaceutical firms typically see higher net revenue per patient in the later quarters of the year.

So, this 1Q reduction in revenue is a regular feature of both prescribing/refill seasonality and reimbursement/copay dynamics, and little conclusion can be drawn from the revenue number. We’ll need to wait for the 2Q number to better assess whether $ACAD remain on track to hit the annual guidance number. This next result will provide an important baseline against which to assess the impact of the expansion of the sales and marketing force which is expected to start contributing in H2.

My Takeaways

Overall, this is a reasonable result from $ACAD on DAYBUE sales.

The 1Q number is difficult to interpret. It was a bit softer than I hoped for, however, if the expanded sales force has the intended impact, I consider it reasonable that $ACAD have left guidance unchanged. Having said that, I don't have a good quantitative understanding of the reimbursement/copay/Part D dynamics - so I am somewhat blind on that, and have to go with what management are saying. That said, under the new CEO Catherine Owen Adams, communications have been clearer and more consistent from one presentation to the next.

The 2Q number will be more telling, as the bounceback after 1Q will set the stage for the second half of the year, and we have last years number to compare with.

The market has therefore responded reasonably in my view, with SP off 3% at the time of writing. There was little news to react to, one way or the other, after all.

We may see some further reaction based on Jon’s delivery at the Macquarie Conference later today. As each quarter advances, $NEU gets closer to its next milestone payments which would come from any EU approval – or rather first commercial sales in any EU territory which could following during 2026. And, of course, the royalty rate for RoW sales are more attractive than the US.

Overall, $NEU remains on track with my “two for the price of one” thesis.

I was considering topping up after today's result, as I still have only a modest 4.7% allocation. However, even though I have some understanding of the 1Q dynamic, I can't tell to what extent it is masking a weaker overall sales growth. So, I'm going to have to wait another Q.

Disc: Held in RL and SM

Neuren CEO John Pilcher is going to be interviewed live in Melbourne by Monsoon Communications next month (May 20th) for those interested. Last year they did the same and posted it to YouTube..

Nice little article in the AFR today, doesn't add much to information, but lifts Neuren's profile a bit more, which might add a little to some positive momentum.

NEU ASX: This $1.3b biotech is still run out of a spare bedroom in Melbourne

https://www.neurenpharma.com/showdownloaddoc.aspx?AnnounceGuid=97de998d-0017-4778-9610-08e690e7a7ef

A vote of confidence for $153,000

Another Angelman competitor. Starting phase 3 1st qrt 2026. So that is Ultagenix and the new Roche drug. Very understandable why Phelan McDermid went first. Might be tough to recruit for Angelman unless Neuren steps on the gas. I would suspect they might tackle HEI or Pitt Hopkins next to mitigate first mover advantage. I also suspect that Neuren’s FDA primary endpoints agreement has just made other companies end point pathways a lot easier.

FDA and Neu have had their meeting and confirmed primary endpoints for a phase 3 trial

Nice to get some positive news. There was some concern that the FDA cuts would cause a delay. Clearly it hasn't.

No surprises re the trial protocol. All seems reasonable to me. It will be interesting to see how many patients they need to enrol. For Daybue it was 187

It is kind of interesting for me, at least, to compare with Opthea, which I got badly burnt by. Opthea had a phase 2b trial involving 366 patients, randomised and blinded, showing strongly positive results. The two phase 3 trials completely crashed and burned, showing the drug basically doesn't work.

NNZ-2591 did a phase 2 trial for Phelan-McDermid syndrome. It had a total of 18 patients, open label. No control group, no randomization, no blinding. There were similar small trials for Pitt-Hopkins and Angelman syndromes. Results were based on questionaires completed by caregivers and clinicians. Huge opportunity for bias and placebo effect. Everyone is desperate for anything to help these children, who currently have no effective treatments at all. Obviously people are primed to look for positive improvements. Best to take these results with a MASSIVE degree of scepticism IMO

So I'm treating NNZ-2591 as nothing more than a lottery ticket at this stage. Fortunately, as others have said, the company is is probably around, or even below fair value based on Daybue alone.

