28th July 2025: Quarterly Cash Flow Report [6 pages] plus Quarterly Activities Report [15 pages].

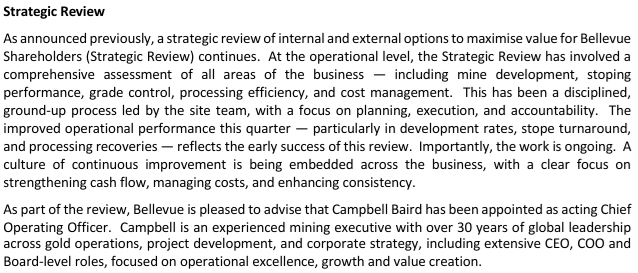

This had me stumped for a minute:

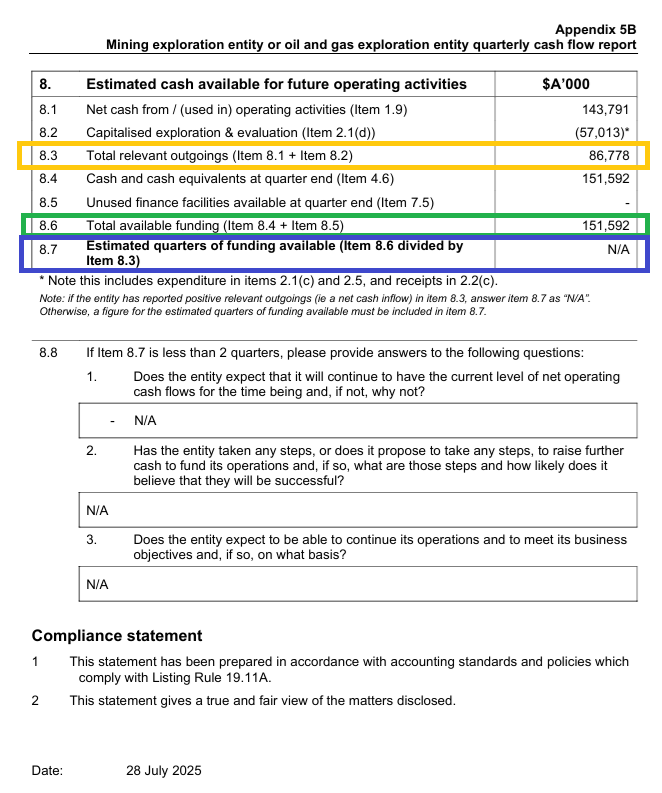

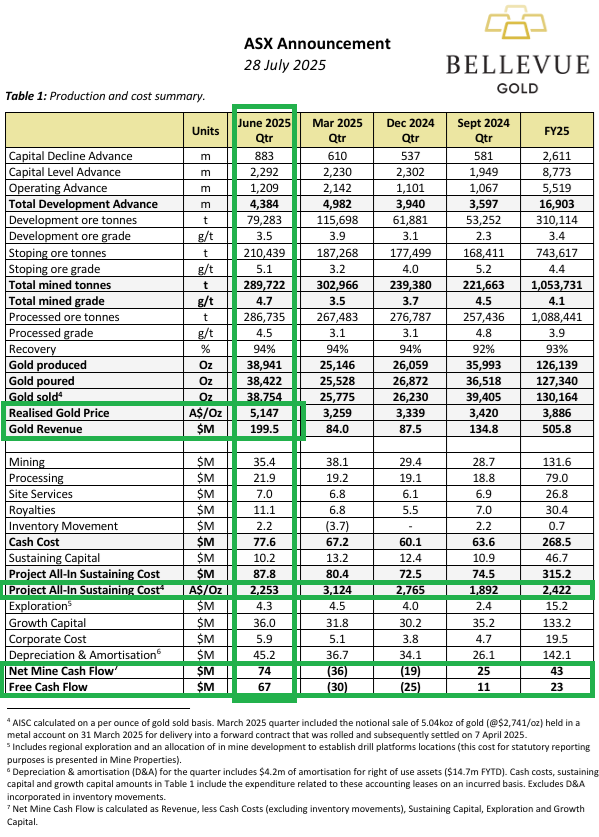

That's from page 5 of today's June Qtr cash flow report. 151,592 (@ question 8.6) divided by 86,778 (@ question 8.3), which is the calculation that question 8.7 is requesting, equals 1.75, which is less than 2, so question 8.8 should not be "N/A". What the...?

