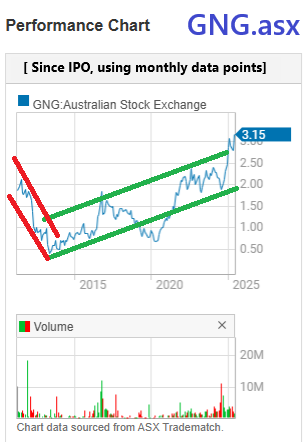

18th June 2025: Firstly, I hold GNG, and remain bullish on the company, so that's the context of this post. However, their share price has run ahead of where I expected them to be right now, and I'm wondering if there's either a takeover brewing or else a fundie is building or increasing a position ahead of what they expect to be a better than anticipated full year report from GNG in August (for FY2025).

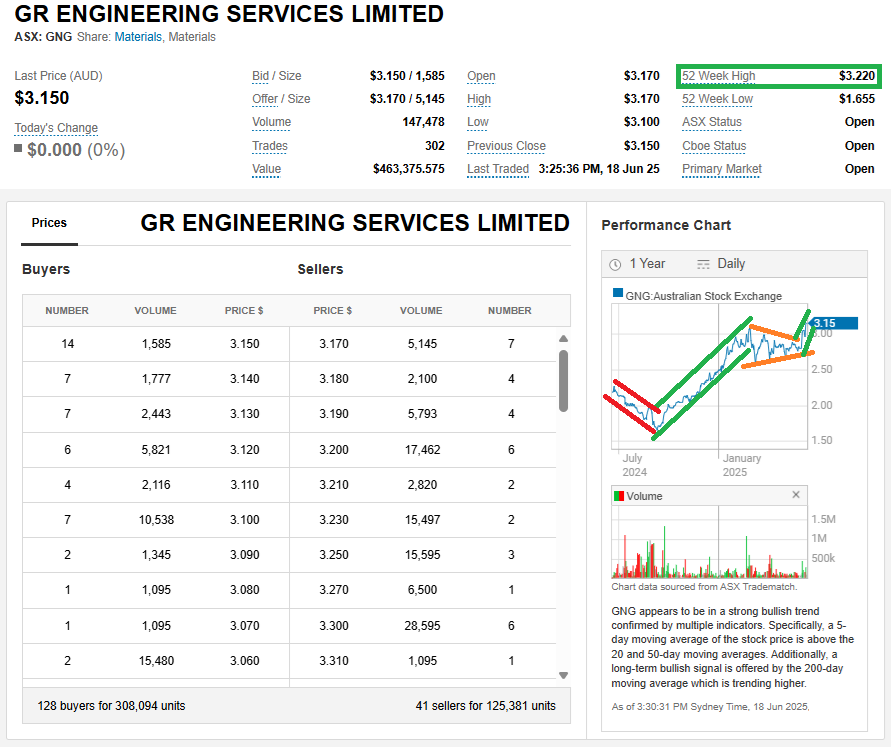

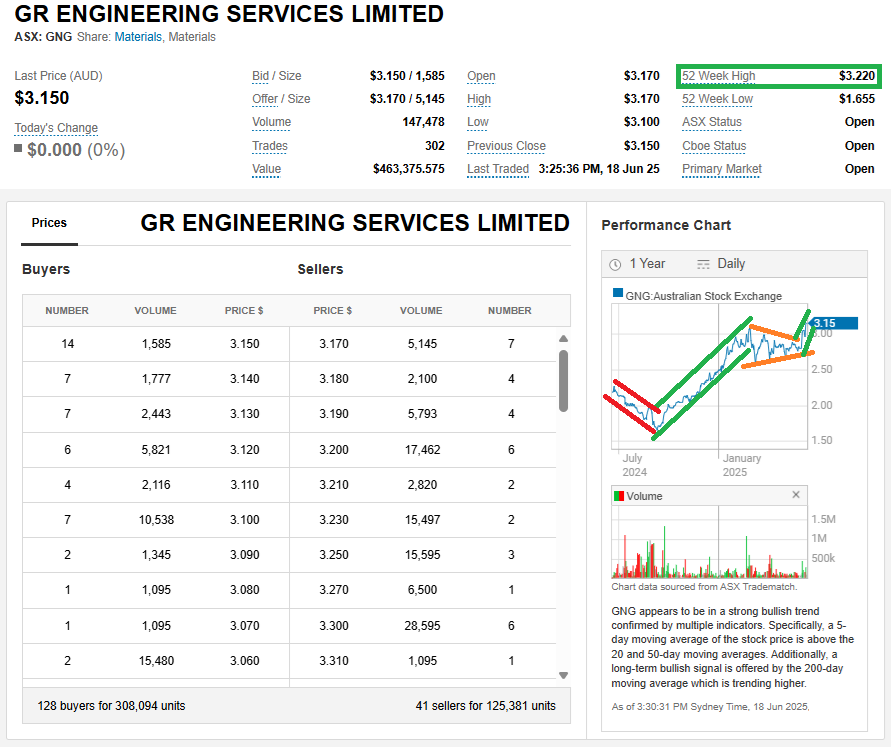

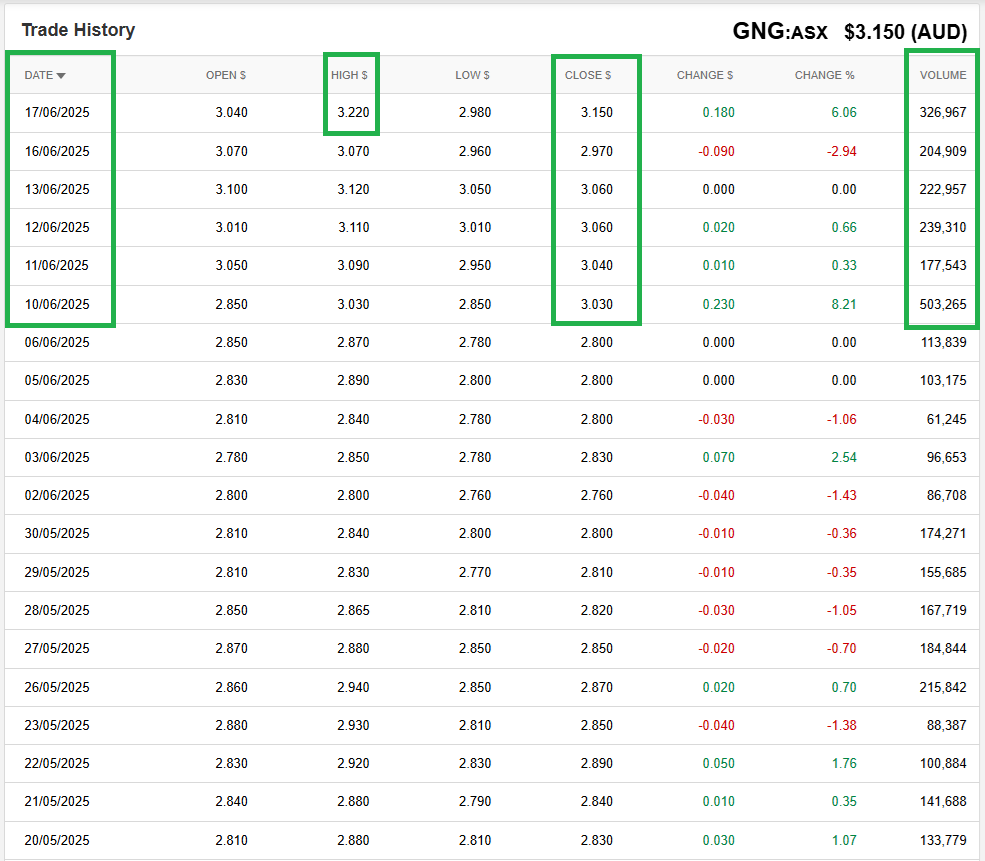

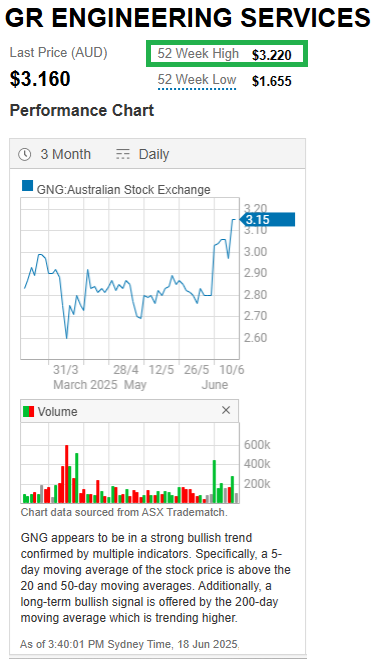

That 52 week high of $3.22 was hit yesterday, as shown below, and that's also an all-time high share price for GNG. Below is the recent daily trading data for GNG and I note that