Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Here's the announcement on the FDA engagements regarding HIE and PTHS clinical development for NNZ-2591.

Basically, Neuren has received written FDA feedback (not a meeting as requested) confirming a clear regulatory path for NNZ-2591 in both HIE and Pitt Hopkins syndrome.

Additional juvenile animal data is required before initiating the HIE IND, i.e., in human Phase 1 clincal trial. So, a minor delay.

And there is alignment that a PTHS-specific CGI plus a functional observer-reported endpoint could support a controlled efficacy trial. Here, I think $NEU are being customarily cautious not to refer to the terms Phase 2 or Phase 3, because we haven't yet heard the readout from the Phase 2 submission currently under consideration. Obviously, $NEU would hope to move into a pivotal Phase 3 trial, but by not using that term now, they avoid a potential future disappointment. Well, that's my reading of it.

Neuren plans to advance both programs in 2026, while continuing its Phase 3 PMS trial, with no material funding impact from the FDA feedback.

I don't consider that this announcement moves the needle one way or the other.

What will in my view move the needle, is any positive update on the ongoing PMS Phase 3 trial. However, as it is a randomised, double-blind, control trial, I think any update will relate to information about progress in enrolment, absence of serious adverse events (maybe), and any update on the foward timeline.

In summary, I don't see a lot here today. Do others have a different view?

Disc: Not held

A blow today for the international rollout of trofinetide by $NEU's US partner $ACAD after a "negative trend vote" by the EU's CHMP on the MAA.

$NEU SP is down around 8% at time of writing, bouncing off an initial low of -15%.

What is the significance of a "negative trend vote"?

Basically, CHMP gives MAA applicants an indication of the direction of travel in its consideration of MAAs (drug approval applications).

A peer-reviewed study conducted over a decade ago showed that a negative "trend vote" results in 75% of applications ultimately being declined, so the news is not good.

$ACAD appears likely to request a "re-examination", however, the odds of success are not strong. Evidence indicates that when requests for re-examination are successful, any subsequent approval is likely to involve label restrictions, wherein the drug is approved for a narrower use case.

From my understanding of Rett, it is hard to imagine what the limitation might look like in this case. Perhaps an age restriction or possibly in cases with the most severe limitations,... but I am grasping at straws here.

As I commented on and predicted last year, the Canadian technical committee "do not reimburse" recommendation after approval in that market looks like it was indeed the canary in the coalmine. It gave me sufficient pause for thought, and weighed heavily enough on my valuation as I assessed it to add a lot of risk to the global rollout of trofinetide, so I sold my entire holding at that time.

I consider that management at $ACAD and $NEU did not communicate clearly enough the Canadian decision to investors, and in the case of $ACAD it was almost swept under the rug, coming to my attention only as a Q&A item at an industry conference presentation!

This underscores for me the importance of taking the time to attend every conference and getting hold of every transcript. Pharma and Medtech is complex, and while each market makes it own determination, decisions in one jurisdiction should be considered in assessing the chances of success in another.

Sadly, for me, this further undermines my "two-for-the-price-of-one" thesis for $NEU, wherein the value of business is covered by DAYBUE, with NNZ2591 being a potentially very material upside.

I'll reconsider my valuation for $NEU once I have the next quarterly result for DAYBUE from $ACAD - my current view being that the product in the US is tracking to a lower peak sales outcome that in my more optimistic scenarios.

So I am watching, and no long hold $NEU, and am less confident that I will hold again, unless there is a significant SP decline so that the risked value of NNZ-2591 becomes compelling. That would potentially require the SP to fall below $12 and, even then, there is probably no hurry given the CT timelines.

Disc: Not held

With the "Canada issue" out of my system in Part 1, here is a summary of last week's $ACAD (Acadial Pharmaceuticals) 3Q Results call.

1. Commercial Performance and Market Dynamics

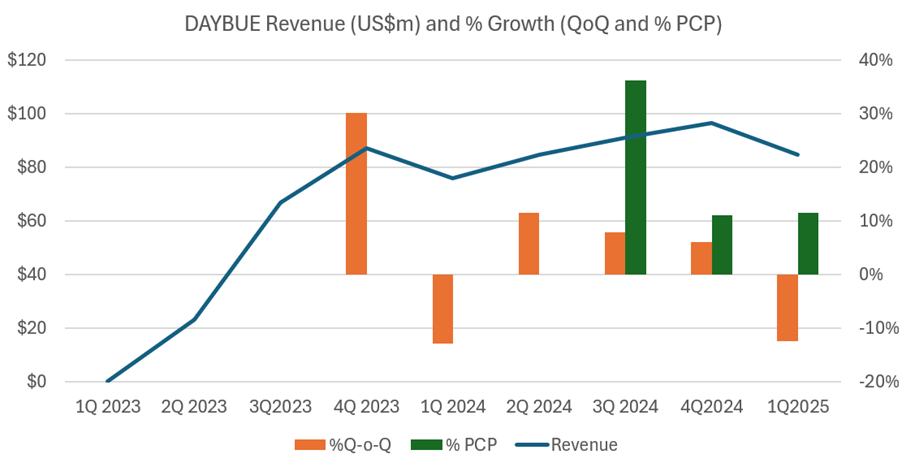

- Net sales: US $101.1 million in Q3 2025, up 11% year-over-year, marking Acadia’s largest quarterly sales for DAYBUE. This was the highest quarter for net product sales overall

- Market penetration: Approximately 40% overall in the U.S. Rett syndrome market, with 27% penetration in community settings

- Referral growth: Achieved the largest quarter-over-quarter increase in referrals since launch, driven by expansion of the field team and outreach to community prescribers.

- Community prescribers: Now account for 74% of new prescriptions, up from 64% the prior year.

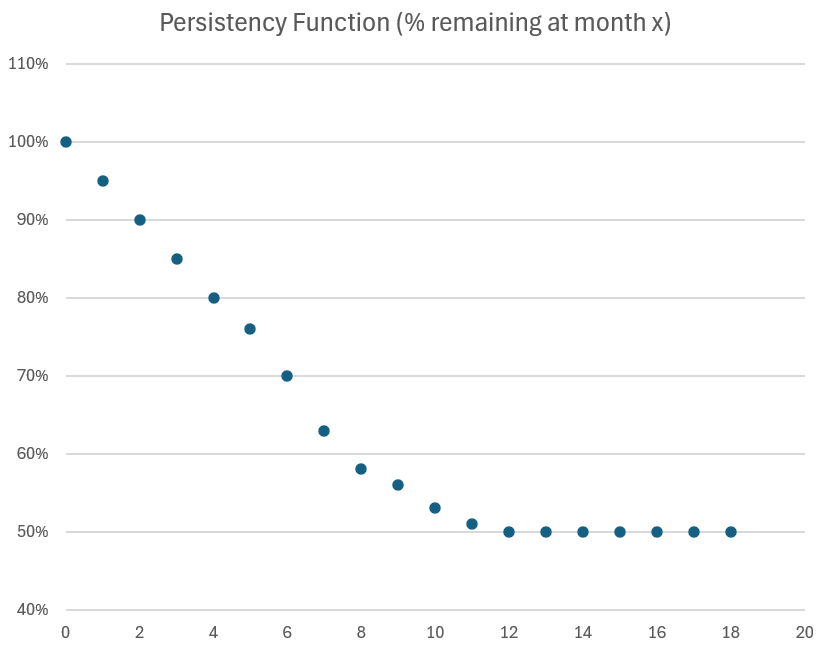

- Persistency: > 50% of patients remain on therapy at 12 months, and > 45% remain on therapy at 18 months, indicating durable adherence.

- Global access: Named-patient supply programs are expanding in Europe, Israel, the Middle East, and Latin America, with 1,006 patients treated worldwide to-date

- Guidance (FY 2025): DAYBUE net sales forecast US$385 – $400 million, with gross-to-net 22.5 – 23.5%, reaffirming momentum

(From Q&A)

- Management reiterated that growth was broad-based across both academic and community prescribers, with community uptake now sustaining most new patient starts. (Note: some 75% of the addressible market is treated by community prescribers, and this segment remains relatively under-penetrated)

- They emphasized that the larger field force deployed earlier in 2025 directly contributed to improved referral rates.

- No change was announced to 2025 guidance, indicating confidence in continued double-digit growth.

2. Regulatory and Geographic Expansion

From presentation

- DAYBUE (trofinetide) is approved only in the U.S. and Canada for treatment of Rett syndrome in adults and pediatric patients ≥ 2 years

- A Phase 3 trial of trofinetide in Japan has been initiated, marking Acadia’s first pivotal trial outside North America

- The company filed a Marketing Authorisation Application (MAA) with the European Medicines Agency (EMA), with an anticipated CHMP opinion in 2026

- Named-patient supply programs already operate in multiple regions (EU, Israel, Middle East, Latin America).

(From Q&A)

- Executives stated that the EMA filing was accepted in Q3, and the CHMP opinion is expected mid-2026.

- They confirmed that Japan’s Phase 3 trial uses the same dosing and endpoints as the U.S. approval study, designed for regulatory alignment.

- Early named-patient use is providing real-world data that will support broader access discussions post-CHMP.

- "Disappointing decision in Canada" (what??! See Part 1 Straw)

3. R&D and Pipeline Integration

From presentation

- DAYBUE remains the core commercial rare-disease asset, while ACP-2591 (cyclo-GPE analogue) is a next-generation follow-up in Rett and Fragile X syndromes

- The company is building a global Rett-syndrome franchise, leveraging DAYBUE’s success to expand to additional indications and geographies.

(Q&A)

- R&D leadership highlighted that DAYBUE’s durable efficacy data continue to inform the design of ACP-2591 Phase 2 planning, with a goal of complementary rather than cannibalistic positioning in Rett syndrome.

- Management also noted interest from academic consortia in exploring DAYBUE in combination therapies, though no new trials have yet been initiated.

