Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 5.23%

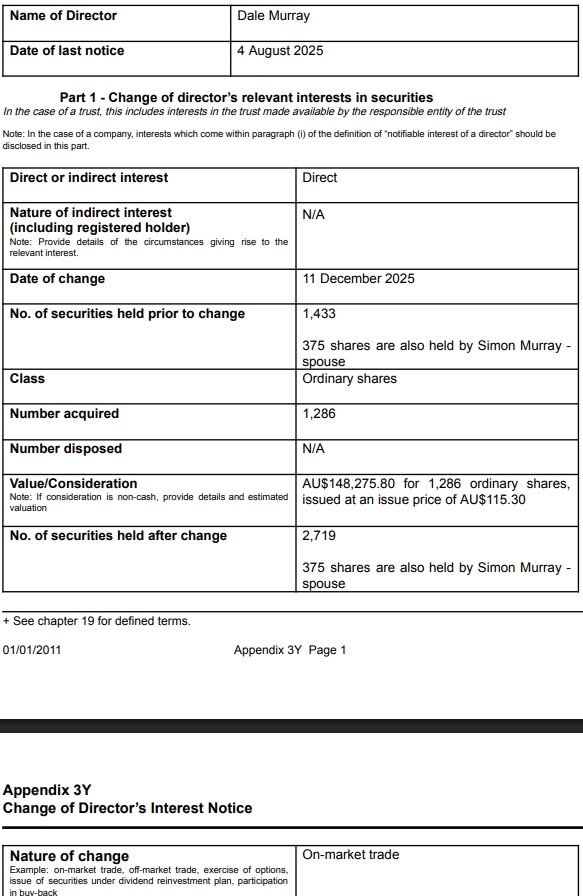

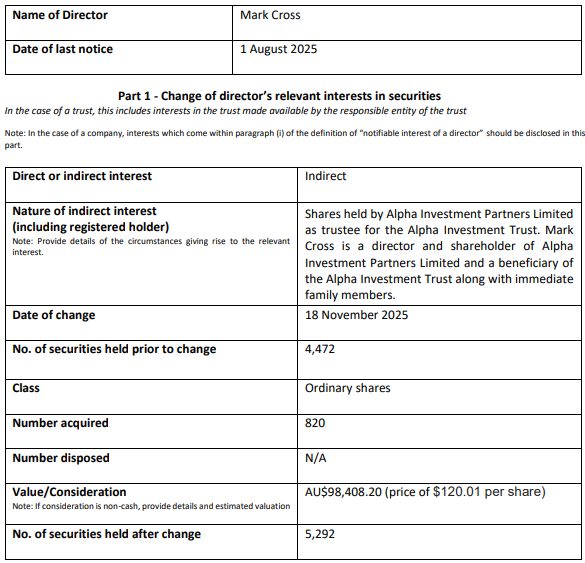

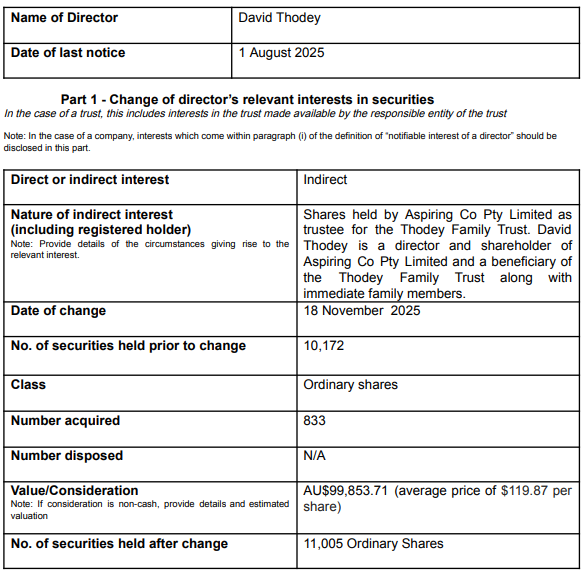

Following the on-market purchases of XRO Directors David Thodey and Mark Cross on 18 Nov 2025, Dale Murray has also made a sizeable on-market purchase last week.

She topped up her holdings by ~90% costing $148.2k, investing 50% more than the ~$100k top up from David and Mark, each.

Sure feels like a Board confidence signaling exercise

The recent straws on XRO have prompted this post. I sold Xero around the cap raise after being a v long-term holder.

Why Sell?

- I have no way of researching the US SME market—no ability to conduct on-the-ground customer research or evaluate “excitement” about the product. I have to rely on company reports and trust management on their progress and vision.

- The US is not one country and is not an easy place to penetrate. I personally think of the US as at least 10 different countries, more akin to a version of Europe. States and regions have their own laws, culture, and ways of doing business. This makes it tough for a business like Xero to establish a foothold, as every state requires a somewhat nuanced product.

- Intuit is established and entrenched. Is Xero’s product different enough or suitable for a niche that isn’t currently well served? Does Melio kickstart Xero? I have no idea.

- I also think Intuit will fight back if Xero starts making inroads in the US. The price war and advertising blitz that occurred in Australia around the time Xero entered the US, I admit is a long bow, but the timing was interesting.

My bias:

During its growth phase in Australia, Xero was a ridiculously easy company to research and to verify customer uptake. Non-financial SMEs “raved” about the product. It was easy to see why—the platform was intuitive compared to MYOB, and it made life much easier for SMEs whose bane of existence is paperwork.

There were many incidental moments that reinforced Xero as a strong platform. For example, a friend who runs a restaurant talking about the time-saving and accuracy from photographing invoices and having them auto-upload, or the first time a tradie pulled out their phone and sent an invoice on the spot.

So my question to the SM community is: how do you do on-the-ground style research to verify your US Xero investment case from afar?

Perhaps my bias and experience from holding XRO through the Australian growth phase is blinkering me.

I’m watching from the sidelines for now.

Interesting article titled "Why Xero won Australia, but will struggle in America"

Well worth a read for those owning and looking to own while the stock is correcting.

https://www.livewiremarkets.com/wires/why-xero-won-australia-but-will-struggle-in-america

Discl: Held IRL 6.44%

Good to see both David Thodey and Mark Cross stumped up ~$100k of their own coin to buy into the XRO dip yesterday.

Given the similar amounts, it does have the look of a Board confidence signaling exercise. Be interesting to see what the other directors end up buying and when to confirm.

Petty cash for these guys for sure, but its more coin that I have, so it works for me ...

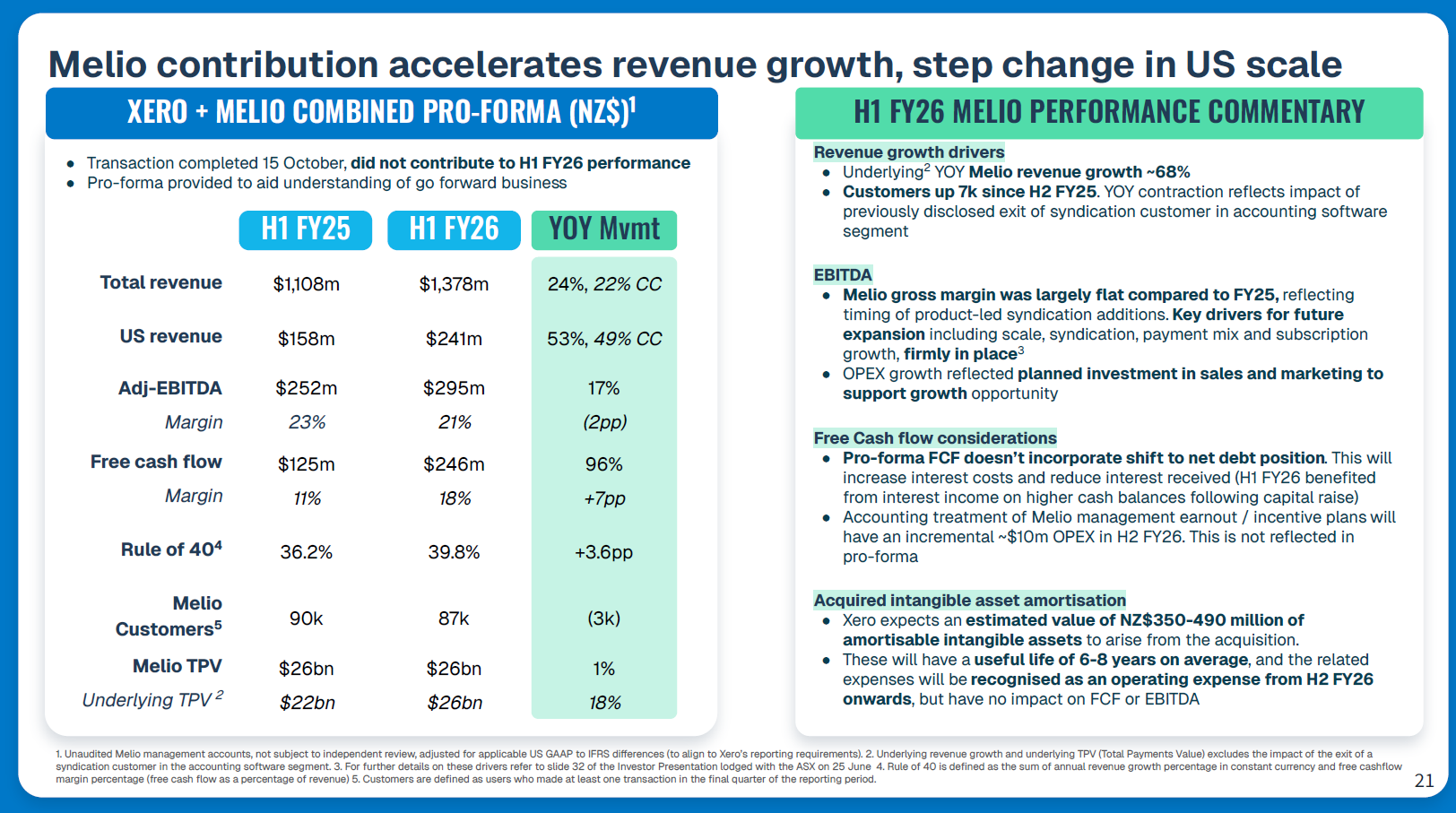

SaaS SMB accounting and payments platform $XRO reported their 1H FY26 Results today.

