Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

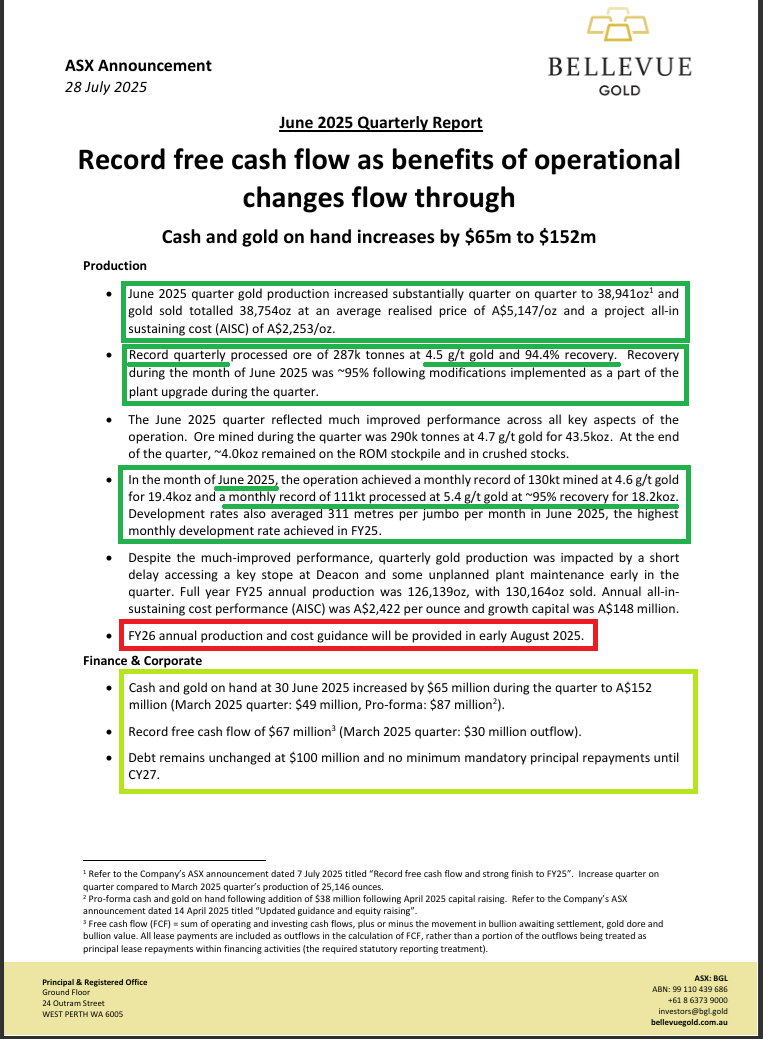

28th July 2025: Quarterly Cash Flow Report [6 pages] plus Quarterly Activities Report [15 pages].

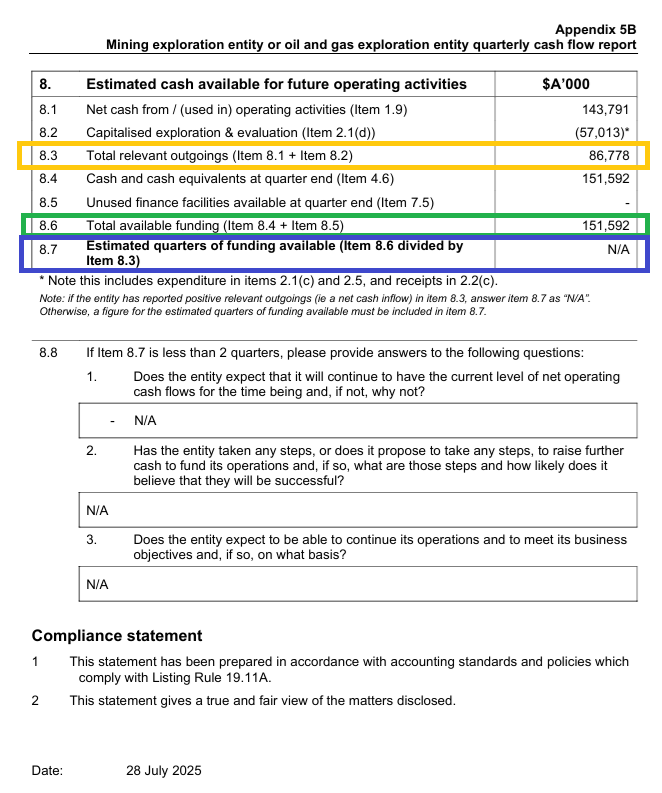

This had me stumped for a minute:

That's from page 5 of today's June Qtr cash flow report. 151,592 (@ question 8.6) divided by 86,778 (@ question 8.3), which is the calculation that question 8.7 is requesting, equals 1.75, which is less than 2, so question 8.8 should not be "N/A". What the...?

Well, a quick look back at the previous pages (I always start with the "Quarters of Funding Available" and then work back from there) had me quickly realising that they were actually profitable for the quarter, so the number @ 8.3 is actually their profit / incoming cash for the quarter rather than their "Total relevant outgoings" as labelled at 8.3. And 8.7 only applies to companies who are still burning cash, i.e. have used more money than they've made in the quarter, and that isn't Bellevue this particular quarter. Bellevue are cashflow positive now.

And it gets better:

It was a great quarter, but June (the last month of the quarter) was their best month of the quarter, and was record breaking in terms of gold production, averaged realised price, record gold recovery (95%), increased average grade (5.4 g/t gold), and record development rates with each jumbo averaging 311 metres for the month (go DVP!).

From a share price perspective, it was a green morning, with BGL up as high as 90.5 cps at one point, which was +5.85% above Friday's 85.5 cps close, however the euphoria didn't last into the afternoon, and BGL closed down half a cent for the day, at 85 cps (cents per share), which probably had something to do with that line I've highlighted in the red rectangle above - BGL are not providing guidance until next week - or the week after (in early August) which may be when they provide their FY25 full year report.

Most of the more important stuff in today's report was already known by the market due to BGL's announcement on July 7th titled Record free cash flow and strong finish to FY25 [4 pages]. The market realised during today that there wasn't much new news today and that they'd have to wait until August for the most important bit, the outlook and guidance.

So let's look at the financial health of the company.

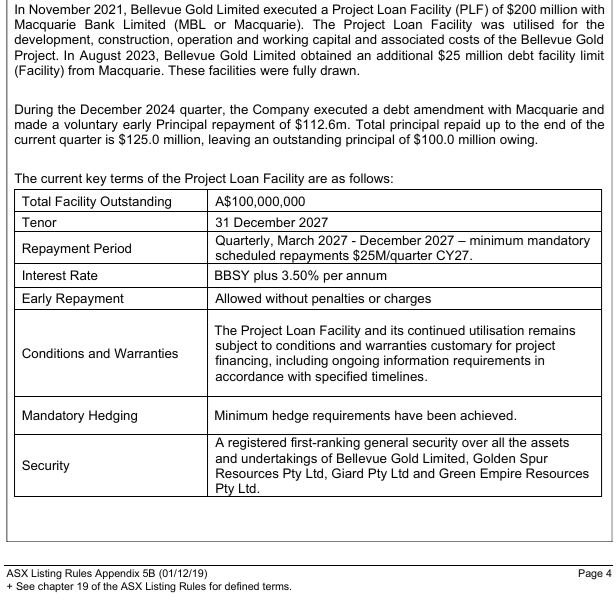

They had $152 million worth of cash and gold on hand at June 30th, however BGL do have $100m of debt.

The good news is that that debt is all with Macquarie who remain bullish on BGL, and all of that $100m of debt is not due to be repaid until 2027:

Source: Page 4 of their Quarterly Cash Flow Report today.

For those who don't follow BGL, they have a history of surprise capital raisings, with their latest being a AU$156.5 million equity placement in April 2025, primarily to close out near-term hedging contracts and strengthen their balance sheet, allowing more gold production to benefit from favorable spot gold prices. A portion of the funds (approximately A$40 million) was also allocated to working capital.

To get their initial $200 million PLF (project loan facility) from Macquarie Bank back in 2021, Bellevue had hedged a significant amount of their gold production at prices that are now well below current market levels, leading to potential losses. By spending $110.5 million in April to close out most of those hedging contracts, the company can now sell their gold at much higher spot prices, improving their cash flow.

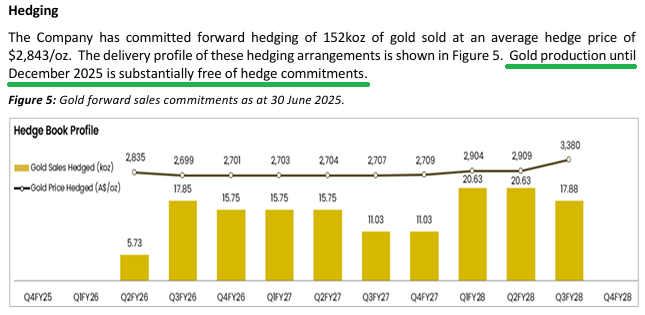

They still have some hedging in place, but it's not much now, and it's even less as a quarterly number:

Source: Page 7 of today's Quarterly Activities Report.

Bugger all this year (just 5.73 koz) then between 11 and 17.85 koz per quarter through until Q4 of FY2027, then between 17.88 and 20.63 per quarter for those last three quarters through until Q3 of FY2028. To put that in some context, they produced 38.94 koz in the June quarter this year and they're still ramping up. In the month of June they produced 18.2 koz, so they're up to a quarterly run rate of 54.6 koz gold production based on their June production, or 218.4 koz per annum of production, and they're still ramping up.

