On 12th May, just over 6 weeks ago, I updated my valuation for SRG Global, moving my price target up from my previous one ($1.18) to $1.67 and gave my reasons, basically because they were growing at a good clip and their M&A had been working for them in terms of acquisitive growth on top of their organic growth. Everything was heading in the right direction at a good clip.

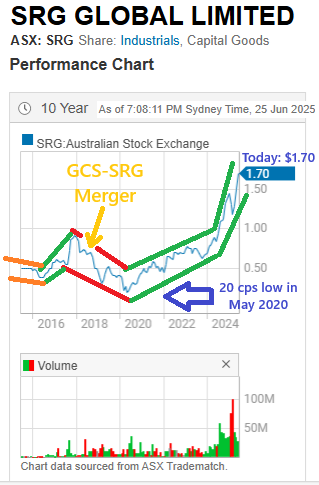

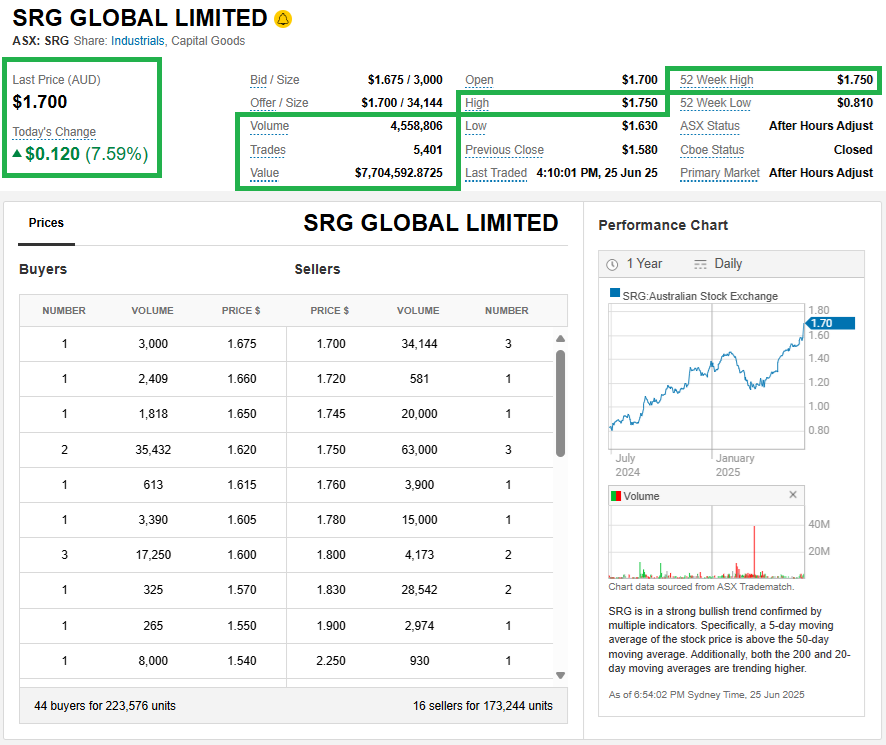

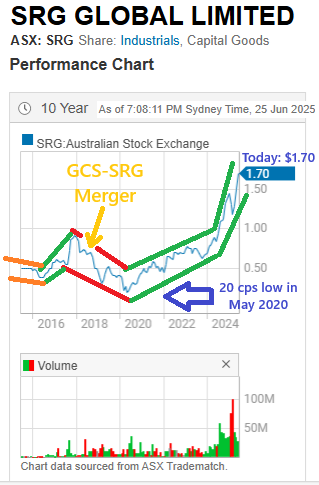

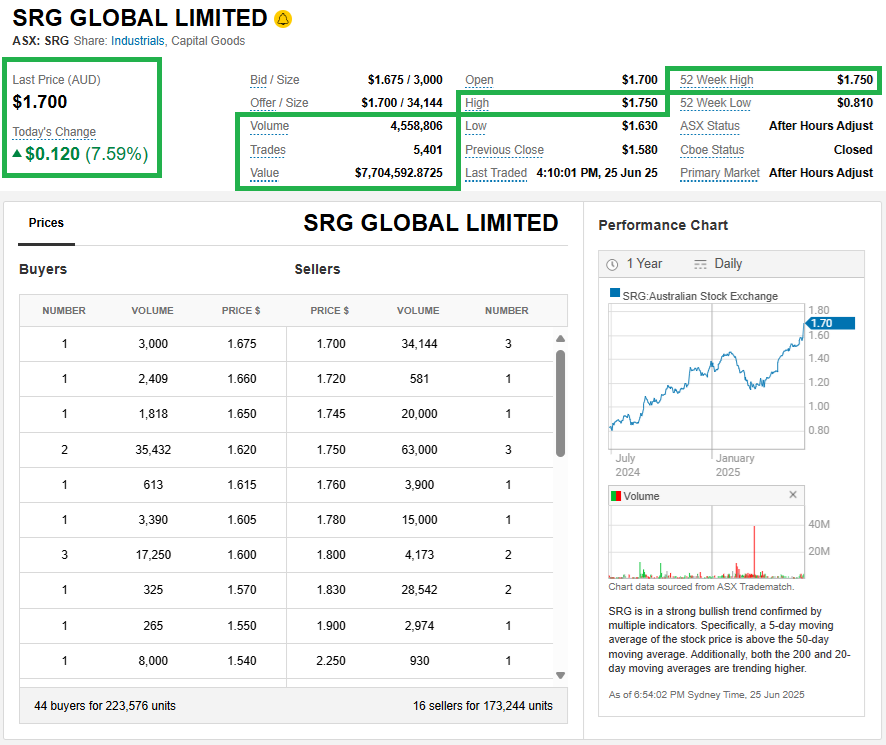

SRG closed at $1.41 that day. Today they have risen +7.59% to close at $1.70 (after tagging $1.75/share earlier in the day), which is a new 15 year high for them. The last time SRG's share price was up here they were called GCS (Global Construction Services) and it was May 2011. They also had completely different management and were a completely different company.

Seven years after that all-time high in 2011, GCS acquired SRG in what they called a merger of equals, and SRG's MD, David Macgeorge took over that same MD role in the larger merged company, which changed it's name to SRG Global and changed it's ticker code from GCS to SRG (which was the same ticker code that SRG had been using before the merger).

Over the next 12 months, everybody who had worked in a senior position (both Management and Board members) for GCS before the merger left SRG Global so while GCS actually took over SRG - likely because GCS had a slightly higher market capitalisation at the time the merger was announced - it was really SRG taking over GCS. Even Peter Wade, who had been the GCS Chairman and hung around as the Chairman after the merger, quit after a year paving the way for Peter McMorrow to resume his prior role as Chairman of SRG.

The rationale for the merger between GCS and SRG was to create a stronger combined entity with a broader service offering and increased scale, positioning them as a leading global specialist engineering, construction, and maintenance group. This enhanced capability would potentially allow the merged company, SRG Global, to better partner with clients throughout the entire asset lifecycle. The merger also aimed to achieve cost synergies and revenue growth through increased cross-selling opportunities. As they always do.

A more honest answer would be that it brought together GCS' experience and clients in the west coast energy sector with SRG's east coast and international construction and infrastructure industry experience and clients to create a larger and stronger company, and one which was supposed to be admitted to the ASX300 Index at the next rebalance in March 2019, or 2020 at the latest. It actually took another 6 years (after that March 2019 index rebalance) to achieve that desired index inclusion because the share price sank after the merger. SRG were only added to the ASX 300 Index this year.

The following couple of years were not a nice ride for SRG shareholders (I was one of them at the time), with their share price being sold down to as low as 20 cps in May 2020. However, it's been a nice uptrend since then, an uptrend which has moved into an even higher gear more recently.

Note - that chart above only shows monthly data points, so it doesn't show the full extent of the drawdown in 2020.

