The picture varies significantly by market.

In Australia its really just $XRO (50%), MYOB (30+%), Quickbooks (10%), and Sage (insignficant).

There is a long tail of others, but none has a significant market share. Different markets shares are estaimated in different sources. So, for example, some have $XRO as high as 60%, with MYOB down to 20-25%, and Quickbooks as high as 15%.

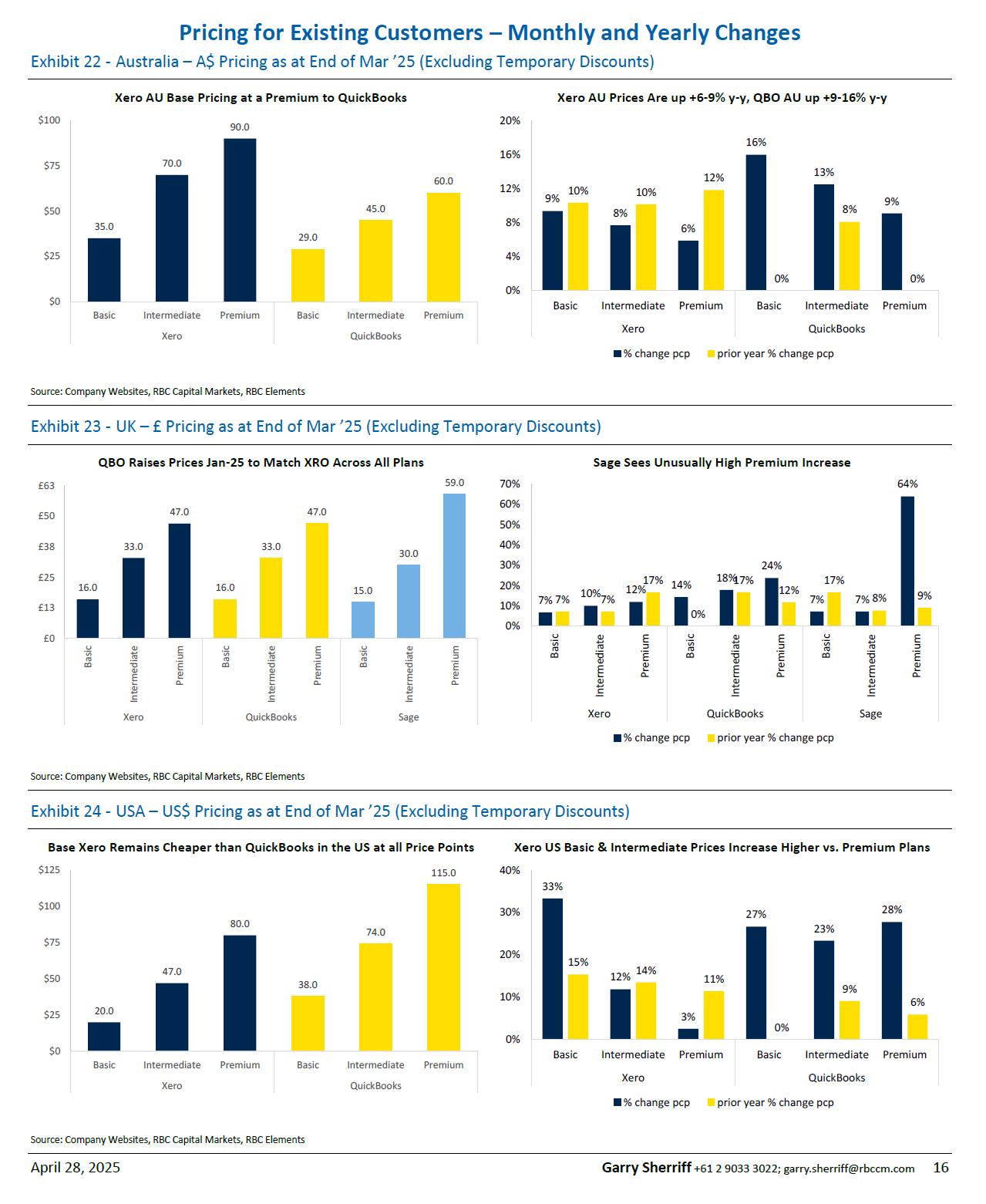

On pricing, $XRO and Quickbooks tend to follow each other. Again, I get some conflicting answers from different sources. RBC published the attached in their recent note, but if I look at the Qucikbooks site today, the premium plan after discounts expire is $100/month for up to 25 users (but with Payroll as an add-on), whereas the $XRO Premium Plan is showing $115/month restricted to 10 people for certain functions, but with payroll for 10 people included.

