Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

25th August 2025: GNG-FY25-Financial-Results---Media-Release.PDF

GNG typically release a results presentation later in the day or during the following week rather than when they release their results, and this appears to be the case once again with no presentation being lodged yet, just the media release announcement (link above).

They have released their Full Year Statutory Accounts.

Here's how the did in FY25 compared to FY24:

As usual, they did not provide any percentages or arrows - that green stuff has been added by me. A small decrease in cash from $74.6 mill to $71 mill is nothing to worry about - the cash moves around a lot with these E&C contractors due to the timing of milestone and project completion payments, etc. They have negligible debt, basically they are debt free with a nice pile of cash relative to their market cap (which is currently $738 million).

Here is an excerpt from their announcement today:

They did disclose more info on their Energy division (GRPS) however they derive the bulk of their income from their Mineral Processing (MP) division, so that's the one that interests me most. Please read the whole announcement (link at the top of this straw) for full details, including their Energy Division performance during the year.

I personally think that what's exciting investors the most about GNG is the sheer number of studies (30) that they are undertaking for clients and we know that some of their clients (like DVP, HRZ and MM8) have already indicated that they expect GNG to be awarded the EPC contracts for those projects when those projects get greenlighted to proceed, which in many cases is going to be in the current financial year or calendar 2026, so we can expect some more contract win announcements from GNG over the next 12 to 18 months. E&C companies like GNG and LYL who do the scoping and then the PFS and FS studies for their clients' projects tend to win the EPC contracts to design and build those projects most of the time, when those projects receive positive FID decisions - not all projects ultimately get built - so study numbers are a leading indicator of future work.

That final dividend was 10 cps last year, so it's 20% higher this year. Fully Franked again.

The market continues to drive GNG's SP higher:

They made a new all-time high this morning of $4.62/share.

Lots to like here - very high insider ownership, zero debt, plenty of cash, profitable, growing, busy, tailwinds (elevated gold price), excellent management with a track record of superb capital allocation - they rarely make acquisitions and they are usually small and paid for using their own cash, superb industry position here in Australia, wonderful reputation that sees them winning more and more work, including from existing/previous clients, some baseline ARR from Energy (GRPS) division; the only negatives are that their MP division can have lumpy revenue and profits, their margins do move around a bit, and they can go through lean times because they're exposed to cyclical sectors like precious metals and base metals mining, but they have tailwinds right now rather than any headwinds.

Disclosure: Holding both here and IRL.

GNG is slated to report in a week's time, on Tuesday 26th August, and they've had a good run-up leading into these results:

And while I have been thinking they looked overbought, and have been lightening (trimming) my positions up here - although I still hold GNG - today's results and associated market reactions from SRG and MND, two other engineering and construction companies who have some similarities to GNG - have been encouraging:

SRG FY25 Full Year Results Announcement

2025 Full Year Results Briefing

2025 Full Year Results Presentation

Monadelphous-Reports-2025-Full-Year-Results.PDF

2025 Full Year Results Presentation

So, both SRG and MND have had a good run up into today's results and then been bid-up on their results on top of that. It's seems like there's some bullish positive sentiment returning to the sector on the back of positive results and increased work and profitability.

Looking forward to GNG reporting next Tuesday (26th) and LYL reporting tomorrow (Wednesday 20th August), particularly LYL (Lycopodium) as they are my largest position in real life by a decent margin.

11-Aug-2025: There are a number of August 2025 results calendars around at the moment, but none of the ones I've looked at have included some of the smaller companies I hold like GNG, so I sent off a bunch of emails over the weekend asking when each of them currently expect to be releasing their FY2025 Full Year Results to the market this month, and Omesh Motiwalla, the CFO & Company Secretary of GNG replied this morning to say that "Our FY25 results will be out on 26 August 2025."

So Tuesday next week.

For larger companies, here are a few of the results calendars I've checked so far:

Motley Fool Australia: https://www.fool.com.au/asx-reporting-season-calendar/

Market Index: https://www.marketindex.com.au/news/asx-reporting-season-calendar-august-2025

Bell Potter: https://www.bellpotteronline.com.au/bpo/reporting-season

18th June 2025: Firstly, I hold GNG, and remain bullish on the company, so that's the context of this post. However, their share price has run ahead of where I expected them to be right now, and I'm wondering if there's either a takeover brewing or else a fundie is building or increasing a position ahead of what they expect to be a better than anticipated full year report from GNG in August (for FY2025).

That 52 week high of $3.22 was hit yesterday, as shown below, and that's also an all-time high share price for GNG. Below is the recent daily trading data for GNG and I note that the last 6 trading days (prior to today) have been above-average volumes for GNG, and they've broken out to the top side of a pennant formation (as shown above).

Here's the past 3 months so you can see that breakout more clearly:

The share price ticked up to $3.16 (from $3.15) when I was screenshotting that, but it dropped back to $3.15 a minute later.

Below is a graph of GNG's share price since IPO and shows that they've been in a long term uptrend for 12 years now - since June 2013:

And they've broken up above that rising channel now, which I do not think is sustainable, however I do reckon it is likely signalling that somebody or some entity (fund or company) is building a decent stake, which is impossible to do in a low liquidity company like GNG without moving the share price.

In my largest real money portfolio (the one outside of my SMSF), GNG is the second largest position (behind LYL), but I haven't added to that position since early June (2nd) when I added more at $2.80, after also topping up in May at prices varying between $2.76 and $2.84 (I made 4 top up buys in May).

It's interesting because LYL (Lycopodium) is a very similar company, and their share price has been trading sideways between $10 and $11 for 3 months and they've been in a short term downtrend during the past 3 weeks, so this rise in the GNG share price on higher volumes does not appear to be an industry sentiment driven thing, it's specific to GNG.

I don't fully understand it yet, but I'll take it.

For further context, GNG have only released two new contract win announcements during the past 3 months (i.e. since their H1 results were released in Feb):

King-of-the-Hills-Operations-Stage-2-Upgrade-(GNG-05-June-2025).PDF

GR-Engineering-Awarded-Black-Swan-Plant-Engineering-Study-(HRZ-08-April-2025).PDF

They did release their HY25 Investor Presentation in mid-March, being just over 3 weeks after their H1 results were released, which included the following slide:

Typically understated confidence. They rarely make any acquisitions and when they have, those have been both strategically smart as well as earnings accretive. They might be about to announce another acquisition, but I also wouldn't be surprised to see another company try to acquire GR Engineering (GNG).

Of course it might just be that one of the three brokers that cover them (see below) have recently released an update and upgraded their call and/or their target price for GNG, and that the subsequent retail buying has caused the share price to break out simply due to the lack of sellers (low liquidity).

Source: https://www.gres.com.au/investors/analyst-reports.aspx

I'm not a client of Argonaut, EH or TC, so I don't have access to those reports. I do subscribe to FNArena, however FNArena don't cover those three brokers within their closely monitored "Expert Views" a.k.a. "Broker Calls", and only have TC on their "Extra Coverage" list (a.k.a. "B.C. Extra"), and they say (about that), "Please note: unlike Broker Call Report, BC Extra is not updated daily. The info you see might not be the latest. FNArena does its best to update ASAP."

FWIW, FNArena have summarised TC's latest three updates like this (below, latest one at the top):

Source: https://fnarena.com/index.php/analysis-data/consensus-forecasts/stock-analysis/?code=GNG

Could also be that news has leaked of an impending major new contract award to GNG. We shall see...

Disc: Holding. GNG is one of my largest positions at this point in time in my real money portfolios. And a smaller position here on Strawman.com.

24-Feb-2025: GNG-HY25-Financial-Results---Media-Release.PDF

Source: GNG-HY25-Financial-Results---Media-Release.PDF [24-Feb-2025]

See also: Half Year Financial Report and Appendix 4D.PDF

Disc: I hold GNG and bought more in my largest real money portfolio today.

I was concerned that this result might have been weaker than what had been expected, particularly with the very strong run-up that the GNG share price has had into this result, but I needn't have worried - they knocked it out of the park.

At today's close of $3/share (GNG's highest closing share price ever), paying 20 cps p.a. in dividends (10c interim + 10c full = 20cps per year), they're paying a 6.7% dividend yield, and that is fully franked, so a grossed up yield of 9.5% including the full value of those franking credits.

Again, income plus growth, gotta love it!

