Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

$IEL provided a trading update this morning.

Reading through it, it is as if they've read my post last week on the Tax Loss selling Forum! So, I can honestly say I was not surprised to see today's announcement.

The SP reaction - well that's another thing altogether!

Here's their headlines.

"IDP’s key destination markets continue to be impacted by policy uncertainty, which is negatively impacting the size of the international student market globally.

• UK: heightened uncertainty following release of Immigration Policy White Paper, with further restrictions on student immigration expected

• Australia / Canada: restrictive policies remain post-election; further policy changes pending •

Canada: student demand continues to decline sharply due to ongoing policy volatility

• US: international student environment increasingly negative

This continued uncertainty has impacted IDP student enrolment pipeline size and conversion rates in the important May and June pipeline build given the timing of the fall intake in the UK, Canada and the US, as well as the second semester intake in Australia.

In FY25, IDP’s Student Placement volumes are now expected to decrease by c. 28% - 30%, and IDP’s Language Testing volumes are now expected to decrease by c. 18% - 20% compared to FY24. The impact on revenue will be partially mitigated by continued strong average fee growth.

IDP now estimates that Adjusted FY25 EBIT1 for FY25 will be in the range of $115m - $125m. The business has continued cost control initiatives since the half year, with Adjusted Overhead Costs2 for H2 FY25 now expected to be approximately 5% below H2 FY24, despite IDP’s negative operating leverage. "

My Assessment

Personally, I'm glad I spend so much of my time following what is happening politically and economically around the world, but you'd have to be living under a rock not to have seen the chilling, headwind blowing across the international student sector at the moment for multiple reasons.

None of this changes my view that $IEL is a global leader in its sector, and also, I believe that in time the business environment will turn. However, what has changed from my perspective in the last few months, is I no longer have a view as to how long these headwinds will blow. And for that reason the impact on enterprise value is real and material.

And that's why my thesis broke. Today, I'm particularly glad I bit the bullet when I did.

Disc: Not held

Airlie flagged the following in the March fact sheet:

• IDP Education (-25%): A poor result from IDP left us with more questions than answers in relation to working capital and cash flow, and we have since exited our position. While we acknowledge we could be selling the stock somewhere near the bottom of the regulatory cycle, we have a growing unease with the combination of a deteriorating balance sheet and a growing divergence between EBITDA and cash flow that to us suggests further downside is possible.

Does anyone have an opinion? insight?

The fall in cash flow appears to be due to "There was a $71.1m increase in contract assets mainly due to finalised UK applications yet to be invoiced for the 2024 fall semester." - which seems reasonable but haven't dug into whether this is usual.

Here’s a belated update on IDP Education following their half year results.

In summary, IDP Education continue to face tough conditions. They have declining student placements and testing revenue, particularly in India and Canada. They are however, well into cost control measures and price adjustments. They report to be committed to long-term growth through digital transformation, market diversification, and operational efficiencies.

I believe there is some murkiness in their reporting but nevertheless I believe they’re on a good path and that they have performed above market average notwithstanding their macro headwinds.

Revenue and Profitability:

- Revenue: $475.4M (down 18% YoY)

- Net Profit After Tax (NPAT): $59.7M ( down 39% YoY).

- Earnings Before Interest & Tax (EBIT): $95.0M ( down 35% YoY).

They state that the decline in revenue and profit was primarily due to reduced student placement volumes and English language testing. They also state that cost management measures helped mitigate some of these declines.

Business Challenges:

There was a decline in student placements (i.e. IDP placing students into universities abroad) of about 18%

- Canada: down 43%

- Australia: down 25%

- UK: down 24%

- USA: down 18%

- New Zealand: up 57%

- Ireland: up 28%

In terms of revenue, India, a key market, saw a 26% drop and China saw 4% growth, driven (they say) by UK placements.

A key part of their business is the English Language Testing (IELTS Exams) services. Revenue fell by 22% which they attribute to:

- Regulatory changes in Canada (this is a big one that has been on the horizon for a while now)

- Visa processing issues in key markets

- Increased competition in India saw IELTS revenue decline by 55%. Note that this is different from above as IELTS is different to student placements… We would for example not expect all IELTS students then go on to apply for university placements through IDP. (there are other agents)

Cost Control

They have been cutting costs aggressively to help combat the projected decline.

- Direct costs were reduced by 10% they say due to cost control across student placement and testing.

- Overhead costs fell by 16% (to $167.8M):

- Corporate expenses (-23%) they say due to lower headcount and discretionary spending.

- Marketing (-7%)

- They also mention that travel costs were cut.

- Gross profit margin declined from 64.6% to 61.3%

Dividend

They issued another 9c per share dividend (50% franked) for March 2025. (it was 9c in September.

Outlook

They comment that there are pressures from declining student volumes and changes to regulation but the call out their growth strategies which include:

- Using digital marketing and student services

- Expanding market presence in China, New Zealand, and Ireland, where demand remains strong

- Investing in technology and customer experience

- Continuing to drive cost efficiency and disciplined financial management

Critical Assessment

I’m always mindful that the combination of macro challenges can be used to hide the truth behind competitive pressures. To that end, there are some areas to keep an eye on for the future. I’m concerned that loss of market share might be hidden behind a ‘market conditions’ narrative.

IDP attributes the 18% revenue decline largely to lower student placement volumes (due to regulatory changes and visa processing delays) and a 55% drop in English Language Testing revenue in India (due to Canada's student visa caps)

At the same time their price per student placement actually increased by 12%

So to what extent should the price increase have mitigated revenue losses and to what extent is IDP losing market share to competitors?

They reported:

- 15% drop in Student Placement revenue (from $287.5M to $244.2M).

- 12% increase in average price per student placement.

- 18% drop in placement volumes.

For ease of calculation let’s assume a volume of 100 courses.

- H1 FY24

- Revenue: $287.5M

- Volume: 100

- Average Price per Placement: $287.5M / 100 = $2.875M per unit

- H1 FY25 (which includes a 12% price increase)

- New Average Price: $2.875M × 1.12 = $3.22M per unit

- Placement Volume Decline: 18% drop → New Volume = 82 units

Expected Revenue in H1 FY25:

- Revenue = 82 * $3.22m = $263.9m

- Reported Revenue = $244.2m

- Gap = $19.7

For those newer to IDP, we have been expecting a change to student numbers in Canada due to international student caps and removal of the Student Direct Stream visa pathway in Canada.

But why this gap? Is it really just down to fee variances? If any Strawpeople know I’d be glad to find out if I’ve made an error here?

That little Tax Issue:

There’s an ongoing tax dispute in India which on the surface looks like they may owe, I think up to $121m if they are unsuccessful. There’s no provision in their accounts for such a penalty. They believe that the risk of paying the full amount is low based on legal advice, historical similar rulings etc. but we need to keep an eye on this one, not least because there’s no provision made for it.

Why I’m bullish

Notwithstanding negatives I’m bullish:

- They’ve increased average revenue per student in the ‘Student Placement’ category which suggests a moat built through the perception of their quality and the relationship they have with universities.

- Growth in NZ and Ireland for student placements is positive diversification

- They have a growing cash balance, and have enough to make growth investments

- They have been successful in implementing cost controls, even if it may have been more reactive rather than proactive. This will set them up when the macro condition improves.

- Folks still want to travel overseas to study. Global demand in this space is growing and IDP is one of the major players in this space. There will be a recovery at some point.

Assuming that we see turn-around and growth at above average rates (assuming 4.5% CAGR in global education) over 10 years I think that the current share price is justified for a hold. I’m not sure we’ll see any significant changes in the next two years but I’m looking to a one to two year rebound in the next five years, then followed by a period of stability.

In the very short term I’m hoping that conditions result in further share price decline into the high $6.XX a share arena, but my monkey brain is saying I should take a position now because I think they're well positioned to out-compete in this space.

Held IRL and SM

Today IDP Education shares reached an intraday high of $13.20 (up over 7% ) before closing at $12.74, up 3.9% for the day.

James Mickleboro from The Motley Fool thinks the share price reaction could have been driven by a broker note out of Macquarie. According to the note, the broker has upgraded IDP Education's shares to an outperform rating with a $16.00 price target.

Before market open today James Mickleboro reiterated Goldman’s view:

“We believe IEL's premium valuation is justified given the medium-term earnings potential driven by: (1) Structural growth in multi-destination placements, supplemented by an ongoing Australian recovery; (2) Ability to grow market share in the highly fragmented Canadian and UK SP markets; (3) Reinvestment in digital capabilities to increase competitive moat and generate new earnings streams.”

Goldman has a buy rating and $19.00 price target on IDP Education's shares.

Goldman Sachs isn't expecting FY 2025 to be a good year financially, it believes that the tide will turn in FY 2026. As a result, the broker thinks that investors should be buying shares now before the rebound takes place.

We have continued to add IDP Education shares IRL at around $11.60, which was close to five year lows. We believe the headwinds IDP Education is currently facing are medium-term (2-3 years), and that the business will emerge from this setback in a much more competitive position, with expanded global markets and improved cost efficiencies. Our business case is based on anticipated annual earnings growth of over 15% and a ROE of 30% from FY25 onwards. IDP Education is one of our top four positions IRL by weight, which includes Codan, CSL and BHP.

Held IRL (9.4%), SM (13.7%)

Will this help IEL?

Article: Wed 18th Dec 2024. The Guardian,

The new Ministerial Direction 111 (MD111), to operate from Thursday, will introduce two categories of student visa processing: “high priority” and “standard priority” instead of capping numbers.

