Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

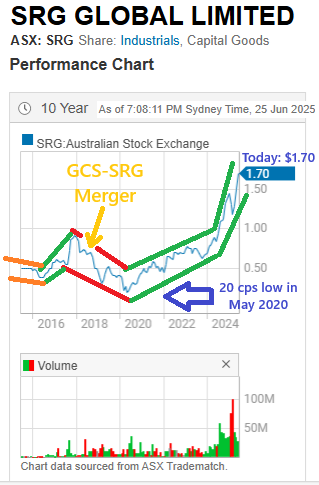

On 12th May, just over 6 weeks ago, I updated my valuation for SRG Global, moving my price target up from my previous one ($1.18) to $1.67 and gave my reasons, basically because they were growing at a good clip and their M&A had been working for them in terms of acquisitive growth on top of their organic growth. Everything was heading in the right direction at a good clip.

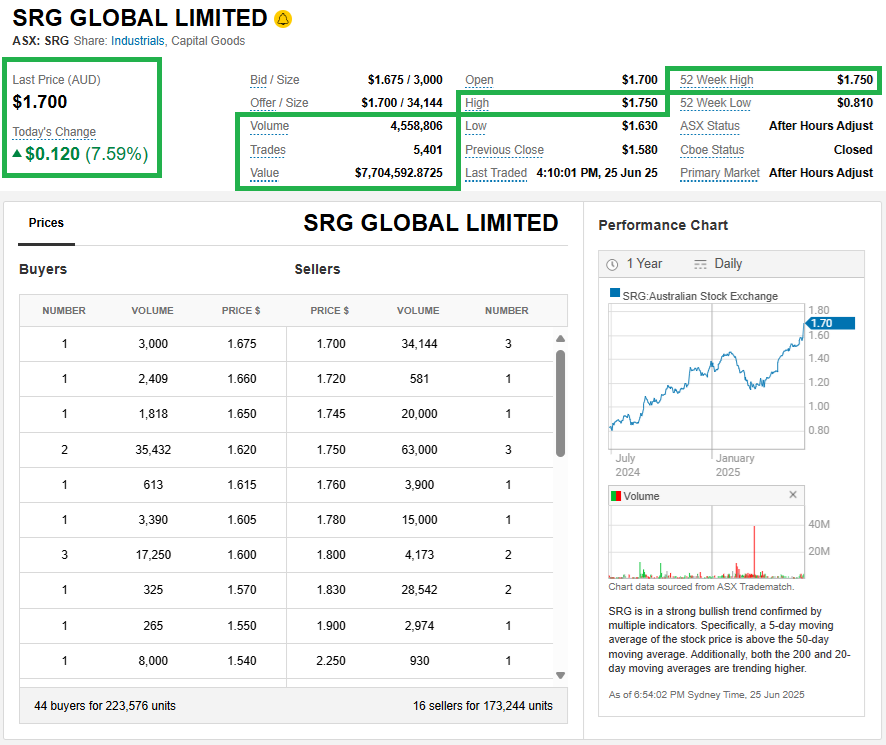

SRG closed at $1.41 that day. Today they have risen +7.59% to close at $1.70 (after tagging $1.75/share earlier in the day), which is a new 15 year high for them. The last time SRG's share price was up here they were called GCS (Global Construction Services) and it was May 2011. They also had completely different management and were a completely different company.

Seven years after that all-time high in 2011, GCS acquired SRG in what they called a merger of equals, and SRG's MD, David Macgeorge took over that same MD role in the larger merged company, which changed it's name to SRG Global and changed it's ticker code from GCS to SRG (which was the same ticker code that SRG had been using before the merger).

Over the next 12 months, everybody who had worked in a senior position (both Management and Board members) for GCS before the merger left SRG Global so while GCS actually took over SRG - likely because GCS had a slightly higher market capitalisation at the time the merger was announced - it was really SRG taking over GCS. Even Peter Wade, who had been the GCS Chairman and hung around as the Chairman after the merger, quit after a year paving the way for Peter McMorrow to resume his prior role as Chairman of SRG.

The rationale for the merger between GCS and SRG was to create a stronger combined entity with a broader service offering and increased scale, positioning them as a leading global specialist engineering, construction, and maintenance group. This enhanced capability would potentially allow the merged company, SRG Global, to better partner with clients throughout the entire asset lifecycle. The merger also aimed to achieve cost synergies and revenue growth through increased cross-selling opportunities. As they always do.

A more honest answer would be that it brought together GCS' experience and clients in the west coast energy sector with SRG's east coast and international construction and infrastructure industry experience and clients to create a larger and stronger company, and one which was supposed to be admitted to the ASX300 Index at the next rebalance in March 2019, or 2020 at the latest. It actually took another 6 years (after that March 2019 index rebalance) to achieve that desired index inclusion because the share price sank after the merger. SRG were only added to the ASX 300 Index this year.

The following couple of years were not a nice ride for SRG shareholders (I was one of them at the time), with their share price being sold down to as low as 20 cps in May 2020. However, it's been a nice uptrend since then, an uptrend which has moved into an even higher gear more recently.

Note - that chart above only shows monthly data points, so it doesn't show the full extent of the drawdown in 2020.