27-Nov-2024: FY24 Annual General Meeting Presentation.pdf

Also: GRES (GNG) 2024 Annual Report.pdf

I've been reducing my exposure to GNG leading up to today's AGM, despite the company being one of my favourites and having been a very positive performer for me over recent years, with a good percentage of those TSRs coming from their generous dividends.

At below $2/share they still looked like a buy, despite their current and near-term headwinds, and I was buying, but at around $2.20 and over, they looked like there was significant near-term downside if they couldn't pull a rabbit out of the hat and outperform again this FY.

The AGM presentation and commentary is usually a decent indicator of how they are travelling, particularly as it comes out towards the end of H1.

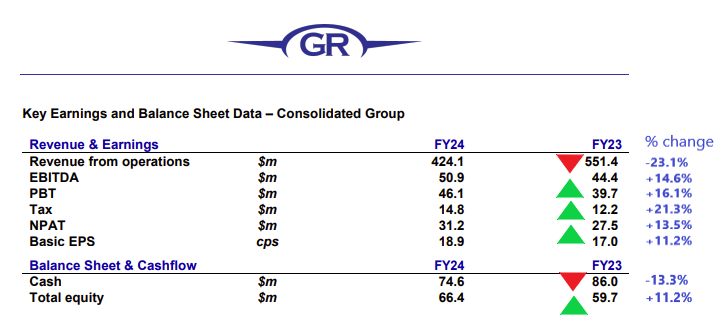

But to understand my concerns over recent months, we need to look at GNG's FY23 vs FY24, and their 2024 Annual Report:

The three projects I have highlighted there (above) all have issues. Kathleen Valley is Liontown's (LTR's) flagship lithium project, and lithium, as everyone knows, has been smashed - and Kathleen Valley won't be profitable at these lithium prices. I don't want to dwell on LTR much, but if you look at their 12-month share price graph, their SP has more than halved this past year from over $1.60/share to now under 80 cents/share (cps). GNG are constructing just two paste plants for Kathleen Valley in FY25 (this FY) and the total value of that work is just $71 million, so GNG's Kathleen Valley (lithium) exposure is not major, but exposure to lithium doesn't look as positive in FY25 as it did a few years ago.

The next one I've highlighted there, West Musgrave, is predominantly a nickel project, which was awarded to GNG by OZ Minerals before OZ Minerals were acquired by BHP. It formed the bulk of GNG's order book (dwarfing other projects) up until July this year when BHP announced a "temporary suspension" of both the West Musgrave project and also BHP's entire Nickel West operations, due to the persistently low nickel price with nickel having undergone a structural change due to low-cost Indonesian nickel now dominating the market.

I had expected West Musgrave to be shelved at some point, and I talked about that here earlier in this calendar year, and that did indeed come to pass in July, and GNG announced the expected financial impact for them from BHP's decision here: Market-Update---West-Musgrave-Project.PDF on July 12th - saying that FY25 revenue would now be $80m lower. My larger concern was that the bulk of that West Musgrave revenue would have flowed through to GNG in FY26 and that FY26 revenue from West Musgrave is now likely to be $0.

The market ran the numbers over the next few days, well - the very tiny percentage of the market that even know that GNG exists and are also interested in them as an investment opp did, and the share price was sold down -21.7% from $2.12 to as low as $1.66 on September 9th. I was buying at those levels (below $2 and especially below $1.80). This was, after all, something I fully expected to happen, so I figured if the market overreacted, which it did, it was a buying opp, so I was buying.

The third project I've highlighted there is Hastings Tech Metals' Yangibana REO project. I won't go into that in too much detail except to say that this was a significant project, worth $210 million to GNG, and Hastings have headwinds right now:

Cash-strapped Hastings yet to draw on taxpayer-funded loan [AFR]

Peter Ker, AFR Resources reporter, Nov 11, 2024 – 7.31pm

Cash-strapped rare earths developer Hastings Technology Metals has not been allowed to draw down the $220 million of taxpayers’ funds pledged towards its Yangibana project more than 33 months after the first tranche of the proposed loan was announced.

The federal government’s Northern Australia Infrastructure Fund confirmed that Hastings had still not met the conditions required to access the money, and the agency would need to review Hastings’ strategic pivot towards China before deciding whether to proceed with the loan.

Hastings is developing the Yangibana rare earths project in West Australia’s Gascoyne region.

The comments from NAIF add to the uncertainty over pre-revenue Hastings’ ability to fund the completion of the Yangibana mine at a time when billionaire businessman Andrew Forrest’s company, Wyloo Metals, is mulling whether to call in a $150 million loan over a debt dispute.

Hastings had just $9.9 million of cash on hand on September 30 and needs to raise close to $300 million to complete the construction of Yangibana, near Carnarvon in Western Australia.

The $220 million pledge from NAIF and a further $100 million pledged by the federal government’s Export Finance Australia agency were supposed to provide a large portion of the money needed for the construction of Yangibana.

The government agencies loaned the money on the condition that Hastings would build a rare earths separation plant for Yangibana.

That plan appealed to government agencies in an era when they were trying to break China’s stranglehold on the processing of the rare earth elements needed for defence applications and clean energy infrastructure.

But Hastings pivoted towards a cheaper strategy in May last year, with plans to produce an intermediate rare earths product. The company has since struck agreements to have that intermediate product processed in China and recently welcomed a Chinese investor to buy 9.8 per cent of its shares.

Asked whether the strategic pivot towards China had soured NAIF’s willingness to pump taxpayer funds into Yangibana, a spokesman said all ownership changes were monitored by NAIF.

“Any material changes to the product sales strategy would require detailed review by NAIF prior to funds being available,” said the spokesman.

“NAIF’s facility has not reached contractual close.”

A company linked to Hastings chairman, Charles Lew, loaned $5 million to Hastings last week, a move that has angered Wyloo, which believes it was a breach of the conditions attached to the $150 million loan it made in 2022.

If Hastings was deemed to be in default of the conditions attached to Wyloo’s loan, the lender would be able to demand repayment.

But Hastings tried to assure investors on Monday that Mr Lew’s loan did not amount to default on the Wyloo loan.

“Both facilities were established for separate purposes and are not in contravention of each other,” said Hastings in an ASX statement.

--- ends ---

Short version is that Wyloo, a large private company owned by Andrew ("Twiggy") Forrest (founder and major shareholder of FMG) is Hastings' major lender and there is a lending covenant that stipulates that Hastings must not seek aditional funding from anyone other than Wyloo, or else Wyloo can call in their loan to Hastings immediately, and Wyloo have now done that, and Hastings are not in any position to be able to either (a) repay Wyloo at this early stage, or (b) refinance at even vaguely reasonable terms so as to pay out Wyloo. The two companies are currently in dispute over this.

It pays to understand that as one of Australia's richest people Twiggy tends to take longer term views and make investments based on longer time horizons than most people, and Wyloo is bullish nickel over a longer term, like 10 to 20 years, and is willing to hoover up distressed nickel assets and then sit on them until the cycle finally turns. Hastings' Yangibana project is rare earths, NOT nickel, but clearly Wyloo also has the capacity and intention to also hoover up REO projects as well.

Nickel and rare earths all play into Twiggy's push for decarbonisation and his belief that demand for battery metals and rare earth magnets are only going to increase over time. Wyloo will likely end up with 100% ownership of Yangibana, which it has security over due to being Hastings' largest lender, and there are no guarantees that the project will continue to be built at this point in time. Once in full control of the asset, Wyloo could easily decide to defer construction, so Yangibana may also get shelved, like West Musgrave was been.

Hastings (HAS.asx) has a share price that has declined even more than LTR's SP; HAS had an SP that was over 70 cps at the start of calendar 2024 - and is now 28 cps, so that's around a -60% SP decline. In January 2022 HAS was trading at $5.70 (closing SP on 31-Jan-2022). They are now -95% below that level, in just under three years.

So perhaps you can see why I had some concerns about GNG's order book as at June 30, 2024, as described in their FY24 results and 2024 Annual Report.

Not all bad news though - here's the next page from their 2024 Annual Report:

Mipac seems to be firing, and the bolt-on acquisition of Paradigm Engineers in Feb adds additional capability in terms of electrical engineering and control systems, automation and technology.

And the level of Studies that GNG are engaged in sounds healthy.

Those who follow GNG & LYL know that a good number of these studies do lead to the award of EPC / EPCM (or in LYL's case also EPM or EP & PM) contracts if and when those studies flow through to positive FIDs (final/financial investment decisions) by the project's owners.