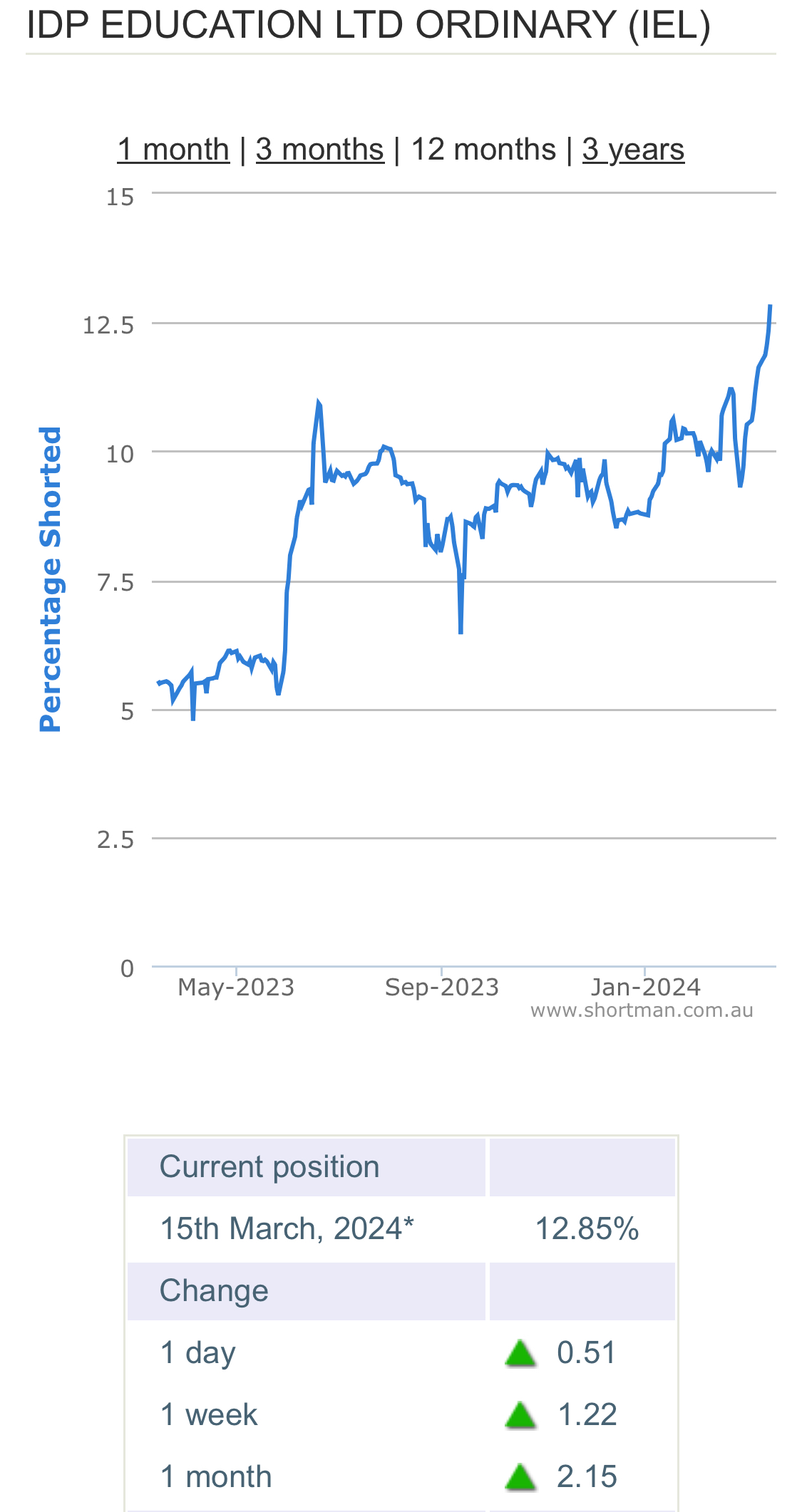

The short position is headed upward again after a dip in May… currently sitting around 14.5% according to short man…

whilst I get the bear case predicated on negative political circumstances I wonder whether the shorting is overdone… on the flipside does anyone buy shorted businesses when the headwinds are apparently short term with a view to a squeeze when things turn? (Hold IRL and SM and would consider adding to position)

I’ve just copied this note from Morgans here for future reference. It’s from @Jimmy’s News Summary DJ Australian Equities Roundup -- Market Talk 30 Aug 2024 15:03:56

0040 GMT - IDP Education gets a new bull at Morgans on the student-placement provider's ability to deliver sustained growth from fiscal 2026. Analyst Scott Murdoch raises his recommendation on the stock to add from hold, telling clients in a note that IDP's current fiscal year looks like being the low point for student flows due to uncertainty over visa regulations, but that the Australia-listed company looks uniquely placed to take market share. Murdoch expects earnings to fall 12% in fiscal 2025 but sees a 21% jump over the subsequent 12 months. Morgans raises its target price by 4.6% to A$18.20. Shares are up 1.4% at A$16.23. ([email protected])

My view

IDP Education is now our largest IRL holding. I’m prepared to be extremely patient with this business. I’m not really expecting huge upward share price movements for at least 12 months, but I won’t knock it back if it happens sooner. This is a quality business, a global leader in the field gaining market share in student placements at the expense of its competitors. I think patient investors will reap the rewards in a few years time. Keeping it in the bottom drawer for now.

Held IRL (11%, now our largest holding), SM (16.5%)

Not a surprising take but Melbourne Uni in the government’s ear pushing a more relaxed policy to international student numbers…

IEL just checked the calendar ???? 29th Aug is official results. The competition Mote has been tested here. The net profit is circa 15% not too shabby though..

On Tuesday (6 August) James Mickleboro from The Motley Fool shared a note out of Goldman Sachs.

“Goldman expects the company to report revenue of $1,030.7 million (cons. $1,028.8 million) and net profit after tax of $153.1 million (cons. $149.6 million) for FY 2024.”

“This is expected to underpin a larger than expected dividend of 39.7 cents per share (cons. 38.2 cents).

The broker will also be looking out for the following:”

IEL will report its FY24 result on Thursday 29 August 2024. At the result we will be looking for: (1) Lead indicators for the SP business into FY25 following regulatory change across AU/CA/UK to manage migration, particularly on the magnitude of potential market share gains which may offset SP market softness; (2) IELTS trough volume expectations and recovery outlook given regulatory uncertainty has driven weaker sentiment from India / South Asia students; and (3) Cost outlook and the implementation of the cost reduction program for FY25, noting IEL do not expect the cost out initiatives to impact its operational footprint.

“Goldman has a buy rating and $21.75 price target on its shares.”

Today IDP Education surged 7.9% following a 3 year low of $13.25 yesterday ( I took the opportunity to add a few more IRL). The surge today might be due to comments made by Education Minister Jason Clare yesterday afternoon.

The Guardian reported “the education minister has rejected a report the government will cap international students at 40% of university enrolments, after concerns such a restrictive cap could help propel Australia into recession.”

Jason Clare on Thursday said Labor was “not intending” a cap of that size, and will help protect the “social licence” of the international education sector and not harm an “incredibly important national asset”.

“The government is yet to finalise the proposed cap. As Australia’s economy softens, some in the government are concerned that inoculating Labor against attacks on immigration should not come at the expense of economic growth, and have pushed back against a more restrictive cap.”

With universities expecting to discover in days what the proposed cap will be, the Australian Financial Review reported on Tuesday it could be capped as low as 40% of total enrolments.

But Clare rebuffed that report.

“That is not right. I have seen those reports. That is not what we are intending to do,” he told reporters in Sydney.

Clare described international education, Australia’s fourth biggest export industry, as “an incredibly important national asset” which “makes us money”.

It also makes us friends, because when students come to Australia to study and fall in love with the place or maybe someone special, they take that love for us back home.

What we’re doing is making sure we protect the integrity of the system – and that is important – but also protecting the social licence for the system to continue to operate.

Clare said he would have “more to say about the levels that will be set” in parliament in the next few weeks.

His comments come after universities sounded the alarm over the proposed international student cap at a Senate inquiry hearing on Tuesday.

The chief executive of UniversitiesAustralia, Luke Sheehy, said the bill was “rushed policy”, “ministerial overreach” and a “political smokescreen”. He said it was designed to give the government the upper hand in “the battle over immigration ahead of the election”.

International students “accounted for more than half of Australia’s GDP growth [last year], almost single handedly saving [the country] from recession”, he said.

“Fewer international students on our shores could result in job losses, reduced economic growth and less money for domestic teaching and research activities.

“We need to seriously consider what we stand to lose in telling them to stay home.”

Australian universities clash over proposed international student cap

According to the Sydney Morning Herald, an analysis by Prof Richard Holden, an economist at UNSW Business School, showed a return to 2019 international student numbers would cause an $11.6bn hit to Australia’s economy in 2025, or about 0.5% of gross domestic product.

“That could easily be enough to tip Australia into an actual recession,” he reportedly said.

On Tuesday the chief executive of the Group of Eight, Vicki Thomson, told the Senate inquiry that capping international enrolments to pre-pandemic levels of 2019 for Go8 members against 2023 post-pandemic enrolment figures would have a massive impact.

It would cost the nation more than $5.3bn in economic output and 22,500 jobs in the economy, the group estimated.

“On the day when we’ve seen Wall Street suffer its worst result in two years, creating massive global economic uncertainty, why would we make a deliberate move to attack our own economic growth?”

ENDS

Earlier this week there was a story in the AFR “Careful what you wish for’: The hidden hit in foreign student caps”. The story describes the impact of student caps in Canada. Students were not applying for visas to study in Canada because they feared being rejected.

The Canadian example might have the Australian Labour Government rethinking their stance on the 40% student cap in Australia. Who knows what might happen from here? I guess we’ll find out more early next week.

I think IDP Education shorters might have panicked a little today!

Held IRL 10%, SM 16%

Since April 2024, Magellan’s Airlie Funds Management has initiated and accumulated shares in IDP Education. Airlie Funds now holds 6.13% of IDP Education which it holds in the Airlie Australian Share Fund.

Trading summary:

- 26 April 2024 Initial Substantial Holder notice, BUY 14,196,310 shares at $18.78 per share (5.1%)

- 13 May 2024 BUY notice for 295,094 shares averaging $15.93 per share

- 15 May SELL notice for 665,174 shares at $17.14 per share

- 31 May BUY notice for 665,174 shares at $16.08

- 18 July BUY notice for an additional 2,800,225 shares averaging $13.92 per share (6.13%)

Emma Fisher explained why Airlie Funds Management initiated a position in IDP Education during a fund update in April 2024 https://www.airliefundsmanagement.com.au/insights/airlie-quarterly-update-apr24/

“IDP Education, a recent addition to the fund, operates in two key areas: English language testing and student placements for international students. As one of only two distributors worldwide for the IELTS test, they hold a significant position in the market. Their expertise in guiding students through the complex process of applying to universities abroad, without charging them directly but rather being compensated by the universities, shows their advantageous business model. With deep-rooted relationships with 600 universities and a 45-year history, IDP Education is a solid foundation in the industry.

The current opportunity arises from the political and regulatory challenges surrounding immigration in countries like the US, UK, Canada, and Australia, which have led to a significant drop in IDP Education's stock price and valuation multiples. Despite these short-term headwinds, the fundamental strength of the business, marked by consistently high returns and significant EBIT growth over the last decade, suggests a compelling long-term investment opportunity. As immigration policies potentially shift back in favour of facilitating international student flows, IDP Education is well positioned for a re-rating, making its current valuation particularly attractive for investors seeking quality growth opportunities.”

James Mickleboro from The Motley Fool shared Goldman Sachs view on IDP Education just recently (copied below). https://www.fool.com.au/2024/06/30/3-fantastic-asx-growth-shares-to-buy-in-july/

“This language testing and student placement company could be an ASX growth share to buy according to analysts at Goldman Sachs.

While the company's growth is expected to be challenged this year and next year due to industry headwinds, the broker believes its growth will resume the following year and then continue long into the future. It commented:

IEL remains well placed to capitalise as conditions normalise into FY26E, with IEL selectively investing for growth while SP competitors come under significant pressure. In our view the regulatory headwinds are cyclical, while structural SP growth can resume off the FY25E baseline.

Goldman has a buy rating and $21.75 price target on its shares.”

My Comments

Personally, I’ve got no idea what the share price will be in 12 months time, but I agree that structural growth is likely to normalise in FY26 then continue long into the future. I believe that at some point over the next 2 years (give or take a year) the market will see future growth returning and the share price will appreciate very quickly.