4. Other Q&A Comments

- CFO Mark Schneyer confirmed that DAYBUE’s gross-to-net deduction (~23%) is expected to remain stable in 2026 given payer mix and limited rebate pressure.

- Analysts asked about inventory levels; management stated they are “healthy and in line with volume growth,” with no channel stuffing anticipated year-end.

My Assessement (thinking out loud, so apologies for the stream of consciousness format)

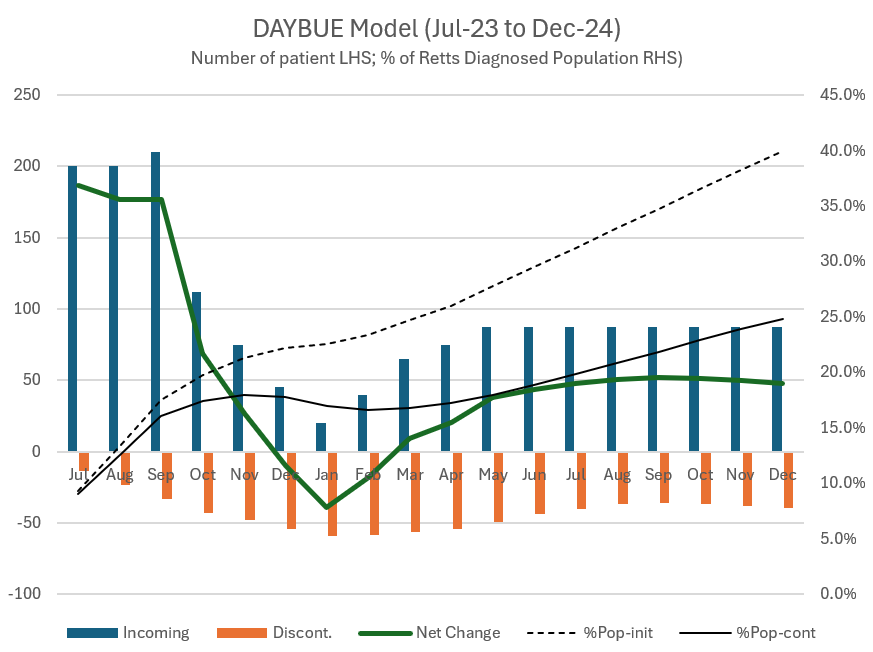

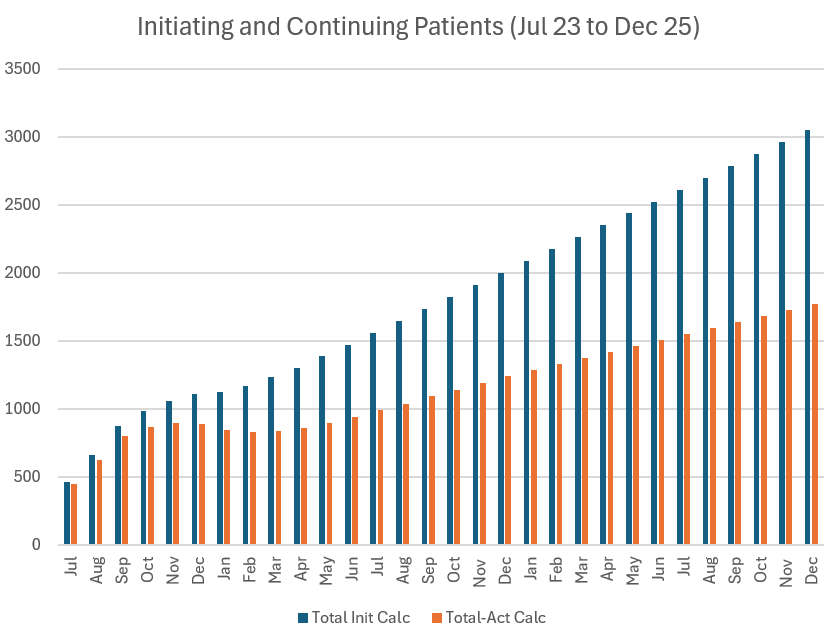

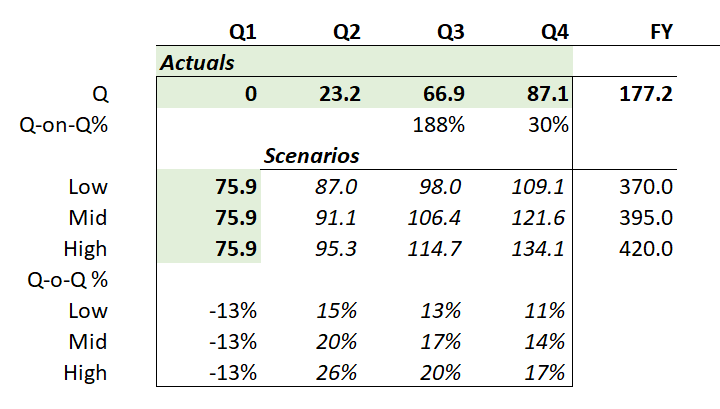

DAYBUE sales of US$101.1m for the Q came in below the low case of my model ($102.3 - $104.3 - $106.2). My model had them hitting a FY range of $388.5 - $400.5, and so with the lower number achieved in Q3, I'm expecting they'll be towards the lower end of the narrowed guidance of $385 - $400m.

But this is really splitting hairs, and the key message is that management have confirmed my view form earlier this year that they have a good grip on how the product is performing in the market, and sales force productivity, and so will be making good resource allocation decisions.

What we don't know is how much of the revenues came from outside the US, given that the product is being made available to patients ex-US in an increasing number of markets in early access programs. It's a high-value product, so it doesn't take for many patients accessing the drug from overseas to start to move this dial.

But I am disappointed at the growth rate, because in Jan-25 the company announced a 30% sales force expansion. This was completed in May-25, and while it will have taken some months for new starters to get traction with their accounts, the period Jul-Oct has in my view enjoyed a full quarter with the expanded field force, focused on the community-based prescribers. My range was meant to capture the full ("80%") confidence I perceived at the time.

A year ago, the 3Q-on-2Q growth rate was +7.8%, so even with the +30% expanded sales force in 2025, the sequential q-o-q growth of +5.2% indicates just how much of a headwind patient churn is. That said, Persistency seems to be holding up: c. 50% at 12 months and 45% at 18 months are again reported, and it will probably not be until next year that we get to see what this is becoming out to 24 months.

So, let's have a stab at considering US Revenue Growth from here:

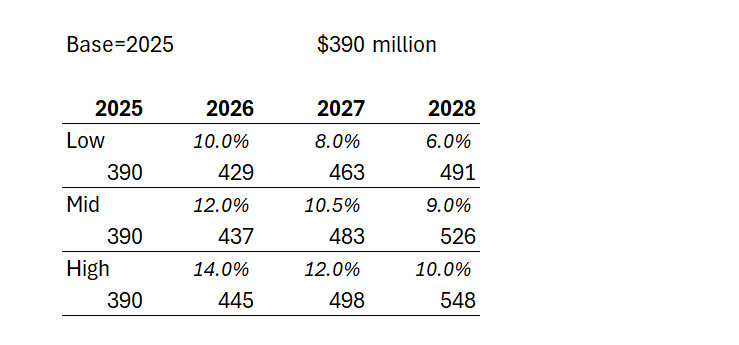

Case 1: Management say they will continue double digit annual revenue growth. So giving them the full benefit of the doubt and assuming they hit 2025 revenue of $390m, at 10% for two years, that gets them to $472m in 2027, and $520m in 2028 - likely the year of plateau sales,... or maybe they'll eek out some further growth in 2029.

Case 2: Being generous, let's assume an upside QoQ growth of 4% or 17% pa for two years. That gets them $533m in 2027, and a likely plateau sales in year 5 of $623m in 2028.

But, then again, I think Case 2 is overly generous. Afterall, the 2025-2024 PCP growth rate was only 11%, and let's trim that to 10% to allow for some overseas patients. The sales force expansion has helped the last quarterly result, and so they will likely struggle to do much better than 10% p.a. over two years, even if the 2026 FY number gives a full year with the expanded salesforce cycling an earlier year before the ramp up, and so exceeding 10% in 2026 should be doable in all scenarios. But it can't be sustained IMHO. The persistency drag is just too high.

Looking at the historical trends, the rate of growth is maturing rapidly. For example, even while benefiting from a full quarter of expanded sales force, 3Q/2Q-2025 was +5.2%, compared with 3Q/2Q-2024 at +7.8%. So there is defintely a sequential decline at play towards a plateau that doesn't look that far off (s-curve).

So, in the table below I've modelled three scenarios for annual US revenue growth over the next 3 years (all in $USm):

Depending on how longer term persistency evolves, we could find either 2028 or 2029 as the plateau year for the US. And in the illustration above, in the low scenario, $NEU doesn't get anymore milestone payments, and on the other two scenarios, will get the US$50m milestone only in 2028. The $750m milestone looks well and truly off the table to me.

I haven't pulled this through my $NEU valuation model yet; however, it is a significant deterioration on my earlier projections.

So, what does this mean for $NEU?

Well, US sales of US$490-$550m in round numbers are $NEU royalties of US$54-$62m or A$83-$95m, and that's much, much lower that the analysts have for $NEU.

Why?

Because I think the analysts are including all of the following things I haven't included:

- Assume continuing growth, and not modelled an s-curve with a continuing persistency driving decline after year-5 plateau

- Added milestone payments

- Added RoW

My model is too complicated to pull through a simple set of number for the value of DAYBUE to $NEU. However, my earlier projections gave me $12 - $20/share (US growth and pro rata RoW offset by 3-4 years)

Today, I believe US DAYBUE will have a plateau in 2028 or 2029 and immediate steady decline, as new patients arrivals fail to keep pace with churn. So, if all we have is the US, then valuing $NEU at 5x peak contining royalties of, let's be generous and say, A$85m to A$120m gives A$425m - $600m, or with SOI of 126.5m shares, that's $3.35 - $4.75 /share.