So, now we get to see where GNG see themselves now, as at today's AGM, and their outlook statement for FY25:

Considering that both GNG & LYL like to set realistic and easily achievable targets and then overdeliver (exceed those targets), GNG providing an FY25 revenue guidance range today (above) that starts just above their FY24 revenue (of $424.1 million) and their FY25 revenue guidance midpoint (of $437.5 million) that is 3% above FY24 revenue, is actually a good result when you consider those individual project and commodity headwinds I mentioned above.

And it's hard to say that GNG are going backwards or even going through a period of weaker demand based on their results and guidance:

Source: GNG AGM Presentation (today)

Source: Commsec

Source: GNG 2024 Annual Report

Source: GNG AGM Presentation (today) (above and below).

By the way, there are just two brokers covering GNG - see below - and they don't make their reports available to the public too often. So the company is not very well known.

The small part of the market that is interested in GNG wasn't underwhelmed at all with today's report; in fact it appears that the market got what they hoped for, it's "steady-as-she-goes" with no surprises in today's new info.

Source: Commsec at around mid-day today.

Here is how they describe their two main divisions in terms of order books (today):

Their "Energy" division (GR Production Services, previously known as Upstream Production Solutions) provides some decent ARR, however GNG's "Mineral Processing" division (GR Engineering) is where the big dollars are made, and it's more lumpy, and we see that West Musgrave and Yangibana have dropped off the June 30th list (see top of this straw) but that Evolution Mining's (EVN's) Mungari expansion (future growth project), Liontown's Kathleen Valley, and TSX-(Canadian)-Listed K92 Mining's Kainantu Gold Mine project are all still there (2nd slide up, above), and that Develop's (DVP's) Woodlawn restart has been added.

So, no need to panic. Onwards and upwards. I reckon I'll be accumulating more on any further share price weakness.

I note that their FY25 guidance at the AGM today suggests that revenue will likely be weighted towards the first half of FY25 and that their forecast FY25 revenue is largely underpinned by the contracted orderbook across the Group - so their forecast / guidance is NOT reliant on further contract wins, and that, to me, suggests that there is scope for a guidance upgrade IF some of their healthy tender pipeline does convert to orders that do start in H2 of FY25.

It is certainly refreshing to have some guidance that is NOT relying on a stronger second half. Relying on a stronger second half to meet guidance is a trend I've seen a fair bit across other companies this AR/AGM season. But not with GNG. Nice!

[held]

Further reading/viewing: https://www.gres.com.au/projects/default.aspx

02-Sep-2024: GR Engineering Services (GNG) has gone ex-dividend today for a 10 cps fully franked dividend, so I expected their share price to fall, probably by more than the dividend, as people who are worried about their order book not being at record levels after BHP shelved West Musgrave sell out after securing that fat dividend, however they've been sold down as much as 16.5 cps today and are sitting around that level at -8.42% or 16 cents per share lower right now (at around midday Sydney time).

I would be buying more GNG IRL, but I already own a heap - they are my third largest real-money position. I might look to free up some cash here and top up my GNG position on SM this evening - depending on what else life throws at me today - there are a few things I need to do away from the office this afternoon.

Today, another very similar company to LYL reported, GR Engineering Services (GNG), and despite having had BHP shelve the West Musgrave project (see here: Market-Update---West-Musgrave-Project.PDF) in July, GNG maintained their very high final dividend at 10 cents per share (cps) which means their full year dividends for FY24 (interim + final divs) adds up to 19 cps, same as FY23, and that means that at yesterday's closing share price of $1.855, GNG are paying a dividend yield of 10.2% and that's fully franked, so if you add in the full value of those franking credits (which I can use), the "grossed up" dividend yield is 14.3%. Again, this is another company (like LYL) who specialise in gold mills (so, tailwinds), have zero net debt, have high insider ownership (17% of the company owned by Directors and company founders and their families) and are conservatively run, but run well. They aren't growing as fast as LYL are though - they are smaller and have lumpier revenue and earnings.

GNG reported $74.6 million net cash, -13.3% lower than the $86 million they had at 30 June 2023, and their ROE is also very high at 47% (based on today's results), and it's been over 45% for the previous 3 financial years also according to Commsec, but the main difference in the eyes of the market appears to be that the market had lower expectations of GNG and GNG did maintain their very high dividend, so GNG is up today, currently trading just over $1.90 and they've traded this morning up to $1.95. I was buying GNG two days ago at $1.81 (average), so that's one thing I did get right this week (selling down Codan yesterday here on SM, not so much...)...

Like LYL, GNG is a highly illiquid stock where large volume trades can significantly move the share price, but unlike LYL who had a detailed and positive outlook statement yesterday, GNG's outlook statement was more, "We'll let you know in a couple of months.":

"FY25 Update and Outlook: GR Engineering has a solid contracted pipeline and has been building its orderbook for FY25 and future periods. GR Engineering intends to provide FY25 guidance at its 2024 Annual General Meeting, to be held on 27 November 2024, when it is likely to have more certainty in relation to the timing of key projects."

'Nuff said. Oh, except their EPS, earnings and margins were all higher, on lower revenue:

Source: GNG-FY24-Financial-Results---Media-Release.PDF

I hold GNG (third largest real life position, plus here also).

30-May-2024: FY24-Guidance-Update.PDF

I saw this sell-down as an opportunity and topped up GNG today both in my largest real money portfolio (@ $2.09) and also here on Strawman.com (at the $2.10/share closing price).

This is an engineering and construction company predominantly, although they do have recurring revenue through their Energy division (was called Upstream Process Solutions / Upstream PS, now called GR Production Services), so I view this downgrade in much the same way that I viewed the recent Duratec (DUR) guidance update.

Here's what GNG reported at the half (for the 6 months ending 31-Dec-2023):

And here's what they reported for FY23 and FY22 (full year results):

FY24 (full year) EBITDA now expected to be $50 to $51m ($50.5m midpoint), so lower than FY22, but +13.7% higher than the $44.4m EBITDA they reported in FY23, so they'll earn more than they did last year.

The market is reacting negatively to the revenue guidance downgrade - previously a midpoint of $515m, now $422.5m (midpoint), which is huge - if you take the lower end of the new guidance, which is $415m of revenue, that's $100m less now, or -19.4%. Using the midpoints ($515m to $422.5m), it's an -18% reduction in revenue.

And it would be significantly lower than FY22, when the reported $651.7m in revenue.

However, as I said with Duratec, that's revenue, let's look at earnings: The second paragraph of the announcement states that GNG continues to achieve solid operational performance across its core business (GRES - GR Engineering Services, a.k.a. their "Minerals Processing" division) and from its two key subsidiaries, GR Production Services (a.k.a. their "Energy" division) and Mipac (which now includes their recent Paradigm Engineers acquisition), and that all divisions are forecast to achieve EBITDA growth - by margin and percentage - in FY24 compared to the prior year.

So their EBITDA margins are improving. That is borne out by their new guidance of $50.5m EBITDA from 422.5m in revenue - giving them an 11.95% EBITDA margin, compared with FY23 where their EBITDA margin was 8% ($44.4m EBITDA from $551.4m in revenue) and their EBITDA margin of 8.6% in FY22 ($55.8m EBITDA from $651.7m in revenue) - as shown above.

Their Net Assets moves around that $60m mark, give or take about $2m, and their cash balance is very up and down because it depends on a lot of factors and the timing of various milestone and completion payments for both ongoing work and completed work, as well as outgoing expenditure when gearing up for new projects at various times. Importantly, GNG rarely carry debt - they almost always maintain a net cash position, which is very wise for a company of their small size and the industries that they operate in, in addition to the types of clients they work for, often it's GNG who get the contracts to construct the initial mills for gold miners who are transitioning from explorers to developers to producers.

As with Lycopodium (LYL), GNG get a lot of initial study work, so the Pre-Feasibility Studies (PFSs) which often lead to Bankable/Definitive Feasibility Studies (BFSs/DFSs). Both companies are involved in the scoping, initial testwork in most cases, the engineering and design of the plant in consultation with the client, and then if they are awarded the EPC (engineering, procurement & construction) contract or the EPCM contract (which includes overall project Management), they are then responsible for the final designs, the tendering and ordering of long-lead-time items (such as ball mills and large drive motors), and the actual plant/mill construction. Because LYL often design gold mills to be built in some of the most dangerous places in the world, such as some of the more risky West African countries, you'll often see them (LYL) announce EPM or EP & PM contracts, which is where they do everything EXCEPT the actual in-country construction; that work is usually subcontracted to a locally owned builder already operating in-country, so those contracts are either called Engineering, Procurement and Management (EPM) contracts or more recently the trend has been to call them Engineering, Procurement, and Project Management. GNG, on the other hand, work mostly within Australia, and they almost always do the "C" (construction) themselves.