In the meantime patient investors might have to be content with a small dividend of just over 2% partly franked, and the risk of more downside.

Held IRL (8.3%) SM (16%)

Having returned home from a 6 week holiday from retirement (it’s a tough gig you know! ;) it’s time to get back to work on our portfolio! It was nice to take a total break from the share market for 9 days while we sailed from Japan to Alaska with no internet! A highlight of the trip which will remain etched in our memories was a beautiful encounter we had with two grizzly bears grazing contently on the fresh spring shoots close to a trail near Eagle River about an hour north of Anchorage. They seemed to be not at all concerned about our close proximity as a small group of hikers watched on quietly. I was hoping we would see a grizzly in the wild. Sometimes you need to be careful what you wish for! :) Here’s a short clip https://vimeo.com/947532816

Sorry about the diversion…it’s time to get back to work!

Thanks @mikebrisy, @Solvetheriddle and @RhinoInvestor for your coverage following IDP Education’s (IDP) Regulatory and Market Update. I agree with almost everything discussed so far.

I was expecting FY24 and FY25 earnings to come in slightly higher than FY23 but analysts are now expecting earnings to decline marginally each year out to FY25 before starting to improve again from FY26. I think there’s a lot of guess work involved in trying to forecast IDP’s earnings over the next three years with the international student visa caps in play in Australia, Canada and the UK.

What’s more important now is to have a longer term view (5 to 10 years) on IDP’s future. Is IDP a growth company, a cyclical business, or a business in structural decline?

Looking at an historical chart of revenue and earnings over the past 10 years (2013 to 2023) apart from a dip during the calendar years 2020 and 2021, earnings per share have grown, on average, at 20% per year. The two year dip in earnings was not cyclical, it was due to COVID 19 travel restrictions, a Black Swan event for the business.

Source: Simply Wall Street

IDP bounced back surprisingly quickly after the travel restrictions were lifted as international students returned to universities in gusto. Due to a pent up demand for an international education earnings over the next two years (FY21 to FY23) grew over 370% from 14 cps to 53 cps and quickly returning to the earnings trajectory path that existed prior to COVID 19.

Over the past decade IDP has clearly been a consistent growth company with management navigating the business through a significant Black Swan event as if it never happened.

So what’s happening to IDP now? Is IDP becoming a cyclical business, or is it in structural decline? I think neither. What IDP is facing now is the second Black Swan event within four years. This time the Black Swan event is a housing crisis in Australia, Canada and the UK resulting in governments introducing temporary international student visa caps to make more homes available for residents until the housing crisis is fixed.

Meanwhile, the student demand for an international education is stronger than ever. Universties are more than ready to meet this demand and IDP is well placed as the global market leader in facilitating these student placements. The business model is structurally sound and has the capacity to continue double digit earnings growth for at least a decade if the temporary visa caps were lifted.

How long will it take to fix the housing crisis and for governments to lift the international visa caps? Who knows? It could take years? This is the risk in owning IDP Education right now. Structurally the business model is strong and resilient. Who would have foreseen this business encountering two significant Black Swan events within four years.

If the market were to close for five years and I could only choose one stock to invest in, I think I would choose IDP Education. My thesis is, the housing crisis will be resolved within 5 years, international student visa caps will be lifted and IDP Education will be back on track with consistent double digit earnings growth and shares trading above $30.

Held IRL (8.8%), SM (17.2%) and nibbling on weakness.

An interesting listen here from the Financial Review.

What cutting immigration will cost Australia

This week on The Fin podcast, Michael Read and Julie Hare explain why net migration spiked and what deep cuts would mean for universities, the jobs market and economic growth.

A reasonably complex web really.

All things that my well read sisters and brothers here at Strawman would be very familiar with, no doubt. Thrown together its, well not simple to sort out. Politics may well ad to the mess.

Migration numbers pushing up house prices and rents. Foreign students make up a large number of folks coming here and it's a massive industry. Duttons migration reduction plans. That may or may not affect housing prices, but may undermine the education industry in this country.

The UK and Canada seem to be in a similar situation.

Keep on Truckin

Over recent months, my reading of the bad news in the broader international education market from $IEL shareholders' perspectives is that things have begun to stablise. Of course, the impacts of that news is yet to play out operationally over 2024/25/26. But the key drivers are in place. However, some of the anticipated developments have started to unfold in a more benign way that at first considered likely.

A couple of weeks ago, GS put out a note with this same view (although I've just read it this afternoon), and as they've expressed things more eloquently and rigorously than I would, I have used their work as the basis for this summary.

The note is entitled: Confidence builds in FY25E earnings base after better-than-feared AU and UK regulatory news

Here is the summary (credit to my Virtual BA Claude). I've chosen to summarise the GS note and annotate the summary, as they have picked point 3., which wasn't on my radar at all.

- The UK Migration Advisory Committee recommended retaining the graduate route in its current form, allowing graduates to remain in the UK for 2-3 years after completing their studies. This was a positive outcome compared to expectations of potential tightening or abolition of the route. However, the government could still change it. The report flagged declining visa numbers already and suggested more stringent reporting requirements on institutions. (My note: With various connections in higher ed. in the UK, I think this has been as the result of vigorous and effective lobbying by the university sector. Post-Brexit, the UK is highly reliant on graduate students into some of its key sectors, including biotech and technology. I wonder if the Australian VC's will be as effective - I know through personal UK-Aus connections that the lessons are being observed.)

- In Australia, ministers were given power to set international student caps for individual higher education institutions, but no overall industry cap will be introduced. While no overall cap was expected, it had been considered to reduce net overseas migration. Institutions may be allowed to grow from a new baseline after consultation***. Visa rejection rates have already reduced overall student approvals by 34% year-to-date (but remember 2023 was +60%). The minimum funds requirement for student visas was also increased, although GS point out that this will disproportionately impact smaller/vocational institutions, with $IEL's primary exposure is in the larger unis, where conversations with industry indicate numbers are "flat-to-growing"). (***My note: The Group of 8 lobby of the biggest universities are going to work key ministers very hard in their own interests. Even though their numbers are only a minor share of the whole, this is where the big $IEL fees are. Going into the elections, I don't think the Labour Government will want to have Australian Unis. declare war, as this is almost an existential issue for Unis funding models. I'm not sure the market understands this nuance.)

- Pearson's quarterly result showed declining PTE test sales, indicating the IELTS volume declines are not purely due to market share losses to PTE but differences in market exposures between the two tests. This reinforces the view that as the key India market troughs, IELTS could resume sub-market growth from FY26 onwards. Australia is also considering changes to test score equivalency that could boost PTE volumes.

In line with my view, GS sees the impact mainly hitting FY25, but they are still expecting $IEL Student Placements into Australia to grow by +8% FY25/FY26, even in the context of declining overall migration numbers. (This is in line with my thesis that SPs are the key value driver, and that $IEL is working hard here to take share in its key markets.)

GS are sticking to their guns with a 12m SP target of $25.30.

The overwhelming market narrative is in such a funk on $IEL that I don't imagine we'll see much SP movement ahead of FY24 results or any update commentary before then.

I am aware in posting this note that I am demonstrating blatant confirmation bias; however, I haven't seen any factual analysis that justifies a contrary view.

While well and truly in the red (with an average cost base between $19-$20) I continue to be happy to ride this one out for a few years.

Disc: Held in RL

Canadaian Immigration March data now available: 42,090 study permits became effective in March 2024 (vs. 27,790 in March 2023)

That takes Q1 2024 to 122,350 (vs 90,550 in Q1 2023) or +35%.

Note: Q1 is a quiet month in Canada for this metric, but indicates strong volumes continuing in FY24, reinforcing the hypothesis that the hit might not come until FY25.

Looking at 9m YTD FY24 over PCP, the numbers are 585,470 over 459,450, or +27%

Disc. Held

Andrew and Henry on Ausbiz:

Stock of the Day: IDP Education (IEL) on ausbiz

The reduction in uncertainty in the UK and AU were good points to support the bounce. We may also have had a bit of short covering today, will see in 3 days on how shorts have moved.

Disc: I own.

IEL / UK Visa Policy: An independent review of the politically charged Graduate Route, which allows international students to stay in the United Kingdom for two years after graduation to try to find work, has recommended that the government leave the post-study work visa scheme in its current form.

Together with the Australian confirmation may help explain the jump.

Temporary migrants are engaging in the equivalent of panic buying as student visa applications from people already in the country increased to an all-time high in March, but rejection rates meant less than one in five were granted.

At the same time, news of the government’s clampdown on student visas and high rejection rates is dampening dreams of study in Australia, with potential students who are still overseas choosing not to stump up the $710 application fee.

In March, new visa applications were almost half that of a year ago.

International student Mai Le says her goal is to achieve permanent residency after she graduates. Dan Peled

A complex picture is emerging of students in their home countries shopping around for the surest study destination, with new research from IDP Education revealing the US is the big winner as Australia, the UK and Canada introduce increasingly restrictive policies to cut overall migration.

The steep rise in visa refusals in Australia has been described as “caps by stealth”, as suggestions the federal government will introduce actual caps, similar to those imposed in Canada, continue to circulate.

“We can see in the numbers that the visa caps-by-stealth approach is clearly beginning to have an impact,” said Phil Honeywood, chief executive of the International Education Association of Australia.

“There is no doubt that high rejection rates are scaring applicants away from Australia.”

The most recent data from the Department of Home Affairs show that applications for student visas from people already in Australia rose to 34,388 in March, up from 25,886 in March 2023.

However, just 6834 were approved during the month, compared to 18,604 in March last year.

The opposite is happening with prospective students who are still in their home country. In March, there were 17,036 visa applications, almost half the 31,382 a year earlier.

From January to March this year, the peak time for international student arrivals, 79,754 offshore applications were received, compared 110,636 for the first three months of 2023.

Approvals fell to 68,542, compared to 97,039 from January to March in 2023.

Visa reforms

Since last July, the government has introduced a raft of measures designed to tighten up both the flow of international students and the quality. These include higher English-language proficiency levels, proof of more money in the bank, and a crackdown on agents and colleges poaching student into cheaper, often questionable, colleges.

While many observers expect next week’s budget will contain a big increase in the cost of a visa application – possibly rising from $710 to $2100 – the idea of an absolute cap on numbers is still under consideration.

It is not thought to have the backing of some of cabinet’s most senior ministers.

However, since December, when Home Affairs Minister Clare O’Neil released the government’s long-awaited migration review, the most effective weapon in reducing student numbers appears to be the steep rise in visa rejections.

A survey of 11,500 prospective, applied and current students by recruitment firm IDP Education found that there has been a sharp increase in the popularity of the US as news of more restrictive policies in Australia, as well as in Canada and in the UK, have started to influence decisions.

Jane Li, IDP Education’s area director for Australasia and Japan, said the US used to rank last on a preference list of four major student destinations but has now leapt to first. Canada has gone from first to last.

“I don’t blame students for changing their preferences. It’s an important decision, and they are facing strong headwinds in terms of policy changes across the three major destinations,” Ms Li said.