Well, a quick look back at the previous pages (I always start with the "Quarters of Funding Available" and then work back from there) had me quickly realising that they were actually profitable for the quarter, so the number @ 8.3 is actually their profit / incoming cash for the quarter rather than their "Total relevant outgoings" as labelled at 8.3. And 8.7 only applies to companies who are still burning cash, i.e. have used more money than they've made in the quarter, and that isn't Bellevue this particular quarter. Bellevue are cashflow positive now.

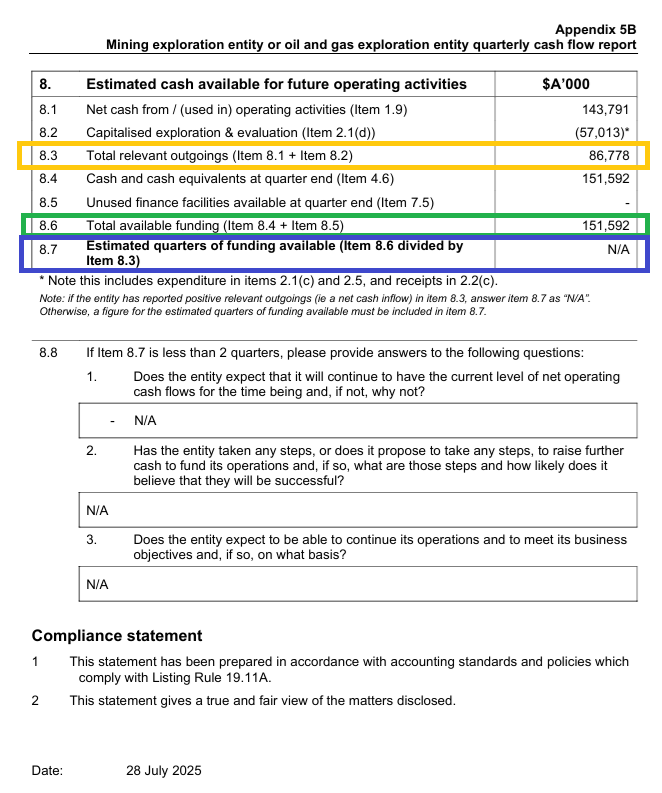

And it gets better:

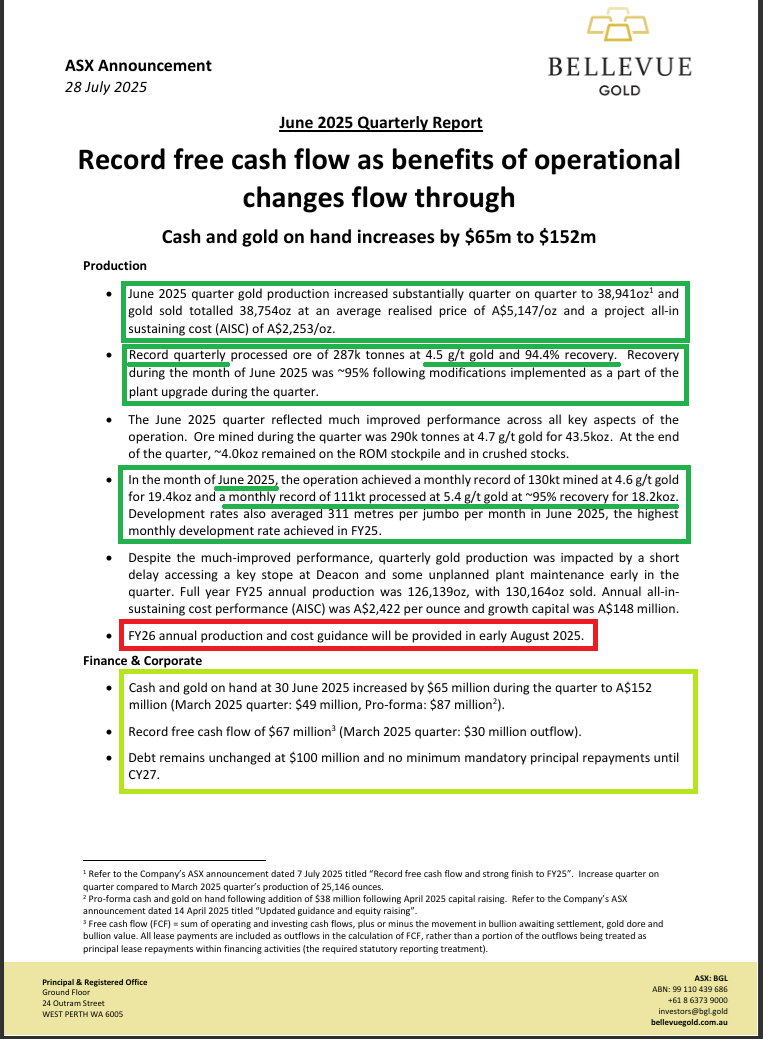

It was a great quarter, but June (the last month of the quarter) was their best month of the quarter, and was record breaking in terms of gold production, averaged realised price, record gold recovery (95%), increased average grade (5.4 g/t gold), and record development rates with each jumbo averaging 311 metres for the month (go DVP!).