Some of these contracts take months, such a mill refurbishment or an expansion or upgrade of an existing mill, however some will take years, such as the West Musgrave Mineral Processing Plant (nickel and copper) for OZ Minerals (now owned by BHP) - see here: GNG-Contract-Award---West-Musgrave-Project.PDF [14/04/2023] - which is worth over $300m (in revenue) and was expected to last around 2 years (so until around April/May 2025).

I did mention here a few months back that with the Nickel price tanking and BHP threatening to lay off hundreds of workers across their nickel operations in WA if they did not receive significant government support to carry them through until nickel prices bounced back, that the West Musgrave project could either be shelved or suspended, and that could definitely affect GNG because it was GNG's largest project at the time - here is an overview of their current Minerals Processing (GRES) contracted projects (as reported in Feb with their H1 results):

Source: HY24-Investor-Presentation.PDF [22-Feb-2024]

And here is the recurring revenue from their Energy (GRPS, formerly Upstream PS) division, along with the various contract lengths, which vary from 2 to 5 years, and are often rolled over (extended) at the end of those periods.

As you can see from those two slides, they are a small company that relies on a relatively small number of contracts to keep them busy at any given time, so their revenue can be lumpy for sure. Last night, GNG was a $364m company (bit smaller after today's SP drop), LYL was a $480m company, and Duratec's market cap was around $255m, so these are microcaps and none of them are in the ASX300 yet.

Since those slides were prepared in Feb, GNG have announced the following:

05-April-2024: Market-Update---Abra-Paste-Plant.PDF [Galena Mining Limited (G1A) reported that voluntary administrators had been appointed to Galena’s 60% owned subsidiary, Abra Mining Pty Ltd. GR Engineering was engaged in September 2021 to undertake the engineering, procurement and construction to relocate, refurbish and commission the Abra Mining owned Higginsville paste plant, which was successfully delivered and commissioned in accordance with the Contract, which included deferred payment terms. Prior to the appointment of the Administrators, Abra Mining has made monthly payments to GR Engineering in accordance with the applicable payment schedule in the Contract. GR Engineering notes the intention of the Administrators to operate the Abra mine and processing plant on a business as usual basis. The Administrators have confirmed that they will continue to pay the contracted monthly payments to GR Engineering. GR Engineering’s current exposure for remaining payments to be made by Abra Mining under the Contract is $8.5m representing unpaid deferred receivables. Given the deferred nature of the progress claims under the Contract, at the time of entering the Contract, GR Engineering sought and obtained first ranking security over the paste plant equipment and design documentation. This security relates to the paste plant only and does not extend to any other assets of Abra Mining. Based on GR Engineering's secured position, its preliminary assessment of the value of the secured assets, the intention of the Administrators to operate the mine and processing plant on a business as usual basis and the Administrators’ intention to continue to pay the contracted monthly payments to GR Engineering, GR Engineering expects that any adverse impact on GR Engineering's financial results for the financial year ending 30 June 2024 will be immaterial.]

18-April-2024: Appointment-of-Non-Executive-Director---Debbie-Morrow.PDF [Deb Morrow has over 25 years’ experience leading large-scale projects and has had a range of senior corporate and sustainability roles across the energy and mining sectors which includes a 20 year career with Woodside Energy Ltd and being a senior executive at OZ Minerals Ltd, prior to its acquisition by BHP in 2023. Ms Morrow is currently the MD & CEO of ASX listed Agrimin Ltd, who are focused on the development of its 100% owned potash projects in WA. Ms Morrow is a NED of Miner’s Promise and Holyoak.]

10-May-2024: GNG-EPC-Contract---Kathleen-Valley-Lithium-Backfill-Project.PDF

plus: LTR-Liontown-executes-Paste-Plant-EPC-contract.PDF

So not just gold. Lithium, copper, nickel, plus their energy division. Happy to be a shareholder of GNG, and thought today's drop was a good buying opportunity.

GNG-1H24-Results.pdf (taylorcollison.com.au) [04-March-2024]

Plain Text: https://www.taylorcollison.com.au/wp-content/uploads/2024/03/GNG-1H24-Results.pdf

Below are screenshots of pages 1 and 2 - please click on the link above for the full report which contains disclaimers and disclosures on pages 3 and 4.

Disclosure: I hold GNG shares both here on Strawman.com and in a real money portfolio as well.

20-Feb-2024: GR Engineering Services (GRES, GNG.asx) have exposure to BHP's West Musgrave Nickel/Copper project and that may get mothballed or have a subtantial part of the intended expenditure deferred soon according to a recent AFR article (link here) (15 Feb 2024) which says: "Construction of the new $1.7 billion West Musgrave nickel mine is only 21 per cent complete, but BHP said it was considering slowing work, which could mean deferral of more than $1 billion of remaining spend on the project."

GRES wins contract to build the West Musgrave Mineral Processing Plant (felix.net) [22-Apr-2023]

BHP acquired OZ Minerals, so West Musgrave is 100% owned by BHP who have all of their nickel assets under review.

Mipac were acquired by GRES (GNG) in 2021: GR Engineering Acquires Leading Process Controls Business (gres.com.au) [27-Apr-2021]

I believe West Musgrave is currently GNG's largest single EPC/EPCM contract in their order book, so this could certainly affect them if BHP go down that path as part of their nickel asset review.

Disclosure: I hold GNG and LYL, but not BHP.

01-Feb-2024: GNG-Acquisition-of-WA-Based-Process-Controls-Business-(Paradigm-Engineers).PDF

GR Engineering Services Limited (ASX:GNG) announced this morning that its wholly owned subsidiary, Mipac Holdings Pty Ltd (Mipac) has entered into an agreement to acquire Paradigm Engineers Pty Ltd (Paradigm), a provider of control systems and electrical engineering, automation and technology services based in Western Australia.

Transaction Highlights

- This transaction enhances Mipac’s control system and electrical design capabilities and expands its existing footprint in Western Australia. Paradigm has significant expertise working across a range of commodities, including iron ore, gold and battery minerals.

- Paradigm is forecasting FY24 revenue of $16 million and an EBITDA margin % consistent with Mipac. Similar revenue is anticipated for FY25, supported by Paradigm’s current order book and pipeline. The combined Mipac and Paradigm business is expected to generate revenue of approximately $50 million on a proforma basis.

- Paradigm’s current management team have agreed to continue in their roles post-completion.

- The purchase price is $9 million, with 50% payable in cash and 50% payable in GR Engineering scrip, subject to voluntary escrow. It is anticipated that the transaction will be immediately earnings per share (EPS) accretive.

This is a small bolt-on acquisition that does NOT require a CR, and is immediately EPS accretive. All good! GNG don't do M&A very often, but when they do make an acquisition, it tends to be a good strategic fit, for a good price.

Paradigm Engineers | Control systems and electrical engineering company

GR Engineering - Global Mineral Processing Solutions (gres.com.au)

GR Engineering Services Limited - Mipac - Engineering Consultants and Contractors (gres.com.au)

Disc: I hold GNG shares (both here and in a real money portfolio).

03-October-2023: Taylor Collison: GNG: Initiation – Super Cycle, Super Profits

Analyst: Sam Pittman.

Excerpt:

Our View

Clean energy mineral demand is underwritten by long-dated secular changes, that in many cases is non-discretionary due to regulatory changes and the desire to move to a lower carbon energy future.

Given the expected duration of this cycle, and its potential to provide consistent profits / high labour utilisation, we believe the payback on a GNG investment will prove to be attractive.

GNG is run by an experienced management team with a long-term track record for managing risk through the cycle. Whilst GNG is susceptible to lumpy single year profits and infrequent losses due to the commodity prices, its long-term ability to grow revenues at attractive returns on equity makes it an attractive way to invest in the transition to a lower carbon economy.

The lumpiness is reflected in a multiple for contractors which is a discount of ~20% - 30% to the index. GNG currently trades at 10.8x FY24e PE, but we think this represents an opportunity. The current demand for clean energy is likely to be prolonged and somewhat independent of the business cycle which usually influences commodity prices.

We initiate with an Outperform and a price target of $2.52 based on an NPV of the next five years estimated dividends and a terminal valuation based on an across the cycle PE ratio.

--- end of excerpt ---

Click on the link at the top for the full report by Taylor Collison.

