Pinned straw:

Update to the above -- if you followed the trade thesis you would have done very well. The price at posting the above was 1.6c. With a current share price of 2.6c following the release of the 4c last night, the trade has returned more than 60% in a few months.

I am still working my way through the 4c, but the quarter was a strong one, in line with prior (strong) Q4 performance.

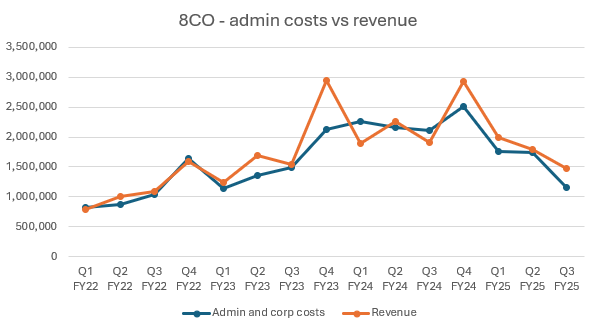

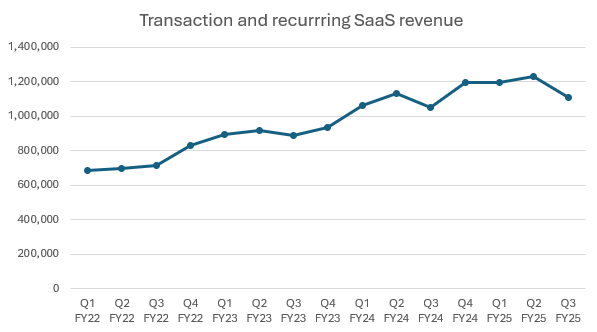

- Transaction and Saas revenue 1.58m, up 32% pcp.

- Total revenue 2.1m, down 10% pcp

- Cash receipts 2.15m, full year 8.5m

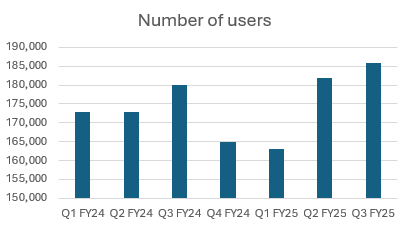

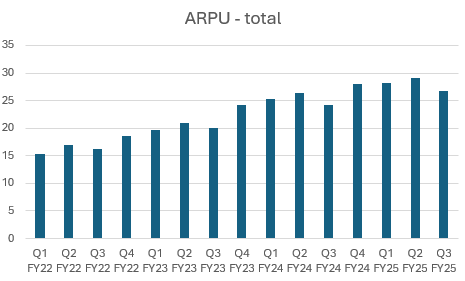

- Significant ARPU expansion, from 27 to 34 QoQ.

- Positive cash flow at 200k, which is pleasing.

- Full year ARR 5.4m, which is essentially 1 x revenue after the bump in the share price today.

I plan to get more in the weeds this weekend and report back.

Given that the Chairman and Founder, Nic, continues to put his own cash into shares on-market (in addition to the $1.5m loan), I think this business will come good over the next few quarters. They have reduced OPEX (cost) over the last 9 months, and so now their goal should be to continue to grow revenue but this time to keep costs fixed to create some operating leverage (the markets would rather see profit rather than unprofitable growth!). They are not too far away from being able to generate $1m in EBIT per annum in the grand scheme of things given that they now have a $5m+ ARR business. The gross margins are relatively high (70%+), and so one would think that this is a business that can generate sustainable profits once at scale. It has been a long wait but I think they are now very close to a maiden profit.