Bit of volatility as market evaluates the Aurelia Minerals raising of $40m for the restart of Federation and appointment of new CEO who used to work at Oz Minerals as Growth and Strategy Director

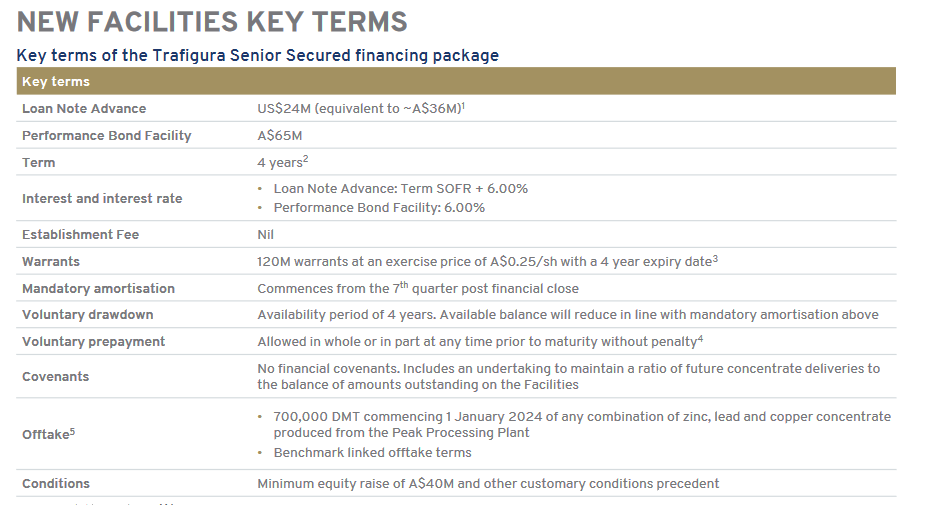

Some details are below:

So there is a bond of 65m plus 24m Loan note advance term on condition of 40m equity raise

The institution raise for 10m was oversubscribed. That leaves retail to pick the remaining 30m shares and is underwritten.

Seems that the institutions are keen. Why?

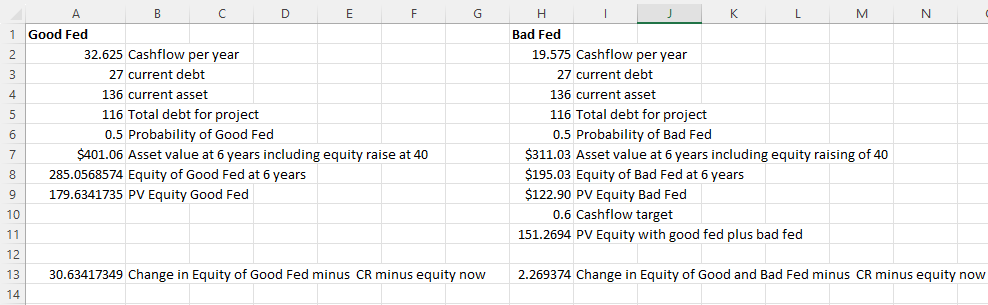

To find out why, I thought I use this time to do a bit of revision using the Damodaran Real Option method of valuing equity

Below displays a good scenario where Federation achieves the total cashflows for the 6 year period and a bad scenario where Federation flops and only gets 60% of what AMI sets out to achieve

In conclusion if "Good Fed" occurs only (ie: probability of Good Fed is 100%), we get a change in equity of 30m.

If however the chance of "Good Fed" is 50% and "Bad Fed" is 50% because of question marks on management and execution, our change in equity is about 2.26m.

So overall this is still OK and CR is fairly valued as it is. But if the management hits their milestones, starts production as scheduled and achieves 100% cashflow target as stated in the DFS, then AMI is in for a significant re-rate.

Just an FYI I used 6 years not 8 years as I had trouble doing the cashflow formula initially before using the FV function and decided to leave it. Plus I used the rate of 4% growth on FV (didn't want to get too carried away with 8% but it is obvious the equity goes up more on both cases).

Hopefully everyone found the Damodaran Real Option method useful. Try it on some of the other companies you know are doing a capital raise. Some come to mind include 4DX, IPD, ANX and NXT.

Again this is not recommendation to take the CR! I'm still debating on this as well even after doing the above numbers.

[held]