Source: ASX email service

I hold GNG shares.

27-August-2023: I'd like to highlight the income and growth track record and future potential of a couple of smaller lower-liquidity microcaps that don't get talked about here much:

Firstly, GR Engineering Services (GRES, GNG.asx):

GR Engineering - Global Mineral Processing Solutions (gres.com.au)

GR Engineering: Providing Global Mineral Processing Solutions - YouTube [video]

GNG-FY23-Financial-Results-23-August-2023.pdf

GNG-FY23-Results-Presentation-23-August-2023.pdf

That presso (from last Wednesday) isn't overly long, however I'll shorten it even more by providing the 10 most important slides for current and prospective shareholders:

FY22 was a great year, and FY23 didn't quite hit those same highs, however FY23 was still a solid year and with negligible debt plus $86m cash in the bank (at June 30th), GRES (GNG) have matched FY22's high 19 cps dividend (for the full twelve months, so adding the interim and final dividends together). In terms of FY24, I'm more than comfortable that the good times are going to keep rolling on with GNG, based on their order book and track record (more on that order book in a minute).

Now, this company has three divisions, as shown above with some examples of their respective current clients. Those 3 divisions are:

- Mineral Processing ("GR Engineering", their main business which provides the majority of revenue and earnings, but the revenue is lumpy due to the one-off nature of the contracts);

- Energy ("Upstream PS", or "Upstream Production Solutions", provides recurring revenue from multi-year maintenance/operations contracts in the Oil/Gas sector); and

- Process Control Systems (Mipac, their most recent division, formed via the acquisition of Mipac in 2021 for just $21.4m max - being only $14.5m upfront - in cash and GNG shares - plus the other $6.9m being deferred subject to meeting EBITDA targets - which shows both how frugal and how smart GNG management are).

That "Mineral Processing" Order Book (confirmed orders) that totals over $650 million is enough by itself to beat both FY22's and FY23's revenue in FY24 (the current financial year), without ANY contribution from their other two divisions, or any further work added to the order book, including those near-term opportunities they mentioned, however it's likely that some of that (order book) work will extend into FY25, especially West Musgrave (for BHP), so part of that revenue will fall into FY25. Regardless, FY24 is going to be another strong year, and I believe they will continue to pay above-market dividends, both because they have the balance sheet (no debt and over $80m in cash) to do so, and also because they have perfect shareholder alignment. Check this out:

Yes, that's right folks, 56% of the company is owned by the company's directors and the company's founders (or their families as some of the founders have sadly pased away) and it's been like that for years, so there hasn't been much selling down of these insider positions at all. I find that when the majority of a company is owned by insiders, they tend to be rather focussed on total shareholder returns, particularly on paying out decent dividends when they can.

And they use debt much more wisely than other companies where management are just managers rather than part-owners of the business. With small companies, I prefer them to have no debt at all, and GNG Management agree, because they have what they refer to as "negligible debt" and over $80m of cash in the bank.

The free float (all shares on issue less those owned by insiders and instos) is notionally 27%, however most of that retail shareholder base isn't selling either, so it could become a lobster pot stock; easy to get into, much harder to get out of in a mad rush. So great for patient money, but perhaps not as good for money you might need to pull out quickly.

That's the last image that I've copied across from that Investor Presentation from last week (link above, near the top of this straw). This is a company with a market cap of around $372m (based on a $2.30 share price, where they closed at on Friday), with $86m cash (at June 30th), that's paying out some really nice dividends, and doing it consistently.

See below:

Source: Commsec

OK, nice dividends, all fully franked since March 2021, and a trailing yield of 8.3% plus the value of franking credits, so a grossed up trailing yield of 11.8% (including the full value of the franking credits) based on a share price of $2.30 (where they closed on Friday). I paid a fair bit less than $2.30/share for most of mine, but I think they still represent value at current levels.

But what about growth? Well...

Source: Commsec.

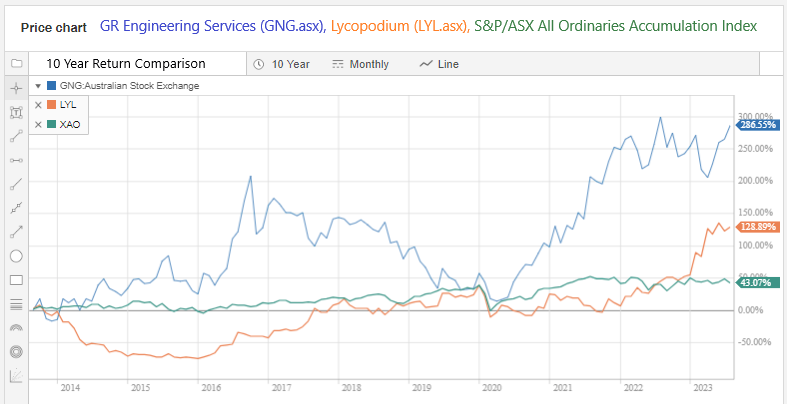

If you want to compare that to the index - here it is - and I've thrown in another similar company that is probably even better - Lycopodium (LYL):

Source: Commsec.

I've used the XAO there for a benchmark, the All Ords accumulation index, which includes all dividends and distributions reinvested back into the underlying companies, whereas the LYL and GNG lines ONLY represent the share price, without any dividends. You could also use the XJO - the S&P/ASX 200 TR (total return) index, however that is almost identical to the All Ords (the XAO) with the XJO returning +38.56% over 10 years (total, not p.a.) vs. the +43.07% return of the XAO. LYL has returned triple that, with +128.89% and GNG has returned +286.55% over 10 years, and that's of course without factoring in any dividends with GNG or LYL. Dividends substantially increase the total shareholder return - way beyond what that chart could show, except for the green line - the XAO - the All Ords Accumulation (or Total Return) Index - because with the XAO the dividends are already factored in.

So there you have it - great INCOME PLUS GROWTH. And LYL is even better, but that's another straw.

Disclosure: I hold GNG & LYL both here on SM and in my real life portfolios.

P.S. While they DO specialise in the design and construction of gold processing plants (gold mills), they also do other stuff, like Mineral Sands for instance:

03-May-2023: This announcement from GNG (who I hold both here and IRL) caught my eye this evening: Binding-Term-Sheet---Yangibana-Rare-Earths-Project.PDF

That's another contract win to add to their order book. Details: GR Engineering (GNG) have entered into a binding term sheet with Yangibana Pty Ltd, a wholly owned subsidiary of Hastings Technology Metals Limited (ASX: HAS) (Hastings), for the engineering, procurement and construction (EPC) of the beneficiation plant and associated infrastructure for the Yangibana Rare Earths Project (the Project) in Western Australia.

The Project is located approximately 250km north east of Carnarvon, in Western Australia.

GR Engineering and Hastings have agreed the material terms of the EPC contract in the binding term sheet. The EPC contract for the works will be finalised shortly and GR Engineering will commence early works. If the EPC contract is entered into, it is expected that the contract sum, including provisional sum, will be $210 million.

Commenting on the award, Mr Tony Patrizi, Managing Director said: “GR Engineering is pleased to have received the binding term sheet for this world class rare earths project in the Gascoyne region of Western Australia. It will be exciting to work on this project as it is focused on globally critical minerals that are used as key components for electric vehicles and wind turbines. We look forward to engaging closely with the Hastings team to deliver safe and successful outcomes for this project."

--- ends ---

Here's a link to the Hastings Technology Metals (HAS) announcement today: HAS-Reduces-Yangibana-Delivery-Risk---Awards-EPC-Contract.PDF

In their H1 results Presentation in February (see here: HY23-Investor-Presentation.PDF) GNG gave us an overview of the major projects in their EPC (Engineer, Procure & Construct) Order Book (on slide 5):

By the way, that West Musgrave Project ccontract (with OZ Minerals) has now been finalised - see here: GNG-Contract-Award---West-Musgrave-Project.PDF [14-April-2023 - Estimated revenue: $312 million over a two year period - I did mention here a little while ago that I thought that West Musgrave would be a Big contract for GNG when it was finalised.]

GNG are a bit like Lycopodium (LYL) in a number of ways - not just in what they do, but also in how they go about things, and they are both very modest - tending to underpromise and overdeliver most of the time. While LYL have been positively re-rated by the market in recent months, GNG have not: Here are GNG's 1 and 3 year charts:

Over 3 years they've done alright, but over the past 7 or 8 months... not so much... in share price terms. However there can often be a disconnect between the business value and the business share price with these microcap companies that aren't followed by the majority of market participants. As we have seen with LYL in recent months, when the market decides to positively re-rate them, they can put on quite a bit in a very short space of time...