My sense is that $XRO and Quickbooks track each other quite closely in Australia

MYOB doesn't scale as well, incremental users see costs increase at a faster rate than $XRO or Quickbooks. The MYOB user experience is generally considered more clunky, and there are fewer integrations. (Xero 1000+, Quickbooks 750, MYOB 300 - but I have no idea how much of a differentiator that is!)

UK

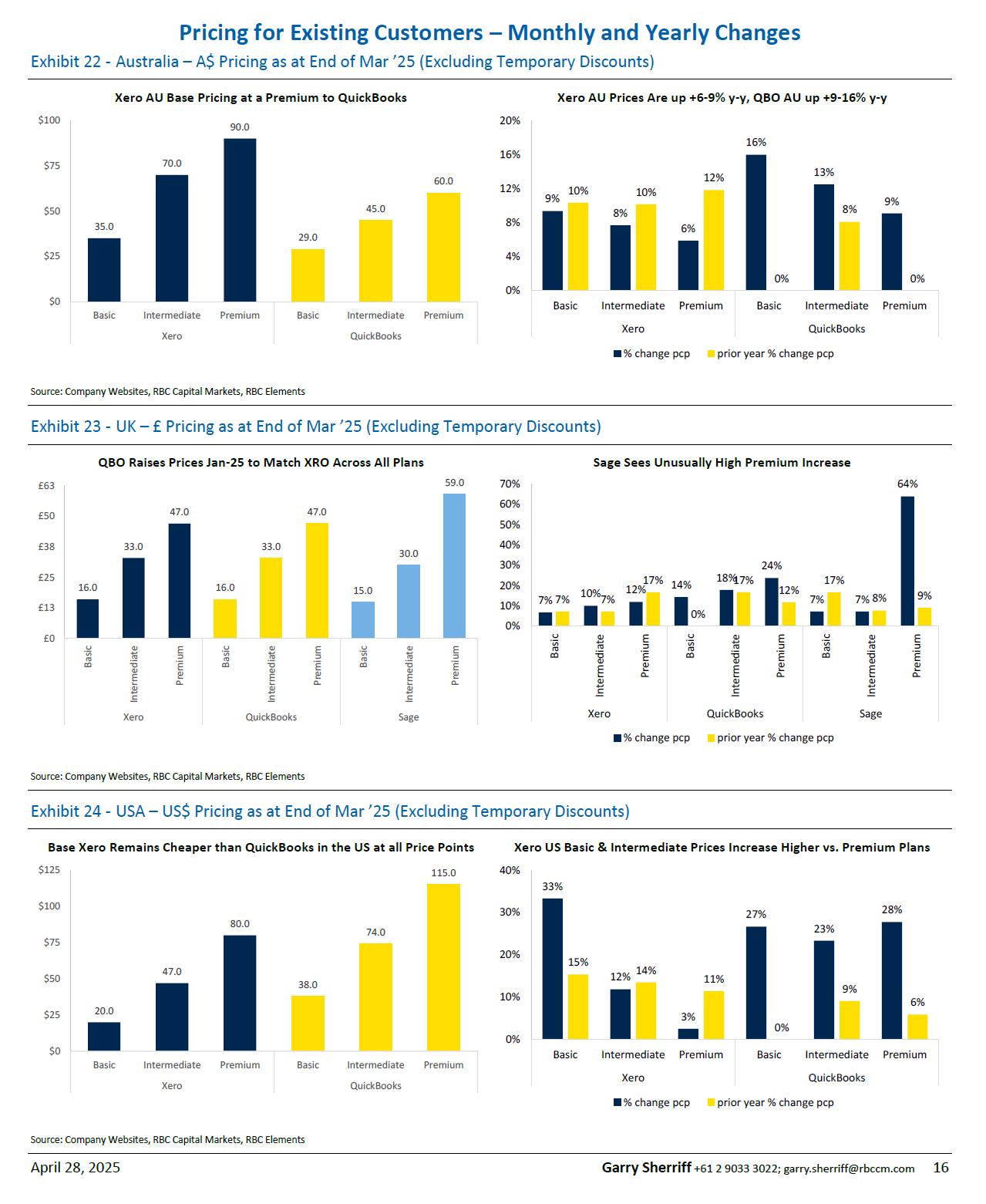

Its a very different picture in the UK, where Sage is the market leader (c. 30% ) in its home market, $XRO (c. 25%) and Quickbooks (c. 20%). It is very much "game on" in the UK between $XRO and Quickbooks. $XRO was able to dominate MYOB in Australia almost unopposed 7-10 years ago. No so in the UK.

Both Quickbooks and Xero are growing market share at the expense of Sage ... Sage is looking more and more like MYOB was in Australia. It's market share has fallen from c. 40% 5 years ago. And that's because both Xero and Quickbooks positioned themselve to take advantage of the MTD (Making Tax Digital) initiative, which has driven cloud accounting adoption in the UK since 2019.

The UK looks to be getting carved up between Quickbooks and Xero. As the RBC analyss shows, Xero and Quickbooks are matching each other plan for plan, and pricing aggressively in the premium segment vs. Sage. (Although I think Sage is more fully featured for the premium clients ... not sure.)

The UK is also different from Australia in that there is a more significant tail of secondary players, so worth keeping a eye on them in case of any disruptive innovations.

Ultimately, I think we'll see Xero and Quickbooks controlling 60%+ of the market between them, and this should allow for "orderly" conduct on pricing. The top-3 could conceovably control 90% of the market before long.

USA

In the US Quickbook has around 80% market share, Sage is second with around 10% and Xero is a close 3rd. (Even in NZ, where $XRO started and dominates, its share is "only" 60%.) So Quickbooks really is the 800-lb gorilla in the US.

However, the US is an evolving story. For example, $XRO are still building the product stack in the US. Billing was only turned on last month.