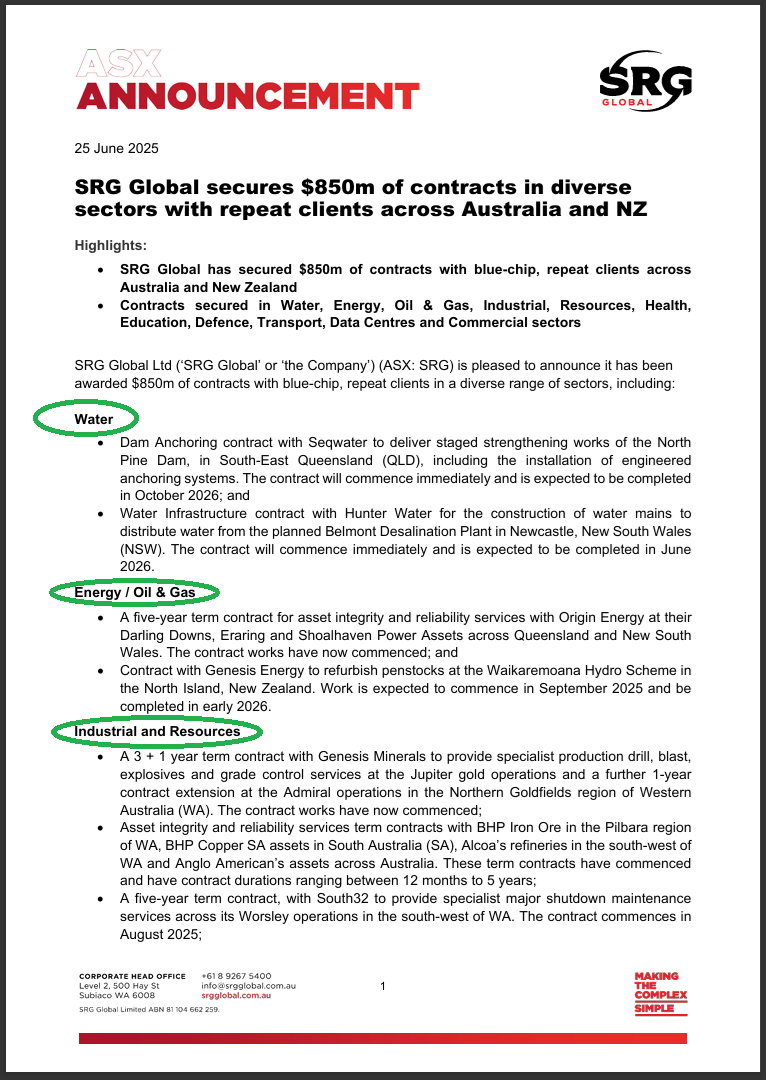

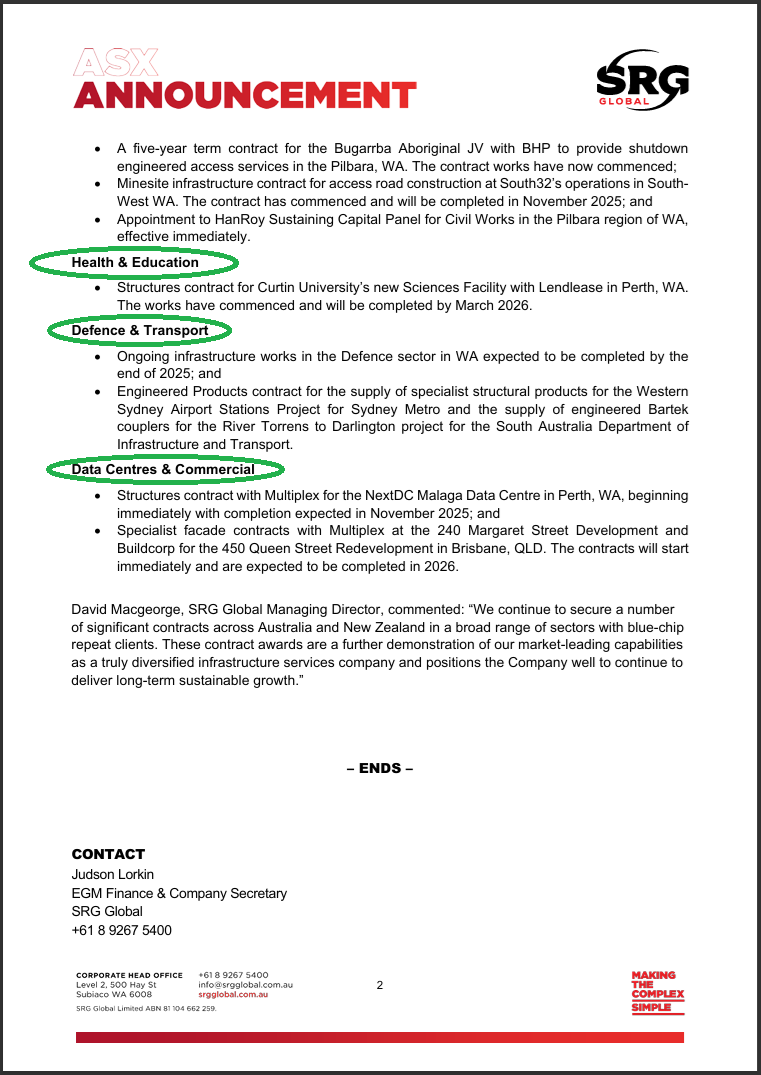

So today SRG released this little gem: $850m-of-Contracts-Secured-in-Diverse-Sectors.PDF

Multiple contract wins across 6 different sectors:

The market liked it, and so do I. Pity I'm not currently holding any SRG shares!

It's not a bad looking chart. Bottom left to top right over the past year, with just the one stumble in Feb/March after the half year results, but they've made up all of that and plenty more since then.

Not a bad looking chart, eh!?!

But is saving up a heap of recent contract wins and then releasing them all in the one announcement during the final week of the financial year a good look?

Well that likely depends on who you are and what your personal incentives are I suppose.

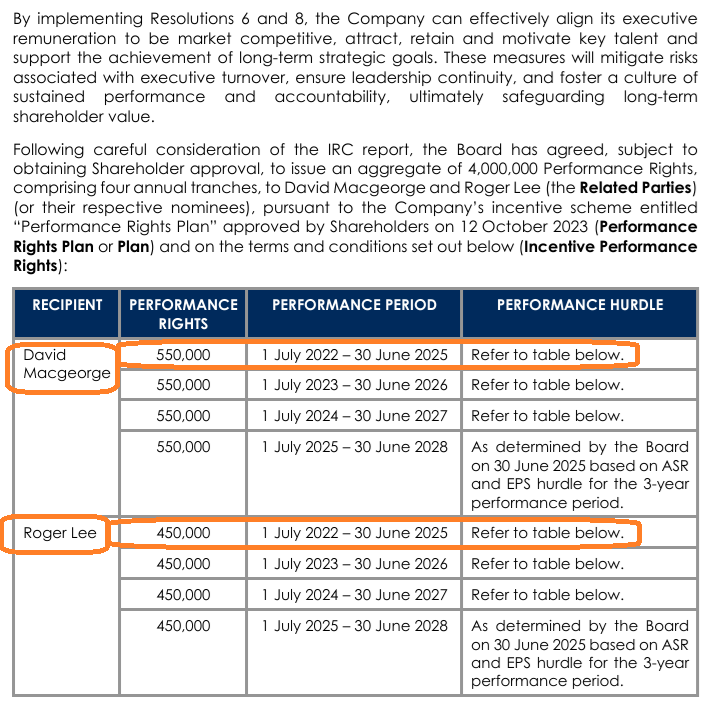

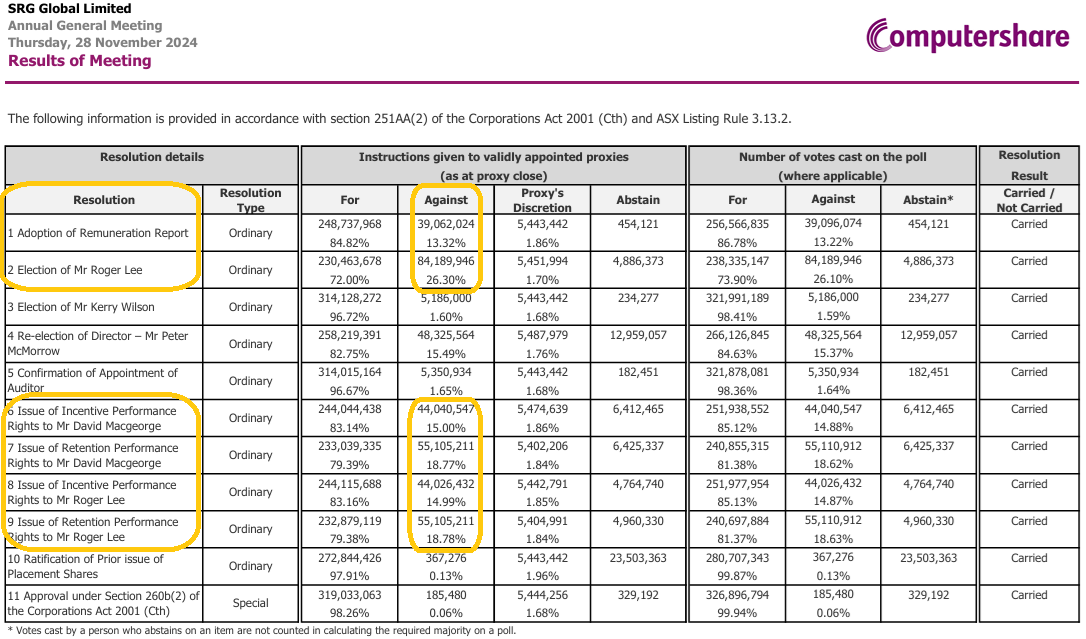

If we look back at SRG's AGM on 28th November 2024, shareholders were asked to vote for what looked like some very generous "Incentive Performance Rights" for SRG's MD, David Macgeorge (DM) and also for Roger Lee (RL) who is an Executive Director, Chief Financial Officer (CFO), and Co-Company-Secretary at SRG Global.

Before joining SRG, RL held various executive roles at Broad Group Holdings (now part of Leighton Contractors Group) including Director/CFO and Managing Director. He also held other Executive Finance roles at Leighton Contractors (now known as CPB Contractors, a wholly-owned subsidiary of CIMIC Group which is majority-owned by Hochtief, a German company, which is ultimately controlled by Grupo ACS, a Spanish construction giant).

But for the purposes of this straw, we're talking about Incentive Performance Rights for DM & RL, SRG's MD & CFO.

But wait, there's more folks!