I hold both companies (GNG & LYL) both here and in real life. Here is GNG's "Outlook" slide from their Feb Presso (H1 FY23 Results presentation, link above):

See what I mean - very understated. For context, here's their FY22 vs FY21 results:

With current guidance for FY23 Revenue in the $500m to $530m range, that's better than FY21 ($392.4m), but not as good as FY22 ($651.7m), however that "return to historical levels" for their EBITDA margin in the second half (current half) of FY23 suggests that the EBITDA margin will be more like FY21's 9.5% than FY22's 8.6%, and their margins have been higher than that in prior years.

They're tracking along nicely. Great dividend yield too. And their share price will recover at some point, sooner or later. Good income stock, with capital growth when it comes, just like LYL.

21-Nov-2022: I've just been looking through some recent announcements from GR Engineering Services (GNG) which is one of my favourite companies, and one that continues to pay me market leading dividends. Their trailing dividend yield is 8.68% based on their closing share price today of $2.19 and the 19c worth of dividends they've paid during the past 12 months, higher if you gross it up to include franking - their dividends are also fully franked). So income and some capital gains as well.

Here's some of their recent announcements, starting with their presentation on August 24th:

24-Aug-2022: FY22-Investor-Presentation.PDF

23-Sep-2022: West-Musgrave-Project---FID-Achieved.PDF

Also: OZL: Green-Light-for-West-Musgrave-Project.PDF

07-Oct-2022: GNGThunderbird-Mineral-Sands-Project-Full-Notice-to-Proceed.PDF

26-Oct-2022: Managing-Director-Transition.PDF

31-Oct-2022: Cosmos-Nickel-Concentrator-Facility-Upgrade---Scope-Change.PDF

21-Nov-2022: GNG-Preferred-Tenderer---Sorby-Hills-Lead-Silver-Project.PDF

Also: BML: BML-GRES-Selected-for-Sorby-Hills-Process-Plant.PDF

Yeah, they're keeping busy!

GNG are involved in dozens of studies for various projects. The specialise in gold mills, but as well as precious metals, they also design and build processing plants for base metals and battery metals, just like Lycopodium (LYL) do. While both LYL and GNG are based here in Australia, and are both listed on the ASX, LYL do most of their work overseas, and they specialise in West Africa, where many others fear to tread, whereas GNG do most of their work here in Australia. I imagine the two companies might merge one day. I hold shares in both, and they have very complimentary businesses, but I guess the other factor is that they both also have very high insider ownership, so perhaps they will always be separate because neither management team wants to give up control. No matter. They both keep performing admirably.

For those who are interested, you can check out Lycopodium's recent announcements here: ASX Announcements | Lycopodium and their presentations here: Presentations | Lycopodium

The studies (PFS, BFS, DFS, etc) often/usually lead to them being the front-runners for the relevant EPC (or in LYL's case, EPCM, or EPM - or EP & PM) contracts for those projects if and when those projects get the green light (positive FID) from the owners (and those owners get their finance sorted out). GNG and LYL don't usually announce the studies (Pre-feasibility, Bankable Feasibility and Definitive Feasibility Studies) when they are awarded them - because they're not usually material, but when those studies lead to the award of Engineering, Procurement and Construction (EPC) contracts or EPC + Management (EPCM) contracts, or Engineering and Procurement plus Project Management (EP + PM) contracts, they do announce them, because they are material. Both companies are quite busy this year, and have been regularly announcing additional contract awards.

In addition to that work, which can be quite lumpy, due to it's one-off nature, GNG also have recurring revenue from their Upstream PS division - which stands for Upstream Production Solutions. It's one of the only acquisitions they've ever made; they prefer organic growth. Upstream PS is the quiet achiever within GNG that keeps churning out profits from recurring revenue from multi-year contracts from some of the largest names in the Australian oil and gas industry - as well as from some of the smaller players.

Here's their main website: Upstream Production Solutions (upstreamps.com)

And here's the section within the main GNG website that discusses Upstream PS: https://www.gres.com.au/our-companies/upstream-production-solutions.aspx

So, yeah, for a company that not many people have heard of, and that even fewer people follow, they are keeping busy, and rewarding their shareholders.

Disclosure: I hold shares in GNG and LYL both here on SM and in real life.

23-Sep-2022: GNG: West-Musgrave-Project---FID-Achieved.PDF

OZL: Green-Light-for-West-Musgrave-Project.PDF

The following is Page 3 of OZ Minerals' (OZL's) announcement (full announcement link above):

I reckon this is a big one - for GNG, in terms of the sort of contracts they have been winning over recent years. The work that GNG did for IGO at their Nova Nickel project back in 2015 was worth $114m plus another $12m for the non-process infrastructure ($126m all up):

Nova Nickel Project (gres.com.au)

GR Engineering wins more work at Nova (businessnews.com.au) (2015)

And that was a smaller project I reckon, and it was nine years ago. GNG (GR Engineering) also have a history of doing a lot of builds and upgrades of nickel concentrators for Western Areas at Forrestania and then Cosmos that dates back to 2008/2009, so while gold processing plants is GNG's game, they are also pretty good at designing and building nickel plants. Western Areas (WSA) was taken over by IGO earlier this year - see here: IGO gets Forrest backing in Western Areas takeover (australianresourcesandinvestment.com.au)

GNG closed down 3c today (or -1.32%) at $2.25, which was also their day-high, so they closed on their highs, having traded as low as $2.16 earlier in the day (which was -5.26% down from Thursday's $2.28/share close).

The market may have been disappointed that there were no estimates of revenue (no $ value) in today's announcement by GNG, however they have yet to finalise the contract details. It is important that OZ Minerals (OZL) did say in their announcement today that GNG (GR Engineering Services) would be building their (OZ Minerals') nickel processing plant at West Musgrave, despite not all of the details (such as the price) being finalised yet.

Interesting that rival engineering firm Lycopodium (LYL) who also specialise in gold processing plants, but do their best work overseas, mostly in Africa these days, rose +12c (or +1.77%) to close at $6.90/share today, on the back of this announcement: LYL-Award-of-Sabodala-Massawa-Project.PDF which is interesting in that it is a EP and PM contract (Engineering & Procurement plus Project Management) but there's no Construction aspect to it, so another company is doing the actual construction of the Sabodala-Massawa Expansion Project in Senegal for Endeavour Gold Corporation (a.k.a. Endeavour Mining, who are listed on the London Stock Exchange with a secondary listing in Canada on the TSX). As I mentioned in my Gold Forum post earlier tonight, Senegal shares a border with Mali and there's plenty going on in Mali that would tend to encourage most sensible people to stay well clear of the area, so it's possible that this is a risk management or risk mitigation strategy by LYL - i.e. to do the majority of the work from here in Australia and let another company do the in-country construction in Senegal. Of course that means that this contract is worth a fair bit less than previous EPC and EPCM contracts that LYL have been previously awarded in West Africa. This contract is "valued at over A$26 million, with first gold pour from the BIOX® plant expected in early 2024."

They would normally get 5 to 10 times that for an EPC or EPCM contract for the delivery of a gold processing plant in West Africa, but when you remove the "C", the price is a lot lower, but then, in this case, I imagine the risks (for LYL) are also a lot lower. Interesting times...

And interesting that the contract that the market learned today that GNG had secured in WA (sure, West Musgrave is in the middle of the desert, just to the west of the bottom left corner of NT and the top left corner of SA, so at the convergence of the three states, but importantly still right here in Australia) is worth at least 10 times what this new LYL contract is worth, in my opinion, and yet GNG were sold down, and LYL were bid up. Doesn't matter, I hold both of them.

Here's an excerpt from the OZL announcement today:

"Our project execution strategy will enable us to mitigate industry-wide cost inflation being experienced globally. An increase in direct Project capital to approximately $1.7 billion* is offset by a substantial increase in Project value and results in stronger cash flow generation of circa $1.9 billion [nominal value from commencement of production] during the first five years of production."

* Nominal value. Assumes a third-party power purchase agreement, a mining fleet lease agreement, and a lease of the Living Hub.

Now that $1.7 billion in direct project capital committed by OZL isn't all going to go to GNG of course, GNG will only get a slice of that pie, but it should be a generous enough slice considering they are going to engineer, procure, construct and deliver the processing plant, which tends to be one of the most expensive elements of new mines. It will be in terms of hundreds of millions in my estimation, not tens of millions. But time will tell.

