I'm looking forward to $XRO’s FY results tomorrow (investor call at 10:30am). With fewer companies reporting (given the April–March cycle), it’s been a quieter week—so I’ve taken the chance today to prepare and record a few thoughts ahead of the results.

Key question: What are the respective contributions to FCF and NPAT growth from price, subscriber numbers, and operating leverage? And what are the implications for my long-term thesis? How much of a drag has weak business confidence been?

The signals are mixed, but overall, the result should be solid. Business formation has remained sluggish across all major markets (ANZ, UK, US), but $XRO continues to push through price increases, supported by feature upgrades—and frankly, customer stickiness.

MRR churn has remained below pre-pandemic levels, although it has trended upward slightly over the past three years. It'll be interesting to see whether the most recent price increases have had any lagged impact on churn, especially when combined with discounted introductory offers from rivals (which $XRO also deploys).

There’s been commendable cost discipline—overheads, development spend, and CAC are all under control. Thankfully, large M&A has been shelved under Sukhinder Cassidy, now into her third year as CEO.

Analysts using app download and search trend data suggest that $XRO’s growth in 2H FY25 has outpaced international competitors QuickBooks ($INTU) and Sage ($SGE). Will that be borne out in the results?

Of course, we need to be cautious interpreting subscriber metrics. Recall the "inactive subscription" cleanout reported in 1H FY25, which muddied the waters across subscriber-linked KPIs. Hopefully, they've resolved this and now report only active subs. There’s really no excuse now.

Because that subscriber reset was disclosed in 1H, it will distort FY-on-FY comparisons. So I’ll be reviewing the FY numbers in light of the “cleaned” 1H base.

By region:

UK:

The March Budget renewed the push on Making Tax Digital (MTD) for sole traders, with phased implementation over the next three years. While this won’t impact FY25 meaningfully, I’ll be looking for FY26 commentary. MTD should drive new subs at the entry level (Xero Simple and Xero Go), which aren’t big value drivers initially—but some of these businesses will grow and eventually upgrade. With UK business confidence still weak, it’ll be interesting to see how $XRO tracks relative to the 11% subscriber growth posted in 1H. Cloud accounting adoption in the UK still lags ANZ, and with $XRO the market leader, there’s further upside. (# of UK subscribers are ~60% of Australia’s, in a market at least twice as large—though with competition for SaaS accounting customer now more well-established than when ANZ was at a similar stage of penetration.)

North America:

This remains a key long-term interest, with QuickBooks the dominant player. Sukhinder has now had two years at the helm and has put $XRO on firmer footing—focused on the core business, abandoned speculative M&A, and improved cash generation. Now is the time to start assessing whether the team has a strategy to become a credible #2 in the U.S. That was a core objective when she joined. I’ll be watching closely for signs of traction and what the key initiatives are—i.e., new features for US customers, accountant engagement, marketing investments etc. For example, US online bill payments went "live" at the end of April. In 1H, North America posted “underlying” sub growth of 10%—a bit “meh”—so let’s see how FY measures up.

ANZ:

I expect subdued subscriber growth, with most revenue expansion coming via ARPU gains. It’ll be worth comparing full-year subscriber growth to the 11% underlying figure reported for 1H FY25. Given that business confidence will be a driver here, the question is, how much has it come off?

Valuation:

I have $XRO roughly at fair value. The analyst 12-month price targets average $188.70 (range: $155–$206, n=13 via TradingView), against today’s close of $173.86.