The phase 3 trial is expected to start around "mid-year 2025"

It will be interesting to see if mass firing of 19%of the FDAs workforce, including the top brass, slows the meetings and information flow down. I suspect yes dramatically and I can’t imagine powerful pharmaceutical companies are going to be happy about potential delays.

With an impending PMS Type C meeting looming we will see if this decision leads to delays for Neu.

God this chaos is exhausting! I am tired I am going to have a lie down.

Ahead of the $NEU FY24 Results call in a few minutes, I put in a question to ask CEO Jon to explain why they seemed to move in late 2024 from expecting the progression into a Phase 3 trial for NNZ-2591 could be managed via email with the FDA to requested a Type C meeting, which will be scheduled for April (from memory).

As part of preparing for the call I include here two items:

- Their 20204 highlights

- My analysis of yesterdays $ACAD call, focusing on progress and outlook for DAYBUE

Overall, I am pleased that the overall outlook for DAYBUE has gone from worrisome, as it was in early to mid-2024, to now a more stable outlook, with the prospect of Europe coming into view.

2024 Results -$NEU's Highlights

- Total comprehensive income for shareholders A$166 million, comprising A$142 million profit after tax and A$24 million foreign currency translation gain

- A$222 million cash and short-term investments at 31 December 2024, A$359 million pro-forma cash adjusted to include receipt in Q1 2025 of PRV sale proceeds, sales milestone and Q4 2024 royalty and payment in Q1 2025 of Q4 2024 tax

- A$56 million US royalty income from DAYBUE™ (trofinetide) in 2024 up 110% from A$27 million in 2023, with guidance for growth to between A$62 million and A$67 million in 2025

- A$445 million cumulative income from DAYBUE over 2023 and 2024

- DAYBUE approved in Canada, first sales expected in Q3 2025

- Trofinetide Marketing Authorisation Application for Europe filed, potential for approval in Q1 2026, Acadia planning managed access programs from Q2 2025

- Acadia commencing small clinical study by Q3 2025 to support marketing application for Japan

- NNZ-2591 potential to address core symptoms of diverse neurodevelopmental disorders, independent of the underlying genetics, supported by positive Phase 2 trial results across PhelanMcDermid, Pitt Hopkins and Angelman syndromes, with other indications under evaluation

- Fast Track designation granted by FDA for NNZ-2591 in Pitt Hopkins syndrome and Rare Pediatric Disease designation granted by FDA for all three syndromes

- Type C Meeting with US Food and Drug Administration scheduled for early April 2025 to discuss primary efficacy endpoints for Phase 3 trial in Phelan-McDermid syndrome, with alignment reached on all other key aspects of the program at End of Phase 2 Meeting

- Preparations continuing for planned commencement of Phase 3 trial in mid-year 2025

Summary of yesterday's $ACAD Presentation

Acadia Pharmaceuticals is positioning DAYBUE as a long-term growth driver in the Rett syndrome market, with strong U.S. sales momentum, a stable patient base, and global expansion plans. The company is investing in commercial resources, patient support, and physician education to further penetrate the market, while its regulatory efforts in Europe and Canada aim to establish DAYBUE as a global standard of care for Rett syndrome.

1. Sales and Revenue Performance

- Q4 2024 Sales: $96.7 million (up 11% YoY, 6% sequentially)

- Full-Year 2024 Sales: $348.4 million (up from $177.2 million in 2023, nearly doubling in its first full year on the market)

- Revenue Growth Drivers:

- Increased bottle use per patient as stable patients titrate toward the recommended dose.

- Higher persistency rates, with 62% of patients on therapy for over 12 months.

- Improvement in patient discontinuation rates (15% QoQ decline).

