Yeah, I used to hold AMI myself back in the day and they disappointed me twice, and I wasn't going to let them do it three times. Just on the current situation @raymon68 a lot of miners are experiencing cost increases but what has saved gold miners is the gold price rising faster than their costs have risen, and AMI's problem is that they also mine copper, zinc and lead in addition to gold, and so they have four commodity prices to contend with. On top of that, even with yesterday's update (FY26-Guidance-and-Outlook-for-FY27&28.PDF), they give an "aspirational outlook for FY27 and FY28" which often means that we'll look back in a few years with the benefit of hindsight and wish they hadn't overpromised and then underdelivered, but then, as @BkrDzn says, that is on brand for them.

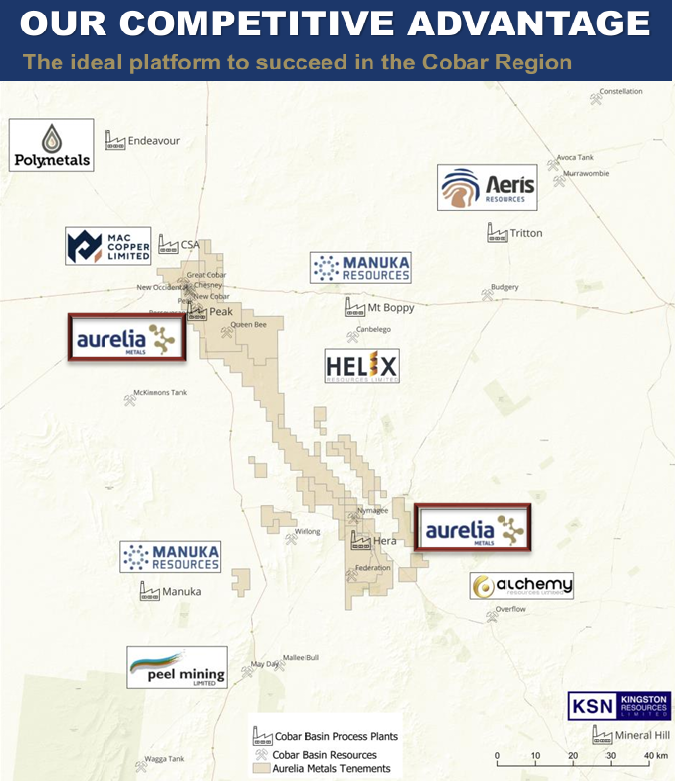

The Cobar region of NSW has always had much promise, but in the past decade or two, not much value delivered. How many of these names below have provided outstanding TSRs?

Even MAC getting a takeover offer from Harmony Gold values them at less than upper end of their trading range last year, so not exactly a stellar outcome even with them being acquired.

And look at who AMI are comparing themselves to:

Note: That graph above, released as part of their presentation today, does not include AMI's -30% share price fall yesterday.

PNR and ALK are both gold companies, MLX is a producer of tin and copper but mostly regarded as a tin play, DVP is a mining services company that is starting up a copper, zinc, lead, and silver mine (Woodlawn) with a lot of zinc but they also have lithium assets, 29Metals had severe flooding which shut down their operations - kind of explains a -62% SP drop, and a number of those other companies are copper miners.

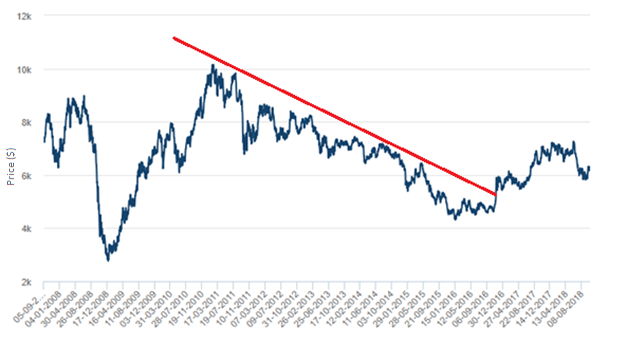

This is what happened to the copper price during the decade through to August 2018 - a 6 year downtrend from the end of 2010 through to late 2016.

Since then, many people have been copper bulls, but the copper price hasn't really shot the lights out.

Source: https://tradingeconomics.com/commodity/copper

From the end of the previous graph, in 2018, the copper price fell back to early-2016 levels and then rose in 2020 but has been trading sideways since 2021, choppy but not breaking through those '21/'22 levels since then, even though they've looked poised to break above on a couple of occasions and it could be argued they are posied to do that again now, making higher lows, but they're not really making higher highs - the graph is forming a pennant on the far right side there.