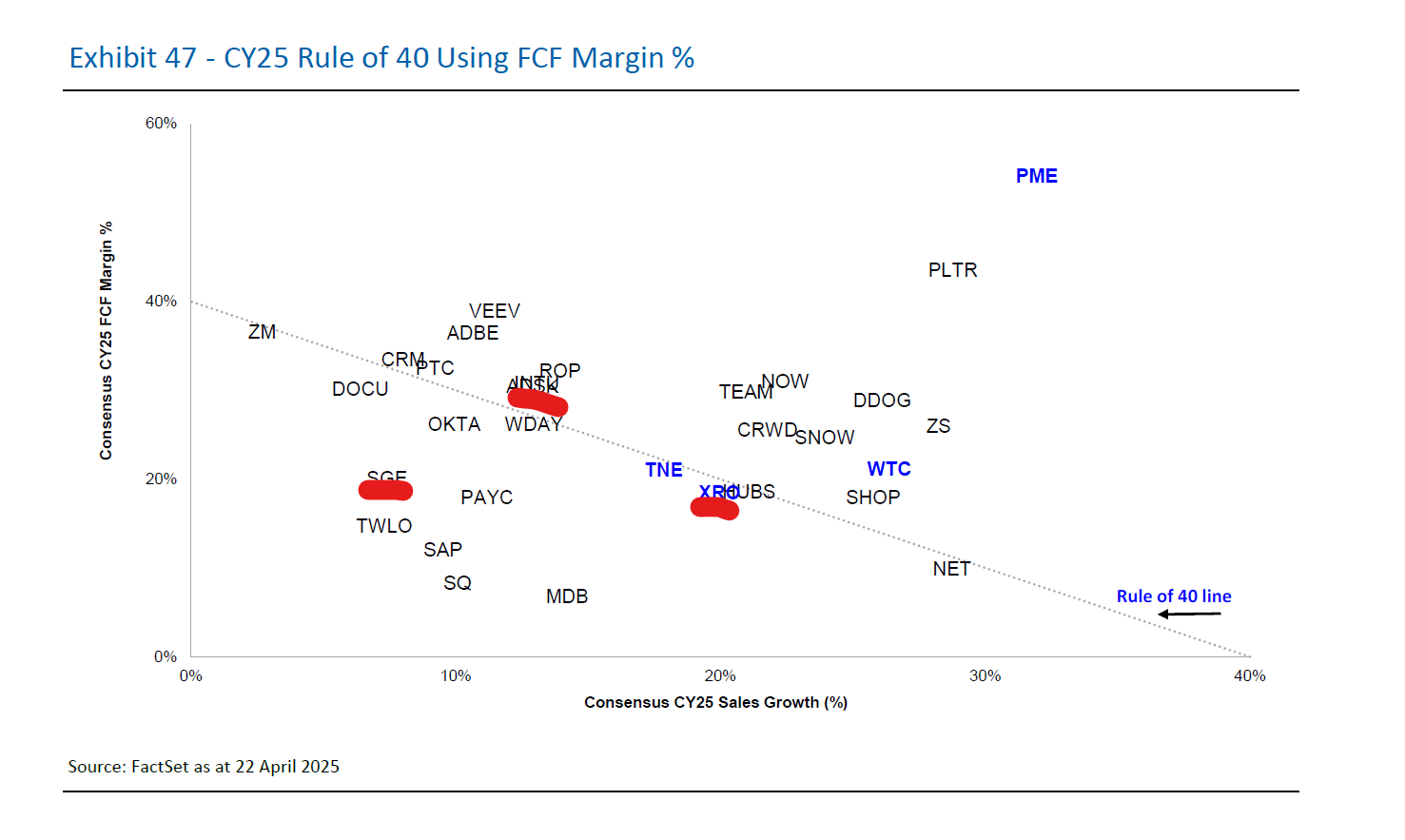

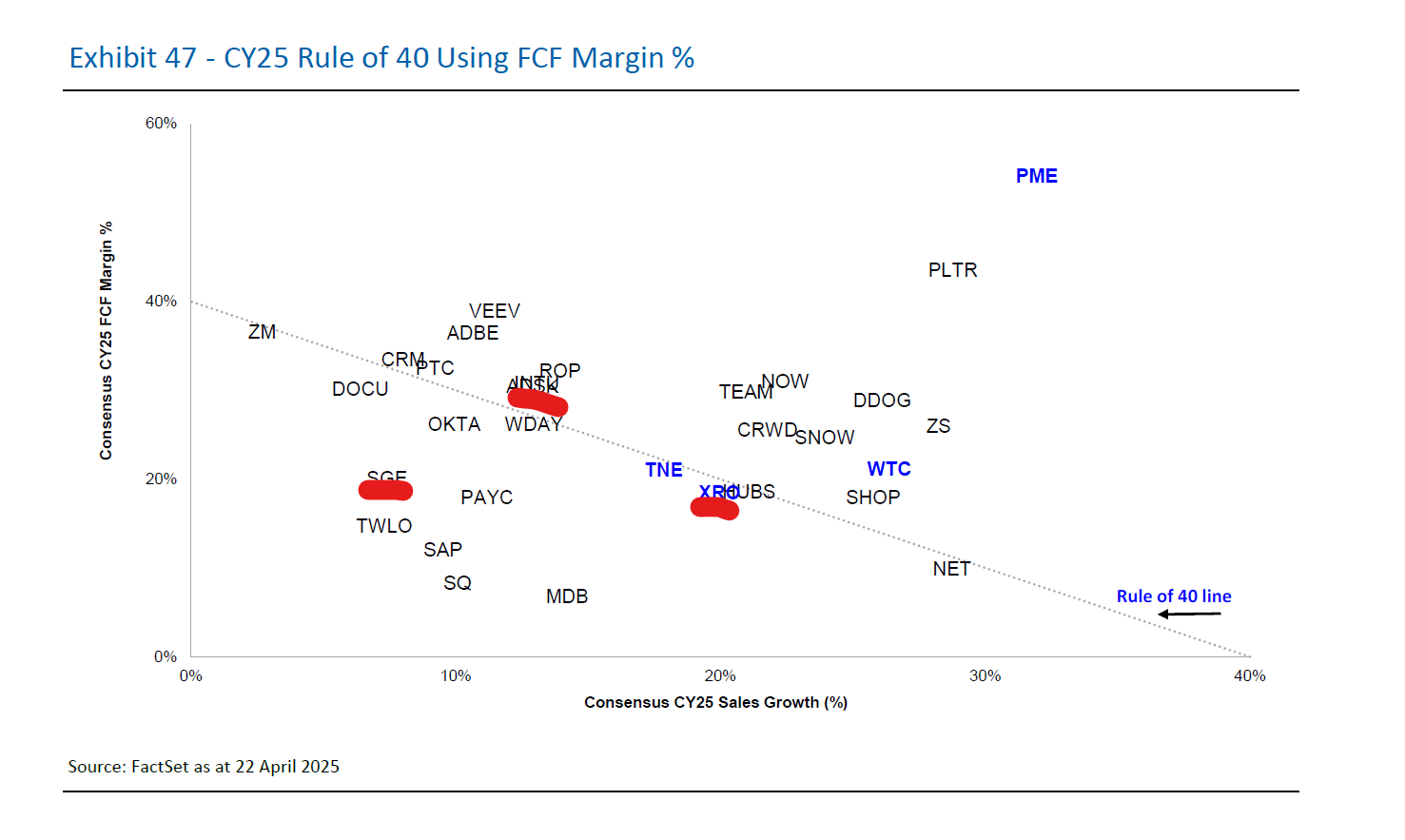

RBC recently benchmarked $XRO against other SaaS peers using the Rule of 40 (on an FCF margin basis). Here’s one of their charts. At a forward P/E of 121x, $XRO clearly carries downside risk if it missteps—but relative to SaaS peers, its valuation isn’t outlandish. (I’ve highlighted $INTU, $SGE, and $XRO for reference - if my marking isn't clear, the red marks indicate left ro right $SGE, $INTU, then $XRO.)

Disc: Held in RL ASX portfolio only (6.5%) , not on SM