Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

11 July 2025: JOHNS LYNG GROUP ENTERS INTO SCHEME IMPLEMENTATION DEED WITH PACIFIC EQUITY PARTNERS (PEP)

Summary - from this morning's JLG enters into Scheme Implementation Deed with PEP announcement:

- Johns Lyng Group (JLG) has entered into a Scheme Implementation Deed (SID) with Sherwood BidCo Pty Ltd (Bidder), an entity owned and controlled by funds managed and advised by Pacific Equity Partners Pty Limited and certain of its affiliates (PEP), under which Bidder has agreed to acquire 100% of the ordinary shares in JLG by way of a Scheme of Arrangement at a price of $4.00 per JLG Share (Scheme Consideration).

- The Scheme Consideration values JLG’s equity at approximately $1.1 billion and implies an enterprise value (EV) of $1.3 billion, based on total diluted JLG Shares outstanding of 284,756,919, taking into account JLG Shares and performance rights on issue, net debt as at 31 December 2024 of $145.7 million (inclusive of AASB 16 leases of $32.3 million) and minority interests of $21.3 million as at 31 December 2024.

- Sherwood BidCo has already accumulated 19.07% of JLG (notice provided today) making them JLG's largest shareholder

- The next largest shareholder is Scott Didier (JLG's MD & CEO) with 17.64% (49,929,171 JLG shares) which he holds both in his own name and through 4 private companies that he controls, namely JLRX Investments Pty Ltd, Yvette and Scott Investments Pty Ltd, Trump One Pty Ltd, and Trump Investments Pty Ltd. Scott is throwing his support behind this PEP proposal and has entered into an agreement with PEP to vote his shares in favour of the Scheme as well as, if requested by the Bidder (PEP), to vote against and not support any competing proposal (see page 2 of the announcement for further details).

Sources: JLG enters into Scheme Implementation Deed with PEP, Commsec, plus previous notices lodged by JLG with the ASX announcements platform.

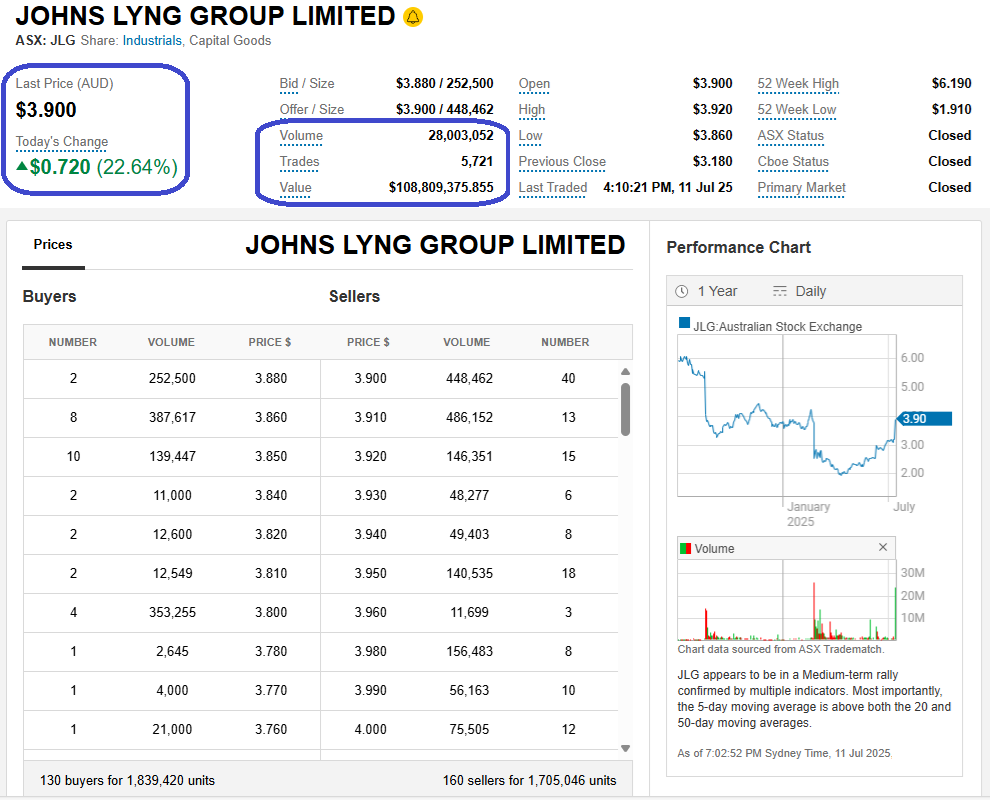

Here's how JLG closed today - after that announcement this morning:

This one is going to go through at $4 or above as it has the founder and second largest shareholder onside (Scott Didier, who is also the company's CEO and Managing Director) and the only shareholder larger than Scott is the bidder themselves (PEP) who have just become the company's largest shareholder.

There's still around 10 cents per share on the table, as JLG closed at $3.90 and traded today in a range between $3.86 and $3.92.

Note the volume today - almost $109 million worth of JLG shares - 28 million shares changed hands.

However the offer price ($4) is below their year high of $6.19 almost a year ago, and well below the $9/share levels the company reached in late 2021 and the first few months of 2022:

All in all it's been a poor outcome for anybody who bought JLG shares at any time from the second half of 2021 through to mid-2024, as shown above.

Further Reading:

AFR: Johns Lyng agrees to $1.3b takeover bid from private equity suitor

by Kylar Loussikian, Deputy editor – business - Jul 11, 2025 – 12.00pm

Johns Lyng Group says it has agreed to sell itself to Pacific Equity Partners in a deal that values the building services business at $1.3 billion.

The company had a market capitalisation of $719 million last month. That was before The Australian Financial Review’s Street Talk column revealed it had been approached by a private equity firm which had secured the exclusive right to conduct due diligence on the business, ahead of a formal bid.

Johns Lyng executives will be able to roll their holdings into the private vehicle that will own the company once the buyout is finalised. Jason South

Despite confirming the discussions, Johns Lyng declined to reveal a purchase price. Shares had slumped from more than $9 in 2022 to under $3 before PEP’s interest was disclosed.

The offer, Johns Lyng told investors on Friday morning, is for $4 per share, “an attractive valuation”.

Johns Lyng executives will be able to roll their holdings into the private vehicle that will own the company once the buyout is finalised.

The company’s largest shareholder is Scott Didier, Johns Lyng’s chief executive. He said he intends to support PEP’s proposal.

Johns Lyng chairman Peter Nash said he was “pleased PEP has recognised the value of [Johns Lyng] integrated building services operations across Australia, New Zealand and the United States, adding that the board’s recommendation in favour of the deal was based on “the potential medium-term share price” without the transaction, along with other factors.

“Scott and the management team of Johns Lyng have built a strong business with a distinctive culture,” said PEP managing director Matthew Robinson.

The transaction requires the approval of shareholders, and the endorsement of an independent expert. If it does not proceed, according to the deal documents, Johns Lyng may have to pay an $11 million break fee.

