Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

$IEL provided a trading update this morning.

Reading through it, it is as if they've read my post last week on the Tax Loss selling Forum! So, I can honestly say I was not surprised to see today's announcement.

The SP reaction - well that's another thing altogether!

Here's their headlines.

"IDP’s key destination markets continue to be impacted by policy uncertainty, which is negatively impacting the size of the international student market globally.

• UK: heightened uncertainty following release of Immigration Policy White Paper, with further restrictions on student immigration expected

• Australia / Canada: restrictive policies remain post-election; further policy changes pending •

Canada: student demand continues to decline sharply due to ongoing policy volatility

• US: international student environment increasingly negative

This continued uncertainty has impacted IDP student enrolment pipeline size and conversion rates in the important May and June pipeline build given the timing of the fall intake in the UK, Canada and the US, as well as the second semester intake in Australia.

In FY25, IDP’s Student Placement volumes are now expected to decrease by c. 28% - 30%, and IDP’s Language Testing volumes are now expected to decrease by c. 18% - 20% compared to FY24. The impact on revenue will be partially mitigated by continued strong average fee growth.

IDP now estimates that Adjusted FY25 EBIT1 for FY25 will be in the range of $115m - $125m. The business has continued cost control initiatives since the half year, with Adjusted Overhead Costs2 for H2 FY25 now expected to be approximately 5% below H2 FY24, despite IDP’s negative operating leverage. "

My Assessment

Personally, I'm glad I spend so much of my time following what is happening politically and economically around the world, but you'd have to be living under a rock not to have seen the chilling, headwind blowing across the international student sector at the moment for multiple reasons.

None of this changes my view that $IEL is a global leader in its sector, and also, I believe that in time the business environment will turn. However, what has changed from my perspective in the last few months, is I no longer have a view as to how long these headwinds will blow. And for that reason the impact on enterprise value is real and material.

And that's why my thesis broke. Today, I'm particularly glad I bit the bullet when I did.

Disc: Not held

Interesting to observe the change in short position following last week's update ("bad news").

As others here have suggested, does the removal of uncertainty and sight of the bottom of the cycle, signal a weakening of the short thesis?

Where to from here, after all FY25 will be the weak year?

$IEL offered the following "market and regualtory update" this morning.

Key Messages

A more restrictive policy environment in IDP’s key destination countries is reducing the size of the international student market

• This has negatively impacted IELTS testing and student placement volumes during H2 FY24

• For FY24 IDP expects a 15-20% increase in student placement volumes, a 15-20% decline in IELTS volumes and solid average fee growth versus FY23

• Adjusted EBIT for FY24 is expected to be broadly in-line with FY231

• Given the current policy settings and market trends, IDP expects that the size of the international education market will decline by 20-25% over the next twelve months2

• In response, IDP is implementing a cost reduction program that is designed to align expenses to the near-term revenue outlook

• As the leading quality player in the sector, IDP remains very well placed to help students and institutions navigate these challenging market conditions and expects to grow its market share in student placement

• Despite the shorter dated cyclical dynamics, IDP remains confident in the long-term growth drivers for the industry

• IDP is strongly leveraged to the powerful long-term macro forces that will underpin the sector’s return to sustainable growth and is executing on a strategy to create a unique offering for students seeking a better life through international education

My Analysis

TBH, this was somewhat worse than I was expecting. However, it is worth pointing out that the SP is already trading at -25% to the consensus target. Thus, reporting that FY24 EBIT is expected to be in line with FY23 is not that bad, and puts the result less than 5% below consensus.

As expected, conditions in FY25 will continue to deteriorate, so $IEL are positioning themselves for this.

From my perspective, the thesis is intact. No idea how the market will respond, but a lot of bad news is already baked in, in my view.

Disc: Held in RL and SM

Over recent months, my reading of the bad news in the broader international education market from $IEL shareholders' perspectives is that things have begun to stablise. Of course, the impacts of that news is yet to play out operationally over 2024/25/26. But the key drivers are in place. However, some of the anticipated developments have started to unfold in a more benign way that at first considered likely.