From a share price perspective, it was a green morning, with BGL up as high as 90.5 cps at one point, which was +5.85% above Friday's 85.5 cps close, however the euphoria didn't last into the afternoon, and BGL closed down half a cent for the day, at 85 cps (cents per share), which probably had something to do with that line I've highlighted in the red rectangle above - BGL are not providing guidance until next week - or the week after (in early August) which may be when they provide their FY25 full year report.

Most of the more important stuff in today's report was already known by the market due to BGL's announcement on July 7th titled Record free cash flow and strong finish to FY25 [4 pages]. The market realised during today that there wasn't much new news today and that they'd have to wait until August for the most important bit, the outlook and guidance.

So let's look at the financial health of the company.

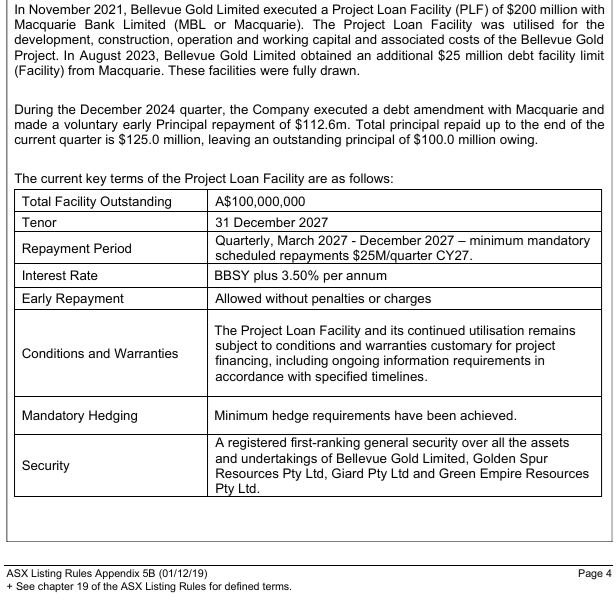

They had $152 million worth of cash and gold on hand at June 30th, however BGL do have $100m of debt.

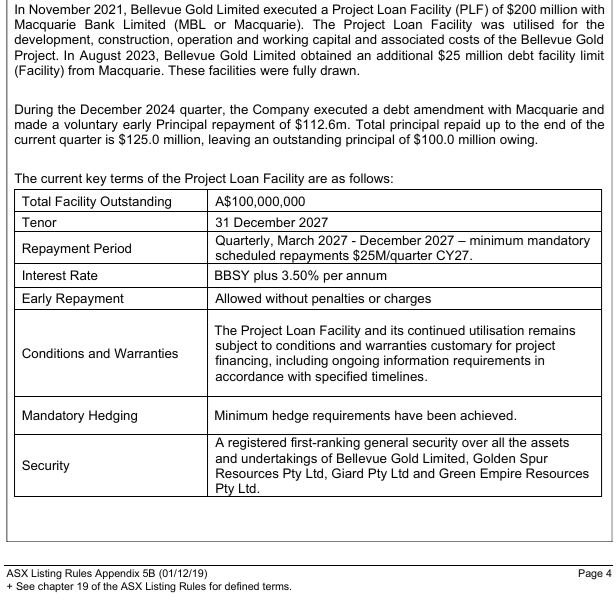

The good news is that that debt is all with Macquarie who remain bullish on BGL, and all of that $100m of debt is not due to be repaid until 2027:

Source: Page 4 of their Quarterly Cash Flow Report today.

For those who don't follow BGL, they have a history of surprise capital raisings, with their latest being a AU$156.5 million equity placement in April 2025, primarily to close out near-term hedging contracts and strengthen their balance sheet, allowing more gold production to benefit from favorable spot gold prices. A portion of the funds (approximately A$40 million) was also allocated to working capital.

To get their initial $200 million PLF (project loan facility) from Macquarie Bank back in 2021, Bellevue had hedged a significant amount of their gold production at prices that are now well below current market levels, leading to potential losses. By spending $110.5 million in April to close out most of those hedging contracts, the company can now sell their gold at much higher spot prices, improving their cash flow.