Yes, that's what $NEU (US-DAYBUE only) could be, if it can't get reimbursement beyond the US and if it can't sustain growth,

Wow.

Of course, I think it will be worth more than that. But hopefully, you can see that at $18/share, NNZ-2591 is now potentially doing a lot of heavy lifting. And it might be worth it. But it also might not.

But that's not what my "2 for the price of 1" investment thesis was all about. So my thesis is well and truly broken.

BIG CAVEAT: I wasn't going to post this, because I was sure I've made an error somewhere. But I have gone through everything a couple of times, and also used a couple of independent methods, and keep getting similar results. And to be clear, I haven't accounted for $NEU's massive cash pile. But I am not doing an enterprise valuation of $NEU, but rather only the value of the royalty stream from US DAYBUE. So, as ever, this is not advice. But it is enough for me to take the decision I have already executed. Oftentimes, more analysis doesn't add more value.

That said, over the coming months, I will properly update my model. And that's because I want to know at what price I am prepared to buy back in for the value of NNZ-2591. But I don't think there is any hurry. The PMS Phase 3 trial has some way to run.

Disc. Not held

I am in the process of writing up my notes from last week's Acadia Pharmaceuticals ($ACAD) earnings call, however, one of the most important insights in the call was a reference by CEO Catherine Owen to a question from Jack Allen (Robert W Bird & Co. Incorporated) about reimbursement in Canada.

TLDR: The Canadian Drug Expert Committee of the CDA in August 2025 filed its decision: "Do Not Reimburse" for trofinetide (DAYBUE)"

I've decided to elevate this to a stand-alone straw for two reasons. First, it is bad news, and in my opinion it could have a significant bearing on the pending EU/UK approval outcome (even though these are completely independent of each other).

Second, I am concerned that it demonstrates a lack of candour by both Acadia and Neuren management, given that I have conducted an extensive search and can find no proactive references to it in investor communications. (And of course, if it is proven I have missed something, then I withdraw this comment unreservedly. This is also why I am flagging the point, in case other eagle-eyed $NEU investors have picked up something I've missed.)

On the call, analyst Allen asked: "I wanted to ask about reimbursement in Europe. I know there were [... inaudible,.. line cut out] ... in Canada over the summer...."

CEO Catherine Owen replied; "Thanks, Jack. So yes, we are obviously in the middle of discussions and thinking right now around reimbursement in Europe. And you're right, we did have a disappointing decision in Canada. Tom, do you want to share a little bit more about how we're thinking about reimbursement in terms of the sequential approach to that in Europe?"

Tom Garner (VP Commercial) continued ... absolutely no reference to Canada!

Both companies have proactively disclosed and continue to communicate that DAYBUE is approved for use in Canada. And that is true. But after approval (based principally on efficacy and safety), a drug has to gain a reimbursement decision. For countries with a mixed public and private healthcare system, the reimbursement outcome by the responsible public agency, has a significant bearing on prices that will be covered by entities like health insurance payers. So the public reimbursement milestone is critical for determining the revenues that can ultimately be achieved in a market.

And yet, the only reference to the Canadian issue either verbally or in writing that I can find are the following words by Catherine Owen "we did have a disappointing decision in Canada". (Again, other $NEU shareholders, please tell me what I've missed.)

So, I've structured this straw as follows:

1. The Canadian CDA-CDEC Decision

2. How Reimbursement Works in Canada

3. Why I think there is a potential, broad "Read Across" to other Jurisdictions

4. Implications for Valuation

5. Investment Decision

----------------------

1. The CDA-CDEC Decision

I attach the link to the full CDA-CDEC decisions. These are published for transparency in the Canadian Journal Of Health Technologies. It makes for interesting reading.

My BA has summarised the document for you as follows:

Summary of Decision

Agency: Canada’s Drug Agency (CDA-AMC)

Committee: Canadian Drug Expert Committee (CDEC)

Date: August 2025

Decision: DDO NOT REIMBURSE trofinetide (DAYBUE) for the treatment of Rett syndrome in adults and children ≥ 2 years of age and ≥ 9 kg.

Key Reasons for the “Do Not Reimburse” Decision

a. Uncertain Clinical Meaningfulness

- The pivotal LAVENDER trial (N = 187) showed statistically significant improvements in caregiver-reported behaviour (RSBQ –3.1 points, 95% CI –5.7 to –0.6) and clinician-rated global improvement (CGI-I –0.3 points, 95% CI –0.5 to –0.1).

- However, no minimal important differences (MIDs) were established, so the committee could not determine if these changes were clinically meaningful

- The trial had high discontinuation (≈25%), missing data, and relied on outcomes not used in Canadian clinical practice.

b. Lack of Evidence on Quality of Life and Function

- The trial provided no measure of health-related quality of life (HRQoL) for patients or caregivers, and data on communication, motor skills, and caregiver burden were limited and unvalidated.

- CDEC therefore could not determine if trofinetide addresses the unmet needs identified by patients and caregivers.

c. Very Low Certainty of Evidence

- The committee rated the overall certainty of evidence as “very low” due to bias, imprecision, and indirectness between the trial population and the broader Health Canada indication.

- Open-label extension (LILAC/LILAC-2) and supportive studies (DAFFODIL, LOTUS) did not resolve these uncertainties.

d. High Cost

- Annual treatment cost estimated at CA $427,000 – $1.34 million per patient, depending on weight

e. Adverse Effects

- Diarrhea (81%) and vomiting (27%) were common, leading to 17% discontinuations in the treatment arm vs 2% with placebo.

- While manageable, these events raised concerns about unblinding and trial validity.

f. Reconsideration and Patient Input

- Sponsor Request: Acadia requested reconsideration, arguing the RSBQ endpoint was valid and that CDEC had undervalued caregiver-reported benefits.

- Patient & Clinician Feedback: Groups emphasized the severe unmet need and the importance of even small improvements in communication and daily function.

- CDEC Outcome: Acknowledged these perspectives but upheld the original decision, concluding the evidence was too uncertain to demonstrate meaningful benefit or long-term safety

2. How Reimbursement Works in Canada

Now it is important to recognise that the report is a recommendation, and not a binding decision. However, for all practical purposes, I consider reimbursement unlikely, unless $ACAD can submit further evidence that addresses the grounds for denial. Clearly, the company will be working on this, and has in fact already had one shot at it.

Let me explain why I feel this is the case, by explaining how the system works in Canada.

The CDA-AMC conducts independent clinical and economic evaluations of new drugs and medical technologies on behalf of Canada’s publicly funded health systems (federal, provincial, and territorial, except Quebec). It does not set drug prices or directly fund products, but rather provides evidence-based recommendations to help governments decide whether to include drugs on their public formularies (lists of reimbursible medicines).

The Canadian Drug Expert Committee (CDEC) is an independent panel within CDA-AMC composed of physicians, pharmacists, health economists, and patient representatives. It reviews clinical trial data, real-world evidence, cost-effectiveness analyses, and patient submissions. The committee then issues a non-binding recommendation to federal, provincial, and territorial drug plans.

Provincial/Territorial Decision-Making: Each province/territory makes its own final reimbursement decision, typically following the CDEC recommendation. In practice, a “Do Not Reimburse” recommendation from CDA-AMC almost always results in non-listing (no public coverage) across the provincial drug plans.

Private insurers may make separate decisions but usually reference the same HTA findings.

Reconsideration and Transparency: Manufacturers can request reconsideration (as Acadia did for DAYBUE). The CDA-AMC publishes both the original recommendation and any reconsideration outcome on its website and in the Canadian Journal of Health Technologies for public transparency.

3. Why I think there is a potential broad "Read Across" to other Approvals

My reading of this situation starts to answer a question I always had on my "issues" list. DAYBUE is by any measure an expensive drug, and it was a question for me how jurisdictions would deal with it in places where cost-benefit analysis has a stronger bearing on the reimbursement decision. While the US is increasingly alert to healthcare economics, there is no question that it is more permissive of reimbursing high cost drugs where the cost-benefit is open to challenge.

It seems the Canadians have issues with both the strength of the effiicacy data, the side effects, tolerability and low persistance of the drug (all indications impacting Quality of Life) and the high cost.

The EU process will follow a similar path to Canada. The EMA-CHMP will make its decision on scientific grounds, whereupon each countries HTA (Health Technology Assessment) process will kick in, leading to the reimbursement decions. In the EU/UK, public medicine is a much larger share of the drug budget than North America, so the single-buyer country agencies will have a lot of clout in the pricing decision. And European countries have even greater pressures on public health budgets, given weak economies, unfavourable demographics, and a greater taxpayer contribution to the healthcare spend.

All European HTAs consider cost-effectiveness, clinical value, budget impact, and comparative benefit (albeit there is no other treatment for Rett). And so I believe the Canadian decision is a potential canary in the coalmine for Europe. Even though the European process is completely independent, I imagine all the European decision-makers will read the Canadian document. In Europe, there is also greater political pressure than in the US for challenging high cost drugs, and even more so when there are clear question marks on quality of life benefits.

In the best case scenario, I anticipate this will result in European prices heavily discounted to the US price. By heavily discounted, I mean 40%, 50% and even up to 70% or more!

