JOHNS LYNG GROUP LIMITED (ASX:JLG) - Ann: FY2024 Results Presentation, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

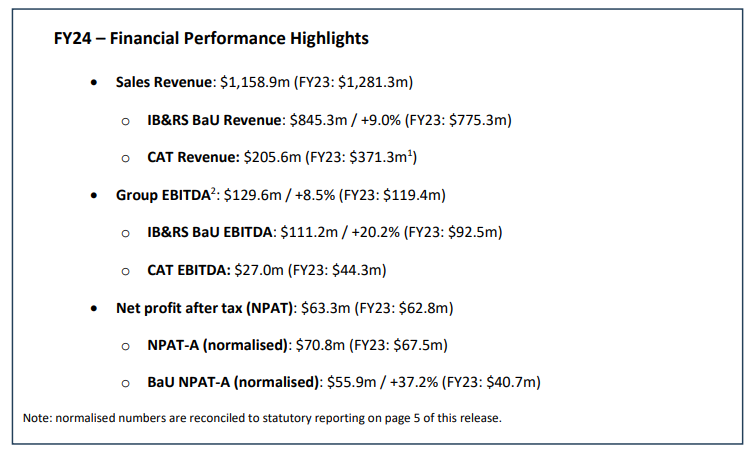

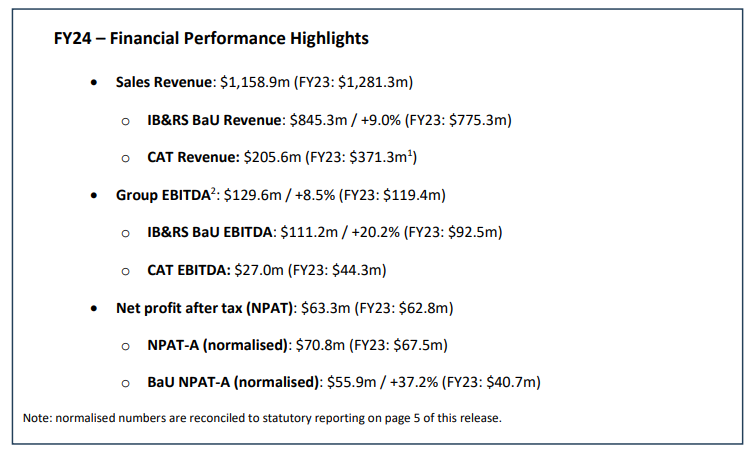

Group Revenue for FY24 was $1,158.9m and BaU revenue (excluding Commercial Construction) increased by 9.7% to $929.7m. BaU EBITDA increased by 18.2% to $111.2m.