And $INTU (Quickbooks) are a much bigger, diversified business. Will they have the same focus as $XRO on SME accounting?

Singificantly, @Mujo pointed out a few days ago that there is also a divergence in strategy emerging, with $INTU encouraging their SME customers to ditch their accountants and do it themselve, using their products like Turbotax. Now, maybe that is the way of the future, I don't know. But with $XRO fully focussed on winning accountants as their key customers and advocates, could this open a valuable niche in the US market? Even if it opened the door for $XRO to take the lead in as little as 25% of the US market, that would be bigger than Australia and UK combined.

The other thing to recognise is that the US is relatively immature in penetration of cloud accounting software. Whereas Australia is at around 80% and UK probably north of 70+% now (with MTD giving real impetus), the US is laging far behind at around 44%.

Conclusion

There is still a lot to play for in Xero's overseas expansion. Without doubt, CAC's will be a lot higher overseas and certainly USA and UK will be more competitive than Australia has been historically.

As long as Xero doesn't mis-step (e.g. big dumb acquisition) and continues to execute well, there is another 5+ years for this to play out IMO. The good news is that there is small number of leading players in each market - 3 in each case - controling around 75% - 80% of market share. And if that is maintained, then there is every chance that these markets will remain orderly from a pricing perspective, with the players able to exert significant pricing power.

So, I can see a path to Xero justifying its valuation on an ongoing basis. However, it is by no means a slam-dunk on risk-reward.

I have a wavering and lower level of conviction on $XRO compared with some of the my other quality holdings ($WTC, $TNE, $RMD, $BRG).I have been that way on $XRO for a while, and have even had some time when I sold out (c. $130, late-2021) only to buy back (c. $70, late 2022).

As you say, "SP incorporate no issues on the horizon", and therefore I'm being mindful of not having a bigger position size than current 6.5%.