- 2025 Sales Guidance: Expected U.S. sales between $380 million and $405 million, with 9-16% volume growth.

2. Commercial Progress and Market Penetration

- Patient Base Stability:

- 920 unique patients received paid shipments in Q4, stable from Q3.

- About 30% of Rett patients in the U.S. have tried DAYBUE.

- Persistency at 12 months remains around 50%.

- Prescriber Growth:

- 830 HCPs have prescribed DAYBUE (up from ~800 in Q3 2024).

- 35% of patients treated at Rett Centers of Excellence (COEs), while 65% receive treatment in other settings (community and high-volume institutions).

- Penetration: 55% at COEs vs. 25% in community settings, indicating room for growth.

- Sales Force Expansion:

- Acadia is increasing its field force by 30% in 2025 to enhance engagement with physicians outside of COEs and improve patient and caregiver support.

3. Patient Experience and Retention Strategies

- Treatment Uptake and Persistence:

- Over 60% of patients have been on DAYBUE for 12+ months.

- Titration trends indicate improved dosing adherence.

- Discontinuation Rates:

- Improved by 15% QoQ due to proactive support and education initiatives.

- Support Programs:

- Acadia Connect: Dedicated team providing individualized care and treatment navigation.

- New Initiatives: Direct-to-consumer campaigns, peer-to-peer engagement (patients, caregivers, HCPs).

4. Growth Strategies and Expansion Plans

- U.S. Market Growth Initiatives:

- Increase penetration in non-COE settings.

- Expand physician engagement and awareness efforts.

- Drive growth through omnichannel campaigns, real-world data insights, and peer-to-peer engagement.

- International Expansion:

- Europe: Marketing application submitted to the European Medicines Agency (EMA); approval expected in Q1 2026.

- Canada: First DAYBUE sales anticipated in Q3 2025.

- Other Markets: Evaluating broader global expansion through managed access programs.

5. Forward Outlook

- Short-Term Outlook:

- Q1 2025 Expectations: Sequential revenue decline due to Q4 pull-forward dynamics, seasonal factors, and pricing adjustments.

- Revenue expected to increase in Q2 2025 and beyond as commercial efforts gain traction.

- Long-Term Growth Drivers:

- Increased patient penetration in non-COE settings.

- Global market expansion beyond the U.S.

- Improved dose adherence and persistence.

- Real-world evidence from the LOTUS study to reinforce efficacy and long-term benefit.

Disc: Held in RL and SM

https://finance.yahoo.com/news/acadia-pharmaceuticals-reports-fourth-quarter-210500883.html

A positive result for Daybue sales from Acadia just released. Q4 sales ”$96.7 million and full year 2024 net product sales of $348.4 million”.

This meets higher end of Acadias guidance for the full year.

Hopefully Acadia has set a more conservative full FY 25 guidance this time: “Daybue net sales guidance of $380 to $405 million”

Canada sales and possibly early European revenues should add to this.

Hopefully Neuren’s share price starts to rise accordingly after being beaten down for so long.

Held IRL and SM

Since last Wednesday NEU has gone from a low of $10.90 to today $13.20 or an increase of 22%. This is no micro-cap NEU having a m/cap of $1.4b.

This is all happened on the back of no public news – or none that half-asleep-Scoonie is aware of.

NEU is not an unknown, with every broker in Australia and most of US all over it & Arcadia and NEU being lauded in the Australian financial press numerous times.

One of the more excitable and retail focused brokers have in the 12 months publicly said in reference to NEU: “It's my favourite stock!” Just like selecting a delicious flavour at Gelatissimo.

Maybe that is the issue – NEU has (or had) too many of these investors.

Adding valuation more as a curiousity - Neuren initiated as a buy @ Ord Minnett with a price target of $29.30.