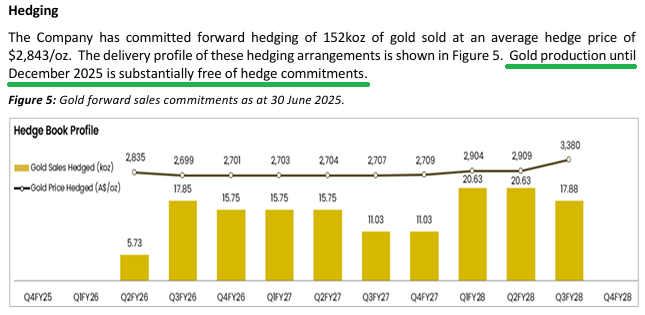

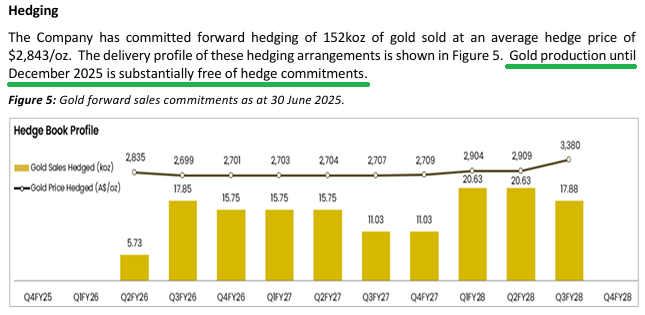

They still have some hedging in place, but it's not much now, and it's even less as a quarterly number:

Source: Page 7 of today's Quarterly Activities Report.

Bugger all this year (just 5.73 koz) then between 11 and 17.85 koz per quarter through until Q4 of FY2027, then between 17.88 and 20.63 per quarter for those last three quarters through until Q3 of FY2028. To put that in some context, they produced 38.94 koz in the June quarter this year and they're still ramping up. In the month of June they produced 18.2 koz, so they're up to a quarterly run rate of 54.6 koz gold production based on their June production, or 218.4 koz per annum of production, and they're still ramping up.

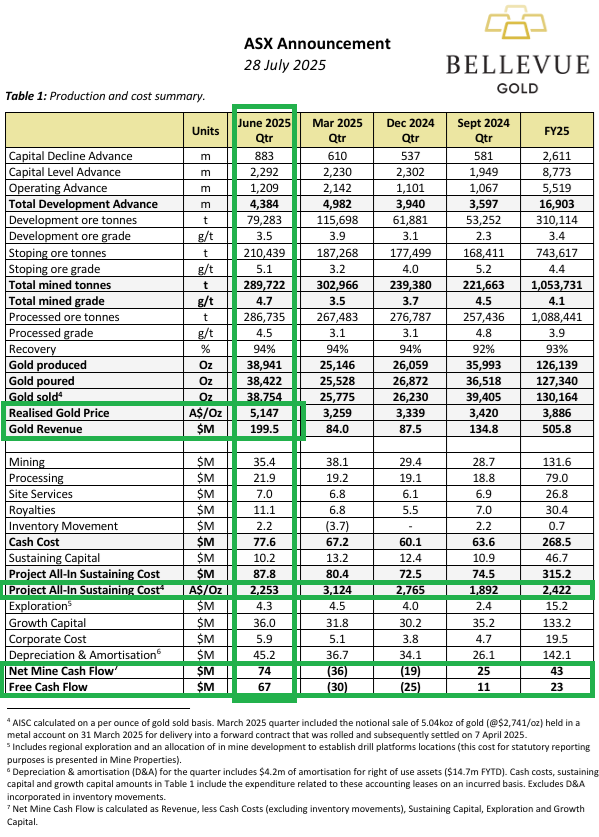

Have a look at how much being unhedged for the majority of the June quarter positively affected their cash flow:

Source: Page 3 of today's Quarterly Activities Report.

- Realised gold price of A$5,147/oz in June Qtr vs $3,259/oz in March Qtr.

- Gold Revenue of $199.5m in June Qtr vs $84m in March Qtr.

- Free Cash Flow of $67m in June Qtr vs a $30m loss in March Qtr.

And they're getting their costs down also, with their June AISC (All-In Sustaining Cost) of A$2,253/oz being lower than 3 of the preceeding 4 quarters and much lower than the March Qtr when their AISC was A$3,124/oz, as shown above.