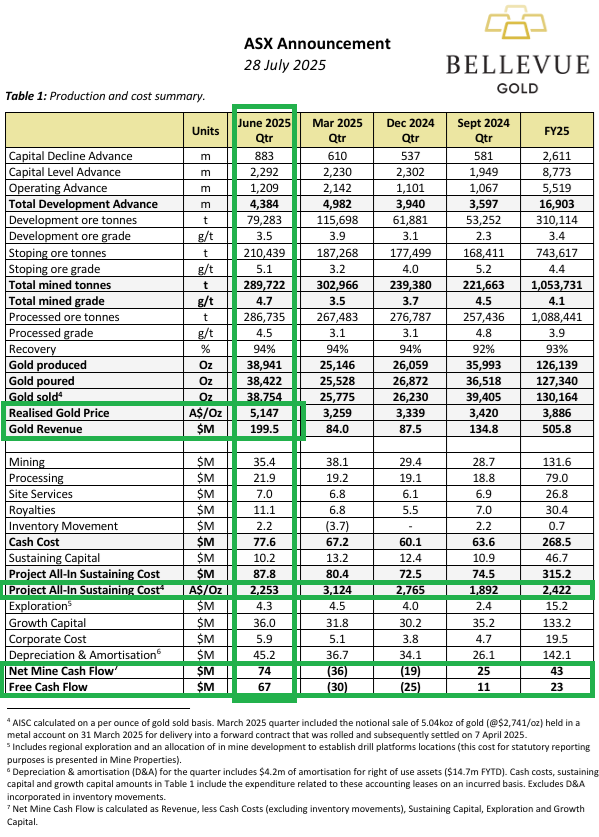

Have a look at how much being unhedged for the majority of the June quarter positively affected their cash flow:

Source: Page 3 of today's Quarterly Activities Report.

- Realised gold price of A$5,147/oz in June Qtr vs $3,259/oz in March Qtr.

- Gold Revenue of $199.5m in June Qtr vs $84m in March Qtr.

- Free Cash Flow of $67m in June Qtr vs a $30m loss in March Qtr.

And they're getting their costs down also, with their June AISC (All-In Sustaining Cost) of A$2,253/oz being lower than 3 of the preceeding 4 quarters and much lower than the March Qtr when their AISC was A$3,124/oz, as shown above.

The main reason why I've broken my own "never trust BGL management again" rule (again) and am holding BGL (again) is the thesis that they would have to get their act together and start making money out of what is after all one of the higher grade gold mines in WA, OR they would get bought out by somebody because of the amount of gold that they have there, and the high grades. So either (a) a recovery in the share price on the back of vastly improved performance, or (b) a significant premium paid by an acquirer. My thoughts were that if (a) failed, then (b) would surely happen because the asset is just too good to be run into the ground by poor management. It seems like (a) is playing out, and (b) is on hold at this point.

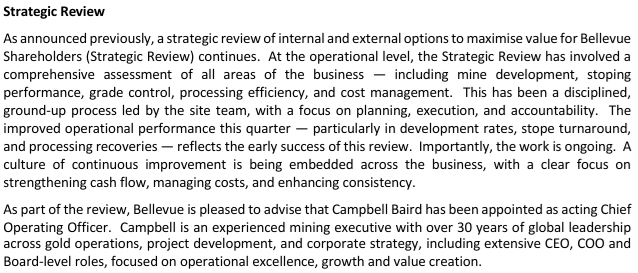

They updated us on their "Strategic Review" today:

Source: From pages 7 & 8 of today's Quarterly Activities Report.

Their new COO could well be this guy: Campbell Baird, Mining Executive, Perth [LinkedIn]

Never heard of him, but that's not surprising considering his background at Metals X, Artemis Resources, Indiana Resources, Indus Coal, Focus Minerals, Vulcan Resources, Iron Ore Company of Canada and Plutonic Gold way back in 1996 to 1998 - none of those are companies I was following when he was working at them. Interesting that the longest he stayed at any of those companies was just under 4 years at Vulcan Resources; He was at the first 4 (in that list - which are his four most recent jobs apart from running his own consulting firm called CCB Capital) for less than 2 years (from 1 year and one month, up to 1 year and 11 months). Might not be the same guy that BGL have just hired as their new COO, but I have a feeling it is.

Anyway, I'm not in BGL for their management quality, hell no!! I am in them for their high grade gold at Bellevue. If they don't work out how to make money there, someone else will, and it looks like they are working out how to make money there, so that's good.

Normally, I make excellent management (competent & trustworthy with great track records) a prerequisite for my investee companies, but Bellevue Gold is an exception to that rule because of the value of their gold, so it's more of an arbitrage play in my view, as I've explained.

They don't always work out, but I think this one will. Not advice, just my personal thoughts on this particular company.

Further Reading: 30-April-2025: Investor site visit presentation [34 pages]

Scroll down - this starts in 2021 - Latest updates will be at the bottom.

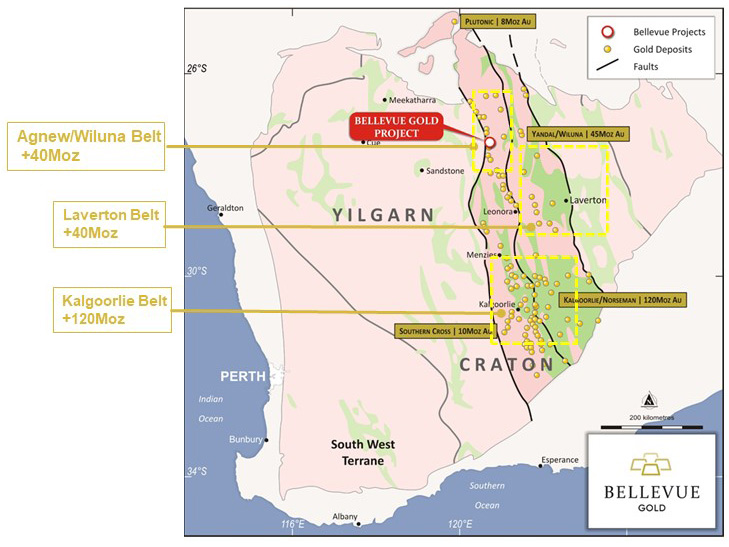

08-Mar-2021: I think they were heading over $1.50 before the gold price fell away, however even at a lower A$ gold price, I still think BGL are worth between $1.35 and $1.40/share, based on their high grades and projected low costs at Bellevue and also because they are going to get Macmahon (MAH) to do the mining for them and GR Engineering (GNG) to build the processing plant. I hold MAH and GNG and they are both the best at what they do, especially here in Australia, which is where the BGP (Bellevue Gold Project) is - in the goldfields north of Kalgoorlie in WA. I've put a lot more detail in a "Bull Case" straw, which was copied from one of my "Gold as an investment" forum posts. I bought a small position in BGL this afternoon, and also added them to my Strawman.com scorecard again.

They are speculative, because they're not yet producing any gold. They will have no income other than from bank interest and capital raisings until they get to production, and they haven't started the plant construction yet - they are still at the FS (feasibility study) stage currently.

07-Sep-2021: UPDATE: $1.37 is a fair way above where BGL are today, however they got there in November and again in December, and I reckon they'll be back up there again soon enough. This is one I do hold in RL as well as being in my SM PF.

BlackRock (the world's largest fund management group) increased their stake in BGL in July from 12.86% to 14.28%, and back in December Van Eck increased their BGL position from 6.43% to 9.78% of the company. The Bank of Nova Scotia (in Canada) also own 12.86% of Bellevue Gold (increased in June from 11.75%), so there are some heavy hitters on the register. Those three alone own a total of 36.92% of BGL.

Four days ago, on 03-Sep-2021, BGL released an announcement titled, "Bellevue Gold fully funded into production" - see here: https://wcsecure.weblink.com.au/pdf/BGL/02417370.pdf

Here's a snippet:

Bellevue on track to become a significant Top 20 Australian high-grade gold producer following successful completion of $106M Institutional Placement

Raising covered multiple times over after Stage Two Feasibility Study forecasts the Bellevue Gold Project to rank among the world’s leading gold projects based on the key criteria of grade, production, location and free cashflow generation

Bellevue Gold Limited (ASX: BGL) is pleased to announce it has received firm commitments for a $106 million fully-underwritten share placement (Placement) to institutional investors at $0.85 per share.

Proceeds of the Placement, together with the $200m debt facility, will be used to fund the development of the Bellevue Gold Project in Western Australia (refer to ASX announcements dated 2 September 2021).

There was strong demand for the Placement from both domestic and offshore institutions with bids covering the Placement amount by multiple times.

Bellevue Managing Director Steve Parsons said: “The strong demand from institutions around the world reflects the quality of the Bellevue Gold Project, the exceptional free cashflow generation forecast and the immense potential for further growth."

"With the project fully-funded to production, we will proceed full-steam ahead with development while maintaining a strong emphasis on further growth by increasing and upgrading the Mineral Resources and Ore Reserves."

“The Stage Two Feasibility Study is based on a Resource of 1.5Moz, which represents just half of the total 3Moz Resource base at Bellevue. We have already announced a host of high-grade drilling results outside that Resource, we have another 14,000 samples awaiting assay and there are now two rigs drilling from underground."

“This multi-pronged approach to expanding the Resource is aimed at growing the mine life, which will increase the already-strong financial results forecast in this Study.”

--- end of snippet ---

Disclosure: I hold BGL shares. They have to be viewed as speculative because they are a gold project developer, not an established gold producer. However their project is excellent, they have very good economics (high grades, easy and cheap enough to process the ore) and they are now fully funded through to production. They also have some top quality companies lined up to build the plant and do their mining for them (GNG & MAH) as I mention earlier (above). I hold shares in those two also.

11-June-2022: Update: Raising PT to $1.48 as I believe the BGP is now substantially de-risked and they have the funding sorted, so Bellevue Gold (BGL) should be able to put on around +50% from their recent $1 high IMO once the they get close to gold production (in 2023).