I might have said that the SP reaction of -9% on the day surprised me (in truth it did), but as a long term holder of this super highly-rated growth stock, you have to expect that anything much short of perfection gets punished, and the effect was amplified by today's marco data hitting several tech stocks (doubts on further interest rate cuts in light of strong October employment numbers).

However, before diving into the details, there are some contextual issues that set-up an adverse reaction, IMHO:

- Acquisition of Melio - many think this is a return to over-paying for material acquisitions that don't deliver the strategic intent. Senitment around this has dragged the SP from a high of $195 in June to a near 18-month low at the close today of $127.

- G&A lept up a whopping 48% driven by accounting treatment of Sukhinder's large remuneration package, which almost got voted down at the AGM. The official explanation is: "primarily due to higher executive personnel costs associated with the accounting treatment of option and sign on equity grants announced last year. The majority of these noncash costs are not expected to recur in fiscal '27."

- While Subscriber additions in North America were strong (+15% to pcp) , revenue growth was relatively weak at +18% on CC. With a welcome breakout of US data (for future reporting with Melio) we can see that Canada is pretty anaemic - but we know that as the economy is hurting as a result of the Trump tariffs. Quelle surprise.

- There is some ongoing concern about the level of development spend being capitalised, at 47%

- Finally, while there are limited numbers around for the 1H consensus, there are reports that EPS missed consensus by 13%.

I attended the analyst call and have sliced and diced the results in detail. Overall, I'm pretty happy.

So much so, that for the first time in ages, I have acquired more $XRO stock today just before the close, adding to my less-than-well-timed purchase yesterday. (Important context is that going in to today's result, the SP was already 28% below the TP consensus, although I think some of the analysts have lost the plot with their lofy targets, which run as high as $230!)

My Highlights

For me there are several highlights:

- CEO reiterated the target to double revenue from FY25 to FY28

- Revenue was up 20% YoY (+18% CC) driven by Subscribers +10 YoY and ARPU +8% YoY (CC)

- Reiteration of capital discipline, with the FY26 Opex Ratio upgraded from 71.5% to 70.5% (including Melio)

- CEO said Melio acquisition is performing above expectionations, and Xero will launch the US payments in $XRO in December.

- Australia performed strongly, with subs +9% to PCP, and revenue +19% in CC.

- UK performed very strongly (IMO given the macro), with subs +13% and revenue +20% in CC.

- Looking past the "one-off" G&A blowout, both S&M and R&D continued to decline as a % of revenue: -0.3pp and -0.5pp respectively. This should give confidence about continuing the operating leverage recent track record.

- Cash Generation was strong, with FCF up 54% to NZ$321m from NZ$209m in the pcp, alebit flattered by interest earned on cash raised for the Melio acquisition and a weak NZD, but strong nonetheless.

- AMRR was also up strongly +26% yoy (albeit only +19% in CC, again because of the weak NZD)

- While Monthly Churn was up slightly to 1.09%, this remains below the long-term pre-pandemic level of 1.15%

- LTV was up 9% in 6 months from $17.95bn to $19.56bn, albeit only $18.52 (+3%) if we back out the FX benefit.

- LTV/CAC weakened again in ANZ to 10.7 from 11.6 in March, explained as being due to chasing customers via the direct channel, where churn is higher for small customers who try the platform out for a few months and decide not to adopt. International stayed steady at the much lower LTV/CAC of 3.3.

My Assessment

Across the board, the results were strong. Yes, there are pockets of relative strength and weakness, if you dig deeper, but overall there is nothing that gives me concern or is surprising.

One orange flag is the need to keep an eye on the ANZ LTV/CAC trend, but this value has been so high for so long, you can argue on economic grounds that they have been underinvesting in the home markets on customer acquisition. Good to see International is stable at the less healthy 3.3, marking the more competitive international markets.

The long term target of doubling revenue by FY28, restated today confidently by Sukhinder, requires a revenue CAGR of 26% or 21% depending on how you measure it. If measured from $XRO's FY25 results of NZ$2.1bn to NZ4.2bn, a 26% CAGR is required. Alternatively, if you start from the pro forma Melio+$XRO combination of NZ$2.36bn, then the actual required organic CAGR is 21%).

This must be achieved while continuing to drive operating leverage. Both CEO and CFO are clear about that.

Clearly, that means that management are confident that Melio is going to transform and accelerate prospects in the US market.

$XRO has a focused strategy: the 3x3 of Accounting, Payments and Payroll across ANZ, UK and North America. Melio and the inegration of Gusto, gives the US business the full offering, with opportunities to sell Melio into $XRO's existing customers, and $XRO into Melio's customers, with a combined saleforce ready to go.

Sukhinder presented a clear US Pro Forma set of financials, and so the US will now be reported separately, with Canada absorbed into International. Yay! The key slide follows.

And so, we will be able to judge progress over the next couple of reports. And given Sukhinder's eye-watering compensation package, I think there will be little tolerance for mis-steps. I guess she knows that. Melio is quite clearly her "big bet" that she can awaken the US Dog that (so far) Hasn't Barked.

And that really is the big unanswered question and one that is worth a lot more than the upfront US$2,5bn paid for Melio. I say that because while ANZ and the UK are solid (with the latter still containing a long runway ahead), those two markets on their own do not justify $XRO's A$23bn market cap. At some point, there has to be an acceleration in North America. And Sukhinder has clearly rolled the dice with Melio. I'm happy she's done that, and Melio looks like a good pick.

Valuation

As I have put more of my RL portfolio into SM, I realise I've never posted my own valuation here for $XRO. And I haven't updated the model for the Melio pro forma FY25 starting point as yet.

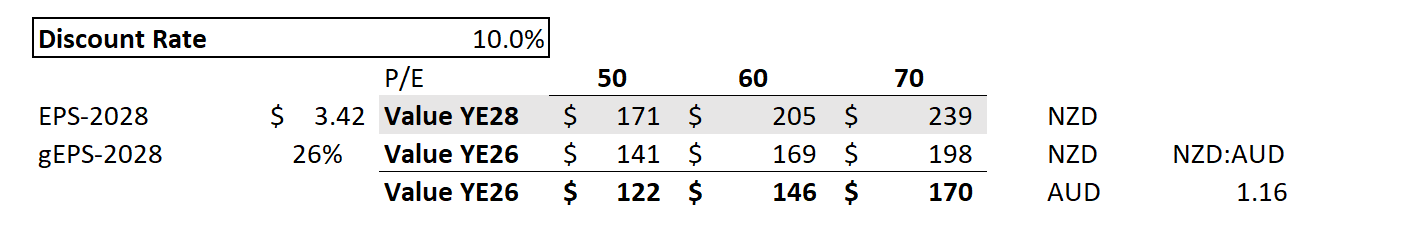

So, as a starting point, I am putting in numbers for $XRO pre-acquisition, with simple assumption of organic annual revenue growth of 21% p,a to FY28, Opex Expense Ratio declining to 69% in FY28, $GM to 90% by FY28. (Discount Rate 10%; Tax 30%; SOI gwor at 1.1%)

While the low %GM Melio business messes this up, I am assuming that the Melio acquisition is value neutral, save for the fact that it enables $XRO to sustain revenue growth of 21% pa, with improving operating leverage out for 3 years.

The following table shows the results for this valuation (A$ shown):

I've chosen P/E's of 50, 60 and 70 because in FY28, the growth in EPS is still 26% so, the business will still likely be highly rated at that point, albeit it will have fallen significantly from recent highs!

I've chosen P/E's of 50, 60 and 70 because in FY28, the growth in EPS is still 26% so, the business will still likely be highly rated at that point, albeit it will have fallen significantly from recent highs!

I note that my FY28 EPS is significantly higher than this morning's analyst consensus of $3.26, so that's something to look at again once I have rebuit my valuation for the $XRO + Melio combination.

This gives my valuation for $XRO of $146 ($122 - $170) at YE FY26,

So how does this compare to the analysts? Looking to MarketScreener.com and converting NZD to AUD at 1.16, the analysts price targets have an average of $192 with a range of $96 to $231. Go figure.

Invesment Decision

Even though my valuation hasn't properly modelled the impact of Melio, I am a great believer that M&A rarely adds value on its own. The long term value comes fom how it transforms the organic economic engine. The above valuation is an upgrade to my numbers from the FY25 results, driven by my belief that Melio will transform $XRO's underweight US offering,

With the SP today falling to $127, $XRO has fallen to the lower end of my range, and therefore I am happy to top up, given that the midpoint of my range would deliver a 15% return in 6 months.

So, if Sukhinder is right, and Melio transfroms progress in the US, and ANZ and UK keep doing their thing, then today the market has offered me a chance to top up on one of my longest held ASX stocks (first held in 9-Sept-16).

I've been happy to take that opportunity, increasing my RL holding today and yesterday from 5.5% to 7.8%.

13-Nov-2025

$146 ($122 - $170)

Base on FY28 eps of NZ$3.42 and P/Es of 50/60/70.

See today's Straw for Details.

May 2022

Valuation of $118 based on Goldman Sachs note dated 12 May 2022.

WELLINGTON, 25 June 2025 — Xero Limited (ASX: XRO) (Xero) today announced it has entered into a binding agreement to acquire 100% of Melio Limited and its associated entities (collectively Melio).

Melio is a leading US SMB bill pay platform that seamlessly integrates Accounting and Payments, offering US SMBs and their advisors easy-to-use accounts payable (A/P) workflows and a wide choice of payment methods.

Acquiring Melio delivers a step change in Xero’s US value proposition and scale, accelerating its 3x3 strategy and global high growth aspirations.

This acquisition solves a critical customer need, uniting Accounting and Payments in one platform for customers.

It’s a powerful strategic fit, aligning with Xero’s 3x3 strategy and it brings Melio's world-class team and platform to Xero.