Suffice to say I'm glad that GNG is one of the largest positions in one of my real life portfolios, and if GNG or LYL were in the ASX300 index, they would both also be in my SMSF (which is in an industry super fund, so I am limited to ASX300 companies unforunately). GNG is in the All Ords, LYL isn't even in that index, too small, and too many shares held by management, so insufficient free float for index inclusion. GNG also have a lot of insider ownership, heaps! But they have a larger market cap than LYL. Both great companies with superb management, and both paying very decent dividend yields this year. They've been showing me the money - by putting it in my bank account.

20-July-2022: GNG-EPC-Contract---Bellevue-Gold-Project.PDF

From BGL: BGL-Bellevue-awards-EPC-Contract-to-GR-Engineering.PDF

That's today. Back on May 24th, both companies announced that GNG were undertaking preliminary works, so had won the contract, but that it had not been officially awarded and signed off.

GNG-Preliminary-Works-Agreement---Bellevue-Gold-Project.PDF

BGL-Preliminary-works-agreement-signed-with-GR-Engineering.PDF

In that announcement, Bellevue said, " GR Engineering knew the project well from its work during the study phase".

That's important to understand, GNG is the main player in doing studies (PFS, BFS and DFS studies) for Australian gold companies, and much of that work does lead to GNG being awarded the EPC (engineer, procure, construct) contracts when those projects do get a positive FID (financial investment decision, i.e. the green light to proceed by the board of the company that owns the project) and funding is secured.

In terms of GNG taking part payment for their services in shares @PortfolioPlus - they have a positive track record of doing this, as does another mining services contractor (who mostly do the actual mining) in the gold sector, MACA (MLD). Both of them have regularly bought shares in their clients, or accepted shares as part-payment for their services, and have for the most part made additional profits by later selling those shares at a higher value that what they were issued at. Not always, but usually. The shares are not generally subject to any escrow agreements, so GNG and MLD are free to sell them any time they wish to.

In GNG's case, they usually only accept a smallish proportion of their total revenue as shares. In this case it's up to $7.5m of the $87.8m fixed price contract value, so around 8.5%. While there are obviously risks associated with taking part-payment in shares, GNG are in a very good position to know exactly what those risks are, especially as they have prepared the DFS (definitive feasibility study) for the project, and they are engineering and building the processing plant themselves.

It also creates further alignment of interest between the two companies, which is positive in my view as they are essentially partnering to bring this project into production. In this particular case, I'm very comfortable with it because the Bellevue Gold Project has such strong metrics (high gold grades, low production costs), so it's a good way for GNG to make even more money out of the contract.

GNG always have a handy net cash buffer with zero net debt so they can afford to hold small positions in other companies like this.

Now in terms of the contract being a fixed price contract, that's what GNG specialise in. Pretty much ALL of their contracts are fixed price contracts, and that is because of the nature of their clients, who are mostly wanna-be gold miners who usually have zero cashflow and need that cost certainty in order to secure the finance to build these projects.

Because GNG have been doing fixed-price-contracts for so long, they have become very good at it, and they very rarely have any cost blowouts. They are well aware of the cost pressures within their industry. In fact they would understand those a lot better than we would. They naturally build fat into these contracts to cover unexpected contingencies, but not too much fat. The space is not as competitive as you might think because most companies are wary of agreeing to build entire plants on a fixed price basis, particularly in the current environment. MACA acquired a company called Interquip a couple of years ago who are a direct competitor of GNG now in that they both do bid for these types of EPC contracts. GNG have the positive track record. Interquip do not. MACA recently reported significant cost over-runs with the King Of The Hills (KOTH) processing plant for gold miner Red 5 (RED) - see here: MLD-Operational-and-Market-Update.PDF

I believe Interquip won that contract based on price. GNG bid for it, but GNG's bid was at a higher price point and they were not prepared to lower it. In other words, GNG knew that MLD's Interquip division were bidding too low and they would likely lose money, and they were not interested in matching or undercutting MLD because they did not want to lose money themselves. That's how GNG operate. They set their prices to cover their costs and give themselves a decent profit, and if they are awarded the contract that's fine, and if they're not, then it's likely because someone else has bid too low and GNG are happy to let them have it.

It just gets back to doing what you do best and relying on your experience and expertise. And GNG are very good at what they do. That's why they pay such good dividends. Because they can.

Disclosure: Of the companies mentioned in this straw, I hold shares in BGL, GNG and MLD, but not RED.

https://the-pick.com.au/bellevue-gold-stage-1-feasibility-study-rates-mine-in-the-top-tier/

Bellevue Gold Project: Production, De-risking & Growth Update Presentation

Selected Slides from that (10-June-2022) Presentation:

22-June-2022: GR Engineering Services (GNG): FY22 GUIDANCE UPDATE

The Directors of GR Engineering Services Limited (ASX: GNG) (GR Engineering) are pleased to advise that full year revenue guidance for the year ending 30 June 2022 (FY22) is forecast to be in the range of $620 million to $640 million.

GR Engineering had previously advised that FY22 revenue was expected to be $580 million to $600 million.

Commenting on the improved revenue guidance, Mr Geoff Jones, Managing Director said:

“GR Engineering is projecting a strong FY22 performance based on the year to date results and the current pipeline of ongoing work. GR Engineering remains well placed to maintain its strong dividend yield to its shareholders through FY23 and future years.”

GR Engineering is intending to release its results for the twelve months ending 30 June 2022 on or around 23 August 2022.

Ends

Disclosure: I hold GNG shares. Based on yesterday's closing price of $1.76/share, their trailing (historical) dividend yield is 9%, PLUS the value of their franking credits, and their last 3 dividends have all been fully franked. However, their dividend yield is even better than that, because that 9% is based on their last two dividends, which were a 7 cps final div paid on 22-Sep-2021 and a 9 cps interim div paid on 25-March-2022. That interim dividend was +80% higher than their previous interim dividend (which was 5 cps), and their final dividend this year will be higher than the 7 cps final div they paid last year, because they've had a better year than they did last year, and they've just upgraded their guidance again.

GNG specialise in the design and construction of Gold Processing Plants, and they do most of their work here in Australia, with some work also done overseas. GNG tend to win the majority of the available EPC contracts for the design and construction of Australian gold processing plants, after preparing or assisting in the preparation of feasibility reports for companies who are developing gold projects and looking to build processing plants. That area of the market has been solid for GNG lately. However, that's not ALL they do. They work in other industries and they also own a division called "Upstream PS" or "Upstream Processing Solutions" which provides maintenance and operations services for the energy (oil & gas) industry. Upstream PS provides a fair chunk of GNG's recurring revenue via multi-year operations/maintenance contracts, whereas their other larger division tends to have more lumpy revenue due to the one-off nature of the contracts. GNG are always busy, but they get busier than usual at times, and this past year has been one of those times when they have had more work than usual - and shareholders reap the rewards of that via increased dividends.

One of the things I like best about GNG is that a large percentage of the company is owned by their board and KMP (key management personnel) so they think and make decisions like they own the business because to a large extent they do own the business. And that's another reason why the profits tend to flow through to the shareholders.

In my 17-May-2020 "Substantial Shareholders" straw for GNG, I listed all of the insider ownership which added up to 60.7% of the company, plus the 33.3% that was held by institutional shareholders - which at the time included CBA/Colonial First State, Carol Australia Holdings/Mitsubishi UFJ Financial Group (MUFJFG, which bought Colonial First State Global Asset Management off CBA in August 2019 and then rebranded it as First Sentier Investors) and Spheria Asset Management.

Today, 2 years and one month later, those three Insto's speak for 28.58% of GNG, plus we have a new shareholder who holds 9.88% of GNG and is listed as both "Superannuation and Investments HoldCo Pty Ltd" and "Comet Asia Holdings II Pte Ltd". All of the company founders/insiders who were listed as substantial holders in 2020 are still on the register except for Barry Patterson who retired from the GNG board in December 2020:

- David Joseph & Jane Frances Sala Tenna holds 7.66% (12,325,000 shares), previously 8.02% (12,325,500 shares),

- Joley Pty Ltd (George Botica) holds 6.54%, formerly 6.85%, still 10,524,000 GNG shares,

- Paksian Pty Ltd (Joe Ricciardo, company co-founder and father of Formula 1 race car driver Daniel Ricciardo) holds 6.09%, formerly 6.38%, still 9,798,578 GNG shares.