Meanwhile, Bill Beament's new mining services company Develop Global (DVP) have managed to snatch the Bellevue mining contract away from Macmahon (MAH) who had earlier been named as the future underground miners for BGL at the BGP. I hold shares in BGL, DVP and MAH and I'm not too fussed about that change of direction from BGL - MAH have plenty of ongoing work to keep them busy, with most of it being copper/gold mining or gold mining for other clients. DVP are just starting out in the mining services game, however I have enough respect and confidence in Bill to believe he isn't going to undercut a company like MAH just to get the Bellevue contract and then lose money on it. Bill held an executive position within an underground mining services contracting company before he ventured into actual gold mining with NST (Northern Star Resources) which he built up from nothing to become Australia's second largest gold miner and one of the world's top 10 gold miners. He's certainly no stranger to underground gold mining.

It's all good!

Our Core Values | Bellevue Gold | ASX:BGL | Australia

07-Dec-2022: Update: In light of BGL saying a week ago (in their presentation to the 2022 Macquarie WA Forum) they were fully funded through to production with $277.3m of liquidity and the plant now 69% complete as well as stating that their "pre-production expenditure status is ~90% contracted and long lead items are ordered"... and then having their share price rise from below $1 to above $1.20 on the back of that... and then (one week after saying they were full funded) they announce a raising at $1.05/share - see here: Progress Update and Capital Raising Presentation - I'm now lowering my "valuation"/price target for BGL down to that $1.05 capital raising level, because announcing this raising is drawing the SP down to that level naturally.

Management credibility is not good. You can no longer trust these people. Plenty of opportunities out there. I prefer those where the management tell shareholders the truth, mean what they say, and do what they say they will do.

I sold more than half of my BGL here on SM today (from 1,700 shares down to just 700 shares), and I only hold 1,000 BGL shares IRL, so just over $1K worth, so my exposure to BGL is not material at all. I have much greater exposure to better quality companies, including a number of better quality gold companies.

I will not be participating in this SPP at $1.05.

I've posted a straw about this BGL CR here earlier tonight.

28-January 2024: Update: Yeah, I cracked the sh!ts with Bellevue back in December 2022 after that capital raise and sold out here at the time, then sold my real-money portfolio BGL shares at $1.15 in early Feb 2023. However, last Thursday (25th Jan 2024) I bought back in - and I hold them once again this time in my SMSF.

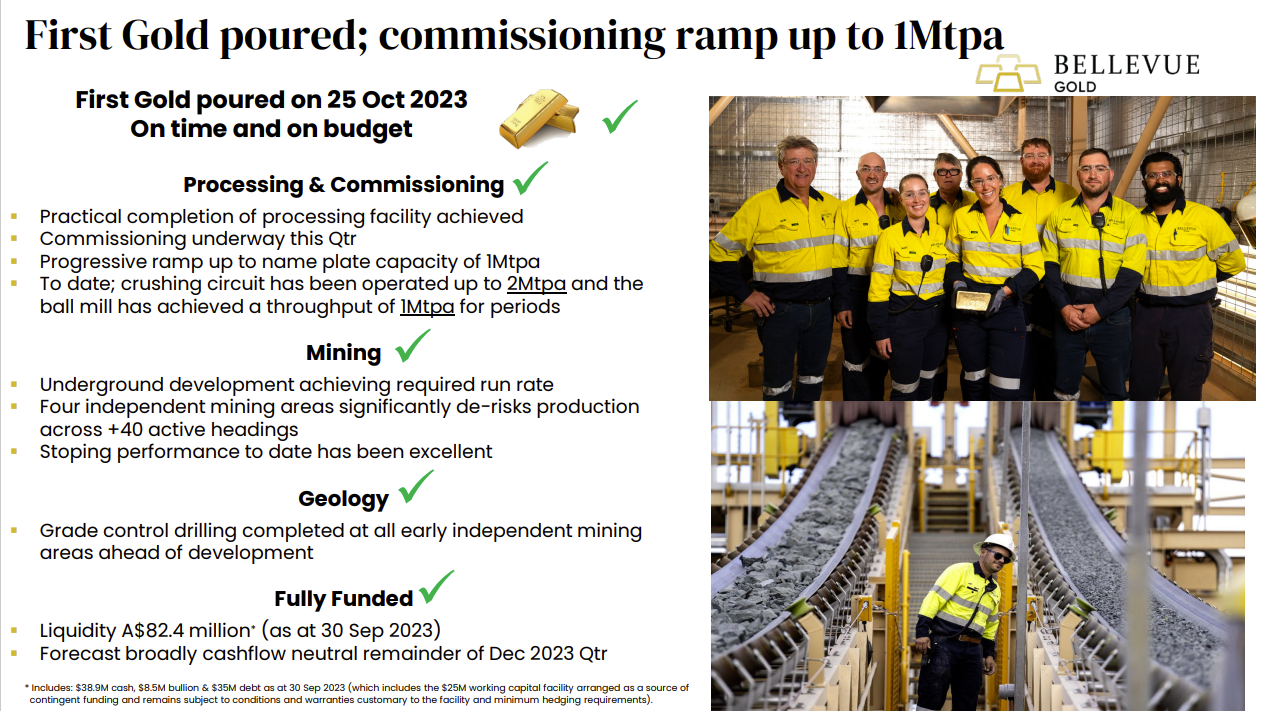

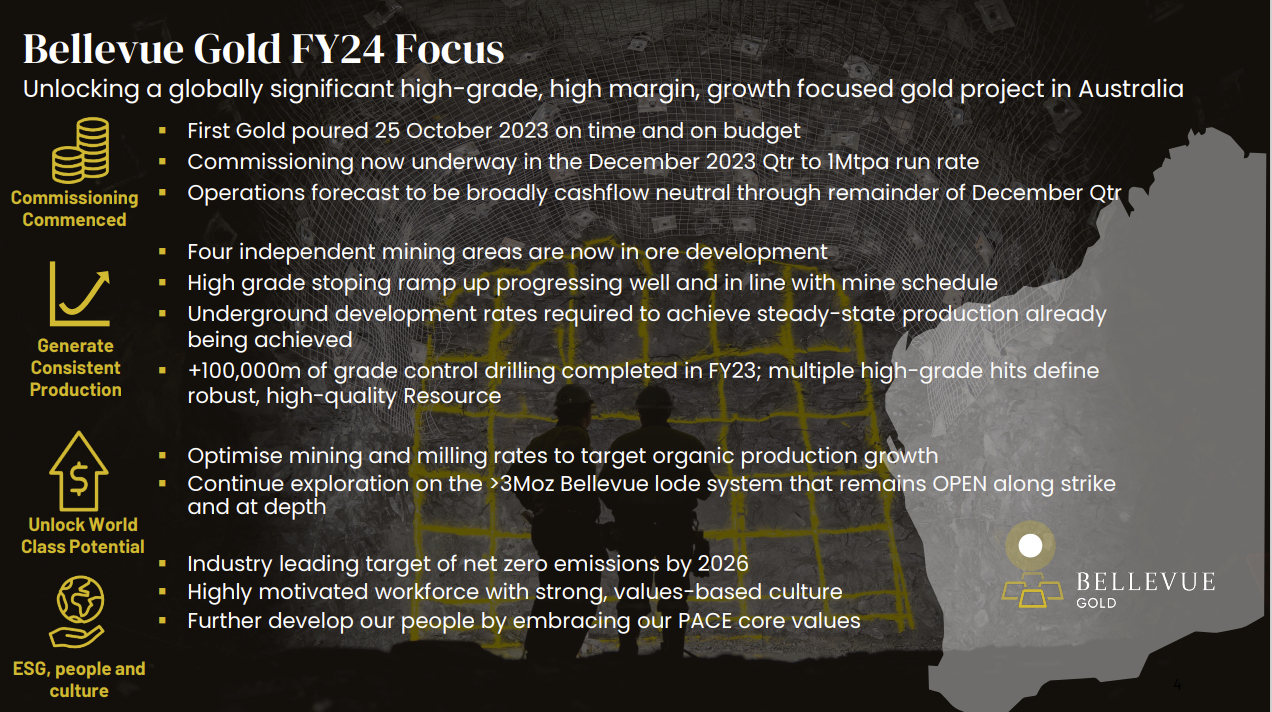

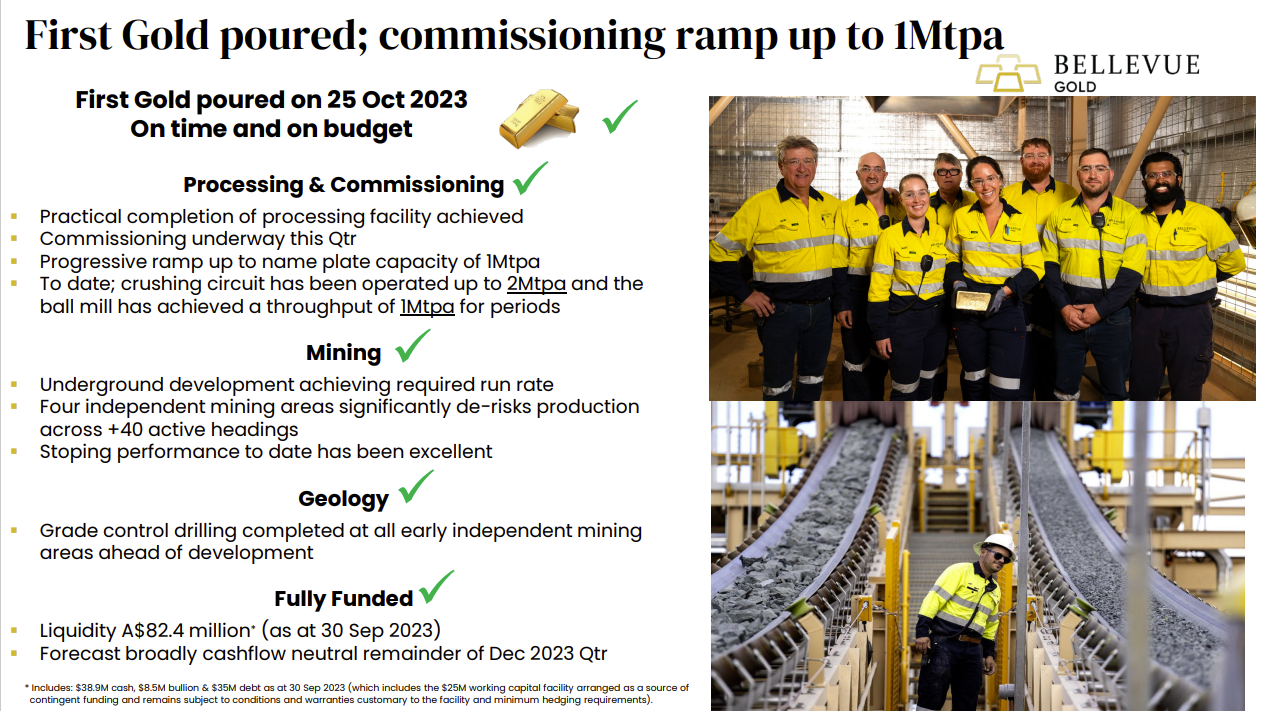

I'll post a Bull Case on them, but in summary I've had a fresh look at the company and I've decided to get back onboard based on their high grades of gold and because I reckon their management (many of them ex-NST) have the experience to get their plant through this commissioning phase without too many more cost or time blowouts and run it without losing money (remain "broadly cashflow neutral") during the ramp up as they have stated they would:

Source: East Coast Roadshow - Bellevue Gold - In Production - 13th November 2023

See: Company Overview | Bellevue Gold | ASX:BGL | Australia

Some skin in the game; some more than others:

High Grades!!