This will drive compelling value creation for the US business and the group globally.

The upfront consideration will be US$2.5 billion (A$3.9 billion) 1 in cash and Xero scrip.

Additional contingent consideration, deferrals and rollovers is payable to Melio employees of up to US$0.5 billion payable over three years.

The majority is linked to delivering against certain pre-agreed outperformance targets, and the remainder subject to the passage of time, annual business objectives and continued employment

$XRO have just released their FY25 results.

Summary

My Quick Take

Quick thoughts ahead of the conference call at 10:30:

- Revenue in line with expectations

- EBITDA - broadly in line/slight miss

- Expense ratio at 71.8% comes in below guidance of 73%, same as 1H

- NPAT - a miss NZ$228m vs. NZ$245m consensus

- FCF - a strong beat: NZ$507m vs NZ$424m

- Subscribers - all over the place because of the 1H cleanup of "dormant accounts" as predicted, Overall, % subscriber additions rate broadly in line with 1H, with slight upticks in US and UK and downticks Aus and RoW compared with rate of additions in 1H.

- ARPU increase of +15% doing most of the heavy lifting for revenue +23%

- Churn appears under control at 1.03% (underlying) in H2, up from 1.00% (underlying) in H1. Continuing a gentle upwards trends, but still below pre-pandemic levels.

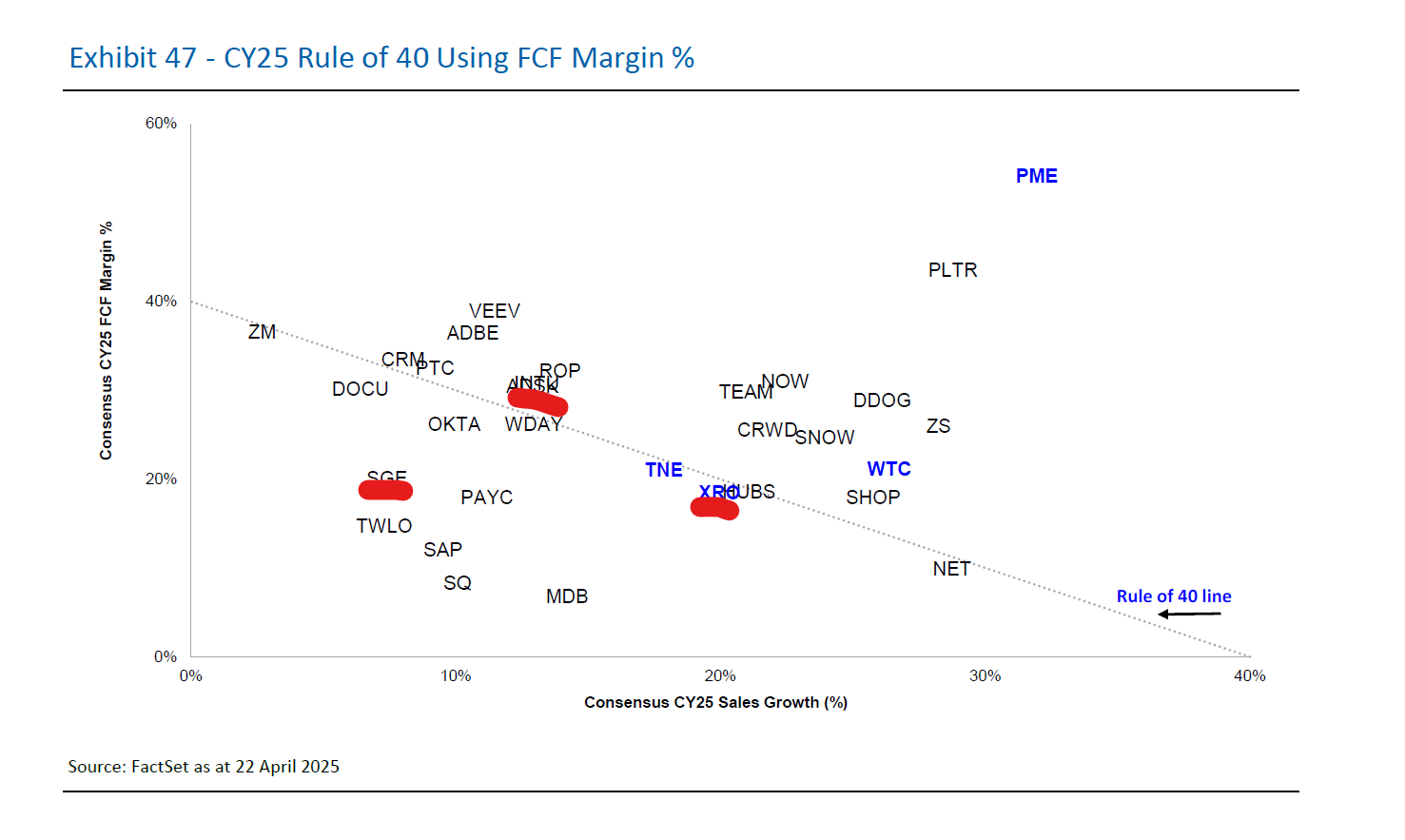

- "Rule of 40" continues to advance higher, with FCF Margin now does most of the work.

Overall, there's a lot to like (not sure how the market will view the NPAT miss), but in the current environment of challenged business confidence, I'm pretty happy with this result. The operational metrics look good, and I love the strong FCF growth of +48%, so that's a big tick for me.

That's just a quick take before I get my morning run in, before the results call.

Disc: Held in RL only

I'm looking forward to $XRO’s FY results tomorrow (investor call at 10:30am). With fewer companies reporting (given the April–March cycle), it’s been a quieter week—so I’ve taken the chance today to prepare and record a few thoughts ahead of the results.

Key question: What are the respective contributions to FCF and NPAT growth from price, subscriber numbers, and operating leverage? And what are the implications for my long-term thesis? How much of a drag has weak business confidence been?

The signals are mixed, but overall, the result should be solid. Business formation has remained sluggish across all major markets (ANZ, UK, US), but $XRO continues to push through price increases, supported by feature upgrades—and frankly, customer stickiness.

MRR churn has remained below pre-pandemic levels, although it has trended upward slightly over the past three years. It'll be interesting to see whether the most recent price increases have had any lagged impact on churn, especially when combined with discounted introductory offers from rivals (which $XRO also deploys).

There’s been commendable cost discipline—overheads, development spend, and CAC are all under control. Thankfully, large M&A has been shelved under Sukhinder Cassidy, now into her third year as CEO.

Analysts using app download and search trend data suggest that $XRO’s growth in 2H FY25 has outpaced international competitors QuickBooks ($INTU) and Sage ($SGE). Will that be borne out in the results?

Of course, we need to be cautious interpreting subscriber metrics. Recall the "inactive subscription" cleanout reported in 1H FY25, which muddied the waters across subscriber-linked KPIs. Hopefully, they've resolved this and now report only active subs. There’s really no excuse now.

Because that subscriber reset was disclosed in 1H, it will distort FY-on-FY comparisons. So I’ll be reviewing the FY numbers in light of the “cleaned” 1H base.

By region:

UK:

The March Budget renewed the push on Making Tax Digital (MTD) for sole traders, with phased implementation over the next three years. While this won’t impact FY25 meaningfully, I’ll be looking for FY26 commentary. MTD should drive new subs at the entry level (Xero Simple and Xero Go), which aren’t big value drivers initially—but some of these businesses will grow and eventually upgrade. With UK business confidence still weak, it’ll be interesting to see how $XRO tracks relative to the 11% subscriber growth posted in 1H. Cloud accounting adoption in the UK still lags ANZ, and with $XRO the market leader, there’s further upside. (# of UK subscribers are ~60% of Australia’s, in a market at least twice as large—though with competition for SaaS accounting customer now more well-established than when ANZ was at a similar stage of penetration.)

North America:

This remains a key long-term interest, with QuickBooks the dominant player. Sukhinder has now had two years at the helm and has put $XRO on firmer footing—focused on the core business, abandoned speculative M&A, and improved cash generation. Now is the time to start assessing whether the team has a strategy to become a credible #2 in the U.S. That was a core objective when she joined. I’ll be watching closely for signs of traction and what the key initiatives are—i.e., new features for US customers, accountant engagement, marketing investments etc. For example, US online bill payments went "live" at the end of April. In 1H, North America posted “underlying” sub growth of 10%—a bit “meh”—so let’s see how FY measures up.

ANZ:

I expect subdued subscriber growth, with most revenue expansion coming via ARPU gains. It’ll be worth comparing full-year subscriber growth to the 11% underlying figure reported for 1H FY25. Given that business confidence will be a driver here, the question is, how much has it come off?

Valuation:

I have $XRO roughly at fair value. The analyst 12-month price targets average $188.70 (range: $155–$206, n=13 via TradingView), against today’s close of $173.86.

RBC recently benchmarked $XRO against other SaaS peers using the Rule of 40 (on an FCF margin basis). Here’s one of their charts. At a forward P/E of 121x, $XRO clearly carries downside risk if it missteps—but relative to SaaS peers, its valuation isn’t outlandish. (I’ve highlighted $INTU, $SGE, and $XRO for reference - if my marking isn't clear, the red marks indicate left ro right $SGE, $INTU, then $XRO.)

Disc: Held in RL ASX portfolio only (6.5%) , not on SM

Assumed 3 scenarios growth ranging from 15% to 25% over 5 year period. Obtaining 20% Net Margins in FY29. Share Count rising to 168m. PE75 for high growth and 35 for lower growth of 15% per year. Discounted Back and Blended the 3 scenarios got a valuation of $169.54.

What has changed in September for Xero USA web traffic?

XRO latest plan changes looking to simplify current offering and also use bundling to increase adoption of other products. Seems to be a high single digit percentage increase in prices.