A couple of weeks ago, GS put out a note with this same view (although I've just read it this afternoon), and as they've expressed things more eloquently and rigorously than I would, I have used their work as the basis for this summary.

The note is entitled: Confidence builds in FY25E earnings base after better-than-feared AU and UK regulatory news

Here is the summary (credit to my Virtual BA Claude). I've chosen to summarise the GS note and annotate the summary, as they have picked point 3., which wasn't on my radar at all.

- The UK Migration Advisory Committee recommended retaining the graduate route in its current form, allowing graduates to remain in the UK for 2-3 years after completing their studies. This was a positive outcome compared to expectations of potential tightening or abolition of the route. However, the government could still change it. The report flagged declining visa numbers already and suggested more stringent reporting requirements on institutions. (My note: With various connections in higher ed. in the UK, I think this has been as the result of vigorous and effective lobbying by the university sector. Post-Brexit, the UK is highly reliant on graduate students into some of its key sectors, including biotech and technology. I wonder if the Australian VC's will be as effective - I know through personal UK-Aus connections that the lessons are being observed.)

- In Australia, ministers were given power to set international student caps for individual higher education institutions, but no overall industry cap will be introduced. While no overall cap was expected, it had been considered to reduce net overseas migration. Institutions may be allowed to grow from a new baseline after consultation***. Visa rejection rates have already reduced overall student approvals by 34% year-to-date (but remember 2023 was +60%). The minimum funds requirement for student visas was also increased, although GS point out that this will disproportionately impact smaller/vocational institutions, with $IEL's primary exposure is in the larger unis, where conversations with industry indicate numbers are "flat-to-growing"). (***My note: The Group of 8 lobby of the biggest universities are going to work key ministers very hard in their own interests. Even though their numbers are only a minor share of the whole, this is where the big $IEL fees are. Going into the elections, I don't think the Labour Government will want to have Australian Unis. declare war, as this is almost an existential issue for Unis funding models. I'm not sure the market understands this nuance.)

- Pearson's quarterly result showed declining PTE test sales, indicating the IELTS volume declines are not purely due to market share losses to PTE but differences in market exposures between the two tests. This reinforces the view that as the key India market troughs, IELTS could resume sub-market growth from FY26 onwards. Australia is also considering changes to test score equivalency that could boost PTE volumes.

In line with my view, GS sees the impact mainly hitting FY25, but they are still expecting $IEL Student Placements into Australia to grow by +8% FY25/FY26, even in the context of declining overall migration numbers. (This is in line with my thesis that SPs are the key value driver, and that $IEL is working hard here to take share in its key markets.)

GS are sticking to their guns with a 12m SP target of $25.30.

The overwhelming market narrative is in such a funk on $IEL that I don't imagine we'll see much SP movement ahead of FY24 results or any update commentary before then.

I am aware in posting this note that I am demonstrating blatant confirmation bias; however, I haven't seen any factual analysis that justifies a contrary view.

While well and truly in the red (with an average cost base between $19-$20) I continue to be happy to ride this one out for a few years.

Disc: Held in RL

Canadaian Immigration March data now available: 42,090 study permits became effective in March 2024 (vs. 27,790 in March 2023)

That takes Q1 2024 to 122,350 (vs 90,550 in Q1 2023) or +35%.

Note: Q1 is a quiet month in Canada for this metric, but indicates strong volumes continuing in FY24, reinforcing the hypothesis that the hit might not come until FY25.

Looking at 9m YTD FY24 over PCP, the numbers are 585,470 over 459,450, or +27%

Disc. Held

Just a quick update on Canada's progress in implementing its targeted 35% reduction on student visas for 2024 over 2023.

Based on January and Feburary data for new student visas granted:

2023 Feb YTD = 63,075

2024 Feb YTD = 80,860 (+28%)

As, I've said before, early months in that market are slow, and the bureaucracy will probably target the next academic year for which the visa grants will start showing through in June, July and August.