And a decent Mill:

There's a lot to like, even if I don't fully trust management any more, especially when they are talking about not needing to raise capital...

The change for me is that that Bellevue as a gold project is largely de-risked now - they should be able to complete this commissioning phase and ramp up the plant. The risk if of course that they encounter problems and have to downgrade guidance and they'll get smashed again if that happens, but looking at their recent share price movement there's a fair bit of negativity already baked in I reckon.

They've come down by ~30% - from a high of $1.84 in early December to $1.29/share now. Looks like a decent entry point to me. It's above where I sold out around a year ago (@ $1.15/share IRL), but not too much above, and certainly a lot lower now than where they were 6 or 7 weeks ago.

They are not going to be a big gold player, not with just the one mine, they're going to be a top 20 Aussie gold producer which means one of the smaller ones, but also one of the more profitable ones I'm thinking, if this plays out as I expect (and hope) it will.

28-August-2024: Update: This one was one I held in my SMSF only, as well as here (but not in my other larger real-money portfolio that I sold up in June), however I exited the company after their last CR - which, once again, came right after a bunch of "We don't need to raise - we have enough cash, and we're producing gold profitably!" assurances to the market.

The previous time they did that (before they were producing but still said they didn't need to raise) I spat the dummy and sold out in disgust. This time I slept on it and even tried to justify their opportunistic behaviour as somehow being in shareholders' best interests - better to raise at a higher share price than a lower one - and then I realised that the market had seriously lost faith in their management this time, and their share price was not going to bounce back.

And then I thought, well, the market has a point! Why am I backing this management team that can NOT be trusted? So, yeah, nah, I'm out again.

I ended up adding CMM, EMR, PRU and WAF to my SMSF, then sold out of CMM & WAF and added RMS. My current gold exposures are through NST, GMD, RMS, PRU and EMR. I also hold RMS outside of my super. Apart from those 5 gold producers I only have 4 other companies in my SMSF at this point, being NWH, PNV, COE and AD8.

Bellevue might be Australia's highest grade gold mine of significant scale at this point in time, but they have some muppets steering that ship, and I don't want to be on onboard any more.

26-March-2025: Update:

I'm back in BGL again for a trade based on Develop Global's (DVP's) Bill Beament's assessment in early Feb of the Bellevue underground gold mine having turned a corner in December/January, and Bill expecting a much better March quarterly from BGL in April. I started getting cold feet again (twice burned with this one already) and sold half at a profit recently, and then this happened:

When Large Global ETF providers like VanEck, BlackRock, State Street and Vanguard remove a company from one of their ETFs they just sell, they are not particularly concerned with the price, or what their selling does to the price.

If you examine the following two "Change of..." notice from Van Eck you may notice that the following ETFs or managed funds DO appear as holders of BGL stock in the first notice, but NOT in the second notice:

- VanEck International Investors Gold Fund (IIG)

- VanEck Small Companies Masters ETF (MVS.AU)

- Van Eck VIP Global Gold Fund (VGOLD)

Change-in-substantial-holding-1.PDF [24-March-2025] 115,435,553 BGL shares (9.06%) down to 97,462,406 BGL shares (7.59%) [VanEck]

Change-in-substantial-holding-2.PDF [26-March-2025] 97,462,406 BGL shares (7.59%) down to 84,187,273 BGL shares (6.56%) [VanEck]

So VanEck have reduced their exposure to BGL across many if not all of their ETFs and Managed Funds that did hold BGL, and they have completely removed BGL from three of them. If we went back and looked at their previous notice, we might find even more ETFs or Managed Funds that previously did hold Bellevue Gold (BGL), but that no longer do.

My point is that passive investing DOES move share prices, and moves by the managers of discretionary ETFs and managed funds CAN really impact companies' share prices, especially smaller companies.

Obviously VanEck weren't the only sellers over those couple of days recently, but they would have been responsible for a big chunk of that SP drop both through their own sell trades and also through the market reacting negatively to their selling, which just increases the selling - it feeds on itself, until it stops.

My assessment however is that this is expected market volatility that can and has been explained, and does not have any direct impact on my investment thesis (IT), which, as I said above, is really all about a shorter term trade based on BGL's next quarterly report next month (and their full year report in August) both exceeding the market's low expectations of this company.

Whether I maintain this real-money position (not held here) or not will depend a fair bit on what Bellevue report in the March quarterly in April.

The issues that they have had, apart from BGL management's lack of integrity and honesty with regard to capital raise guidance that I've already covered, is mostly around the hardness of the ground that DVP have to drill and blast through at Bellevue - the rock has been a lot harder than expected which has slowed everything down - with both mine development and production, as well as services not being up to scratch through until late CY2024, so mostly a lack of adequate water and power infrastructure underground that meant that DVP spent a lot of time waiting when they should have been drilling and blasting.

Now, while the rock is still just as hard, they have the necessary services in place and being rolled out as required as development progresses, which means that metres drilled per week has significantly increased which will translate into much better monthly and quarterly numbers this calendar year.

In other words, a major bottleneck has been removed.

That's my IT for BGL right now - based on that scuttlebut from Bill B mostly (in early Feb - link above), so let's see how that pans out.

No change to the PT at this point; I'll review it after I read their March quarterly. If I read what I'm hoping to read in there, then my BGL price target will get increased at that point.

Arrgh BUGGER!

While I was typing that update above just now, this happened:

They're DOWNGRADING their production guidance.

Have lowered my PT to 90 cents. Why do I keep getting drawn back into companies where I've been burned before?!?!

At least it's a relatively small position now, and only in my SMSF.

I'll likely dump them (again!) when they start trading again.

--- --- ---

17th June 2025: Update:

Raising my price target back up to $1.45. They could still underwhelm once again with their 4th Qtr report and/or downgrade FY26 guidance again, but I'm thinking that (yet again) the worst is likely behind BGL management now - however I note that this is not the first time I've thought that.

My current view is that BGL have finally learnt from their many past mistakes, and this has been bourne out by their lowered future production guidance - or production plan reset which means their targets are now much more manageable and they don't need EVERYTHING to go right for them. They have also - as part of that reset - renegotiated their lending covenants with Macquarie so they are less likely to breach any lending covenants going forwards, because they've been relaxed. On top of that they raised capital yet again (as mentioned at the end of my last update above).

All in all, I'm betting now that one of two things is going to happen with BGL:

- They get a takeover offer from an existing Australian gold producer who wants the extra gold Resource ounces; or

- BGL finally start kicking goals, i.e. meeting their own guidance, doing what they say they're going to do, now that they have lowered guidance and expectations and won't have their previous "Production at all costs" MO which meant that last Qtr they strayed away from the gold on the edges of their deposit and therefore produced less gold at a higher cost - those days are hopefully behind us.

One or the other. So instead of selling out again, I increased the BGL position in my SMSF to 10% of that portfolio at below 90 cents/share, lowering my average costs for all of the BGL I hold there in my SMSF to 95 cps.

Today, on a day when some goldies like Genesis (GMD, -2.3%) were down, and others were fairly flat (EVN, -0.12%, NST +1.5%, GOR +0.6%), BGL were up +7%:

Closing at a bee's whisker under $1/share. It's been a decent month for BGL, as shown on that one month graph there (above, right), but to put that into perspective, below is their 3 year chart:

In mid-July last year they were over $2/share (closed @ $2.03 on 12/7/24) and they're now less than half of that, so... yeah, one good month, but a nasty 12 months.

Anyway, my IT (investment thesis) doesn't rely on M&A, however I do think that M&A is going to provide a floor for the BGL share price, as in: They are unlikely to go substantially lower from here without someone lobbing in a T/O offer, IMO.

My base case is that they start to execute on their new more achievable mine plan and we see that reflected in their share price as it recovers.

Not guaranteed, they could stumble yet again and nobody might lob in an offer, but I think that is unlikely.

The gold price could also fall significantly, but that's the risk with ALL gold miners, not specific to this one, and it's a risk I'm comfortable with, especially as BGL's grades are high and their costs should reduce significantly as they execute their plans from here.

So it's either a turnaround story OR an M&A story, but I'm thinking it HAS to be one or the other because there's just too much gold there at Bellevue for them to go down the gurgler.

I've been wrong before and I might be wrong this time again, but that's what I'm thinking, and why I continue to hold BGL at this point despite their woeful track record. It goes against my number one rule, of investing in quality management with great track records of profitable execution and superb TSRs, but I think BGL is a special case in that I can see limited downside and substantial upside from here mostly because of how badly they've done since they commissioned the mill and how far down their share price has run as a result of those issues.