However, the US’ newfound primacy as a destination could be short-lived. The prospect of a second Trump presidency has around a quarter of all prospective students saying they would reconsider their options.

“About 56 per cent of students said the results of the presidential election would not affect their decision, but there was a strong preference for Joe Biden over Donald Trump,” Ms Li said.

“Students are very tuned into politics and policy changes when considering their destination.”

Mai Le arrived in Australia in 2019 from Vietnam to undertake two years of senior school before moving to Queensland University of Technology to study business and IT at the beginning of 2023.

While Canada and the US were on her radar before she decided to study in Australia, policy changes have dented her confidence that she will get permanent residency after she graduates.

“The goal is to figure out how I can get PR (permanent residency),” Ms Li said. “I’m going to everything I can to achieve that.”

As AFR Weekend revealed last week, Federation University in Victoria is set to make more than 200 jobs – or 15 per cent of its workforce – redundant as its student numbers collapse leading to an $80 million slump in revenue in 2023.

At the same time, numerous small private colleges are also reeling under a sudden decline in enrolments.

“There is no doubt high-quality, small private colleges will be the most affected by all of this,” Mr Honeywood said.

Just a quick update on Canada's progress in implementing its targeted 35% reduction on student visas for 2024 over 2023.

Based on January and Feburary data for new student visas granted:

2023 Feb YTD = 63,075

2024 Feb YTD = 80,860 (+28%)

As, I've said before, early months in that market are slow, and the bureaucracy will probably target the next academic year for which the visa grants will start showing through in June, July and August.

But the data indicates the tailwind for FY24 results for $IEL haven't gone away.

(I know I'm getting a bit micro here, but I can't resist!)

In seeking to replace the large hole in my portfolio ALU had filled as a large cap quality growth company I have picked up some RMD and SHL with a view that I disagreed with bears who drove the price down recently. I am looking at IEL to plug the rest of that hole, but I am still trying to understand and respect the bear position. With over 14% short, I have to accept there is at least a decent amount of smart money saying it is overvalued, a point I fully agreed with 6 months ago, but today it seems more reasonably valued, unless those bears are right and they can smell their winter feed still to come.

So here are the factors that I think are supporting a bear position (no particular order):

· Fem Fatal: Tennealle O’Shannessy, the new CEO has quite an unenviable share market performance record as CEO, having IPO’ed Adore Beauty with it’s 80% share price drop and now 50% plus for IEL. Her move from 10+ years at SEEK to lead a listed fashion retailer was probably an awkward fit, the role at IEL which has a strong SEEK heritage is more aligned with her previous training focus at SEEK, seems a better fit. However, bears may see her as a dark omen, rational or not, it plays into sentiment and can be self-reinforcing enough for bears to make a nice profit on in the short to medium term. Bear’s may also believe she is no good at the job, but the Adore Beauty debacle seems more about the IPO price than operating performance, which was reasonably solid but over hyped at IPO. If her leadership is questionable, then having the former CEO Andrew Barkla (who lead IEL from $670m at IPO to $6.8b valuation at his exit in 7 years) as an NED should provide strong downside protection from something stupid happening.

· Geo-Political: Lets face it, Russia, China, Iran and lets not forget North Korea are good for any bear thesis for just about any company… but an international student business is very exposed to global conflict. IEL did well during Covid considering, with online options, so is well positioned, but a disease is a war everyone in the world has an interest in helping to win, the other kinds provide longer lasting and sometimes permanent division along geographical lines. A real risk, but hard to price and assess.

· Sovereign Risks: Probably the most tangible and quantifiable risk bears can call upon are changes in government policies and unofficial sanctioning hitting sales in certain markets. New and proposed tightening of student work rights and targeting non-genuine students in Australian and the UK as well as Canadian reduced immigration resourcing in India are all headwinds to what have been growing channels that may stagnate or shrink.

· Competition and Fees: IEL has been part of, if not the lead in the commercialisation of education by Universities, leading the growth of a new and untapped industry. Additional competition like the Canadian government allowing 4 new competitors added to a maturing of the industry suggests that previous growth will be hard to replicate. Even the reduced PE of around 30 still anticipates a long and solid growth runway, bears may be betting that runway is shortening and less attractive off what is now a higher base to justify high PE’s. The PE’s of the previous couple of year were “priced to perfection”, so it only takes a small reduction in expectations for a large re-rating, but at what price and PE does the bear case become the one based on unrealistic expectations.

· Other: The bears may know something others don’t or I have simply missed a major risk or issue in play. There are other issues such as a $60m contingent tax liability issue for GST on Indian state taxes which could blow up for instance, costing a lot more or leading to regulatory backlash.

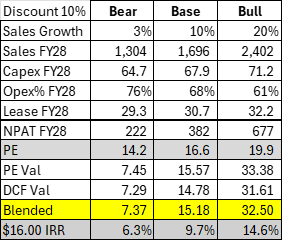

I would like to better understand what is driving the bears, but it may just be a pure valuation assessment that says the previous price around $30 required 20%+ growth rates whereas now we are looking at a more reasonable 10% top line growth (FY25-FY28) which by my calculations has a value closer to $15.

Draft Valuation:

It’s a great business at a much better price, but I am still unsure if it’s a good price… if the bears keep going I am sure we will get there as the asymmetry switches to the upside.

Please let me know any bear points I have missed or more insights on the ones highlighted.

Cheers.

Disc: Don’t own, but its on the top of the watch list

I found this story below about the history of IDP Education (IEL) fascinating. It was covered by Julie Hare from the AFR in June 2023.

After reading this story I felt like the headwinds IDP Education is currently facing, including the temporary international student and spousal visa caps in Canada, Australia and UK, and opening up the International English Language Testing Scheme (IELTS) to competition in Canada will be viewed in future years as a temporary ‘blip’ in the history of a growing global business.