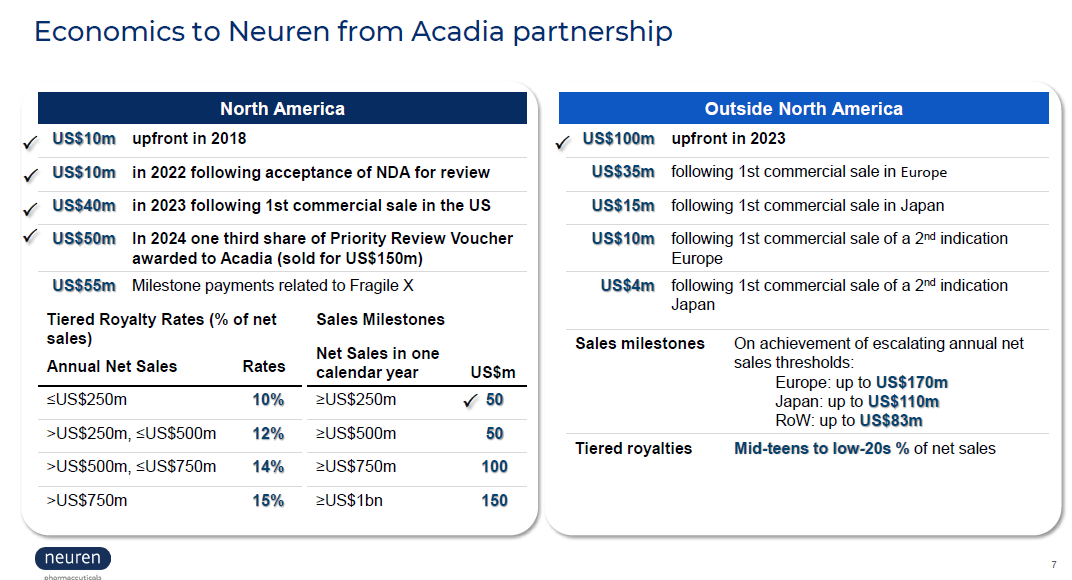

4. Implications for the Valuation of Neuren

The Canadian "canary in the coalmine" puts a questionmark over the remaining value in the right-hand slide above. While RoW paitents may be given access to the drug on special grounds ("early access programs"), these are unlikely to trigger the "commercial sale" milestone payments. Privately-funded patients might also find ways to get access to the drugs.

The Canadian decision also indicates to me that negotiations towards an acceptable reimbursement decision could be protracted. $ACAD needs to hold out for a good enough price that make sense, given that it is on the hook for the initial milestone payments irrespective of the value of the commercial sales. So, in Europe, it will have to see revenues that cover: US$35m royalty + "mid teens to low-20's" tiered royalties + distributors margin (or fixed cost of sales force, if direct).

So with potentially a much lower price, a relatively high fixed royalty, and a lower Gross-To-Net, $ACAD will need to see material revenues, before agreeing to launch.

The reimbursement negotiation is therefore likely to be protracted. $ACAD will marshall all the real world data that they can from the US, as well as the continuing open lable trial data on long term persistency (now down to 45% at 18 months, down from 50% at 12 months) potentially pushing RoW cash flows further into the future.

5. Investment Decision

I haven't crunched this all in my model. However, on a risked view, I am materially marking down my Outside North America DAYBUE revenues (start, ramp, peak), and therefore also the royalties to $NEU (note: the percentage tiered royaties here are significantly higher than the US.)

By eyeballing my current model my "2 for the price of 1 thesis" is blown for $NEU at $18.

In round numbers, my valuation of DAYBUE ($12-$20), has clearly fallen to the lower end, with a significantly lower downside case if DAYBUE cannot achieve significant commercial traction outside the US.

Which means that much more of the current share price rests on the development of NNZ-2591. I had given NNZ-2591 $8 of value at a 50% risking (from $16). Perhaps that is harsh, but until I have a better view, then that is my number.

Which means that at a SP of $18, I need to see $10 of value in DAYBUE, and I don't see that with confidence, as I will make clear in my next write-up on the $ACAD results.

For me, the bottom line here is that more of the value in this business lies in drug development risk, rather than commercial execution. Looking across my entire portfolio, I am carrying quite a bit of this risk, and I am not confident that I have a good grip on the outlook for $NEU. I'd therefore like to take 2-3 quarters to evaluate DAYBUE's progress from the sidelines. And that's because I think there is a reasonable chance that we will soon have visibility of US DAYBUE plateau sales below US$500m (downside) and not much more (upside). I'll sketch this out in more detail in my next note.

Accordingly, I have sold my shares in $NEU.

Disc: Not held

$NEU have announced that their first site for the phase 3 trial of NNZ-2591 in Phelan-McDermid Syndrome (PMS) is underway.

Here's the short text:

"Neuren Pharmaceuticals (ASX: NEU) today announced initiation of the first investigational site in the United States for its Phase 3 clinical trial of NNZ-2591 in Phelan-McDermid syndrome (PMS), after receiving Institutional Review Board (IRB) approval. Other trial sites in the US are at various stages of the initiation process. This is the first ever Phase 3 trial in PMS, a serious neurodevelopmental disorder with no approved treatments. The randomised, double-blind, placebo-controlled trial will assess treatment for 13 weeks in approximately 160 children aged 3-12 with PMS. All participants may be eligible to continue treatment with NNZ-2591 for 12 months in an open-label extension trial. The trial program is fully funded by Neuren’s existing cash reserves. Neuren conducted an End of Phase 2 Type B meeting and a subsequent Type C meeting with the US Food and Drug Administration, at which alignment was reached on the design of the Phase 3 trial, including the primary efficacy endpoints."

My comments

So this is the Phase 3 trial for the first of several rareneurological conditions for NNZ-2951, and likely the most consequential for thbusiness. If success is achieved here, it increases the likelihood that treating the bioavailability of IGF-1 may hold the key to treatment of several conditions.

As a rare condition, recruitment will take a while, although Neuren will have maintained involvement with the relevant patient advocacy groups. A clear motivation for patients to join the trial, is the possibility of continuing on after the trial period is complete.

Over the coming months expect newsflow like: 1st patient in, 50% patients in, 100% patients in, trial complete, preliminary readout.

Disc: Held in RL and SM

Jon Pilcher has been teasing investors for some time that $NEU are investigating other conditions that might be treated with NNZ-2591. Today, he's revealed the next target is the SYNGAP1-related disorder (SRD), another rare and intreated neurological condition.

SRD is caused by a genetic variation and patients affected suffer "intellectual disability, low muscle tone, global development delay, epilepsy, sensory processing disorder, gross and fine motor skill delays, coordination disorder, speech delay, sleep and behavior disorder and autism spectrum disorder."

The prevalence is reportedly 1 in 16,000 individuals, which would offer a potential population in theUS of 21,000. Given that there once again no existing condition sets up the product for a high cost of treatment per patient. (Recall, the Rett prevalent population is 5,000-6,000, and DAYBUE looks like it will make peak sales in the US of c. $500m.)

The nature of the condition and the fact that there is currently no treatment marks it out as another potential candiate for orphan designation and priority review. But I am getting ahead of events now.

NNZ-2591 in SRD alone could potentially be a blockbuster (a term from my heyday in pharma in the '90s for a drug that achieves $1bn revenue). Of course, there is likely 4-5 years of clinical development ahead, with all the risk that entails, so don't give up your day job yet if you have one!!

And of course there is also competition risk, with NNZ-2591 more generally being susceptible to any breakthroughs in gene therapies.

But today is a day not to focus on the risks - that will surely come - but to celebrate the fact that NNZ-2591 is truly starting to turn into a single molecule product pipeline.

I'm looking forward to hearing more from this, and from yesterday's news, at the $NEU HY results in a couple of weeks. (They report on a Jan-Dec calendar.)

Of course, the key incremental value-driver is the prgress of the NNZ-2591 Phase 3 trial for PMS (Phelan-McDermid Syndrome). That should keep us all entertained (one way or the other) through 2026!

A good week for $NEU. Yesterday shored up the base(DAYBUE) of my "two for the price of one" investment thesis. Today, has just added a new slide to the upside (NNZ-2591).

Disc: Held in RL and SM

US Pharma company (licensee for DAYBUE) announced 2Q results including DAYBE Sales. The key results are shown below:

I'll give a more complete assessment of the data from the call later this morning, but the bottom line is, this is an excellent result.

In the words of CEO Catherine Owen, DAYBUE is moving "through stabilisation and back into growth".

$ACAD are holding to guidance for the year, but according to my analysis they should comfortably now hit the midpoint of guidance and may well get to the upper limit of even exceed it. They were pressed on this in Q&A and said any modification of guidance will come at 3Q. (There is a history with this product of disappointment, so I think they are being cautious. Catherine clearly is in the "under promise and over deliver" camp. Which is fine with me.)

More later. Also, we should expect a related ASX announcement from $NEU before the market opens and likely a conference call to get Jon Pilcher's take. I imagine he'll be delighted and upbeat.

As for SP action, $NEU has run quite hard over recent months. I'm not sure if this is because any of the instos have insights into the sales via channel checks. Persoanlly, I've not read any research on this. If that is the case then today's sales results explain the SP action.

From my perspective, today's result shores up the base of my "two for the price of one" investment thesis (i.e. de-risks the downside) but probably not enough to justify a valuation update. I'll reconsider this after the $NEU results later this month,

I remain a happy hold here. More detail and analysis later.

Disc: Held in RL and SM

$NEU are holding their AGM today. I was surprised to see the disclosure marked as price sensitive, and so have done a bit of digging to try and figure out the new disclosures.

1. Confirmation of Phase 3 Trial Design and Timing for NNZ-2591 in Phelan-McDermid Syndrome (PMS)

- New detail: The Phase 3 trial will commence mid-2025, and is described in detail:

- 160 children aged 3–12 years, randomized 1:1 to NNZ-2591 or placebo

- 13 weeks double-blind period, followed by 12 months open label

- Two co-primary endpoints aligned with FDA

- Estimated total cost: US$80–90 million, fully funded from existing cash

- Significance: While earlier announcements referenced planning for Phase 3 and FDA discussions, this is the first disclosure of full trial design, size, timing, and funding details.

- Next milestone will be commencement of the Phase 3 trial. (Pending final review and approval of the protocol by FDA. Expected "mid-2025")

2. Hypoxic-Ischemic Encephalopathy (HIE) – Expanded Program and Regulatory Plans

- New detail: Neuren confirms it has planned a Pre-IND meeting with the FDA in Q4 2025 for NNZ-2591 in HIE.