But the data indicates the tailwind for FY24 results for $IEL haven't gone away.

(I know I'm getting a bit micro here, but I can't resist!)

GS have a PT on $IEL at $27.60, not yet updated as the below is a "First Take" - broadly in line with my remarks, although they have also called out the pricing strength.

Here's there summary takeaway issued recently.

"GS Take: We expect investors to react positively to IEL’s 1H24 result. IEL’s strong performance in student placement, through a period where aggregate student visa volumes are already softening, should in our view begin to build the case for market share to drive continued SP growth despite regulatory tightening. IELTS was a touch softer and we remain of the view that the Canada visa cap is likely to have a greater impact on IELTS than SP. That said, IEL’s impressive price increases in both SP and IELTS are a handy offset, while costs may be managed relatively lower in the 2H in line with the revenue outlook - helping to support achievement of full-year consensus expectations, in our view. Buy."

Education services provider $IEL announced their 1H FY24 results today.

Overall a minor beat to consensus on revenue, EBIT and NPAT, however, from my perspective its a result that is strongly supportive of my investment thesis, which I'll discuss briefly below.

Their Highlights

- Record revenue of $579 million, up 15 per cent on H1 FY23, driven by strong student placement revenue growth of 44 per cent.

- Adjusted earnings before interest and tax (EBIT) of $159 million, up 25 per cent and adjusted Net Profit After Tax (NPAT) of $107 million, up 23 per cent, demonstrating strong operating leverage in the business model.