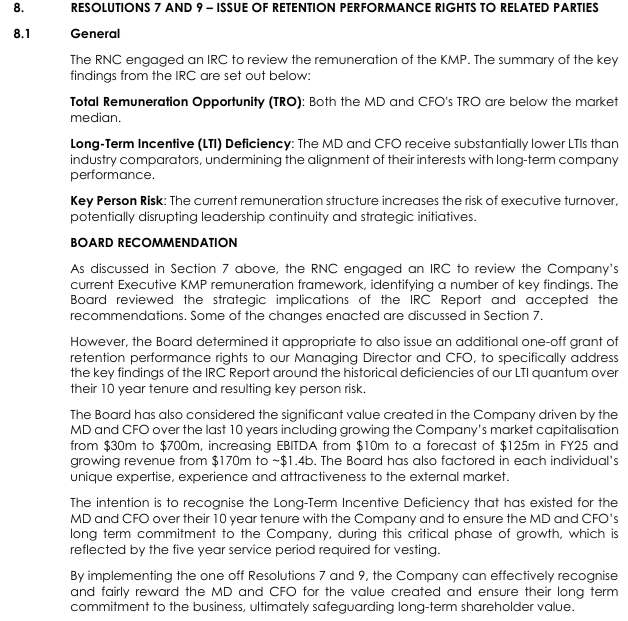

Shareholders were ALSO asked to vote on additional "Retention Performance Rights" for the same two gentlemen at the same AGM.

Some Details:

[Exceprt from the Notice of Annual General Meeting & Proxy Form, released to the ASX on 25th October 2024]

First the Incentive Performance Rights:

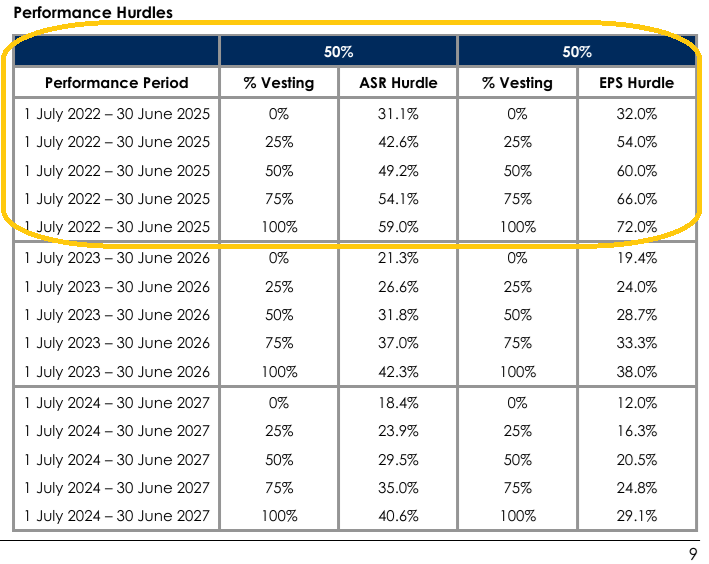

In the context of SRG Global's various Remuneration Reports, General Meetings and associated resolutions, the term "ASR Hurdle" refers to a performance condition tied to the company's Adjusted Shareholder Return (ASR). The ASR is a metric that measures the total return to shareholders, factoring in both share price appreciation and dividends, adjusted for certain items to provide a clearer picture of the company's performance

And now the Retention Performance Rights:

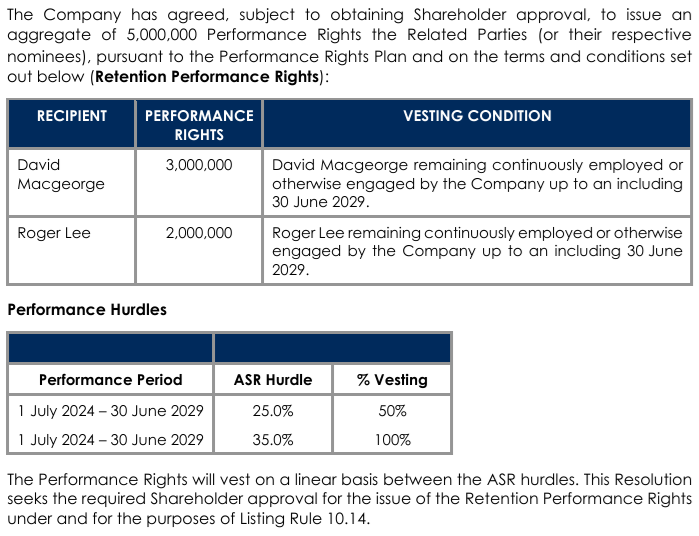

How happy were shareholders to wave that lot through? Well, the resolutions were passed, however there was a protest vote, as shown below in the orange squircles:

SRG is still a relatively small company without much insto ownership at this point, so proxy advisers didn't really come into play very much. There's DM and a few (not many) supportive small cap fundies onboard and a lot of retail shareholders. ETF provider Vanguard Group is the only current substantial shareholder of SRG (with 5.01%).

SRG were only added to the ASX 300 Index in March this year (3 months ago, i.e. after that AGM in November last year), so they haven't been on many people's radars up until very recently. And most market participants probably still don't know anything about them today.

As you can see, the share price as at June 30th 2025 (this coming Monday) is the biggest determining factor in the ASR Hurdle that determines how much of the Incentive Performance Rights (IPRs) vest to DM and RL.

Half of those IPRs depend on EPS hurdles (I like that part!), and the other half depend on the ASR which is mostly dependent on the share price at June 30th.

So the SRG share price on Monday (30th June) will determine how much of a possible 275,000 IPRs (half of 550,000) David Macgeorge receives, and how much of a possible 225,000 IPRs (half of 450,000) Roger Lee receives, and that will happen again each year for the next two financial years also (they can earn the same number of IPRs each year for 3 years under this plan). The other half depends on SRG's EPS. But - to be clear - the EPS half is NOT affected by the share price, and the ASR half is not affected by the EPS, each half has its own distinct hurdle.

At first glance, it looked like the Retention Performance Rights (RPRs) (the other Rights) don't vest until after 30th June 2029, as they are for a period of 5 years from 1st July 2024, however it says in the explanatory notes that: The Retention Performance Rights will be issued to the Related Parties (or their respective nominees) no later than 3 years after the date of the Meeting (or such later date as permitted by any ASX waiver or modification of the Listing Rules) and it is anticipated the Retention Performance Rights will be issued on one date.

It also says: The Company values the Retention Performance Rights at: (a) $1,944,000 for David Macgeorge; and (b) $1,296,000 for Roger Lee, being the value of the Retention Performance Rights) (based on the valuation methodology set out in Schedule 5).

And it should be noted that those RPRs have ASRs as the sole hurdle, so, again, the SRG Share Price will be the largest determining factor in how many of those RPRs DM and RL receive, whenever they receive them. But only the SP on 30th June each year -- that's the day that matters. The SRG share price throughout the rest of the year doesn't matter at all in terms of those Rights hurdles. Just the June 30th share price each year.

So, yeah, I reckon there's some good motivation there for SRG's MD and CFO (who is also an executive director) to release all of this good news so close to June 30th and have the share price react positively to it.

And I don't think I'm being overly cynical either - show me the incentives and I'll show you the outcome (Charlie Munger).

That said, there has to be good news there to release, and there was, so it isn't nothing, it's something, I'm just saying perhaps the time to be buying SRG is probably after their half year results in Feb or March when their share price sometimes slumps - as it did this year - rather than close to June 30th when their management is MORE incentivised to get the SP elevated.

Whatdayareckon?

24-Aug-2021: SRG Global (SRG) reported their full year results this morning, and they have delivered increased profit, cash and doubled their dividend, and they are forecasting strong growth in FY22 .

Highlights

- Revenue Up 4% to $570m (from FY20)

- EBITDA Up 61% to $47.1m

- EBIT(A) Up 151% to $25.1m

- Strong operating cashflow (FY21 Net Cash of $12.2M from FY20 Net Debt of $8.4m)

- Well-funded for Growth - available funds of $88.2m + undrawn $27.7m equipment finance facility

- Final Fully Franked Dividend Doubled to 1 cent per share (total FY21 dividend of 2 cps)

- Record $1b Work in Hand, Up 41% (from 30 June 2020)

- Strong opportunity pipeline of $6b in diverse sectors and geographies

- Two Thirds Annuity Earnings Profile in FY21 and beyond (recurring revenue)

- Long term Strategy on track and well positioned for long term sustainable growth

- FY22 EBITDA expected to be ~15% higher than FY21 EBITDA result

"The FY21 results demonstrate the continued execution of the SRG Global strategy. The significant level of new contract wins and the record work in hand of $1b is underpinned by demand for the Company’s engineering led, end-to-end solutions, across the asset services, mining and construction sectors."