- Also disclosed: the company is exploring a Phase 2/3 trial and identified HIE as a potential in-hospital channel with a repeating pool of patients.

- Significance: While HIE was first disclosed as a new indication in an April ASX announcement, this is the first time Neuren has confirmed regulatory timing, trial strategy, and commercial positioning.

3. Named Patient Supply Expansion Outside Major Markets (Announced by Acadia on 20-May)

- New detail: Acadia has appointed a distributor to facilitate named patient supply for DAYBUE outside North America, Europe, and Japan, potentially including the Pacific region.

- Significance: This specific geographic detail and execution step had not been previously disclosed in ASX filings.

4. Expanded Potential Indication List

- New detail: Neuren explicitly states it is now advancing Prader-Willi syndrome and/or an undisclosed indication, suggesting further pipeline expansion beyond those currently in trials.

- Significance: This is new information indicating potential pipeline expansion beyond the current four NNZ-2591 indications.

My Key Takeaways

There is nothing earth shattering here, however, all the reported developments are positive, so in aggregate, I guess they warrant a positive SP response.

If pressed, I'd say the potential strength of NNZ-2591 as a multi-indication drug appears to be growing over time. Should it be successful in PMS, then that will be the major catalyst for the company. However, patience is required.

I'll admit to be slightly annoyed at the amount of time the Chairman spent bemoaning the share price. The market is the market, and the timelines in clinical development are long.

Disc: Held in RL (5.7%) and SM

$NEU have issued an ASX announcement this morning reporting on the 1Q 2025 US sales and broader progress of DAYBUE, as reported this morning by $ACAD at the end of the trading day on Wall Street.

I’ll post here $NEU’s overview and then provide my own analysis, having attending the analysts call this morning.

Their Highlights

• Q1 2025 DAYBUE™ (trofinetide) net sales of US$84.6 million, up 11% from Q1 2024

• Record number of unique patients received shipments, up 4% from Q4 2024

• Neuren’s Q1 2025 royalty income was A$13.5 million, up 17% from Q1 2024

• Acadia retained full year 2025 DAYBUE US net sales guidance of US$380 - 405 million, implying full year 2025 US royalty income for Neuren of A$62 - 67 million

• Marketing approval in Europe anticipated in Q1 2026, first shipment of DAYBUE to Europe was made in April 2025 under a Managed Access Program

• Orphan Drug designation granted in Japan

• Distribution agreements now in place to facilitate named patient supply in other regions including Latin America, Middle East and Asia Pacific

• Neuren cash and short-term investments $341 million at 31 March 2025

• Neuren is presenting at Macquarie Australia Conference on 8 May 2025

Further Details from the $ACAD Investor Call

As I will explain in the next section, understanding q-o-q revenue changes is complex. So $ACAD focused on the report that patients treated with DAYBUE in the quarter rose from 920 in Q4 2024 to 954in Q1 2025, i.e., +3.6%.

Last quarter, $ACAD announced they would expand their sales and marketing force by 30%. The reason is that the current salesforce is focused on the high-prescribing Centres of Excellence, with less coverage in the broader community-based physicians who support some two-thirds of the total market. Today, $ACAD reported that the recruitment of these additional sales reps have been completed, and they expect to see the benefit of sale force expansion in the second half of 2025.

At this stage, $ACAD believe that only one-third of the population diagnosed with Retts have tried DAYBUE.

$ACAD also report that now >65% of the 954 patients taking the drug at end of Q1 have been on it for more than 12 months, and that persistency tails off at greater than 50% after 12 months, and thereafter continues to be stable (although I note that no quantification has at this stage been given for what 18 month persistency is looking like. At the next quarterly report, we might reasonably expect to be given a 2-year persistency statistic!)

On tariff impacts, $ACAD report that they “have several years of inventory” in the US, so they are well protected in the short term.

There was some discussion on their exposure to intervention in the US market by the Trump Administration. DAYBUE is a high cost drug and it would exposed if the Administration implements a “most favoured nation” requirement on drug pricing. In essence, such a move would mean that $ACAD would only be able to receive pricing based on prices achieved in overseas markets. The key risk is that if prices in Canada or, say in 2026 / 27 in the EU, are substantially lower than the very high treatment price in the US, then US agreements would be renegotiated. Of course, this is a systemic risk facing the entire pharmaceutical industry, and we are yet to see how this plays out. (Go, the US pharma lobby!!)

Approval in the EU is still expected in 1Q 2026, and $ACAD will soon pass the key 120-day milestone, which is a point in the EMA approval process at which the initial assessment of data is complete. At this point, the EMA can choose to "stop the clock" on its approval process and issue questions to the pharmco. No "Clock Stop" would be a very positive sign for the approval process. So, we should expect a further update on the EU process in the next few weeks. (Remember, any EU approval of DAYBUE in 1Q 2026 then starts the process of country by country negotiation on pricing and reimbursement. Particularly for expensive drugs like DAYBUE, this process itself can take many months and even years!)

My Analysis

The $NEU summary above gives a good overview of what’s going on. Basically, we are seeing steady progress on new patient adds, which remains the key revenue driver.

I want to focus the remainder of this report on the patterns of revenue growth, as there are some important dynamics at play, which are now becoming clearer, and which management have done a reasonable job of explaining.

Patterns in Revenue Growth

Now, the eagle-eyed among us will note that the 1Q-on-4Q revenue decline that was predicted (based on what happened last year, and which took the market by surprise then) has indeed occurred.

The 1Q 2025 sales of US$84.6m were down 13% on 4Q 2024. Interestingly, last year the decline was also around 13%.To provide an overall picture, I’ve plotted the quarterly revenues as well as the percentage changes Q-o-Q (orange bars) and % to PCP (green bars) in the chart below. Early values of the % growth figures are omitted, as they are not meaningful, coming off a small base.

I’d like to dig into this in some detail, as it was discussed on the $ACAD call this morning.

Three things seem to be happening consistently between 4Q and 1Q, as follows:

- Patients pull forward their refills in 4Q from 1Q – potentially ahead of holidays. Management explained that this “pull forward” effect accounted for US$3.5m of revenue being pulled from Q1 into Q4.

- Consequently, scripts and refills are down in 1Q, and there may also be a seasonal effect with fewer patient presentations to clinicians in the winter months

- Net revenue per script falls in 1Q, and this recovers in later Qs due to seasonal patterns in reimbursement, particularly for patients on hybrid Medicare-Private cover.

The first two points are simple to understand. The third requires some explanation. Here goes.

Pharmaceutical companies often see lower net revenue per patient in the first quarter of the year due to how U.S. insurance plans—including Medicare Part D—are structured. At the beginning of the year, many patients haven’t met their deductibles, which means they face higher out-of-pocket costs. This can delay prescription fills or reduce adherence, especially for expensive drugs. In response, companies may provide increased copay assistance, which reduces the revenue they recognize per patient.

Under the 2025 Medicare Part D redesign, the financial burden on drugmakers has also shifted. Manufacturers must now cover a portion of drug costs earlier in the year under the new benefit structure, even before patients reach coverage. This increases rebate obligations in Q1, further lowering net revenue per prescription.

As the year progresses, more patients move past their deductibles and into more stable coverage phases, leading to steadier prescription volumes and fewer financial concessions from manufacturers. As a result, pharmaceutical firms typically see higher net revenue per patient in the later quarters of the year.

So, this 1Q reduction in revenue is a regular feature of both prescribing/refill seasonality and reimbursement/copay dynamics, and little conclusion can be drawn from the revenue number. We’ll need to wait for the 2Q number to better assess whether $ACAD remain on track to hit the annual guidance number. This next result will provide an important baseline against which to assess the impact of the expansion of the sales and marketing force which is expected to start contributing in H2.

My Takeaways

Overall, this is a reasonable result from $ACAD on DAYBUE sales.

The 1Q number is difficult to interpret. It was a bit softer than I hoped for, however, if the expanded sales force has the intended impact, I consider it reasonable that $ACAD have left guidance unchanged. Having said that, I don't have a good quantitative understanding of the reimbursement/copay/Part D dynamics - so I am somewhat blind on that, and have to go with what management are saying. That said, under the new CEO Catherine Owen Adams, communications have been clearer and more consistent from one presentation to the next.

The 2Q number will be more telling, as the bounceback after 1Q will set the stage for the second half of the year, and we have last years number to compare with.

The market has therefore responded reasonably in my view, with SP off 3% at the time of writing. There was little news to react to, one way or the other, after all.

We may see some further reaction based on Jon’s delivery at the Macquarie Conference later today. As each quarter advances, $NEU gets closer to its next milestone payments which would come from any EU approval – or rather first commercial sales in any EU territory which could following during 2026. And, of course, the royalty rate for RoW sales are more attractive than the US.

Overall, $NEU remains on track with my “two for the price of one” thesis.

I was considering topping up after today's result, as I still have only a modest 4.7% allocation. However, even though I have some understanding of the 1Q dynamic, I can't tell to what extent it is masking a weaker overall sales growth. So, I'm going to have to wait another Q.

Disc: Held in RL and SM

Ahead of the $NEU FY24 Results call in a few minutes, I put in a question to ask CEO Jon to explain why they seemed to move in late 2024 from expecting the progression into a Phase 3 trial for NNZ-2591 could be managed via email with the FDA to requested a Type C meeting, which will be scheduled for April (from memory).

As part of preparing for the call I include here two items:

- Their 20204 highlights

- My analysis of yesterdays $ACAD call, focusing on progress and outlook for DAYBUE

Overall, I am pleased that the overall outlook for DAYBUE has gone from worrisome, as it was in early to mid-2024, to now a more stable outlook, with the prospect of Europe coming into view.