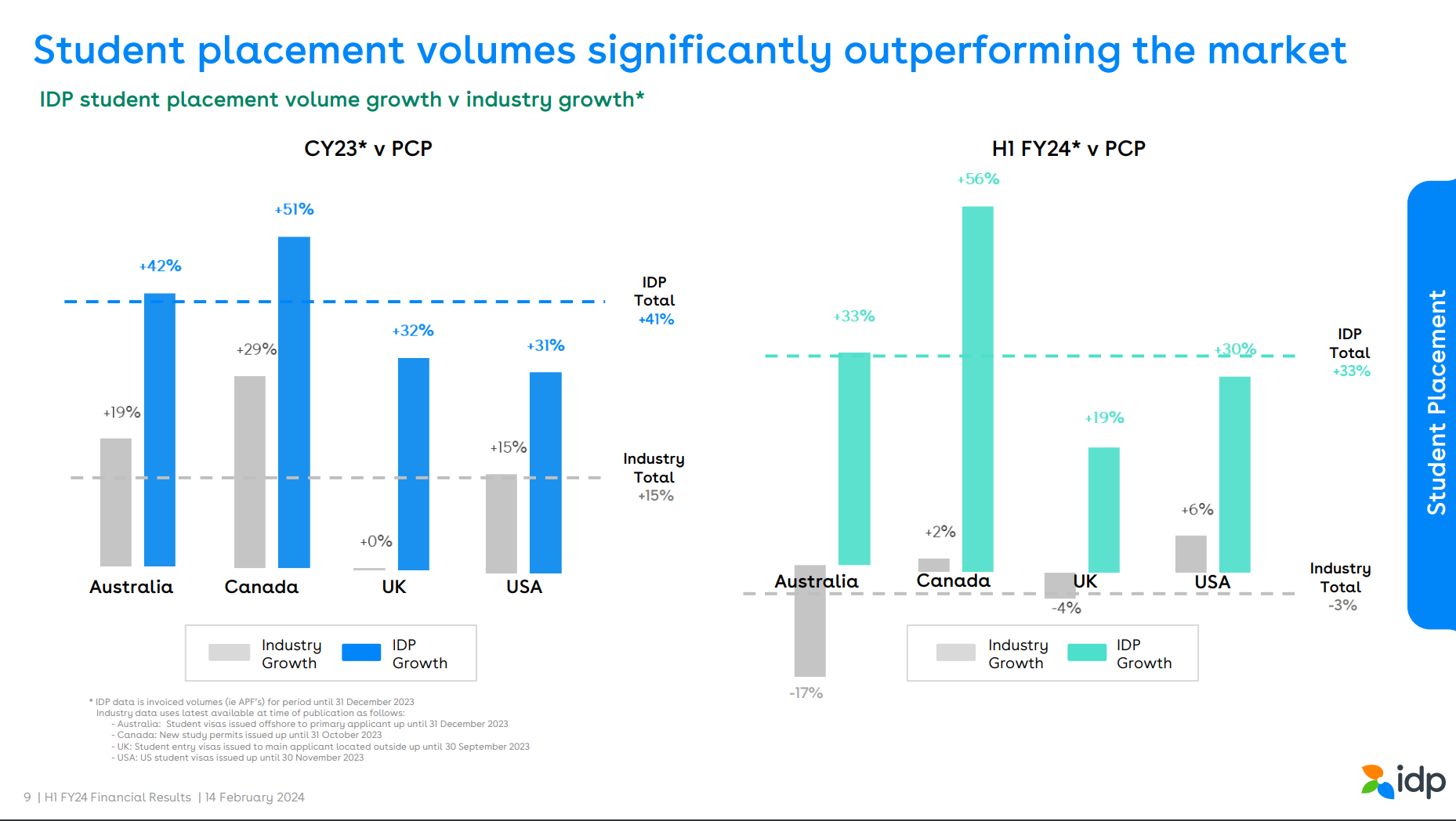

- Record student placement volumes of 57,300, up 33 per cent.

- English language testing (IELTS) volumes of 902,000, down 12 per cent.

- English language teaching volumes of 51,600 courses, up 15 per cent.

My Analysis

So first, the bad news, and there is some.

Testing took a hit due to a significant slowdown in India, particularly wth respect to the Canadian market. This reflects increased competition, economic and sentiment factors, and rules changes. Without India, IELTS volumes grew 17%, with $IEL noting that the testing network spans 87 countries. At it is, IELTS revenues fell 5%.

