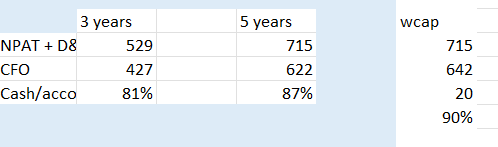

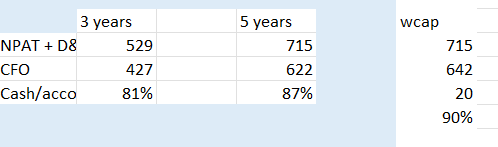

@Mujo i have a holding here, but not particularly large. Airlies' move is interesting as they are serious investors. imo. at this stage, i am aware but not concerned about the ND levels, but cash flow has clearly deteriorated. The FY24 result was 61% cash/npat conversion, and even adjusting for w/c, not great. signs of a business under stress. i usually use yearly averages here because cash can be quite lumpy. so the jury is out for me. if it persists, it calls into question the quality of the company, as this kind of company should have reasonable cash conversion, imo.

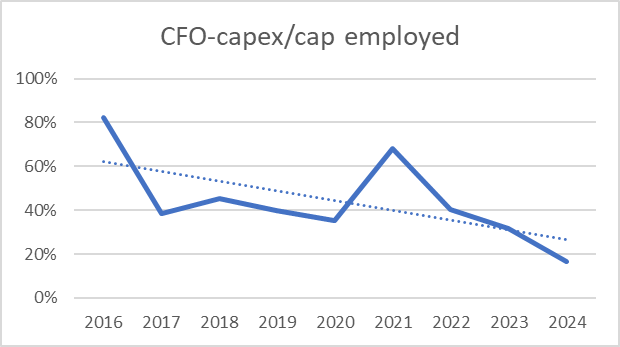

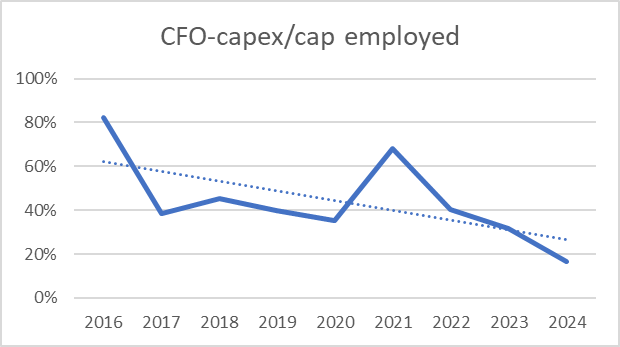

(CFO-PPE)/cap employed also downward deterioration. these indicators are not healthy and I would not at least some signs of stabilisation before i increase the weight ion any meaningful way. We all know the issues here with international student trends and the company will always have excuses, but I'm just holding at this stage. certainly, the SP will not improve until these fundamentals start to turn or at least stabilise, imo.