I also know they have Bill Beament's Develop Global doing their contract mining, so as long as BGL's Geo's give DVP's drilling crews the right instructions on where to drill, we know the gold is there, and they just have to blast it and process it, which DVP are very capable of doing (the drilling, blasting and loading part).

Let's see if I'm right, or if I'm throwing good money after bad.

07-May-2024: Commercial-production-declared--expansion-studies-commence.PDF

Plus: East Coast & USA Roadshow Presentation.PDF (07-May-2024, titled: "Set for growth and superior financial returns.")

Website: https://bellevuegold.com.au/

Investor Page: https://bellevuegold.com.au/investor-centre/

The concern was whether they could get to this point (commercial production declared) without another CR, and they have, so well done Bellevue!

Disclosure: I hold BGL Shares.

28-Jan-2024: Bull Case straw for BGL - I added them to my SMSF on Thursday (25th Jan 2024).

The SP has come down ~30% from a high of $1.84 in early December to $1.29 in late January. The company is going through the commissioning phase and ramping up the Bellevue gold mill to nameplate capacity currently, and the December Quarterly Activities Report will be telling in terms of how smoothly that has been going. That should be lodged by BGL to the ASX's announcements platform during the next three business days (the last 3 in January - and January 31 is their deadline for lodging that report). If things are going badly, then the share price will go even lower, but if things are going alright I reckon we could see some upside from here.

The following slides are from their November East Coast Roadshow Presentation slide deck:

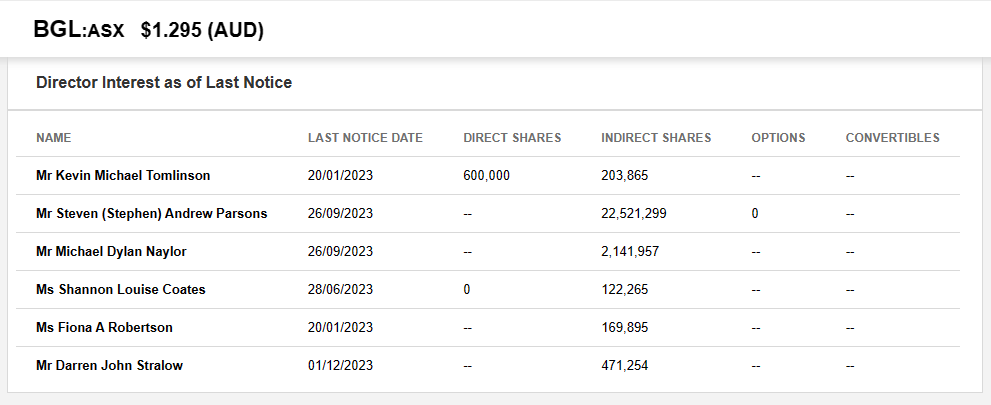

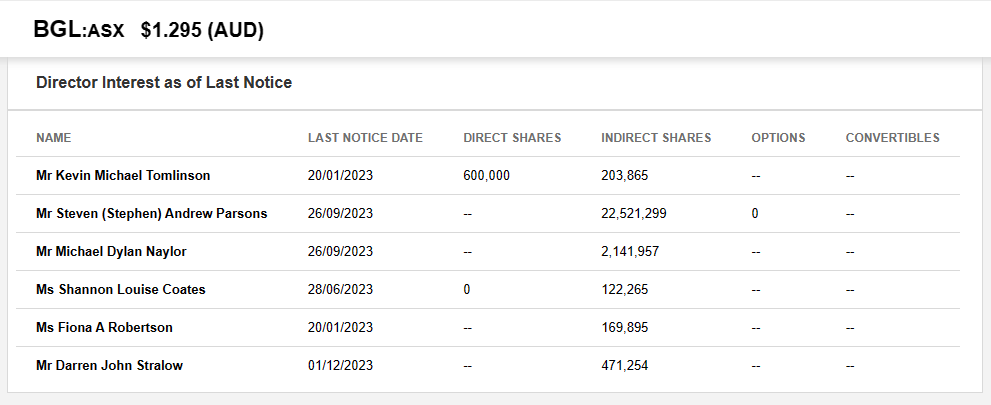

Some skin in the game - some more than others, but all directors own some shares:

Bellevue (BGL) currently have three substantial shareholders:

- 15.16%, Blackrock, the world's largest asset managers, they own and manage iShares ETFs and their IAU iShares Gold Trust ETF has US$25.6 Billion in AUM and their IAUF iShares Gold Strategy ETF has US$34.5 Billion in AUM.

- 5.71%, Van Eck, another ETF provider, Van Eck specialises in mining and materials ETFs and they have their NUGG Physical Gold ETF as well as their global gold miners ETFs, GDX (VanEck Gold Miners ETF, with US$11.4 Billion of FUM) and the US-listed GDXJ (VanEck Junior Gold Miners ETF, with US$3.8 Billion of FUM, available through NYSE Arca - or NYSEARCA - which is an electronic communications network - or ECN - used for matching orders - rather than a physical stock exchange.) and GDXJ holds BGL.

- 5.03%, Vanguard, the OG of ETFs, Vanguard's founder Jack Bogle is credited with inventing Index Funds (ETFs), and Vanguard have included BGL in at least two of their ETFs - see below.

According to https://fintel.io/so/au/bgl, "Bellevue Gold Limited (AU:BGL) has 63 institutional owners and shareholders that have filed 13D/G or 13F forms with the US Securities Exchange Commission (SEC). These institutions hold a total of 266,994,874 shares. Largest shareholders include AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Gold & Special Minerals Fund Class C, INIVX - International Investors Gold Fund Class A, GDXJ - VanEck Vectors Junior Gold Miners ETF, SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, FKRCX - Franklin Gold & Precious Metals Fund Class A, PRAFX - T. Rowe Price Real Assets Fund, Inc., ASA Gold & Precious Metals Ltd, Dfa Investment Trust Co - The Asia Pacific Small Company Series, and VTMGX - Vanguard Developed Markets Index Fund Admiral Shares."

From Bellevue's own website: (https://bellevuegold.com.au/)

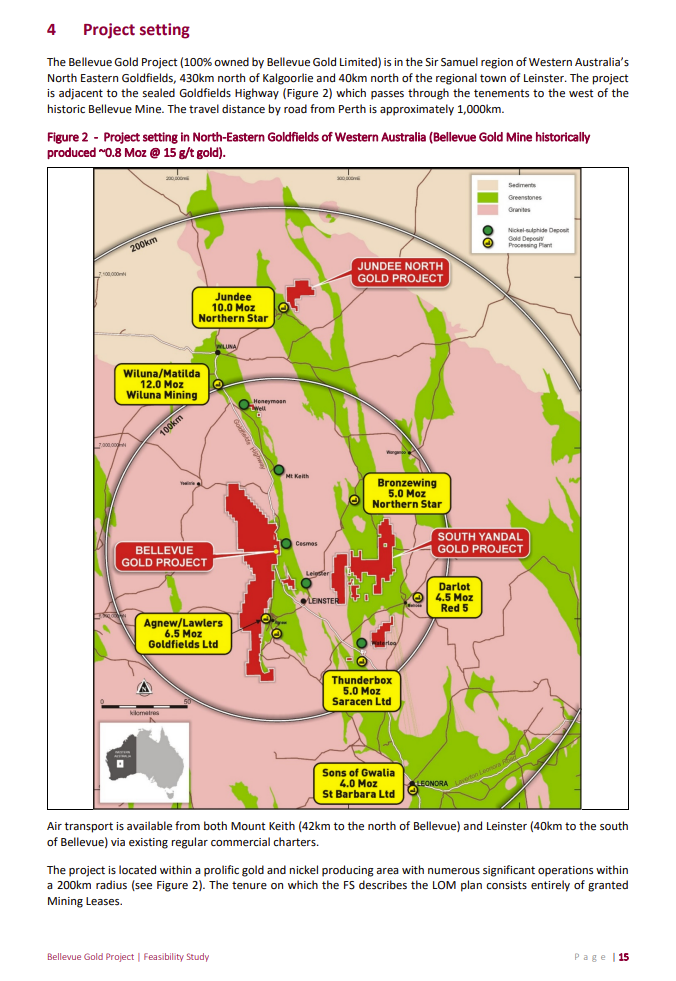

Bellevue Gold Limited is an Australian Securities Exchange (ASX) listed company developing the high-grade Bellevue Gold Project. The Project has a current global Mineral Resource of 9.8Mt @ 9.9 g/t gold for 3.1 Moz, including a Probable Ore Reserve of 6.8 Mt @ 6.1 g/t gold for 1.34 Moz, making it one of the highest grade gold discoveries in the world and the highest grade gold development project in Australia.