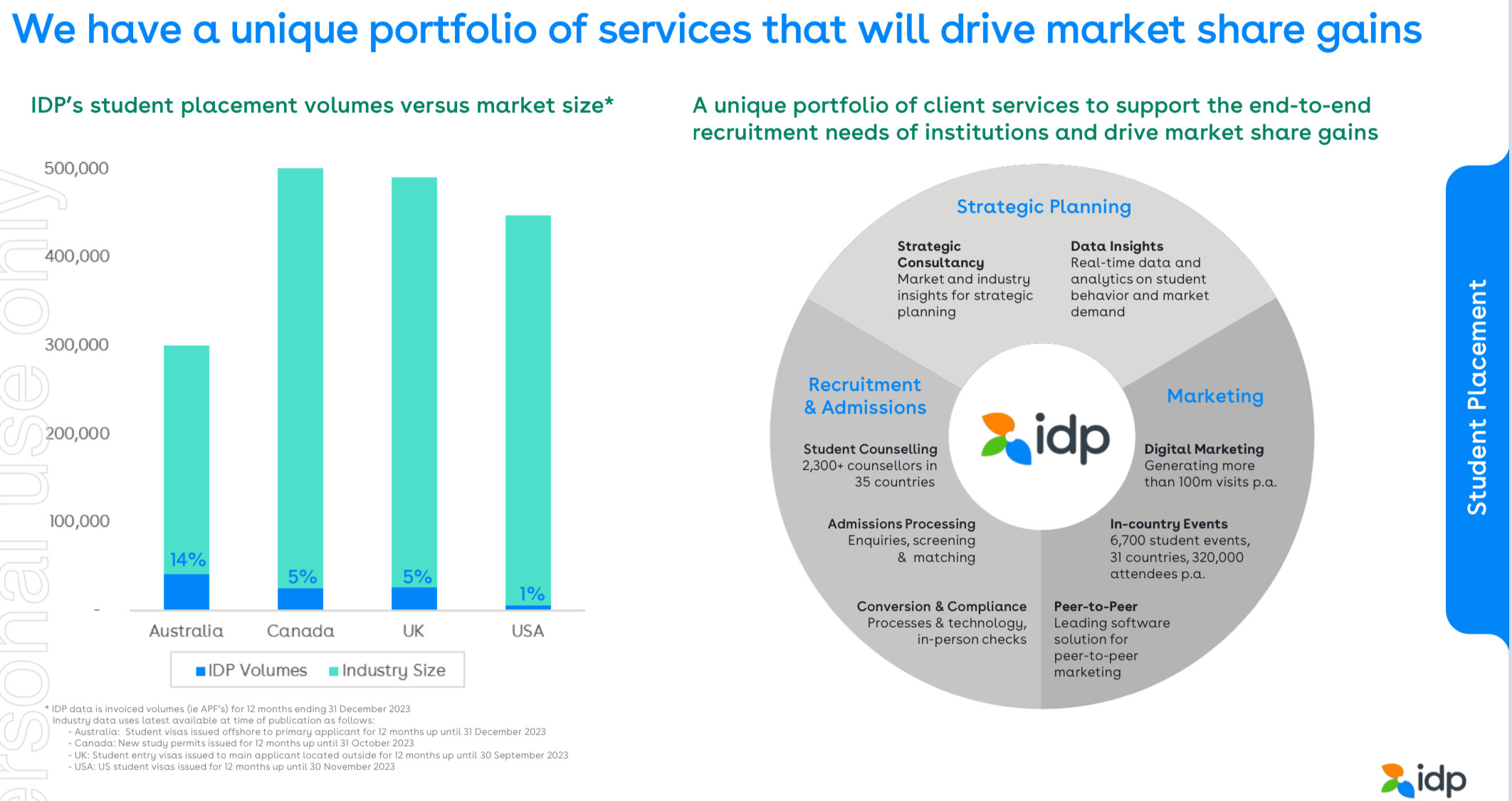

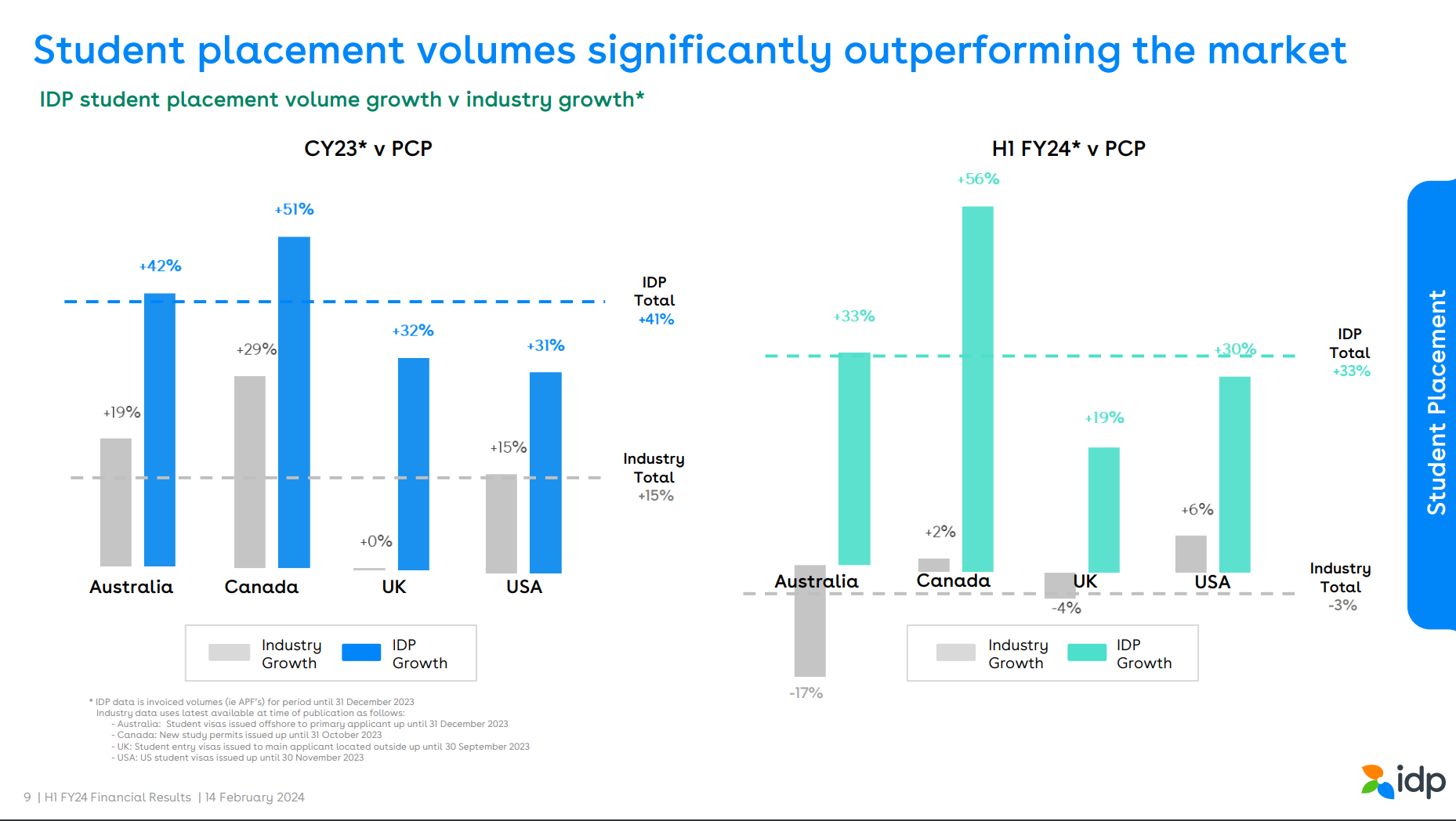

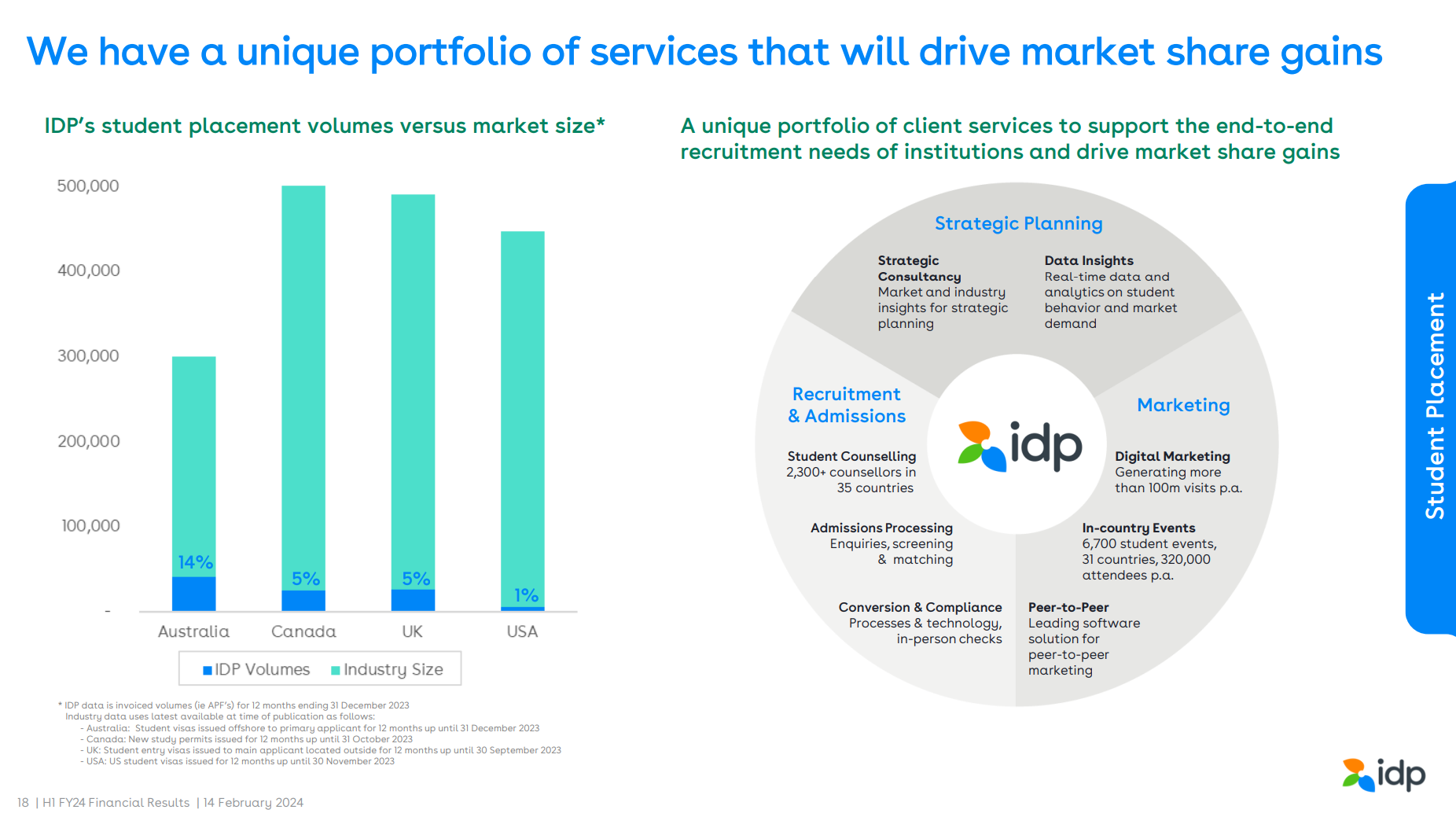

The future of IDP Education is swinging more toward international student placements where they have significant pricing power in a huge total addressable market (TAM), as this chart from the 1H24 Investor presentation shows. IDP Education student placement volumes in the US are only 1% of the total potential market.

The slide below shows how quickly IDP Education is transitioning toward student placements where they have more pricing power and higher margins. EBIT for student placements was up 43% in twelve months and now surpasses IELTS as the major source of EBIT.

And now to the history of IDP Education…

How this company created its own multibillion dollar industry

IDP Education has one of the most peculiar origin stories of listed companies, creating from scratch a world-first industry that is now Australia’s third-largest export sector.

The first-ever student recruitment agency has surfed a tidal wave of demand for study in English-speaking destinations. Six million people now travel to another country to study.

The groundbreaking company was also integral to the introduction of the world’s first English-language proficiency test but, according to its new chief executive officer Tennealle O’Shannessy has never, in its 44-year history, veered from its central mission: connecting people to a transformative future.

“It’s important to understand where IDP has come from. This is an organisation that is driven by purpose and a clear set of value that permeates through the culture and the team. That’s why it has been able to achieve so much over so many years,” says O’Shannessy, who has been at the helm of IDP since February.

“It’s been 50 years of building trusted relationships with student and institutions. That is the core of our business.”

In The Australian Financial Review’s Fast Global list, IDP Education has the largest offshore revenues in 2022 of $754.8 million. Its success reflects a diversification strategy that began in 2009 and continues to this day.

The strength of the company can be seen through its figures during the pandemic. With borders closed and students learning from home, IDP still reached $428 million in offshore revenue in 2021, down from $529.7 million in 2020.

IDP Education has a provenance unlike any other company in the ASX 200.

Its beginnings were humble, emerging in 1969 as a government scheme to link Australia’s universities research with Asia and as a soft diplomatic power. Throughout the 1950s and 1960s, students had been coming here to study under the scholarship-based Colombo Plan. Others arrived as private students.

However, in 1986, the forward-thinking Hawke government saw a new source of potential revenue for universities in educating the children of middle-class families in South-East Asia.

IDP – or the International Development Program – already had an office in Jakarta and in 1986 it introduced a counselling service to recruit students to Australian universities.

Over the next few years, it opened new offices and by 1997 had a presence in the Philippines, Singapore, Thailand, Malaysia, Taiwan, China, India, Vietnam and Mauritius.

As numbers increased, it became evident that a test was required to determine and verify the English-language skills of prospective students. In 1989, the groundbreaking IELTS – International English Language Testing System – was launched in partnership with the British Council and Cambridge University.

By 1996, the Hawke government passed ownership of IDP to Australia’s 38 universities and a corporate structure was created.

Australia was the world leader in commercialising education to international students. While wealthy families had for centuries sent their children across the globe to be educated at the world’s finest institutions – think Oxford, Cambridge, the Ivy League – Australia was the first country to see the economic possibilities of a university degree from an English-speaking country.

By 2006, numbers were booming and the 38 university shareholders came to the realisation that they did not have the necessary skill sets to run it efficiently and profitably.

So in 2005 it went looking for a corporate partner that could take it to the next level.

Brothers Andrew and Paul Bassat were riding high with their online jobs board seek.com and were on the lookout for adjacencies to their core product. Universities, they figured, was a way of connecting education and employment and improving the value chain of seek.

In 2006, they paid $36 million for its 50 per cent stake in IDP with the 38 universities retaining the other 50 per cent.

In 2007, Peter Polson was named chairman of the board, a position he still holds.

Two years later, IDP embarked on what, at the time, was a controversial and counterintuitive strategy – to recruit students to universities in countries that were competitor nations to Australia. It started with the US and now includes New Zealand, UK, Ireland and Canada. It now has more than 190 offices in 35 countries.

The next step in the company’s evolution was to list on the Australian Securities Exchange in 2015, which saw the end of seek’s involvement and the recruitment of a new chief executive, Andrew Barkla.

Barkla pushed a diversity agenda, with the company extending IELTS operations to new markets, oversaw the acquisition of aligned companies and the development of a new and sophisticated online platform.

IDP is now the world’s largest student recruitment company, which has in the past few years fortified its capabilities by developing sophisticated digital platforms. It has a 600-strong campus near Chennai in India that is dedicated to building IDP’s technical and digital innovations.

Its newest offering is called FastLane, which promises to get students an offer from an institution in seconds.

“We are focused on reducing the time in bringing offers to students earlier on in the process,” says O’Shannessy.

“The decision to study overseas and embark on an international education and possible migration is an incredibly high stakes decision for students. There is a lot of uncertainty in the process. With FastLane we aim to bring certainty more quickly around the offer process.”

In Australia alone, IDP recruits about 30 per cent of the half million or more students who come here each year.

It’s a company that has, in its many guises, been characterised by big bold visionary moves.