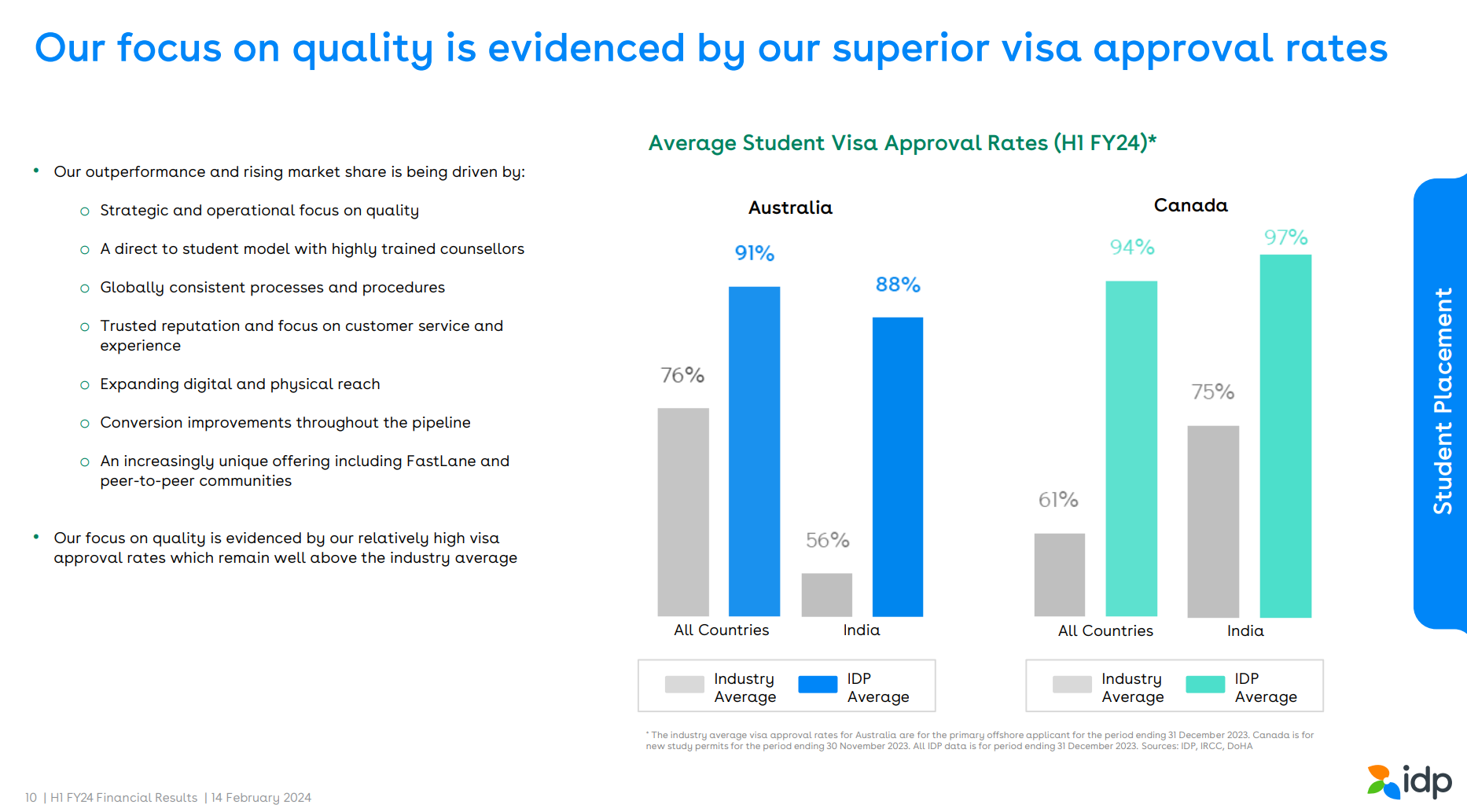

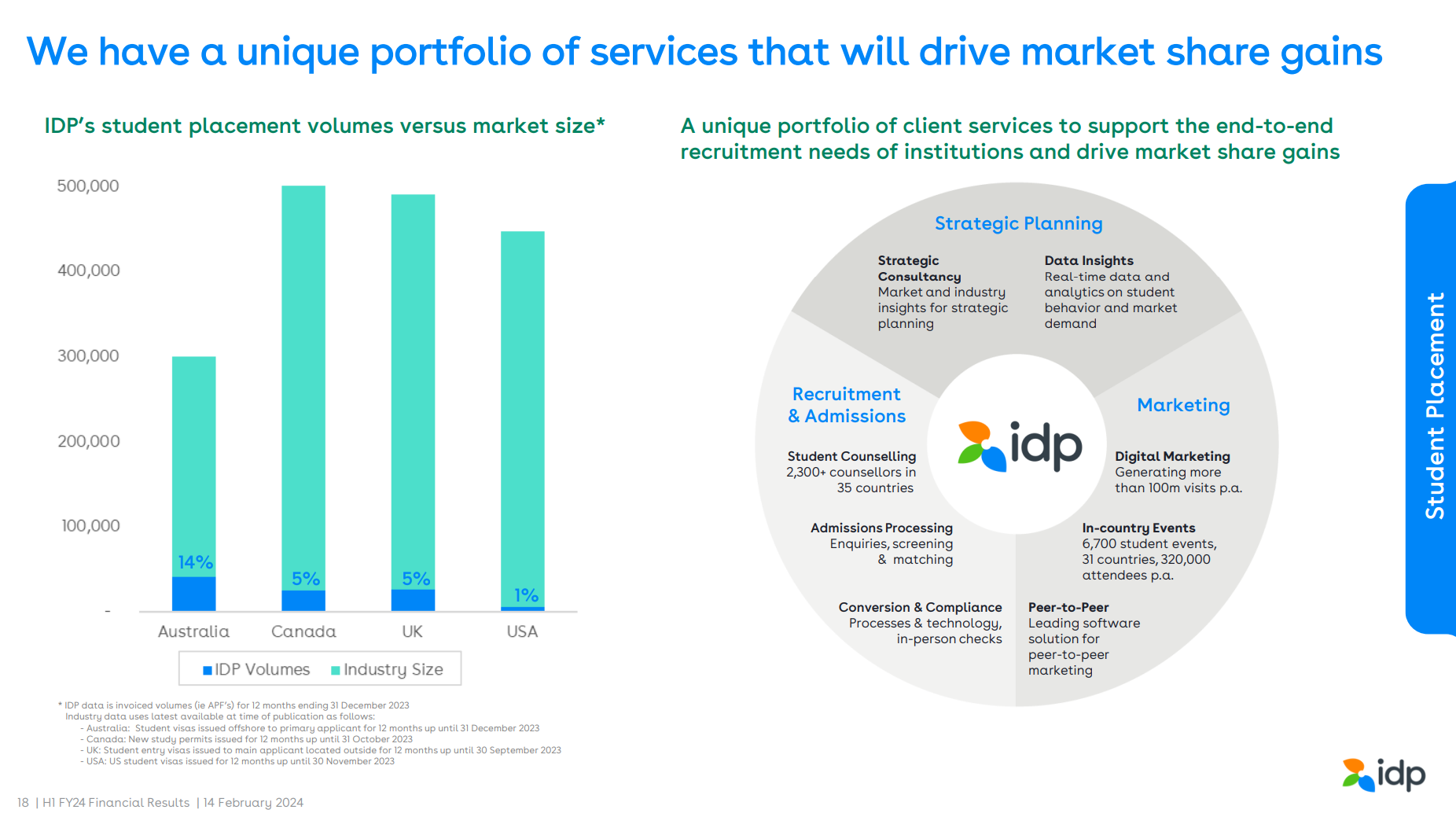

Good news - Student Placements. Placement revenues grew strongly up 44%, with volumes up 33% and with pricing increases on top. This is the thesis-supporting result. Student placement and the suite of services around it represent the core part of the $IEL offereing where it can differentiate itself. And in an environment where governments across the board are tightening up on student admissions and visa approvals, what is an industry headwind is perhaps allowing quality providers like $IEL to take market share. Given their low penetration of the markets in Australia, Canada, UK and USA, to achieve 44% revenue growth is encouraging. Of course, the environment has changed significant over the last year and indeed over recent months, so it will be interesting to see to what extent this kind of performance can continue through H2 FY24 and into FY25. But so far, so good. I call out some more detail on this below from the presentation.

The rest of the financials looks, at first glance, to be a good story of reasonable operating leverage. Total expenses have been reasonably well controlled at +13% below revenue growth.

Interest at $11.3m is up 70% reflecting higher rates and the higher debt being carried as a result of the acquisitions of Intake (in FY23) and the smaller acquisition of Ambassador in May 2023, which gives a small, unquantified boost to the Ohter Student Services.

On the cash flows, there were strong investing cash outflows for the acquired business deferred considerations ($22m) and opening of 11 international offices (PPE $8.5m) and investment in the technology platforms (intangibles of $19.3m).

Operating Cashflow was actually quite weak, almost flat on the prior period. There is nothing remarkable on receipts and payments (in line with the financials). The big difference is on cash taxes paid, which at $52m (up 67%), so this will be a timing issue and, as there has been nothing untoward on recent reports on taxes reported in the P&L, I'll just make a note to look at this at the FY.

On the balance sheet, while borrowing rose from $209m to $285m to fund acquisitions and expansions, net debt to EBITDA is modest at about 0.83 (144/173) by my estimate.

Student Placements - a deeper dive

I include 2 charts from the presentation on students placements. They speak for themselves.

In the context of low market penetration, in a more challenging environment, $IEL as a quality provider is well-positioned to take market share. This is a service where quality (incl. chances of success in getting a Visa approved) can be a very strong reputational driver.

My Key Takeaways

Good results in line with my thesis. However, like most analysts I didn't quite foresee the strength of placements and the weakness of IELTS.