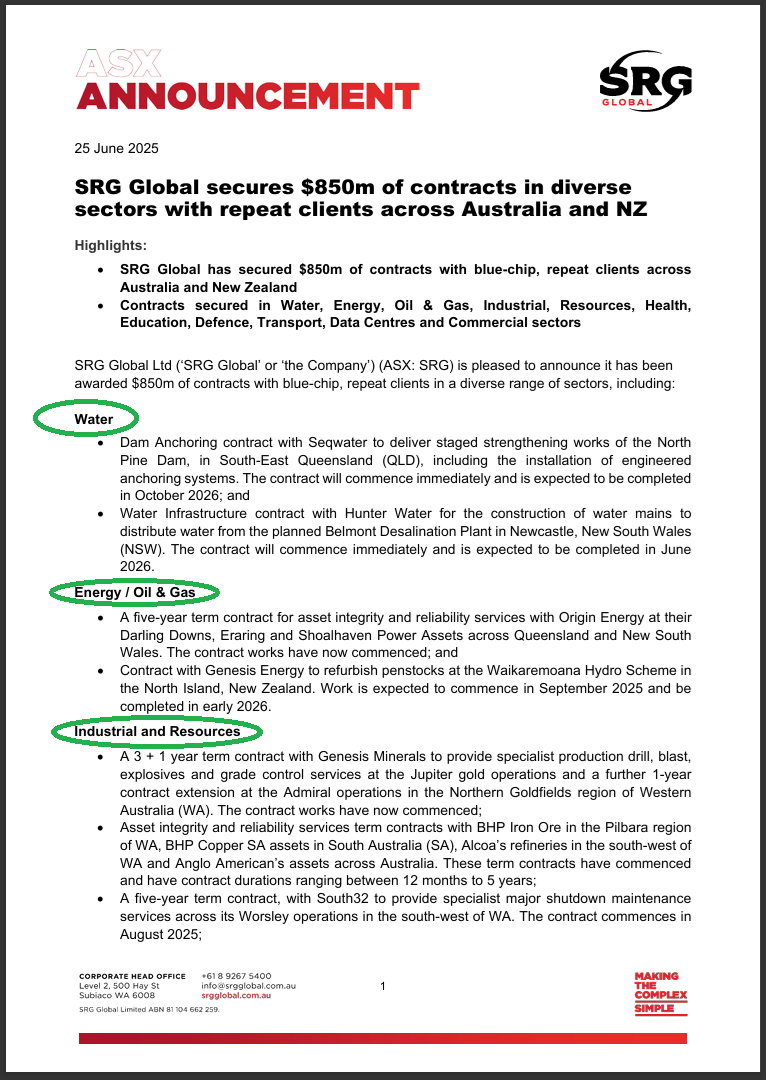

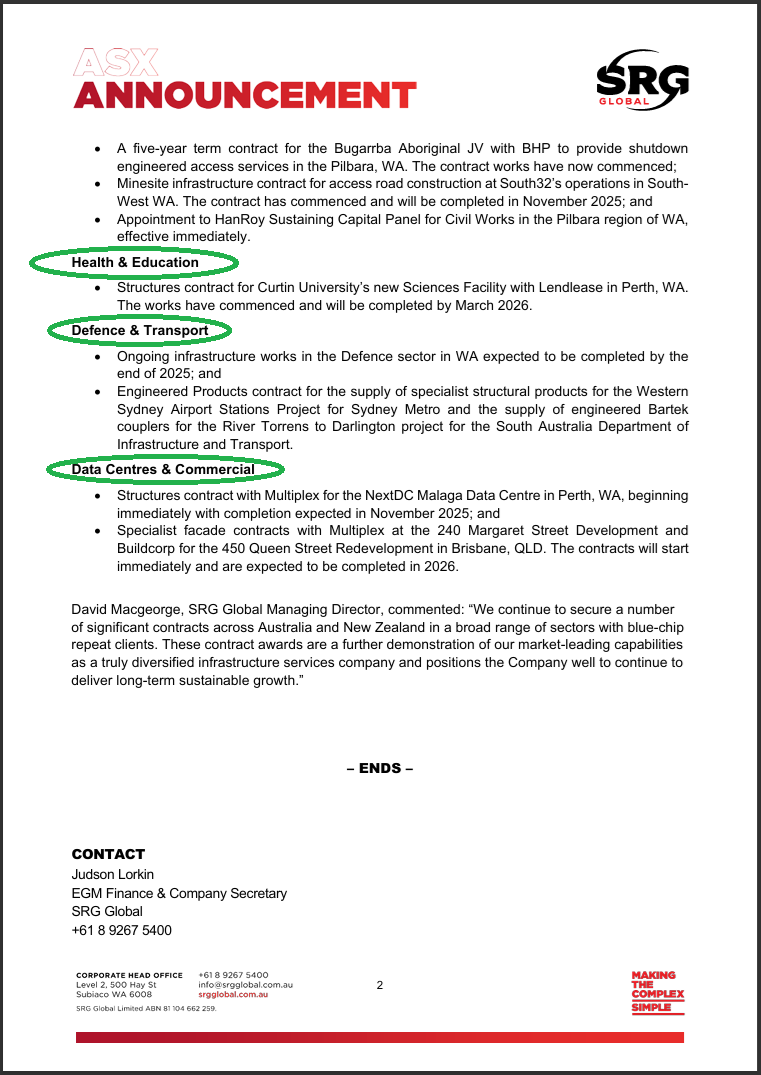

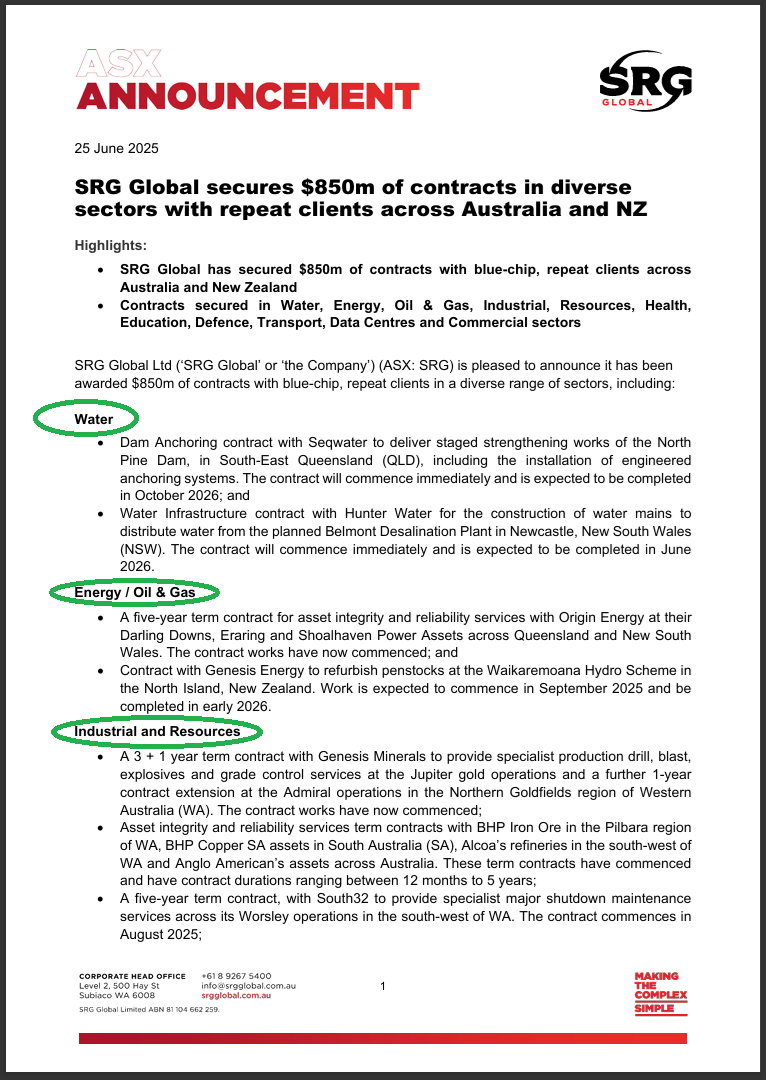

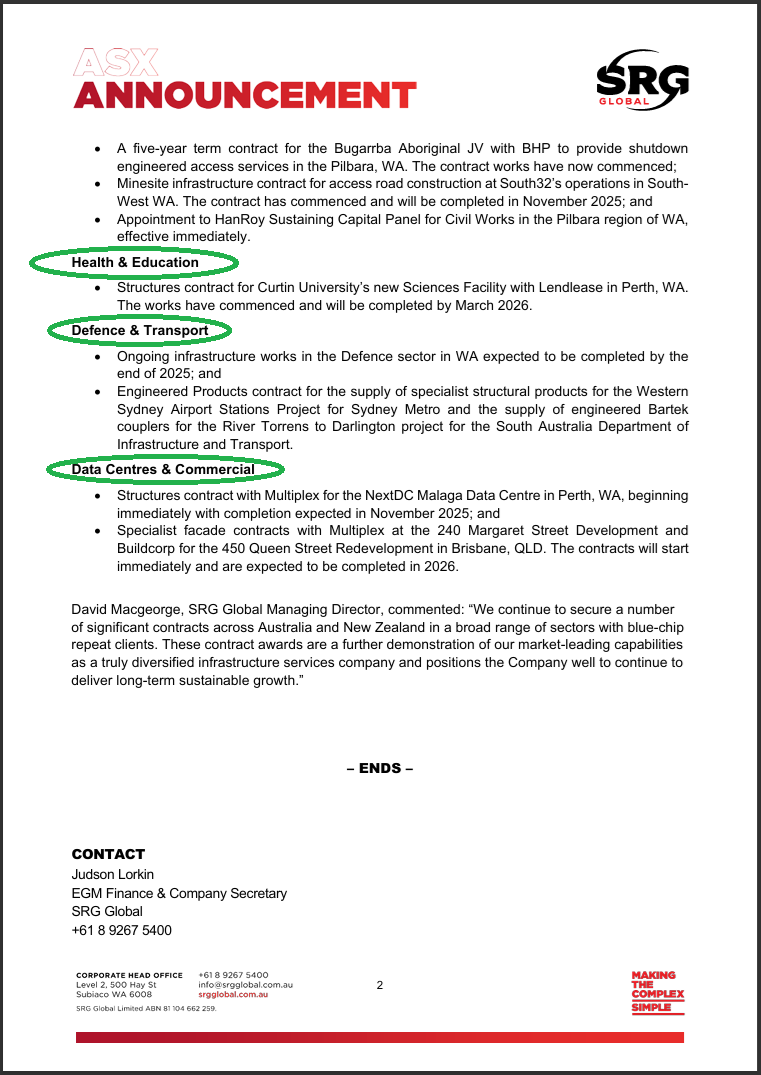

So today SRG released this little gem: $850m-of-Contracts-Secured-in-Diverse-Sectors.PDF

Multiple contract wins across 6 different sectors:

The market liked it, and so do I. Pity I'm not currently holding any SRG shares!

It's not a bad looking chart. Bottom left to top right over the past year, with just the one stumble in Feb/March after the half year results, but they've made up all of that and plenty more since then.

Not a bad looking chart, eh!?!

But is saving up a heap of recent contract wins and then releasing them all in the one announcement during the final week of the financial year a good look?

Well that likely depends on who you are and what your personal incentives are I suppose.