"The Company is well positioned for long term sustainable growth with two thirds annuity-style earnings and positive exposure to a diverse range of sectors and geographies across the asset services, industrial and mining sectors and government stimulus programs in the infrastructure and construction sectors."

"SRG Global has significantly strengthened its financial position over the past twelve months, moving from net debt of $8.4m to a net cash position of $12.2m. It has also improved its liquidity to $88.2m of available funds, plus an additional undrawn $27.7m of equipment finance facility, with the Company well-placed to fund future growth."

I hold SRG Global (SRG) shares. They have been through a period since the merger with GCS (Global Construction Services) where they have certainly underwhelmed the market and have not lived up to their own or the market's expectations. However, I feel they are starting to live up to that potential now, starting with this positive FY21 result, and strong guidance for FY22 (FY22 EBITDA expected to be around 15% higher than FY21 EBITDA). They certainly have some tailwinds now, and the headwind of a tight labour market and skills shortages - particularly in WA - has not bothered them very much at all in FY21, which is a good sign for the future as well.

23-Feb-2021: 1H FY21 Half Year Results Announcement plus 1H FY21 Half Year Results Presentation and Appendix 4D & 1H FY21 Half Year Report

SRG Global delivers increased profit, cash and dividend, upgrades full year guidance

SRG Global Limited (ASX: SRG), an engineering-led global specialist asset services, mining services and construction group, has delivered its Half Year Financial Results for the six months ended 31 December 2020 (‘1H FY21’).

Highlights

- Revenue Up 6% to $283m (from 1H FY20)

- EBITDA Up 32% to $20.5m (from 1H FY20)

- Net Cash Improved to $5.3m (from Net Debt of $8.4m as at 30 June 2020)

- Fully Franked Dividend Doubled to 1 cent per share in 1H FY21 (from 1H FY20)

- $750m of Contract Wins announced since 1 July 2020 with repeat / targeted clients

- Record $1b Work in Hand, Up 41% as at 31 December 2020 (from 30 June 2020)

- Well funded for growth - available funds of $82m plus undrawn $26.5m equipment finance facility

- Two Thirds Annuity Earnings Profile in FY21 and beyond

- Upgraded FY21 EBITDA Guidance to $45m - $47m (up from $42m - $45m)

The 1H FY21 results demonstrate the continued execution of SRG Global’s stated strategy for growth. The significant level of new contract wins and the record work in hand of $1b is underpinned by demand for the Company’s engineering led, end-to-end solutions, across the asset services, mining and construction sectors.

The Company is well positioned for long-term sustainable growth, with two thirds annuity-style earnings, exposure to the broader macro-economic growth drivers across the mining and asset services sectors, and COVID-19 Government stimulus programs in the Infrastructure and Construction sectors.

SRG Global has significantly strengthened its financial position over the past six months, moving from net debt of $8.4m to a net cash position of $5.3m. The Company has improved its liquidity to $82m of available funds, plus an additional undrawn $26.5m of equipment finance facility, with SRG Global well-placed to fund future growth.

SRG Global Managing Director, David Macgeorge, said: “SRG Global’s strategy of shifting towards a greater proportion of annuity / recurring earnings, with a disciplined focus on core business, core clients and core geographies, is delivering. The Company is in a strong position to continue the momentum in the second half of FY21 and deliver further growth in FY22 and beyond.

“We have upgraded our full year EBITDA guidance range to $45m - $47m, which is a significant increase on the previous year.

“The improved financial performance and guidance is underpinned by our recent contract wins, record work in hand position of $1b and a high level of annuity earnings. The outlook for SRG Global remains positive given the Company’s exposure to diverse sectors and geographies, quality commodities, a tier one client base and growing levels of infrastructure, construction and maintenance expenditure.

“The strength of result means SRG Global will pay shareholders a fully franked dividend of 1c per share, which is double the first half dividend paid in the previous corresponding period.”

--- End of excerpt - click on the links at the top for more ---

[I hold SRG shares, and they are also on my Strawman.com scorecard.]

04-Feb-2021: SRG Global secures two Term Contracts valued at $45m

Highlights:

- SRG Global has secured a five-year term contract with GFG Liberty OneSteel to provide engineered access solutions at its Steelworks operations in Whyalla, South Australia

- SRG Global has also secured an initial 12-month term contract with Pit N Portal to provide specialist production drill and blast services and explosives supply at the Great Western gold mine in Western Australia

SRG Global Ltd (ASX: SRG) is pleased to announce it has been awarded a new term contract with GFG Liberty OneSteel. The term contract is expected to commence immediately for a period of five years comprising an initial three-year term, with options for a further two years. The scope of works includes the provision of engineered access solutions at the Liberty Steelworks site in Whyalla, South Australia.

SRG Global has also been awarded a term contract with Pit N Portal Mining Services Pty Ltd (Pit N Portal). The term contract is expected to start immediately for an initial 12-month term. The contract scope includes the provision of specialist production drill and blast services and explosives supply at RED 5 Limited’s Great Western gold mine in Western Australia.

David Macgeorge, Managing Director commented “We are very pleased to have secured these two term contracts, adding to our recurring annuity earnings. Importantly, the GFG Liberty OneSteel contract is with a repeat customer, providing new services in addition to our existing refractory services term contract. The Pit N Portal contract was specifically targeted as it builds upon our Mining Services portfolio of high quality growth commodities whilst diversifying SRG Global’s customer base.”

--- ends ---

[I hold SRG shares.]

01-Dec-2020: Market Update and Revised Guidance Announcement plus Market Update and Revised Guidance Presentation and Market Update and Revised Guidance Investor Briefing (Today, Tuesday, 1 December 2020, 08.30am WST / 11.30am AEDT)

Highlights

- FY21 EBITDA guidance revised to $42m - $45m (previously $38m - $42m)

- 1H FY21 EBITDA anticipated to be in the range of $19m - $20m

- $550m of contract wins announced since 1 July 2020 with repeat / targeted clients

- Record Work in Hand of $1b, as at 30 November 2020, up 41.5% since 30 June

- Further near-term contract wins expected with repeat / targeted clients

- Earnings profile expected to be two thirds annuity / recurring in FY21 and beyond

--- click on the links above for the full announcements and presentation ---

[I hold SRG shares. They have halved since I started buying them, back before the merger (of SRG & GCS), but they're heading in the right direction again now.]

24-Nov-2020: $100m Specialist Facades and Structures Contracts Secured

Also - back on 17-Nov-2020 (one week ago): $55m Specialist Dam, Bridge & Tank Contracts Secured

Today's announcement ($100m is a big contract for a $145m company like SRG):

SRG Global Secures Specialist Facades and Structures Contracts Valued at ~$100m

Highlights:

- SRG Global has secured two contracts totalling ~$100m

- Specialist Facades contract with Multiplex for works at the Queens Wharf Residential Tower in Brisbane, QLD

- Structures contract with D&C Corporation for the Elizabeth Quay West development in Perth, WA

- $550m of new contract wins since the start of the FY21 financial year

SRG Global Ltd (ASX: SRG) is pleased to announce it has secured two new contracts totalling ~$100m.

The first contract is with Multiplex to complete Specialist Facades works at the Queens Wharf Residential Tower in Brisbane, QLD. The scope of works includes the design, supply and installation of engineered curtain wall facades. The project is expected to start immediately and conclude around March 2023.

The Queens Wharf Residences, Tower 4, is a 67-level residential tower. It is the first of the three residential towers to be constructed as part of the Queens Wharf precinct. Once fully developed, Queens Wharf Residences will be a mixed-use building which includes a Skydeck on Level 26 and recreational facilities on the lower floors.

The second contract, with D&C Corporation, is to complete Structures works at the Elizabeth Quay West development in the Perth CBD, WA. The project is expected to start immediately and end around June 2022. This will be the fourth major contract SRG Global has been awarded in the Elizabeth Quay Water Front Precinct.

David Macgeorge, Managing Director, commented: “We continue to secure significant contracts, on some of the most important developments across Australia, demonstrating the value of our long-term, trusted relationships with our key clients. These contract awards are also evidence of our strong technical expertise and 40-year track record of delivering specialist building projects.