The takeover approach came after a year of poor financial results for the comes as John Lyngs struggled to recoup the year’s steep losses.

The takeover approach came following a year of poor financial results for Johns Lyng that have driven the shares to shed around a third of their value since July. Interim accounts published earlier this year were similarly poor, pushing the stock down 24 per cent in one day.

Johns Lyng is being advised by JPMorgan and Nomura, while PEP has engaged MA Moelis and Goldman Sachs for the transaction.

Johns Lyng shares jumped 22 per cent, or by 70¢, to $3.88.

--- end of article ---

Note: That AFR article was published at 12 noon, and JLG put on anther 2 cents in the afternoon to close at $3.90.

Disclaimer: Not held. Have held in prior years.

This was an absolutes small cap fundie favorite back in the day especially among the 'quality growth' managers. It has been shellacked time to take a look? Anyone have any views?

10-July-2022: Johns Lyng Group (JLG) were one of the 10 stocks covered on Ausbiz's "The Call" last Monday (4th July) with Mathan and Gaurav - Here's the link to that episode: the call: Monday 4 July on ausbiz

Plain text link: https://www.ausbiz.com.au/media/the-call-monday-4-july?videoId=22509

The JLG coverage starts at the 35 minute mark. Mathan seemed to like JLG, saying it is a quality company with quality management and that it is on his shopping list, but more of a Hold than a Buy at current levels. His main initial concern (last Monday) was rising input costs, such as the tradies charging more for their services and building materials becoming more expensive.

Gaurav thinks JLG is a sell because they are expensive (60 times earnings by his calculations) and every fund manager and his dog are already in it so the boys suggested that there might not be (m)any fundies left to drive up the price from here unless the ones who are already there decide to up their own stake further. More on that in a minute (they're wrong about that).

Gaurav also mentioned that JLG's margins are around 4%, so he rates them as a good business, but not a great business. However, they both rate JLG's management highly and think they've done an excellent job to date. However neither rate the company as a "buy" here and I get the feeling it's just not the type of company that interests Gaurav, so he would be unlikely to consider them a buy at any time - regardless of the prevailing share price (IMO).

I prepared my first investment thesis (or IT) for JLG back in late December 2017 when they hadn't quite been listed for 2 months, and decided not to buy them based on the risks being too high and there being too many unknowns with such a young company (in terms of being publicly listed). Geoff Wilson's WAM Microcap fund (WMI) already held 5.06% at that very early point (they got an allocation in the IPO and then added to it on-market) and WMI itself was only 6 months old (from their own IPO in June 2017) and their (WMI's) share price during that initial period was all bottom left to top right, so I was interested in anything they took a substantial holding in; Interested enough to prepare an IT, but not always interested enough to buy shares. It depended on how compelling the IT was, and I didn't think that JLG (based on the IT that I had prepared back then) was one of my best investment ideas at that time. I did hold WMI shares during that period, having participated in the WMI IPO due to already holding shares in WAM and WAX and liking the whole WAM Funds LIC set-up quite a bit.

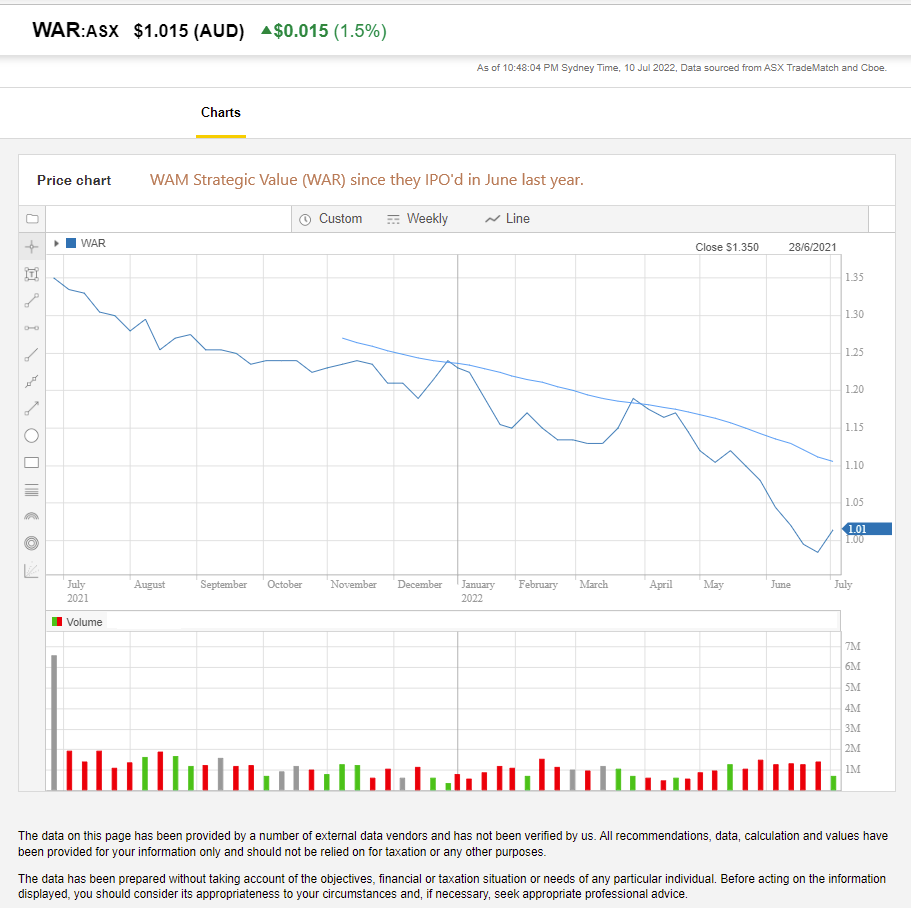

I don't hold any WAM Funds managed LICs right now, but I've held 7 of their current 8 at various times and mostly done quite well out of them. The only LIC of theirs I have never owned is their most recent one, WAR (WAM Strategic Value) which has been all top left to bottom right, the exact opposite of what you want to see on a share price graph of a company that you hold, so I'm glad to not be holding it. WAM Funds as a funds management company have now gotten to the stage where they are simply trying to milk too much money out of their once-very-loyal shareholder base, and managing 8 LICs is probably about 3 or 4 too many. Plenty of fees being generated for the management company (WAM Funds), but the consistent outperformance their individual funds (all structured as LICs - Listed Investment Companies) enjoyed in their earlier years is often lacking now.