the last 6 trading days (prior to today) have been above-average volumes for GNG, and they've broken out to the top side of a pennant formation (as shown above).

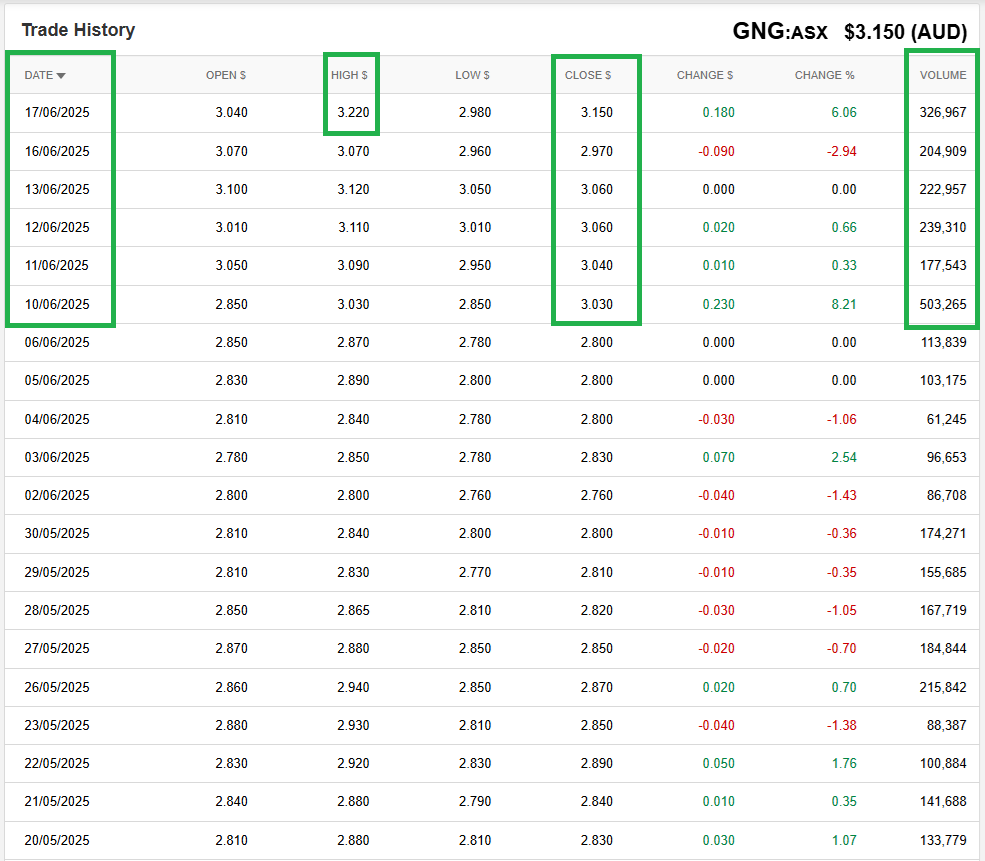

Here's the past 3 months so you can see that breakout more clearly:

The share price ticked up to $3.16 (from $3.15) when I was screenshotting that, but it dropped back to $3.15 a minute later.