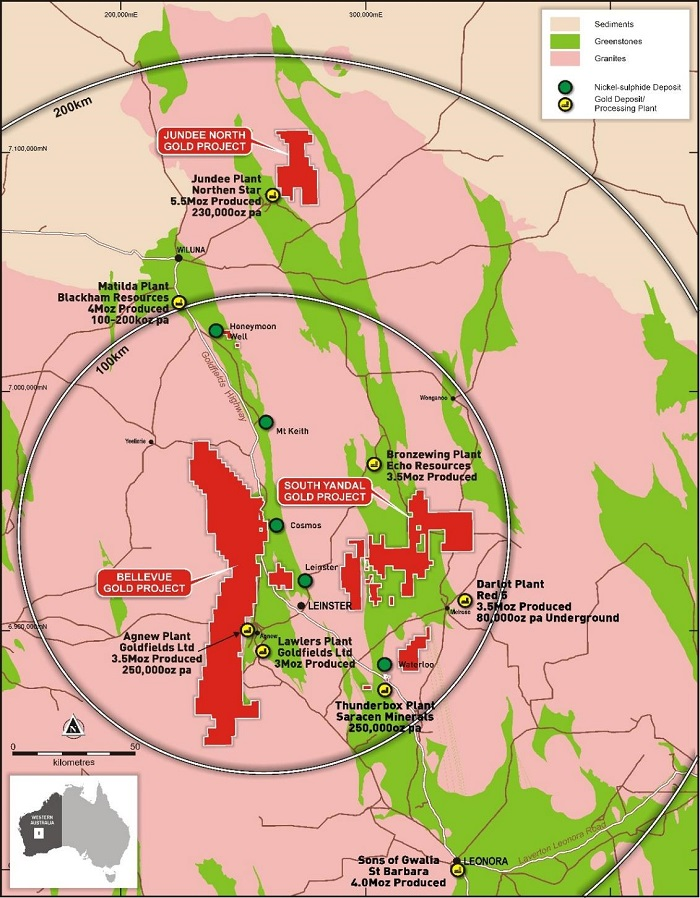

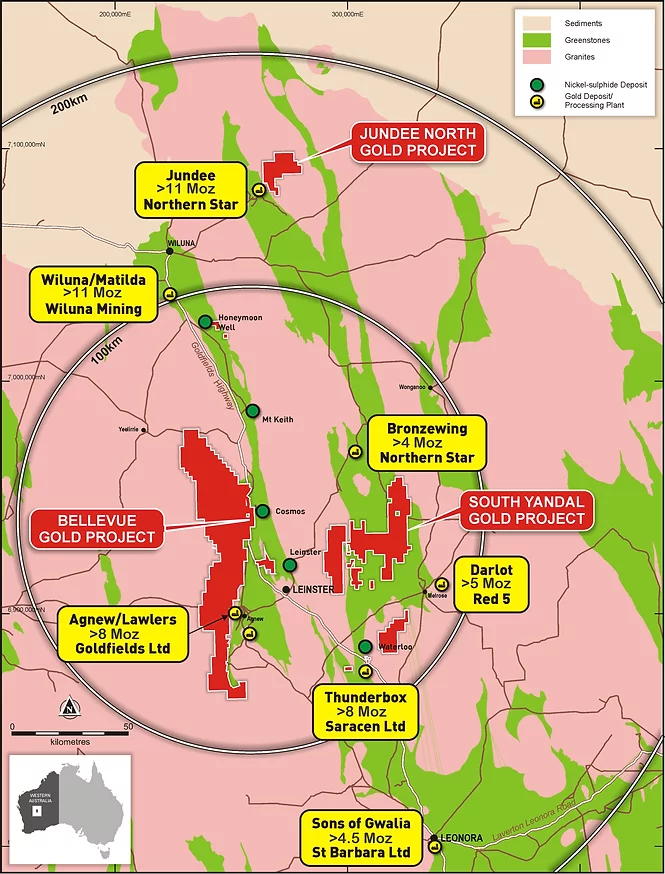

The Project is located 40km to the north west of Leinster in the Goldfields region of Western Australia and sits in a major gold and nickel producing district with mines such as Jundee (ASX:Northern Star), Agnew & Lawlers (Goldfields), Darlot (ASX:Red 5), Bronzewing (ASX:Northern Star), and Thunderbox (ASX: Northern Star) all in close proximity.

The Company has a highly skilled Board of Directors and Management team with a track record of discovery success and corporate growth and a strong supportive global institutional shareholder base.

--- end of excerpt ---

So, looking at all of that, including the number of ex-NST people at BGL (their MD & CEO, their COO, their CFO and their Chief Sustainability Officer and Head of Corporate Development all worked previously at Northern Star Resources, as I have highlighted about 8 images up), and the fact that their Bellevue Gold Project is located in close proximity to three of Northern Star's mines (Jundee, Bronzewing and Thunderbox) and also close to Red 5's (RED's) Darlot satellite underground gold mine (that helps feed RED's KOTH mill), I think it's fair to assume that there MIGHT be some M&A down the track... Economies of scale and all that. NST acquires BGL, or RED acquires BGL, or BGL acquires RED, something along those lines - I would prefer BGL to be a target than a hunter, but that would of course depend on the prices paid at the time.

Source: Bellevue Stage One FS (feasibility study) 18-Feb-2021

That map above is nearly 3 years old, so there have been some changes, including Gwalia now being owned by Genesis (GMD) instead of St Barbara, Thunderbox now being owned by NST (after the Saracen-Northern Star merger), and Wiluna Mining (formerly known as Blackham Resources) going into voluntary administration in July 2022, with mining ceasing in December 2022 and final ore processing completed in February 2023.

https://bellevuegold.com.au/bellevue-gold-project/

I'm heading back over there in a couple of weeks for a few days - to the SW of WA, SW of Bunbury. Flying, not driving, to Perth, then driving, so won't be going through the WA goldfields.

Source: Bellevue Gold Project (gres.com.au) [GRES = GR Engineering Services, GNG.asx, who I also hold shares in]

See also: Project_Focus_-_Bellevue_Gold_Project.pdf (gres.com.au)

Source: Bellevue Gold Project, Australia (mining-technology.com)

Source: https://247solar.com/bellevue-gold-mining-raises-the-sustainability-bar/

Not all positive unfortunately:

Bellevue Gold: Bellevue Gold Limited fined $41,000 after it left 'visible salt scar' (9news.com.au)

https://www.wa.gov.au/government/announcements/gold-miner-fined-hypersaline-spill-0

(21) Bellevue Gold Limited: Overview | LinkedIn

Investor Centre | Bellevue Gold | ASX:BGL | Australia

Disclosure: Despite getting pissed off with management in December 2022 when they said they didn't need to raise capital and then promptly did a CR (including an SPP) when the share price rose... I have now taken a fresh look at the company in the new light of their current position and the substantial de-risking of their Bellevue Gold Project which is nearing the end of the commissioning phase now and should be approaching nameplate capacity if things are going OK, so looking at BGL as a gold producer now who should be a top 20 Aussie gold producer, so not large, but not insignificant either, and as potentially one of the more profitable ones in the future based on those high gold grades they keep finding, I'm back onboard BGL. Bought some in my SMSF on Thursday (25th Jan 2024).

03-Aug-2023: Exceptionally-high-grade-infill-drilling-results.PDF

BGL (Bellevue Gold) is a company I've held before, and I've also been critical of management, particularly when they said they were fully funded through to production and then announced an opportunistic CR within a few weeks when the share price was up on a couple of positive announcements. Being able to trust management is usually a prerequisite for me in terms of one of the boxes that I need to tick before investing in a company (or speculating more than investing with a company that is burning through cash but should become a profitable gold producer shortly). Trusting management often boils down to whether they do what they say they are going to do, and saying they are fully funded through to production sends a clear message to the market (and their investors in particular) that they will not be raising more capital, at least for the next few months, and they said that, and then did a raising shortly afterwards, so a big "Fail" on that score for mine.

I'm not against capital raisings, indeed they are often necessary and expected, and can be a good way to increase your exposure to a good company - if the CR is extended to ALL shareholders rather than just an elite group (such as a placement). However, unexpected CRs force existing shareholders to stump up more cash or be diluted (i.e. make your existing holding worth less, as it's a lesser share of the company because the company has issued more shares), and we make our investing decisions based on a number of assumptions, and we have to make those assumptions based on what we know, which includes what the company's management has told us, so when they say one thing and then do another, that's not good at all.