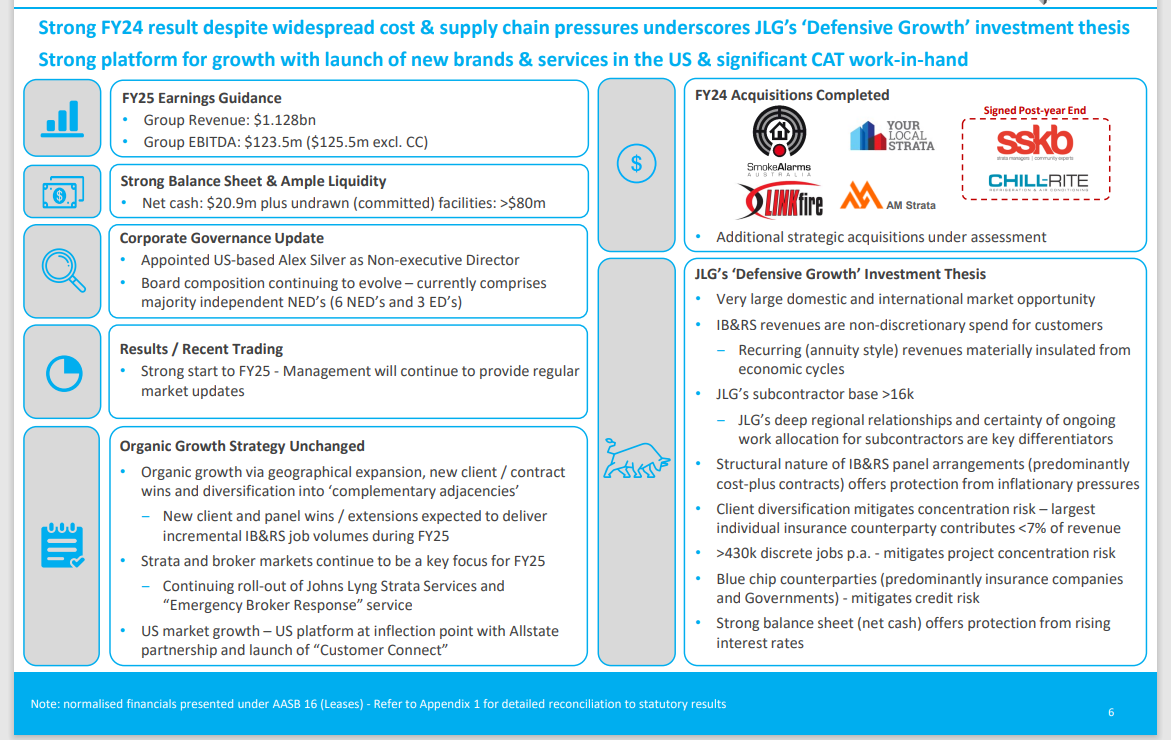

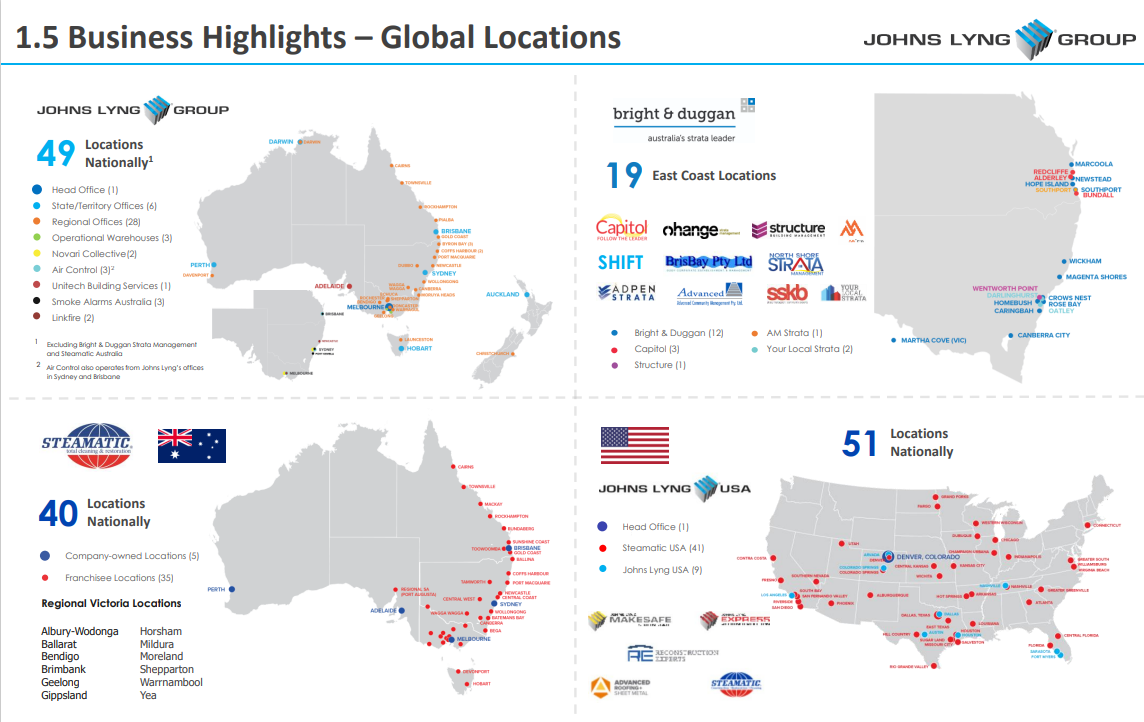

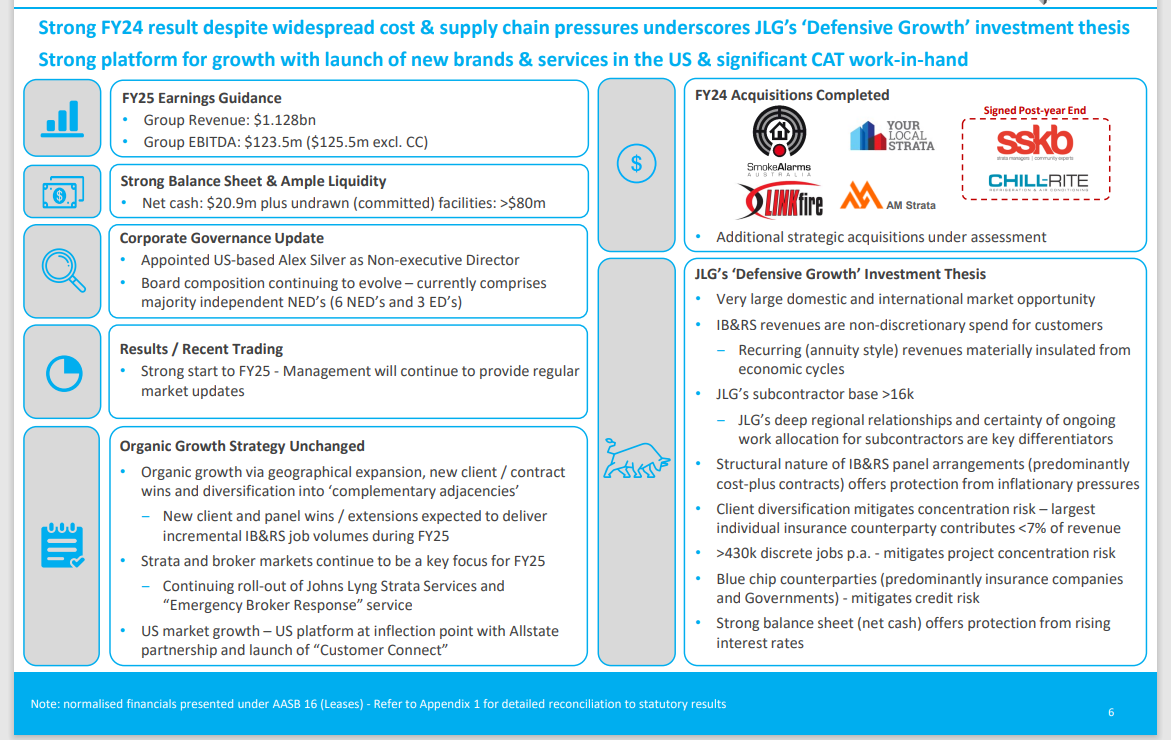

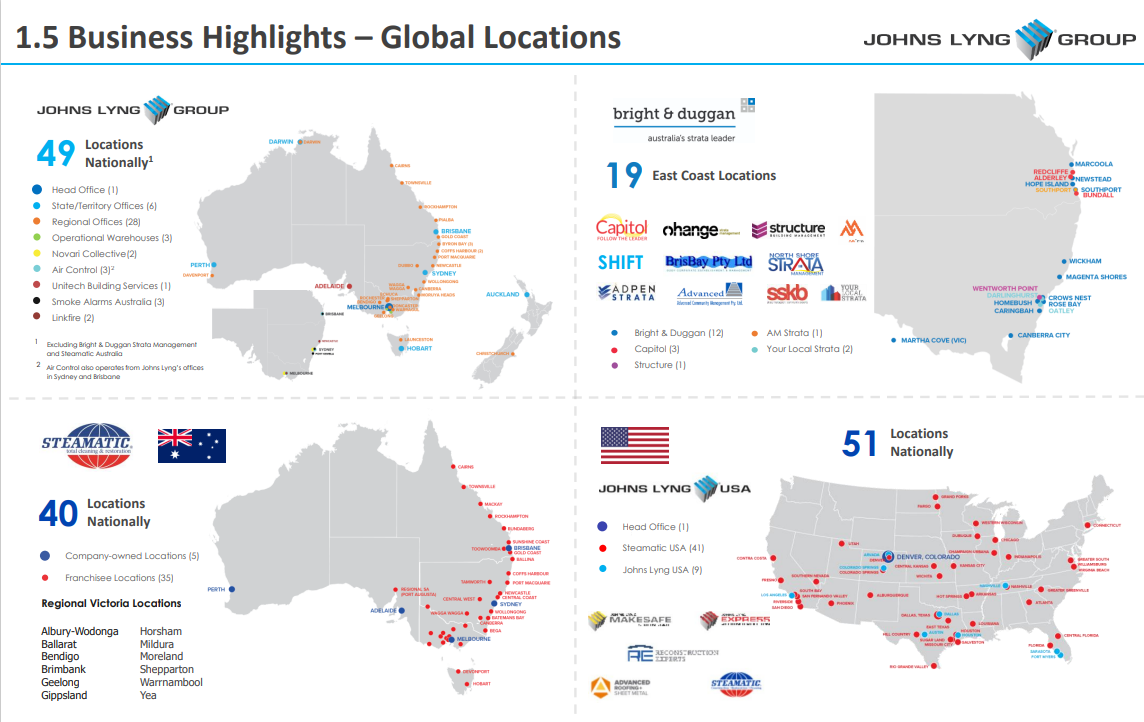

Following successful strategic and bolt-on acquisitions and organic growth initiatives during FY24, JLG is wellpositioned for continued growth in FY25.

The Group has commenced the first half of FY25 maintaining strong workflow and has accordingly forecast BaU revenue growth of 15.1%.

FY25 Forecast Johns Lyng is well placed for another strong year in FY25, with the first quarter maintaining the positive momentum of FY24.

The Group has a solid BaU job registration pipeline which has contributed to the forecast BaU revenue growth of 15.1% 3 . With several CAT contracts continuing into FY25, the Group expects strong revenues from CAT related activity.

JLG will continue to assess further acquisitions and growth opportunities across all 5 strategic growth pillars.

• FY25 (F) Sales Revenue: $1.128bn o Includes BaU Revenue3 : $1.070bn (15.1% increase vs. FY24)

• FY25 (F) EBITDA: $123.5m o Includes BaU EBITDA3 : $119.2m (7.2% increase vs. FY24)