Anyway, I digress. Back to JLG. There were other fundies also talking up JLG right at the start (just after they IPO'd/floated on the ASX) - like Perpetual - see here: https://www.livewiremarkets.com/wires/a-small-company-with-a-wide-moat

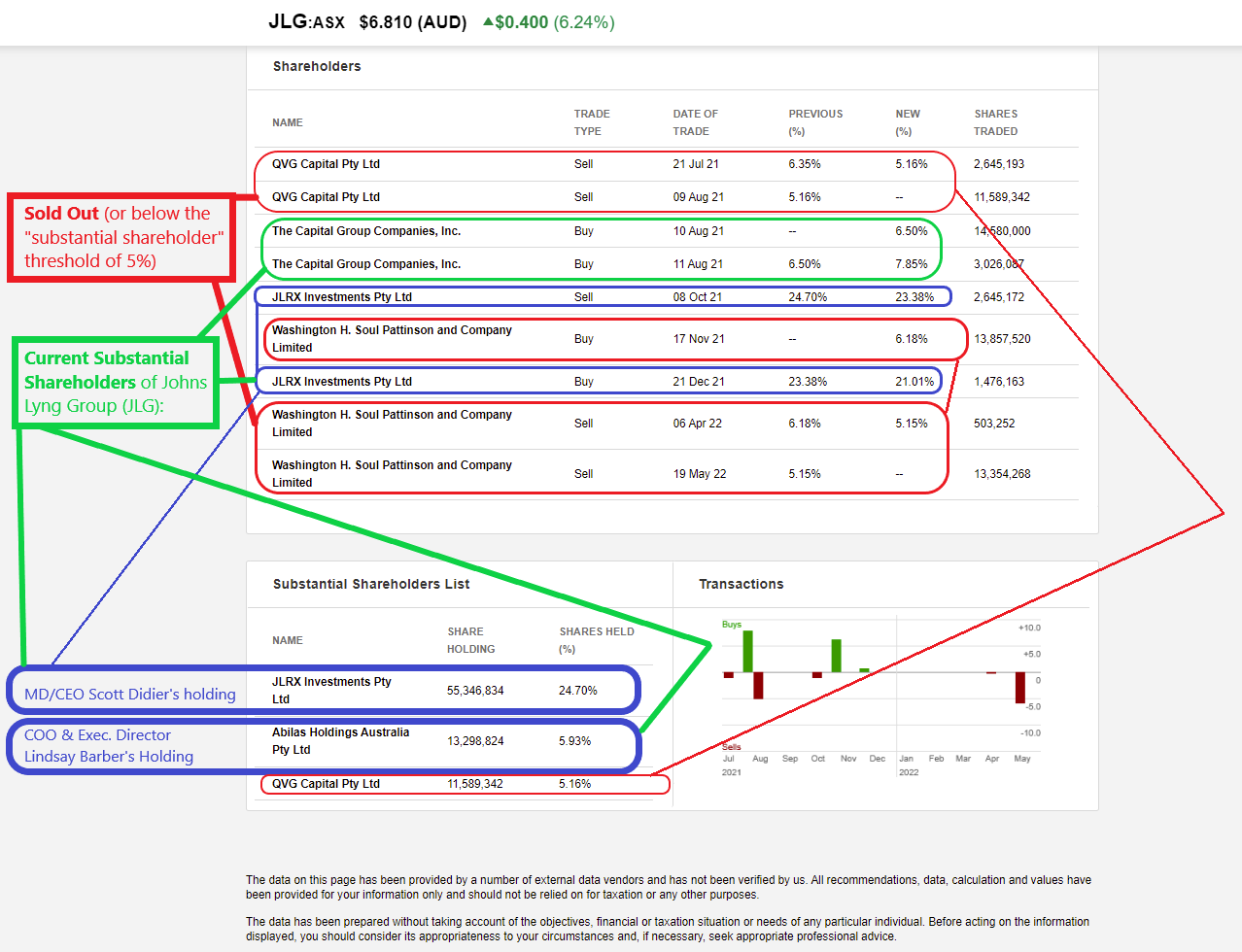

Here is how the substantial shareholder list for JLG looks now:

Source: Commsec, edited by me.

So WAM Funds (WMI) and Perpetual are out, QVG and SOL (Washington H Soul Pattinson and Company Ltd) have sold down or out, but we have "The Capital Group Companies, Inc." with 6.5%, plus JLG's MD & CEO, Scott Didier (JLRX Investments) with 21.01% of the company and JLG's Chief Operating Officer (COO) and executive director, Lindsay Barber (Abilas Holdings) with 5.93%.

So Gaurav and Mathan were somewhat concerned that there were "too many" fundies in JLG but it actually looks like there is now just one - US-based "The Capital Group" whose registered address is in Los Angeles, California. When they lodged their Becoming-a-substantial-holder.PDF notice in August 2021, they said:

The Capital Group Companies, Inc. (“CGC”) is the parent company of Capital Research and Management Company (“CRMC”) and Capital Bank & Trust Company (“CB&T”). CRMC is a U.S.-based investment management company that serves as investment manager to the American Funds family of mutual funds, other pooled investment vehicles, as well as individual and institutional clients. CRMC and its investment manager affiliates manage equity assets for various investment companies through three divisions, Capital Research Global Investors, Capital International Investors and Capital World Investors. CRMC is the parent company of Capital Group International, Inc. (“CGII”), which in turn is the parent company of five investment management companies (“CGII management companies”): Capital International, Inc., Capital International Limited, Capital International Sàrl, Capital International K.K, and Capital Group Private Client Services, Inc. CGII management companies and CB&T primarily serve as investment managers to institutional and high net worth clients. CB&T is a U.S.-based investment management company that is a registered investment adviser and an affiliated federally chartered bank.

Neither CGC nor any of its affiliates own shares of your company for its own account. Rather, the shares reported on this Notification are owned by accounts under the discretionary investment management of one or more of the investment management companies described above.