Graham Witcomb from II had an article out today, perhaps a little premature as it seems to be missing some of the updated information from the presentation the company released to the ASX today. None the less it makes the good point that Daybue royalties to 2030 are expected to generate ballpark $1b so the current price also includes success in the research pipeline and/or higher than anticipated royalties from Daybue.

I recommend subscribing to II, but this is the passage which covers the less talked about or well know aspects:

Acadia shakes

While there's no reason to doubt the cash pipes will keep gushing in the short term, Neuren's heavy reliance on Acadia for manufacturing and distribution is a potential weak spot.

A new chief executive, Catherine Adams, took Acadia's reins in September and that could shift priorities to other drugs in Acadia's stable or lead to strategy changes. Neuren has practically no influence over sales under the current licence, which was expanded to a global exclusive licence in 2023, multiplying Neuren's reliance on Acadia.

A management transition may complicate what already appears to be a slowing sales outlook. Acadia's most recent guidance is for Daybue sales of US$340m-350m in 2024—a fantastic sum given the drug was only recently approved, but we can't help but notice it's at the low end of Acadia's earlier (reduced) guidance of US$340m-370m.

Some 30% of diagnosed patients have now tried Daybue, and those patients are almost certainly the most in need and easiest to access, due to their proximity to specialist clinics or recruitment during the clinical trial process. Reaching the next 30% will be a tougher slog, so if Acadia is already lowering expectations, that tells us the drug isn't performing as well as expected. On the bright side, as sales grow outside of North America, royalty margins expand to 20% or more, so Neuren takes a larger cut of net sales.

Competitive pressures are also something to watch. Advancing gene therapies—two of which are in clinical trials—could in time challenge Daybue's relevance. With a single-product focus, Neuren is vulnerable to anything that could disrupt Daybue's status, including post-market surveillance which sometimes reveals safety issues that smaller trials failed to uncover. This is more common for rare diseases with tiny patient pools.

Neuren has transformed from a speculative micro-cap to one of Australia's most profitable biotechs, anchored by a leading product in a high-potential market. While its short-term dividend prospects are strong, the stock's 10-40% premium to projected Daybue royalty payments over the next decade means its investment appeal depends on the success of next-generation drugs. The company only has a few products in the research pipeline and all are in Phase 1 or 2 trials, where failure is the norm. Neuren's current share price appears justified given Daybue's cash flow potential, but the clock is ticking on how long the gushers remain open.

Disc: I own SM+RL

15-Jan-2025: 1:30pm: NEU down as much as -9.17% today (closed @ $12 yesterday and down to an intraday low of $10.90 so far today) with a couple of hours to go. So much for being close to the bottom of their downtrend.

I'm not seeing negatives in today's announcement - Trofinetide-marketing-application-submitted-in-Europe.PDF - but clearly it's below some market participants' expectations. Perhaps it's the pace of the DAYBUE™ (trofinetide) roll-out globally that has some punters thinking that while the growth is there it might take longer to play out than previously expected.

I guess that's the trick. How do you accurately manage market expectations when the market is often irrational and many people are simply following trends or charts without too much understanding of what the business does and the environment in which the business operates?

Pharma is well outside of my wheelhouse, but I know enough to know that trofinetide has been derisked and is going to be rolled out globally, and it's already selling in the US and Canada, and the FDA in the US is regarded by most people to be one of the hardest nuts to crack for pharmaceuticals. And the global roll-out will take time, i.e. years - it won't happen overnight.

I'm bemused, but otherwise unphased. I was obviously back in too early with NEU (in December) and I guess that tends to happen to me more often with companies that operate within sectors that I have less overall knowledge about and experience in (outside my sphere of competency), however when I bought back into NEU in December, it was in my SMSF only, and I'm back to being comfortable with 5 year plus timeframes there now - after my TPD claim got approved and paid in October so my prior need to make shorter term profits is no longer there. I'm back to being a medium-term value investor - mostly - who also likes to make a buck here and there on shorter term opportunities. All good.

Today's Announcement:

Disclosure: I hold NEU both here and in my SMSF.