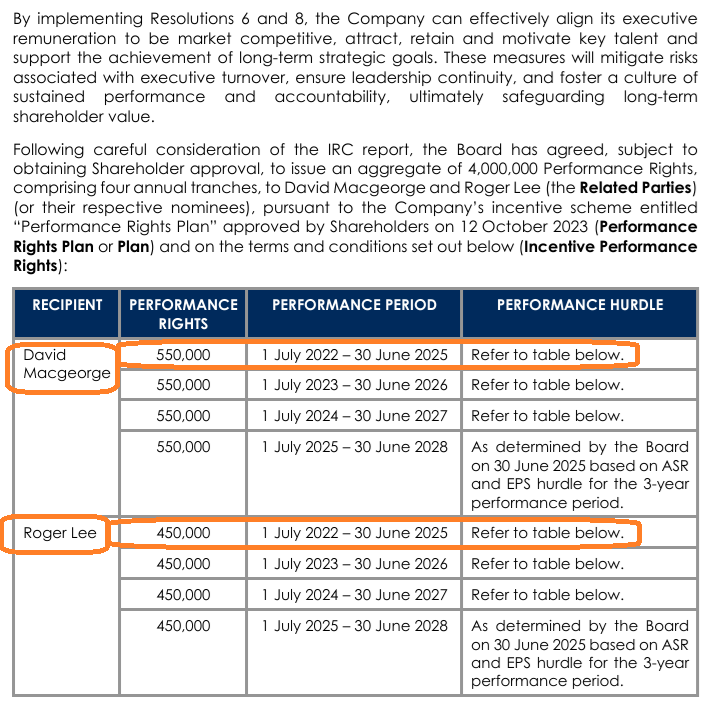

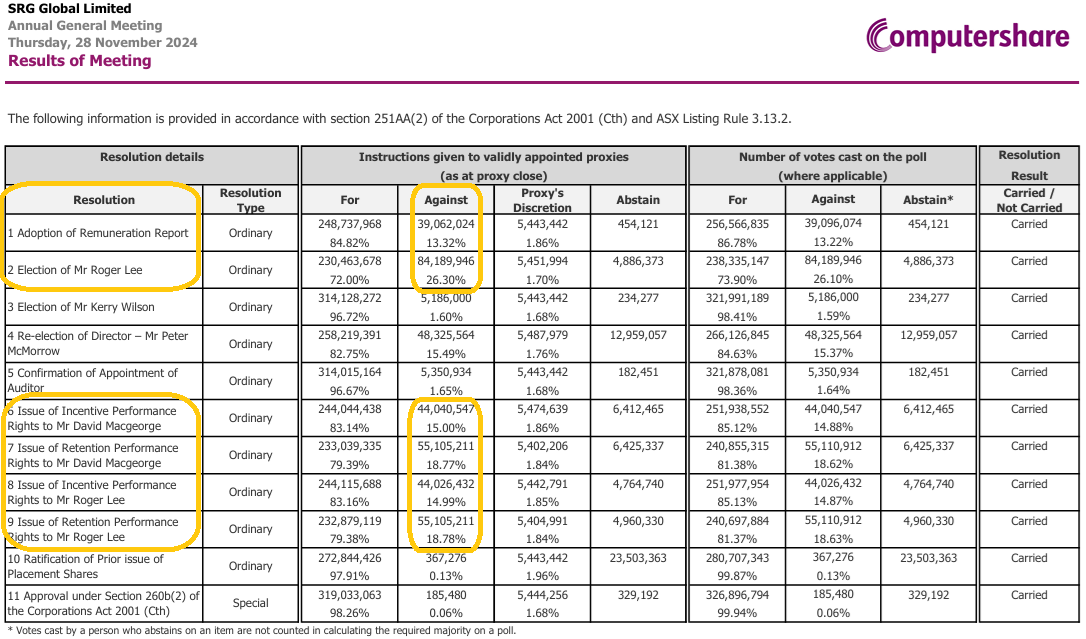

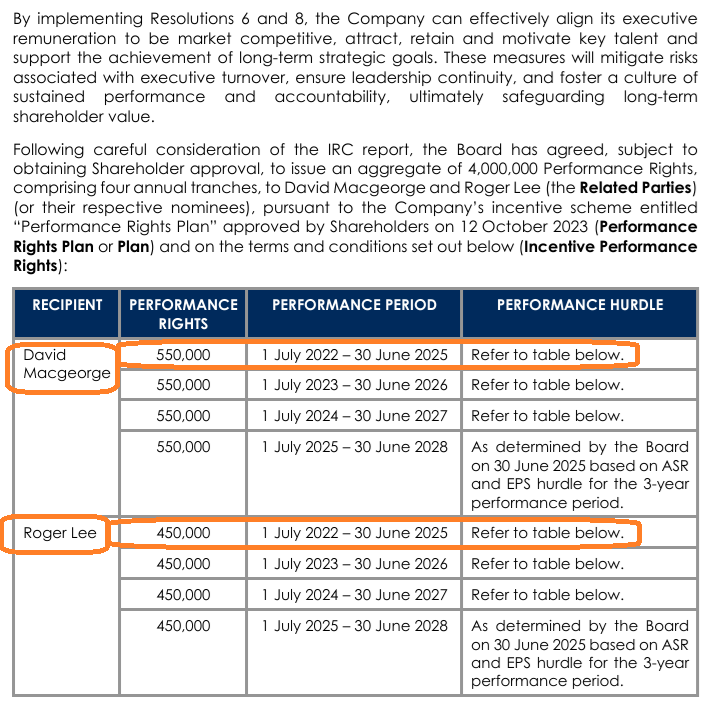

If we look back at SRG's AGM on 28th November 2024, shareholders were asked to vote for what looked like some very generous "Incentive Performance Rights" for SRG's MD, David Macgeorge (DM) and also for Roger Lee (RL) who is an Executive Director, Chief Financial Officer (CFO), and Co-Company-Secretary at SRG Global.