“With $550 million of new contract wins since July, many of them long-term, SRG Global is in a period of significant momentum that we anticipate extending well into calendar 2021. Importantly, the contract wins are being achieved across a diversity of sectors and geographies, positioning SRG Global well for long-term, sustainable growth.”

--- ends --- [I hold SRG shares.]

17-Nov-2020: $55m Specialist Dam, Bridge & Tank Contracts Secured

Highlights:

- Specialist balanced cantilever bridge contract variation with Transport for NSW as part of the New England Highway upgrade at Bolivia Hill, NSW

- Specialist design and construct contract with Water Corporation for a 20ML water tank in Karratha, WA

- Specialist dam remedial works at Paradise Dam, QLD for Sunwater / CPB Contractors

SRG Global Ltd (ASX: SRG) is pleased to announce that it has been awarded a contract variation with Transport for NSW as part of the previously announced New England Highway upgrade project at Bolivia Hill. The project is expected to complete in August 2021.

SRG Global has also secured an additional contract with Water Corporation to provide specialist design and construction of a 20ML water tank in Karratha, Western Australia. This project will commence immediately and is expected to finish towards the end of 2021. This further strengthens our relationship with Water Corporation being the third tank construction project we have been awarded in the last two months.

A further contract has been awarded to SRG Global by CPB Contractors to provide specialist dam remedial works at Paradise Dam for Sunwater. This continues our longstanding relationship with Sunwater, having recently successfully completed the Fairbairn Dam project. This is a return to Paradise Dam having previously been engaged on this dam in 2016. The project is expected to be completed by the end of the current financial year.

David Macgeorge, Managing Director, commented: “These contract awards highlight our diverse capability using specialist construction methods in our core markets of dams, bridges and tanks. We look forward to continuing our relationship with Transport for NSW, Water Corporation, Sunwater and CPB Contractors and building on our strong track record in these markets.”

[I hold SRG.]

10-Sep-2020: $65m Specialist Facades and Engineering Contracts Secured

[I hold SRG shares. When SRG reported on August 25th, they said that there were more new contracts to be announced shortly. Every time they have said that in the past, they have delivered. And they have this time as well. I expect that these three new contracts (detailed in this announcement) are not all of them either. In July, they had 5 different announcements of new work, and then another one in early August.]

SRG Global Secures Specialist Facades and Engineering Contracts Valued at ~$65m

Highlights:

- Specialist post-tensioning engineering and engineered products contract with John Holland for the Sydney Football Stadium Redevelopment at Moore Park in Sydney

- Specialist Facades and Structures contract for the Capital Square Development in Perth

- Specialist Facades contract with Lendlease for works at 150 Lonsdale Street in Melbourne as part of the Wesley Place precinct

SRG Global Ltd (ASX: SRG) is pleased to announce that it has secured a contract with John Holland to provide specialist post-tensioning engineering and engineered products for the Sydney Football Stadium Redevelopment at Moore Park in Sydney.

SRG Global has also been awarded a contract to complete Specialist Facades and Structures works at the Capital Square development in the Perth CBD. The scope of works includes the design, supply and installation of engineered curtain wall facades and structures work.

SRG Global has also secured a Specialist Facades contract to design, supply and install the specialist engineered curtain wall facades at 150 Lonsdale Street in Melbourne. This contract will be the third project undertaken by the Company for Lendlease, on behalf of Charter Hall in the Wesley Place precinct, having previously completed 130 Lonsdale Street and with 140 Lonsdale Street currently under construction.

David Macgeorge, Managing Director, commented: “We are pleased to be involved with these significant landmark developments at Sydney Football Stadium at Moore Park in Sydney, Capital Square Development in Perth and the Wesley Place precinct in Melbourne. These contract awards are evidence of our engineering-led specialist capability with repeat tier one clients”

--- ends ---

21-7-2020: $25m 5-Year Access and Maintenance Services Contract Secured

David Macgeorge, Managing Director of SRG Global, commented: “This is a significant contract award for SRG Global. We are pleased to be commencing our partnership with Yara Pilbara and look forward to driving value for their business. Importantly, this is another term contract that SRG Global has secured that adds to our growing portfolio of annuity / recurring term contracts.”

[I hold SRG shares]

15-7-2020: $25m Specialist Facades Contract Secured

[I hold SRG Shares]

7-7-2020: NZ$25m Transport Infrastructure Maintenance Contract Secured

In their Market Update last Thursday (2-7-2020), SRG Global (SRG) mentioned that there were a number of imminent new contract award announcements coming soon. Here is the first of those. [I hold SRG shares]

02-July-2020: Market Update & Interim Dividend Payment Brought Forward

This was some positive news from SRG Global at long last. In fact, I remember that the last time David Macgeorge said that some new contract awards were imminent, he was correct, and we got a steady flow of new contract award announcements over the next few weeks. That was too long ago however. The market had all but written SRG off before this morning. They closed at 19c yesterday, -68% below their 60c year-high almost 12 months ago. While they're up around +30% today on this update, it's clearly off a low base and they've got a lot more work to do. However, it's a start, and it will hopefully be a positive turning point.

Market Update & 1H Dividend payment brought forward

SRG Global Ltd (ASX: SRG) provides the following market update, including the impact of COVID-19 during which the Company implemented a number of actions to ensure the safety and wellbeing of its people, continued delivery of services to customers and cost mitigation initiatives to ensure the Company remains in a robust financial position. These actions have resulted in a more simplified business with a reduced fixed cost base and a focus on core business, core clients and core geographies.

Pleasingly, the Company has withstood the short-term challenging market conditions and is now well positioned for long-term sustainable growth, with high levels of annuity earnings, strong exposure to growth industry sectors and the fast tracking of Government stimulus in Infrastructure Construction.

Highlights

- FY20 Underlying EBITDA1 expected to be $20m - $21m

- FY21 EBITDA growth expected to be ~50% from FY20 Underlying EBITDA(*1)

- Significant liquidity with available funds of $73m, with net debt reduced in 2H to $8m

- 1H Interim Dividend payment of 0.5 cents per share brought forward to 30 July 2020

COVID-19 Impact

- FY20 EBITDA(*1) results impacted by a number of key drivers related to COVID-19, including:

- New Zealand Government imposed complete shutdown of operations for a six week period

- Deferral of non-essential maintenance and major shutdown work in Australia and NZ

- Productivity and commercial issues in the Building divisions as a result of COVID-19 driven compliance measures and industry pressures

- Disruption on international projects due to reduced access to sites and labour

- Credit loss positions are anticipated due to the economic challenges caused by COVID-19 and as a result a provision of ~$5m within the Building divisions is expected to be recognised

- Restructuring costs incurred in 2H FY20 of $2.5m, taking the total annual cost for FY20 to $4m

Business Outlook

- Work in Hand (‘WIH’) of $707m and an opportunity pipeline of $6.2b

- Imminent / near-term contract wins in Asset Services, Specialist Civil and Specialist Facades

- Asset Services expected to return to normal levels of activity in Q1 FY21

- Mining Services operating in high quality growth commodities, ie. gold and iron ore

- Positive exposure to fast tracked Government stimulus programs in Infrastructure Construction

- Continued transition of business mix towards recurring revenue with SRG Global’s earnings profile expected to be two thirds annuity / recurring in nature and one third project based

Note 1 (*1): Pre-adoption of AASB 16 and before restructuring costs & COVID-19 related credit loss provisions (all subject to audit)

Strategy

David Macgeorge, Managing Director said, “SRG Global’s focus has and will remain the safety and wellbeing of our people and accordingly we proactively implemented a range of safety, supply chain and cost mitigation measures to manage the company through the uncertainty caused by COVID-19.

“SRG Global’s strategy has been to shift towards a greater proportion of annuity / recurring earnings versus project-based earnings. COVID-19 came at a very challenging time as we were starting to build strategic momentum in the business. The uncertainty caused by COVID-19 made us reflect on what we needed to focus on in the future. We have now simplified the business, changed the way that we operate and reduced the fixed cost base, fast tracked what we were not going to do moving forward and focused on core business, core clients and core geographies.

“With the actions we have now taken, we expect FY21 EBITDA growth to be circa 50% from underlying FY20. We have a strong pipeline of opportunities in excess of $6b, with positive exposure to Government backed Infrastructure investment, high quality commodities, diverse industries and a tier one client base. This has us well positioned for long-term sustainable growth.”

