PE1

PE1

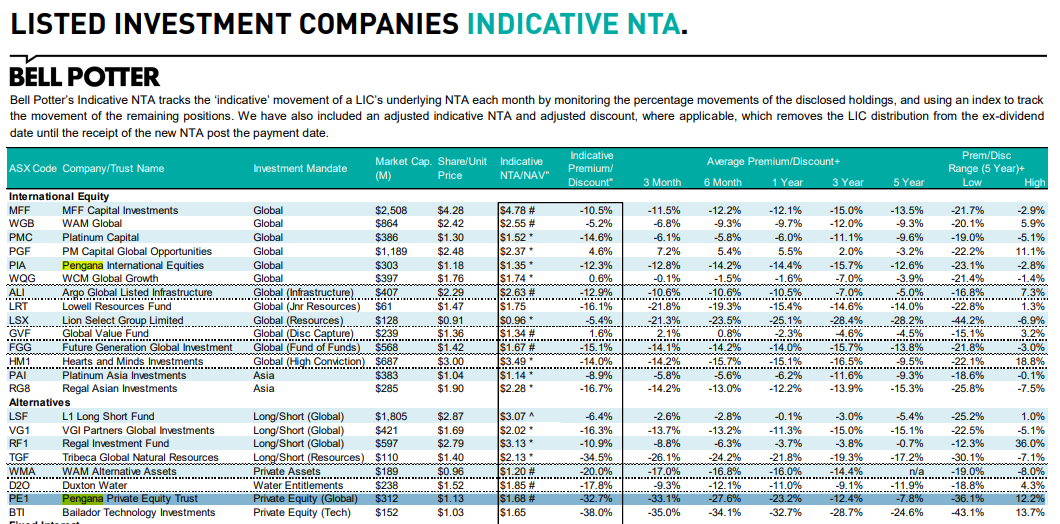

Business Model/Strategy

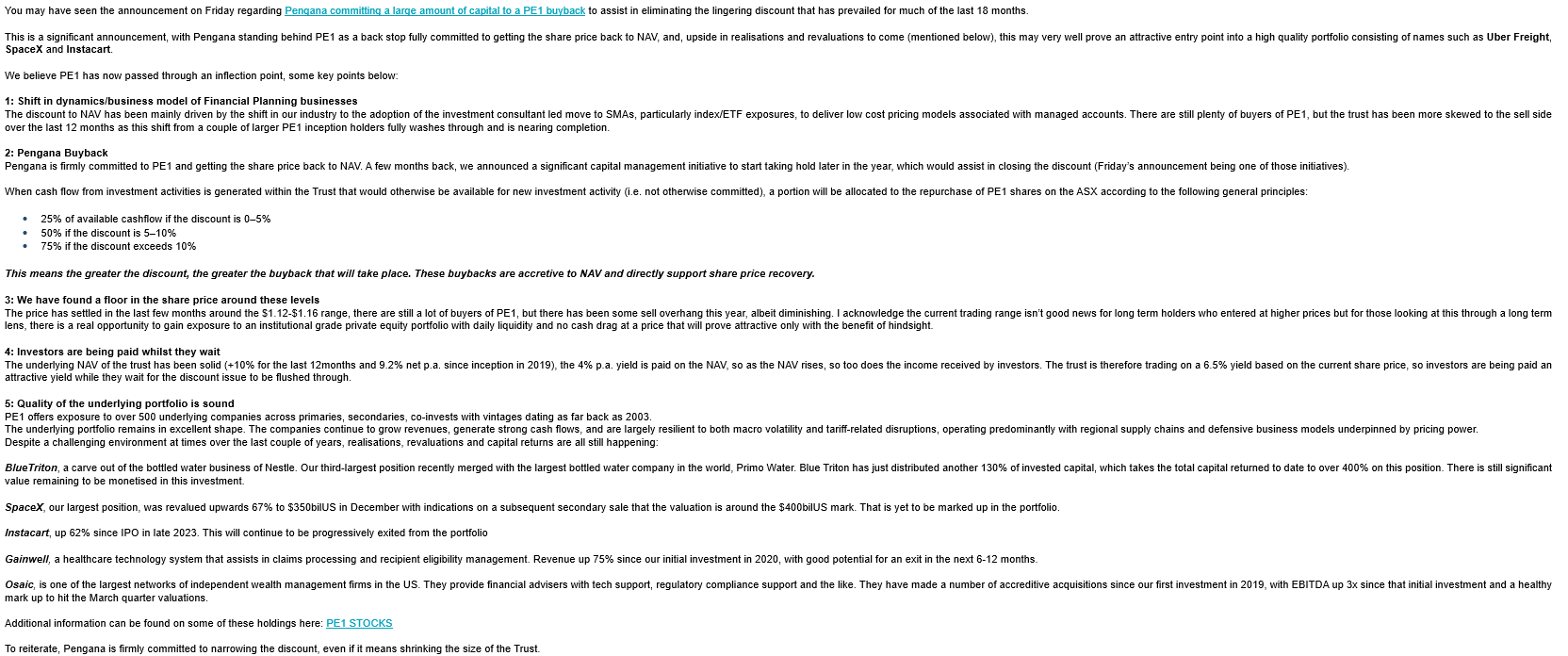

Pinned straw:

Largest position in the LIC too at about 6%.

SpaceX share sale values company at $600b

Bloomberg

Elon Musk’s SpaceX is planning an insider share sale that would value the company at about $US400 billion ($614 billion), according to people familiar with the matter.

The deal marks a rapidly climbing value for Musk’s rocket and satellite maker, and cements SpaceX as the world’s highest-valued startup.

The per-share price of $US212 is up substantially from the $US185 set in a prior transaction in December, said the people, who spoke on condition of anonymity because the matter is confidential.

A SpaceX representative didn’t immediately respond to a request for comment.

9