01-Sep-2021: So Xero is one of the WAAAX companies (WTC, ALU, APT, APX, XRO) - and is one of just a couple of those that has consistently performed well and has really only pulled back on sentiment shifts around the tech sector and sector rotation (including growth to value rotation). I found this Livewire Markets article (by Ally Selby) from May 2021 interesting: https://www.livewiremarkets.com/wires/is-it-all-over-for-the-waaax-stocks-or-is-this-just-a-dip-to-grip It starts with the following: "Once the darlings of the ASX, the WAAAX stocks have recently tumbled from their throne. It would appear the hullabaloo around inflation (utter kryptonite for stocks trading at sky-high valuations) has finally taken its toll. Since the beginning of the year, these tech titans have together fallen 133% (or by an average of nearly 27%), while the benchmark S&P/ASX 200 has lifted more than 6%, surpassing its monumental 7100 mark." Appen (APX) has continued to fall. They've got their own company-specific issues which have been well documented. WiseTech (WTC) has put on +76% since then (May 12th) and is now making new all-time highs (currently over $47/share as I type this). Altium (ALU) has been back up over $35/share on the back of an official takeover offer priced at $38.50 (and an unofficial verbal offer of $40/share which the ALU Board also rejected), however ALU has been beaten down yesterday on the basis that there has been a delay in getting the accounts audited and there are possible question marks over the way they've claimed to have achieved their previous target of $200m in annual revenue, as well as question over whether they can achieve their latest target of $500m in annual revenue by CY2025 (FY2026). I hold ALU and I'm comfortable to hold them both in RL and in my SM portfolio. Afterpay (APT) are now being taken over (acquired) by Square Inc., and the APT SP is back over $130/share. Edit: Square is now Block. Xero (XRO) is back up at around $150/share, levels not seen since mid-December (2020), so look like going on to set a new all-time high again shortly. So it looks like the rise and rise of WiseTech, Afterpay and Xero is set to continue from here. I'm setting a $170 PT (price target) for XRO, based on this renewed positive investor/market sentiment and the positive momentum they seem to have, and I'll continue to hold XRO and ALU in my Strawman.com portfolio for now. In real life (RL), I hold ALU, but not the other 4. What I like about ALU is that they set ambitious targets and then meet them. Sure, there are delays sometimes, and they might have to do some fancy accounting to get there occasionally, but the overall growth in terms of revenue and customers (and market share) continues. Much the same could also be said about Xero, and Xero has been on my watchlist for a long time also, and is the only other WAAAX company that I'd be seriously interested in owning shares in in RL. However, I tend not to buy shares in companies that are trading at all time highs, or near them, it's just not my style. I like growth, who doesn't?, but I am at heart a value investor. What you pay is at least as important as what you buy. Would like to buy XRO on a decent pullback, but I have a feeling we might not get one in the near future, I think they're going higher in the near-term.

14-Mar-2022: Update: So I damn near picked the top, when I said, "I think we're going higher..." above back in early September 2021. We did get that pullback that I wanted but did not really expect, and I am now a happy holder of Xero (XRO) shares.

As @slymeat says, the acronym WAAAX should probably be BWAX now, with Afterpay now Block, and Appen not deserving of inclusion any more. I agree with that. In terms of buying XRO, I have had two bites, but I'm not up to my desired weighting yet, because they're still falling. I've decided to tread carefully in the current environment and buy in tranches, because it's hard to know just how far these pullbacks will go, and when the recovery will begin. I'm no good at timing markets (clearly) yet I don't want to miss out on the opportunities that are presenting themselves, so I'm buying in thirds or quarters of my desired total weighting for quality companies like this when they have had a decent pullback but are still in a strong downtrend. Then buying more when they fall another 10 or 15%, and so on. I reckon I'll look back at my average price paid in 5 years' time and be happy with it.

There hasn't been anything that has changed in terms of Xero, except the share price, so I'm keeping my $170/share PT (price target). Not sure how long it will take to get there, but I'd be happy with $170 within 5 years.

Chart Source: Intuit Vs Xero: Better Accounting Software Stock To Buy (NASDAQ:INTU) | Seeking Alpha [13-Jan-2021]

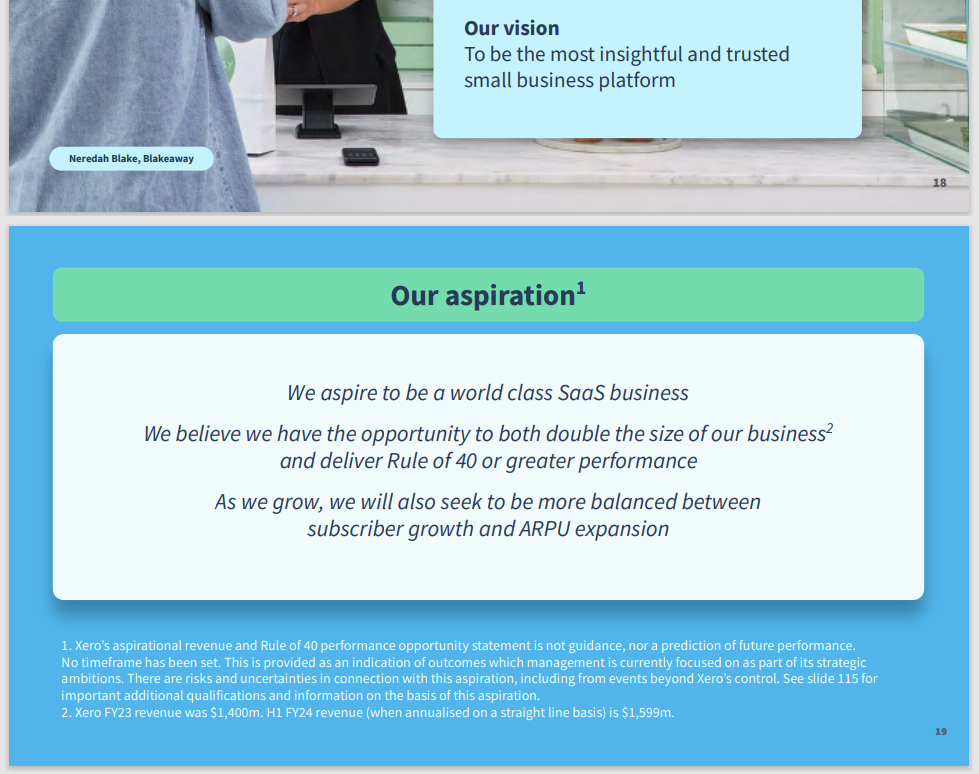

05-March-2024: Update: Haven't looked at this one for a while - two years - and I just posted a straw here on Xero today ("#Rule of 40") prompted by their recent Investor Day Presentation - find the link to that here: https://www.xero.com/au/investors/announcements/#

I have held them, sold them, and now I'm getting interested in buying back in. As explained in that straw this arvo. I'm leaving my target price up at $170 - now that they have new management with a positive focus on sustainable profitability. They should get there within the next few years.

They may also attract some Insto money that gets recycled out of Altium in the next little while - due to the acquisition of Altium (ALU) by Japanese company Renesas. Instos often like to redeploy the capital back into a similar quality company within the same sector, and XRO might fit the bill (as would WTC).

05-March-2024: Interesting that Xero's new CEO, Ms Sukhinder Singh Cassidy, has signalled a reduction in spending at Xero and a focus on the "Rule of 40", as shown on slide 19 of their recent Investor Day Presentation last week (29th Feb):

The Rule of 40 is a principle that states a software company's combined revenue growth rate and profit margin should equal or exceed 40%. SaaS companies above 40% are generating profit at a rate that's sustainable, whereas companies below 40% may face cash flow or liquidity issues. (Source: https://www.cloudzero.com/blog/rule-of-40/)

Ben and Jeremy from TMS Capital reckon that's a different approach for Xero and it could be an inflection point for them in terms of sustainable growth and profitability. See here: TMS Insights February Reporting 2024 - YouTube [29-Feb-2024]

In that video and in their previous "Insights" video (TMS Insights January 2024 (youtube.com)), the boys also discuss the recent spate of takeovers in the building products space, including CSR (https://www.afr.com/companies/manufacturing/saint-gobain-buys-into-csr-s-dark-past-along-with-its-bright-future-20240227-p5f887), Adbri (ABC, formerly known as Adelaide Brighton Cement) (https://www.afr.com/companies/manufacturing/irish-giant-crh-and-barro-family-in-2-1b-bid-for-adbri-20231218-p5es4e) and Kerry Stokes' Seven Group's bid for Boral (BLD) (https://www.afr.com/companies/infrastructure/kerry-stokes-seven-group-bids-to-take-full-control-of-boral-20240219-p5f5xo)

Further Reading: https://www.afr.com/chanticleer/why-bids-are-flying-for-australia-s-overlooked-building-materials-groups-20240222-p5f6wo

It's interesting that Ben & Jez reckon that Brickworks (BKW) is the one they like most in the sector and one that could see some fund inflows in terms of Instos reinvesting money from BLD, ABC & CSR, because all three are all-cash bids and Insto's often look to redeploy funds into the same sector in these cases.

In the same vein, Insto money from the Altium takeover might be looking to redeploy into the Aussie tech sector - which brings us back to Xero (XRO) and Wisetech (WTC), being the premier remaining ASX-listed tech exposures.

I had previously held Xero shares but sold out a couple of years ago because they looked like pushing out that "profitable and growing those profits" stage indefinitely, partly due to overpaying for acquisitions with questionable strategies behind those acquisitions (booking write-downs/impairments in subsequent years, suggesting they overpaid and that the synergies just were not there). New management at Xero seem to have a clearer focus on sustainable profitability, as demonstrated by this reference to trying to adhere to that "Rule of 40".

Positive!