2024 Results -$NEU's Highlights

- Total comprehensive income for shareholders A$166 million, comprising A$142 million profit after tax and A$24 million foreign currency translation gain

- A$222 million cash and short-term investments at 31 December 2024, A$359 million pro-forma cash adjusted to include receipt in Q1 2025 of PRV sale proceeds, sales milestone and Q4 2024 royalty and payment in Q1 2025 of Q4 2024 tax

- A$56 million US royalty income from DAYBUE™ (trofinetide) in 2024 up 110% from A$27 million in 2023, with guidance for growth to between A$62 million and A$67 million in 2025

- A$445 million cumulative income from DAYBUE over 2023 and 2024

- DAYBUE approved in Canada, first sales expected in Q3 2025

- Trofinetide Marketing Authorisation Application for Europe filed, potential for approval in Q1 2026, Acadia planning managed access programs from Q2 2025

- Acadia commencing small clinical study by Q3 2025 to support marketing application for Japan

- NNZ-2591 potential to address core symptoms of diverse neurodevelopmental disorders, independent of the underlying genetics, supported by positive Phase 2 trial results across PhelanMcDermid, Pitt Hopkins and Angelman syndromes, with other indications under evaluation

- Fast Track designation granted by FDA for NNZ-2591 in Pitt Hopkins syndrome and Rare Pediatric Disease designation granted by FDA for all three syndromes

- Type C Meeting with US Food and Drug Administration scheduled for early April 2025 to discuss primary efficacy endpoints for Phase 3 trial in Phelan-McDermid syndrome, with alignment reached on all other key aspects of the program at End of Phase 2 Meeting

- Preparations continuing for planned commencement of Phase 3 trial in mid-year 2025

Summary of yesterday's $ACAD Presentation

Acadia Pharmaceuticals is positioning DAYBUE as a long-term growth driver in the Rett syndrome market, with strong U.S. sales momentum, a stable patient base, and global expansion plans. The company is investing in commercial resources, patient support, and physician education to further penetrate the market, while its regulatory efforts in Europe and Canada aim to establish DAYBUE as a global standard of care for Rett syndrome.

1. Sales and Revenue Performance

- Q4 2024 Sales: $96.7 million (up 11% YoY, 6% sequentially)

- Full-Year 2024 Sales: $348.4 million (up from $177.2 million in 2023, nearly doubling in its first full year on the market)

- Revenue Growth Drivers:

- Increased bottle use per patient as stable patients titrate toward the recommended dose.

- Higher persistency rates, with 62% of patients on therapy for over 12 months.

- Improvement in patient discontinuation rates (15% QoQ decline).

- 2025 Sales Guidance: Expected U.S. sales between $380 million and $405 million, with 9-16% volume growth.

2. Commercial Progress and Market Penetration

- Patient Base Stability:

- 920 unique patients received paid shipments in Q4, stable from Q3.

- About 30% of Rett patients in the U.S. have tried DAYBUE.

- Persistency at 12 months remains around 50%.

- Prescriber Growth:

- 830 HCPs have prescribed DAYBUE (up from ~800 in Q3 2024).

- 35% of patients treated at Rett Centers of Excellence (COEs), while 65% receive treatment in other settings (community and high-volume institutions).

- Penetration: 55% at COEs vs. 25% in community settings, indicating room for growth.

- Sales Force Expansion:

- Acadia is increasing its field force by 30% in 2025 to enhance engagement with physicians outside of COEs and improve patient and caregiver support.

3. Patient Experience and Retention Strategies

- Treatment Uptake and Persistence:

- Over 60% of patients have been on DAYBUE for 12+ months.

- Titration trends indicate improved dosing adherence.

- Discontinuation Rates:

- Improved by 15% QoQ due to proactive support and education initiatives.

- Support Programs:

- Acadia Connect: Dedicated team providing individualized care and treatment navigation.

- New Initiatives: Direct-to-consumer campaigns, peer-to-peer engagement (patients, caregivers, HCPs).

4. Growth Strategies and Expansion Plans

- U.S. Market Growth Initiatives:

- Increase penetration in non-COE settings.

- Expand physician engagement and awareness efforts.

- Drive growth through omnichannel campaigns, real-world data insights, and peer-to-peer engagement.

- International Expansion:

- Europe: Marketing application submitted to the European Medicines Agency (EMA); approval expected in Q1 2026.

- Canada: First DAYBUE sales anticipated in Q3 2025.

- Other Markets: Evaluating broader global expansion through managed access programs.

5. Forward Outlook

- Short-Term Outlook:

- Q1 2025 Expectations: Sequential revenue decline due to Q4 pull-forward dynamics, seasonal factors, and pricing adjustments.

- Revenue expected to increase in Q2 2025 and beyond as commercial efforts gain traction.

- Long-Term Growth Drivers:

- Increased patient penetration in non-COE settings.

- Global market expansion beyond the U.S.

- Improved dose adherence and persistence.

- Real-world evidence from the LOTUS study to reinforce efficacy and long-term benefit.

Disc: Held in RL and SM

$NEU gave an update on the engagement with the FDA on NNZ-2591 endpoints for the PMS Phase 3 trials.

"Neuren Pharmaceuticals (ASX: NEU) today announced that the US Food and Drug Administration (FDA) has granted a Type C Meeting to discuss the primary efficacy endpoints in Neuren’s planned pivotal Phase 3 clinical trial program for NNZ-2591 to treat Phelan-McDermid syndrome. Neuren previously announced the positive outcomes from a Type B End of Phase 2 Meeting, at which alignment with FDA was reached on the other key features of the Phase 3 clinical trial program. A Type C Meeting was considered by FDA as the best forum for completion of the remaining efficacy endpoints discussion. The meeting will take place face-to-face in early April. Neuren CEO Jon Pilcher commented: “We look forward to another constructive discussion with FDA. Having a confirmed Type C meeting now establishes a clear timetable and in parallel we are continuing all our preparations, planning for mid-year commencement of the first ever Phase 3 trial for children with Phelan-McDermid syndrome.”

My Assessment

We've been waiting for this news, and I think it confirms my puzzlement at the unfolding delay at getting agreement on endpoints. CEO Jon Pilcher had previously indicated that the endpoints would be agreed via email correspondence. Not so.

Clearly, this indicates that there hasn't been a ready agreement on endpoints for Phase 3, or perhaps that $NEU wishes to get greater clarity from the FDA than they have been able to get from the email correspondence.

As I understand it, a Type C meeting is one that is requested by the drug sponsor, and it is not a required part of the End of Phase 2 process.The release says that "A Type C Meeting was considered by FDA as the best forum for completion of the remaining efficacy endpoints discussion." In reading between the lines, this indicates to me that $NEU were perhaps looking for greater clarity on what the FDA was writing in their email responses, and the FDA said something along the lines of "we have written what we've written, if you want to discss further, then request a Type C meeting." I am speculating here, but I am trying to reconcile this latest news with Jon's previous statements.

I expect there will be quite a bit of discussion about this at the FY24 Results presentation, which should be towards the end of this month. Hopefully Jon will illuminate why they've gone down this path.

The other news is that we are getting a first indication on timing for Phase 3:TYPE C FDA meeting in early April, leading to the trial starting in mid year.

If, the endpoints are agreed!

The market doesn't seem to have read any additional uncertainty into this. So maybe, neither should I.

Disc: Held in RL and SM

$NEU have announced an on-market share buyback of us to $50m.

This is not a surprise as Jon has indicated that the Board have been considering how much cash they need and what should be done with an excess cash.

$NEU were already sufficiently cashed-up to fund the planned two Phase 3 Trials for NNZ-2591, and with a perpetual incoming stream of royalties from DAYBUE, the windfall of $US50m for the PRV sale by $ACAD, has clearly been judged as excess cash, a one-off, to be returned to shareholders.

For long term holders of $NEU, this is an opportunity to deliver some returns. Good to see management exercising discipline.

From my perspective, the return makes sense. I consider $NEU remains materially under-valued, and they won't need the cash for NNZ-2591.

If the strategy evolves and they develop the company to take (in the success case) NNZ-2591 all the way to market, there's probably enough future cashflow coming from DAYBUE to fund that.

Disc: Held in RL and SM

$NEU paused, presumably while they prepare their release on the DAYBUE sales number. No biggie.

They will however likely now give very tight guidance on FY24 renveue, which will be uplifted due to proceeds from the PRV sales, which $ACAD expects to close in Q4.

So for those in the market who don't understand the details of what's going on, FY24 is going to look strong. It will be interesting to see what this does!

Still writing up my more detailed notes from $ACAD and doing some analysis on DAYBUE.

$ACAD have just announced their Q3 results.

DAYBUE sales were $91.2m, up 36% to pcp and +8% q-o-q, so clearly new scripts are outpacing discontinuations, which is good news.

Guidance is lowered from $340 - $370 to $340 - $350m.

This is pretty much exactly where I expected. Going on the call now.

Disc: Held in RL and SM

Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced that it entered into a definitive asset purchase agreement to sell its Rare Pediatric Disease Priority Review Voucher (PRV) for US$150 million upon the closing of the transaction.

Good news for $NEU, who receive a one-third share, or $US50m.

$NEU had conservatively assumed they would get one third of US$100m of $US33m. So a small upside further boosting $NEU's cash reserves to press ahead with development of NNZ2591

A one-off, but good news.

NEXT: tomorrow morning's 3Q 2024 $ACAD numbers for DAYBUE sales.

Disc: $NEU held in RL and SM

Summary

Following $ACAD 2Q Results in Aug and recent conference presentations in September also by $ACAD, I have firmed up on my recent valuation ($24, $12-$46), and am getting more comfortable with the future US sales trajectory for DAYBUE.

As a result, I've added back most of the shares I sold in May at yesterday's price, which I consider a bargain.

I consider that today the market is offering $NEU on a "two for the price of one" basis, ... or thereabouts.