--- end of excerpt ---

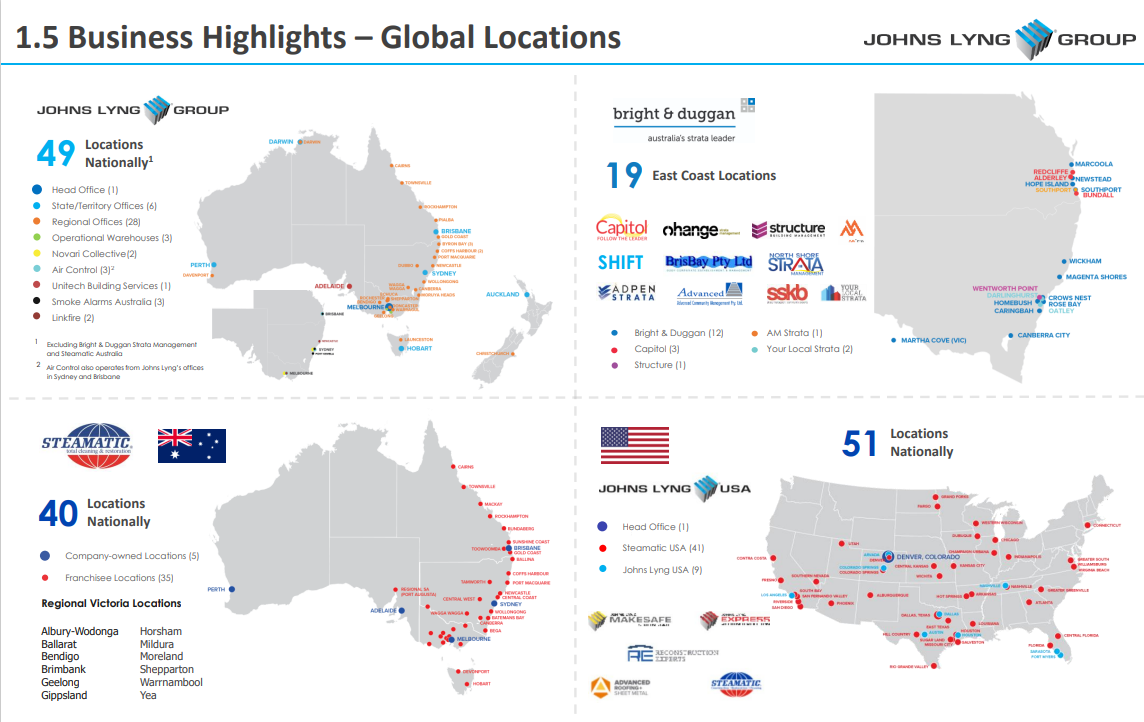

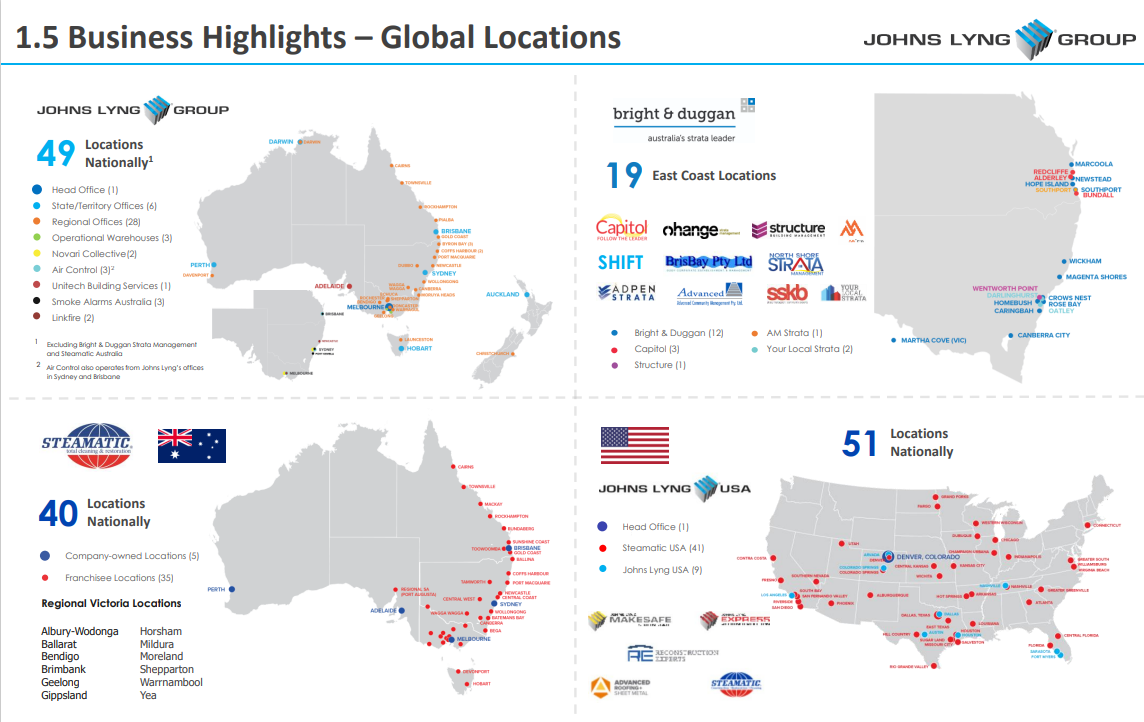

I guess I should quickly point out what JLG do., for those who don't know. Their main revenue is earned from providing repairs to properties for insurance companies here in Australia, as explained on their home page of their website: Johns Lyng Group - Johns Lyng Group - Building Australia - Plain Text: https://www.johnslyng.com.au/

Also - see here: https://www.johnslyng.com.au/history.html

They have been very successful here in Australia and have very good relationships with a number of insurers, however they are now looking to take that success and try to replicate it in the USA, something that might be a bit trickier to achieve in Gaurav's opinion.

Back in 2017, JLG's client list included:

AAMI. AIG. Allianz. ANSVAR. APIA. AustBrokers. Aveo. BJS Insurance Brokers. Cerno. CGU. Chubb. CommInsure. Crawford and Company. Cunningham Lindsey. Dan Murphys. Department of Education. DTZ. Fitness First. IAG. Innovation Group. Insurance Adviser Net. Kathmandu. Kmart. LMI Group. Macedon Ranges Shire Council. Nike. Peter Stevens Motorcycles. PSC Insurance Brokers. QBE. RACV. RACQ. Spotlight. Steadfast. St Ives Retirement. Stockland. Suncorp. Vero. Victoria Police. Woolworths. Zurich.

They have obviously added more clients since then (they'd only been listed a couple of months then). Remember however that JLG WERE operating as a private company before they listed, so they had built up that client list over a number of years.

JLG do remediation and repair work for all types of damage, from a burst water pipe in a bathroom or in the wall cavity of a house, to flood damage of the sort we have been getting in Queensland and NSW recently. Obviously they are very busy at the moment, so that's a tailwind, but the shortage of tradepeople and rapidly rising costs in the building industry are probably headwinds.

They provide services across residential and business premises. Basically anything that can be insured in terms of structures where an insurance claim for damage can be lodged and repairs need to be made. JLG do emergency repairs as well as full remediation. They have their own team of assessors which are used by some of their clients. Other clients like to use their own assessors to inspect and report on damage and likely causes, but then will get JLG to do the repairs.

My concerns back in late 2017 was more around lack of history (as a listed company with the reporting/data that is available with listed companies) and that over half of their shares on issue (54%) were subject to escrow with the majority of those coming out of escrow in either August/September 2018 or August/September 2019. My thoughts were to wait and see how much selling pressure there was from those shareholders once they were able to sell those shares.

I revisited my IT (investment thesis) in September 2018 and updated it, and then did the same in April 2020.

My concerns had shifted by then. They'd handled the escrowed shares thing quite well. One of my new concerns was that JLG's CEO and MD, Scott Didier, appeared to me to be a bit of an "empire builder" in terms of creating and nurturing a number of companies for his children to run. I did note that at that point this side focus did not appear to have hampered the growth of JLG or the TSRs [total shareholder returns] for their shareholders, but that it was still worth keeping in mind and it made me question whether Mr. Didier was truly aligned with ordinary retail shareholders (he was the company's largest shareholder, owning over 20% of the company) or more interested in looking after his own family and their futures. I just wasn't sure where the majority of Scott's focus was at the time.

I also noted that he was often photographed with high profile sports stars and seemed to enjoy that association, but that he certainly wasn't Robinson Crusoe there; Many successful businesspeople also take active roles in sport, either as fans, financial supporters (sponsors) or in an administrative role, such as becoming the President or Chairman of a football club or the owner of a soccer club (for example).