After 1H 24 result:

Morgans Hold $105.00

Macquarie Underperform $87.00

Citi Buy $135.50

UBS Buy $139.30

Morgan Stanley Overweight $125.00

Ord Minnett Lighten $78.00

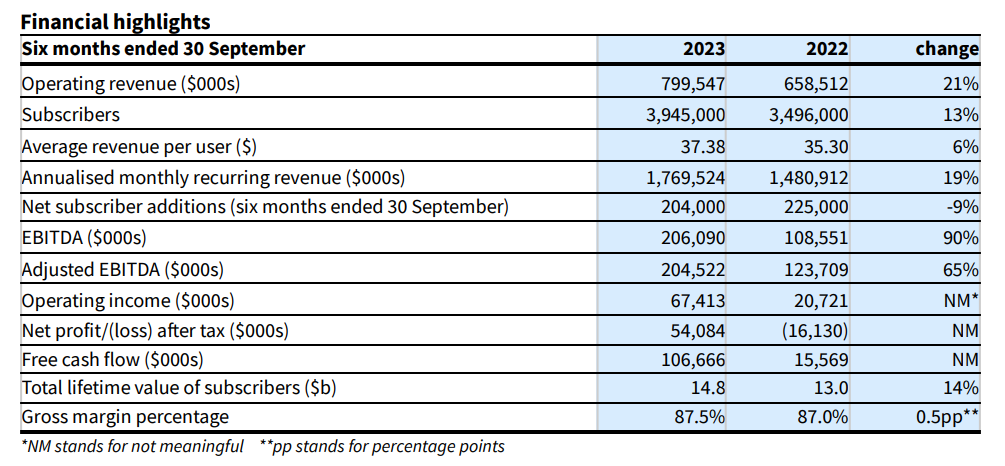

$XRO announced their 1H FY24 results this morning. These are the first results where we can see the full impact of CEO Sukhinder Cassidy's refocusing the business towards a strategy of profitable growth.

Their Highlights

Xero delivered strong operating results with operating revenue up 21% (20% in constant currency (CC)) to $799.5 million. This, along with disciplined cost management and restructuring outcomes, supported a 90% increase in EBITDA compared to H1 FY23, to $206.1 million. This reflected Xero’s ongoing focus on balancing growth and profitability, and resulted in free cash flow increasing to $106.7 million, representing a free cash flow margin of 13.3% compared to 2.4% in the prior period. This focus was also reflected in Xero’s net profit, which increased to $54.1 million compared to a net loss of $16.1 million in H1 FY23.

CEO Sukhinder Singh Cassidy said: “We’ve demonstrated good momentum this half. As we look forward, we’re sharpening our focus on Xero’s key levers of growth as we aspire to become a higher performing SaaS company. We will continue to balance growth and profitability, while delivering more value to our customers.”

My Analysis

The bottom line improvements (EBITDA +90%, Operating Income +225% and an NPAT result of $54m) are impressive, and they follow logically from the refocusing on to profit.

Interestingly, if I look across the consensus results (as reported a few days ago by GS):

- Revenue growth $800m (+21%) vs consensus of $814m

- Gross Profit $700m vs consensus of $710m

- EBITDA $206m (+90%)vs consensus of $211m

- EBIT of $79.5 vs consensus of $94m

- Subscribers 3.945m vs consensus of 3.964m

So on all metrics, expectations were high, and the result - while impressive, came in a little short.

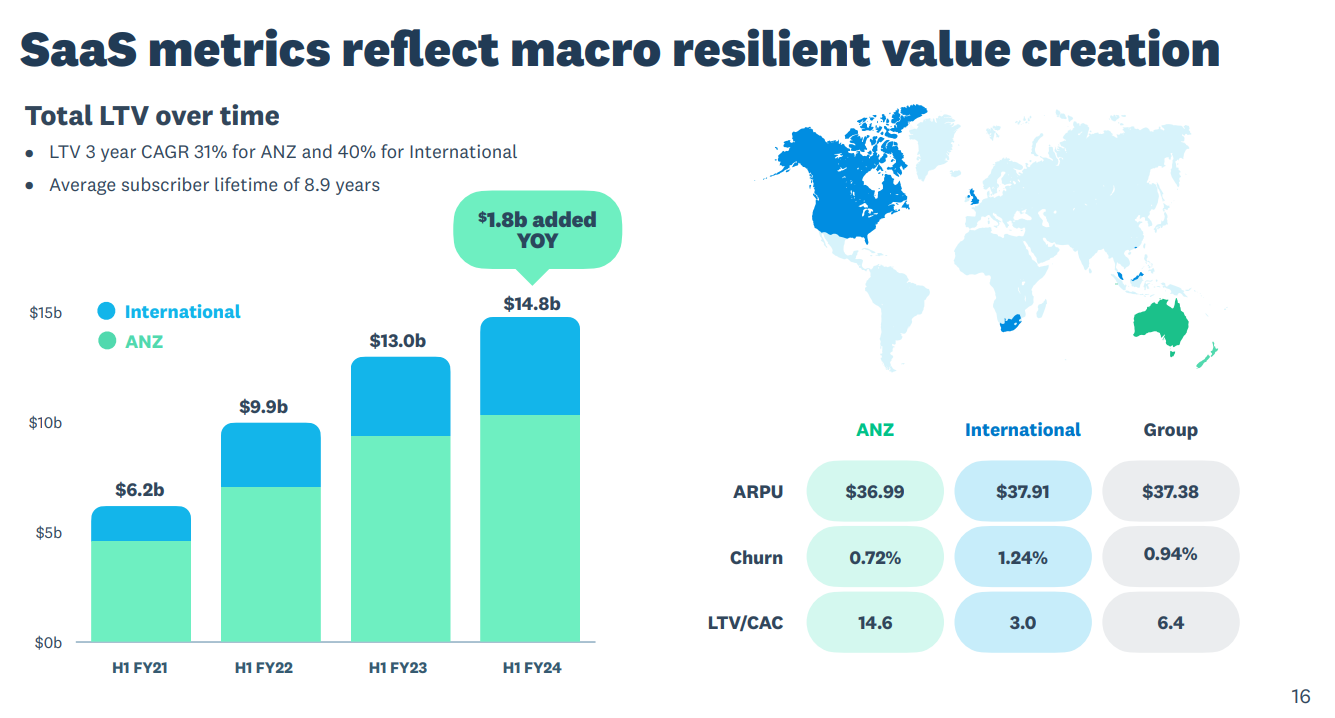

$XRO has been pulling the pricing lever this year, adding $1.8bn on LTV by growing ARPU from $34.61 to $37.38 with additional assistance from FX and product mix.

Despite the price increases, churn has stayed comfortably low with monthly churn only nudging up from 0.90% to 0.94%.

Rather than go into lots of detail, I want to focus on a few important points.

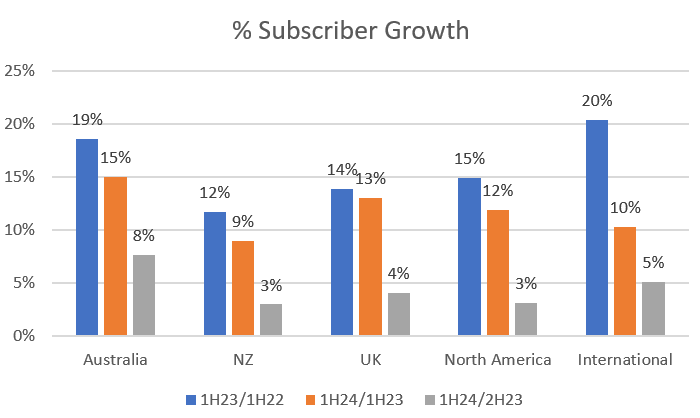

Subscriber growth is moderating. In the graph below I have compared the 1H %y-o-y additions by region (blue and orange) and I've also added the 1HFY24 h-o-h comparison to FY23 (grey bar).

Its an interesting story.

Figure 1: % Subscriber Growth (1H y-o-y for FY24 and FY23 and 1H h-o-h for FY24)

Looking first at the Y-o-Y comparisons

The powerhouses in ANZ are holding up well, although growth is moderating.

The UK is maintaining solid subscriber growth, despite the depressed economic environment in that country.

North America is also slowing - with the growth rate trending down to the ANZ average, however, $XRO has only achieved a subscriber base in this market of 396k (vs. 584k in NZ!), and while 42k were added for the year, only 12k were added in the last half (NZ added 17k in the last half!).

International, once a hypergrowth segment as $XRO entered markets such as South Africa and Singapore, is cooling significantly.

Now look at H-o-H comparison (1H24/ FY23)

The grey bar shows a very mixed story.

Australia is holding up well. 8% h-o-h is actually 17% annualised!

However, NZ, UK and North America have slowed significantly, with international holding steady at 5%, which is 10% annualised.

The slowdown should not be suprising for three reasons:

- The macro-environment has continued to cool, with businesses tighening their belts and tighter credit conditions likely a brake on new SME starts

- Price increases over the last year have been significant. Although we are not seeing churn for existing customers, perhaps there is some price elasticity for new customers?

- Competition: $INTU has declared Australia, Canada and UK as its priorty markets for international expansion. But there are multiple competing offerings, all on SaaS, in all markets.

This story is supported by the chart below from $XRO's presentation. On the key SaaS value metrics, the international business is of much lower quality with a LTV/CAC of 3.0 compared with the stunning 14.6 in Australia and NZ.

$XRO has clearly broken through into positve earnings territory - a major milestone. The focus on profitable growth and control of costs is turning this into a cash gusher, with $107m FCF and a FCF of 13%....there'll be more to come.

With guidance on operating expenses, $XRO should continue to grow strongly both with cash generation and earnings growth as all three levers contribute: price, subscriber growth and cost control.

Valuation

However, $XRO is still priced as a high growth stock, with a forecast P/E going into this mornings result of 124x and EV/Revenue of 11x.

My Key Takeaways

Directionally, today's result was always going to happen given the strategy shift. We are staring to see the economic power in this business and that is going to drive earnings and cash for some time to come. But in the details, it is a softer result. How the market responds to a soft result and slowing subscriber growth remains to be seen.

Embedded in the presentation are further details of Sukhinder's strategic review of North America. Its simply about focus and discipline in execution. We were given a heads-up at the AGM, which triggered my exist from $XRO in RL and SM. While it makes perfect sense, its not enough. $INTU has a strong incumber position, and there are other alternatives.

$XRO is a quality business, with a great product. Its leadership in ANZ appears unstoppable.