And yet, says O’Shannessy, it never lost sight of the need to be “deeply connected to our customer needs”.

-ENDS-

UBS is forecasting EDP Education’s profits to increase from $162 million in FY24 to $312 million in FY28, almost doubling over the next 4 years.

Tristan Harrison from The Motley Fool shared UBS forecasts in his article published on Friday 12 April 2024 (see story below).

Top broker tips one of the ASX 200's worst performers of the past year to surge 50%

“In this article, I'll look at why UBS sees an opportunity with the IDP Education share price and how much it thinks profit can grow.

Potential headwinds

UBS acknowledged that changes in government policies in Canada — such as a tightening of spousal visas — created uncertainty for the education provider in FY24 and FY25.

We have previously covered some of the other issues in Canada, which the ECP Growth Companies Fund investment team explaining as follows:

IDP Education underperformed as the Canadian government opened up its SDS immigration visa requirements to 4 new English language tests, increasing competition for IDP's IELTS [International English Language Testing System] business.

It is uncertain how much market share IELTS could lose over the next few years, however market estimates point to an 8% to 15% EPS impact.

UBS also pointed to UK news that suggests a "potential tightening of study work rights."

In Australia, we've just heard that international student fees are going to increase, according to reporting by the Australian Financial Review. This comes after new measures were announced to stop non-genuine students.

UBS said these countries were "targeting the problem of non-genuine students". However, the broker thinks IDP's competitors are more exposed to these changes, which could result in some offsetting market share benefits for IDP, or potential "consolidation".

The broker noted that the UK could implement further changes, though there has already been a tightening of restrictions on students' ability to bring in independents.

Any tightening announcement should be the "last major piece of negative regulatory news", though any US changes could "impact the growth angle".

Despite these headwinds, UBS thinks the ASX 200 stock may generate net profit after tax (NPAT) of $162 million in FY24, $179 million in FY25 and $226 million in FY26.

Ongoing profit growth?

The broker has forecasted that the IDP Education net profit could continue to grow in FY27, with NPAT of $271 million, and then reach $312 million in FY28.

Based on UBS' profit estimates, the IDP Education share price is valued at 28x FY24's estimated earnings, 26x FY25's estimated earnings, 20x FY26's estimated earnings, 17x FY27's estimated earnings and 15x FY28's estimated earnings.

Despite the challenges IDP Education is facing, it's pleasing to see the business predicted to see steadily growing profit, which is usually a very supportive driver of pushing the share price higher.

According to the projections, the dividend could also increase each year between FY24 and FY28, but I'm not going to focus on that because the IDP Education share price performance could be the key factor in total shareholder returns.

IDP Education share price target

UBS currently has a share price target of $25.30 on the company. A price target tells us where the broker thinks the share price will be in 12 months.

At the current IDP Education share price, the price target implies it could rise 54%. That would be a big return – even half that would probably outperform the ASX share market quite nicely.”

-ENDS-

Held IRL (8.6%), SM (16%)

Here is my thesis for IDP Education in pictures. All tongue in cheek of course! :)

If this chart…

Plus this chart…

Equal this…

And if this is what really happens…

then this could be the result…

But, there’s always the distinct possibility it could turn out more like this…

or this…

You can’t take this stuff too seriously!

Disc: Held and adding

There’s always a time lag on Shortman.com.au, so the current chart does not show further capitulation on the CFO announcement (24/03/2024). My guess is that the short positions have moved even higher than the 3 year chart below, which shows 13.3% of the stock shorted on the 21/03/2024.

IDP Education has moved to take 3rd position on the most shorted stocks on the ASX. It could get worse than this.

The only reason these punters would be taking out short positions is to make a profit. They make a profit by buying back their short positions at a lower price. So the punters are thinking the share price will go lower still. Of course technical analysts are the shorters best friends. I don’t think you’d find a single chartist who would be calling IDP Education a buy at the moment. It would be a huge AVOID / SELL! Chartist say the market is driven by sentiment and charts, not fundamentals.

I think the chartists are absolutely right…short term! If you are short term investor you should heed what the shorters and the technical analysts are saying/doing, and head for the hills!

However, for a time horizon investor we are trying to look past the short term headwinds (one year is short term for me) and share price volatility, into the future of the business (2 years plus).

Benjamin Graham said “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” For long horizon investors shorters are our “best friends”. When Polynovo was trading under $1.00, David Williams (the Chairman) said shorters are our “best friends”. I didn’t quite understand what he was saying at the time, but I get it now.

So if shorters are your “best friends”, chartists are your second best friends because they help to perpetuate the downward share price cycle and leading it to capitulation. It’s not great if you own it!

We shouldn’t ignore our “best friends” though. They influence the market by destroying sentiment and they appear to be “right” for a long time. It’s extremely risky betting against these guys with a short term horizon in mind. However, if you have a long term fundamental point of view (two years plus), shorters and chartists are indeed your “best friends”. Why? Because they convince the market to do irrational things and serve you up “once in a lifetime” bargains. Although, taking up these bargains is an extremely lonely place to be. No one else is doing it which is precisely why you are getting a bargain.

So don’t expect anyone to back your call. You’re all alone here! Of course your long term fundamental thesis needs to be right, or things will turn very sour, both in the short term and the long term.

So we must listen to what the our “best friends” are saying, watch the charts and try to pick an entry point that delivers the least amount of pain as possible. A point where the downside starts to appear limited. That’s easier said than done. It’s not a great feeling arriving too early only to see the stock go down another 20% to 30%.

Matt Joass has some really great thoughts about this in his article on The Hidden Power of Inflexion Points

Adding to the UBS share price target of $25.30 shared by @Jimmy today, I’ve included consensus views from 15 analysts supplied by Simply Wall Street. Share price targets have been tracked against the current share price for the last 2 years in the chart below.

Source: Simply Wall Street

The first thing that strikes me about this chart is how the 12 month price target follows the share price down. It doesn’t give you a lot of confidence in the target if the share price tracks down even further.

The other concern is the low level of agreement amongst analysts on the 12 month share price target with a dispersion of 15%. The highest price target is $29.47 and the lowest is $17.00. The consensus share price target is $23.84.

If the most bearish of the 15 analysts turned out to be correct and we bought IDP Education shares today at 3 year lows of $17.18, we would be down 1% in 12 months time. If we included 40 cps in dividends (77% franked, 53 cps gross), we would be up 2% on our investment in 12 months time. That’s not a great outcome, but if that’s the down side I’d be happy to cop that.

If the upside is analyst consensus of $23.84 we could be up over 40% in 12 months time, including the dividends.

Of course all 15 analysts could turn out to be wrong, and the shorters might be correct. During the COVID 19 pandemic IDP Education fell to a low of $10.89, so it’s possible for the share price to fall even further.

However, all these opinions are based on a 12 month horizon, and I’m more interested in how IDP Education will be performing in 2 to 3 years from now.

Source: Simply Wall Street

News SummaryDJ IDP Keeps Bull Despite Regulatory Uncertainty -- Market TalkIEL$17.51-$0.59 (-3.3%)$19.26$15.76

26 Mar 2024 15:44:551 View0444 GMT - IDP Education keeps its bull at UBS despite regulatory uncertainty including in Canada and the U.K.

Analyst Tim Plumbe tells clients in a note that the initial disruption on the Australian student-placement provider from policy changes in Canada aren't fully reflected in analysts' FY 2025 forecasts.

In January, Canada announced a two-year cap on foreign students.

With the U.K. heading for a national election this year, any tightening of student work rights being mulled by the center-left opposition could also have an impact, Plumbe says.

Nonetheless, he remains positive on the long-term opportunity. UBS cuts its target price 9.6% to A$25.30 and keeps a buy rating on the stock, which is down 3.5% at A$17.46. ([email protected])

(END) Dow Jones Newswires

March 26, 2024 00:44 ET (04:44 GMT)

It seems shorters of IDP Education (IEL) are looking for any excuse to put further downward pressure on the share price.

Today, IEL announced the appointment of Kate Koch to replace Murray Walton who is stepping down at the end of this week (31st March, 2024).

Kate comes with excellent experience and credentials, previously holding CFO roles at SEEK, RMIT, Tesco and Peason (London). Kate seems like a perfect fit for the role with her experience in the education and technology sectors.

The only issue is there is a 6 month delay between Murray Walton finishing in the role and Kate commencing with IEL (by October 2024). In the interim period the CFO responsibilities will be shared by the Finance Leadership Team, other members of the Global Leadership team and the CEO.

I don’t see this as a problem, but the shorters are having a field day using it as an excuse to drive the share price down another 4% in this mornings trade.

Short positions are now the highest on record with 12.85% of the stock now shorted (Shortman.com.au, 15/03/24).

For patient investors with a long time horizon (2 to 3 years), I think IEL is a tremendous buying opportunity at today’s prices. At least I am excited by the opportunity and have filled up my shopping trolley this morning. Now I just need to be patient for a few years!

Held IRL (7.9%), SM (13%)

Kate Koch to join IDP Education as Chief Financial Officer

Following an extensive global search, IDP Education Limited (ASX:IEL) is pleased to announce that Kate Koch has been appointed to the role of Chief Financial Officer.

Kate is an accomplished senior finance executive with broad international experience, including in the education and technology sectors. Kate will join IDP from SEEK Limited where she has held the role of CFO since June 2021.

Prior to SEEK, Kate was CFO at RMIT University and held senior finance leadership roles at Tesco Plc and Pearson Plc in London. Through these experiences, she developed a deep understanding of the needs of international students and educational institutions, as well as leading global teams, including large shared services functions. Kate’s extensive and well-rounded experience supports a successful transition to IDP.

Tennealle O’Shannessy said “The IDP Board is delighted to have Kate join the team. Her commitment to purpose driven organisations and her passion for developing people align fully with IDP’s values. We feel fortunate to have identified someone with Kate’s unique experience of our industry, outstanding financial and commercial skills, as well as her exposure to complex international operating environments. Her appetite for creating transformative experiences for customers using technology has shone through.”

Kate’s appointment follows Murray Walton’s decision to step down from the CFO role, effective 31 March 2024, as was previously announced in December 2023. Kate will join IDP’s Global Leadership Team and report to Tennealle O’Shannessy. Kate will commence with IDP by October 2024. In the interim period between 1 April 2024 and Kate commencing with IDP, the CFO responsibilities will be shared by the Finance Leadership Team, other members of the Global Leadership team and our CEO.

-ENDS-

Change in substantial shareholding notice from Challenger. They are up to 26m shares, buying 3m at a time every month or two for the last few months.

the optimist in me suggests that Challenger think that the 2% dividend will increase over time with profits (as per analyst predictions) and they are unconcerned with the risk of visa issues curtailing profits.