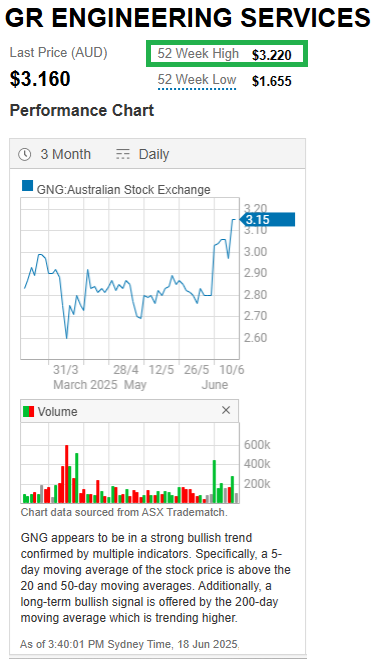

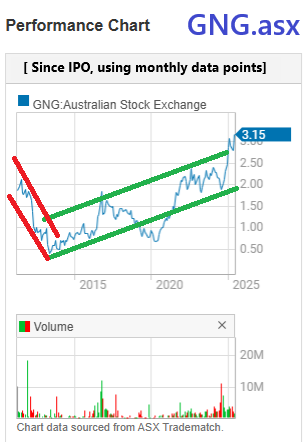

Below is a graph of GNG's share price since IPO and shows that they've been in a long term uptrend for 12 years now - since June 2013:

And they've broken up above that rising channel now, which I do not think is sustainable, however I do reckon it is likely signalling that somebody or some entity (fund or company) is building a decent stake, which is impossible to do in a low liquidity company like GNG without moving the share price.

In my largest real money portfolio (the one outside of my SMSF), GNG is the second largest position (behind LYL), but I haven't added to that position since early June (2nd) when I added more at $2.80, after also topping up in May at prices varying between $2.76 and $2.84 (I made 4 top up buys in May).

It's interesting because LYL (Lycopodium) is a very similar company, and their share price has been trading sideways between $10 and $11 for 3 months and they've been in a short term downtrend during the past 3 weeks, so this rise in the GNG share price on higher volumes does not appear to be an industry sentiment driven thing, it's specific to GNG.

I don't fully understand it yet, but I'll take it.

For further context, GNG have only released two new contract win announcements during the past 3 months (i.e. since their H1 results were released in Feb):

King-of-the-Hills-Operations-Stage-2-Upgrade-(GNG-05-June-2025).PDF

GR-Engineering-Awarded-Black-Swan-Plant-Engineering-Study-(HRZ-08-April-2025).PDF

They did release their HY25 Investor Presentation in mid-March, being just over 3 weeks after their H1 results were released, which included the following slide:

Typically understated confidence. They rarely make any acquisitions and when they have, those have been both strategically smart as well as earnings accretive. They might be about to announce another acquisition, but I also wouldn't be surprised to see another company try to acquire GR Engineering (GNG).

Of course it might just be that one of the three brokers that cover them (see below) have recently released an update and upgraded their call and/or their target price for GNG, and that the subsequent retail buying has caused the share price to break out simply due to the lack of sellers (low liquidity).