So what mostly held me back was some minor questions over management focus and the share price being too high for the upside potential (IMO). Poor risk/reward trade-off, IMO, at the time. It's interesting that Gaurav and Mathan said last Monday that their high quality management is probably one of the JLG's best asset. However they still feel the price is too high, particularly Gaurav, who thinks they look VERY expensive for what they are.

Gaurav also raised an interesting point about positive relationships with insurers and a track record of competent repairs done on time and on budget being things that make it harder for would-be-competitors and gives JLG a competitive advantage, however those are the very things that JLG are up against with their plans to break into the US market. The incumbents over there already have those established relationships and track records and that will likely make it hard for JLG to break into that market in a meaningful way. Gaurav further suggested that IF JLG were able to overcome those obstacles and break into the US market and be successful there, building significant market share within a reasonable timeframe (profitably), then he would be worried about their Australian business in that what is there to stop another company doing to JLG here what JLG would have done to the incumbents in the US?

So it's a double edged sword in a way. Either it's a hard market to break into in a meaningful way, which protects them here but should make their US expansion plans problematic, or it's NOT such a hard market to break into which would mean their "moat" here is (or competitive advantages are) probably NOT as compelling and effective as we have previously assumed. One or the other.

There was one aspect where Mathan seemed to be contradicted by Gaurav and it seems Gaurav is right, and that's on M&A. Mathan (near the start of the discussion) was suggesting that JLG management were loathe to buy growth via acquisitions and preferred slower organic growth, with that being a positive thing, however Gaurav said that a lot of their growth HAD been due to acquisitions, and a quick look back through JLG's announcements backs Gaurav up, with a number of acquisitions being made by JLG across their short listed history, from when they were listed in 2017. There's been organic growth as well, but also growth via acquisition. I don't think it's a problem as long as they remain debt free and continue to grow their EPS, which is what they've been doing.

So - Pros and Cons:

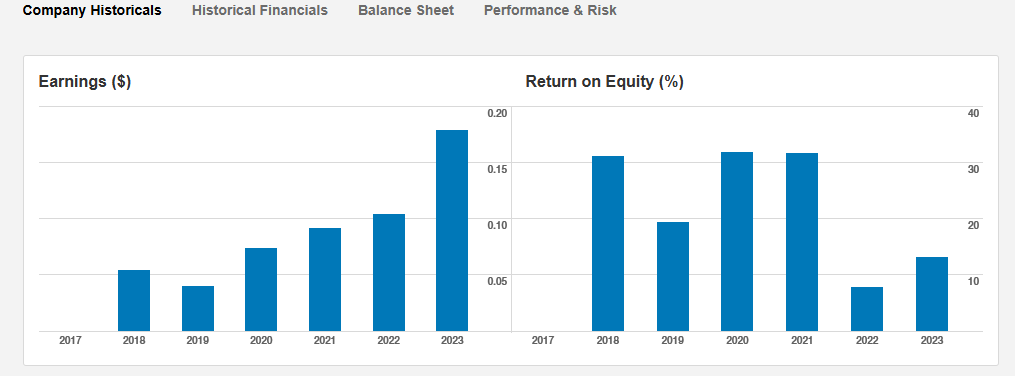

Source: Commsec (all graphs in this straw were sourced from Commsec tonight and edited by me)

Pros - Tailwinds:

- The company is very busy doing repairs for insurance companies, asset owners and asset managers; Natural disasters such as floods and other severe weather events are tailwinds for them because they provide JLG with more work.

- After declining from $9 to $5 in about 6 weeks during May and June, the JLG share price is now back in a strong uptrend once again by the looks of it (see graph above), yet is still well below their December to April highs.

- The company has a negative net debt to equity (ND/E) ratio meaning that they are in a net cash position with no net debt.

- The company is well positioned within their sector with an impressive client list and a strong track record. JLG have built strong relationships with their major clients which provides them with a competitive advantage ("moat") which makes it harder for would-be-competitors to establish a significant presence in the industry and effectively compete against JLG.

- JLG appear to have very competent and highly incentivised management who have plenty of skin in the game, especially their COO (who owns 5.93% of the company) and their CEO/MD (who owns 21% of the company).

- JLG have upgraded guidance twice in the past 12 months - see here: Johns-Lyng-Group-Limited-provides-earnings-upgrade-for-FY22.PDF ...so they appear to tick the "underpromise and overdeliver" box.

- Commsec lists JLG's ROE as being over 30% (31.6% in FY21, see graph below) and ROC (Return on Capital) as being 30%, 20%, 21% and 25% in FY18, FY19, FY20 and FY21 respectively. That is VERY respectable if it's correct, even though their profit (earnings) margin on revenue is only 3% to 4% according to those Sales (revenue) and Earnings numbers listed below.

- JLG's earnings per share (EPS) have been growing since 2019, as shown below:

Source: Commsec.

Cons - Headwinds or "reasons to be wary":

- On a PER (share Price to Earnings per share Ratio) basis JLG are expensive, even though the share price is still well below recent highs.

- All of the fund managers who were previously substantial shareholder of JLG - including WAM Funds' WMI (WAM Microcap Fund), Perpetual Investment Management's "Perpetual Pure Microcap Fund", QVG Capital and Washington H. Soul Pattinson and Co. - are now NOT substantial shareholders so have either sold out or sold down to below 5%. The only fund manager on the JLG register now as a "sub" (>5%) is US-based The Capital Group Companies with 6.5%, and those shares are held in discretionary investment management accounts on behalf of (presumably US) insto's and high net worth clients according to them. This suggests that those Australian fund managers no longer see the same upside in JLG that they once did. In the case of WAM Microcap and the Perpetual Pure Microcap Fund it's worth noting that JLG is now a $1.767 billion (market capitalisation) company, so they're not a Microcap anymore by Australian standards, so would no longer be suitable for Microcap funds, however both WAM Funds and Perpetual manage other funds that hold much larger companies, and neither WAM Funds or Perpetual show up as current substantial holders of JLG for ANY of the funds that they manage.

- JLG's profit margins on revenue is low, having been between 3% and 4% for the last couple of years, so any cost blow-outs could mean the differences between making profits and making losses.

- Their input costs have risen rapidly in recent months and will likely rise further due to high demand for tradespeople and building materials. If JLG are able to pass those costs through to their clients that might not be a big problem, but if they have any issues passing those cost increases through, that could be problematic for them considering their low margins.

- Their biggest growth should now come from the US if they are successful there, however they could face obstacles from incumbents there who already have those same competitive advantages in the US that JLG have here - such as strong relationships with insurance companies and other clients plus a solid track record of being reliable and getting work done on time and within budget.

In summary, while I admire the management and what they have achieved to date, and there was certainly money to be made in JLG looking back, I'm going to continue to remain on the sidelines with this one, mostly because they are far from cheap on a PER (P/E Ratio) basis and I believe the upside (pros) don't significantly outweigh the downside risks (the cons), IMO. As Geoff Wilson used to say (according to Matthew Kidman in his book, "Bulls, Bears and a Croupier: The insiders guide to profiting from the Australian stockmarket"), back before it was considered politically incorrect, "You can't kiss all the pretty girls". Claude Walker has a more PC version nowadays: "You can't pat all the fluffy dogs".