Corporate

SRG Global has implemented a number of cost mitigation initiatives to ensure the Company remains in a robust financial position through the uncertainty of the COVID-19 pandemic. The outcome is a more simplified business moving forward with a reduced fixed cost base. This has resulted in the implementation of significant restructuring initiatives including:

- Reduced Board positions from seven to four

- Reduced Executive positions from eight to six

- Reduced fixed cost base within both the corporate and business unit overhead bases

- Exited fixed cost base in the US

- Scaling back of the Building division, specifically Structures Victoria and Building Post Tensioning in both Australia and the Middle East

SRG Global is in a strong liquidity position with available funds of $73m, banking facilities not due for renewal until early FY22 and access to additional equipment finance facilities. The Company continued to invest in growth capital in 2H FY20 including the commencement of five-year contracts with both Alcoa and Saracen Minerals, the latter requiring new drill rig purchases of $6m (funded through equipment finance debt). Despite the above investment, the Company’s net debt position improved in the second half to $8m (inclusive of $26m of equipment finance debt).

On 31 March 2020 the Company announced a deferral of its 1H FY20 interim dividend of 0.5 cents per share to 29 October 2020 which was part of a prudent approach to cash management due to the uncertainty of COVID-19. However, with a positive outlook and a strong liquidity position, the Board has resolved to bring forward the payment of the interim dividend to 30 July 2020.

As part of the annual reporting and audit process SRG Global will undertake a review of its intangible asset base in the Construction Segment. As part of this review and in relation to a scaled back approach to the Building division, a non-cash impairment of goodwill may be recognised.

Segment Update

SRG Global provides the following update on the business activities and conditions across the company’s operating segments.

Asset Services Segment

- Experienced significant growth in FY20 through multiple contract wins

- 2H FY20 activity levels impacted by COVID-19 through the deferral of non-essential maintenance and major shut-down work across Australia and New Zealand

- New Zealand experienced a Government imposed 6-week shut down of operations

- Asset Services operations expected to return to normal levels of activity in Q1 of FY21

- Excellent contract mobilisation with Alcoa for five-year multi-disciplinary contract

- Continue focus on innovation and technology as a market differentiator

- Imminent / near term contract wins expected in both Australia and New Zealand

Mining Services Segment

- Continued to perform strongly through the COVID-19 period

- A number of early and proactive operational measures were implemented to ensure continuity of service delivery across all operations

- Minimal financial impact in production drill and blast as a result of the above

- COVID-19 had some financial impact in Geotech through deferral of non-essential work to FY21

- Excellent start up with new five-year contract with Saracen Minerals

- Key commodity exposure remains in gold and iron ore sectors

- Focus is on innovation and selective growth in high quality commodities

Construction Segment – Specialist Building

- Specialist Facades business largely unaffected due to differentiated business / operating model with a number of imminent / near term contract wins expected

- COVID-19 significantly impacted productivity in Structures Victoria and Building Post-Tensioning businesses along with a challenging operating environment. Moving forward these businesses will be scaled back and focused on key tier one clients only

- Structures West now commenced major Multiplex project addressing the known carrying cost issue with a number of good opportunities in the pipeline

Construction Segment – Specialist Civil and Engineering

- Civil operations in Australia performing strongly and largely unaffected by COVID-19

- Positive exposure to a pipeline of opportunities being fast tracked through Government stimulus

- Engineered product sales are continuing to grow with a positive pipeline of opportunities

- COVID-19 impacted International operations and access to the US, Middle East and South Africa

- A reduced fixed cost base business model has been implemented including managing future US opportunities from Australia and scaling back operations in the Middle East

- Will continue to target specialist projects in dams, bridges and tanks globally from Australian base

- Imminent / near term contract wins expected in Australia

Work in Hand

The Company has work in hand of $707m as at 30 June 2020 with approximately two thirds of work in hand annuity / recurring in nature. SRG Global has a strong pipeline of opportunities in excess of $6b, with positive exposure to Government backed Infrastructure investment, high quality commodities, diverse industries and a tier one client base.

Outlook

SRG Global is very well positioned for sustainable growth in FY21 and beyond underpinned by a solid work in hand position, a strong opportunity pipeline with a number of imminent and near term contract wins expected and a future earnings profile of two thirds annuity / recurring in nature and one third project based.

SRG Global expects FY21 EBITDA growth to be ~50% from FY20 EBITDA of $20m - $21m.

– ends –

Disclosure: I hold SRG Global shares. I've been very patient with them, and I'm hoping that patience is now going to be repaid. There are a lot of positives in this update, however words are cheap, and it's actual results that matter. I'm hopeful now (based on available information of course, not just based on hope) that the results that myself and other shareholders have been waiting for are now on the way. I think SRG is well positioned and well managed and I particularly like their recurring (annuity-style) revenue focus for two thirds of their revenue, allowing them to be very selective with the work they take on in shorter-term construction projects. In the conference call today, David Macgeorge made it clear that they don't need to take on high-risk or low-margin construction work, and they won't be doing that. That's what I wanted to hear. That one-third-of-revenue construction segment work might be lumpy but it WILL be profitable. That's the story they're telling today, and I'm inclined to believe them.

31-Mar-2020: COVID-19, Guidance and Dividend Update

10-Mar-2020: Euroz Conference Presentation March 2020

09-Mar-2019: Post 1HFY19 Results, the 4 broking houses / analysts that cover SRG Global have updated their advice to clients and produced updates that include new price targets.

All 4 reports can be reached from here: http://srgglobal.com.au/investors/broker-reports/

SRG closed at 36c/share yesterday (Friday 08-Mar-19).

Euroz have maintained their "Buy" call and their new price target (PT) is 49c (downgraded from 87c).

"On balance, despite 1h 2019 disappointment, with $16.8m net cash, the stock is worth more than $0.37 fundamentally. That said, it may trade sideways for a period pending outlook clarity."

Next, Hartleys have retained their "Speculative Buy" call, with a valuation of 47c and a 12-month PT of 48c. Their valuations have barely changed.

"At the current share price, SRG appears good value. It is going to take some near term good contract wins for a re-rating, or else it will probably take time for market to have earnings confidence. The management team have a long track record turning around businesses, and are motivated and capable to dramatically improve SRG. We retain our Speculative Buy though. We need some near term evidence and comfort that earnings risk is well behind us."

Next, Baillieu Research (formerly Baillieu Holst) have retained their "Buy" call and changed their PT to 50c (from 68c).

"We believe the digestion of the GCS/SRG merger has been the key driver of divisional underperformance in 1H19, and this has now been washed through our forecasts. As a specialist services provider, SRG’s pipeline remains (along both the east and west coasts of Australia). Looking through the aberrations of FY19, we believe SRG’s valuation remains attractive, trading on a FY20f EV/EBITDA of 3.6x."

Finally, Argonaut maintain their "Buy" rating with a new 60c valuation (down from 70c).

"...we expect the benefits of the SRG-GCS tie-up, and FY19’s deferred revenue, to become more apparent in FY20, where we have EBIT climbing to $34.0m. Next year’s metrics look appealing and on this basis we maintain a BUY call, although acknowledge sentiment will weigh in the near term."

Disclosure: I hold SRG shares.

It's going to take time - the market doesn't like SRG right now, but they will get positively re-rated in future years - There's value there, and limited downside from here. IMHO.

27 February 2020 - SRG Global awarded $72m Integrated Construction Package in Perth, WA

Highlights:

- SRG Global has been awarded a significant $72m integrated construction package with Multiplex for the One The Esplanade project at Elizabeth Quay, in Perth’s Central Business District

- The scope of works includes the complete concrete structure and the design, supply and installation of engineered curtain wall facade for the 29-level tower development

- Continues SRG Global’s long-term relationship with Multiplex

On Tuesday, when SRG reported their first half results, they said that further contract awards were "imminent". Today, they announced the first of these. This $72m contract is significant for a small company like SRG.