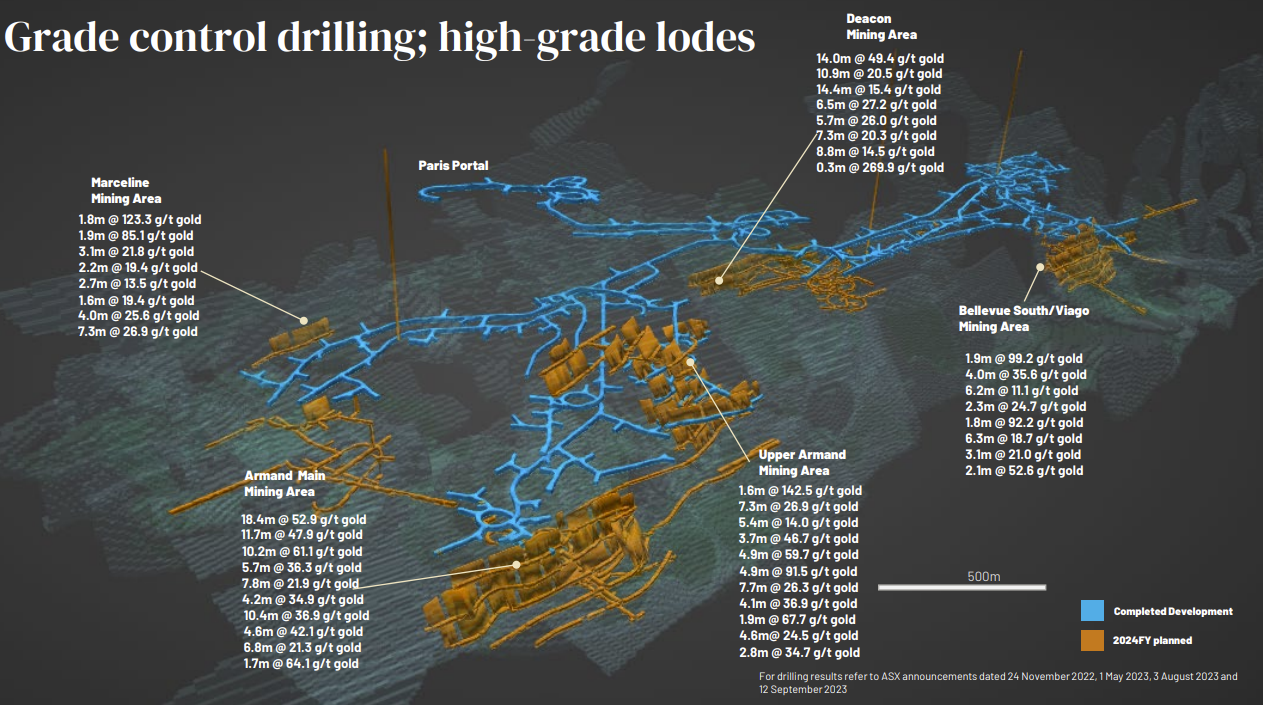

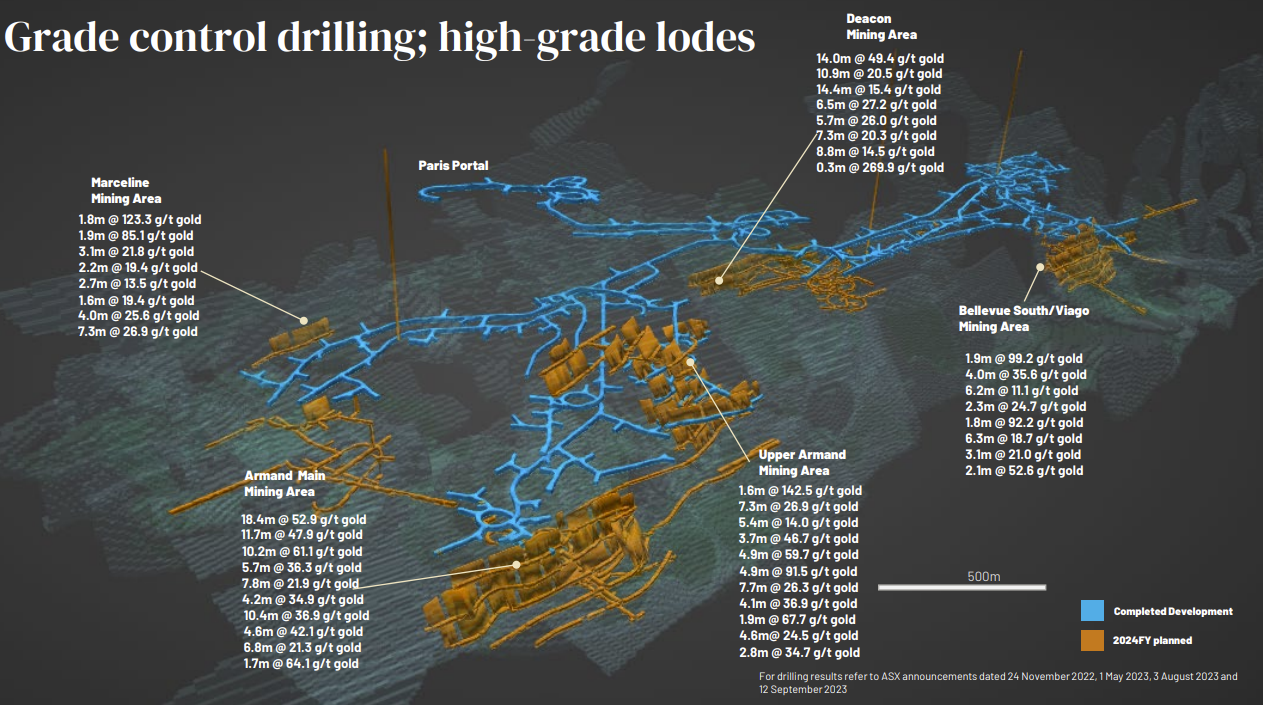

All that said, BGL is finding some VERY good grades of gold at the minute. Have a gander at these numbers:

When you have companies that are profitable mining gold with ore that contains only 1 (one) gram of gold per tonne of ore, these results, which range up to 99.2 grams/tonne, suggest a very high grade deposit indeed.

So I guess that's the positive with Bellevue - they have some great grades which should result in lower costs and higher profits, when they get around to processing that ore. Maybe it's like that famous Tiger Woods quote, "Winning takes care of everything."

Maybe...

Disclosure: I do not hold BGL shares at this time.

07-Dec-2022: Yes @Gprp - in answer to your #Business Model/Strategy Straw earlier today - Management have indeed been very naughty - and have lost a fair amount of credibility in my eyes also - which is why I sold down more than half of my BGL position here in my Strawman.com virtual portfolio today - moving that money into RMS (Ramelius Resources, which look better to me sub-$1/share). I only have just over $1K worth of BGL IRL (1,000 shares, to keep me following them, because they COULD become a decent producer one day). I have a lot more RMS IRL, and I'm building an RMS position here on SM once again. RMS are a proven gold producer who always find ways to get around their issues, such as their recent issues with a number of their mines nearing the end of their useful lives. And I rate their (RMS') management quite highly. BGL - not so much, after this week's developments.

On the 29th November at the Macquarie WA Forum - BGL said this on the first page of their presentation (after the standard disclaimer pages) - - -

Then they went on to explain how close they were to becoming producers.

I won't reproduce the whole presentation again here, but it was very compelling. Here it is: 2022 Macquarie Western Australia Forum Presentation [29-Nov-2022]

That's a link to the presentation (as supplied on the BGL "announcements" page of their website) because the file is too large to upload to this site (believe me, I tried and failed).

Here's the crux of the issue as explained by me along with their recent share price history:

I like the opportunity. I like the contractors they've got building the plant (GR Engineering Services, or GRES, ASX:GNG, who I hold both here and IRL) and I like the contractors they've got to do the actual gold mining - Develop Global - Bill Beament's new company (he's the dude that built NST up from nothing to become Australia's second largest gold miner). But I no longer like Bellevue Gold's management too much.

I haven't dumped them completely, but I hardly had any to start with. On the one hand I can see that they wanted to sieze the opportunity, but what about all of the punters who believed what they said on the 29th and bought into the company at prices ranging all the way up into the $1.20s, only to have them pull this one? Raising money at $1.05, which naturally drags the share price back down to damn close to $1.05. Not a good look Bellevue!

It will be interesting if the market dumps them based on this credibility damage, or forgives them because it's all about the future value? I view management quality as a very important factor in my investments, and it's pretty high up on my checklist actually, and after this, Bellevue no longer tick that box.

10-June-2022: Bellevue Gold (BGL) updated their recent update after the market closed this evening (at 6:15pm) - see here: Project Production, De-risking and Growth Update-update

This is an update to the update released on Tuesday (07-June-2022): Project Production, De-risking and Growth Update

So far I've noticed some cosmetic changes such as a frame around figure 3 at the bottom of page 5, and that the wording of the 3rd dot point under the "Key Points" heading on page 1 has changed from:

"The life-of-mine (LOM) Reserves and Mineral Inventory has increased to 1.85Moz, underpinning an increase in mine life to 10 years"

to now:

"The life-of-mine (LOM) Project LOM inventory has increased to 1.85Moz, underpinning an increase in mine life to 10 years"

...which I'm guessing is to do with complying with the JORC code in relation to gold Reserves. Interesting that they do not provide any explanation of what has changed in the updated version of the update. I just opened both documents in different tabs and switched between them to pick up any differences. If you line the pages up exactly and switch between them you can easily see if anything has changed. So far I've only noticed those two changes that I've mentioned (wording on page 1 for one of those dot points and the frame around figure 3 on page 5), but there's probably some more further in.

Still looks like a very decent project to me. But then - I hold BGL shares, as well as shares in GNG (who are building the gold processing plant at Bellevue) and also Develop Global - who have been appointed mining contractor (mining has commenced already at Bellevue).

GR Engineering (GNG) has commenced early works and has ordered the long-lead and critical path items required for the plant construction. GNG is a company I have held shares in for many years and have written about here extensively. GNG are quite busy at the moment with a number of contracts on the go at the same time. They do have a division which generates recurring revenue from the energy sector (Upstream PS) but the bulk of GNG's revenue is from completing studies (FS, PFS, BFS, DFS, etc., i.e. Feasibility, Pre-Feasibility, Bankable and Definitive Feasibility Studies) and doing EPC (Engineering, Procurement and Construction) contracts, which means their revenue tends to be quite lumpy. After having a bit of a dry spell for a couple of years, they had an excellent first half and are tracking to back that up with an equally good second half (for FY22) - they also pay a very generous fully franked dividend yield. Definitely a company I'm happy to hold through their cycles, but I trim at the highs and load up when they look particularly cheap, trading around a core position. At over $2/share they are fairly fully priced compared to when they are down at $1/share or lower. They closed bang on $2/share today after rising +2% (or +4c) on a down day for the market. In April 2020 they were trading ay 64 cents/share. Very cheap at the time. It was a quiet period for them, but work always picks up again eventually, and it has recently.

GNG are one of two ASX-listed EPC contractors who specialise in the design and construction of gold processing plants. The other one is Lycopodium (LYL) who I also hold. LYL do most of their work in Africa, while GNG do most of theirs here in Australia. But that's not set in stone, that's just historical, and GNG do also do work outside of Australia and LYL do occasionally perform work here in Australia, but as a general rule LYL specialise in working in areas of the world where there are increased sovereign risks, and they get paid accordingly. Both are very good at what they do, and both have excellent risk management processes in place to deal with the risks they face, which are substantial. GNG tend to win the majority of the gold plant EPC contracts for new gold projects located here in Australia.

DVP (Develop Global) is Bill Beament's new company, the man, the legend, who built NST up from nothing to become Australia's second largest listed gold miner, behind NCM (Newcrest Mining) and also one of the top 10 largest gold miners in the world (both in terms of market capitalisation and ounces of gold produced per annum). Bill started off in mining services before he got into gold mining, and now he's back in mining services again. I think there are exciting times ahead for DVP. I'm excited to see where Bill B takes DVP.

Disclosure: I hold shares in BGL, GNG, DVP, NST and LYL (all mentioned above).

You can keep up-to-date with the Bellevue Gold Project development here: Investor Centre | Bellevue Gold | ASX:BGL | Australia

Image Source: July 2019: Bellevue Gold Ltd delineates 1.8 million ounces in under 18 months at namesake WA project (proactiveinvestors.com.au)

Updated version from the Bellevue website below:

11-Sep-2021: Macquarie sometimes stop covering companies for a period either because they are raising capital for them, or because they are in negotiations to raise capital for them. Macquarie were involved in BGL's CR in mid-2020 and they have just been named as one of the underwriters of the current CR by BGL.

