This has been a tough hold. I had a look at my research tonight in an attempt to work out next steps. On a side note, I am a long term holder, but I do think there is potential here for a short term trade too (if you can stomach it).

I am going to give 8CO another quarter before I call it thesis busted and move on. This is just such a darn’ frustrating company, because they have a strong foothold within government (state and commonwealth -- mainly the latter), which I actively seek as an investor – tough to lock in, but once in, they are sticky and rewarding. Unfortunately, this hasn’t been the case with 8CO, far from.

Q4 is normally their strongest quarter – this has been the case for a few years (as far as my research goes back), with Q4 always delivering the strongest revenue and cash flow generation by some margin. This is the short-term trade opportunity – the market currently hates them, with a market cap of 3.36m, and many have written them off.

The long term outlook is less rosy. Here are some high-level graphics below that tell a story:

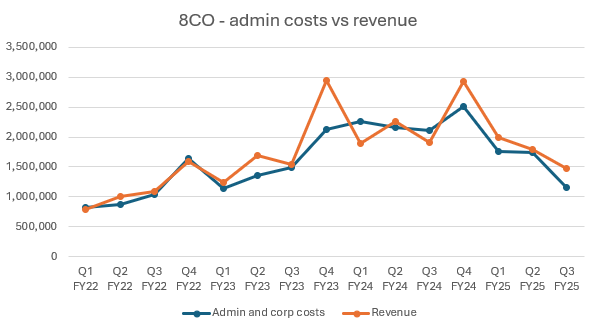

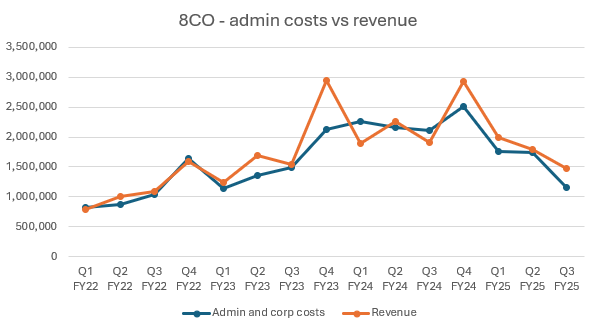

While admin costs have been decreasing, so has revenue – with the last three quarters delivering modest decreases one after the other.

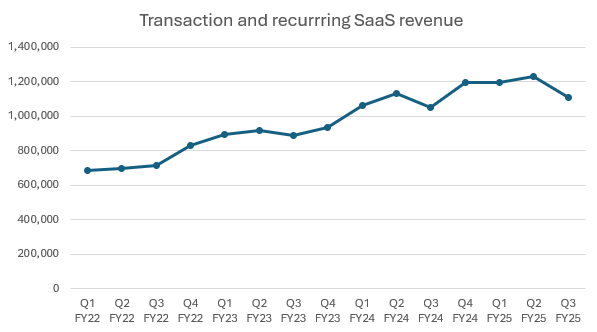

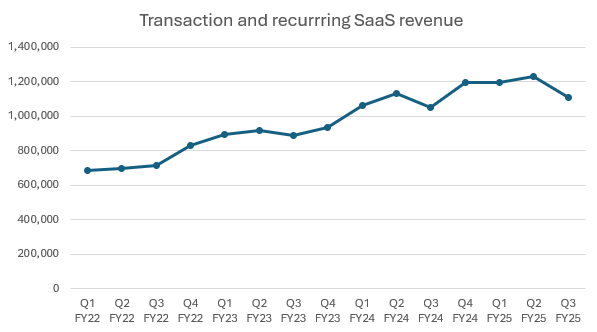

On the transaction and recurring revenue side, there were three quarters of essentially no growth before the last quarter delivered a worrying decline. No growth was bad enough in itself – declines have quite rightly spooked the market even further.

They aren’t going broke anytime soon. They have recently taken out a 700k director loan with a reasonable interest rate (6%), with another 800k available to them should they need it.

The biggest question is whether this is truly a sustainable business, irrespective of what pure junk management spin in their quarterlies. The reason (as above) I was tracking revenue in conjunction with admin costs is because the two have moved closely together for a few years now, with the exception of a few quarters. My justification was, as seen in a few quarters only, we may start to see evidence of scaling during strong revenue quarters. This hasn't really come to fruition. There is now a serious question mark over their survival. The director appears to be reasonably confident, with him putting 1.5m of his own funds on the line to keep the lights on.

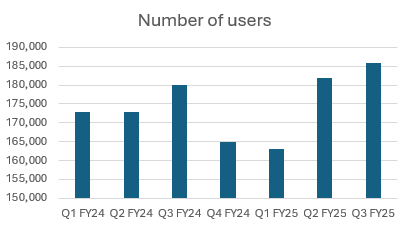

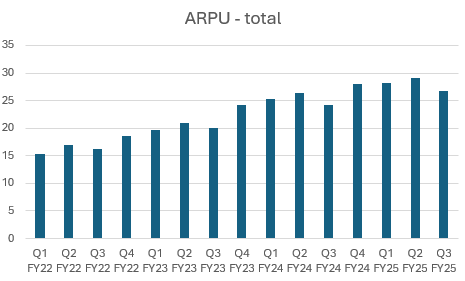

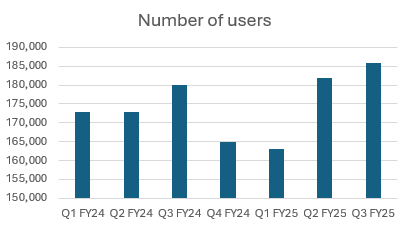

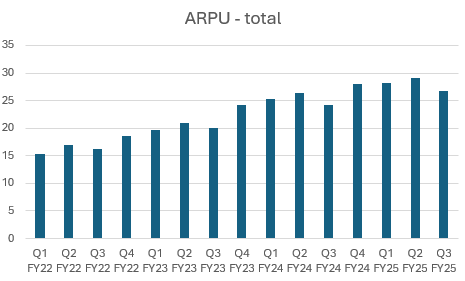

On a positive (and there aren't many!) number of users has resumed on its trajectory upwards, while ARPU remains steady:

It is time to execute though. We need results. 8CO have onboarded more than 25 federal government agencies; if they cant make a buck now I don’t hold much hope for the future without bringing on Defence – and even then, nothing suggests they will be able to do that sustainably.

I want to see significant improvement in Q4 – cash flow positive and finishing the quarter with more cash then they started, at the very least. If they don’t achieve this, I will sell. If they do, I will await the annual report and reassess.