25-Feb-2020: SRG Global's FY2020 H1 Results were disappointing - with record work-in hand and higher revenue, but lower earnings (reduced profit margins). They did however mention a couple of times that they are expecting to be awarded some new contracts very shortly. One positive is that circa ~70% of their record $737m work-in-hand (confirmed order book, up +42% in 12 months) is now recurring revenue, rather than one-off shorter-term contracts. Moving to a greater percentage of longer-term recurring revenue contracts bodes well for their future. If the new contract awards that their management is expecting actually happen - that improves their situation even further. I do hold SRG shares, and their performance has been disappointing to date, but they keep telling us that things will get better, and I think they proably will.

Half Year Results - Announcement

31-Jan-2019: New Contract Win for SRG Global - see here.

SRG Global secures $41.6m transport infrastructure project in JV with WBHO

Highlights:

- SRG Global has entered into a 50/50 joint venture (‘JV’) with WBHO Infrastructure Pty Ltd to deliver the Wanneroo Road and Ocean Reef Road Interchange project

- The 18 month, $41.6 million contract was awarded by Main Roads Western Australia

Project scope includes:

- Specialist engineering and construction of substantial bridge structures over the existing intersection,

- Construction of off and on ramps,

- Service relocations,

- Drainage enhancements, and

- Upgrades to all related path and pedestrian crossings

SRG Global Ltd (ASX: SRG) is pleased to announce that it has been awarded the large-scale Wanneroo Road and Ocean Reef Road Interchange project. SRG Global will enter into a joint venture on an equal basis with WBHO Infrastructure Pty Ltd (‘WBHO’) to deliver the $41.6 million contract (SRG Global share: $20.8 million). The project is funded by the Commonwealth and State Government as part of a $2.3 billion investment in road and rail infrastructure. This project will alleviate congestion at one of the busiest intersections in Perth’s North Metropolitan area, improving journey times and safety for road users and pedestrians. Specialist engineering and project planning works are expected to commence in early 2019 with a total project duration of approximately 18 months.

29-Jan-2020: $90.0m Multi-disciplinary Asset Services with Alcoa Executed

Highlights:

- SRG Global has now executed a new $90.0 million multi-disciplinary asset services contract with Alcoa of Australia Limited (‘Alcoa’)

- The scope of services includes heavy mechanical and electrical maintenance, specialist rope access and scaffold services at Alcoa’s alumina refinery in Kwinana, Western Australia

- Site mobilisation is well advanced with contract services to commence in February 2020.

SRG Global Limited (SRG) announced in December 2019 that the Company had been awarded preferred tenderer status for a new $90.0 million multi-disciplinary asset services contract with Alcoa. SRG is pleased to advise that the contract has now been executed.

The services will be provided at Alcoa’s Kwinana Alumina Refinery in Western Australia with a contract duration of five years. Site mobilisation is well advanced with contract services to commence in February 2020.

SRG Global Managing Director, David Macgeorge said, “We are very pleased to have now executed this contract. This is a very significant contract award for SRG Global in our Asset Services division and showcases our ability to deliver multi-disciplinary integrated solutions for tier one customers. We look forward to building a long-term partnership with Alcoa to deliver value-engineered maintenance and access services that drives value for their operations.”

Disclosure: I hold SRG shares.

July 2018:

Global Construction Services (GCS) website

The proposed merged entity (after GCS & SRG are merged) is to be called "SRG Global". There is already a company called "SRG Global" operating in the USA making chrome plated plastic automotive components:

Wikipedia page for SRG Global - a US company

Website for existing SRG Global, a US company not connected with ASX-listed SRG or GCS

The following is a link to the proposal presentation co-released by GCS and SRG:

Merger Presentation - June 2018

The following is a link to the conference call about the merger:

They may change the name of the proposed merged entity - to avoid any confusion with the existing SRG Global business in the USA, or they may not bother. I would expect them to change their ASX ticker code from GCS to SRG however.

15-Sep-18: Edit: Additional: The merger has now occurred. GCS has absorbed SRG and the new business is called SRG Global, but is still trading under the GCS ticker code. I'm still tipping that they'll apply to get that changed at some point - probably to SRG. Here's the two old logos, followed by the new one.

now equals:

And here's their new website:

The new management team contains people from both GCS and SRG, some of them in new roles, and the combined group now has a market capitalisation of almost $300m, and should get the nod to be included in the S&P/ASX300 index next time they announce a rebalance, which should elevate the profile of the company amongst investors and investment managers. They've missed out on the index rebalance that will occur on the 24th of September 2018, where AMI, CUV, IGL, JMS, KGN, MNY, MP1, NEA, OMH, PNI, PNV, PPS, SEA & WGN are all being added, and AGI, BDR, IPD, ISD, ISU, MNS, MOC, RFG & SKT are all being removed from the ASX300) but SRG Global should make the next one.

Their board and management have good experience, and most have skin in the game too:

http://srgglobal.com.au/leadership/

Disclosure: I hold GCS shares, having been a previous shareholder of both GCS and SRG.

29-Dec-2018: Additional: Please see my other straws in this section for the latest news about SRG Global (ASX: SRG). There have been some developments since I typed up this straw many months ago, including a significant share price decline which has substantially reduced their market capitalisation. I still hold SRG shares. It is one of my larger positions.

27 June 2019: SRG Global secures $20m facades contract for Brisbane office tower

Highlights:

- SRG Global has secured a $20m contract for the design, supply and installation of engineered curtain wall facade for the Midtown Centre Project, Brisbane

- Project works are expected to commence in January 2020 with a total contract duration of approximately 18 months

- The project award builds on SRG Global’s strong working relationship with tier-one builder J Hutchinson Pty Ltd

SRG Global (ASX: SRG) is pleased to announce that it has secured a $20m contract for the Midtown Centre Project in Brisbane. The Midtown Centre Project is a $175.0m, 26-level development which will redevelop two Queensland Government buildings into one significant A-grade office tower in the centre of the Central Business District.

SRG Global’s Facades division will design, supply and install engineered curtain wall facade with works expected to commence in January 2020 and run for approximately 18 months.

SRG Global Managing Director, David Macgeorge said, “Securing this contract is a significant success for our Facades division and SRG Global. We are pleased to be again partnering with tier-one contractor J Hutchinson, who we already have a strong relationship with in both our Facades and Structures businesses. This project also enhances our secured long-term project work in hand.”

08-Dec-2018: Additional #2:

Perennial Value Management, a subsidiary of IOOF (ASX: IFL, who fell -35.8% on Friday after they announced that APRA were pursuing them over alleged breaches of the Superannuation Industry Supervision Act of 1993) have increased their stake in SRG to 11.37% recently, and 5 of the 7 SRG directors have been buying shares on-market in the past 10 days:

-

MD, David Macgeorge, has bought 100,000 SRG shares for $49,750 (at an average price of 49.75 cents per share)

-

Deputy Chairman, Peter McMorrow, has bought 197,000 shares for $96,155 (av=48.8cps)

-

Non-Executive Director, John Derwin, has bought 100,000 shares for $50,142 (av=50.1cps)

-

Non-Executive Director, Peter Brecht, has bought 120,000 shares for $59,343 (av=49.5cps)

-

Non-Executive Director, Michael Atkins, has bought 56,300 shares for $26,997 (av=48cps)

Those purchases have all been made since the AGM on the 27th November. While these recent on-market purchases are small change for some of these guys, like MD David Macgeorge who holds over 9 million SRG shares, and Deputy Chair (and previous Chair of SRG before the merger) Peter McMorrow, who holds over 11 million SRG shares, it does signal to the market that the board believes that the current share price significantly undervalues the company and its future prospects.

There are also broker reports available from Hartleys (Buy, valuation=85c, price target=91c), Euroz (Buy, price target=$1.20) and Baillieu Holst (Buy, price target=86c) that are all positive on SRG. The latest reports from those three brokers (all released in September after the merger details were provided to the market) can be viewed from here.

If those guys are even in the ball park, there is significant upside from the current SRG share price - which closed yesterday at 52 cents.

EGP Capital still hold SRG and when I spoke to David Prescott after the FG Funds Presentation in Adelaide the day before the SRG AGM, he confirmed than Lanyon Asset Management still held SRG (then GCS) although Lanyon had been dilluted to below the 5% threshold (that defines substantial holders) by the issue of GCS shares to SRG shareholders at the time of the merger in September. IFL's Perennial Value hold 11.37% of SRG. Directors are buying.

There should be significant upside from here, but it might take 12 months (or longer) for the current negative sentiment to turn positive. Hopefully it happens sooner, but it's a marathon, not a sprint.