The main reason why I've broken my own "never trust BGL management again" rule (again) and am holding BGL (again) is the thesis that they would have to get their act together and start making money out of what is after all one of the higher grade gold mines in WA, OR they would get bought out by somebody because of the amount of gold that they have there, and the high grades. So either (a) a recovery in the share price on the back of vastly improved performance, or (b) a significant premium paid by an acquirer. My thoughts were that if (a) failed, then (b) would surely happen because the asset is just too good to be run into the ground by poor management. It seems like (a) is playing out, and (b) is on hold at this point.

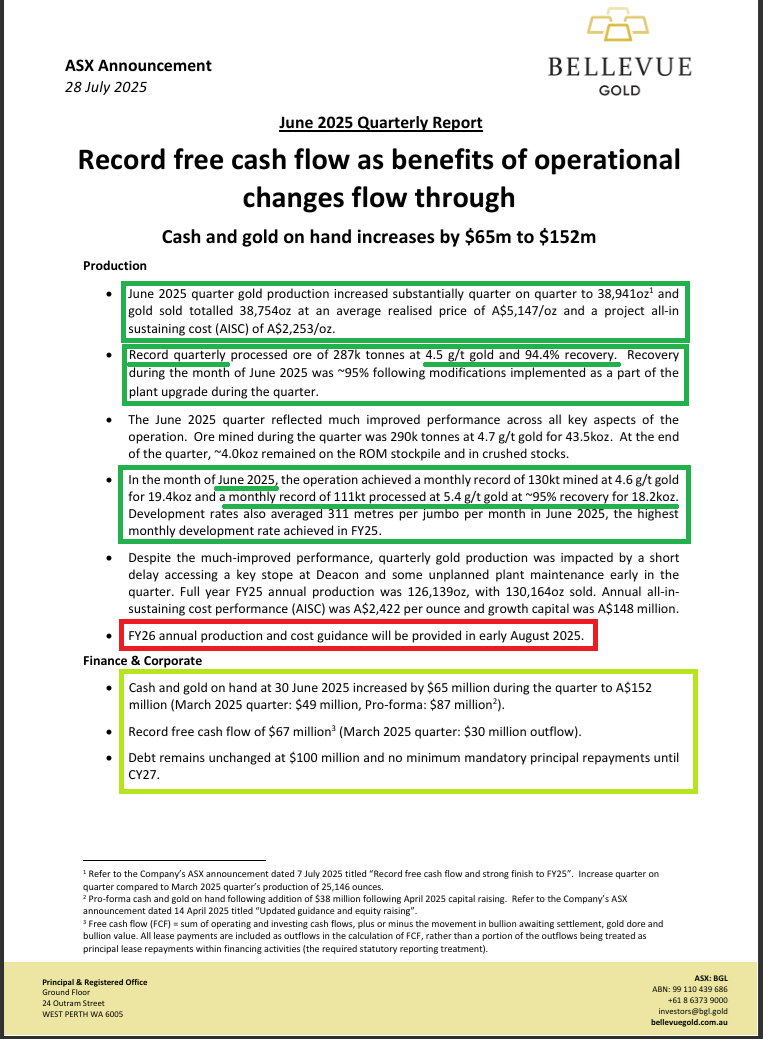

They updated us on their "Strategic Review" today:

Source: From pages 7 & 8 of today's Quarterly Activities Report.

Their new COO could well be this guy: Campbell Baird, Mining Executive, Perth [LinkedIn]

Never heard of him, but that's not surprising considering his background at Metals X, Artemis Resources, Indiana Resources, Indus Coal, Focus Minerals, Vulcan Resources, Iron Ore Company of Canada and Plutonic Gold way back in 1996 to 1998 - none of those are companies I was following when he was working at them. Interesting that the longest he stayed at any of those companies was just under 4 years at Vulcan Resources; He was at the first 4 (in that list - which are his four most recent jobs apart from running his own consulting firm called CCB Capital) for less than 2 years (from 1 year and one month, up to 1 year and 11 months). Might not be the same guy that BGL have just hired as their new COO, but I have a feeling it is.

Anyway, I'm not in BGL for their management quality, hell no!! I am in them for their high grade gold at Bellevue. If they don't work out how to make money there, someone else will, and it looks like they are working out how to make money there, so that's good.

Normally, I make excellent management (competent & trustworthy with great track records) a prerequisite for my investee companies, but Bellevue Gold is an exception to that rule because of the value of their gold, so it's more of an arbitrage play in my view, as I've explained.

They don't always work out, but I think this one will. Not advice, just my personal thoughts on this particular company.

Further Reading: 30-April-2025: Investor site visit presentation [34 pages]