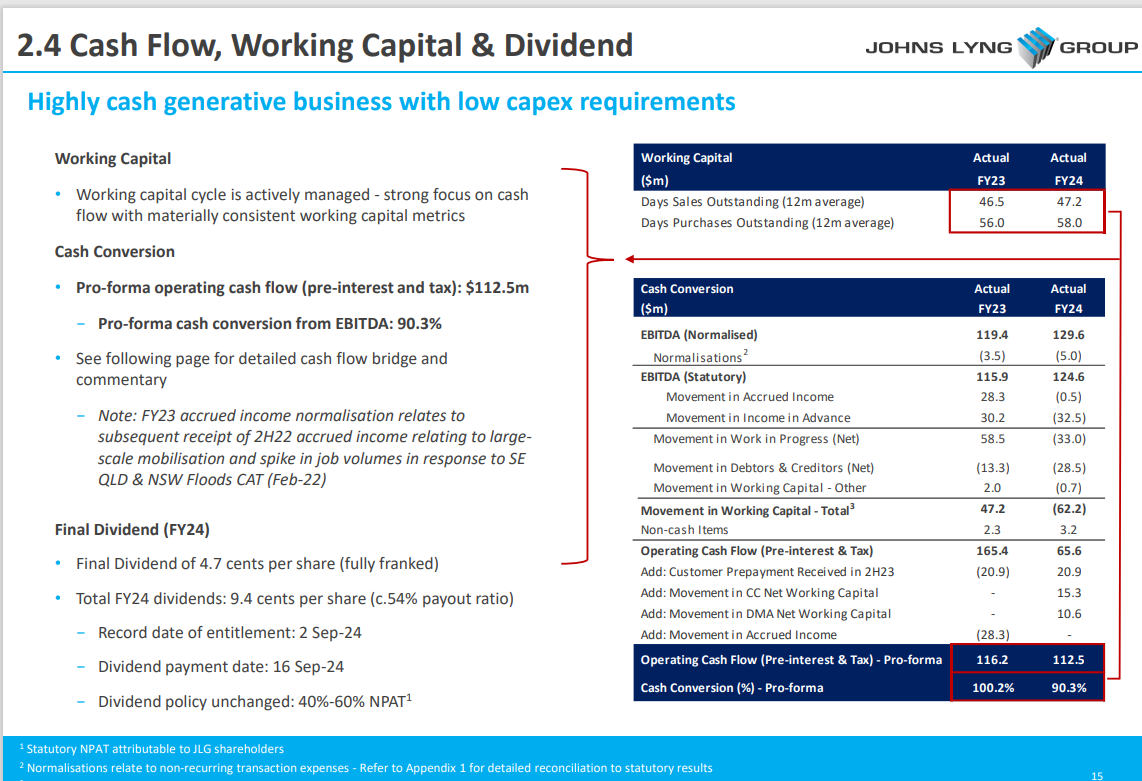

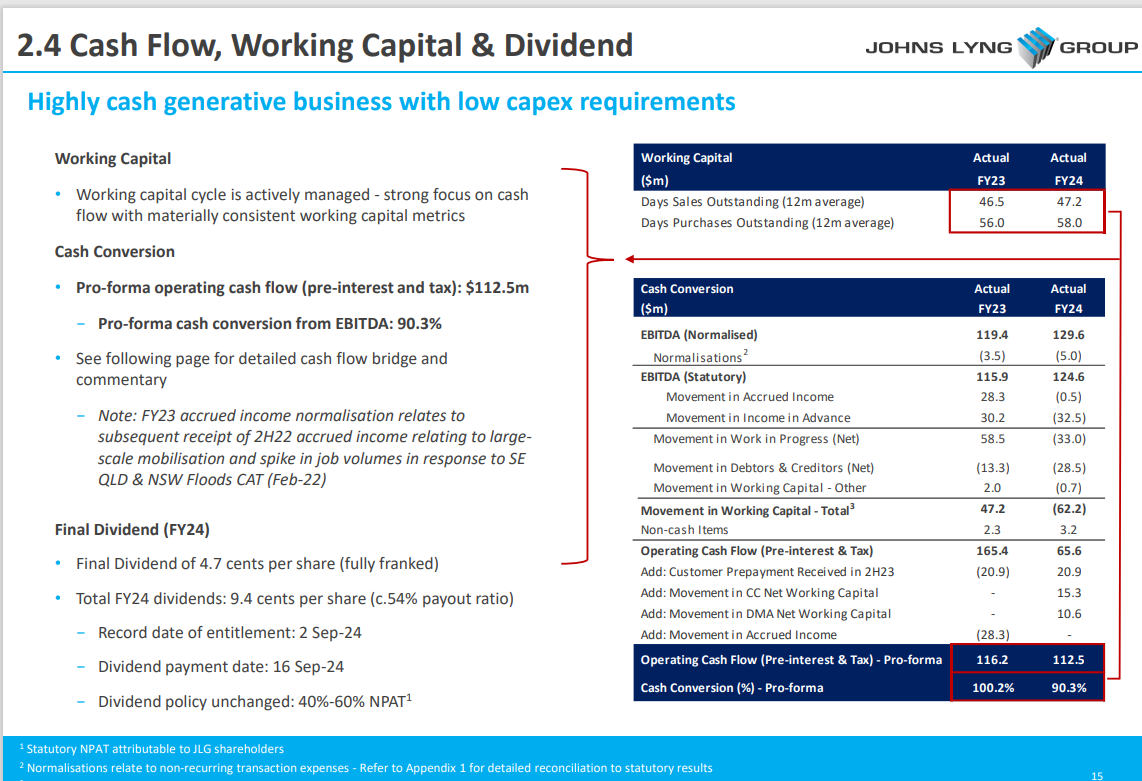

Dividend On 27 August 2024, the Board declared a final dividend of 4.7 cents per share (fully franked). This final dividend is in addition to the previously announced half year (interim) dividend of 4.7 cents per share (fully franked), totalling 9.4 cents per share (fully franked) and representing approximately 54% of NPAT attributable to the owners of Johns Lyng Group for FY24.