Context

With all the focus on ASX reporting over recent weeks, I’m only now catching up with some of the wider research opportunities in my portfolio. One area I am giving some focus is $NEU. I’ll not repeat information here from earlier straws and posts, but in summary, this business has two important things going on:

1) DAYBUE being sold under licence by $ACAD in the US, with work underway to gain approval in Canada (likely end-24/early-25) and EU & Japan (approvals likely only in 2026+)

2) NNZ-2591 has completed Phase 2 studies in three neurological conditions, with an end of Phase 2 meeting with the FDA for Phelan-McDermid syndrome due this month. (This is likely the first indication to advance to Phase 3, given the US market potential of 17,000-32,000 patients. While there's still clincal development risk, it's potentially much bigger than DAYBUE)

We’ve covered NNZ-2591 in other recent straws/posts. My focus here is to consider my view on DAYBUE in the light of recent communications from $ACAD, including over the Summer Conference season in the US.

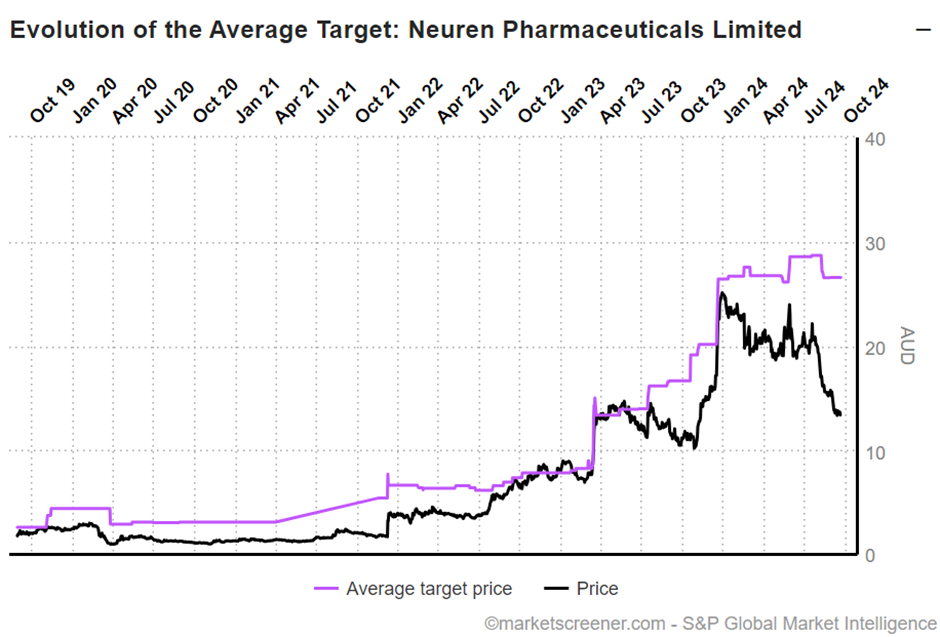

I’ve given a rough valuation of $NEU as $24.00. Being $16.00 due to DAYBUE and $16.00 due to NNZ-2591, risked at 50%. In my normal way of presenting valuations, I have this down as $24 ($12-$46).

This compares with analyst views of $26.56 ($22.90 - $29.90, n=6).

This picture below shows the SP progression relative to the consensus view, which suffered a modest downgrade in August, due to $ACAD downgrading guidance for 2024 DAYBUE sales.

So, we all know that momentum players in the market hate downgrade cycles, and so a very large gap has opened up between valuations of the business and the SP.

Hence the title of this straw: I view that with $NEU you are essentially getting a DAYBUE business (which I see as worth $16) and a success case for NNZ-2591 (which I see as worth $16 unrisked) for $13.59 at the time of writing. The analysts agree – two for the price of one!

The reason I sold down 1/3rd of my RL holding in $NEU on 15-May was that I was concerned about the 1Q report from $ACAD. According to my model, $ACAD were never going to hit 2024 guidance for DAYBUE, and I didn’t buy the offered story about a harsh winter causing clinics to shut down. But as importantly, I became suspicious of management – having prematurely offered annual guidance, and then spinning a 1Q story and acting as though things were on track for the year.

Roll forward to the 2Q report in August. While sales began to recover, guidance was indeed finally lowered, and that pushed many ASX shareholders into a funk with shares sliding from c. $18 to $13-$14.

To put this in context, you can buy $NEU today for less that you could at the launch of DAYBUE, which pre-dated the stream of positive newsflow on NNZ-2591.

So, What Can We Say About DAYBUE?

Having gone back over the $ACAD 2Q Results call (8-Aug), the Morgan Stanley Healthcare Conference (4-Sept) and the Baird Conference (11-Sept), I have firmed up my view on what is happening with DAYBUE. (BTW, recordings of both conferences are accessible on the $ACAD website.)

It is now clear to me that what happened following the launch of DAYBUE: $ACAD were completely surprised by the demand in the first 5-6 months. In retrospect, this should not have been surprising. Rett Syndrome is a very challenging condition, and there is a strong global Rett community. With no pre-existing treatments on the market, there is a well-established specialist support network via Rett Centres of Excellence that support about 25% of US Rett patients. Highly motivated patients, including the parents of sufferers who carry the burden of care, quickly accessed their HCPs requesting the product as soon as it was launched.

This drove strong initial sales in Q3 and Q4 2023, and it led $ACAD to prematurely issue what now turns out to be overly-optimistic guidance (… which was clear to me as early as May).

But as we know, DAYBUE is not well tolerated by many patients. So Q1 and Q2 2024 saw two things happen. 1) The initial “surge” from "c. 25%" of the potential market subsided and 2) discontinuations from this initial “bolus” swamped new patient adds. Aaaaah! DAYBUE has stopped growing! Sell!

This complex dynamic made the interpretation of data from Q2 very challenging. But as a new normal in net patient adds began to establish itself, $ACAD were able to reset 2024 guidance to a more realistic level.

Why Am I So Interested in What $ACAD have been saying in September?

With the “panic spin” of the 2023/24 winter behind us, I have been forensically examining $ACAD's statements throughout September, to test them against what was said in August. I can bring myself to overlook what I consider as “Winter Spin” because, indeed, the dynamic – while easy to model after the fact – must have been very disorientating at the time. And who knows, maybe winter clinic closures and delays in reimbursement renewals for refills created a genuine “winter fog”. Management word salad didn't help, but perhaps I was too quick to judge.

What matters is the future and whether $ACAD are properly characterising the current performance, and the path ahead.

So Where Are we Now?

Throughout the last three public disclosures, a consistent picture is emerging. Here are the key points.

Persistency in the real world remains about 10% ahead of clinical trials. This has been a consistent story for 2024. The best estimate of long-term persistency remains around 50%

Patient adds are net positive, and they are coming into line with the patterns $ACAD say they more typically expect to see in rare disease treatments

A consistent picture is emerging for each of the HCP segments:

1. COEs (25% patients) – 50% penetrated, 1/3rd of prescriptions to date. Major area of focus, as these continue to attract new patients. (My thesis is that the availbility of a treatment might increase diagnoses, expanding the market from 5,000 current to the 6,000-9,000 estimated prevalence. CoEs will likely attract an outsized share of new diagnoses.)

2. High volume non-COEs (60% patients) – “good penetration” and the current area of focus

3. Low volume HCPs (25%) – many treating only 1 or 2 Rett patients – large number of HCPs.

Overall, c. 30% of the total diagnosed Rett populated has started treatment on DAYBUE and, by my calculations, Q2 revenue represents an annual revenue run-rate of c. US$340m.

Against the updated (downgraded) guidance for 2024 Revenue ($340-$370m), $ACAD have said at the September conferences that they are tracking to “just below the midpoint of guidance” which I interpret as being c.$350m.

They’ve also said that they see “more upside than downside” from here, which says to me that they are seeing the guidance offered in early August as still appropriate, and we are now getting to the closing phase of the year.

My Analysis

The message consistency across three presentations spanning 5 weeks, indicates to me that $ACAD have got to grips with DAYBUE sales performance. Things seem stable.

I see the journey of the 16 months since launch in three clear phases:

Phase 1: The Pent-up Demand “Bolus Surprise" - April-October 2023

Phase 2: “Winter of Discontent”: Early Patient Discontinuations swamp new scripts - Nov 2023 – March 2024

Phase 3: “Stabilisation” – Normal Market Penetration and Steady Growth - April 2024 onwards

Looking further ahead, while, based on my model, $NEU are unlikely to get their 2025 $500m US milestone, this is likely to come in during 1H 2026. Canada might give 2025 royalties a bit of a push, as it experiences its own “mini-bolus”, and then hopefully Japan and EU will add new impetus to revenue with milestones and royalties in FY26 and FY27.

So, overall, I’m increasingly comfortable about the downside floor to the SP being in the $low-teens. Which is where we are today!

So, my original investment thesis is intact. Today, I can buy $NEU for less than the fair value of DAYBUE, with the free option of the upside of NNZ-2591.

Investment Decision

My valuation remains as published previously. However, yesterday in RL I have added some $NEU to my portfolio, getting back to 94% of my original position. I’ll potentially add some more, but at just over 5% in RL, I’d also be happy to settle here.

Near term upcoming news flow is:

- Readout from September FDA meeting on NNZ-2591

- $ACAD Q3 results in mid-October

Disc: Held in RL and SM

From a quick scan, the Angelman Result looks good. This one won't be a priority to commercialise, but its building evidence that NNZ-2591 is a platform molecule with benefits for a range of neurological disorders related to its mechanism of action. In that respect, it further de-risks NNZ-2591.

Some snap-shots:

Pretty good results for Phase 2. Not great that improvement is minimal, but the consistency is good.

Again, the story is less about Angelman, but more about providing more data on safety/side effects for PMS and PHS.

Confernce call at 11:00.

Overall takeaway - good news.

I've now gone back over the recording of the $ACAD announcement with a fine tooth comb.