This is not a full valuation or a bear case, it’s a base case on the currently commercial part of the business to get a feel for what it is worth. On this basis I now have a full position in NEU, with a simple thesis that the current prices is reasonable for just the royalty income from Daybue (as @mikebrisy concluded with much better analysis) and I expect milestone payments to cover the cost of any further research in NNZ-2591 and assume that research fails to generate any commercial value.

Assumptions:

· Duybue sales in NA of US$400m growing at the cost of capital, generate US$43m (A$64.2m) in Royalties, which I view as conservative.

· ROW sales are worth around the same value, so A$64.2m in Royalty revenue.

· The cost to operate the business and for further NNZ-2591 research is covered by Milestone payments on Duybue (ie they net out) including the US$50 for the current milestone and US$50m for the PPV sale.

· PE of 12 and Cash as at 30 Sep of $210m.

· Base Value per share of A$10 per share

Given how rough this is I have bought in at under $13, seeing the downside as minimal. The upside however is significant and I am yet to put any figures on it but each of the following could be worth at least the current value of the company:

· Daybue commercial success above current expectations.

· Fragile X royalties and milestones from Acadia.

· NNZ-2591: multiple opportunities but current Phase 2 candidates for Phelan-McDermid, Pitt Hopkins and Angelman are worth ascribing value too.

I have a lot more work to do on NEU which will take a long time and I had thought I had missed the opportunity when the price spiked, but thanks to RFK’s appointment and the market I am taking this second chance on the basis that this is a very asymmetrical investment in my view.

Disc: I own RL

Neuren seems to have been caught up in the biotech sell off following the appointment of RFK Jnr as the head of the Department of Health and Human Services in the US.

What are everyone's thoughts on this appointment? Seems like the market is looking quite short term towards news that may not actually eventuate to much.

Drugmaker stocks slide as Trump taps vaccine skeptic RFK Jr for US health job | Reuters

Disc: Held IRL and on Strawman.

JP Morgan: Overweight PT $23

Share buyback surprise; focus on first NNZ-2591 Phase 3 trial to start in 2025

Emerging biotechs do not typically find themselves in a position to announce share buybacks. However, for Neuren, the early arrival of a higher-than-expected sale price of Acadia Pharmaceuticals’ Priority Review Voucher (PRV) let them do just that. Neuren announced a $50m share buyback this week, a surprising move but one which speaks to the company’s comfort with its current spending requirements. We are somewhat cautious on what the exact next cost of the phase 3 clinical trial of NNZ-2591 in Phelan-McDermid patients will be, however, Neuren’s current cash position and lean operating model should allow the company to meet requirements comfortably. At this stage, we remain focused on the nearterm catalysts in the development of NNZ-2591 to a late stage clinical asset and view the risk/reward as favourable. Retain Overweight, PT unchanged at $23

• Buyback driven by PRV sale. At Neuren’s current cash position of ~$210m and incoming steady royalties from Daybue, the company maintains it will have sufficient funds to execute on at least two Phase 3 trials (likely to be NNZ-2591 for Phelan-McDermid syndrome and Pitt Hopkins syndrome). We view the announcement of a share buyback as somewhat unnecessary, but understand the rationale of returning excess cash to shareholders

• Clinical trial preparation on track. We await the news of the defined endpoints for NNZ-2591’s first Phase 3 trial in Phelan-McDermid Syndrome patients, likely to be announced in early 2025, for commencement shortly thereafter. Management have maintained the line it will cost US$50-100m per trial and we expect to get a clearer picture once further details emerge of how large the patient size of the Phase 3 trial will be required to be

• Daybue patient adds now steady. Daybue September quarterly sales of US $91.2m was within our expectations, as full year guidance was unsurprisingly narrowed to the lower end at $340-350m. Sales reassuringly continue to grow, lifting 8% QoQ as discontinuations stabilise. Moving forward the focus will be on driving penetration outside the Rett’s Centres of Excellence (more than 70% of patients treated) in the US and abroad, the submission of the European dossier in 1Q CY25. We make limited changes to our Daybue forecasts