27-Aug-2024 - Update: - I did briefly buy JLG after the Murray River flooding and noticing their signage around in SA where they were doing restoration work along the river after the floodwaters subsided, but then sold out soon after to rotate that money into a better idea. I could never get quote comfortable with their management to be honest.

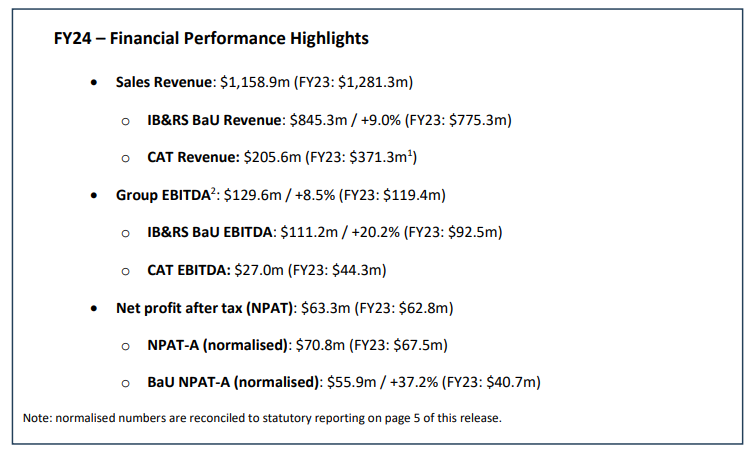

Thats a big reset by the market:

- JLG

- $3.865

- Down $-1.705 (-30.61%)

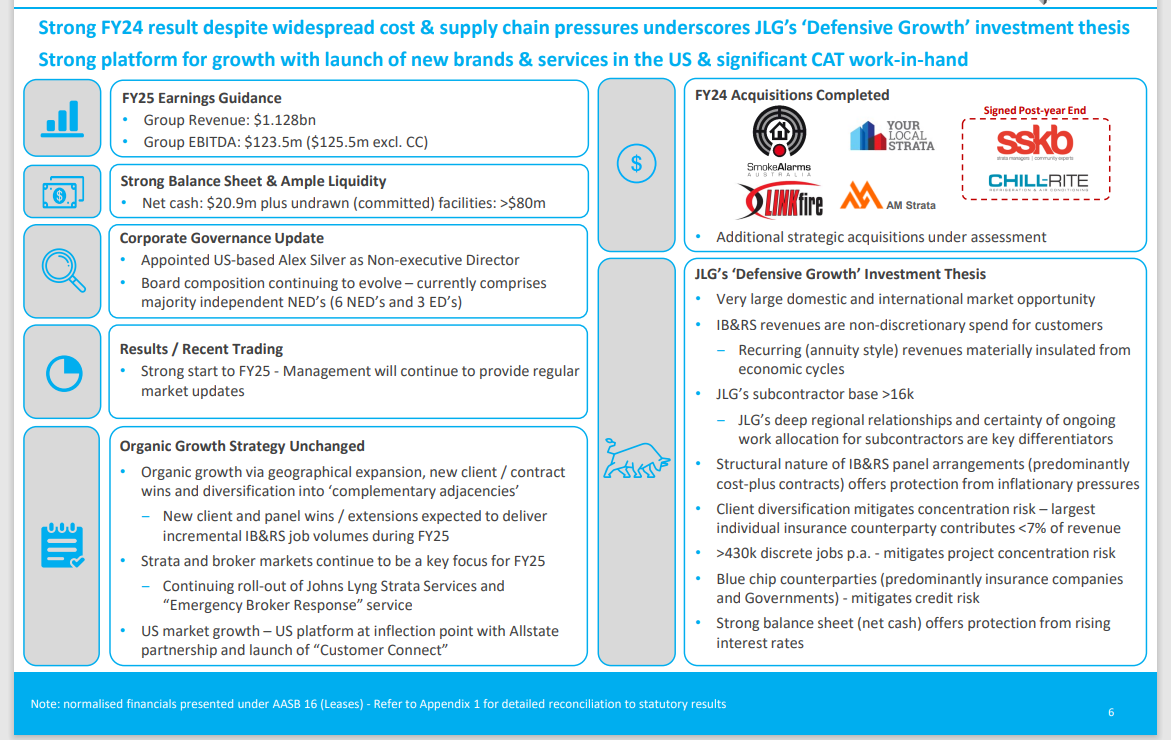

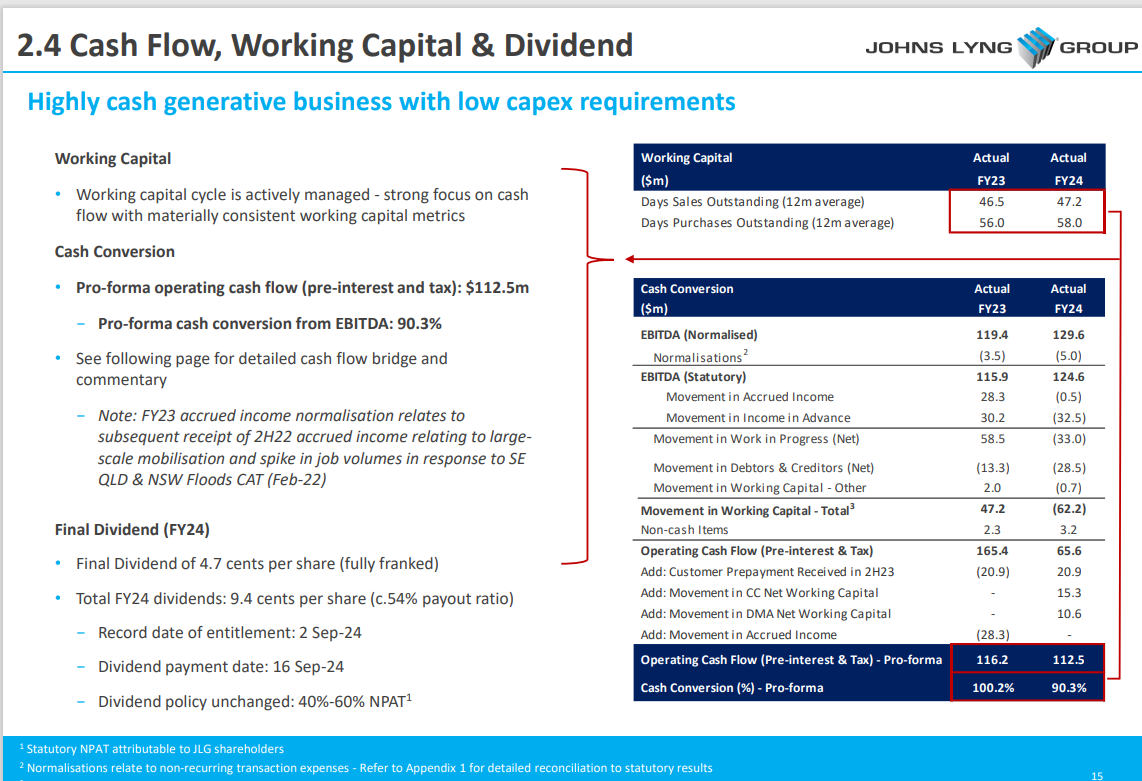

Group Revenue for FY24 was $1,158.9m and BaU revenue (excluding Commercial Construction) increased by 9.7% to $929.7m. BaU EBITDA increased by 18.2% to $111.2m.