But that's not enough to justify the valuation. The fact is that there are other offerings for SaaS accounting in the material target markets of UK and USA. While the UK is still progressing well, it is apparent that success in the US will be a long haul.

$XRO has started pulling the pricing lever to drive revenues earlier and harder than my thesis to account for moderating subscriber growth. That could have a negative feedback loop on growth and create further opportunity for competition.

So farewell from me for now, and thank you for being one of my best investments ever on the ASX in the last 7years. But investing for me is about numbers and not sentiment. For me, the numbers don't stack up.

Disc: No longer held in RL and SM

Xero is increasing it price since last year to combat increasing inflation and it is constantly at it. Latest price increase in Australian market as listed in link below

https://www.xero.com/au/pricing-plans/update/

So far all businesses that subscribe to xero sees value in either xero's offering or not switching to other provider.

If you read/listen/see fundies/analysts talking about Xero. Everyone says that it's a great business but if its growth in ANZ is excellent, in the UK it's good and in the USA it's average ( general sense I get this). So I compared how subscribers have grown over the period ( from 2016 to 2023) and I found Interesting numbers.

From 2016 to 2023, in 7 years

- ANZ subscribers have gone from 498K to 2133K increase of 428%

- UK subscribers have gone from 133K to 970K increase of 970%

- USA subscribers have gone from 62K to 384K increase of 800%

- RoW subscribers have gone from 24k to 254k increase of 1270%

Considering the USA is the region it has to face maximum competition, I think I would consider it a success so far.

Another interesting fun fact, in Xero's IPO prospectus they have spelled out what is the potential market they believe they are going after and how they thought what success looked like at that point in time for them. They have done remarkably well.

Funny how after this tweet from Emmanuel Datt of Datt Capital, the share price keeps rising.

Emmanuel Datt completely missed the point.

But there's still hope he just maybe be proved right. Still lots of time between now and the next year.

I attended the investor call for the $XRO FY23 results. In my earlier straw today, I summarised the key metrics, which I’ll not repeat here. As a replay of the call is available on the IR website, I’ll just focus here on some of the key takeaways important to my investment thesis, rather than giving a summary of the entire results. I very much recommend all holders listen to the replay.

Overall, strong growth was driven by mid-teens subscriber growth (Australia 15%; NZ 11%, UK 14%, NA 13% and Int. 12%) and ARPU by 10% from $31.36 to $34.61 primarily due to price increases.

Australian growth was impressive, given the maturity in this market.

Growth in the UK has ticked up again, so the work to fine tune the model appears to be bearing fruit. Sukhinder believes that HMRC relaxing the framework for full MTD for small businesses is not essential, as small business are increasingly understanding the benefits (including business resilience) of cloud accounting. If this is true then, with a larger potential market size and much smaller penetration than ANZ, there could be a lot of running room ahead in the UK.

The presentation includes all the standard slides with some new ones added providing further transparency into the business performance, so that you get a good understanding of what is underlying and what is one-off. With the various write-downs and Waddle exit, the finances are messy, so this increased transparency is helpful.

Our first in-depth view of new CEO Sukhinder Singh Cassidy

Two words characterised the call and were repeated throughout the presentation and again in the Q&A more times than I can remember: “focus” and “discipline” as $XRO pivots from a seemingly unconstrained drive for revenue growth, to one of “profitable growth”. In a word, Sukhinder gave an impressive performance. Moreover, her presentation was well-structured and clear. In the Q&A where she had an answer to give, it was clear. Where she didn’t, she was candid and explained why.

Sukhinder has been in the CEO chair a little over 100 days, and has acted swiftly in reducing organisation costs, with a $35m restructuring charge in the P&L and the majority of cash costs to come in FY24. The benefits of these are yet to show through. I don’t think this is a slash and burn exercise, because I believe the $XRO cost base had gotten bloated as it tried to pursue too many initiatives as once.

The most important content of the presentation – for me – was Sukhinder sharing her key observations on: 1. North America, 2. Planday, and 3. Modernisation.

Observation 1. North America

We’ve all watched over the years as $XRO has made grinding progress in North America, where it remains unprofitable and a distant fourth to Australia, UK and NZ.

Sukhinder has met with customers and accountants and said she has continued confidence that North America is a critical market and that customers value Xero. $XRO estimate their global TAM is 45m customers (English-speaking markets), of which 34.5m are in North America. Today, NA only has 384k customers - a penetration of 1%, compared with ANZ where 2.14m customers represent 57% of the TAM of 3.7m customers. Even in the UK, $XRO has 970k customers of a TAM of 5.5m, so 18%.

If its early days in the UK, then North America hasn't even really begun.

She was candid in saying that she doesn’t know what the right strategy for North America is, but she committed to focusing on this over the next 6 months and reporting back to investors in November. On the Q&A a couple of the analysts tried to push for more on North America, but with only 100 days under her belt, the internal restructuring and resetting of the cost base has been the right initial focus. So, Sukhinder would not be drawn further on what she believes the answer for North America is. She is clearly keeping all options on the table.

My reflection is that we have to recognise that $XRO was first with a cloud offering in ANZ and early in the UK. By the time it had got going in North America, Intuit (QuickBooks) had launched its cloud offering, and it is the 800lb gorilla in that market. (Just doa Google trends for Quickbooks vs. Xero in the USA and you'll see what I mean!)

However, Sukhinder reiterated the view of previous management, that NA is way behind ANZ on adoption of cloud accounting, and she considers the market opportunity is sufficient for several winners. So let's see what she concludes after her deep dive!

Observation 2. Planday

$XRO took a write-down of $77.9m on Planday, reflecting a “reduction in valuation multiples along with an element of operational performance.” With the acquired Planday CEO leaving and a new CEO in place, Sukhinder noted that it had taken longer than planned to get Planday launched in Australia.

Planday (workforce management software) was acquired in March 2021 for up to Euro 183.5m, however, the upfront payment was only Euro 155.7m, and given performance to date I’m not sure how much of the performance payments were made, if any. However, as the table below shows, there is still $139m of goodwill on the books for Planday, so we might not have seen the end of this part of the story.

Waddle is now completely exited. In the Q&A, Sukhinder made clear that there are plenty of other aps available for lending against invoices, and that $XRO’s focus will be to connect to the aps customers use rather than to build an entire eco-system – an example of clear strategic focus.

Table 1: Goodwill

Source: $XRO FY23 Annual Report

In looking at the above numbers, we have to remember that these are sunk costs and while Planday may continue to muddy the financials, I am not concerned now that it is being managed within a disciplined resource allocation framework.

So where does this leave Planday? From my perspective, the original problem with the acquisition has not gone away. Most of its business is in countries where $XRO is not focused on, i.e., continental Europe. In Q&A as well as in the presentation, Sukhinder made clear that she sees a lot of opportunity in the existing (English-speaking) markets. She wants to focus on these first and importantly to find a way to crack North America. She is not looking to move into other markets in the short-to-medium term. Under Q&A she was asked about India and answered it is a “future option” that they will not be pursuing at this stage.

So $XRO will focus on seeing what Planday can achieve in Australia and in the UK, and presumably preserving the value of what it has elsewhere. There are many other workforce management platforms out there for the SMB sector, and so I expect the Planday CEO will be given a year or two (at most) to see what can be delivered and whether there is an offering that customers really value.

Sukhinder described her resource allocation strategy of a disciplined approach to “core”, “growth” and “emerging” parts of the business. I see Planday very much as in the “emerging” bucket, and it will need to prove whether it moves into the growth stage.

Observation 3. Modernisation

Sukhinder spoke at some length about the multi-year journey to modernise the software stack – its been around a while. This will be key to achieving driving greater productivity and efficiency, as well as bring greater value to customers. It sounds like this will be a core and significant ongoing part of the development spend.

Controlling Costs

Efficiency is a key new focus, measured by operating expenses as a % of operating revenue. This was 84% in FY22 and has been driven down to 80.7% for FY23, excluding the restructuring costs. The target for FY24 is “around 75%”.

If you assume revenue growth of 25% in FY24 (my target, not theirs), then for a FY24 revenue of $1.75bn, moving the cost base from 84% to 75% represents an incremental operating cash flow contribution on $158m before tax. If we use $XRO’s definition of $102m FCF this year, then that would indicate the potential for very strong FCF growth over the year ahead.

Of course, this requires efficiencies to be extracted without impacting revenue growth or investment in the platform. The good news is that Sukhinder has put a marker in the ground and I think this is what the market has reacted to positively today.

Sukhinder’s Growth Framework – Rule of 40

Sukhinder thinks about growth using the “Rule of 40”.Here the goal is to achieve annual revenue growth percentage + annual free cash flow margin percentage (FCF as a % of revenue) totalling 40%.

Under this model, the FY23 result was revenue growth 28% + 7% FCF margin (102/1400) = 35% (- even though I don’t agree with $XRO’s calculation of FCF, and I get a number more like $69m, incl lease payments or $85m if acquisitions are excluded).

If mid-20’s % revenue growth is achieved, this implies FCF getting to 15% of Revenue ... or $260m to hit Suhinders "target" (which she made clear is not a target for next year). But I think this could be do-able given what I've written in the costs section above.

Valuation

With the SP breaking back above $100 for the first time since over a year ago, $XRO is not cheap at an EV/Revenue multiple of 12x or a whopping 55x $XRO’s "adjusted" EBITDA.

Prior to analyst revisions, target prices average $100 (n=16, min=$61 to max=$128; www.marketscreener.com ). It will be interesting to see what the revisions bring. It comes down to whether the analysts see more value in a more focused, higher margin set of markets vs. previous assumptions. What they assume about NA is anyone's guess, and this will likely explain a continuing wide divergence in views on value.

My own DCF – which requires significant updating – has a central value of $113.

For now, I am happy to have bought back into $XRO, and I am happy to hold and see what the team can deliver over the next year.

Finally, a Note on my journey with $XRO

I was a long-term holder (first purchase 9-Sept-2016) and $XRO has been my most successful ASX investment in absolute terms. However, I lost patience with the approach of previous management to fail to follow a more balanced approach to growth, bailing out of my last holding in June 2021 (RL only).