Before joining SRG, RL held various executive roles at Broad Group Holdings (now part of Leighton Contractors Group) including Director/CFO and Managing Director. He also held other Executive Finance roles at Leighton Contractors (now known as CPB Contractors, a wholly-owned subsidiary of CIMIC Group which is majority-owned by Hochtief, a German company, which is ultimately controlled by Grupo ACS, a Spanish construction giant).

But for the purposes of this straw, we're talking about Incentive Performance Rights for DM & RL, SRG's MD & CFO.

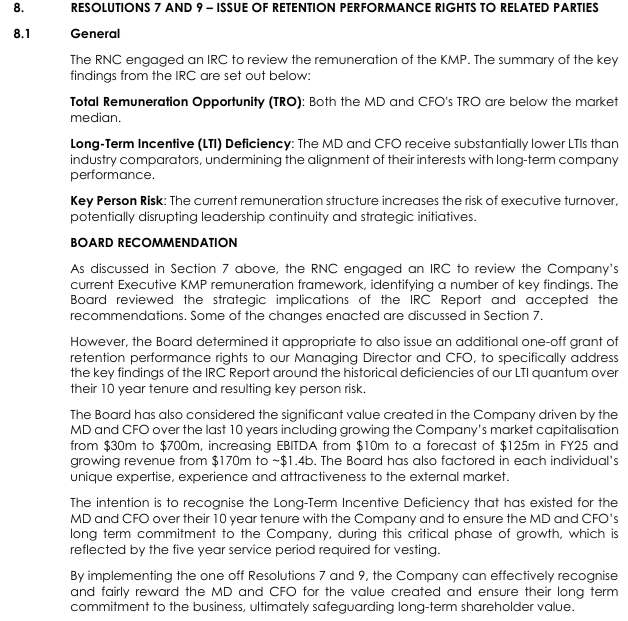

But wait, there's more folks!

