11 July 2025: JOHNS LYNG GROUP ENTERS INTO SCHEME IMPLEMENTATION DEED WITH PACIFIC EQUITY PARTNERS (PEP)

Summary - from this morning's JLG enters into Scheme Implementation Deed with PEP announcement:

- Johns Lyng Group (JLG) has entered into a Scheme Implementation Deed (SID) with Sherwood BidCo Pty Ltd (Bidder), an entity owned and controlled by funds managed and advised by Pacific Equity Partners Pty Limited and certain of its affiliates (PEP), under which Bidder has agreed to acquire 100% of the ordinary shares in JLG by way of a Scheme of Arrangement at a price of $4.00 per JLG Share (Scheme Consideration).

- The Scheme Consideration values JLG’s equity at approximately $1.1 billion and implies an enterprise value (EV) of $1.3 billion, based on total diluted JLG Shares outstanding of 284,756,919, taking into account JLG Shares and performance rights on issue, net debt as at 31 December 2024 of $145.7 million (inclusive of AASB 16 leases of $32.3 million) and minority interests of $21.3 million as at 31 December 2024.

- Sherwood BidCo has already accumulated 19.07% of JLG (notice provided today) making them JLG's largest shareholder

- The next largest shareholder is Scott Didier (JLG's MD & CEO) with 17.64% (49,929,171 JLG shares) which he holds both in his own name and through 4 private companies that he controls, namely JLRX Investments Pty Ltd, Yvette and Scott Investments Pty Ltd, Trump One Pty Ltd, and Trump Investments Pty Ltd. Scott is throwing his support behind this PEP proposal and has entered into an agreement with PEP to vote his shares in favour of the Scheme as well as, if requested by the Bidder (PEP), to vote against and not support any competing proposal (see page 2 of the announcement for further details).

Sources: JLG enters into Scheme Implementation Deed with PEP, Commsec, plus previous notices lodged by JLG with the ASX announcements platform.

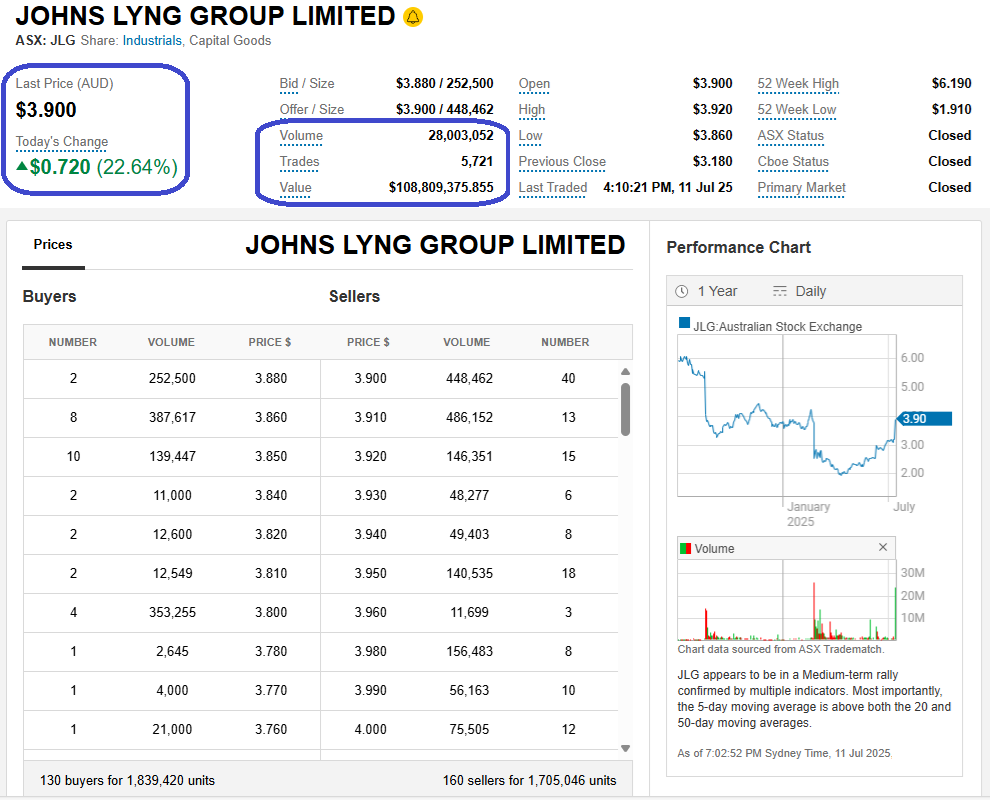

Here's how JLG closed today - after that announcement this morning:

This one is going to go through at $4 or above as it has the founder and second largest shareholder onside (Scott Didier, who is also the company's CEO and Managing Director) and the only shareholder larger than Scott is the bidder themselves (PEP) who have just become the company's largest shareholder.

There's still around 10 cents per share on the table, as JLG closed at $3.90 and traded today in a range between $3.86 and $3.92.

Note the volume today - almost $109 million worth of JLG shares - 28 million shares changed hands.

However the offer price ($4) is below their year high of $6.19 almost a year ago, and well below the $9/share levels the company reached in late 2021 and the first few months of 2022:

All in all it's been a poor outcome for anybody who bought JLG shares at any time from the second half of 2021 through to mid-2024, as shown above.

Further Reading:

by Kylar Loussikian, Deputy editor – business - Jul 11, 2025 – 12.00pm

Johns Lyng Group says it has agreed to sell itself to Pacific Equity Partners in a deal that values the building services business at $1.3 billion.

The company had a market capitalisation of $719 million last month. That was before The Australian Financial Review’s Street Talk column revealed it had been approached by a private equity firm which had secured the exclusive right to conduct due diligence on the business, ahead of a formal bid.

Johns Lyng executives will be able to roll their holdings into the private vehicle that will own the company once the buyout is finalised. Jason South

Despite confirming the discussions, Johns Lyng declined to reveal a purchase price. Shares had slumped from more than $9 in 2022 to under $3 before PEP’s interest was disclosed.

The offer, Johns Lyng told investors on Friday morning, is for $4 per share, “an attractive valuation”.

Johns Lyng executives will be able to roll their holdings into the private vehicle that will own the company once the buyout is finalised.

The company’s largest shareholder is Scott Didier, Johns Lyng’s chief executive. He said he intends to support PEP’s proposal.

Johns Lyng chairman Peter Nash said he was “pleased PEP has recognised the value of [Johns Lyng] integrated building services operations across Australia, New Zealand and the United States, adding that the board’s recommendation in favour of the deal was based on “the potential medium-term share price” without the transaction, along with other factors.

“Scott and the management team of Johns Lyng have built a strong business with a distinctive culture,” said PEP managing director Matthew Robinson.

The transaction requires the approval of shareholders, and the endorsement of an independent expert. If it does not proceed, according to the deal documents, Johns Lyng may have to pay an $11 million break fee.

The takeover approach came after a year of poor financial results for the comes as John Lyngs struggled to recoup the year’s steep losses.

The takeover approach came following a year of poor financial results for Johns Lyng that have driven the shares to shed around a third of their value since July. Interim accounts published earlier this year were similarly poor, pushing the stock down 24 per cent in one day.

Johns Lyng is being advised by JPMorgan and Nomura, while PEP has engaged MA Moelis and Goldman Sachs for the transaction.

Johns Lyng shares jumped 22 per cent, or by 70¢, to $3.88.

--- end of article ---

Note: That AFR article was published at 12 noon, and JLG put on anther 2 cents in the afternoon to close at $3.90.

Disclaimer: Not held. Have held in prior years.