The final dividend will be paid on 16 September 2024 with a record date of entitlement of 2 September 2024

- FY2024 Results Presentation

JOHNS LYNG GROUP LIMITED (ASX:JLG) - Ann: FY2024 Results Presentation, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

Observation:

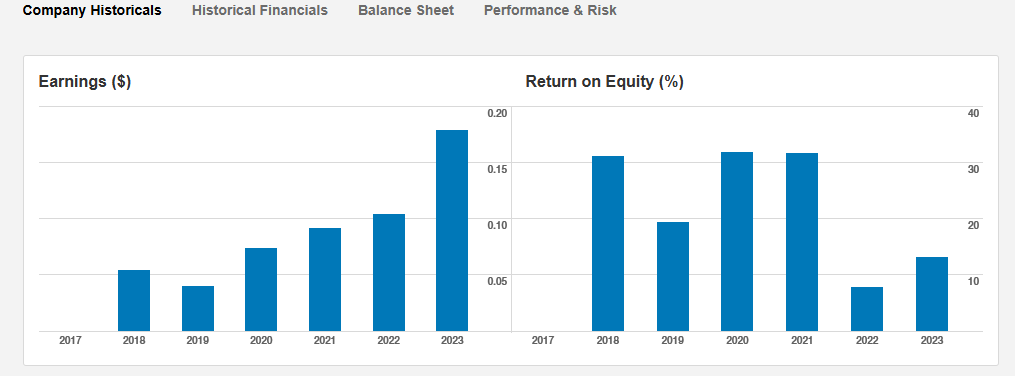

Return (inc div) 1yr: 2.22% 3yr: 1.47% pa 5yr: 29.55% pa

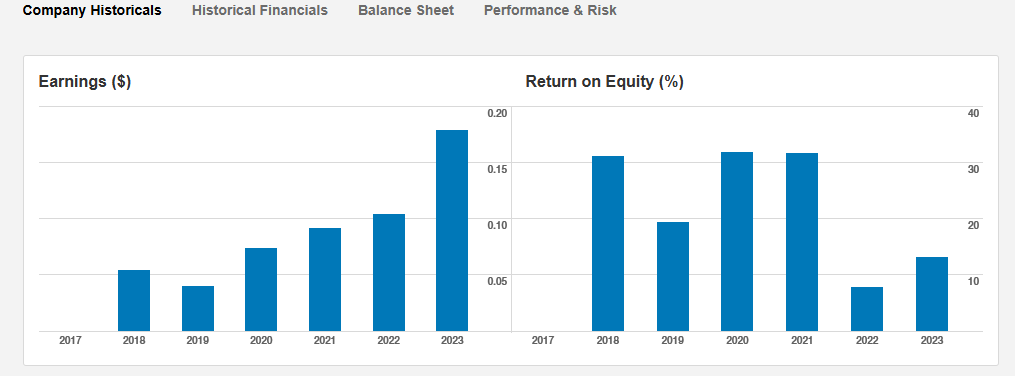

Earnings trend is Ok ..ROE has lost the consistency there

Note: JLG Profitability has stagnated while setting up in the USA,