08-Dec-2018: Additional. As soon as the GCS officially became SRG Global (at their November AGM), they immediately arranged to have their ticker code changed to SRG - as I expected - as it made sense to do so - and they now trade as SRG.

Their market capitalisation is appreciably lower than the $300m that they were expected to be worth, due to a significant slide in their share price. They dropped 12% on the day of their AGM alone. They hadn't given any revenue or earnings guidance for the merged group up until the AGM, and the guidance they provided at the AGM underwhelmed. If they do hit the mid-point or upper half of their earnings guidance range, then they will deliver growth in FY19 over FY18, but not much growth. Their guidance missed expectations, and will mean that even if they do achieve growth, the growth will be slower than the adjusted pro forma growth of the merged group in the past couple of years. They've only just merged, but they've given adjusted pro forma numbers for the past 3 financial years. Their AGM presentation can be viewed here.

They have also stated that their FY19 earnings will be weighted to the second half due to the delayed timing of project awards.

Tony Hansen's EGP Capital (formerly Eternal Growth Partners) holds SRG in their Concentrated Value Fund (CVF) as they have been holders of GCS for some time. Tony wrote a very interesting piece on SRG in his November report for the EGPCVF, which can be viewed here.

Tony identifies three reasons for the slide in the GCS/SRG share price since the merger announcement as being (1) general weakness in the construction sector, (2) the outlook for the business more specifically, and (3) the way the board has chosen to remunerate their executives.

On the third point, Tony points out that SRG had granted very generous performance rights to their CEO, David Macgeorge, which would almost certainly NOT have vested if the merger had not proceeded. The same applied to Enzo Gullotti, who was the CEO of GCS, but on a meaningfully smaller scale. All of those performance rights DID vest as a direct result of the merger proceeding. The SRG business at the time of the merger announcement had a market capitalisation of $156m, so the vesting of the performance rights that had not been earned, and to a large extent seemed unlikely to be earned, effectively gifted 2.64% of SRG to the CEO (David Macgeorge). The blame here lies squarely with the Board.

Disclosure: I hold SRG shares.

30-May-19: Six year $45m Asset Services contract secured with OneSteel

That one is for an initial 4 year term, worth ~$30m, and a two year extension option, so their headline assumes that GFG Liberty OneSteel (OneSteel) exercise that two year option, which extends the contract out to 6 years and would be worth an extra ~$15m, making the full 6 years worth ~$45m all up.

The announcement says: "The contract is clear evidence of the benefits that are being delivered through the creation of SRG Global, an engineering-led specialist construction, maintenance and mining services group operating across the entire asset life cycle. The award of this refractory services contract at Whyalla Steelworks will complement existing works being undertaken by SRG Global’s Mining Services division, which has been operating in the region since 2012."

SRG Global Managing Director, David Macgeorge said, “We are extremely pleased that SRG Global has been awarded this long-term contract. It highlights our depth of experience in complex asset services and is further evidence of the diverse capabilities we offer as a combined entity. We look forward to working closely with our new partner, OneSteel.

The contract award is significant in that it aligns with SRG Global’s long-term strategy of securing a greater proportion of recurring revenue contracts in the asset services sector. It is also a considerable achievement in leveraging our refractory services expertise to significantly bolster work in hand.”

Daniel Schmidt, Manager Sourcing & Procurement at GFG Whyalla commented, “GFG Liberty OneSteel has been impressed with the capability and performance of SRG Global in recent months and now looks forward to building a long-term partnership at our Whyalla operations.”

This announcement comes hot on the heels of another big contract announcement (big for a company as small as SRG) only 3 days ago (May 27th) - see straw below (or above, somewhere) which was with S32's Worsley Alumina operation in SW WA and was worth up to $60m if S32 exercised their option to increase the length of the contract out to 6 years.

SRG went up a cent and a half on the day (Monday 27th), but that just took them back to close where they were one week ago (last Thursday), as they had dropped by 1.5c on Friday. They went up another cent on Tuesday, but the market seemed more impressed by today's announcement. The contract is worth less than Monday's but it's still a decent contract for a company as small as SRG and the message seems to be getting through, which is that the merger (of SRG & GCS to create SRG Global) DID make sense, and IS resulting in more work being won by the combined group. The comments I've reproduced above (made by David and Daniel in SRG's announcement to the market) seemed to strike a chord, as SRG rose +10.5% today - up 4c from 38c to 42c.

There's still a long way to go to get back to the levels (over 70c) that they were trading at a year ago, but they've bottomed now - at just below 30c in early April, and they're clearly rising now.

Disclosure: I hold SRG shares. They are one of my top 5 largest holdings. MND, GNG, WPL, and FOR are the other 4 at this point in time, but the order changes regularly, and the names change reasonably often too. WLE is probably at #6. As long as Matt Haupt didn't dump the banks before the election, his next NTA (for May 31st) - when reported in June - should be good, and should drag the WLE SP up somewhat. FOR looks cheap, SRG & GNG both look very cheap here, and MND & WPL are just high quality larger cap stocks that I have as anchor holdings, although I have been trimming both MND and WPL recently, as well as NWH. I've trimmed NWH so much, they're now a mid-sized position instead of a larger position, but they've more than doubled in the past year, so I had to lock in some profits on that one. They were trading at $1.35 12 months ago, and were trading at over $3 again yesterday - they got up to $3.085 yesterday before closing at $2.94 and then dropping back to $2.78 today. They are very news driven, with big reactions to contract announcements and then profit taking from people (like me) who bought them at much lower levels. Anyway, getting off the topic somewhat. SRG is one of my larger positions, and I expect it to get larger still - as the SP rises further.

05-Apr-19: SRG Global have announced this morning (see here) that they secured an initial three-year term contract with gold company Evolution Mining Ltd (EVN), with an option to extend for a further two years. Total estimated revenues under the contract are approximately $78m over the 3 year term, and approximately $115m if the two-year option to extend is exercised by EVN. SRG Global will provide drill and blast services under an Umbrella Agreement at Evolution’s Mt Rawdon, Cowal and Mt Carlton operations. This new contract builds on SRG Global’s existing five-year relationship with Evolution.

This contract is with the D&B (drill and blast) section of their mining services division, which is actually a relatively small part of the SRG Global business. SRG Global was created last year from the merger of SRG and GCS. SRG had that SRG Mining business, but their main focus was/is on complex engineering solutions, such as bridges with small footprints, tall buildings that are not ordinary (such as those that have overhangs at the top that need a very strong core through the entire building to support that) and dam walls. GCS have traditionally provided building services to the construction and mining industries, particularly scaffolding, and done a lot of building themselves. The combined group, SRG Global, got down to an all-time low share price of 28.5 cents earlier this week (Tuesday April 2nd), but have risen 14% so far today to 36.5c, which would be 28% above Tuesday's close if they can hold on to today's gains. They still look remarkably cheap to me, to be honest, but I'm a holder, so I guess I could be biased.

SRG have a JV with a larger company in the USA, Traylor Bros, that aims to secure a number of dam wall repair and construction contracts across North America which is a massive opportunity. Traylor Bros have licenses to work in almost all of the states of the US, so that is why SRG formed the JV with them. Progress so far has been slow, but that remains a major growth opportunity in the future.

Back here in Australia, they also have a lot of experience in building facade restoration and repair work (something that GCS brought with them), which could also provide a lot of growth in the future if the many high rise buildings that have flammable ACM (Aluminium Composite Material) Panels (or ACPs) are directed to replace those flammable panels with non-flammable ones. See here for more info on that opportunity: http://www.abc.net.au/news/2017-09-04/australian-high-rises-swathed-in-flammable-cladding/8862784

And then there's SRG's core business, which is complex engineering solutions. Increased infrastructure spending (federal election anyone?) will likely give them an increased pipeline of opportunities. SRG also sell a variety of ground anchors and many other engineering and construction devices and supplies, so even when they don't win an engineering & construction (E&C) contract that they are bidding on, they often end up supplying material to the company that does win the contract.

When a stock has been beaten down as much as SRG has, it doesn't take much good news for us to see some decent SP recovery - in percentage terms - as we have seen today.

Disclosure: I hold SRG.

Post a valuation or endorse another member's valuation.