Update 14/02/2023

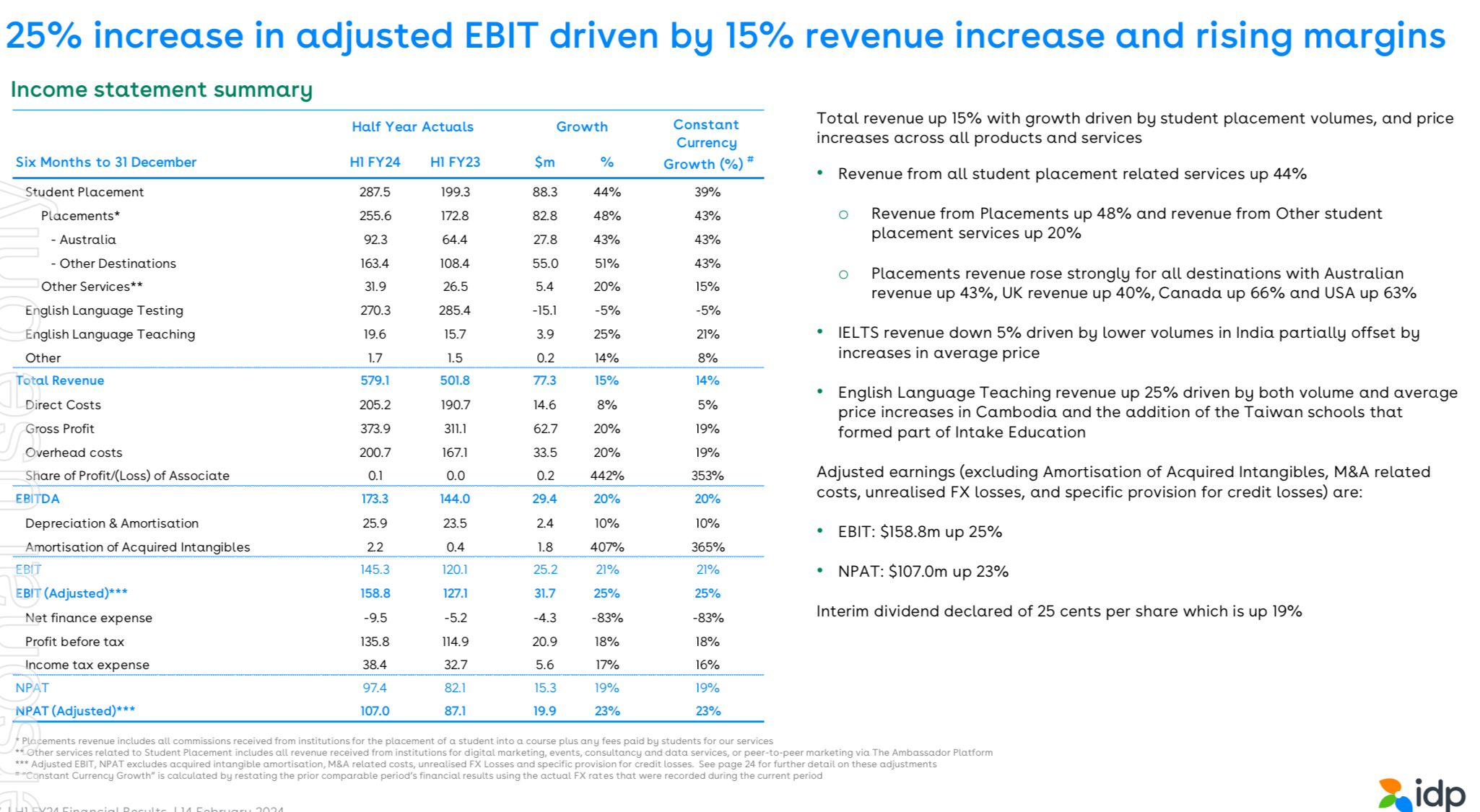

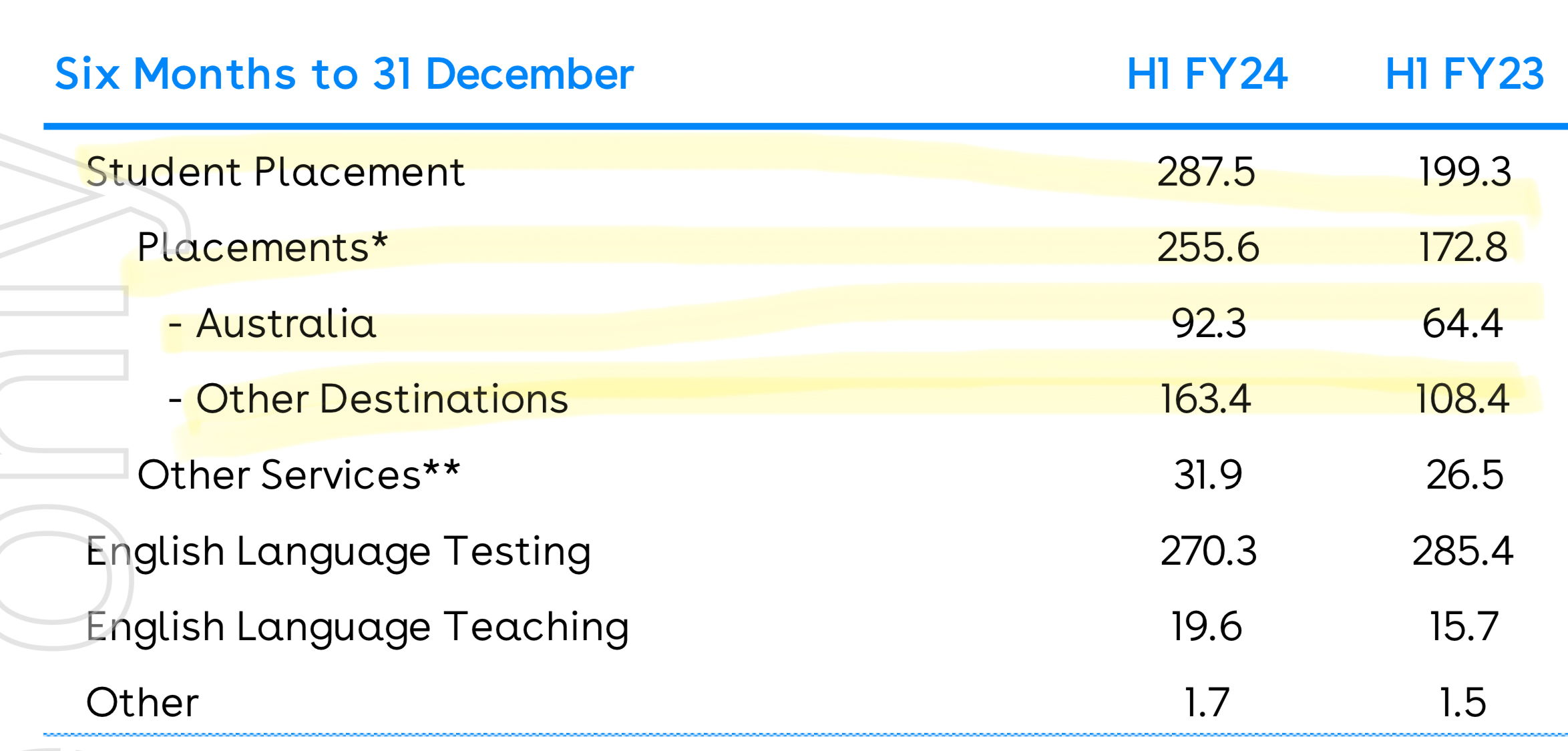

Updating based on 1H FY24 results.

- Revenue up 15% on pcp to $579.1

- NPAT up 19% on pcp to $97.4m

1H results usually are stronger seasonally compared to 2H. So assuming similar growth for 2H compared to pcp, NPAT for the full year would be around $175m.

Based on a fwd 40x PE, gives a valuation of $25.15.

Updated chart below:

Have been accumulating shares around $20, so happy to see a pop up today.

Disc: Held IRL and on Strawman.

Update 02/03/2023

Personally I thought the IEL results for the 1H FY23 were pretty good.

- Revenue up 26% to $501.8m

- NPAT up 62% to 82.1

Just simply doubling these numbers for the full year would give EPS of around 59c.

Now perhaps you could argue that with interest rates rising, a PE of 60x was a bit excessive, however you could also argue that they have justified this with NPAT increase of more than 60x.

If I give them a more conservative 40x fwd PE based on the 1H results then it gives a valuation of $23.60.

Updated chart below:

Disc: Not held but if the price fell below around $25 I think I will take a small nibble.

Update 25/08/2022

Updating valuation based on their FY22 results.

IDP Education have (imo) knocked it out of the park in the 2H with total revenue of $793.3m and NPAT of $102.8m. Putting the growth trajectory on track after covid disruptions.

Below is the updated chart with the FY22 numbers imputed.

Valuation is based on 60x their NPAT result of $102.8m.

Disc: Not Held

Original Valuation

Had a bit of a look at IDP Education over the weekend after they reported their 1H22 results:

- Total Revenue = $396.8m

- EBITDA = $96.6m

- NPAT = $50.8m

I've graphed out what they've reported as results for the past 4 years below

Revenues are now higher than 1H20 which was pre-covid and is a good sign of recovery however both EBIDTA and NPAT were lower than reported in 1H20 (apologies my graph is a bit small to compare).

Seasonally 2H seems to be less profitable than 1H so I'm gonna assume around $90m NPAT for FY22 which means at the current share price ($28.53) they are trading at around 88x fwd PE.

Back in 2019 their avg PE was around 60x. So my valuation is based on a fwd PE of 60x on an assumption of around $90m NPAT for FY22.

I had a read through their announcement and presentation and didn't see any guidance given. And I'll admit that with a reopening to international students there may be a big backlog in 2H22 which may push their revenues and profit higher than my assumptions.

At this stage I'm more of a wait and see in terms of their future results. I don't expect there to be many more disruptions in terms of covid lockdowns but I also don't expect their growth to be reset back to pre-covid levels.

Disc: Not held

GS have a PT on $IEL at $27.60, not yet updated as the below is a "First Take" - broadly in line with my remarks, although they have also called out the pricing strength.

Here's there summary takeaway issued recently.

"GS Take: We expect investors to react positively to IEL’s 1H24 result. IEL’s strong performance in student placement, through a period where aggregate student visa volumes are already softening, should in our view begin to build the case for market share to drive continued SP growth despite regulatory tightening. IELTS was a touch softer and we remain of the view that the Canada visa cap is likely to have a greater impact on IELTS than SP. That said, IEL’s impressive price increases in both SP and IELTS are a handy offset, while costs may be managed relatively lower in the 2H in line with the revenue outlook - helping to support achievement of full-year consensus expectations, in our view. Buy."

IDP Education is the 5th most shorted stock on the ASX with short positions on 10% of its shares. Today, following a good 1H24 result, there might be some nervousness amongst the short sellers which is helping to fuel the higher share price (up 10% at time of writing). Sometimes higher prices lead to higher prices, and we could see a short squeeze on IEL shares. It will be interesting to see how this plays out.

Source: Shortman.com.au https://www.shortman.com.au/stock?q=IEL

Education services provider $IEL announced their 1H FY24 results today.

Overall a minor beat to consensus on revenue, EBIT and NPAT, however, from my perspective its a result that is strongly supportive of my investment thesis, which I'll discuss briefly below.