My previous valuation of $IEL is $24-25. Today's result probably lifts that slightly, although some caution is advisable given the industry headwinds. So, I'll probably sit with the valuation unchanged until the FY result is in.

I suspect we'll see a positive market reaction today to the result, so I will await the next price weakness opportunity, as I'd like to increase my holding.

Disc: Held in RL, not on SM

$IEL announced their FY23 results today.

Their Highlights

- Record revenue of $982 million, up 24 per cent vs FY22; driven by strong student placement revenue growth of 63 per cent vs FY22.

- Adjusted EBIT* of $228 million, up 40 per cent vs FY22 and Adjusted NPAT* of $154 million, up 45 per cent vs FY22, demonstrating strong operating leverage in the business model.

- Record student placement volumes of 84,600, up 53 per cent vs FY22, driven by the Australian market growing 77 per cent vs FY22, and other study destinations growing at 39 per cent.

- Record IELTS volumes with 1.93 million tests administered by IDP during FY23.

- English language teaching course enrolments of 94,300, up 35 per cent vs FY22.

- Final dividend declared of 20 cents per share taking full-year declared dividends to 41 cents per share, which is an increase of 52 per cent vs FY22.

My Analysis

A strong result but, with today's "trigger happy" market, this is a marginal miss, so who knows what's coming:

- NPAT = $149.1m vs consensus $153m (-2.5%)

- EBIT = $220.7m vs consensis $227m (-2.8%)

- EBITDA = $271.2m vs consensus $274m (-1.1%)

"Consensus" depends on your dataset. Mine is marketscreener.com (n=9 to 13 depending on the metric)

Overall, it is a strong performance on volumes and pricing, with revnue up 23% y-o-y on a constant currency basis.

Control of direct cost growth to 10% has helped gross profits grow 33% and lower tax growth and low net debt have enabled NPAT growth of 45% or 42% on constant currency.

Now, having recovered from the impacts of COVID on the sector, % gross margin and % operating margin are back on trend showing the operating leverage of the business.

Overall, cash generation was strong with FCF over $100m (including payment of $80.9 for acquisition).

The Student Placements business is the core growth driver and, within this, you can see the importance of the Indian market, shown below, with China yet to return to pre-pandemic strength.

My Key Takeaways

International education is back, and $IEL has performed well in FY23, with strong growth and margin expansion.

I had been watching this company for several years and couldn't justify the SP in the heady days of $28-$32/share. However, earlier this year, when the market had a little tantrum over opening of the Canadian market to competition in IELTS my patience was rewarded, and I took an initial 2.5% RL position.

My reading is that the result today is strong, and with the SP below my preliminary valuation of $24-$25 (likely to be increase with the FY result in the bank), I'll happily take another bite today if the market has another sad-on with this minor miss.

Disc: Held in RL (2.6%) but not on SM. (I consider $IEL a proven,profitable, quality company and I tend not to hold these on SM)

So, $IEL down another 6% today, so down a total of 21% since the Canada news.

With a few days water under the bridge, all the brokers have had a chance to update, and the results are:

- 2 days before announcement: TP $32.66 (min. $22.50; max. $37.00; n= 14)

- Since then, looks like 12 downward SP revisions; net recc. moves: 1 to underperform; 1 new coverage

- 3 days after announcement: TP $27.57 (min. $18.50; max $35.50; n=15)

- Net TP reduction: -15.5%

I picked up a 2% holding at -16%. I will now wait to see what happens. I expect the effect of the downgrades, the ST price action, and the high daily volumes (c. 10x usual) might keep some downward momentum going for a bit (maybe someone who is a chartist can help here)? Biding my time to pick up another 2%.

My person quick val. is $24.00-$25.00 and unchanged by Canada as I formed my view of IEL in a competitive context and consider overall macro for the sector and its focus on high margin placements to be much bigger drivers of value.

But, I'm very happy for the traders to let it rip for a while.

Disc. Held in RL.

Post a valuation or endorse another member's valuation.