Source: https://www.gres.com.au/investors/analyst-reports.aspx

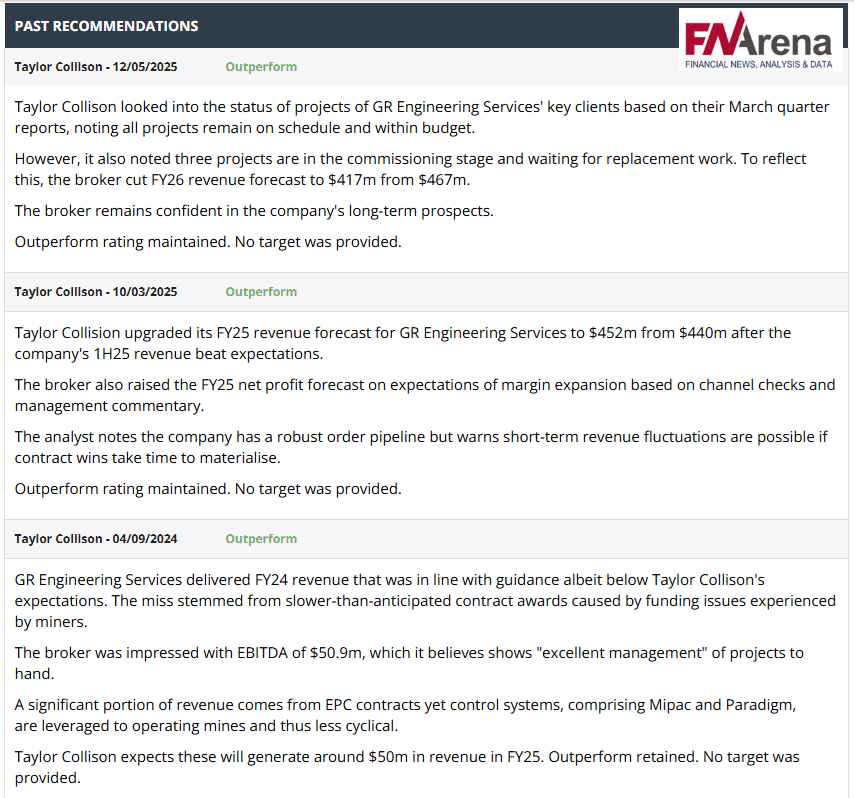

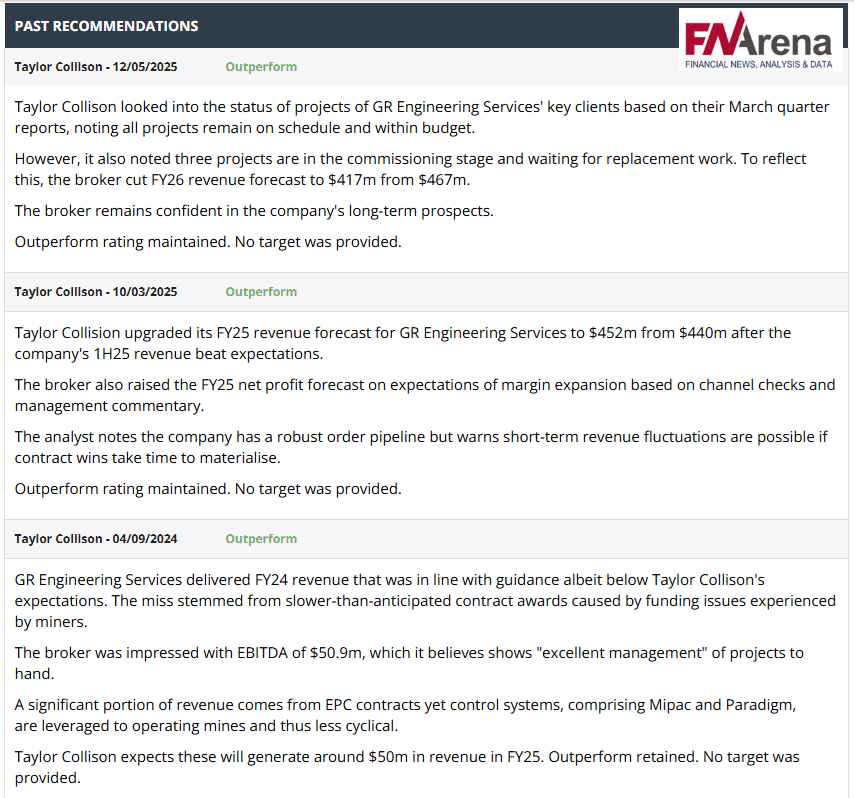

I'm not a client of Argonaut, EH or TC, so I don't have access to those reports. I do subscribe to FNArena, however FNArena don't cover those three brokers within their closely monitored "Expert Views" a.k.a. "Broker Calls", and only have TC on their "Extra Coverage" list (a.k.a. "B.C. Extra"), and they say (about that), "Please note: unlike Broker Call Report, BC Extra is not updated daily. The info you see might not be the latest. FNArena does its best to update ASAP."

FWIW, FNArena have summarised TC's latest three updates like this (below, latest one at the top):

Source: https://fnarena.com/index.php/analysis-data/consensus-forecasts/stock-analysis/?code=GNG

Could also be that news has leaked of an impending major new contract award to GNG. We shall see...

Disc: Holding. GNG is one of my largest positions at this point in time in my real money portfolios. And a smaller position here on Strawman.com.