When the new CEO was announced I re-initiated a position in November 2022 (RL and SM). What had separated this business from my thesis was a management that didn’t appear to prioitise cashflow generation, and were following what was in my opinion a dilutive and unfocused strategy without addressing the key question of whether the core offering could succeed in North America. I felt $XRO needed a fresh set of eyes from someone not wedded to the decisions and statements of the past.

Sukhinder’s approach is exactly what I think is needed, and so my conviction for this business has increased today, and the thesis is restored. Let’s see if the team can deliver, and let’s tune in in November to hear what Sukhinder has decided about North America!

$XRO is unproven in terms of its ability to deliver shareholder value through sustainably growing Free Cash Flows. Therefore it qualifies for inclusion in my SM portfolio, which is why I added it in November 2022.

Disc: Held RL (5%) and SM (9%)

$XRO reported their FY23 results this morning. The table below from the release show their highlights.

The financials are messy, due to yet more write-downs of acquisition goodwill (Waddle and ... wait for it ... PlanDay). However, looking past the profligacy of the past, on an operating basis the result is strong, with 28% revenue growth, Operating Cash Flow of $390m (up 65%) and FCF of over $100m.

Costs have been well-managed, and we are yet to see the full benefit of the cost reduction effort initiated late in the financial year. The restructuring costs of $35m are also a drag on the financials.

As highlighted above, the operating leverage is now showing through strongly and with disciplined management, we will now start to see $XRO becoming a strong cash generator.

Growth was driven both by new subcribers, price increases and usage, and monthly churn stayed low at 0.9%. Importantly, as the major price rise was in September, with a small one in mid March, there is a strong revnue exit run rate for the year, which sets up FY24 with a good start.

Customer additions were strong in Australia (+15% yoy) and UK (+14% yoy), and were double digits across the board. North America still making steady but slower progress at +13% (competition from Intuit is just too strong).

Jumping on the Investor Call at 10:30 and will report any significant insights over the next day or so.

HIGHLIGHTS FROM RELEASE

CASH FLOW TRENDS

(Note my numbers for FCF are different from their reports, as it looks like we include/exclude different items in getting to FCF.)

Disc: Held IRL (4.8%) and SM (8.3%)

Acquisition History

· December 2021 Taxcycle (the trading name of Trilogy Soware Inc) CA$70m to be settled 71% in cash and 29% in shares. a leading Canadian tax preparation soware company for accountants and bookkeepers, to support Xero's strategy for growth in this strategically important market. The acquisition will provide Xero with immediate access to an established Canadian income tax solution and customer base, local expertise and capability to extend its product offering in that market. https://www.asx.com.au/asxpdf/20211223/pdf/454hw7tthwp4yz.pdf

· November 2021 LOCATE (trading name of New Tack, Inc) US$19m - a US cloud-based inventory management provider, to better support the inventory needs of small business and enhance its ecommerce capability. https://www.asx.com.au/asxpdf/20211111/pdf/452v0lm25r3hzv.pdf

· March 2021 Tickstar Total consideration for the purchase of 100% of Tickstar will be up to SEK 150 million, comprising an upfront payment of SEK 60 million, to be settled 50% in cash and 50% in shares in Xero Limited, and subsequent earnout payments based on product development and performance milestones, of up to SEK 90 million. Tickstar an e-invoicing infrastructure business that allows organisations such as Xero and its customers to connect to a global e-invoicing network. https://www.asx.com.au/asxpdf/20210324/pdf/44ty3g7fw7qhcp.pdf

· March 2021 Planday With an upfront payment of €155.7 million and a subsequent earnout payment of up to €27.8 million based on product development and revenue milestones, the total potential consideration for the acquisition of Planday is €183.5 million. Planday a leading workforce management platform with more than 350,000 employee users across Europe and the UK that simplifies employee scheduling, allowing businesses to forecast and manage their labour costs. https://www.asx.com.au/asxpdf/20210304/pdf/44tb94y37knkhc.pdf

· August 2020 Waddle upfront cash payment of AUD $31 million and subsequent earnout payments based on product development and revenue milestones, of up to AUD $49 million, the total potential consideration for the purchase of 100% of Waddle is AUD $80 million. Waddle a cloud-based lending platform that helps small businesses access capital through invoice financing. https://www.asx.com.au/asxpdf/20200825/pdf/44lvg45xcc251t.pdf

· August 2018 Hubdoc acquisition price for Hubdoc in two stages, initially US$60 million consisting of 35% cash and 65% in Xero equity. Xero has arranged new debt funding for the cash component of the acquisition price. A second tranche of US$10 million in equity will be issued to Hubdoc’s shareholders in 18 months, subject to meeting agreed operational targets and conditions. Hubdoc is leading data capture solution that helps accountants, bookkeepers, and small businesses to streamline administrative tasks such as financial document collection and data entry. https://www.asx.com.au/asxpdf/20180801/pdf/43wzn9dc6s54rv.pdf

· November 2014 Monchilla US$4.12m Cash & 238,490 XRO shares - Seattle-based online payroll company. Integrating Monchilla with Xero provides improved business-to-government connectivity, and the opportunity to deliver 2015. https://www.asx.com.au/asxpdf/20141106/pdf/42tjfnvyky2j9p.pdf

Abbreviated Short History

· March 2023 Reduce costs, organisational changes reduce 700-800 roles globally and streamline Xero’s business. Xero also plans to exit cloud-based lending platform Waddle - which Xero acquired in 2020 - and expects to incur a write down of $30-40 million in FY23 as a result of this decision. https://www.asx.com.au/asxpdf/20230309/pdf/45mgyyq418tmt0.pdf

· November 2022 Announced Steve Vamos to step down and be replace by Sukhinder Singh Cassidy on 1 February 2023. https://www.asx.com.au/asxpdf/20221110/pdf/45hfn9n6d9p2r3.pdf

· November 2020 Launches an offering of US$700m convertible note offering. https://www.asx.com.au/asxpdf/20201124/pdf/44q6rdfcnybh4m.pdf

https://www.asx.com.au/asxpdf/20201203/pdf/44ql2pxnf05g9s.pdf

· September 2018 Launches an offering of US$300m convertible note offering.

https://www.asx.com.au/asxpdf/20180926/pdf/43yp0pghpr9bq4.pdf

· March 2018 Rod Drury one of founders of Xero steps down and replace by Steve Vamos. https://www.asx.com.au/asxpdf/20180305/pdf/43s54m25355b9b.pdf

· February 2015 Raised NZ$147.2m from Accel Partners and Matrix Capital Management https://www.asx.com.au/asxpdf/20150225/pdf/42wv72yvmgd4z2.pdf

· October 2013 Raised NZ$180m from a range of US and NZ investors including Matrix Capital and Peter Thiel backed Valar Ventures at NZ$18.15 per share. https://www.asx.com.au/asxpdf/20131014/pdf/42k023vzfmf4ts.pdf

@TycoonTerry interesting perspectives. I am also a long term holder (9-Sept-16; $19.36; courtesy of Matt Joass, MF Pro)

I think it is important to understand how $XRO got to where they are and the strategy that drove the acquisitions - which I am sure you know.

$XRO started as an NZ small business accounting software provider that was the first to disrupt traditional accounting by providing a cloud solution that removed a bunch of on-prem hassles from business users, and more importantly transformed the way businesses could manage their book keeping and their relationship with their accountants. Both business owners and accountants appear to love it.

Starting in NZ, which has an entrepreneurial culture and is adept at rapid adoption of innovative home-grown solutions, over time it grew to dominate the market - achieving c. %60 market share in cloud accounting in NZ by 2021.

This provided the spingboard to enter Australia, where the incubment - MYOB - was not yet cloud-based. Rapid growth in Australia turbocharged an already profitable and focused NZ business, and delivered the operating cash surplus for reinvestment in the platform and international expansion.

The various acquisitions were part of building an overall integrated SME finance "ecosystem". At one stage around 2018-19, some pundits were saying the blue sky valuation was $100bn! I think we all got wrapped up in that story - I certainly did.

In truth, the various acquisitions to broaden the scope of the $XRO platform are essentially unproven in large part and international expansion faced inevitable competition, nothwithstanding the relative immaturity of cloud-accounting. As international expansion was taking off, everyone else (Intuit, Sage, etc.) also moved to the Cloud. So the initial point of difference in ANZ was lost.

Furthermore, each local jurisdiction requires a tailored implementation and, the relationship between businesses, book-keeping, accountants and tax professionals are different, requiring both localised code and local go-to-market strategies.

A further complication is that UK, where $XRO had a good initial run at a market that could be 2-3x ANZ, got bogged down in BREXIT and COVID blues. HMRC relaxed some of the MTD deadlines that provided initial impetus for small business and sole traders to go online, so growth there has slowed and they face more competition than in ANZ. However, they still have a strong position and are in the early days compared with ANZ. (See Figure 1)

See Figure 1 (UK), Figure 2 (USA) and Figure 3 (Canada). Competitive position looks strong in UK, very weak in USA and moderately weak in Canada. However, together USA and Canada are much larger markets than ANZ and UK combined, so even a small business here - if it is focused - might ultimately be profitable. Also, cloud accounting adoption has been relatively quick in ANZ, with other countries several years behind ... especially USA!

Figure 1: Google Trends Analysis for UK (Xero, Quickbooks, Sage; last 5 years)

Figure 2: Google Trends Analysis for USA (Xero, Quickbooks, Sage; last 5 years)

Figure 3: Google Trends Analysis for Canada (Xero, Quickbooks, Sage; last 5 years)

My concern, is that with Waddle, I wonder if we are seeing a foretaste of a future larger writedown of the more material PlanDay acquisition? There hasn't been much newsflow of $XRO kicking goals with PlanDay, and despite it being available in Australiasince 2021, Google Trends almost shows a flatline, when compared with Deputy and ELMO - other SME solutions in HR and workforce management. I also haven't met any Xero users who use it.

So why do I still hold $XRO? (albeit regretting not offloading at $150!)