See here: Bellevue Gold kicks off $106m placement, three brokers on board (afr.com, 02-Sep-2021)

and here: Gold play Bellevue set to launch $100m placement, two brokers hired (afr.com, 08-July-2020)

If those stories are behind a paywall, the main info is that Bellevue Gold is currently attempting to raise $106 million in an institutional placement underwritten by Canaccord, Goldman Sachs and Macquarie. It was also Canaccord Genuity and Macquarie Capital that organised the July 2020 raising.

Of the seven (7) brokers covered by FNArena.com, (Citi, Macquarie, Morgans, UBS, Credit Suisse, Morgan Stanley and Ord Minnett) - Only Macquarie currently covers Bellevue Gold (BGL) and they have an "Outperform" rating and a $1.40 PT/TP (price target/target price, a.k.a. target) for BGL. The following shows a little bit of their more recent coverage, with the most recent at the top and the least recent at the bottom.

Disclosure: I hold BGL shares. It should be noted that FNArena does NOT cover a number of other brokers (other than the seven listed above - in bold) - and some of the ones that they do NOT cover who MIGHT be covering BGL include Canaccord Genuity and Goldman Sachs who both - along with Macquarie (who FNArena DO cover) - have been involved with capital raisings on behalf of Bellevue Gold.

[Click on the below image to make it bigger]

14-July-2021: Bellevue receives attractive project debt funding proposals

Bellevue receives overwhelming response to call for project debt funding proposals

Bellevue to draw up shortlist of potential lenders after securing non-binding debt offers of up to A$289M from 12 leading Australian and overseas institutions

KEY POINTS

- Bellevue has received indicative debt funding proposals for the Bellevue Gold Project from 12 leading domestic and offshore financial institutions, with non-binding offers up to A$289m (ranging between $170m and $289m)

- Bellevue had A$94m cash on hand at 30 June 2021; The project’s estimated capital cost in the Stage 1 Feasibility Study was A$255m (see ASX release dated 18 February 2021)

- The debt offers contain attractive commercial terms consistent with project financing of this nature

- Given the number of highly competitive offers, Bellevue will devise a short-list of potential lenders

- The strong response from lenders comes as the Company prepares to complete the Stage 2 Feasibility Study on its Bellevue Gold Project this quarter

- This study will consider expanding processing capacity from 0.75Mtpa to 1Mtpa as part of a strategy which would grow the production rate and increase project economics for minimal extra capital cost

- The Stage 2 Feasibility Study will be based on Bellevue’s recently increased global Resource of 3.0Moz at 9.9g/t gold (see ASX release dated 8 July 2021)

--- end of excerpt --- [click on link at the top for the full announcement]

Disclosure: I hold BGL shares.

23-June-2021: Drilling Results Underpin a Proposed Upscaled Operation

Bellevue Gold Project, Western Australia

Further exceptional drilling results underpin a proposed upscaled mining operation to 1Mtpa, to grow production rate and increase project economics for minimal extra cost

In light of these results, the deadline for new drilling data to be included in the upgraded feasibility study has been extended to ensure their full impact on the project’s value is captured

KEY POINTS

- Strong step out drilling results pave way for further increases in Resources and Reserves across the project; current total Resources of 2.7Moz at 9.9 g/t include 1.2Moz at 11.0 g/t of Indicated Resources and a Reserve of 0.69Moz at 8.0 g/t

- Drilling has identified significant extensions at the Deacon North and Marceline lodes, with the extensions expected to add further ounces at a low level of capital intensity

- Due to the location of the discoveries, they are expected to deliver a significant increase in the project economics for the upgraded Stage 2 Feasibility Study; the lodes sit proximal to planned development that was incorporated into the Stage 1 Feasibility Study

- Latest extensional results outside the Reserve at Deacon North/Marceline have defined some of the best intersections on the Project to date, results include:

- 5.6m @ 62.7g/t gold from 496.4m (UG drilling)

- 12.5m @ 18.8g/t gold from 704.7m

- 10.1m @ 9.7g/t gold from 412.2m (UG drilling)

- 0.8m @ 288.2g/t gold from 670.2m

- 2.7m @ 113.2g/t gold from 450m (UG drilling)

- 1.4m @ 125.7g/t gold from 524.6m

- 2.2m @ 22.9g/t gold from 447.7m and 2.7m @ 13.4g/t gold from 491.2m

- 3.8m @ 25.4g/t gold from 579.3m (UG drilling)

- 5.3m @ 14.9g/t gold from 417m

- 14.3m @ 5.5g/t gold from 692.3m

- 4.3m @ 15.6g/t gold from 696.6m

- 0.9m @ 97.0g/t gold from 376.3m

- 1.8m @ 42.1g/t gold from 506.8

- 2.3m @ 19.6g/t gold from 693m

- In light of the latest drilling results, the updated Feasibility Study is considering the option of expanding the production plant capacity by 33% from 0.75Mtpa to 1.0Mtpa at start-up

- Increase in processing capacity will see an increase in production and the overall project economics from the Stage 1 study that delivered $1.1B of free cash flow (at $2,300/oz) at bottom quartile All in Sustaining Costs (AISC)

- Given the potential impact of the latest results on the Resource, the cut-off date for inclusion of fresh drilling data in the upcoming Stage 2 Feasibility Study has been extended with the study now expected to be released in the September quarter, 2021

- Such an expansion is expected to incur minimal additional capital costs due to growth provisions contained in the original Feasibility Study underground mine design and upscalable plant layout: refer Figure 1 [image below]

- The Company remains well funded to complete existing works and exploration with $116m in cash and equivalents (as at 31 Mar 2021)

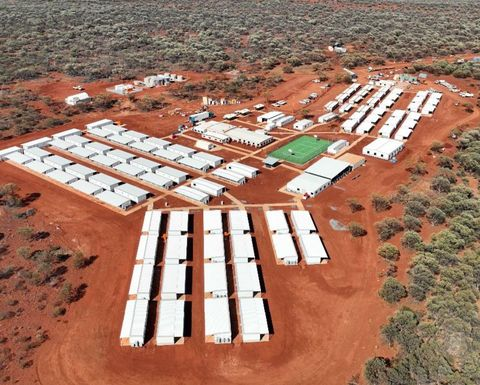

- Short-list of potential project lenders expected to be completed within weeks. Long lead items including Ball Mill purchase and construction of the mine camp are anticipated to commence in the September quarter

- Grade control drilling has commenced, as previously announced. Results confirm excellent orebody continuity of the Bellevue lode system with results (included in ASX announcement on 16 June 2021) of:

- 5m @ 76.4g/t gold from 55m (incl 2m @ 176.6g/t)

- 5m @ 31.7g/t gold from 43m

- 5m @ 30.5g/t gold from 28m

- 2m @ 48.9g/t gold from 20m

- 5m @ 17.1g/t gold from 52m

- 3m @ 24.8g/t gold from 42m

- 5m @ 14.5g/t gold from 27m

- 5m @ 12.5g/t gold from 35m

- Step-out and Infill drilling continues with five surface rigs and two underground rigs operating

- “These results are entirely consistent with our goal of growing the production rate and project economics for a minimal increase in the capital cost.” – Bellevue MD Steve Parsons

--- click on the link at the top of this straw for the full announcement ---

[I hold BGL shares, which rose +5% today to $0.925/share.]

28-April-2021: Quarterly Activities Report

March 2021 Quarterly Report

Highly successful quarter sets up Bellevue to be a high-grade, long-life producer

Stage One Feasibility Study completed; Subsequent Global Resource increase to 2.7Moz at 9.9g/t, including Indicated Resources of 1.2Moz at 11.0g/t gold paves way for potential growth in production and project economics as part of Stage Two Feasibility Study in progress.

Further drilling underway aimed at increasing and upgrading Resources at Marceline, Deacon North and the open pits for inclusion in Stage Two Feasibility Study.

KEY POINTS

- Stage One Feasibility Study delivered; key findings include:

- Bellevue Gold Project expected to be ranked among Australia’s Top-25 gold mines based on annual production

- Forecast to be one of the most profitable gold operations in Australia based on a Life of Mine (LOM) EBITDA Margin of 63% (based on gold price of A$2,300/oz)

- Initial projected mine life of 7.4 years

- Average annual production of 160,000oz in years 1 to 5 and a LOM average of 151,000ozpa

- LOM AISC costs of $1,079/oz

- Maiden Probable Ore Reserve of 2.7Mt at 8.0g/t gold for 690,000oz (based on a gold cut-off grade price of A$1,750/oz)

- LOM Mineral Resources and Ore Reserves of 5.6Mt at 6.4g/t gold for 1.1Moz

- Standout ESG credentials; including low levels of carbon, water and energy on a per ounce basis

- First gold pour targeted for December quarter 2022

- Strong ongoing exploration success during the quarter, including significant drill results at the Marceline discovery and two new emerging discoveries; Lucknow and Lucien.

- Subsequent to end of March quarter, Maiden Resource for the Marceline discovery announced: 0.98Mt at 9.7g/t gold for 310,000oz, including Indicated Resources of 410,000t at 10.1g/t gold for 130,000oz.

- Marceline and Deacon North sit in the upper levels of the mine plan, close to planned underground development, meaning their inclusion in the Stage Two Feasibility Study currently underway could have a positive impact on forecast financial returns.

- The Paris Decline has progressed >1,300m, advancing an average of 233m/month during the quarter. Stage 1 development is more than half completed, with current mining contract works on track for completion at the end of 2021.

- Experienced project director, Rod Jacobs, appointed.

- Bellevue is well-funded, with $116 million in cash at 31 March 2021.

- A 3D viewer of the project and recent discovery is available at: https://inventum3d.com/c/BGL/Bellevue

Bellevue Gold Limited (ASX: BGL) is pleased to report on an outstanding quarter during which the Company set itself to be a high-grade, long-life producer in a Tier-1 location.

--- click on the link at the top for the full report ---

[I hold BGL shares. I'm attracted to their project location, their high grades, and their low projected costs. Be aware however that they are targeting gold production some time in calendar 2022, not this year, so there will be no sales or cashflow coming in for some time.]