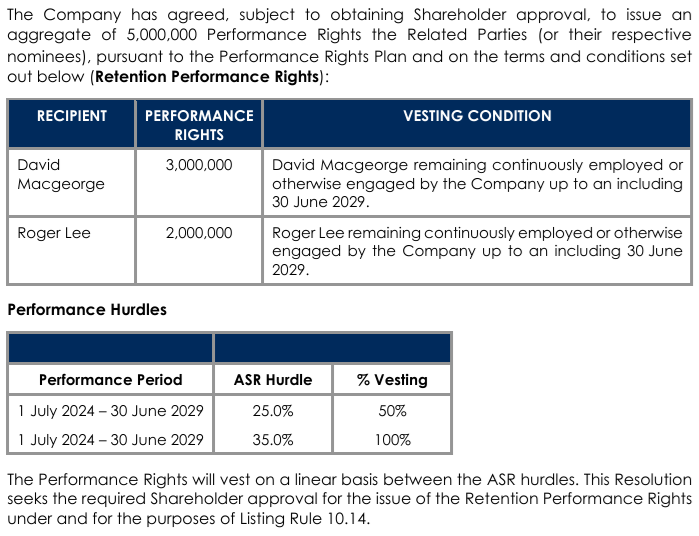

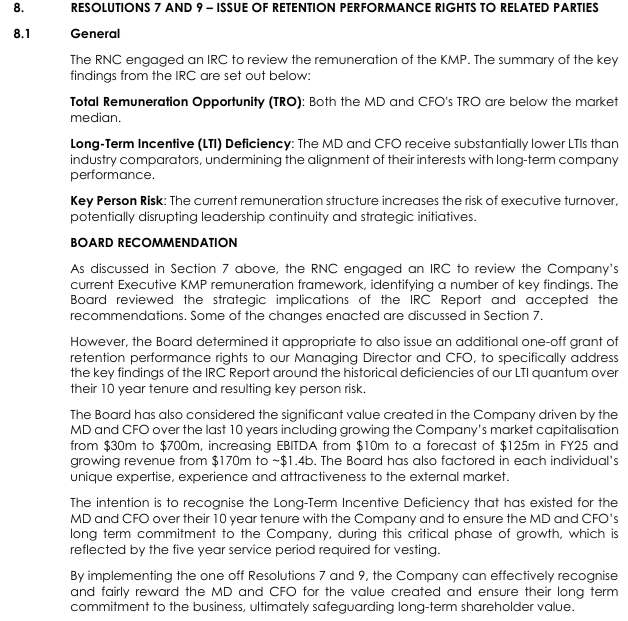

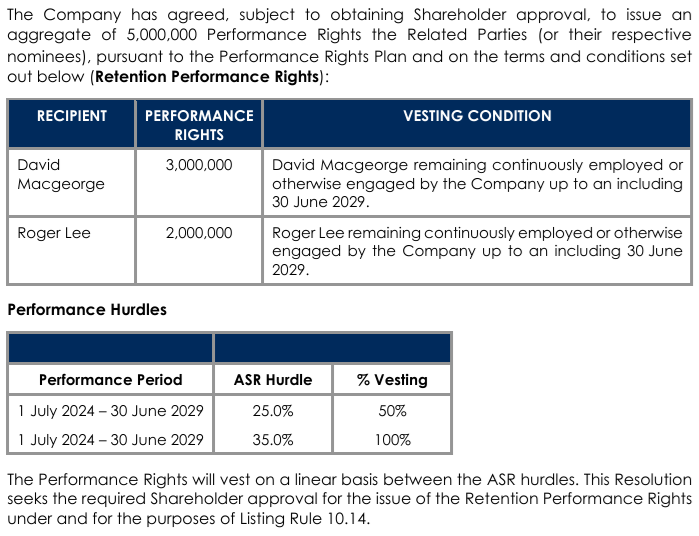

Shareholders were ALSO asked to vote on additional "Retention Performance Rights" for the same two gentlemen at the same AGM.

Some Details:

[Exceprt from the Notice of Annual General Meeting & Proxy Form, released to the ASX on 25th October 2024]

First the Incentive Performance Rights:

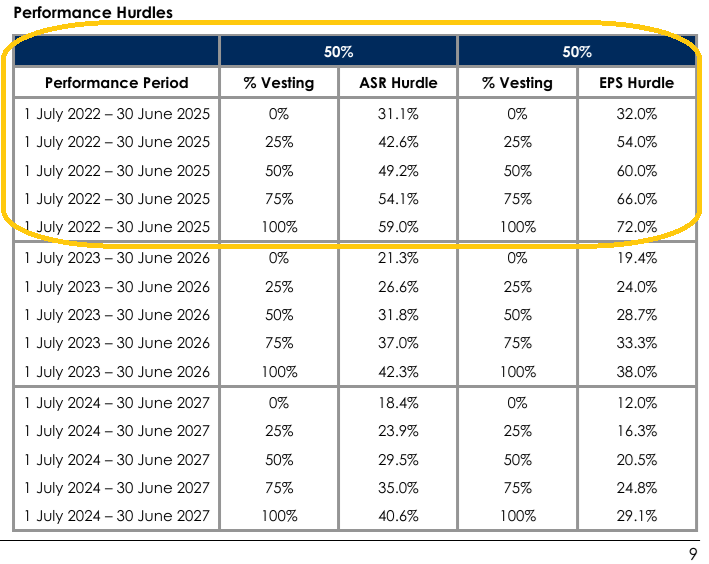

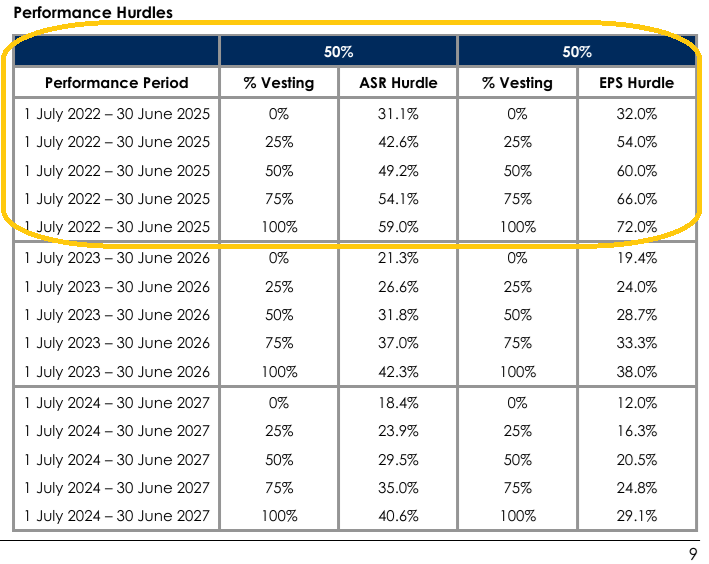

In the context of SRG Global's various Remuneration Reports, General Meetings and associated resolutions, the term "ASR Hurdle" refers to a performance condition tied to the company's Adjusted Shareholder Return (ASR). The ASR is a metric that measures the total return to shareholders, factoring in both share price appreciation and dividends, adjusted for certain items to provide a clearer picture of the company's performance

And now the Retention Performance Rights:

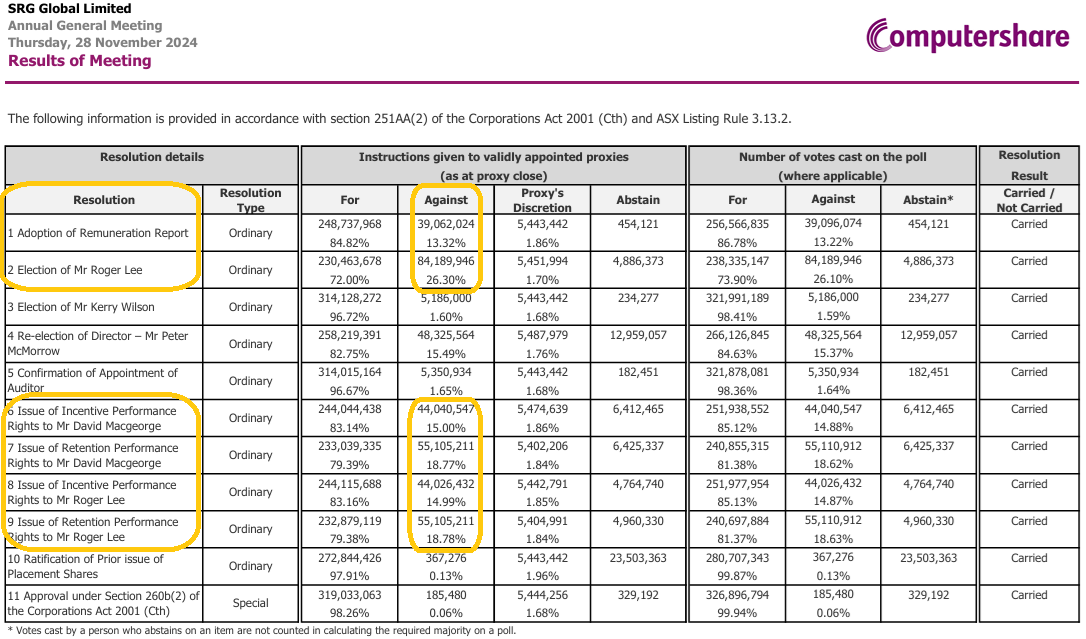

How happy were shareholders to wave that lot through? Well, the resolutions were passed, however there was a protest vote, as shown below in the orange squircles:

SRG is still a relatively small company without much insto ownership at this point, so proxy advisers didn't really come into play very much. There's DM and a few (not many) supportive small cap fundies onboard and a lot of retail shareholders. ETF provider Vanguard Group is the only current substantial shareholder of SRG (with 5.01%).

SRG were only added to the ASX 300 Index in March this year (3 months ago, i.e. after that AGM in November last year), so they haven't been on many people's radars up until very recently. And most market participants probably still don't know anything about them today.

As you can see, the share price as at June 30th 2025 (this coming Monday) is the biggest determining factor in the ASR Hurdle that determines how much of the Incentive Performance Rights (IPRs) vest to DM and RL.

Half of those IPRs depend on EPS hurdles (I like that part!), and the other half depend on the ASR which is mostly dependent on the share price at June 30th.

So the SRG share price on Monday (30th June) will determine how much of a possible 275,000 IPRs (half of 550,000) David Macgeorge receives, and how much of a possible 225,000 IPRs (half of 450,000) Roger Lee receives, and that will happen again each year for the next two financial years also (they can earn the same number of IPRs each year for 3 years under this plan). The other half depends on SRG's EPS. But - to be clear - the EPS half is NOT affected by the share price, and the ASR half is not affected by the EPS, each half has its own distinct hurdle.

At first glance, it looked like the Retention Performance Rights (RPRs) (the other Rights) don't vest until after 30th June 2029, as they are for a period of 5 years from 1st July 2024, however it says in the explanatory notes that: The Retention Performance Rights will be issued to the Related Parties (or their respective nominees) no later than 3 years after the date of the Meeting (or such later date as permitted by any ASX waiver or modification of the Listing Rules) and it is anticipated the Retention Performance Rights will be issued on one date.

It also says: The Company values the Retention Performance Rights at: (a) $1,944,000 for David Macgeorge; and (b) $1,296,000 for Roger Lee, being the value of the Retention Performance Rights) (based on the valuation methodology set out in Schedule 5).

And it should be noted that those RPRs have ASRs as the sole hurdle, so, again, the SRG Share Price will be the largest determining factor in how many of those RPRs DM and RL receive, whenever they receive them. But only the SP on 30th June each year -- that's the day that matters. The SRG share price throughout the rest of the year doesn't matter at all in terms of those Rights hurdles. Just the June 30th share price each year.

So, yeah, I reckon there's some good motivation there for SRG's MD and CFO (who is also an executive director) to release all of this good news so close to June 30th and have the share price react positively to it.

And I don't think I'm being overly cynical either - show me the incentives and I'll show you the outcome (Charlie Munger).

That said, there has to be good news there to release, and there was, so it isn't nothing, it's something, I'm just saying perhaps the time to be buying SRG is probably after their half year results in Feb or March when their share price sometimes slumps - as it did this year - rather than close to June 30th when their management is MORE incentivised to get the SP elevated.

Whatdayareckon?