At its core, is a set of functions valued by customers. Clearly the cloud accounting is core, and only $XRO management truly understand the respective value of each of the other functions in the platform. I believe that the expansionist mindset of previous management meant that they were not examining this core.

The new CEO appears to have got this. I believe there is headroom to grow the core adoption and value in the established markets: NZ, Aus, UK, USA, Canada, South Africa, Singapore, and the operating cashflow is strong enough for $XRO to continue to innovate and build its core offering, while also generating free cashflow.

I had been waiting for and hoping for this change of direction. I almost sold out last year despairing that we would ever see it under Thodey / Vamos, but I decided to hold on when the new CEO was announced.

In truth, I now have a much lower conviction on $XRO. I am going to give the new CEO 12-24 months to see whether she can move the dial. I will not hold any future write-downs of past acquisitions (e.g. PlanDay) against her, as that would be consistent with my overall thesis and in any event these costs are sunk.

Disc. Held

@mikebrisy I just wonder if cutting 700-800 roles is in line with broader tech layoffs and whether it will affect disruption in the industry (Intuit), or both.

Sure cutting that many staff will add to Opex but it’s also going to affect their ability to innovate and disrupt what they are clearly targeting with their US operations.

If the goal is top line growth, what will the impact of this be?

Maybe this new, streamlined Xero can make new inroads in that tough market (I hope so, been holding since $20 IRL). It is good news no doubt, as I really think change was needed as over the past few years they really have seemed to lose that midas touch and have finally acknowledge some less than intelligent acquisitions but as always. Time will tell.

Precisely 2024 will tell what they do with that 20-30m of cash and added Opex

Very rough thumb suck.

Listened to the Equity Mates podcast with Owen from Rask Australia and they did a rough valuation.

Their predictions for 2032 (10 years time)

- Revenue of $3b

- NPAT of $1b

Profit margins of 30% are not outrageous if they can continue to grow their subscriber base.

At a 30x PE in 2032 and then discounting back 10% a year gives a valuation around $77.

On the podcast, Owen gave a range of valuation of between $70-$85.

This is probably more of a look into what Xero needs to achieve at the current share price. The above is probably possible provided they nail growth in the UK and NA (Canada is being touted as the possible main growth possibility here). And then some further minor growth at home in ANZ should get them to the desired targets.

I think under $70 is probably a better buy in price given the current uncertain macro conditions.

Disc: Held IRL and on Strawman.

Good read on the business and current challenges - The Xero Story (a 2023 update) - find the moat

Some more bad publicity on Intuit (competitor) in the US

Nine years ago, ProPublica reported on how for-profit tax-preparation software companies, such as Intuit, the maker of TurboTax, had successfully lobbied to stop the IRS from creating an easy way for millions of taxpayers to file online for free (something many other countries provide). Instead, the IRS struck a deal with these companies to offer their products for free to qualifying taxpayers, while the government pledged not to create its own competing system.

In 2019, as Intuit was lobbying Congress to make this agreement permanent, ProPublica exposed how TurboTax was using deceptive design and misleading tactics to steer low-income filers to paid versions of its service when they were eligible to file for free. This tactic worked. Only a tiny percentage of eligible taxpayers actually used the free products.

Our investigation spurred public outcry, federal and state investigations, lawsuits and more. The IRS announced major reforms to its agreement with the tax-prep software industry, including new policies that allow citizens to file their taxes for free directly with the IRS. And this summer, the recently passed Inflation Reduction Act included $15 million for the IRS to study free tax filing options. This is a critical step toward a public filing option for all Americans.

This entire investigation represents how powerful and wide-reaching journalism can be when published in the public interest. And with the public’s support, we’re able to really dig deep and uncover practices that corporations would much rather remain hidden.

Claude Walkers post on a Rich Life leaves you in no doubt as to his feelings re: XRO's FY 23 results and Management.

https://arichlife.com.au/xero-asx-xro-results-see-xero-share-price-slump-on-h1-fy-2023-numbers/

Held IRL but not SM

FY22 AGM about to start. Attached, the addresses and presentations.

Key messages:

- No change to guidance

- OpEx coming in at lower end of the range of 80-85% of revenue

- UK growth continues to be sluggish, but they still see opportunity. (Personally, having just returned form UK, things are generally quite depressing there!)

- Xerocons up and running again, including first in UK.

Nothing of any substance about US.

Onwards and upwards.

Disc: Held IRL

Just putting out a contrarian view on Xero. I'm missing the continued excitement about Xero. I'm willing to concede it may be a high quality company. And also concede I haven't studied the company intensely. But the current price is enough to turn me off with some back-of-the-envelope calculations. Assuming 20% growth over next 5 years (given they are maturing in Australia I think it unlikely they can achieve the 30% CAGR they have shown over last 5 years), even allowing them to grow to 20% net income in 5 years (which I believe is very optimistic), and granting a PE of 30 (reasonable for a company growing 20%), and discounting 15% pa (allowing for some risk given they are a long way off the estimate of 20% net income), I get $50. Even if I discount by only 10% I get a price of $62. Or if I allow for an ambitious 25% pa growth over next 5 years and a PE of 35 (both of which I see as unlikely) I get a price of $70. Big picture, personally I'd need to see a further drop of at least 30% in share price before I became interested. The thesis for Xero seems to depend on them being able to achieve the same outcome overseas that they have achieved in Aust and NZ but I think they will struggle with growth and margins overseas with greater competition and different regulations.

A few quick points I took away from the Q&A on today’s investor call, summarised in my words. (Presentation was a rehash of the results pdf)

- No significant churn increase with recent price hikes, subscribers average 9.3 years

- Investment into growth is still a key criteria. The de rating of tech stocks hasn’t changed the reinvesting revenue thesis.

- Wage inflation has been considered with op expense budget

- Competition, there has been no significant changes in the landscape. UK in particular sounds like a land grab with the impending digital compliance for small business pushing them towards digital/cloud solutions, currently 1/3 SME have migrated in the UK.

- Pricing strategy focuses on adding value through new/additional components to improve ARPU

- M&A comments, cultural fit with XRO noted as key consideration and management are happy with acquisitions integration to date.

Held IR

below is the last 6 haves, rev cfo and pbt. the last year had $42m in acquisition rev. At $80 11-12x rev TTM. XRO is/was the tech insto favourite so traded on 20x sales at one stage. given the lack of earnings there is a possibility of it gets marked down if the Fed goes hard or long or both. choose your own multiple of sales, under 5x would be a great price. disc not held

I agree with @Wakem that XRO's results were positive, in that they reported:

- Good growth

- Low churn

- Continuing to grind out inroads in North America

- Very small Loss

So why the 10%+ sell down to around $77 to $78 share? The main areas of concern that the market may have, as I see it, are the reduction in free cash flow and the lack of profitability. In the current environment, I think the market is looking for companies that are on the verge of profitability to report profits rather than small losses. It's mostly psychological but it seems to make a difference to Mr. Market at this point.

I like that they are highlighting the balance required to keep investing in the business for growth in the commentary I've reproduced below:

It looks like a "buy" to me. However, in the current environment where tech stocks are getting hammered and the NASDAQ is leading the US markets south, I'm not sure how much lower XRO can go, but I feel that lower levels are still possible.

Disclosure: I hold XRO IRL and I'm thinking it's time to add them back into my Strawman.com portfolio also.

Highlights

- Good growth

- Low churn

- Continuing to grind out inroads in North America

- Very small Loss

Xero are continuing to execute...

This is more my target price to buy, rather than my valuation. I believe XRO will be trading around these levels as the US Fed hammers global liquidity over Q3 2022.

Update: $1.1 BN revenue, but negative operational leverage. Cost anticipated to remain at similar run-rate going forward.

Xero is investing in its platform, and attempting to build market share. Long term, this may pay off for shareholders. One notable thing with subscriptions is that Xero is yet to normalise what they are charging customers. This may be a sign of intensifying competition.

Given that revenue growth has recovered, and the substantial investment being made, this should ensure this growth momentum is continued. Risks concerning execution, and competitive landscape are things to watch.

Given tightening liquidity, and rising interest rates (for the moment), I am applying an EV/S of 5 on FY 2023 anticipated revenue.

Xero has announced the acquisition in Planday -- a workforce management platform (that allows small businesses to manage payroll, staffing levels, leave etc) -- in a deal worth EU155.7m plus a further EU27.8m in earnouts if certain targets are met (AUD$240m, plus AUD43m in earnouts). It has around 350,000 users.

It's all about broadening the small business offering. It will allow Planday to be cross-sold to existing Xero users, and expand it outside of Europe and the UK.

In theory, it should also bind Xero's offering tighter into customer's processes, and thereby increase retention and pricing power. Planday has been an ecosystem partner with Xero since 2019, so it's already integrated and you'd imagine Xero has some good insight into its popularity with users.

45% of the deal will be paid in shares (roughy $1m new shares, next to 146.7m outstanding), the rest in cash.

I really like xero. Actually bought a lot of shares years ago at ~$12 and thought i was a genius when i sold out at ~$20.. Not sure how many times i'm going to make the mistake of being too fussy and too conservative on price for high-quality, fast-growing businesses with long runways..

But maybe i'm still making that mistake with Xero right now. I just find it very hard to get past some of the multiples. A 24x price to sales, and a 320x PE, for a $17b+ company, just seems waaaay up there.

From December 21, 2020, XRO will enter the S&P ASX50 index, as will Afterpay (APT). OSH & VCX are the two stocks moving out to make room for XRO and APT in the ASX50.

APT is also entering the ASX20 index (replacing IAG), which is a MAJOR milestone!

Other index inclusions and removals:

ASX100: In: IEL, MIN, REH. Out: ILU, FLT, NHF.

ASX200: In: KGN, REH. Out: AVH, COE, WSA

ASX All Technology Index: In: 3DP, 4DX, BID, DTC, FDV, FZO, HTG, LBY, MMM, OTW, TNT, WBT, YOJ. Out: RAP.

All of these changes will occur prior to trading on Monday December 21st, 2020. See here.