• Retain Overweight, PT unchanged. The overhang on Daybue sales volatility appears mostly removed, since the latest Acadia quarterly numbers suggest patient discontinuations have stabilised. Our focus remains on the progress of Neuren’s pipeline drug, NNZ-2591, as it enters late stage clinical trials which should over time demonstrate its platform potential. We continue to see the risk/reward as favourable for Neuren and retain our Overweight rating, PT unchanged at $23 p/share

DISC: Held in RL & SM

$NEU have announced an on-market share buyback of us to $50m.

This is not a surprise as Jon has indicated that the Board have been considering how much cash they need and what should be done with an excess cash.

$NEU were already sufficiently cashed-up to fund the planned two Phase 3 Trials for NNZ-2591, and with a perpetual incoming stream of royalties from DAYBUE, the windfall of $US50m for the PRV sale by $ACAD, has clearly been judged as excess cash, a one-off, to be returned to shareholders.

For long term holders of $NEU, this is an opportunity to deliver some returns. Good to see management exercising discipline.

From my perspective, the return makes sense. I consider $NEU remains materially under-valued, and they won't need the cash for NNZ-2591.

If the strategy evolves and they develop the company to take (in the success case) NNZ-2591 all the way to market, there's probably enough future cashflow coming from DAYBUE to fund that.

Disc: Held in RL and SM

A 34% pop in SP in just the past week on the back of the good DAYBUE numbers - FWIW here's what one broker had to say

MST Marquee: Buy 12m PT $28

Daybue back: Bumper qtr for NEU

MST upgrades CY24 NPAT 13.4%

▪ Daybue grows Q/Q: active patient numbers show pos linear profile

▪ 3Q delivers NEU A$76m each for voucher sale + milestones (2xUS$50m)

▪ Positive progress in Qtr for NNZ-2591 puts NEU on cusp of Ph3 in PMS

▪ MSTe adjusts FY24e/FY25e EPS +13.4%/-9.4% PT $28ps. Buy rating

At 3QCY24, Acadia Pharmaceuticals (ACAD.US) demonstrated a consecutive qtr growth or ‘linear’ profile of active Daybue patients. Despite ACAD’s updated guidance pointing to the low-end of its previous range, NEUe royalties of $54-56m still landed modestly ahead of MSTe. ACAD’s CY24 YTD Daybue sales exceeded US$250m & triggered a further US$50m milestone payment (as MSTe). ACAD’s sale of the Daybue Priority Review Voucher (PRV) adds another US$50m to 2H. NEUe total CY24 rev at ~$216-218m (incl $11m interest). MSTe CY24 rev is increased +11%; we also update for Phelan-McDermid syndrome (PMS) Ph3 R&D costs from 2H25. Our FY24e EPS gains +13.4% but FY25e EPS falls -9.4%. MST PT A$28ps, with longer term FCF profile unchanged

Acadia (ACAD): 3Q royalties, milestone & Voucher sale

ACAD’s 3QCY24 (All US$) net sales for Daybue grew +36.3% on pcp to $91.2m (+7.8% on consec qtr) with growth in unit sales including patient on treatment at ~923 (was ~920 in 2Q). Based on 3Q result, NEU will receive royalties of ~A$13m (10% for sales ≤$250 and 12% between $250-500m). ACAD narrowed CY24 Daybue sales guidance to $340-350m (was $340-370m) implying 4Q royalty to NEU at ~$17m. For 9mths CYTD sales were $251m, above the >$250m for CY required to trigger a further $50m milestone. Separately ACAD sold its rare paediatric PRV for US$150m with NEU to receive ~US$50m