Following successful strategic and bolt-on acquisitions and organic growth initiatives during FY24, JLG is wellpositioned for continued growth in FY25.

The Group has commenced the first half of FY25 maintaining strong workflow and has accordingly forecast BaU revenue growth of 15.1%.

FY25 Forecast Johns Lyng is well placed for another strong year in FY25, with the first quarter maintaining the positive momentum of FY24.

The Group has a solid BaU job registration pipeline which has contributed to the forecast BaU revenue growth of 15.1% 3 . With several CAT contracts continuing into FY25, the Group expects strong revenues from CAT related activity.

JLG will continue to assess further acquisitions and growth opportunities across all 5 strategic growth pillars.

• FY25 (F) Sales Revenue: $1.128bn o Includes BaU Revenue3 : $1.070bn (15.1% increase vs. FY24)

• FY25 (F) EBITDA: $123.5m o Includes BaU EBITDA3 : $119.2m (7.2% increase vs. FY24)

Dividend On 27 August 2024, the Board declared a final dividend of 4.7 cents per share (fully franked). This final dividend is in addition to the previously announced half year (interim) dividend of 4.7 cents per share (fully franked), totalling 9.4 cents per share (fully franked) and representing approximately 54% of NPAT attributable to the owners of Johns Lyng Group for FY24.

The final dividend will be paid on 16 September 2024 with a record date of entitlement of 2 September 2024

- FY2024 Results Presentation

Observation:

Return (inc div) 1yr: 2.22% 3yr: 1.47% pa 5yr: 29.55% pa

Earnings trend is Ok ..ROE has lost the consistency there

Note: JLG Profitability has stagnated while setting up in the USA,

Big overreaction here I think when it dived below $6

Didn't think of adding more at the time as was distracted by work

CAT Revenue was a bit volatile.

EPS could have been the main negative as it went backward.

S&P consensus. Everyone was expecting 10cps versus 8.5cps Actual

Checking the call transcript, there is a bit of delay from government of dealing with CAT events but JLG expects some of the work to come in the second half

[held]

· July 2023 acquire 100% of Project Safety Holdings Pty Ltd (“Smoke Alarms Australia” or “SAA”) and 70% of Link Fire Holdings Pty Ltd (“Linkfire”) for total upfront cash consideration of A$61.8m plus an aggregate earn-out of up to A$17.25m (together, the “Acquisitions”) Both businesses have long-standing reputations in fire, electrical and gas compliance testing and maintenance for residential and commercial properties. https://announcements.asx.com.au/asxpdf/20230705/pdf/05rb5263m0zty3.pdf

· November 2022 announce three bolt-on acquisitions across its catastrophe response (CAT) and strata management businesses.

Johns Lyng Disaster Management has acquired a 60% equity interest in A1 Estimates Pty Ltd (A1). A1 is a Byron Bay-based insurance repairs estimating business that has worked as a key sub-contractor for the Group’s Flood Property Assessment Program in Northern NSW. Total potential consideration for the 60% equity interest is a maximum of $2.341m, with $1.515m cash at Completion, deferred consideration of $0.550m payable in JLG Ltd shares, and an earn-out of up to $0.276m payable in JLG Ltd shares.

80% equity interest in North Shore Strata (NSS) based on the Sunshine Coast. NSS currently manages 1,751 lots across 250 schemes and has been in operation since 1996. North Shore was acquired by Johns Lyng’s strata management subsidiary Bright & Duggan, with a 20% equity interest retained by current Principal Cathy Pashley. Total potential consideration for the 80% equity interest in North Shore is a maximum of $2.379m, with $1.933m cash at Completion, and an earn-out of up to $0.446m payable in cash.

Adpen Strata (Adpen) based in Brisbane. Adpen currently manages 372 lots across 40 schemes and has been in operation since 2013. Adpen was acquired by Bright & Duggan’s subsidiary Capitol Strata, with Adpen’s current strata portfolio to be managed by current Capitol Strata Managing Director Ian D’Arcy. Total consideration for Adpen was $0.322m paid in cash at Completion. https://announcements.asx.com.au/asxpdf/20221116/pdf/45hn50b8rmmy7f.pdf

· August 2022 Johns Lyng Group announces retirement of Trevor Bright and acquisition of his 44.5% equity interest in Bright & Duggan. The purchase price was $25.6m for the 44.5% equity interest comprising $15.4m in cash (funded from existing cash reserves and debt facilities) and $10.2m in JLG shares (50% subject to escrow for 6 months). https://announcements.asx.com.au/asxpdf/20220826/pdf/45dbgvtcz3c0j2.pdf

· December 2021 acquires Reconstruction Experts, for US$144m, a leading providers of insurance focused venor-managed repair services to occupied properties in the US. Established in Colorado in 2001, Reconstruction Experts is a leading provider of insurance focused repair services to occupied properties in the U.S. The Company’s primary client base is Homeowner Associations (“HOAs”) - the U.S. equivalent of Strata Managers/Owners’ Corporations, i.e. large multi-family properties including apartments, condominiums and master planned communities. https://announcements.asx.com.au/asxpdf/20211209/pdf/453zfn3qdh5kg3.pdf

· July 2021 acquires Steamatic Australia. Johns Lyng Group (ASX:JLG) has acquired a 60% controlling equity interest in Steamatic Australia - a leading national restoration services company, effective 1 July 2021. The deal consolidates Johns Lyng’s position as a national market leader in restoration services and represents natural progression of the Group’s global expansion strategy following the acquisition of the Steamatic Global Master Franchise in FY19. Established in 1986 under the Global Master Franchise, Steamatic Australia employs 190 staff and operates a total of 39 locations including 34 regional franchisees and five company-owned metropolitan locations. https://announcements.asx.com.au/asxpdf/20210729/pdf/44yrhg4zmyt35v.pdf

· July 2021 completes acquisition of Unitech. Founded in 1995, Unitech has established a strong base of insurance industry clients, presenting clear synergies with Johns Lyng’s core business offering. The acquisition will increase Johns Lyng’s exposure to the South Australian market. At completion, Johns Lyng paid $1.9m in cash https://announcements.asx.com.au/asxpdf/20210712/pdf/44y6qrs587mzjk.pdf