Contrary to my initial impression, listening a little (i.e. A LOT) more carefully, I felt there was less evasion and more just some incompleteness and relatively minor inconsistencies. More a "misty day" than a heavy fog or smoke screen. So, I do need to row back a little on some of my less generous remarks about the management team.

I still believe there wasn't a straight answer on the active patients as at 30-June. However, I can understand from my own experience why a management team would agree not to put out such data for 30-June and 1-August, which covers the Summer month of July, to mitigate the risk that some idiot analyst would multiply the difference x 12 to get a misleading annual growth number. I.e., discontinuations don't slow down, but new scripts do over the summer month. Fair dues, I have also been guilty of managing similar messages when on their side of the table. And we all have our our experience here in Australia of the "Dance of the Seven Veils" with DW at $PNV.

OK, now I've got that off my chest, on with my analysis and key takeaways.

We've had a lot of posts on $NEU from several members with a lot of data and sound bites, so I'll not repeat any of it. Rather, I will lay out some calculations, based on the US alone, and then use that as a basis for further discussion of value and risk.

Methodology

I have decided to use a range of M&A mutliples of forecast peak sales to set out a range of scenarios for the value of DAYBUE in the US to $NEU.

Method is as follows:

- Market size (A): base 5,000. Range 6,000-9,000,... so conservatively I am taking scenarios of 6,000 and 7,500

- Long Run Persistency (B): 50% - there is upside and downside, but I'm keeping that simple

- Peak Market Penetration (C): scenarios of 40%, 45% and 50% (we're already at 30%-33%)

Revenue Per Patient (D) : As a shortcut, I used an RBC Capital Note from June 2024. They set out their calculations using dosing assumptions and cost per patient per annum of $585k and a gross-to-net leading to $536k per patient per annum.

The reason I chose RBC Capital, is that they appear to be a House Broker, who undertook or commission some detailed market research to support the valuation. I'm therefore not accepting their market assumptions, as I think they might be biased, but there dosing and revenue per customer assumptions appear to be OK.

Continuing the Method:

- Calulate Peak US Revenue: (PRev) = (A) x (B) x (C) x (D)

- Calculate $NEU Royalty Payments from tiered US Royalty Schedule (Roy)

- Apply Peak Revenue Multiple: (M)x(Roy)

- Add Sum of Milestone Payments (SMP)

- Convert to $A

- Value of US DAYBUE to $NEU = (M)x(Roy) + (SMP)

- Divide by Shares of Issue

- Result is an estimate of the $/Share of $NEU attributable to the Payments from $ACAD due to US Sales of DAYBUE

Acquisition Revenue MultipleBenchmarks

For the acquision revenue multiples, I have considered a wide range.

I've rejected more spicey multiples of forecast peak revenues in biotech, which can get up to 12x to 20x and more, and this is perhaps an area requiring further consideration.

Having examined some benchmarks, the reasonable range for a pharmaceutical company with a fully commercialised product in the market is an EV/Forecast Peak Revenue multiple ranging from 5 to 10.

In any event, it is simple enough for you to form your own view.

Here are the calculations:

So What? (Part 1)

If I assume that DAYBUE gets to a peak 45% market penetration within the next 2-3 years, so as to attract an acquisition multiple of 7.5 x Revenue, then the revenue stream to $NEU could be valued in the ballpark of $7 - $12.

Now I have to allow for Canada, Japan, EU and RoW - should these eventuate. These have a more attractive royalty structure, however, they are likley not to be as material in aggregate as the US. Let's assume that the better royalty structure is balanced by the small underlying aggregate revenue, so that Peak RoW equals Peak USA.

Assuming Peak ROW occurs 4 years after Peak USA, then by the same method, its worth $5 - $8 /share

This means the value of DAYBUE to $NEU is $12 - $20 - or $16 at midpoint.

But What About NNZ-2591

NNZ-2591 could be worth $0. But it could be worth 3 x DAYBUE, but another 5 years into the future, so let's say it could be worth 2x DAYBUE today.

My Decision

Who knows what the market will do tomorrow. But now, I just don't care.

My investment thesis is that $NEU is worth the value of DAYBUE, giving me a free option to the Upside of NNZ-2591.

If tomorrow, $NEU tanks 20% to below $14, then my thesis is completely intact, because I believe even given the less-than-stellar performance of DAYBUE, $NEU is worth anywhere from $12 - $46.

There is still uncertainty around DAYBUE, but it is rapidly becoming de-risked with now 9-months of Real World persistency data, and the growing evidence of open label clinical extension data spanning 3 years.

This is precisely the kind of risk I still want in my portfolio. I'm so grateful for the Angelman Trading Halt, because it has given me the time to do a proper analysis.

In fact, if the market throws a tantrum tomorow, I will buy back the one-third I offloaded on the back of the 1Q result.

I'm laying this all out in detail, as I value the views of the other StrawPeople who are following this one closely. (I won't hold my breath while you find the obvious errors!!)

Disc: Held in RL and SM

P.S. I have referred to the work of $ACAD House Broker RBC Capital. While they have a bias that is plain for all to see, they are one of the few houses I have seen that has done a detailed market analysis, based on primary research. Their reaction to the $ACAD result was to mark it down from $29 to $26 vs. closing SP of $15.17. The bias is evident in their elevated valuation; however, the fact thay they only marked $ACAD down by $3 or 11% from their elevant elevated valuation is telling - it is in line with my own view based on entirely indpedendent analysis - apart from the $/patient assumption.

The Australian put out the following piece on $NEU, which I missed yesterday. There are a few things to consider in this.

First, Wilsons still have their PT "under review" - I expect they will update after the Angelman report, expected tomorrow morning.

While the article was written prior to the overnight market reaction of -20% in the SP of $ACAD, it is right to remind us that some of the momentum already taken out of the SP earlier in the year was due to Culper Research short report. The return of growth in DAYBUE sales and some of the other metrics disclosed yesterday do indeed show the short thesis is dead. Were it true, falling persistency would overwhelm the relatively modest flow of new patients.

So, even though DAYBUE FY forecast is downgraded to $340m-$370m (and likely to come in around the lower end IMO), we are still on the upward sloping part of the s-Curve.

------------------------------------------------------------------------------------------------------

Neuren Pharmaceuticals shrugs off short attack as key trial results to be announced

11:34amAugust 07, 2024.

Updated 17 hours ago

The Australian Business Network

Neuren is about to release new clinical trial data.

Sales of Neuren Pharmaceuticals’ flagship Rett syndrome treatment Daybue have held up, flying in the face of a short attack launched earlier this year, as the company prepares to release key clinical data flowing on another drug’s use in treating Angelman syndrome.

US outfit Culper Research released a report in February alleging that Daybue was shaping up as a “total flop”, in a bid to profit from shorting the stock of US-based Acadia Pharmaceuticals, which has the exclusive licence to market the drug.

The Culper report said there were “horror stories” about adverse effects circulating through the Rett syndrome community and suggested that revenues from the drug would drop sharply.

Neuren’s market update on Wednesday appears to put that theory to bed, with the company saying Acadia’s net sales for the second quarter of this calendar year were $US84.6m, up from $US75.9m in the first quarter, earning Neuren royalties of $13m.

“The rate of new patient starts was 12 per cent higher than the previous quarter and the rate of discontinuations was 46 per cent lower than in the previous quarter,’’ Neuren said.

“Penetration continues to increase, with approximately 30 per cent of the 5000 diagnosed patients having initiated therapy.

“In market research, physicians surveyed stated that over the next 24 months they expect to expand prescribing to more than 70 per cent of their eligible patients.’’

Neuren said while the momentum in the second quarter was encouraging, the rate of patient additions was slower than expected, which had caused Acadia to downgrade its net sales guidance for the calendar year to $US340m-$US370m, from $US370m-$US420m.

“Assuming the updated guidance range is met and an exchange rate of 0.65, Neuren would earn royalties of $55m-61m (was $61m-70m), plus $77m from the first sales milestone payment of $US50 million due for the first calendar year in which net sales exceed $US250m,’’ Neuren said.

Neuren said Acadia presented new real-world Daybue data in June, which showed caregivers for 67.7 per cent to 82.2 per cent of enrolled participants reported improvements at months one to six in at least one Rett syndrome symptoms category.

“The most consistently reported improvements over six months were non-verbal communication, alertness and social interaction/connectedness,’’ Neuren said.

The company also said there was the potential for Daybue to be approved for use in Canada around the end of this calendar year, with a marketing application to be filed in Europe early next year and discussions are under way in Japan.

Neuren also placed its shares into a trading halt as it prepares to release top line results of its Phase 2 clinical trial in the use of compound NNZ-2591 in treating Angelman syndrome.

The compound has already demonstrated positive top line results in a Phase 2 trial in patients with Pitt Hopkins Syndrome and Phelan McDermid syndrome.

Broker Wilsons Advisory said it maintained its overweight rating on Neuren and had its $30 price target under review.

“Daybue sales in the US continue to track largely to our expectations, with NNZ-2591 progress a greater contributor to our valuation and positive investment thesis moving forward,’’ Wilsons said.

Neuren shares last changed hands at $17.09.

$NEU is into a trading halt as it prepares a presentation on the top line results of the Angleman Phase 2 Study for NNZ-2591.

This is tricky timing, as buying and selling was setting up a 10% fall in SP based on the DAYBUE result.

Shareholders looking to exit may be bothered that they weren't given the chance to get out early. By the time trading resumes (presumably Friday morning) analysts will have given reports on DAYBUE sales, which as I wrote at length is complex and likely disappointing.

Personally, I'm pleased, as it gives me some time to properly digest the DAYBUE result and then consider what weight to give to NNZ-2591 in light of the Angleman result, taken together with the previous results.

This was tricky from an investor relations perspective - not allowing the market to react to reported results. Some investors may take cues from $ACAD SP response tomorrow. However, $ACAD is a multi-product company, where the other product was upgraded. However, there may be a range of analyst commentary to consider before taking decisions.