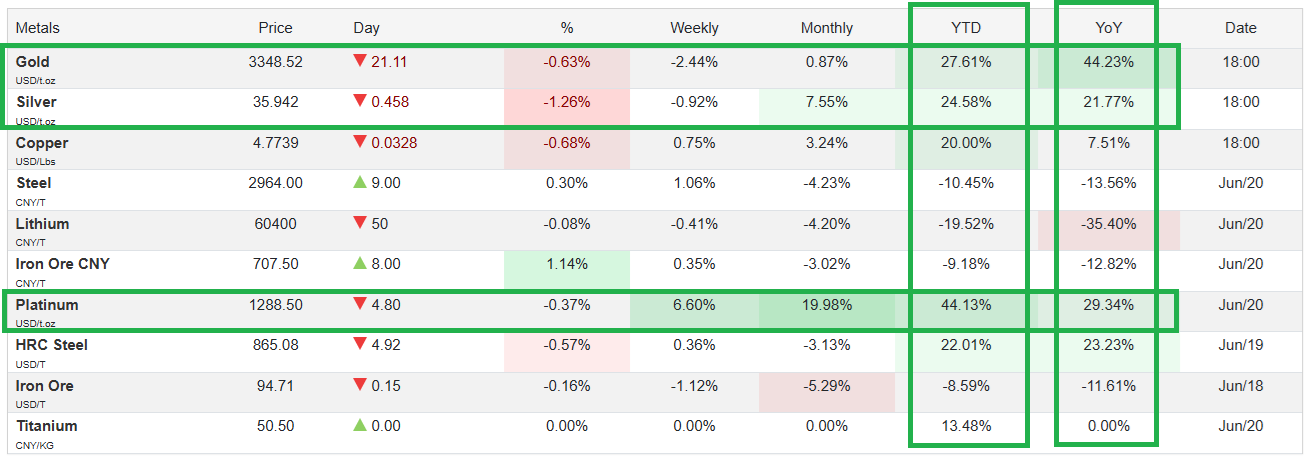

If we look at metal prices over the past year, the outstanding returns have again been in precious metals (gold, silver & platinum), and the worst performing metals have been lithium and iron ore. Copper might be up 20% year-to-date (this calendar year), but it's only 7.5% above where it was 12 months ago.

Source: https://tradingeconomics.com/commodities

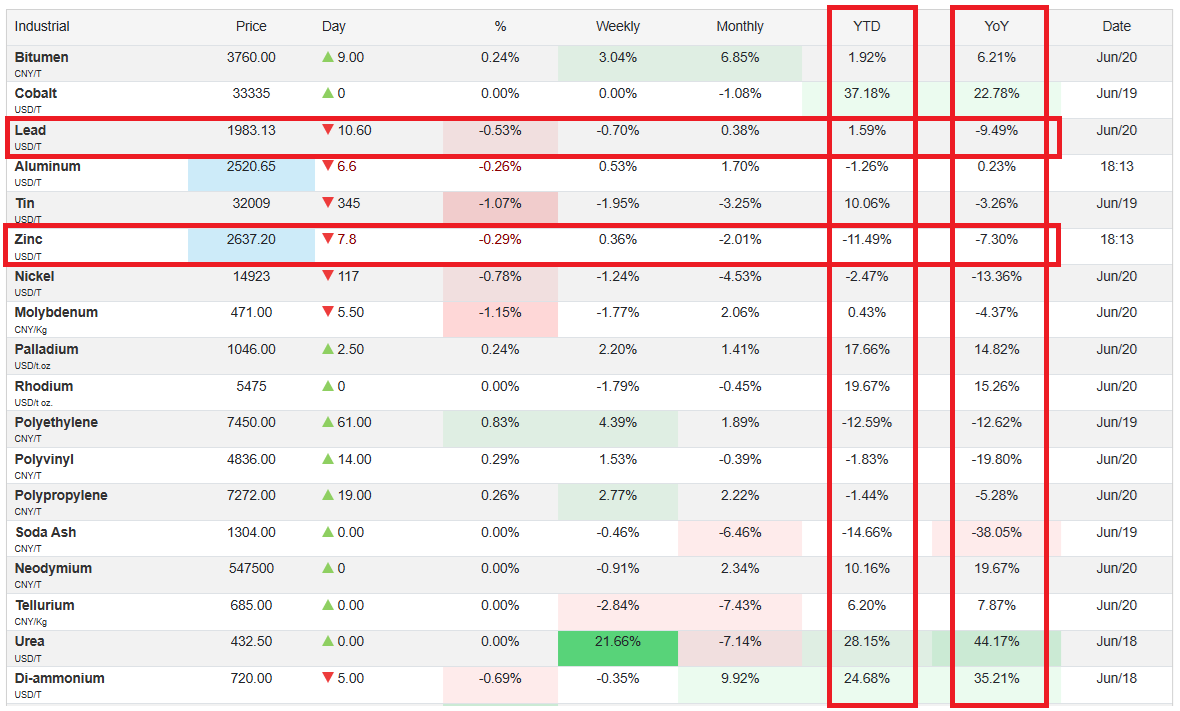

Zinc and lead are down (shown below), especially over the past 12 months (YoY):

Source: https://tradingeconomics.com/commodities

Nickel is also well down (-13.36%) on 12 months ago.

However if you're mining in the Cobar, it's going to contain zinc and lead, probably copper and silver, maybe some gold, and to be flying you need most of the commodities you produce to have prices heading in the right direction, and be able to contain costs reasonably well, allowing for inflation and expected cost increases. You also need to say what you're going to do, and then do it, not publish aspirational targets and then miss them.

Disc: I don't hold AMI because of their management's poor track record, and because of their commodity mix.