· February 2020 JLG acquires 60% interest in Air Control Australia. Melbourne-based Air Control Australia Pty Ltd – a leading heating, ventilation and air conditioning mechanical services business. Founded in 2004, the business has established a strong track record servicing assets such as commercial office buildings, hotels, shopping centres and large retail chains. Its client base comprises well-known blue-chip brands including Hyatt, Pullman and Miele, among others. Johns Lyng will pay $1.6 million cash, plus $0.3 million in JLG shares at Completion plus a potential earn-out over 18 months for its equity interest in the business. Residual equity will be retained by co-founders and Joint Managing Directors Luke Vandersluis and Anthony Zisis. https://announcements.asx.com.au/asxpdf/20200217/pdf/44f4b161w3jxql.pdf

· February 2020 JLG subsidiary Bright & Duggan has acquired an 85% controlling equity interest in Queensland-based Capitol Strata Management (Holdings) Pty Ltd. Founded in 1995 and headquartered in Brisbane, Capitol Strata is a leading strata and property management business, with a portfolio of 1,250 strata schemes, which include 16,000 properties and associated common areas. Bright & Duggan paid $7 million cash for an 85% equity interest in Capitol Strata in a debt free transaction. Residual equity will be retained by incumbent Managing Director Mr Ian D’Arcy, and other founding shareholders. https://announcements.asx.com.au/asxpdf/20200203/pdf/44ds8svfc6rbnm.pdf

· August 2019 JLG acquires Sydney based Bright & Duggan Group Pty Ltd. Founded in 1978 by Ray Bright and Phil Duggan, Bright & Duggan is a leading Strata and Facilities Management business with 14 offices across four states and territories with more than 220 full time equivalent staff. The business operates well-established and widely recognised strata and facilities management brands including Bright & Duggan and Cambridge Management Services and currently has more than 55,000 strata titled units under management across more than 1,500 strata schemes. https://announcements.asx.com.au/asxpdf/20190813/pdf/447fllwgnkhzkf.pdf

· April 2019 JLG acquires US Company Steamatic. Texas-based water, fire and flood restoration services company. Established in 1948, Steamatic Inc. has become a household name in the US for fire and water damage restoration services and will provide JLG with immediate access to that market, estimated to be worth US$200B. Steamatic’s network of 63 domestic franchisees and 14 international Master Franchise Agreements is expected to create a platform for international expansion of JLG’s core restoration and building services offering. JLG will pay a total of US$3.1m non-contingent consideration from cash reserves plus a potential earn-out over 18 months. The transaction is expected to have an immediate positive but immaterial impact on earnings. https://announcements.asx.com.au/asxpdf/20190410/pdf/44463zrffrqjh3.pdf

· February 2019 JLG acquires 57% of Home Staging company Dressed For Sale, a pre-sale residential property staging business. The strategic ‘bolt-on’ will integrate with, and expand upon, JLG’s existing home maintenance service offering, creating a sound platform for growth. JLG will invest approximately $2 million as part of the deal which includes approximately $1.3 million in capital earmarked for growth initiatives. https://announcements.asx.com.au/asxpdf/20190227/pdf/4430ck9yc27wkb.pdf

· December 2018 JLG enters into partnership with Suncorp. Exclusive Master Services Agreement with Suncorp Group, in an arrangement that will see JLG facilitate all domestic property repairs for insurance claims estimated at greater than $100,000.Agreement is for a minimum two year term with provision for a further third. https://announcements.asx.com.au/asxpdf/20181204/pdf/440xwx4j20hjjl.pdf

· July 2018 Divests stake in Club Home Response to RACV for a $4 million cash sum under a Share Sale Agreement (SSA). https://announcements.asx.com.au/asxpdf/20180702/pdf/43w6m313wyz1ny.pdf

Capital Raise History

· July 2023 Raised $70m, Intuitional $65m, $5m Retail at $5.15,

· December 2021 Raised $230m, Intuitional $221m at $7.00, $9m Retail

· IPO October 2017 At $1.00 raising $95.8m

Inside Ownership Ordinary Shares % JLG Issued Net Value at $6.50

Peter Nash 392,370 0.14% $2.550m

Scott Dider 49,555,507 17.83% $322.11m

Nick Carnell 2,391986 0.86% $15.55m

Adrian Gleeson 1,819,318 0.65% $11.82m

Robert Kelly 6,011,940 2.16% $39.1m

Curt Mudd 728,344 0.26% $4.7m

Larisa Moran 5,366 0% $34K

Peter Dixon 79,714 0% $518K

Total 60,984,545 21.95% $396.4m

Note: Robert Kelly shares are owned by Steadyfast group, Robert Kelly is the Managing Director and CEO of Steadyfast.

Intrinsic Value $7.08

Assumed 3 different scenarios 30% growth next 5 years, 15% and 10%. Assumed share count will grow to 350.6m by FY28 and Net Margin of 5%. Blended 3 different outcomes and discounted back to give $7.08. Consider buying in $5 range for margin of safety.

Seems the share price is taking a while to respond to the situation unfolding from Cyclone Jasper in Qld

Held

A bit expensive at 7xEBITDA but the overall margin of the combined group increases

This is because LinkFire and SAA are higher margin businesses. So maybe the 7xEBITDA price tag is justified.

Seems like a logical bolt-on.

Unfortunately was not able to catch this early enough before the share price took off this week.

The SPP was also oversubscribed

Beginning to see a trend here with oversubscribed raisings.

09-July-2023: We are in Sydney tonight, but we were driving through the SA Riverland yesterday and came across this JLG signage around what's left of the Blanchetown Caravan Park.

The park was very badly hit with only the tops of some cabin roofs visible during the worst of the flooding at the beginning of the year. Basically, everything has to be removed and the whole caravan park rebuilt from scratch.

I hadn't previously seen any evidence of JLG operating over here in SA, but they're here, and there is certainly plenty of work!!

The River is back to normal levels now. I snapped the following image yesterday near Moorook, which is on the Kingston Road between Kingston on-Murray and Loxton.

La Nina difficult to forecast this period. So possibly could be another busy period for JLG

https://www.abc.net.au/news/2023-04-10/el-nino-forecasting-difficult-unpredictable-autumn-climate/102189516

Have noticed price targets from brokers still north of $9. Valuation might still be justified despite all the inside selling. If I put growth at 40% we could see prices north of $9

DCF workings below at discount rate of 6.8%. The numbers are very rough as it was quite an effort to balance the income, cashflow and balance sheet at the same time so it made sense.

Updated to include better screenshot of workings.

See straw 24/4/23

Bear case will be 3.55 if any of the comps on the list decide to make a move into the disaster biz and compete with JLG.

Went through previous straws with a bit of "amusement" with the story on director selling etc...

So I decided to do a multiples comparison and valuation using the median. However this is very difficult as it stands as it is hard to find a comparable firm as you can see below

On a multiples basis, got a share price of 3.55. But this is a bit unfair considering that the above firms don't really do disaster recovery although to some extent Downer EDI will be asked to repair infrastructure.

On a DCF basis I get 6.04 if we assume growth will moderate back to around 20% then gradually tail off to 5% over 10 years.

Maybe if the share price pulls back to 6.00 I'll be interested.