Their Highlights

- Record revenue of $579 million, up 15 per cent on H1 FY23, driven by strong student placement revenue growth of 44 per cent.

- Adjusted earnings before interest and tax (EBIT) of $159 million, up 25 per cent and adjusted Net Profit After Tax (NPAT) of $107 million, up 23 per cent, demonstrating strong operating leverage in the business model.

- Record student placement volumes of 57,300, up 33 per cent.

- English language testing (IELTS) volumes of 902,000, down 12 per cent.

- English language teaching volumes of 51,600 courses, up 15 per cent.

My Analysis

So first, the bad news, and there is some.

Testing took a hit due to a significant slowdown in India, particularly wth respect to the Canadian market. This reflects increased competition, economic and sentiment factors, and rules changes. Without India, IELTS volumes grew 17%, with $IEL noting that the testing network spans 87 countries. At it is, IELTS revenues fell 5%.

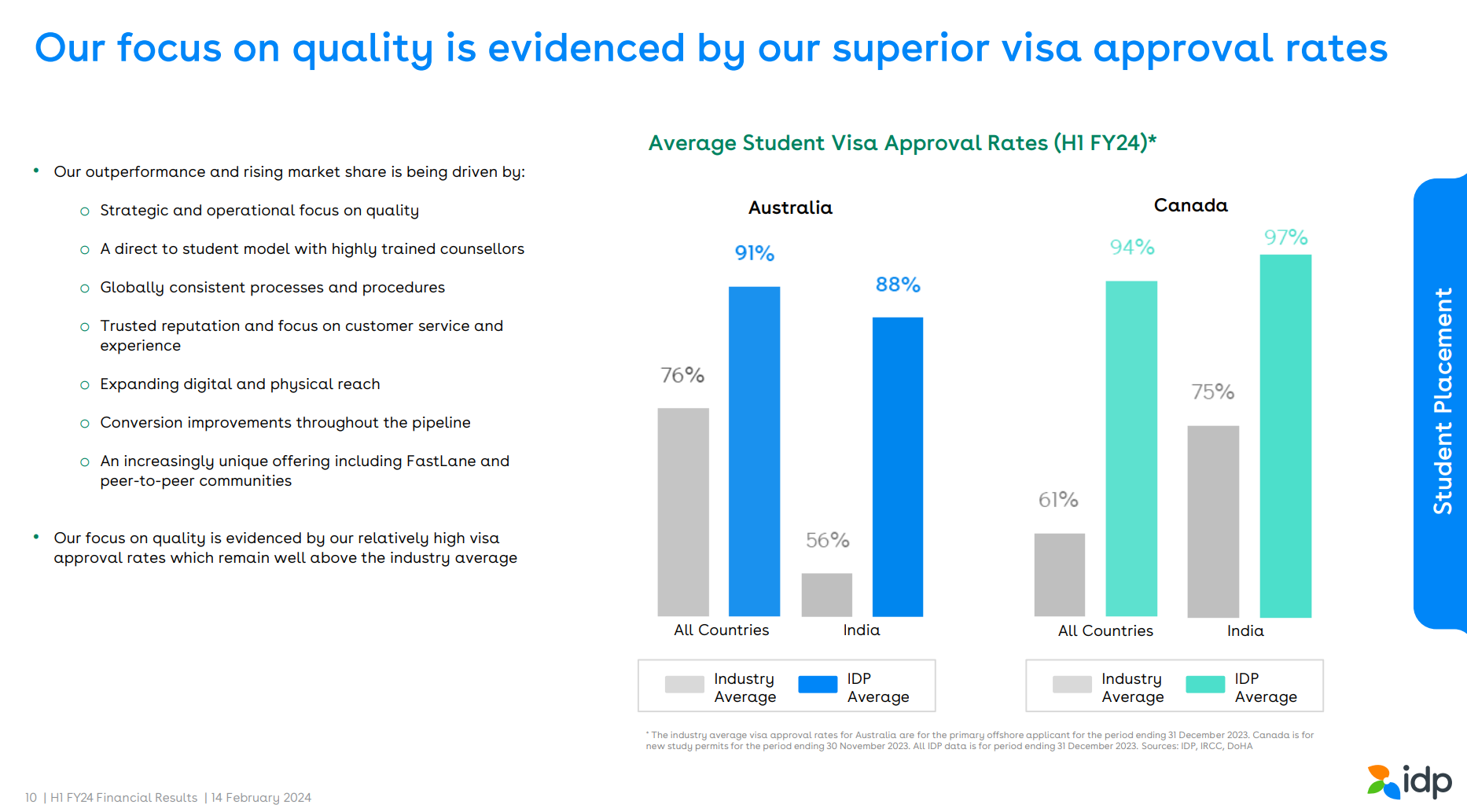

Good news - Student Placements. Placement revenues grew strongly up 44%, with volumes up 33% and with pricing increases on top. This is the thesis-supporting result. Student placement and the suite of services around it represent the core part of the $IEL offereing where it can differentiate itself. And in an environment where governments across the board are tightening up on student admissions and visa approvals, what is an industry headwind is perhaps allowing quality providers like $IEL to take market share. Given their low penetration of the markets in Australia, Canada, UK and USA, to achieve 44% revenue growth is encouraging. Of course, the environment has changed significant over the last year and indeed over recent months, so it will be interesting to see to what extent this kind of performance can continue through H2 FY24 and into FY25. But so far, so good. I call out some more detail on this below from the presentation.

The rest of the financials looks, at first glance, to be a good story of reasonable operating leverage. Total expenses have been reasonably well controlled at +13% below revenue growth.

Interest at $11.3m is up 70% reflecting higher rates and the higher debt being carried as a result of the acquisitions of Intake (in FY23) and the smaller acquisition of Ambassador in May 2023, which gives a small, unquantified boost to the Ohter Student Services.

On the cash flows, there were strong investing cash outflows for the acquired business deferred considerations ($22m) and opening of 11 international offices (PPE $8.5m) and investment in the technology platforms (intangibles of $19.3m).

Operating Cashflow was actually quite weak, almost flat on the prior period. There is nothing remarkable on receipts and payments (in line with the financials). The big difference is on cash taxes paid, which at $52m (up 67%), so this will be a timing issue and, as there has been nothing untoward on recent reports on taxes reported in the P&L, I'll just make a note to look at this at the FY.

On the balance sheet, while borrowing rose from $209m to $285m to fund acquisitions and expansions, net debt to EBITDA is modest at about 0.83 (144/173) by my estimate.

Student Placements - a deeper dive

I include 2 charts from the presentation on students placements. They speak for themselves.

In the context of low market penetration, in a more challenging environment, $IEL as a quality provider is well-positioned to take market share. This is a service where quality (incl. chances of success in getting a Visa approved) can be a very strong reputational driver.

My Key Takeaways

Good results in line with my thesis. However, like most analysts I didn't quite foresee the strength of placements and the weakness of IELTS.

My previous valuation of $IEL is $24-25. Today's result probably lifts that slightly, although some caution is advisable given the industry headwinds. So, I'll probably sit with the valuation unchanged until the FY result is in.

I suspect we'll see a positive market reaction today to the result, so I will await the next price weakness opportunity, as I'd like to increase my holding.

Disc: Held in RL, not on SM

IDP Education (IEL) has just released a solid result for 1H24.

• Record revenue of $579 million, up 15 per cent on H1 FY23, driven by strong student placement revenue growth of 44 per cent.

• Adjusted earnings before interest and tax (EBIT)ii of $159 million, up 25 per cent and adjusted Net Profit After Tax (NPAT) of $107 million, up 23 per cent, demonstrating strong operating leverage in the business model.

• Record student placement volumes of 57,300, up 33 per cent.

• English language testing (IELTS) volumes of 902,000, down 12 per cent.

• English language teaching volumes of 51,600 courses, up 15 per cent.

At this stage IEL are tracking ahead of analyst expectations with NPAT of $97.4 million ($107 million adjusted) and consensus of $173 million for FY24. However I am expecting the changes in Canada to make the second half a little tougher.

Management said “ the decrease in IELTS volumes of 12 per cent was due entirely to lower volumes in India, partially offset by increased volumes in other high-growth markets. The decline in Indian volumes was due to weaker industry conditions, increased competition and lower repeat testing rates for Canada.

The weaker industry conditions reflect a period in which international student demand was impacted by a decline in sentiment towards Canada, rule changes for student and dependent visas in the UK and an increase in visa rejection rates for Australia.

“Outside of India, IDP recorded IELTS volume growth of 17 per cent. This performance reflects IDP’s diversified global testing network which spans 87 countries and includes key growth markets for English-language testing. Our focus for English Language Testing continues to be on strategic investment in network expansion, multi-modal delivery, and product innovation,” Ms O’Shannessy said.

Quote ends.

Hopefully the market will react positively today. I’ve been accumulating IEL in IRL and on SM. I accept that in the short term there are a few headwinds facing this business, but I think the headwinds are short term and I am very bullish for continued growth in the long term. Will continue to add IRL on weakness.

A quick overview for now ahead of the market opening, but I’m expecting the market will be reasonably happy with the result today.

Held IRL (4%), SM (15%)

The Canadian government has introduced a temporary two year cap on International student visas. Here’s a quick summary below:(https://monitor.icef.com/2024/01/canada-announces-two-year-cap-on-new-study-permits/ , 22nd January 2024)

- Canada will establish a cap on the number of new study permits issued to international students

- The cap will be in effect for 2024 and 2025, and is described as a temporary measure

- Canadian immigration officials anticipate that the cap will result in a 35% reduction in the number of new study permits issued in 2024, compared to 2023 levels

- In addition to the cap, the government also announced today that as of 1 September 2024, students enrolled in programmes delivered via public-private partnerships will no longer be eligible for post-graduate work permits

- The government will also move to limit open work permits available to spouses of international students

- However, post-graduate work rights will be expanded for students completing graduate studies in Canada, with such students soon being able to apply for a three-year post-graduate work permit

My Take

To date I haven’t heard any comments from management at IDP Education (IDP) however it can’t be good news for IDP, particularly on top of the Immigration, Refugees and Citizenship Canada (IRCC) announcing the approval of several other English language tests (CAEL, PTE Academic, TOEFL iBT and CELPIP General) for the Student Direct Stream (SDS) visa program starting from 10 August 2023 (https://bellpotter.com.au/ideas/idp-education-iel-stiff-competition/)

Previously, only IELTS was accepted. SDS is an expedited study permit process for students applying to study in Canada from ~14 countries. In 2022 IRCC finalised ~739k study permit applications. Bell Potter estimates that ~45% of these are via the SDS and the test is taken ~1.7x on average equating to ~500-600k IELTS exams p.a.

Bell Potter has assumed IDP could lose approx. 30% of the SDS market in making adjustments to their forecasts (https://bellpotter.com.au/ideas/idp-education-iel-stiff-competition/).

Importance of the Canadian market to IDP?

IDP provided the following graph in their FY23 Financial Results Presentation (https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02700602-3A623946)

During FY23 Canada made up 24% of the enrolments by destination.