- Kingarth Pty Ltd (Tony Patrizi) holds 6.09% (9,795,000 shares), formerly 5.87% (9,025,000 shares),

- Joe Totaro, one of the co-founders, and previously the CFO and Company Secretary, remains on the board as a non-executive director, and still holds 8m GNG shares, which is 4.97% of GNG but was 5.21% of the company 2 years ago (due to dilution over the past two years due to executive remuneration),

- Peter Hood still owns half a million shares.

- Geoff Jones, GNG's Managing Director, owns 200,000 shares plus 864,447 share appreciation rights, formerly 772,134 shares, plus 1.1 million appreciation rights.

- Quintal Pty Ltd (Ron/Toni Harken) holds 5.28% (8.5m shares), formerly 6.18% (9.5m shares), and

- Beverley Jone Schier (Rodney and Beverley Shier) owns 5.03%, formerly 5.27%, although that reduction is once again just due to a small amount of dilution over the 2 years due to GNG issuing of a small number of new shares as part of their usual executive remuneration; Bev's shareholding remains at 8.1 million GNG shares.

So Geoff Jones has been selling down (apparently to satisfy "tax obligations") however he was never a substantial shareholder, and is not one of the original founders of the business. Geoff joined the company in 2013. Everyone else has either maintained their position, or trimmed their position slightly, or added to their position in the case of Tony Patrizi who was a co-founder and remains on as an executive director.

In May 2020 I calculated that the company founders and insiders plus those three institutional investors (insto's) held around 94% of the company, leaving a free float of only about 6%.

Back then, in my "Substantial Shareholders" straw, I also listed a number of other insider shareholders from their annual report that held less than 5% but still held GNG shares.

There has been some movement but it looks to me like at least 90% of the company is still held by insto's and insiders. So liquidity can be a problem. There are sometimes not much in the way of buyers or sellers for GNG, particularly the sellers, and there can be some pretty substantial gaps between the price points. Which adds to the volatility of the share price. It can be very choppy or not move much at all for days or weeks.

So I hold GNG and I like the company a lot. Today's revenue guidance upgrade is not unexpected but it's always nice to know that my investment thesis is playing out OK. Great company. Great income stock.

01-Nov-2021: Just as they did last year, GR Engineering (GNG) have provided conservative guidance and then upgraded it:

FY22 GUIDANCE UPDATE:

The Directors of GR Engineering Services Limited (ASX: GNG) (GR Engineering) are pleased to advise that full year revenue guidance for the year ending 30 June 2022 (FY22) is forecast to be in the range of $540 million to $560 million.

GR Engineering had previously advised that FY22 revenue was expected to be $440 million to $460 million.

GR Engineering is well positioned for significant growth in FY22 based on recently announced contract wins, increased confidence in the conversion of near term opportunities to engineering, procurement and construction (EPC) contracts and the execution of the existing order book. Importantly, GR Engineering continues to build its contracted pipeline of work into FY23. Commenting on the improved revenue guidance,

Mr Geoff Jones, Managing Director said: “GR Engineering is forecasting significant growth on the record results achieved in FY21. The pipeline of ongoing and near term work is growing and provides increased revenue and earnings visibility for both FY22 and FY23, enhancing GR Engineering’s ability to deliver returns to its shareholders”.

See here.

That's how it's done.

Underpromise and overdeliver. We're only one third of the way through FY22 (4 months in) so I fully expect another upgrade during the next 6 months.

Disclosure: I hold GNG shares. Excellent management. Heaps of skin in the game. Superb dividends. Lumpy revenue, but they're flying again this year (and last year).

24-Aug-2021: Euroz Hartley's Analyst Trent Barnett has maintained his "Buy" call on GNG and raised his PT from $1.76 to $1.93. I have attached Trent's update.

Brief Extract:

"GNG has released FY21 results, which were better than our estimates; FY22 revenue guidance of $440-460m;

We have increased our earnings estimates, our valuation and price target;

We maintain our Buy recommendation. There remains a strong pipeline of tender opportunities, suggesting the order book can be replenished beyond FY22. However, the work required to win is building, and the share price is now factoring in higher repeating revenue, consequently, valuation risks are increasing;

That said, valuation multiples still remain attractive as long as earnings can be maintained (let alone if they continue to grow). Our model assumes lower earnings in FY23 as the Government oil & gas contract winds down (on our estimates). We hope to see upside to our FY23 estimates, but maintain conservatism for now;

Cash generation and return on capital is particularly strong, highlighting the capital light nature of the EPC industry, and the alignment of management and Board to shareholder returns;"

Disclosure: I hold GNG shares in RL. Their dividend yield is outstanding, and even better at the prices I paid for my GNG shares. Their share price has been rising strongly recently, so I wouldn't be buying up here. I have written about them here and also in the "Gold as an investment" forum. I have also discussed them in relation to LYL (Lycopodium) - who I also hold. LYL and GNG both specialise in the design and construction of gold processing plants. Both are also in my SM portfolio here, as well as my RL income-generating portfolio.

24-Aug-2021: GR Engineering Services (GRES, ASX: GNG), a company I have personally held for years, have reported this morning. After a couple of rough years, they have had a really good one in FY21. Their final dividend is going to be 7c fully franked, so 12c fully franked for the year (including the 5c interim div), which - ignoring the franking credits entirely - puts them on a dividend yield of 8.2%, with franking credits as a bonus for those of us who can and do use them. That's based on their closing share price yesterday of $1.455. Understandably, they're up today on this result, around +10% as I type this (@ $1.60).

Key Earnings and Balance Sheet Data – Consolidated Group:

Revenue & Earnings:

- Revenue from operations: $392.4m (vs $222.4m in FY20)

- EBITDA: $37.2m (underlying) (vs $11.31m in FY20)

- PBT: $33.7m (vs ($9.7m) loss in FY20)

- Tax: $10.5m tax paid (vs ($2.5m) tax credit in FY20)

- NPAT: $23.2m (vs ($7.2m) loss in FY20)

- Basic EPS: 14.9 cps (vs (4.7 cps) loss (negative 4.7 cps) in FY20)

Balance Sheet & Cashflow:

- Cash: $69.0m ( vs $37.5m in FY20)

- Total equity: $51.6m (vs $34.7m in FY20)

- Net operating cashflow: $49.5m (vs $11.2m in FY20)

That's quite the turnaround. For further details see their FY21 Financial Results - Media Release, their Preliminary Final Report and their Full Year Statutory Accounts FY21.

Very high insider ownership (skin in the game), and very well run, although revenue and earnings can be very lumpy due to the shorter-term contract nature of a lot of their EPC (Engineer, Procure, Construct) work.

They do have recurring revenue however from their oil and gas services business, Upstream Production Solutions Pty Ltd (Upstream PS), which during FY21 achieved sustained revenue contributions primarily through a combination of operations, maintenance and brownfields projects servicing the coal seam gas (CSG), liquefied natural gas (LNG), carbon sequestration and onshore and offshore oil and gas sectors throughout Australia.

FY22 Update and Outlook

GR Engineering has a strong order book dominated by Australian projects and has been building its pipeline for both FY22 and FY23. The consolidated entity expects revenue for FY22 to be in the range of $440 million to $460 million.

GR Engineering’s design and construction order book for works currently being undertaken and which will continue into FY22 include:

- Thunderbox 6 Mtpa Expansion Project - $101.0 million EPC Contract with Northern Star Resources Limited in relation to the design, engineering, procurement, construction and commissioning of the Thunderbox 6 Mtpa Expansion Project. Work commenced in July 2021.

- Warrawoona Gold Project - $75.0 million EPC Contract with Calidus Resources Limited in relation to the design and construction of the processing plant and associated infrastructure for the Warrawoona Gold Project. Work commenced in late CY20.

- Newmont Tanami Gold Mine - $68.0 million subcontractor with RUC Cementation Mining Contractors Pty Ltd (RUC) in relation to Newmont Corporation's (Newmont) Tanami Gold Mine in Australia. RUC has been engaged by Newmont under a head contract to complete certain underground construction works for Newmont. GR Engineering is responsible for the construction and commissioning of the temporary and permanent works associated with the surface infrastructure. Work is expected to be completed by April 2023.

- Norseman Gold Project - $59.5 million EPC Contract with Pantoro Limited for the engineering, procurement and construction of a new processing plant for its 50% owned Norseman Gold Project in Western Australia. GR Engineering commenced work during the first quarter of CY21.