Cashed up: Bal sheet & cash-tax asset from NZ credit

At end 3QCY24, NEU cash and short-term investments totalled A$210.2m, with interest income covering corporate expenses. NEU expects to recognise a deferred tax asset of approximately A$17m in CY24 from New Zealand tax losses, partially offsetting its ‘cash-tax’ given A$12.5m was applied at CY23

Updates: Canada apvl & NNZ-2591 PMS progress

Daybue was approved in Canada in Oct to treat Rett syndrome in patients >2yrs. NEUe TAM for Rett in Canada at 600-900 patients & sales will add NEU royalty payments. On NNZ-2591 NEU says its FDA meeting on key aspects of its Ph3 trial for PMS was positive. NEU plan a 13wk randomised, double-blind, placebo controlled trial in 3-12yrs olds. Ph3 likely starts 2HCY25, but timing and costs remain subject to final efficacy & endpoints

DISC: Held in RL & SM

$NEU paused, presumably while they prepare their release on the DAYBUE sales number. No biggie.

They will however likely now give very tight guidance on FY24 renveue, which will be uplifted due to proceeds from the PRV sales, which $ACAD expects to close in Q4.

So for those in the market who don't understand the details of what's going on, FY24 is going to look strong. It will be interesting to see what this does!

Still writing up my more detailed notes from $ACAD and doing some analysis on DAYBUE.

$ACAD have just announced their Q3 results.

DAYBUE sales were $91.2m, up 36% to pcp and +8% q-o-q, so clearly new scripts are outpacing discontinuations, which is good news.

Guidance is lowered from $340 - $370 to $340 - $350m.

This is pretty much exactly where I expected. Going on the call now.

Disc: Held in RL and SM

Daybue has just received approval for use in Canada. This will add to the US sales numbers.

Lets see if this can halt the continued slide of Neu share price - despite good news.

The recording of today's meeting with Jon Pilcher from Neuren is now up.

The big takeaways:

- NNZ-2591 has the potential to be much more impactful than Daybue -- both in terms of addressable market and the nature of partnership agreements (which should be much more favourable than the initial agreement with Acadia)

- Jon was extremely optimistic about its prospects, not just because of very encouraging Phase 2 results, but because of their experience bringing trofinetide to market

- Expect about 2 years or so before this is contributing to revenues

- In the meantime, they have a fortress balance sheet. It seems more than enough to support them, especially given their Daybue business is profitable and fast growing.

- The partnership agreement outside of North America was significantly better than the initial terms with Acadia, and the market in Europe is essentially the same size.

- The business is in the best shape its ever been, and yet the share price is down 50% or so from its high. I suspect because the market got a little carried away last year, but also because of some doubt cast by a short report targeting Acadia, and a downward revision in Acadia sales -- but Jon said that had little to do with their partnership

Neuren operates in a high-risk space, but it seems like things have been substantially de-risked in recent years. A reliable cash-cow in Daybue with a long runway of growth, a rock-solid balance sheet and another candidate coming to market (hopefully) in the coming years with even bigger potential.

I haven't had a crack at a valuation, but things certainly seem more compelling now given the recent decline in price.

Summary

Following $ACAD 2Q Results in Aug and recent conference presentations in September also by $ACAD, I have firmed up on my recent valuation ($24, $12-$46), and am getting more comfortable with the future US sales trajectory for DAYBUE.

As a result, I've added back most of the shares I sold in May at yesterday's price, which I consider a bargain.

I consider that today the market is offering $NEU on a "two for the price of one" basis, ... or thereabouts.

Context

With all the focus on ASX reporting over recent weeks, I’m only now catching up with some of the wider research opportunities in my portfolio. One area I am giving some focus is $NEU. I’ll not repeat information here from earlier straws and posts, but in summary, this business has two important things going on:

1) DAYBUE being sold under licence by $ACAD in the US, with work underway to gain approval in Canada (likely end-24/early-25) and EU & Japan (approvals likely only in 2026+)